Creating an estate plan for a blended family requires more than a standard will; it's about thoughtfully ensuring everyone you love—your spouse, your children, and your stepchildren—is protected. Navigating this process can feel overwhelming, but with the right legal guidance, you can build a clear, intentional roadmap that preserves both your assets and your family’s harmony, ensuring your legacy is one of care, not courtroom battles.

The Unique Challenges of Blended Family Estate Planning in Texas

For a blended family, estate planning can feel like navigating a minefield of emotional and financial complexities. You're not just dividing assets; you are working to protect delicate family relationships and provide for loved ones whose best interests may not always align. This guide is built on the principle that creating a specific plan isn't about mistrust—it's a profound act of love and foresight.

Many people realize the need for a tailored plan when they see how default inheritance rules in the Texas Estates Code can create chaos for blended families. If you pass away without a will or trust, Texas law dictates who gets what, often with surprising and deeply upsetting results.

Why Standard Texas Inheritance Laws Fall Short

In Texas, if you die without a will (a situation known as dying "intestate"), your property is divided according to rigid legal formulas. For example, if you have children from a previous relationship, your separate property is divided between your current spouse and those children. This can turn your spouse and your children into unwilling co-owners of property, which is a recipe for conflict over how to manage or sell it.

This scenario highlights a critical issue: the law does not automatically protect stepchildren. Unless you have legally adopted them, stepchildren have zero inheritance rights under Texas intestacy laws. If all your assets go to your surviving spouse, your own children from a past marriage could be left with nothing if your spouse later creates a new will that only favors their biological children.

The Growing Need for Customized Plans

These complex situations are increasingly common. Blended families are a significant part of American life, with roughly 40% of married couples having at least one partner who has been married before. With over 1,000 new stepfamilies forming daily, a one-size-fits-all estate plan is simply not sufficient. Discover more insights about blended family estate planning on choreoadvisors.com.

A well-crafted estate plan is the only way to override the state’s default inheritance rules. It gives you the power to name your beneficiaries, appoint trusted individuals to manage your affairs, and structure distributions in a way that protects everyone you care about.

Understanding these potential pitfalls is the first step toward building a custom plan that provides clarity and prevents family disputes. A Texas estate planning attorney can help you design a strategy using tools like wills, trusts, and powers of attorney to ensure your exact wishes are followed, strengthening your family for generations.

Essential Legal Tools for Texas Blended Families

When creating an estate plan for a blended family, you need the right instruments in your legal toolbox. These tools are designed to protect the people you love in practical, real-world ways.

The foundation of any plan is a Last Will and Testament. If you have remarried, updating your will isn't just a good idea—it's essential. This is your official opportunity to name all your heirs, including stepchildren who have no automatic inheritance rights under the Texas Estates Code. It also formally removes an ex-spouse from inheriting. Relying on an old will, or no will at all, is a sure way to invite conflict.

To get this right, blended families need a solid understanding of the essential estate planning documents that secure their future. Each document serves a specific purpose, and together, they build a protective framework around your family.

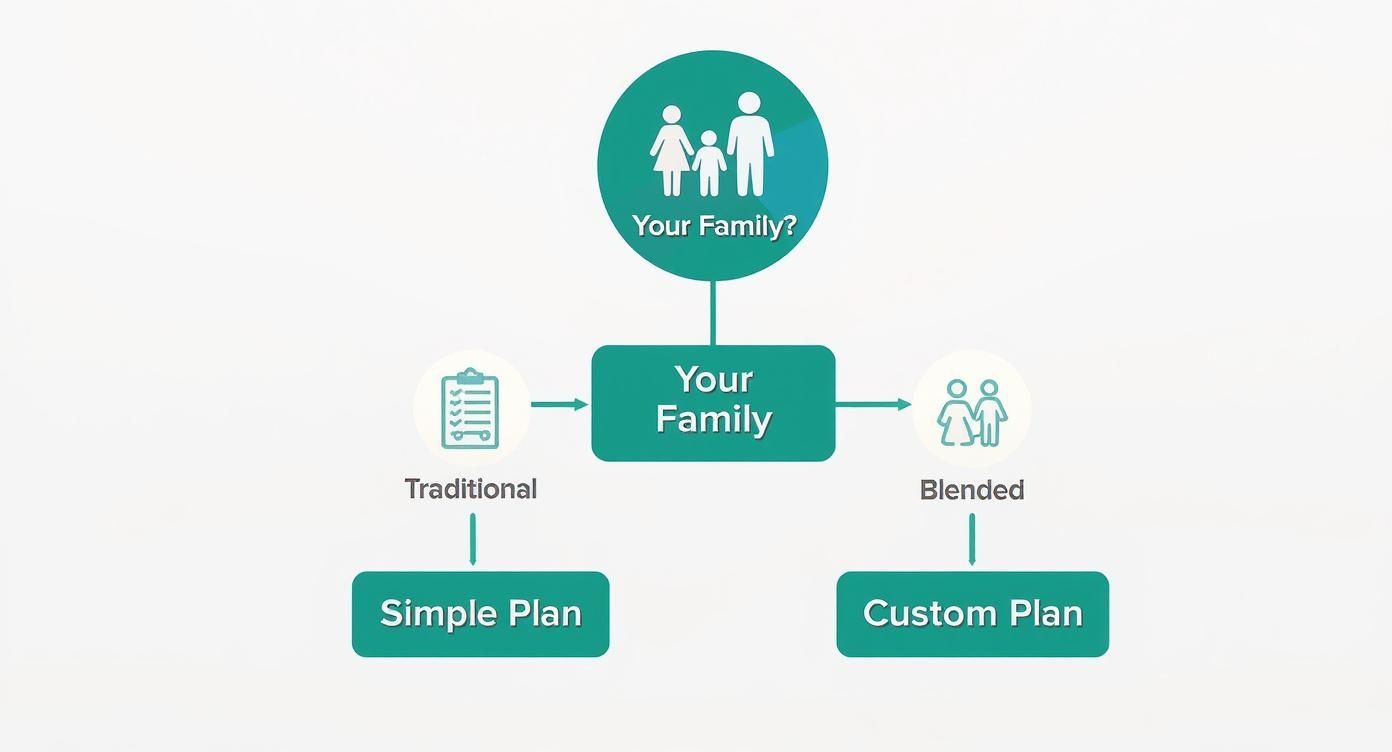

This decision tree gives you a starting point for thinking through a plan, but with a blended family, a customized strategy is almost always the answer.

As you can see, the unique dynamics of a blended family mean a "simple" plan can easily backfire, leading to disputes or even the accidental disinheritance of your own children.

Going Beyond the Will with Trusts

While a will is a must-have, trusts often provide far more control and flexibility—invaluable for blended families. Think of a trust as a legal container you create. You place assets into it, and a third party, the trustee, holds and manages them for your chosen beneficiaries according to your instructions.

A Revocable Living Trust is a popular choice for good reason. It allows you to maintain complete control over your assets while you are alive and provides clear instructions for what happens after you're gone. One of its greatest advantages is that assets within a trust typically bypass the public and often lengthy probate process.

For many of our clients, this privacy and efficiency are significant benefits. You can also be very specific about how and when your children or stepchildren inherit, perhaps linking distributions to milestones like graduating from college or reaching a certain age.

To give you a clearer picture, here's how some of the most common tools stack up for blended families.

Comparing Key Estate Planning Tools for Blended Families

This table breaks down the primary legal instruments we use in Texas estate planning, highlighting their purpose and how they can specifically help blended families navigate their unique challenges.

| Tool | Primary Purpose | Key Benefit for Blended Families |

|---|---|---|

| Last Will and Testament | To direct the distribution of your assets after death and name guardians for minor children. | Explicitly includes stepchildren (who would otherwise not inherit) and disinherits former spouses. |

| Revocable Living Trust | To manage assets during your lifetime and distribute them after death, avoiding probate. | Provides precise control over inheritance timing and conditions, preventing a young adult from receiving a large lump sum. |

| QTIP Trust | To provide for a surviving spouse for life while ensuring assets ultimately pass to children from a prior marriage. | Guarantees children from a previous relationship will inherit, preventing accidental disinheritance by the surviving spouse. |

| Power of Attorney | To appoint an agent to make financial and legal decisions if you become incapacitated. | Ensures a trusted person (not necessarily your new spouse) can manage finances, preventing potential conflicts. |

Each of these tools plays a critical role. A well-rounded plan often uses a combination of them to create a seamless strategy that covers all your bases.

Advanced Trust Strategies for Blended Families

Sometimes, a situation calls for a more sophisticated solution to balance everyone's needs. That’s where Texas law offers powerful trust options, and one of the best for a blended family is the Qualified Terminable Interest Property (QTIP) Trust.

A QTIP Trust is an elegant solution for a common blended family dilemma: how to provide for your current spouse for the rest of their life while guaranteeing that your children from a previous marriage ultimately inherit your assets.

Let's walk through a real-world scenario of how this works:

- You fund the QTIP trust with certain assets—perhaps the family home or an investment portfolio.

- Your surviving spouse receives all income generated by the trust for as long as they live. You can also allow them to access the principal for specific needs, like healthcare.

- Here’s the key: Your spouse cannot change the final beneficiaries of the trust.

- When your spouse passes away, whatever remains in the trust goes directly to the beneficiaries you originally named—your children.

This structure ensures your spouse is cared for without giving them the power to rewrite their own will and leave your children with nothing. It’s a legally binding way to honor both your partner and your children, heading off the risk of accidental disinheritance. The trustee has a fiduciary duty under the Texas Trust Code to manage the assets responsibly for all parties involved. An experienced Texas estate planning attorney can help you determine if a QTIP trust is the right solution for your family.

Protecting Inheritance for Children and Stepchildren

One of the most sensitive yet vital topics in blended family planning is ensuring every child—yours, theirs, and ours—is provided for exactly as you intend. This requires a deliberate plan, because without one, Texas law can produce outcomes that feel deeply unfair and were never your wish.

Under the Texas Estates Code, stepchildren have no automatic right to inheritance. If you have not legally adopted them, they will not receive anything from your estate if you pass away without a will. This means if you want to include your stepchildren in your legacy, you must specifically name them in your will or trust.

Formally Including Stepchildren in Your Plan

Relying on your surviving spouse to "do the right thing" is a significant gamble. After you're gone, your spouse is free to write a new will that leaves everything—including the assets they inherited from you—only to their biological children. This can, and often does, unintentionally disinherit your own children.

To prevent this, you must take clear, legally binding action:

- Name them in your Will: Be explicit. State the specific assets or percentage of your estate you want your stepchildren to receive. Ambiguity is the enemy of a peaceful estate settlement.

- Include them as Trust Beneficiaries: A trust offers even more control. You can designate stepchildren as beneficiaries and set specific terms for how and when they inherit. You might also want to learn about setting up a trust for a child to manage their inheritance responsibly.

A key part of protecting everyone's inheritance also involves Understanding Inheritance Tax. While Texas does not have a state inheritance tax, a well-structured plan considers federal tax implications to maximize what your loved ones receive.

Navigating Guardianship for Minor Children

For parents with minor children, choosing a guardian is one of the most critical decisions you will make. In a blended family, this choice can become emotionally charged and legally complex, especially when a stepparent is involved.

Your will is the legal document where you nominate a guardian. However, it's vital to understand how Texas courts view these nominations.

A critical point to remember: if your children's other biological parent is still living and has legal rights, they will almost always be granted custody, regardless of who you nominate in your will. Your nomination becomes crucial if both biological parents have passed away or if the surviving parent is deemed unfit by the court.

Even with that in mind, documenting your choice is absolutely essential. It provides the court with clear evidence of your wishes for your children’s care, which can heavily influence their decision during an incredibly difficult time.

The Importance of Open Communication

Legal documents are the bedrock of your plan, but they don't replace the need for honest conversations. Discussing guardianship with your ex-spouse, your current spouse, and your chosen nominee is a proactive step that can prevent future custody battles.

Here are a few practical steps to consider:

- Talk to the Other Parent: If you are on amicable terms, have a conversation with your ex-spouse. Finding common ground now can prevent a painful court battle later.

- Inform Your Nominee: Ensure the person you want to name is willing and able to take on the immense responsibility of raising your children.

- Explain Your Decision: Let your current spouse and other family members know the reasoning behind your choice to manage expectations and soothe potential hurt feelings.

The goal is to build a support system that prioritizes your children's well-being. A thoughtful approach to both legal paperwork and personal conversations is the key to protecting your entire family. An experienced Texas estate planning attorney can be an invaluable partner in formalizing these decisions.

Common Estate Planning Mistakes to Avoid

Even with the best intentions, a blended family’s estate plan can unravel due to a few common, yet critical, oversights. Avoiding these pitfalls is essential to ensure your wishes are honored and your loved ones are shielded from conflict. A thoughtful plan isn’t just about drafting documents; it’s about anticipating challenges and building a strategy strong enough to withstand them.

Many families don't realize that some of their largest financial accounts operate entirely outside the control of their will. This simple misunderstanding can lead to devastating errors.

Forgetting to Update Beneficiary Designations

A classic and heartbreaking mistake is failing to update beneficiary designations on retirement accounts—like 401(k)s and IRAs—and life insurance policies after a divorce and remarriage. These forms are legally binding contracts with financial institutions, and they will always supersede your will.

If your ex-spouse is still named as the beneficiary, they will receive those assets. It makes no difference if your will clearly states that your current spouse or children should inherit everything. That beneficiary form is the final word.

It's a tragic scenario we've seen play out too many times: a person's entire life savings or a massive insurance payout goes to a former partner, while their current family is left with nothing from that asset. Regularly reviewing these forms is a non-negotiable step in responsible estate planning.

You can dive deeper into the process with our guide on updating will recipients and exploring beneficiary changes.

Relying on Unenforceable Verbal Promises

"Don't worry, I'll make sure your kids are taken care of." These kinds of verbal promises, often made with genuine love, are completely unenforceable in Texas. Once you pass away, your surviving spouse has no legal obligation to follow through on any handshake deals.

They are free to write a new will that benefits only their biological children, spend every penny, or even remarry and leave everything to a new partner. The only way to guarantee your children's inheritance is through legally binding documents like a will or, for greater security, a trust.

Mishandling Jointly Titled Property

Titling property, like your home or a bank account, jointly with your new spouse may seem like a simple way to merge your lives. However, using a Joint Tenancy with Right of Survivorship (JTWROS) can cause significant problems for children from a previous marriage.

When property is held as JTWROS, the surviving owner automatically inherits the entire asset when the other owner dies.

- This means the asset completely bypasses your will and your estate.

- The moment your spouse inherits it, they have total and complete control.

- Your children from a prior relationship have no legal claim to that property.

This is another common way children are accidentally disinherited. A Texas estate planning attorney can show you safer ways to title property, such as Tenants in Common or placing the asset into a trust, which protects everyone's interests.

Neglecting Incapacity Planning

Estate planning isn't just about what happens after you die. It’s also about deciding who will make decisions for you if you become incapacitated. Without the right legal documents, that responsibility falls to the courts, often leading to family friction during an incredibly stressful time.

Blended families, which make up 16% of households, face unique challenges here, with a staggering 40% experiencing disputes over asset distribution. According to Trust & Will's 2025 report, the consequences of poor planning are severe: inflated probate costs, unnecessary taxes, and bitter family conflict. The answer lies in targeted solutions like trusts and, especially, powers of attorney for incapacity.

A comprehensive plan must include:

- Durable Power of Attorney: This appoints an agent to manage your finances.

- Medical Power of Attorney: This designates someone to make healthcare decisions for you.

Choosing your agent requires careful thought. Will it be your spouse or an adult child? Making that decision now—and formalizing it in a legal document—prevents a potential power struggle between your spouse and children down the road.

Using Open Communication to Preserve Family Harmony

You can have the most ironclad wills and trusts, but they only form the foundation of your estate plan. The real glue that holds your family together—both now and after you’re gone—is clear, honest communication. A technically perfect plan can be undermined by suspicion and hurt feelings if no one ever discussed the "why" behind it.

Talking about your estate plan can feel awkward, but reframing the conversation can help. This isn't just about money; it’s a conversation about love, fairness, and your desire to make things easier for the people you care about most. An open dialogue manages expectations and turns your plan into what it's truly meant to be: a final act of care.

Framing the Conversation with Your Spouse and Family

Initiating these conversations requires sensitivity and strategy. Your goal isn't to open the floor for a debate over who gets what, but to build understanding and reinforce your shared family values.

Here are a few steps for a successful approach:

- Schedule a Dedicated Time: Do not bring this up during a holiday dinner or a stressful week. Find a calm, private moment where you and your spouse can talk without interruptions.

- Focus on the ‘Why,’ Not Just the ‘What’: Lead with your heart. You could start by saying, "Our top priority is making sure everyone is secure and that we prevent any misunderstandings down the road." This frames the discussion around protection, not just possessions.

- Present a United Front: You and your spouse must be on the same page before including the children. Discuss your goals together first so you can present a consistent, thoughtful message to the rest of the family.

When you lead with your values, you transform a potentially tense topic into a meaningful conversation about your legacy.

The Power of a Personal Letter of Intent

Your will and trust are legal instruments. They can feel cold and formal because they must be precise to be effective. They establish the "what," "who," and "when" of your estate plan but often omit the most crucial part: the "why."

This is where a personal letter of intent becomes an invaluable tool.

While not legally binding under the Texas Estates Code, its emotional impact is immense. Think of it as your final message to your loved ones, a chance to explain the love and reasoning behind your decisions.

This letter provides the human context that legal documents cannot. It’s your opportunity to explain that providing for your surviving spouse through a trust isn't a sign of mistrust, but a carefully chosen strategy to protect both them and your children in the long run.

You can use this letter to express your hopes for the family’s future, share cherished memories, or explain why you chose a specific person as your executor or trustee. It can also soften the blow of what might seem like an unequal distribution by explaining the context—perhaps one child received significant financial help during your lifetime that the others did not.

This letter is your final, heartfelt word, helping to preserve the relationships you spent a lifetime building. A Texas estate planning attorney can help you draft this letter in a way that complements your formal legal documents without creating legal ambiguity. By pairing solid legal work with thoughtful communication, you give your blended family the best possible chance at peace and unity.

Answering Your Texas Blended Family Estate Planning Questions

As you delve into estate planning for a blended family, many "what-if" scenarios and specific questions naturally arise. Let’s address some of the most common questions we hear from families across Texas, providing clear answers to help you feel informed and secure.

Does My New Spouse Automatically Inherit Everything in Texas?

No, but this is a common misconception that can lead to significant family conflict. If you pass away without a will (intestate), the Texas Estates Code dictates how your assets are divided.

For example, if you have children from a previous marriage, your separate property—assets you owned before your current marriage or received as a gift or inheritance—is split between your current spouse and those children. This creates co-ownership of assets, which is often a source of disputes.

A will or trust is the only way to override these default state rules. It empowers you to decide who gets what, ensuring your spouse is cared for and your children receive exactly what you intend, not what a court decides.

How Can I Provide for My Spouse but Still Protect My Children’s Inheritance?

This is the central question for most blended families, and Texas law offers an excellent tool for this exact situation: the Qualified Terminable Interest Property (QTIP) Trust.

A QTIP trust is a powerful way to achieve both goals. Here’s a step-by-step guide on how it works:

- You place specific assets into a trust designed to support your spouse.

- Your surviving spouse receives the income from that trust for the rest of their life. They may also access the principal for major needs, like medical emergencies.

- Crucially, your spouse cannot change the final beneficiaries.

- Once your spouse passes away, the remaining trust assets go directly to your children, just as you planned from the start.

This strategy ensures your spouse is secure while providing peace of mind that your children's inheritance is protected from being spent, given away, or lost if your spouse remarries.

What Happens If I Forget to Update My 401k Beneficiary?

This small oversight can have devastating consequences. Beneficiary designations on accounts like 401(k)s, IRAs, and life insurance policies are legally binding contracts that override whatever your will says.

It does not matter what your updated will states—if your ex-spouse is still named as the beneficiary on your 401(k), they will receive the money. The courts must honor the name on that form. It is absolutely essential to review these designations immediately after a divorce or remarriage. A Texas estate planning attorney can help you perform a thorough audit of all your accounts to ensure nothing is missed.

Can My Ex-Spouse Challenge My Choice of Guardian for My Kids?

Yes, and they likely will. When you name a guardian for your minor children in your will, it's vital to understand the legal hierarchy. If your children's other biological parent is alive and considered fit, they have the primary legal right to custody. That right almost always supersedes your nomination.

Your choice of a guardian (such as your new spouse) typically only comes into play if both biological parents have passed away or if a court deems the surviving parent unfit. However, documenting your wishes is still incredibly valuable. It provides the court with clear proof of your desires for your children's upbringing, which can heavily influence a judge’s decision if a custody dispute arises.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process. You can schedule your consultation at https://texastrustadministration.com.