As a business owner in Texas, your company isn't just a line item on a balance sheet. It's the culmination of your vision, your hard work, and your sacrifice. It supports your family, your employees, and their families. But have you ever stopped to ask what happens to all of that if you're suddenly not in the picture? Managing your life's work can feel overwhelming—but with the right legal guidance, it doesn’t have to be.

That’s what estate planning for business owners is all about. It’s not just a will. It’s a strategic roadmap you create to dictate your company's future if you die or become incapacitated. Without it, you’re leaving the fate of your life’s work to Texas law, and the fallout can be disastrous for those you love.

Why Your Business Needs a Strategic Estate Plan

Think of all the hours you pour into operations, growth, and putting out fires. Now, imagine all of that grinding to a halt because you're gone. An abrupt absence creates a leadership vacuum that can unravel a company with shocking speed, often leading to forced liquidation, bitter family disputes, and crippling tax burdens.

The answer to the question, "What happens next?" is what truly defines your legacy.

The Chaos of an Unplanned Exit

Let's paint a picture with a real-world scenario. Imagine a thriving manufacturing business right here in Houston. The founder and majority owner passes away unexpectedly, leaving behind a spouse, two adult children, and no estate plan whatsoever.

What happens next is chaos.

- Family Feuds: Under Texas intestacy laws (the rules for when there’s no will), his shares are split between his wife and kids. The son who worked in the business feels he should take over. The other child and the spouse have no experience and just want to cash out, fast. The arguments begin almost immediately, creating a deep family rift.

- Operational Gridlock: The bank freezes the company's line of credit. Why? Because all the key banking relationships were tied to the founder. With no clear successor legally authorized to sign checks or make decisions under the Texas Estates Code, payroll can't be met and suppliers go unpaid.

- Forced Sale: The family infighting and financial paralysis spill into a courtroom. With no agreement in sight, a judge orders the business to be liquidated to pay off creditors and distribute what’s left. The company is sold for pennies on the dollar, loyal employees lose their jobs, and the founder's legacy is completely erased.

This isn't just a scary story; it’s an all-too-common reality for Texas families. Proactive estate planning is the only way to prevent this kind of disaster, turning that uncertainty into a clear, legally enforceable game plan.

A business estate plan isn't a sign that you're slowing down. It’s one of the most powerful tools you have to maintain control, protect your family, and guarantee the future success of the very enterprise you built from the ground up.

Before we dive into the specific documents you'll need, let's get a bird's-eye view of the core components. Think of these as the essential building blocks for a solid plan.

Core Components of a Business Owner's Estate Plan

This table summarizes the essential legal documents and strategies every Texas business owner should have on their radar.

| Component | Purpose in Plain English | Governing Texas Law (Example) |

|---|---|---|

| Succession Plan | The playbook for who takes over the business and how, ensuring a smooth leadership transition. | Texas Business Organizations Code |

| Buy-Sell Agreement | A contract between owners that dictates what happens to a departing owner’s shares (due to death, disability, retirement, etc.). | Governed by contract law and the Texas Business Organizations Code |

| Will or Trust | The core document that directs where your personal and business assets go after you pass away. | Texas Estates Code, Chapters 251-255 (Wills); Texas Trust Code, Chapter 112 |

| Powers of Attorney | Legal documents that appoint someone to make financial and healthcare decisions for you if you become incapacitated. | Texas Estates Code, Chapters 751-752 |

| Life Insurance | A key funding mechanism, often used to provide the cash needed to buy out a deceased owner's shares. | Texas Insurance Code |

Each of these pieces works together to create a comprehensive shield for your business and your family, guided by specific Texas statutes.

The Alarming Reality for Family Businesses

This isn't a hypothetical problem. The statistics are jarring. A staggering 66% of family businesses—nearly two-thirds—don't have a formal, documented succession plan.

This is especially concerning when you consider there are 2.9 million businesses in the U.S. owned by people aged 55 or older, and together, they support over 32 million employees. You can dig into more of these insights from Teamshares.

Effective estate planning is about integrating tools like succession plans, buy-sell agreements, and trusts to create that seamless transition. It's about making deliberate choices now to protect your business, your team, and your loved ones from the turmoil of an unplanned future. With a strategy grounded in the Texas Estates Code, you can secure your company’s future with confidence.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

What's Your Business Really Worth? Valuation and Succession Planning

Before you can even think about who's taking over the reins, you need to know exactly what those reins are attached to. Getting a precise, professional business valuation is the absolute bedrock of a solid estate plan for any business owner. This isn't just about slapping a price tag on your company for a potential sale. It's the critical number that fuels everything else: funding buy-sell agreements, figuring out potential estate tax hits, and making sure any transfer of ownership is fair for everyone involved.

Frankly, without an accurate valuation, even the most brilliant plans can crumble. You risk sparking family feuds, leaving buyouts underfunded, and getting blindsided by massive tax bills.

Getting a Handle on Your Company's Value

When it comes to figuring out what your business is worth, there’s no single magic formula. Instead, appraisers have a few trusted methods in their toolkit. A crucial first step in any succession plan is understanding how to value a business accurately to ensure the whole transition is equitable and smooth.

Here is a step-by-step look at the three main approaches, broken down simply:

- Asset-Based Approach: This is the most straightforward of the bunch. It’s basically a balance sheet calculation: take your total assets and subtract your total liabilities. This method is often the go-to for businesses heavy on physical assets, like real estate holding companies or manufacturing plants.

- Market-Based Approach: Think of this like a realtor pricing a house by looking at "comps" in the neighborhood. An appraiser compares your business to similar companies that have been sold recently. This works best when there's good data available on comparable sales in your industry.

- Income-Based Approach: This method looks to the future. It calculates your business's value based on its projected future earnings or cash flow. It’s a common choice for service businesses or companies with strong, predictable revenue streams.

A seasoned appraiser will typically blend these methods to land on a valuation that's both realistic and legally defensible. This isn't a DIY weekend project. An official valuation from a certified professional is non-negotiable if you're serious about your estate plan.

Don't Wait Until It's Too Late

So many business owners know they need to do this, but they keep pushing it down the to-do list. Recent research shows just how common this regret is. A staggering 40% of owners who sold their businesses wished they had started estate and tax planning sooner, and 38% wished they had given themselves a longer runway for the transition.

The good news? The tide is turning. 60% of business owners have had their business formally valued in the last two years—a huge leap from just 18% in 2013. You can dig into more of these findings in the BNY Wealth Management report.

The value of your business is a moving target. Getting a professional valuation is not a one-time event but a recurring necessity, especially as your business grows and market conditions change.

The Big Question: Who's Next in Line?

Once you've got a firm number on your company's value, you face what might be the most personal question of all: who will take over? This decision dictates every other piece of your succession plan. The paths generally lead to family, key employees, or an outside buyer.

- Passing the Torch to Family: For many founders, this is the dream. But it requires a brutally honest assessment. Does your child or relative truly have the passion, the skills, and the business savvy to lead? Naming a successor based on emotion instead of merit is a fast track to jeopardizing the company you built.

- Selling to Your Key People: Your trusted managers or long-time employees might be the perfect fit. They already know the business, the culture, and your clients inside and out. A management buyout can be a fantastic way to reward loyalty and ensure a smooth continuation of your legacy.

- Prepping for an Outside Sale: If you don't have a clear internal successor, preparing to sell to a third party is the logical move. This means getting your financials in pristine, audit-proof condition and making sure the business can hum along perfectly without you in the corner office.

No matter which road you take, writing it all down is absolutely critical. This is where a formal business succession plan comes in. It's the written playbook that outlines who takes over, under what conditions, and how that transition will happen. Having this plan provides clarity for your family, your team, and your stakeholders, heading off the conflicts that always seem to bubble up from uncertainty.

For a practical starting point, check out our guide on creating a business succession plan template. It’s designed to ensure your wishes are followed in line with Texas law and sound fiduciary principles.

Crafting Effective Buy-Sell Agreements

Ever heard of a prenuptial agreement for your business? That's exactly what a buy-sell agreement is. Think of it as a legally binding contract that lays out a clear, predetermined exit strategy for you and your partners. It kicks in during a "triggering event" like a death, disability, or retirement.

Without one, you're essentially gambling with your company's future. You could force your partners into business with your heirs or spark messy, expensive court battles over the company's value. It gets ugly, fast.

For any business owner serious about estate planning, a well-drafted buy-sell agreement isn't just a good idea; it's a non-negotiable tool for stability and continuity. It protects your family by guaranteeing a fair buyout price, and it shields the business by preventing a chaotic scramble for control.

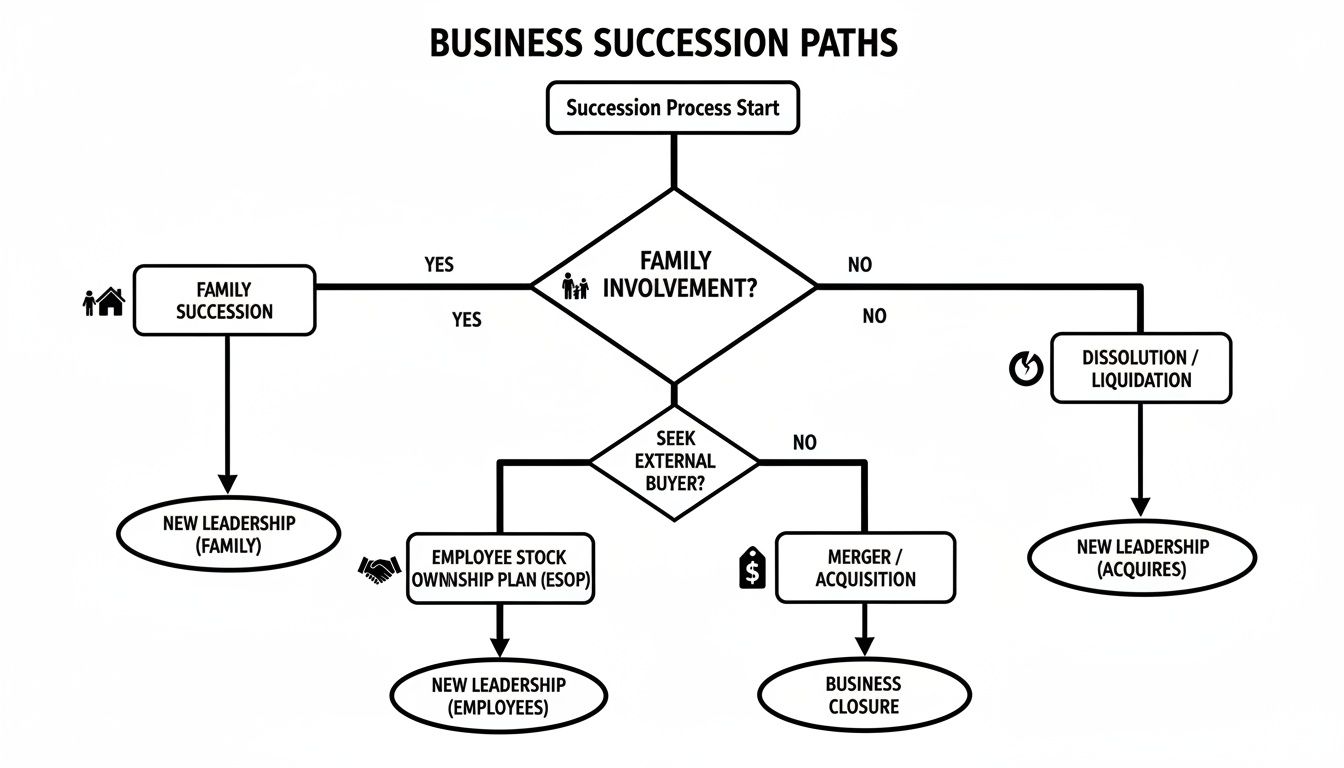

This flowchart maps out the main succession paths you'll need to consider, and a buy-sell is the document that makes your choice official.

Whether you plan to keep the business in the family, sell to your trusted employees, or bring in an outside buyer, you need a legally sound mechanism to make the transfer happen. This decision tree makes that crystal clear.

Key Types of Buy-Sell Agreements in Texas

Down here in Texas, these agreements usually take one of three forms. Each has its own structure and affects the business and its owners differently. To see how this works in the real world, let's imagine a Dallas-based tech startup with three equal partners: Alex, Ben, and Carla.

- Cross-Purchase Agreement: This is where the remaining owners personally agree to buy the departing owner’s shares. If Alex were to pass away, Ben and Carla would each be on the hook to purchase half of Alex’s shares directly from his estate. This is most often funded by each partner owning a life insurance policy on the others.

- Redemption Agreement: With this setup, the business entity itself agrees to buy back the departing owner's shares. If Alex died, the company would use its own funds (or cash from a life insurance policy it owns on Alex) to purchase his shares. It's a simpler approach, especially if you have a lot of partners, since there's only one buyer.

- Hybrid Agreement: This model is the most flexible, mixing elements of the other two. Typically, it gives the company the first right of refusal to buy the shares. If the company passes or can't afford the whole lot, the remaining owners then have the option (or obligation) to buy the rest.

Picking the right structure comes down to things like the number of owners, your company’s cash flow, and tax implications. A Texas estate planning attorney can sit down with you and figure out which approach makes the most sense for your long-term goals.

Crucial Components of a Rock-Solid Agreement

A buy-sell agreement is far more than a handshake deal memorialized on paper. It has to be a detailed document that leaves zero room for interpretation.

A vague buy-sell agreement is almost as dangerous as having no agreement at all. The goal is to provide absolute clarity during a time of crisis, not to create more questions.

Here are the non-negotiable elements every agreement must nail down:

- Triggering Events: The contract must spell out exactly what events activate the buyout. Common triggers include death, long-term disability, retirement, and even divorce (to keep an ex-spouse from becoming an unwelcome partner), personal bankruptcy, or an owner simply deciding to leave.

- Valuation Formula: This is a big one. How will the business be valued when a trigger occurs? The agreement must specify the method—whether it’s a fixed price that's updated annually, a formula based on earnings or revenue, or a mandate to hire an independent appraiser. Locking this in prevents nasty fights over what the shares are really worth.

- Payment Terms: It needs to detail exactly how the buyout will be funded. Is it a lump-sum cash payment? Or will the payments be made over time through an installment note with a specific interest rate?

- Funding Mechanism: This might be the most critical piece of all. Where is the cash for the buyout actually coming from? Without a clear funding plan, the agreement is just an empty promise that could easily bankrupt the company.

Funding Your Buy-Sell Agreement

A buyout obligation without the money to back it up can cripple a business. The three most common funding methods each have their own pros and cons.

- Life and Disability Insurance: This is often the most effective and affordable route. For a cross-purchase plan, each owner buys a policy on the other owners. For a redemption plan, the company buys a policy on each owner. When an owner passes away, the tax-free death benefit provides the exact cash needed for the buyout. Simple and clean.

- Cash Reserves: The company can set aside cash in a sinking fund to cover a future buyout. While this means no ongoing premium payments, it also ties up a ton of working capital that could otherwise be used for growth. It can also create tax headaches if too much cash accumulates.

- Installment Notes: The agreement can stipulate that the buyout will be paid out over several years. This definitely eases the immediate financial burden, but it also means the departing owner's family won't see the full value right away. They'll have to rely on the company's future success for payment, which adds risk.

For a deeper dive into structuring these critical documents, feel free to review our buy-sell agreement template as a solid starting point for discussions with your legal team. Crafting an effective agreement is a cornerstone of responsible estate planning for business owners.

Weaving Your Business and Personal Plans into a Single Legacy

Think of your business and personal assets as two sides of the same coin. They aren't separate islands; they're deeply connected parts of the life and legacy you've built. Too often, business owners treat them as distinct, creating estate plans that inadvertently sabotage each other. A truly effective plan weaves these two worlds into one cohesive strategy.

The primary way we accomplish this is through a combination of trusts and wills. This approach lets you control exactly how your business interests are managed and passed on alongside your personal wealth. The goal here is simple: create a unified plan that protects both your family and the company you poured your life into, leaving no room for conflict or confusion.

Trustee Responsibilities: Using Trusts to Hold and Protect Your Business

One of the most powerful tools in our playbook for this kind of integration is the Revocable Living Trust. It’s a remarkably effective strategy. You simply transfer ownership of your business interests—whether that’s your stock in a corporation or your membership units in an LLC—into the name of your trust.

This one move, just retitling the assets, sidesteps the entire public and often painfully slow probate process here in Texas. When you pass away, the successor trustee you’ve already chosen can step in immediately to manage the business. There’s no waiting for a court to give the green light, which can be the difference between a smooth transition and a business grinding to a halt.

Here’s a step-by-step breakdown of what that looks like in the real world:

- Total Privacy: A will becomes a public court record once it hits probate. A trust, on the other hand, is a private document. The details of your business succession plan stay confidential, exactly where they belong.

- Speed and Efficiency: Your successor trustee can manage or sell the business according to your private instructions without the delays of probate court. For a business, that kind of stability is everything.

- Unwavering Control: You lay out the rules. You say who takes over and what they can and can’t do, all within the protective framework of the Texas Trust Code.

Choosing the right person for these jobs is paramount. Your trustee needs to understand their fiduciary duties in Texas, but they also need the business savvy to oversee your company during a critical transition. Finding a trustee with that blend of legal knowledge and business sense is one of the most important decisions you'll make.

The Pour-Over Will: Your Ultimate Safety Net

Even the most buttoned-up estate plan can have a few loose ends. It's easy to miss an asset or acquire a new one right before you pass away. That's where a Pour-Over Will comes in as an essential safety net.

Think of it as a special type of will with one simple job: to catch any assets not already in your trust and "pour them over" into it after your death. This ensures that every last asset is ultimately handled according to the terms of your trust, keeping your unified plan intact. While this will does go through probate, it’s a much simpler process because it has only one beneficiary: your trust.

Advanced Planning for Tax Savings and Asset Protection

For business owners with more complex estates or those funding a buy-sell agreement, we can bring in some more advanced strategies to maximize tax efficiency and protection. A classic example is the Irrevocable Life Insurance Trust (ILIT). A Texas trust administration lawyer can be an invaluable partner in this process.

An ILIT is a sophisticated tool that allows business owners to house life insurance policies outside of their personal estate. By placing the policies inside the trust, the death benefit is paid directly to the trust, not to your estate, which means it isn’t counted for estate tax purposes.

This single strategy can save your family a massive amount in estate taxes, preserving more of the wealth you worked so hard to build. The ILIT’s trustee then uses the insurance money to buy your share of the business from your estate. This provides your family with immediate cash while executing the succession plan perfectly. Our attorneys can walk you through the specifics of how to transfer business ownership and how to modify a trust in Texas using these powerful legal structures.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

What If You're Still Here, But Not in Charge? Incapacity & Asset Protection

We spend a lot of time in estate planning talking about what happens after you're gone. But what happens if you're still alive, but an accident or illness leaves you unable to run your business?

This is the scenario that keeps a lot of business owners up at night. One bad day can create an immediate leadership vacuum, throwing everything you've built into chaos.

Without clear, legally enforceable instructions, your family could be forced into a lengthy and expensive court battle just to get a guardianship. Imagine them trying to get a judge's permission simply to sign payroll checks. It’s a nightmare. This is why planning for incapacity isn't just a "nice-to-have"—it's an absolute must.

The Power of Attorney: Your Most Important Stand-In

In Texas, the Power of Attorney (POA) is the tool we use to grant someone you trust—your "agent"—the legal authority to act on your behalf. But for a business owner, a generic, one-size-fits-all POA is basically useless. You need specific documents for specific jobs.

- Durable Power of Attorney: This is for your financial and business life. The word "durable" is key; it means the document stays in effect even if you become incapacitated. You can give your agent sweeping authority or very specific powers, like managing business bank accounts, signing contracts, and keeping payroll going.

- Medical Power of Attorney: This is only for healthcare decisions. It empowers your agent to make medical choices for you when you can't.

Let me be crystal clear: these must be separate documents. Your brother with the medical POA has zero authority to sign a business check. And the standard durable POA you downloaded online probably doesn't grant the specific authority needed to truly run your company. Details matter.

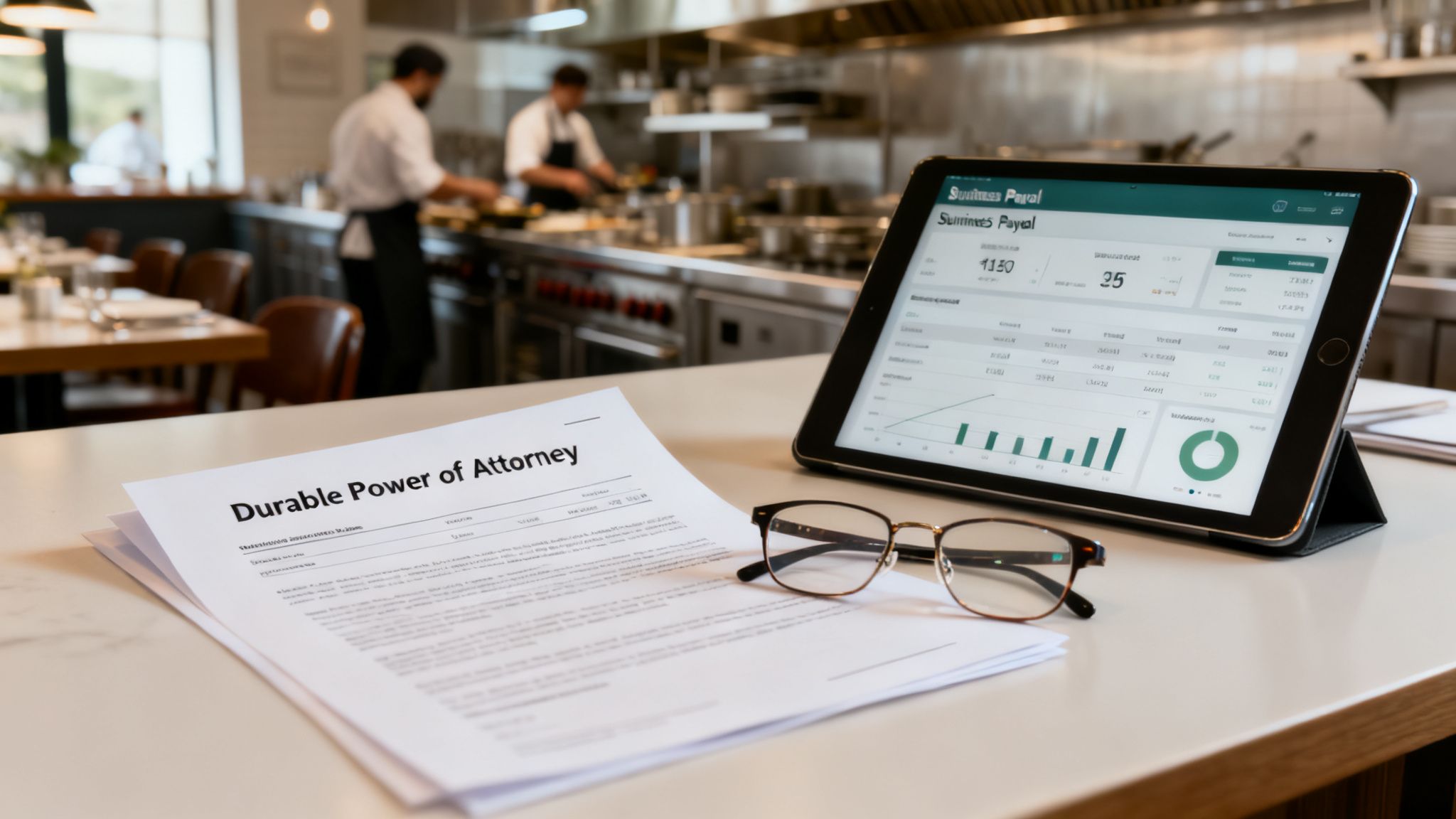

A Real-World Story: When Incapacity Strikes

I worked with the owner of a popular Houston restaurant. She had a massive stroke and couldn't communicate or make decisions for months. It could have been the end of her business.

Fortunately, she had a comprehensive plan. Her brother, named in a robust Durable Power of Attorney we drafted, stepped in immediately. He paid suppliers from the business accounts, handled payroll without a hitch, and even renewed the restaurant's lease. Meanwhile, her husband used the Medical Power of Attorney to make crucial healthcare decisions that honored her wishes.

Without those documents, the restaurant would have bled out while the family fought in court for control.

Planning for incapacity isn't about being pessimistic. It's about maintaining control. You ensure the person you trust has the power to protect your legacy and your health when you are completely vulnerable.

Building a Fortress Around Your Assets

Beyond incapacity, a core goal of estate planning for business owners is building a fortress. You have to shield your personal wealth from business liabilities and, just as importantly, protect your business from personal liabilities. This is the art of strategic asset protection.

The most basic layer of defense is your business structure. If you’re still operating as a sole proprietorship, you're playing with fire—you are personally on the hook for every business debt and lawsuit.

- Limited Liability Company (LLC) or Corporation: This is non-negotiable. Forming a proper entity like an LLC or a corporation creates a legal "liability shield." It draws a bright line between your business assets and your personal assets (your home, your savings). If the business gets sued, creditors generally can't cross that line to come after your personal property.

Taking Protection to the Next Level with Trusts

Trusts add another powerful layer to your fortress. By transferring your business ownership or other key assets into a properly structured irrevocable trust, you can legally remove them from your personal balance sheet. This can place them beyond the reach of future personal creditors.

This strategy is incredibly valuable for isolating the business from personal risks—think a nasty divorce or a catastrophic car accident that leads to a lawsuit. A skilled Texas estate planning attorney can design a trust that works with the Texas Trust Code to give you maximum protection for your unique situation.

When you combine the right business entity with smart trust planning, you create a formidable defense. You build a structure that can withstand the unexpected threats that can derail even the most successful business owners.

If you’re ready to protect what you’ve built, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of this critical process.

Your Action Plan for Securing Your Legacy

Knowing you need an estate plan is one thing. Actually building one is something else entirely. It’s the leap from theory to action that truly protects everything you’ve built. Procrastination is, without a doubt, the biggest threat to your business legacy, but you don't have to tackle this alone. We can break it down into a clear, manageable game plan.

Your first move? Assemble your "A-Team." This isn’t a solo mission. You’ll need a Texas estate planning attorney to architect the legal framework, a sharp CPA to navigate the tax implications, and a trusted financial advisor to make sure the entire strategy aligns with your long-term wealth goals. Once that team is in place, you can move forward with real confidence.

Creating Your Implementation Timeline: Step-by-Step Guidance

A realistic timeline is your best defense against feeling overwhelmed. It keeps the ball moving forward without the pressure of trying to do everything at once. While every business is different, this structured approach generally keeps the process on track.

- Phase 1 (The First 30 Days): This is all about getting clear. You'll have your initial consultations with your advisory team to nail down your succession goals. The big question to answer here is: who do you want to take over, and under what specific circumstances?

- Phase 2 (Days 30-90): Now it's time for valuation and documentation. You'll bring in a professional appraiser for a formal, defensible business valuation—no guesswork allowed. As that's happening, your attorney will get to work drafting the core documents, like your buy-sell agreement, will, and any necessary trusts.

- Phase 3 (Days 90-120): This is the funding and execution stage. It’s where you’ll put the final pieces in place, like securing life insurance policies to fund the buy-sell agreement. Then comes the most important part: formally signing all your estate planning documents, from your will and trusts to your powers of attorney.

The Real Cost of Doing Nothing

It's a strange paradox. Most business owners know they need a plan, but something holds them back from acting. The numbers are telling: a staggering 63% of owners feel it's 'too early' to plan, and 45% say they're simply 'too busy'.

But with nearly half of all business owners looking to exit within the next five years, that delay is a ticking time bomb. You can dig into more of these eye-opening business owner exit planning statistics to see just how big the risk is.

Taking that first step is usually the toughest part, but it’s a step you don’t have to take by yourself. Our team is here to walk you through each phase, making sure your life's work is protected for the generations to come.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

Common Questions About Texas Business Estate Planning

When you start mixing your business with your personal legacy, a lot of questions pop up. It's only natural. Let's tackle some of the most common ones I hear from Texas business owners just like you.

When to Modify or Terminate a Trust or Plan

Think of your estate plan like your business plan—it's not a "set it and forget it" document. You should be giving it a hard look at least every three to five years.

Of course, life doesn't always wait that long. Certain events should have you calling your attorney immediately. These include a big jump (or dip) in your business's value, the death of a partner, a divorce, a new child, or whenever Austin or D.C. decides to shake up the tax laws. Regular check-ins keep your plan sharp and perfectly aligned with where your business and your life are today.

Can I Have a Co-Trustee Run the Show?

Absolutely, and for many business owners, this is the smartest play. You can appoint someone who gets your family—like your spouse or an adult child—to serve alongside a professional or corporate trustee who lives and breathes business management.

It's a brilliant checks-and-balances system. You get the personal touch and family insight paired with unbiased, professional expertise. This dual approach ensures the business is managed just as you'd want while upholding the strict fiduciary duties required in Texas.

What if I Don't Have a Buy-Sell Agreement?

Rolling the dice without a buy-sell agreement is a dangerous game. If you pass away, your chunk of the business typically goes to your heirs through your will, which means wading through the probate process.

Suddenly, your surviving partners could find themselves in business with your spouse or kids, who might not know the first thing about running the company—or even want to. This almost always sparks ugly disputes over what your shares are worth. The worst-case scenario? A judge could force a liquidation of the entire business just to pay out your heirs, torching the legacy you spent a lifetime building.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.