Planning for your family’s future can feel overwhelming, but understanding your options is the best first step. One of the most effective tools for Texas families is an inter vivos trust, more commonly known as a living trust. With the right legal guidance, creating one doesn’t have to be complicated.

Think of it as a private instruction manual for your assets, created by you during your lifetime to ensure your wishes are followed precisely, without unnecessary court involvement.

What Exactly Is an Inter Vivos Trust?

Don't let the Latin term intimidate you. An inter vivos trust is a legal arrangement you create during your lifetime—"inter vivos" simply means "between the living." It works by allowing you to transfer your property into a trust that is managed by a person you choose, called a trustee.

This structure provides a clear plan for managing your assets if you ever become unable to and for distributing them to your loved ones after you pass away.

The primary benefit of a living trust is its ability to completely bypass the often slow and public Texas probate process. This means your assets can be transferred to your family smoothly, privately, and without the need for court intervention.

Why a Living Trust is Essential for Texas Families

At its core, a living trust is a practical solution for anyone looking to secure their financial future and maintain control over their legacy. It’s not just for the wealthy; it’s a foundational tool for responsible estate planning.

Here are the key advantages for Texas families:

- Avoiding Probate: Assets held within a living trust are not subject to the probate court system. This saves your family significant time, money, and stress during an already difficult period.

- Ensuring Privacy: A will becomes a public record once it enters probate. A trust, however, is a private document. Your family’s financial affairs and your final wishes remain confidential.

- Planning for Incapacity: If you become incapacitated, your chosen successor trustee can step in immediately to manage your finances. This avoids the need for a court-ordered guardianship, which can be a costly and public process.

- Maintaining Control: While you are alive and well, you serve as your own trustee. You retain complete control over all your assets, just as you do now.

The term inter vivos trust perfectly describes its function: it is an agreement made “between the living.” It allows you (the settlor) to transfer assets to a trustee for your beneficiaries' benefit while you are still here to oversee the plan. This is fundamentally different from a testamentary trust, which only becomes active after your death. The Texas Trust Code governs these powerful legal tools. By using a living trust, families can avoid probate delays that often last 12-18 months and reduce estate settlement costs, which can consume 4-7% of an estate's total value.

Of course, a trust is a formal legal document. For those with assets or beneficiaries in other countries, it is crucial to understand how to accurately translate legal documents to ensure your instructions are honored globally. A knowledgeable Texas estate planning attorney can guide you through these complexities, ensuring your plan is secure.

The Key Players and Components of a Texas Living Trust

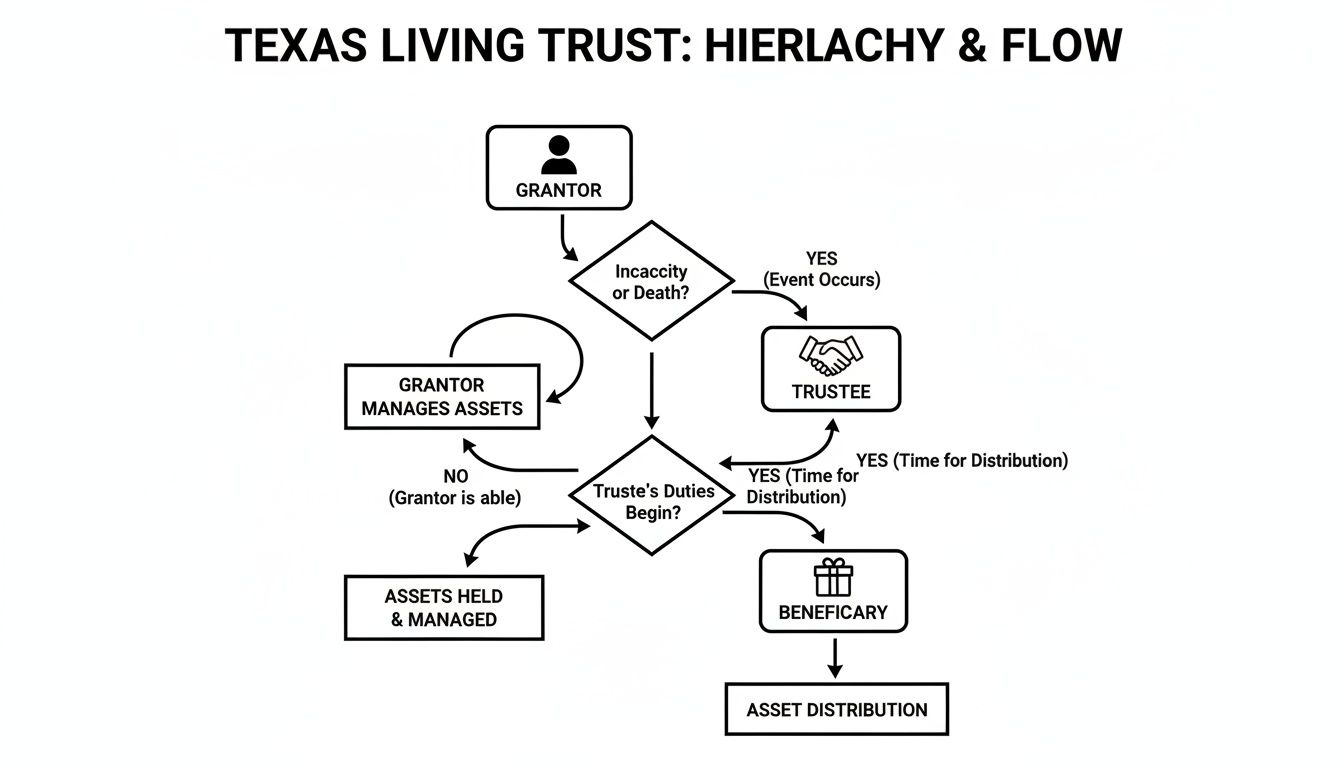

Every living trust has three essential roles. Think of it as a private entity you establish to hold and manage your assets. Understanding these roles is the first step to creating a plan that works for you.

Initially, you will likely occupy all three roles. This structure gives you the same complete control over your financial life that you have today and is designed for a seamless transition when you can no longer manage your affairs.

The Grantor: The Architect of the Trust

The Grantor (also known as a Settlor or Trustor) is the individual who creates the trust. As the Grantor, you design the entire plan. You decide which assets to place in the trust, who will benefit from them (the beneficiaries), and the specific rules the trustee must follow.

With a revocable living trust—the most common type in Texas—you retain the power to amend the terms, add or remove property, or even dissolve the trust entirely, as long as you are mentally competent. This flexibility makes it an invaluable tool for families whose circumstances may change over time.

The Trustee: The Manager with Fiduciary Duties

The Trustee is responsible for the day-to-day management of the trust. This person or institution has a strict legal obligation, known as a fiduciary duty, to manage the trust’s assets solely for the benefit of the beneficiaries. Initially, you will almost always serve as your own Trustee.

In the trust document, you will also name a Successor Trustee. This is the person you select to take over management of the trust if you become incapacitated or after your death. Choosing a reliable and trustworthy successor is one of the most critical decisions in the entire estate planning process. A Texas trust administration lawyer can help you understand the responsibilities this role entails.

The Beneficiary: The Intended Recipient

The Beneficiary is the person, people, or entity (such as a charity) who will ultimately receive the assets from the trust. During your lifetime, you are typically the primary beneficiary, ensuring the trust assets are used for your care and benefit.

After your death, the assets are distributed to your chosen successor beneficiaries—your children, grandchildren, or a charitable cause—according to the precise instructions you have provided in the trust document.

A common scenario in Texas involves a married couple creating a joint living trust. They serve as co-grantors, co-trustees, and primary co-beneficiaries. When one spouse passes away, the surviving spouse continues in these roles seamlessly. Only after both spouses have passed does the successor trustee step in to distribute the assets to their children or other heirs, all without court supervision.

Finally, the assets you transfer into the trust are known as the trust corpus or principal. This is more than just making a list; it involves legally retitling your property—such as the deed to your home or your bank and investment accounts—into the name of the trust. This essential step, called funding the trust, is what gives it the power to avoid the probate process.

Choosing Your Path: Revocable vs. Irrevocable Trusts

When establishing a living trust in Texas, you will face a critical decision: should the trust be revocable or irrevocable? While both help you manage assets and avoid probate, they offer vastly different levels of control and protection.

Making the right choice is fundamental to creating an estate plan that achieves your family’s goals. This decision impacts everything from your day-to-day financial flexibility to long-term asset protection and tax strategies.

The Flexible Path: The Revocable Living Trust

For most Texas families, the revocable living trust is the preferred option due to its flexibility. As the grantor, you retain complete control throughout your life.

This means you can change beneficiaries, sell property held by the trust, add new assets, or even revoke the entire trust if your circumstances change. It’s like writing your financial plan in pencil—you can revise it as your life evolves.

However, this control comes with a trade-off. Because you still technically own and control the assets, they are not shielded from your creditors or potential lawsuits. For most people whose primary goals are avoiding probate and planning for incapacity, this is a perfectly acceptable arrangement.

The Permanent Path: The Irrevocable Living Trust

An irrevocable living trust is a different type of tool altogether. As the name implies, it is designed to be permanent. Once you transfer assets into an irrevocable trust, you generally cannot change the terms or take the assets back. You are formally relinquishing control and ownership.

Why would someone choose to give up control? Because doing so unlocks powerful benefits unavailable with a revocable trust:

- Robust Asset Protection: Since the assets are no longer legally yours, they are generally protected from future creditors and lawsuits.

- Estate Tax Reduction: For individuals with significant wealth, moving assets out of your personal estate can reduce its taxable value and potentially minimize federal estate taxes.

- Medicaid Planning: Certain types of irrevocable trusts are essential tools for helping seniors qualify for long-term care benefits without exhausting their life savings.

This flowchart illustrates the basic structure of a Texas Living Trust, clarifying the roles of the Grantor, Trustee, and Beneficiary.

This visual helps explain the legal separation of asset management from beneficial ownership, which is the core principle of a trust, whether it's revocable or irrevocable.

Real-World Scenario: A Dallas-based physician is concerned about potential malpractice claims affecting her personal assets. She works with her attorney to place her family home into a carefully structured irrevocable trust. Now, if a lawsuit were to arise from her medical practice, her family’s home is shielded and cannot be seized to satisfy a professional liability judgment.

To help you understand the differences at a glance, here is a side-by-side comparison.

Comparing Revocable and Irrevocable Inter Vivos Trusts in Texas

| Feature | Revocable Living Trust | Irrevocable Living Trust |

|---|---|---|

| Flexibility to Change | High. Can be amended, changed, or dissolved by the grantor. | Low. Generally cannot be changed once created. |

| Asset Control | Grantor retains full control over the assets during their lifetime. | Grantor gives up control and ownership of the assets. |

| Probate Avoidance | Yes. Assets in the trust bypass the probate process. | Yes. Assets in the trust bypass the probate process. |

| Creditor Protection | No. Assets are still considered yours and are vulnerable. | Yes. Assets are generally protected from future creditors. |

| Estate Tax Benefits | No. Assets remain part of your taxable estate. | Yes. Can remove assets from the taxable estate. |

| Common Use-Case | Probate avoidance and incapacity planning for the average family. | Asset protection, tax planning, and Medicaid qualification. |

This table summarizes the core trade-offs. The choice comes down to balancing complete control (revocable) against powerful protection (irrevocable).

Determining the right path for your family requires careful consideration of your assets, goals, and risk tolerance. An experienced Texas estate planning attorney can provide tailored advice to help you build a secure legacy. To learn more about the most common choice, read our guide on what is a revocable trust.

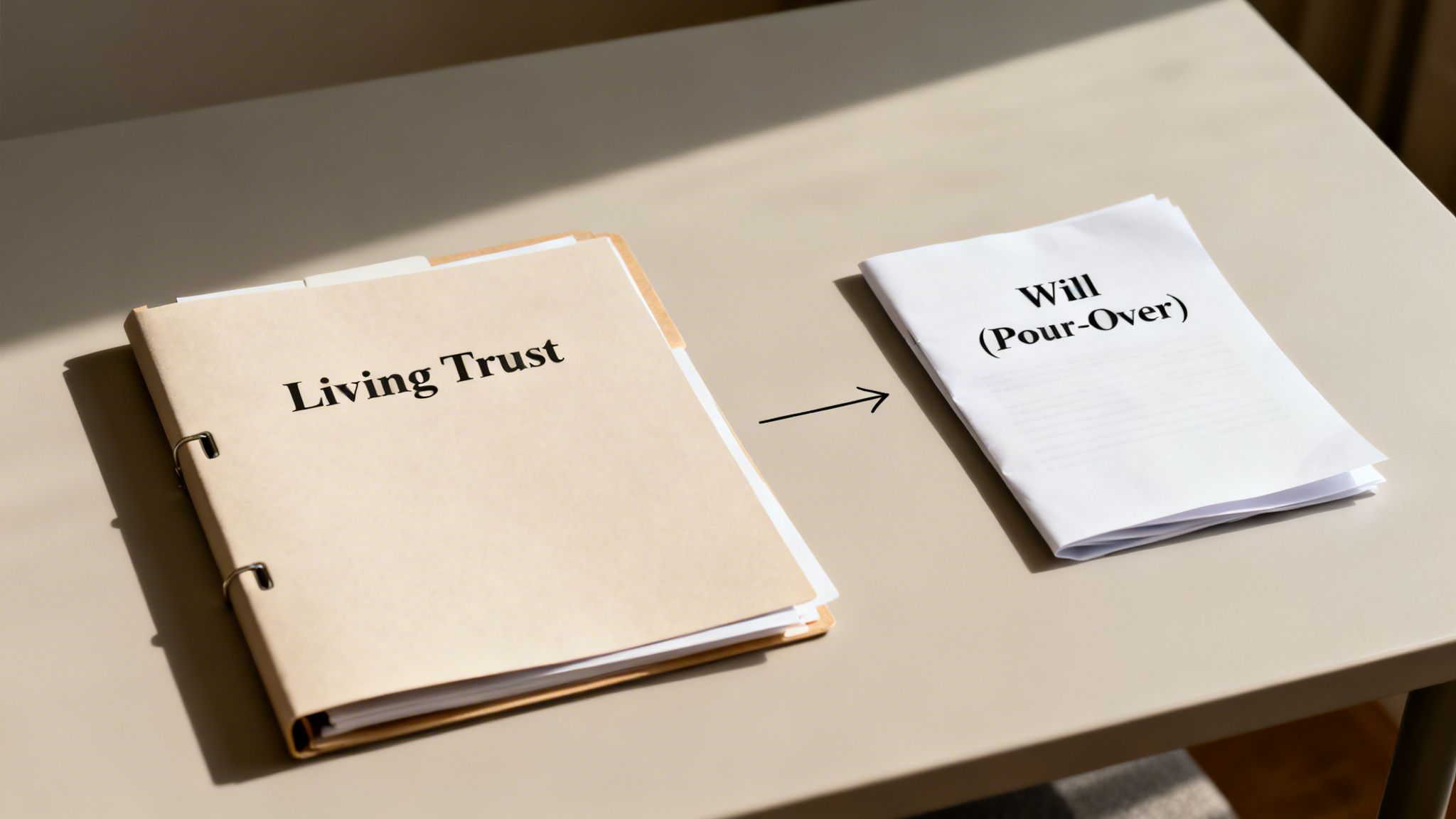

How a Living Trust Works Alongside a Will

Many Texas families assume that creating a living trust eliminates the need for a will. The truth is, these two documents are not competitors; they are partners that work together to create a comprehensive and secure estate plan.

A last will and testament only takes effect after you pass away and must be validated through the public probate court system—a process that is often slow and expensive. A living trust, by contrast, is active from the moment you create and fund it, managing your assets during your life and after death without court supervision.

This is a critical distinction. A trust keeps your affairs private and avoids court delays, while also providing vital protection if you become incapacitated. Your successor trustee can step in immediately to manage your affairs, helping you avoid a stressful and public guardianship proceeding.

The Pour-Over Will: A Critical Safety Net

If the trust handles the heavy lifting, why do you still need a will? The answer is a special type of will called a "pour-over will." Think of it as the ultimate safety net for your estate plan.

Life is busy, and it's easy to forget to transfer an asset into your trust. You might buy a new property or open a new bank account and not get around to retitling it in the trust's name.

If an asset is not legally owned by the trust upon your death, it falls outside the trust's control. This is where the pour-over will becomes essential.

This legal document has one simple but vital job: to "catch" any assets you left out and "pour" them into your trust after you pass away. While these overlooked assets will still need to go through probate, the will ensures they ultimately end up where you intended—managed under the private terms of your trust.

This coordinated approach is a cornerstone of modern estate planning. For decades, trusts and wills have worked together to manage estates efficiently. Historically, living trusts have been used to avoid the substantial 5-10% in fees that probate can consume. This strategy continues to be a core component of well-crafted estate plans today.

A truly comprehensive plan leverages the strengths of both documents. The living trust serves as the primary vehicle for managing and distributing your assets, while the pour-over will acts as an essential backup, ensuring your entire legacy is handled exactly as you planned. You can explore a detailed comparison in our article on living trusts vs. wills in Texas.

Understanding the Responsibilities of a Trustee

Being asked to serve as a trustee for a loved one’s trust is a significant honor, but it also comes with serious legal responsibilities. This role involves more than just administrative tasks; you are stepping into a position with legally binding obligations known as fiduciary duties.

Under the Texas Trust Code, a trustee is required to act in the absolute best interest of the trust's beneficiaries. This is not a suggestion—it is a legal mandate. Failing to meet these duties can result in personal liability and legal disputes.

Core Fiduciary Duties in Texas

Understanding your role begins with the three pillars of fiduciary duties in Texas. These principles are designed to protect the beneficiaries and ensure the grantor's wishes are honored.

- The Duty of Loyalty: This is the foundation of your role. You must act solely for the benefit of the beneficiaries. This means you cannot use your position for personal gain, engage in self-dealing, or favor one beneficiary over another unless the trust document specifically allows it.

- The Duty of Prudence: You are required to manage the trust’s assets as a "prudent person" would manage their own affairs. This includes making sound investment decisions, avoiding unnecessarily risky ventures, and taking steps to preserve the value of the trust property.

- The Duty to Account: Transparency is paramount. As trustee, you must keep meticulous records of all transactions—income received, expenses paid, and distributions made. You are also required to provide regular, detailed accountings to the beneficiaries so they remain informed about the management of their inheritance.

A Practical Example for Trustees

Consider this common Texas scenario: a successor trustee takes over a trust for the benefit of the grantor’s two minor children after their parents have passed. The trust contains the family home, an investment portfolio, and a checking account.

The trustee’s first step is to inventory and secure all assets. Guided by the duty of prudence, they must review the investment portfolio to ensure it aligns with the children's future needs, such as college expenses.

Each month, the trustee uses trust funds to pay the home's mortgage and utilities, keeping flawless records of every transaction to fulfill their duty to account. If a relative offers to buy the home for a below-market price, the duty of loyalty requires the trustee to decline. Their obligation is not to give a family member a good deal but to achieve the best possible outcome for the children. For a deeper dive, explore the complete list of trustee duties and responsibilities in Texas.

This example shows how these fiduciary duties guide every decision a trustee makes. A Texas trust administration lawyer can be an invaluable partner, helping you navigate these responsibilities with confidence and ensuring you remain compliant with the law.

Taking the Reins: From Trust Knowledge to a Lasting Legacy

You now understand the power of an inter vivos trust and how it can protect what you’ve built, provide for your family, and keep your affairs private. This knowledge is the first step toward creating a legacy that reflects your values and hard work.

However, knowing what a trust is and creating one that is legally sound under Texas law are two different things. A generic, fill-in-the-blank document can have serious flaws. Tailoring a trust to your family’s unique circumstances is where professional guidance becomes essential. An experienced attorney doesn’t just draft documents; they help you build a comprehensive strategy to ensure your wishes are followed and your family is protected from future conflict.

Turning Your Plan into a Reality

The journey from planning your estate to having peace of mind involves several crucial steps, including:

- Deciding whether a revocable or irrevocable trust best suits your goals.

- Selecting a successor trustee who is both trustworthy and capable of managing the role.

- Properly funding the trust by transferring your assets into it.

Each of these steps must be handled in accordance with the Texas Trust Code to ensure your plan is effective.

Think of it this way: using a generic online trust template is like using a map of Dallas to navigate the backroads of the Texas Hill Country. It might get you close, but you are likely to encounter problems. These one-size-fits-all documents often fail to address Texas-specific legal nuances, which can leave your assets vulnerable to probate or create ambiguities that lead to family disputes.

Our team of attorneys is here in Texas, ready to guide you through every part of the process. We will help you feel confident that the plan you create today will stand strong for generations.

Frequently Asked Questions About Texas Living Trusts

Here are answers to the most common questions Texas families have when they begin exploring living trusts.

Does a Living Trust Protect My Assets from Creditors?

It depends on the type of trust. A revocable living trust, where you retain full control, generally does not offer creditor protection. Because you can reclaim the assets at any time, the law considers them yours, making them accessible to creditors.

In contrast, a properly structured irrevocable trust can provide powerful asset protection. By legally transferring ownership of the property out of your name, you can shield it from future claims. A knowledgeable Texas estate planning attorney can help you determine if this strategy is right for your situation.

What Happens If I Forget to Put an Asset in My Trust?

This is a common concern. Any asset not formally titled in the name of your trust will likely have to go through the public probate process.

This is precisely why a pour-over will is a critical component of a comprehensive estate plan. It acts as a safety net. After you pass away, the will directs that any forgotten assets be "poured" into your trust, ensuring they are ultimately managed according to your private wishes.

Can I Be the Trustee of My Own Revocable Trust?

Yes, absolutely. In fact, this is the standard practice. When you create a revocable living trust as the Grantor, you also name yourself as the initial Trustee. This allows you to maintain complete and uninterrupted control over your assets throughout your lifetime.

You will also name a successor trustee in the trust document. This is the person or institution you trust to step in and manage the trust on your behalf if you become incapacitated or after you pass away.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.