Bringing a Texas trust to a close is a formal legal process, not just a matter of handing out the remaining assets and calling it a day. Managing a loved one’s trust can feel overwhelming — but with the right legal guidance, it doesn’t have to be. Officially dissolving a trust requires following the rules set by the Texas Trust Code and, just as importantly, adhering to the specific instructions left behind in the trust document itself. This step-by-step process ensures the creator's final wishes are honored to the letter.

Navigating the End of a Texas Trust

Dealing with the final stages of a loved one's trust can feel like a heavy burden, but you don't have to walk that path alone. The first step to making this a smooth process for everyone is simply understanding what lies ahead. A trust isn't meant to last forever; it's a legal tool with a specific job and a finite lifespan. When that job is done or circumstances have changed, closing it down is the final, necessary chapter in its story.

This guide is designed to give you a clear, practical look at how to terminate a trust in Texas. Our mission is to cut through the legal jargon and empower you with the knowledge you need, whether you're a trustee fulfilling your duties or a beneficiary awaiting a final distribution. We want to make you feel informed and secure in your next steps.

Why Do Trusts End?

A trust can reach its end for several reasons, and each scenario comes with its own set of legal steps. The path to termination depends on the type of trust you're dealing with and what specific events trigger its conclusion.

Here are a few common reasons a trust might be terminated in Texas:

- The Mission is Accomplished: The trust did exactly what it was set up to do. For example, a trust created to fund a grandchild's college education can be terminated once that final tuition payment has been made. The trust's purpose is fulfilled.

- A Specific Date or Event Occurs: The trust document might have a built-in expiration date, such as terminating when the youngest beneficiary turns 30, or it could be tied to an event, like the death of the primary beneficiary.

- The Trust Assets are Depleted: All the trust's assets have been properly paid out to the beneficiaries according to the trust's terms. There's simply nothing left to manage.

- All Beneficiaries Agree to End it Early: Sometimes, all beneficiaries can unanimously agree to terminate the trust ahead of schedule. As a practical matter for families, this is a common approach but requires careful adherence to the Texas Trust Code.

Revocable vs. Irrevocable Trusts

The process for how to terminate a trust changes dramatically depending on one key factor: is it revocable or irrevocable?

A revocable trust, often called a living trust, is the most flexible type. The person who created it (the grantor) holds all the cards. They can change the terms, add or remove assets, or dissolve it entirely at any point while they are alive and mentally competent.

On the other hand, irrevocable trusts are built to be rigid. By their very nature, they can't be easily altered or terminated after they're created. This structure is a powerful tool for specific goals like asset protection or minimizing estate taxes. Trying to end an irrevocable trust before its designated time is a complex affair that might require a court order or the unanimous consent of every single beneficiary. This is not DIY territory; you'll want a knowledgeable Texas trust administration lawyer in your corner to navigate these much stricter rules.

When to Modify or Terminate a Trust in Texas

Terminating a trust in Texas isn't as simple as closing a bank account. The decision must be rooted in solid legal ground as laid out by state law. The Texas Trust Code provides a clear framework for when and how a trust can be dissolved, ensuring the original creator’s intent is honored while recognizing that life circumstances can change.

Understanding these legal reasons is the first step for any trustee or beneficiary considering this path. The reasons can range from the trust’s original purpose becoming impossible to a situation where every beneficiary agrees it's time to move on.

When a Trust Has Run Its Course

Sometimes, a trust simply outlives its usefulness or becomes impossible to manage as originally intended. The law recognizes these practical realities and allows for termination in several key situations.

A court can step in and order a trust terminated if its purpose has become illegal, impossible to fulfill, or has already been fulfilled. For instance, a trust was created to pay for specific medical treatments for a family member, but those treatments are no longer needed. This is a perfect example of a trust whose primary mission is complete, making it a prime candidate for termination.

Likewise, a trust can be dissolved if its purpose becomes wildly impractical. Imagine a trust set up to maintain a family beach house in Galveston. If a hurricane destroys the property and the family has no plans to rebuild, continuing the trust would be senseless, and a court would almost certainly agree to terminate it.

The bottom line: The Texas Trust Code is built for the real world. It won’t force a trust to continue when its original mission is no longer relevant, achievable, or even legal. This is a crucial protection for trustees, who are not stuck with impossible duties, and for beneficiaries, who are not blocked from assets locked away for no good reason.

Getting Everyone on Board: Termination by Beneficiary Consent

One of the most common ways to end an irrevocable trust before its scheduled end date is to get every single beneficiary to agree. Under the Texas Trust Code, specifically Section 112.054 of the Texas Property Code, a trust can be terminated if all beneficiaries consent and its continuation isn't necessary to achieve any important, unfulfilled purpose of the trust. This pathway is behind a significant number of voluntary trust terminations. You can find more insights about trust and estate trends from recent analyses.

But "unanimous consent" has a strict legal meaning. It means every single person with an interest in the trust—both current beneficiaries enjoying the benefits now and future beneficiaries who might inherit down the road—must be on board.

This can get tricky if a beneficiary is a minor or lacks the legal capacity to make decisions. In those cases, a guardian or a court-appointed representative must consent on their behalf. This usually requires a judge's approval to ensure the decision is truly in that beneficiary's best interest—a critical safeguard under Texas law.

When Life Throws a Curveball: Unforeseen Circumstances

Life is unpredictable, and sometimes events occur that the trust's creator (the grantor) could never have anticipated. The Texas Trust Code accounts for this, allowing a trust to be modified or even terminated if unforeseen circumstances arise. If sticking to the original terms would defeat or seriously undermine the trust's goals, the law provides a path forward.

Real-World Scenario: A Special Needs Trust

Consider a special needs trust established for a beneficiary with a significant disability. Its primary purpose is to provide for their care without jeopardizing essential government benefits like Medicaid.

Now, imagine years later there's a medical breakthrough, and the beneficiary makes a full recovery. They are independent, working, and no longer need government assistance. The entire reason for the trust—to supplement public benefits without disqualifying them—is now moot.

In this situation, the beneficiary could petition a Texas court to terminate the trust. The argument would be that their unforeseen recovery makes the trust's restrictive rules unnecessary and that receiving the assets directly would better serve their needs. This is a perfect example of how the law acts as a safety valve for situations the grantor couldn't have predicted, which aligns with our firm's experience in guardianship and planning for incapacity.

Now, let's break down some of these legal pathways. Figuring out which justification fits your situation is key, and it's not always straightforward.

Pathways to Trust Termination in Texas

Here's a look at the common legal grounds for terminating an irrevocable trust in Texas, comparing what’s required for each.

| Termination Method | Key Requirement | Common Scenario Example |

|---|---|---|

| Purpose Fulfilled | The original objective of the trust has been fully accomplished. | A trust was created to fund a grandchild's college education. The grandchild has now graduated and all expenses are paid. |

| Purpose Impossible/Illegal | The trust's objective can no longer be legally or practically achieved. | A trust set up to maintain a specific property that was destroyed by a natural disaster and cannot be rebuilt. |

| Unanimous Beneficiary Consent | All current and future beneficiaries agree to terminate, and no material purpose of the trust remains. | Siblings who are the sole beneficiaries of a trust agree they would rather manage their shares of the inheritance directly. |

| Unforeseen Circumstances | A situation arises that the grantor did not anticipate, and continuing the trust would impair its purpose. | A beneficiary of a special needs trust experiences a full medical recovery, making the trust's protections unnecessary. |

Understanding these distinctions is the first step, but applying them to a real-life trust document and family situation requires a trained eye. An experienced Texas estate planning attorney can analyze the trust document, assess your specific circumstances, and map out the most effective and compliant path forward.

Trustee Responsibilities Under Texas Law: A Roadmap for Winding Down a Trust

When a trust is ready for termination, your role as trustee shifts into its final, most critical phase. You have a legal and ethical obligation—your fiduciary duties in Texas—to manage this conclusion with absolute precision. This step-by-step guidance is about honoring the trust creator's legacy and ensuring every beneficiary is treated fairly under Texas law.

Think of the following as your personal checklist for the wind-down process. It’s designed to ensure every detail is handled correctly, protecting both you and the beneficiaries from any future complications.

The Wind-Down Checklist

Winding down a trust demands meticulous organization. Rushing through these final steps could lead to significant legal and financial consequences, including personal liability.

Here’s where your focus needs to be:

- Conduct a Final Inventory: Your first task is to identify and value every single asset left in the trust. This includes everything from real estate and bank accounts to stocks, bonds, and personal property.

- Settle All Debts and Liabilities: Before a single beneficiary receives their distribution, all the trust’s outstanding debts must be paid off. This includes final administrative costs, professional fees, and any legitimate claims from creditors.

- File Final Tax Returns: The trust is its own taxable entity. It’s your job to file its final income tax return (Form 1041) and pay any taxes owed. Missing this step can create significant problems with the IRS.

- Prepare a Final Accounting: Transparency is crucial. A final accounting is a detailed report showing all financial activity since the last accounting period. It must clearly lay out all income, expenses, and the distributions you propose to make.

Remember, meticulous record-keeping isn't just a good habit; it's your legal shield. Document every decision, every transaction, and every communication.

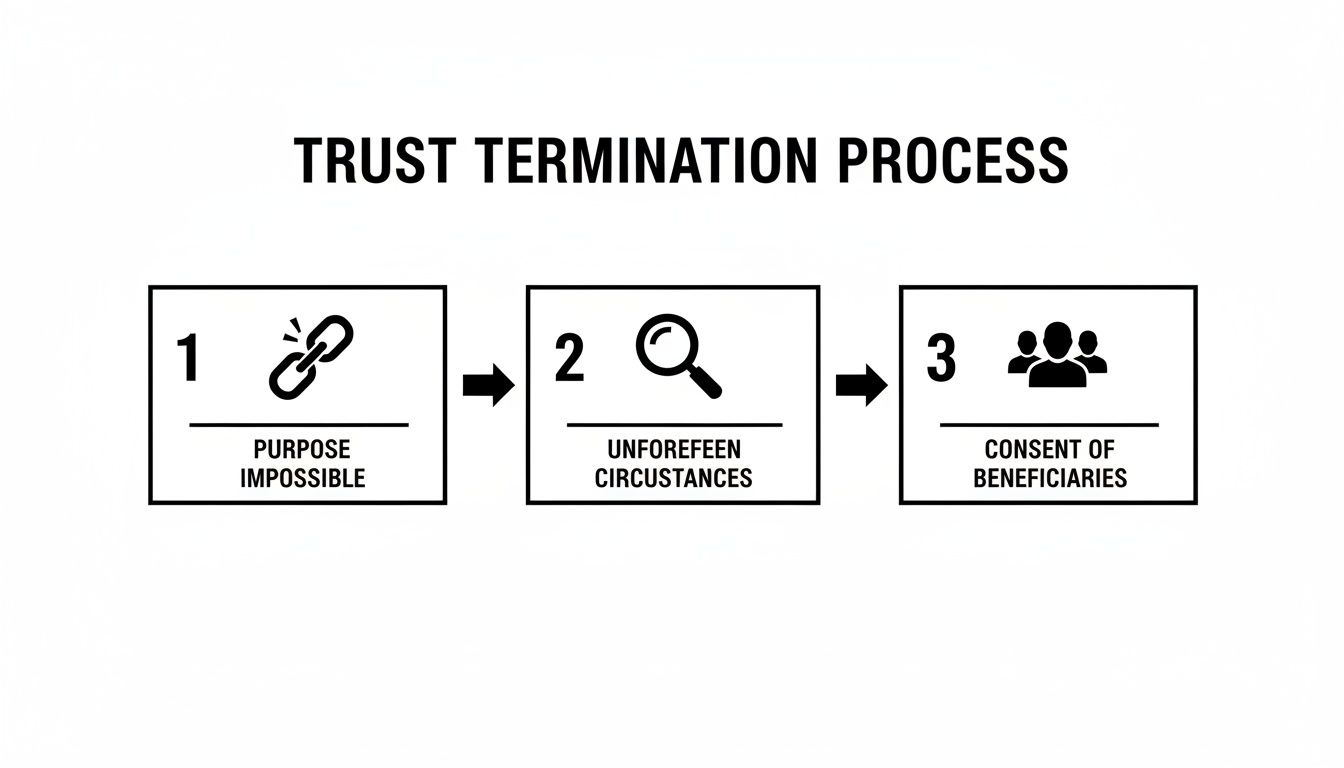

The flowchart below shows some of the key reasons the trust termination process gets started here in Texas.

This visual breaks down the main legal pathways—the purpose becoming impossible, unexpected changes, or simple agreement among beneficiaries—that signal it’s time for a trustee to begin the wind-down.

Notifying and Communicating with Beneficiaries

Clear, consistent communication is one of the most important trustee duties and responsibilities in Texas. Keeping everyone in the loop builds trust and dramatically reduces the risk of suspicion or conflict. This isn’t just a courtesy; it’s a legal requirement.

Under the Texas Trust Code, trustees must provide beneficiaries with a final accounting. This gives them a chance to review your actions and raise any objections before the trust is closed. Following these simple notice and reporting rules can prevent the vast majority of potential disputes.

Key Takeaway: Proper beneficiary communication and accounting are not optional. They are mandatory steps that protect you as the trustee while upholding the rights of the beneficiaries. Failing to provide a clear and accurate accounting can open the door to legal challenges down the road.

Once your final accounting is ready and you’ve shared it with the beneficiaries, the next move is to get their official sign-off.

Securing a Release of Liability

After the beneficiaries have had a chance to review the final accounting and get their questions answered, you’ll want to ask them to sign a "receipt and release" document.

By signing this form, they’re officially acknowledging that they’ve received their full distribution, they approve of how you managed the trust, and they release you from any future liability related to your role as trustee.

Getting a signed release from every single beneficiary is the final step that closes the book on your duties. It protects you from being second-guessed years from now. If a beneficiary refuses to sign, you may need to seek court approval to finalize the termination. That’s a process a Texas trust administration lawyer can easily guide you through.

Court Approval Versus a Private Agreement

The idea of dissolving a trust often brings to mind courtrooms and legal filings, but it doesn't always have to be that way. Not every trust termination needs a judge's sign-off.

Texas law offers flexible paths that can keep the process private, more affordable, and collaborative. Knowing the difference between going to court and using a private agreement is key to choosing a path that keeps conflict—and costs—to a minimum.

The best-case scenario for most families is a non-judicial settlement agreement. This is a powerful tool in the Texas Trust Code that lets everyone involved in the trust resolve matters, including termination, without ever setting foot in a courthouse. It's essentially a private contract between the beneficiaries and the trustee.

The Power of a Non-Judicial Settlement Agreement

A non-judicial settlement agreement is a streamlined, cooperative way to wrap up a trust. For it to be valid in Texas, the agreement cannot violate a material purpose of the trust, and its terms must be something a court would have approved anyway.

This route is a perfect fit when:

- Every beneficiary is an adult, legally competent, and everyone agrees on the plan.

- The trust's terms are fairly straightforward.

- The family dynamics are more cooperative than contentious.

When everyone works together, you can often resolve matters much faster and with significantly lower legal bills than with a formal court proceeding. This approach empowers families to take control, fostering goodwill instead of resentment.

So, When Is Court Intervention Necessary?

While private agreements are almost always preferred, sometimes involving the court is unavoidable. In certain cases, it's necessary to protect everyone involved. A trustee or a beneficiary might need to ask a judge to terminate or modify the trust when complexities arise that a simple agreement can't solve.

You'll typically need to head to court in situations like these:

- Beneficiary Disputes: If even one beneficiary objects to the termination or how assets are being divided, a judge will likely need to step in to settle the conflict.

- Minor or Incapacitated Beneficiaries: A minor cannot legally consent to ending a trust. In these cases, a court must appoint a representative (an ad litem) to ensure the minor's best interests are protected before approving anything.

- Ambiguous Trust Language: If the trust document was poorly drafted or its instructions are unclear, a court can provide a final, definitive interpretation of what the grantor intended.

- Trustee Protection: A trustee might seek court approval to get a judicial "blessing" on their final accounting and distribution plan. This provides a powerful shield against any future lawsuits from unhappy beneficiaries.

Navigating these kinds of disputes on your own is challenging. If you're facing a disagreement over a trust, our attorneys have deep experience in trust dispute resolution. We can help you understand all your options. Learn more about how we handle dispute resolution and litigation in Texas trusts to protect our clients.

An Advanced Strategy: Decanting the Trust

In some tricky situations, direct termination just isn't an option. But there's another creative solution: decanting. Think of it like pouring wine from an old bottle into a new, better one.

Under Texas law, a trustee with the right authority can "pour" the assets from an old, restrictive trust into a brand-new one with more favorable and modern terms.

For example, a trustee could decant assets into a new trust that includes a provision allowing for an easier termination process by the beneficiaries. This is an effective way to modernize an outdated trust, clear up ambiguities, or adapt to new circumstances without a complex court modification.

Decanting is an advanced technique. It demands a deep understanding of fiduciary duties in Texas and the specific language in the trust document. When used correctly by a knowledgeable Texas trust administration lawyer, it can be an incredibly effective tool for paving the way toward a much smoother termination down the road.

Final Accounting and Distributing Assets Correctly

The final accounting isn't just a spreadsheet; it’s the moment where your hard work and dedication as a trustee are formally documented. This step is a big deal. Under Texas law, it's a mandatory, comprehensive report that tells the story of every financial move you made for the trust. Think of it as your final act of transparency, building confidence and showing the beneficiaries you’ve managed things responsibly.

Your accounting needs to lay out all the income, expenses, gains, losses, and what you plan to distribute. The goal is simple: make it so clear that anyone can follow the money and understand how you arrived at the final numbers. This document is your ultimate record of good stewardship.

Crafting a Clear and Compliant Final Accounting

To put together an accounting that will sail through review, you need to have your paperwork in order. This isn't the time for guesswork; your report must be backed by solid proof.

Here's what you'll need to pull together:

- Bank and brokerage statements covering the entire accounting period.

- Receipts and invoices for every single expense paid by the trust—think professional fees, property repairs, you name it.

- Records of all income the trust received, like dividends, rent, interest, or capital gains.

- Valuation documents for assets without a clear price tag, like real estate or a family business, to lock in their final value.

How you present this information is just as important as gathering it. Grouping transactions into logical categories like "Income," "Administrative Expenses," and "Distributions" makes the report easier to digest. Providing this level of detail is a core part of your fiduciary duties in Texas and your best defense against any future disagreements.

A Note on Transparency: Always remember who you're writing this for: the beneficiaries. Avoid technical jargon and keep the numbers straightforward. The clearer your report, the smoother the final sign-off will be.

If you want to get into the details of what’s required, we’ve put together a guide on the specifics of a trust accounting in our detailed article. It’s a great resource for understanding your full reporting duties under Texas law.

The Final Step: Distributing Trust Assets

Once the beneficiaries have given your final accounting the green light, it’s time to distribute the remaining assets. This is the last major task you'll perform as trustee, and getting it right is crucial. The process depends on what kind of assets you're dealing with.

For instance, distributing a house means preparing and filing a new deed to transfer the title from the trust to the beneficiary. This is a formal legal document that must be recorded with the county clerk. For investment accounts, you'll work directly with the financial institution to transfer ownership, a process that usually requires special paperwork.

Beyond the trust's own accounting, a good settling an estate checklist can be a lifesaver for navigating all the other financial and legal tasks that often come up when a trust is being terminated.

Handling Complex Distributions

Not every distribution is as simple as writing a check. You might encounter situations that need a delicate touch, especially when a beneficiary is a minor or has special needs. You generally can't just hand over a large sum of money or property to a minor. The trust document will likely guide you to transfer the assets into a custodial account under the Texas Uniform Transfers to Minors Act (UTMA) or perhaps into another trust set up just for them.

It's a similar story if a beneficiary receives government benefits for a disability. A direct, outright inheritance could disrupt their eligibility for those critical programs. In that scenario, the trust might require you to move their share into a special needs trust instead. These are exactly the kinds of complexities that make consulting with a Texas trust administration lawyer so important. We can help you navigate these rules to ensure you're fully compliant and protecting every single beneficiary.

Even the most careful trustee can hit a snag during the final stages of trust administration. While these errors are almost always unintentional, they can cause serious headaches—think significant delays, financial penalties, and even personal liability.

Knowing the common pitfalls is the best way to steer clear of them and ensure you wrap things up smoothly and by the book.

Terminating a trust is a high-stakes process where every detail matters. One wrong move can undo months of hard work, create friction with beneficiaries, and open you up to legal trouble. Dodging these common mistakes is absolutely critical to protecting yourself and honoring the trust creator's wishes.

Overlooking Creditors and Final Taxes

One of the riskiest moves a trustee can make is distributing assets to beneficiaries before settling all of the trust’s final debts. This means paying off any lingering creditor claims and—this is a big one—filing the trust’s final tax returns and paying whatever is owed.

Picture this: a trustee, eager to finalize everything, distributes all the cash and property left in the trust. A few months later, a final tax bill from the IRS arrives.

Now what? The trust is empty, with no assets left to cover the bill. Under Texas law, the trustee can be held personally liable for that tax debt because they distributed the funds too early. It's a stressful, messy, and completely avoidable situation.

Failing to Get Unanimous Consent

When you’re ending a trust with a private agreement instead of going through the courts, "unanimous" means exactly what it says. Every single beneficiary has to agree—and that includes anyone with a future or contingent interest. A common mistake is thinking you only need approval from the primary, current beneficiaries.

For example, a trustee might get the three adult children of the grantor to sign off on terminating the trust. But if the trust document says that if one of those children passes away, their share goes to their own children (the grantor's grandchildren), those grandchildren are now contingent beneficiaries.

If the trustee moves forward without their consent (or the consent of a court-appointed representative if they're minors), the entire termination agreement could be invalid. This kind of oversight can send you right back to square one.

Miscalculating the Final Payouts

Once all the bills, debts, and taxes are paid, the remaining assets must be distributed exactly as the trust document dictates. It's easy to misread the instructions, especially with complex formulas for dividing property. For instance, a trust might specify that distributions should be made per stirpes or per capita—two very different ways of splitting assets among family lines.

Using the wrong method could mean one branch of the family gets a windfall while another gets shortchanged. This isn't just a simple math error; it's a clear breach of your fiduciary duties in Texas and can easily spark disputes that require a judge to sort out. An experienced Texas trust administration lawyer can review the distribution plan before a single dollar is sent, ensuring everything is compliant and preventing these costly mistakes.

Questions We Hear All the Time About Ending a Texas Trust

As you approach the final stages of administering a trust, many specific questions tend to arise. Here are straightforward answers to the questions we hear most often from trustees and beneficiaries in Texas.

How Long Does It Take to Close Out a Trust in Texas?

The timeline can vary significantly. Simple trusts with cooperative beneficiaries and easy-to-liquidate assets can often be wrapped up in just a few months without court involvement.

However, more complicated situations involving a family business, disagreements among beneficiaries, or the need for a judge's approval can easily stretch the process to a year or longer. The keys to success are patience and being meticulous with every single detail.

What Are the Tax Implications When You Terminate a Trust?

Closing a trust always comes with tax duties you can't ignore. First, the trustee is responsible for filing the trust's final income tax return on Form 1041.

Beyond that, you have to consider what happens when assets are distributed. If the trust passes on appreciated assets—like real estate or a stock portfolio that has grown in value—it can trigger capital gains taxes. This is precisely why it's so important to have both a Texas trust administration lawyer and a good tax advisor in your corner. Navigating this alone can lead to expensive mistakes.

Can a Trustee Get Paid for Closing Down a Trust?

Absolutely. The Texas Trust Code is clear that trustees are entitled to receive reasonable compensation for their work, and that includes the significant effort involved in winding down and terminating the trust.

Any fee should be clearly and transparently detailed in the final accounting provided to all beneficiaries. Everyone should have the opportunity to review and approve it before the final distributions are made.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process. Give us a call for a free consultation.