Placing your property into a trust is a powerful step in securing your legacy, but the trust document itself is only the beginning. To make the trust effective, you must formally transfer the property's title from your name into the name of the trust. This essential process is called "funding the trust," and it’s what activates the protections you worked so carefully to create.

Without this critical step, your trust is simply an empty vessel. It cannot protect your assets, and your real estate will not avoid the public and often costly probate process in Texas. Managing a loved one's estate can feel overwhelming, but with the right legal guidance, funding your trust is a straightforward process that provides lasting peace of mind.

Why Funding Your Trust Is a Step You Can't Skip

Creating a trust is a foundational move for your family's future, but it's the act of funding it that brings your plan to life. An empty trust offers no protection. The real work—and the true benefit—comes from transferring your assets, like your home, into the trust's ownership.

This is the linchpin for achieving your estate planning goals. Think of your trust as a secure vault for your legacy; actually placing your most valuable assets inside is what makes it work.

The Heartbreak of an Unfunded Trust

Let me paint a picture for you. Imagine a Houston family meticulously creates a revocable living trust but never completes the final step of transferring their family home into it. When the parents pass away, their children are stunned to learn the house must still go through the public, expensive, and painfully slow Texas probate process.

The very outcome the trust was designed to prevent still happens. An unfunded trust is one of the most common and gut-wrenching mistakes we see in estate planning. It undermines your intentions and can leave your family facing the exact legal challenges you wanted to help them avoid. This is why working with a detail-oriented Texas estate planning attorney is so vital.

Key Benefits of Properly Funding Your Trust

When you properly transfer your property into the trust, you're ensuring the plan works exactly as you designed it. For Texas families, the advantages are clear and significant:

- Avoiding Probate: Assets legally owned by a trust bypass the probate court system entirely. This allows for a private, efficient, and typically far less expensive transfer of property to your beneficiaries.

- Ensuring Your Wishes Are Followed: A funded trust guarantees the property will be managed and distributed according to the specific rules you laid out in the trust agreement, overseen by the trustee you chose to carry out your wishes. This process is governed by the Texas Trust Code, which outlines the fiduciary duties in Texas that your trustee must uphold.

- Maintaining Family Privacy: A will becomes a public record once it is filed for probate. A trust, however, keeps your family’s financial affairs—what you owned and who inherits it—completely private.

- Adding a Layer of Protection: Once an asset is in the trust, it's legally owned by the trust, not you personally. Depending on the type of trust, this can offer a shield from potential creditors or legal claims, a key component of effective asset protection.

A trust is only as effective as the assets it holds. The act of transferring your property is what activates its power to protect your legacy and provide for your loved ones seamlessly.

Creating the trust and then funding it are two separate but equally vital parts of a complete estate plan. For a deeper dive, check out our guide on how to create a trust in Texas.

Gathering Your Essential Documents for the Transfer

Before you can officially move your property into a trust, you need to gather the right paperwork. Getting your documents in order upfront is the key to making the transfer seamless and legally sound. This isn’t just about administrative tasks; it’s about laying a solid foundation to prevent future complications.

Think of it like building a house—you wouldn't pour the concrete without a precise blueprint. Rushing this stage is a common mistake that often leads to title defects, frustrating delays, and completely avoidable legal fees.

Locating the Current Property Deed

First, you'll need the current deed to your property. This is the official document that proves you are the legal owner. It contains all the critical information that must be mirrored exactly in the new deed transferring the property to your trust.

You should have received a copy of this deed when you purchased the property. If you can't find it, don't worry. You can obtain a certified copy from the county clerk’s office in the Texas county where your property is located.

Obtaining the Exact Legal Description

A simple street address will not suffice for a legal property transfer in Texas. You need the property’s official legal description. This is a highly specific, detailed description that identifies your piece of land based on government surveys or recorded plats.

You'll typically find the legal description on your current deed. However, it's always a good idea to double-check it against the county clerk's records to ensure it's 100% accurate. Even a tiny error, like a single wrong digit in a lot or block number, can invalidate the transfer or create a "cloud" on the title, making it a nightmare to sell or mortgage the property later on.

Just recently, a Dallas couple we worked with discovered an old, forgotten lien on their property while gathering their documents. By identifying and resolving it then, they avoided what could have been months of delays and legal drama. It’s a perfect example of why this preparatory work is so important.

Your Signed Trust Agreement

You will also need a complete, signed copy of your trust agreement. This is the core of your estate plan, laying out all the rules, naming the beneficiaries, and defining the trustee's duties according to the Texas Trust Code. The new deed will refer to the trust by its exact name and the date it was created, so having this document ready is non-negotiable.

The trust's name must be written on the new deed precisely as it appears in the trust agreement. For instance, if your trust is named "The Smith Family Revocable Living Trust dated January 15, 2024," using a shorthand like "The Smith Trust" is incorrect and will cause legal problems.

To keep everything organized, we recommend creating a master list of all your documents. A comprehensive estate planning documents checklist is a great tool to ensure you don't miss anything.

Additional Necessary Information

Besides the main documents, have these other key details ready for the attorney drafting your new deed:

- Trustee Information: The full legal name(s) and address(es) of the current trustee(s).

- Mortgage Details: If there is a mortgage on the property, have your loan information handy. Federal law often protects you during this kind of transfer, but it's still wise to notify your lender.

- Property Tax Information: Your latest property tax statement is useful, as it contains your parcel identification number, which helps in cross-referencing records.

Gathering these items before you start streamlines the whole process, ensuring every detail aligns with Texas law and your personal goals for protecting your assets.

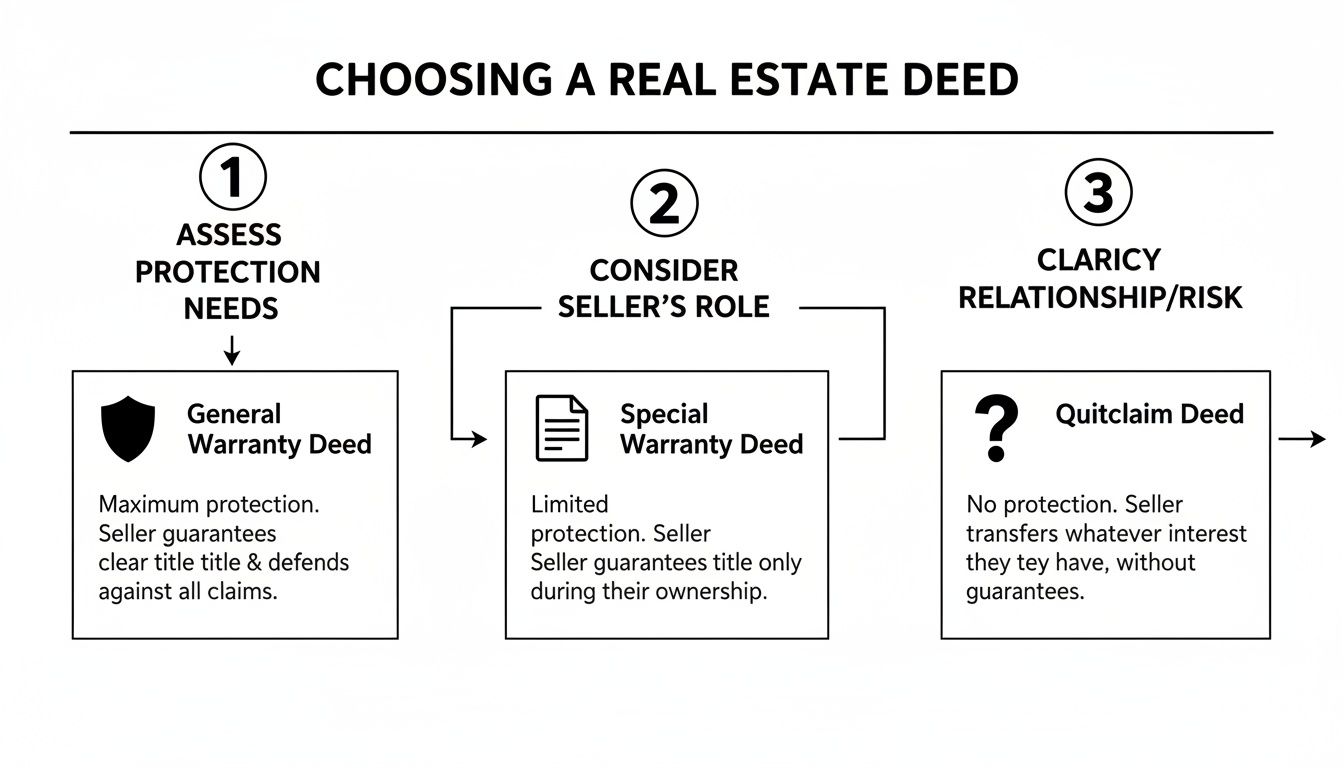

Choosing the Right Deed for Your Texas Property

The deed is the legal instrument that officially transfers your property's title from your name into your trust. In Texas, the type of deed you choose is incredibly important. This is not a one-size-fits-all situation; the right choice depends on the level of protection you want to provide for the property once it's held by the trust.

Picking the right deed is a critical step when you're learning how to transfer property to a trust. An incorrect choice—using a weak deed or imprecise language—could create a significant title issue for your family years from now. Such mistakes can cost a fortune in legal fees to correct.

Understanding General Warranty Deeds

A General Warranty Deed offers the highest level of protection for your trust. When you, as the "grantor," sign this deed, you are making powerful promises—or "warranties"—to the trust, the "grantee."

You are essentially guaranteeing that the title is free and clear of defects, not just during your ownership, but throughout the property's entire history. If an old title issue from a previous owner suddenly emerges, you are legally responsible for defending the trust against that claim. This makes it an exceptionally secure option for funding your trust with valuable real estate.

The Role of a Special Warranty Deed

A Special Warranty Deed is more limited but remains a very common and practical choice. With this deed, you only warrant the title against problems that arose while you personally owned the property.

You are not making any promises about what happened before you took ownership. It is often the perfect middle ground, giving the trust solid protection without you having to assume liability for unknown title defects from decades ago. For most individuals transferring property into their own revocable living trust, this deed strikes an ideal balance between security and practicality.

When a Quitclaim Deed Might Be Used

Finally, the Quitclaim Deed offers the least protection. When you use a quitclaim, you are simply transferring whatever interest you have in the property—if any—to the trust. You make zero warranties or guarantees about the title.

This deed essentially says, "I am giving the trust whatever I own, but I'm not promising the title is good or that I even have ownership." While quitclaims have specific uses, like clearing a potential "cloud" on a title or in divorce settlements, they are generally a poor choice for funding a trust because they leave the asset vulnerable to past claims.

Key Takeaway: The deed you choose directly impacts the legal security of your property once it's in the trust. A General Warranty Deed offers the strongest shield, while a Quitclaim Deed provides none. The best way to determine which is right for your situation is to consult with a Texas estate planning attorney.

To help you see the differences more clearly, let's break them down side-by-side.

Comparing Texas Deeds for Trust Funding

When you're transferring real estate into a Texas trust, the type of deed you use determines the level of legal protection the trust receives. This table compares the most common options to help you understand the key distinctions.

| Deed Type | Level of Protection for the Trust | Common Use Case | Key Consideration |

|---|---|---|---|

| General Warranty Deed | Highest. Guarantees a clear title throughout the property's entire history. | Transferring a primary family home where you want maximum security for your beneficiaries. | The grantor assumes liability for all past title issues, even from previous owners. |

| Special Warranty Deed | Moderate. Guarantees the title is clear only during the grantor's period of ownership. | A common and practical choice for transferring property into a personal revocable trust. | Strikes a balance, protecting the trust from recent issues without exposing the grantor to ancient ones. |

| Quitclaim Deed | None. Transfers any ownership interest the grantor might have without any promises. | Rarely recommended for initial trust funding; used more for resolving specific title issues. | Leaves the trust vulnerable; title insurance companies in Texas often won't insure a title based on a quitclaim. |

Ultimately, a General or Special Warranty Deed is almost always the better choice for ensuring the property is a secure and valuable asset for your beneficiaries.

Essential Components of a Texas Deed

No matter which type you choose, every deed in Texas must include specific elements to be legally valid under the Texas Property Code. Missing even one can invalidate the entire transfer.

- Grantor and Grantee Details: The deed must clearly name the grantor (you) and the grantee (your trust, using its full legal name and the date it was created).

- Consideration: You must state that something of value was exchanged. For a transfer into a trust, this is typically handled with language like, "for ten dollars and other good and valuable consideration."

- Granting Language: The deed needs the correct legal verbs to show you're conveying the property, such as "grant, sell, and convey."

- Legal Property Description: This is crucial. You must use the official legal description of the property from the county records, not just the street address.

- Grantor's Signature: You, the grantor, must sign the deed in front of a notary public.

Getting the deed right is the foundation of successful trust funding. For a deeper look into this topic, you can explore our detailed guide on real estate considerations in Texas estate planning. Nailing this step ensures your property is securely titled and your trust can work exactly as you planned.

Executing and Recording the Deed to Finalize the Transfer

You've had the deed drafted and reviewed. Now it's time for the final, critical steps that make the transfer legally binding: signing and recording. This part of the process is about careful, deliberate action. Getting this right is what officially moves your property from a personal asset into the protective ownership of your trust.

This isn't just a formality. Recording the deed puts the world on notice that the trust is the new legal owner. It's a crucial shield that protects the property from potential third-party claims and solidifies the trust's ownership under the Texas Property Code. If you skip this step, the transfer is incomplete and vulnerable.

Signing the Deed Correctly Before a Notary

For a deed to be valid in Texas, the grantor—the person transferring the property—must sign it in the presence of a notary public. This is a non-negotiable requirement. The notary's role is to verify your identity and witness your signature, then affix their official stamp and signature to the document.

Here are a few practical tips to ensure this goes smoothly:

- Don't Sign Ahead of Time: Wait until you are physically in front of the notary to sign the deed. A notary cannot legally notarize a signature they did not personally witness.

- Bring Your ID: You'll need a valid government-issued photo ID, such as a driver's license or passport. Ensure it is not expired.

- One Last Review: Before you sign, do one final review of the deed. Check that all names, dates, and the legal property description are perfect.

A simple mistake here, like signing in the wrong spot or forgetting the notary, can render the entire deed invalid, forcing you to start the process over.

This flowchart breaks down the common deed types in Texas and their different levels of protection.

As you can see, General and Special Warranty Deeds offer real protection, making them far better choices for funding a trust than the riskier Quitclaim Deed.

The Importance of Timely Recording

Once the deed is signed and notarized, the final step is to record it at the county clerk's office in the county where the property is located. Recording the deed officially places it in the public record, which legally completes the transfer and establishes the trust as the property's new owner.

Failing to record the deed is one of the most common and costly mistakes in Texas trust administration. An unrecorded deed is essentially invisible to the outside world, meaning it is not effective against future purchasers or creditors who have no notice of the transfer.

Key Insight: Imagine you sign a deed transferring your home to a trust but then file it in a drawer and forget about it. If a creditor later places a lien against you personally, they could argue the lien attaches to the house because, according to public records, you still own it. Recording the deed closes this dangerous loophole.

How to File with the County Clerk

Filing is usually a straightforward process, but it demands attention to detail. Most Texas county clerk websites post their specific requirements for formatting, margins, and filing fees. It’s always a good idea to check their site before you go in person or mail the document to avoid having it rejected.

Streamlining your real estate document processing can help ensure everything is accurate for both execution and recording. While you can often file the deed yourself, working with an experienced Texas trust administration lawyer guarantees it's done correctly the first time.

After the clerk accepts and records your deed, they will stamp it with the filing date and time and assign it a unique recording number. You will receive the original, stamped document back. This is your official proof that the property has been successfully transferred to your trust—the tangible result of your careful planning.

Navigating Mortgages, Taxes, and Homestead Rights

Putting your home into a trust is a cornerstone of smart estate planning, but it's natural to wonder how it affects the practical details of homeownership. For most Texas homeowners we work with, three key questions arise: What about my mortgage? Will I lose my property tax breaks? And what happens to my Texas homestead protection?

Fortunately, both federal and Texas laws have strong safeguards in place to make this process much smoother than you might think. Understanding these rules provides the confidence you need to move forward without stepping on any legal landmines.

Will Transferring My Property Affect My Mortgage?

The most common fear we hear is, "Will transferring my house to a trust trigger the 'due-on-sale' clause and force my bank to call the loan?"

Here's the good news: for most people using a standard living trust, this is not an issue. A federal law, the Garn-St Germain Depository Institutions Act of 1982, protects homeowners. It specifically prohibits lenders from accelerating your loan when you transfer residential property (with fewer than five units) into a revocable living trust, as long as you remain a beneficiary of that trust.

The Bottom Line: If you are a Texas homeowner setting up a typical revocable trust for estate planning, federal law protects you. Your lender cannot call your mortgage due simply because you moved the property's title into the trust's name.

Even with this legal protection, we always recommend giving your mortgage lender a courtesy notice. A simple letter informing them of the transfer, along with a copy of the recorded deed, is usually all it takes to keep their records updated and prevent any administrative confusion.

Protecting Your Texas Homestead Exemption

In Texas, our homestead exemption is more than just a tax break; it's a powerful shield against creditors and a fundamental property right. It's understandable to be concerned about losing this protection when placing your home in a trust.

Rest assured, you can maintain your homestead exemption. The Texas Property Tax Code is clear that you can keep this benefit on a primary residence held in a qualifying trust. The key is that the trust agreement must explicitly grant you, the creator of the trust, the right to use and occupy the property as your principal residence. Any well-drafted Texas trust will include this specific language.

Once the new deed is recorded, you will simply need to file an updated homestead form with your county appraisal district, listing the trust as the new owner. This simple step ensures your valuable property tax benefits continue without interruption.

Tax Implications and the "Step-Up in Basis" for Your Heirs

Properly transferring property is also critical for smart tax planning, especially when it comes to the capital gains taxes your beneficiaries might face in the future. While you're dealing with the transfer, you may need to fill out various tax information forms, and using templates can make that process a lot smoother.

For a revocable living trust, the transfer itself is a non-event for tax purposes. The IRS still considers you the owner. You'll continue to use your own Social Security number for any trust income and pay property taxes just as you always have.

But the real magic happens after your lifetime. Assets held in a revocable trust receive a "step-up in basis" when the grantor passes away. This is a tremendous tax advantage. It means the property's cost basis is readjusted to its fair market value at the date of death.

- Real-World Example: Let's say a couple bought their Dallas home for $100,000 years ago. At the time of their passing, it’s worth $700,000. When their children inherit it through the trust, their new cost basis is not the original $100,000—it's the current $700,000.

- Why This Matters: If the children then sell the home for $700,000, they would owe virtually nothing in capital gains tax. Without that step-up, they would be taxed on a $600,000 gain, potentially costing them tens of thousands of dollars.

This powerful tax benefit is a major advantage of using a trust for asset protection. It goes far beyond simply avoiding probate. Working with a Texas estate planning attorney ensures your trust is structured to secure these crucial benefits for your family.

Common Questions About Transferring Property to a Trust

As you move from planning to action, practical questions are bound to arise. Getting these details right is what makes your estate plan work as intended, giving you confidence and peace of mind.

Here are answers to some of the most common questions we receive from Texas families.

Can I Put My House in a Trust if I Still Have a Mortgage?

Yes, you absolutely can, and it is a very common part of the estate planning process. Many people worry this will trigger the "due-on-sale" clause in their mortgage, forcing them to pay off the entire loan immediately.

Fortunately, a federal law called the Garn-St Germain Act protects homeowners. This law prevents lenders from calling your loan due simply because you transfer your home into a revocable living trust where you are still the beneficiary. It was specifically designed to allow people to engage in this type of planning without jeopardizing their financing.

Even with this protection, it is a smart move to send your lender written notice of the transfer. A simple letter keeps their records updated and prevents future confusion. However, if you are using an irrevocable trust or transferring a commercial property, the rules can be different. It is critical to have a Texas trust administration lawyer review the mortgage agreement first in those situations.

Will I Lose My Texas Homestead Exemption if I Put My Home in a Trust?

This is a major concern for Texans, as our homestead protections are among the best in the nation. The good news is that you generally will not lose your exemption.

The Texas Property Tax Code allows you to maintain your homestead exemption when you transfer your primary residence into a "qualifying trust," which includes most standard revocable living trusts.

The key is that the trust document itself must contain the right language. It needs to clearly state that you, the grantor, have the right to live in and use the home as your principal residence. Any experienced Texas estate planning attorney will ensure this specific provision is included.

After the new deed is recorded, you will just need to file an updated homestead application with your county appraisal district. This small administrative step ensures all your tax benefits continue without interruption.

What Are the Biggest Mistakes People Make?

While the process is straightforward with proper guidance, a few simple errors can cause major headaches. Knowing what to avoid is half the battle.

- Inaccurate Legal Descriptions: A single typo in the lot and block number or an incorrect survey reference can create a "cloud on the title." This makes it extremely difficult to sell or refinance later. The legal description on the new deed must be a 100% perfect match to the existing one.

- Improperly Executing the Deed: In Texas, the grantor's signature on a deed must be acknowledged by a notary public. Signing it without a notary present or having the notarization done incorrectly can render the transfer completely invalid.

- Forgetting to Record the Deed: This is a critical and surprisingly common mistake. A signed and notarized deed is not effective until it is officially filed with the county clerk in the county where the property is located. An unrecorded deed means the transfer isn't legally complete, leaving the property vulnerable and outside the trust's protection.

A knowledgeable Texas estate planning attorney is your best defense against these costly mistakes. They ensure every detail complies with the Texas Trust Code and that your assets are properly protected.

What Does It Cost to Transfer a Property to a Trust in Texas?

The costs are quite reasonable, especially when you consider the alternative. You can expect to pay attorney's fees for drafting and reviewing the deed, a small notary fee, and the official filing fee charged by the county clerk's office.

While it is an upfront investment, it pales in comparison to the thousands of dollars in legal fees, court costs, and frustrating delays your family would face if that same property had to go through the public probate process.

Think of it as a small price to pay for a private, efficient, and seamless transition for your loved ones. Proper planning today is truly one of the kindest and most responsible things you can do for your family's future.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.