Planning for your family's future can feel overwhelming, but with the right legal guidance, it doesn’t have to be. You want to protect what you’ve built and ensure your loved ones are cared for without being stuck in legal limbo or having private matters made public. A living trust in Texas is one of the most effective tools to achieve this, allowing you to sidestep the public probate process and secure your legacy on your own terms.

Why a Texas Living Trust Can Secure Your Family’s Future

Managing a loved one's estate can feel like a heavy burden during an already difficult time, but a well-structured plan can make all the difference. A living trust acts as a detailed instruction manual for your assets, ensuring everything is distributed exactly as you wish, without needing a judge’s approval.

Think of it this way: a living trust is a private legal entity you create to hold your property. You transfer your assets into this trust, but you remain in complete control as the trustee for as long as you live. This simple, strategic move is the key to keeping your estate out of the often lengthy, expensive, and public probate court system that a standard will almost always goes through.

Key Benefits of Establishing a Trust Under Texas Law

For many Texas families, a living trust is the bedrock of a strong estate plan, offering a level of security and peace of mind that a simple will cannot match.

- Avoids Probate: This is the primary benefit. Assets held within a trust pass directly to your heirs, completely skipping the time-consuming and public probate process mandated by the Texas Estates Code.

- Ensures Privacy: A will becomes a public record once it enters probate. A trust, on the other hand, is a private document. Your family’s financial affairs remain confidential.

- Manages Incapacity: If you become unable to manage your own finances, your hand-picked successor trustee can step in immediately to take care of everything, avoiding the need for a court-ordered guardianship.

- Maintains Control: You set the rules. You decide precisely how and when your assets are distributed, allowing you to provide structured, long-term support for your beneficiaries.

This guide will explain what a living trust is, how it functions under Texas law, and the practical steps to create one. Our goal is to provide you with the clarity and confidence to protect your estate planning goals and secure your legacy.

How a Living Trust Works in Texas

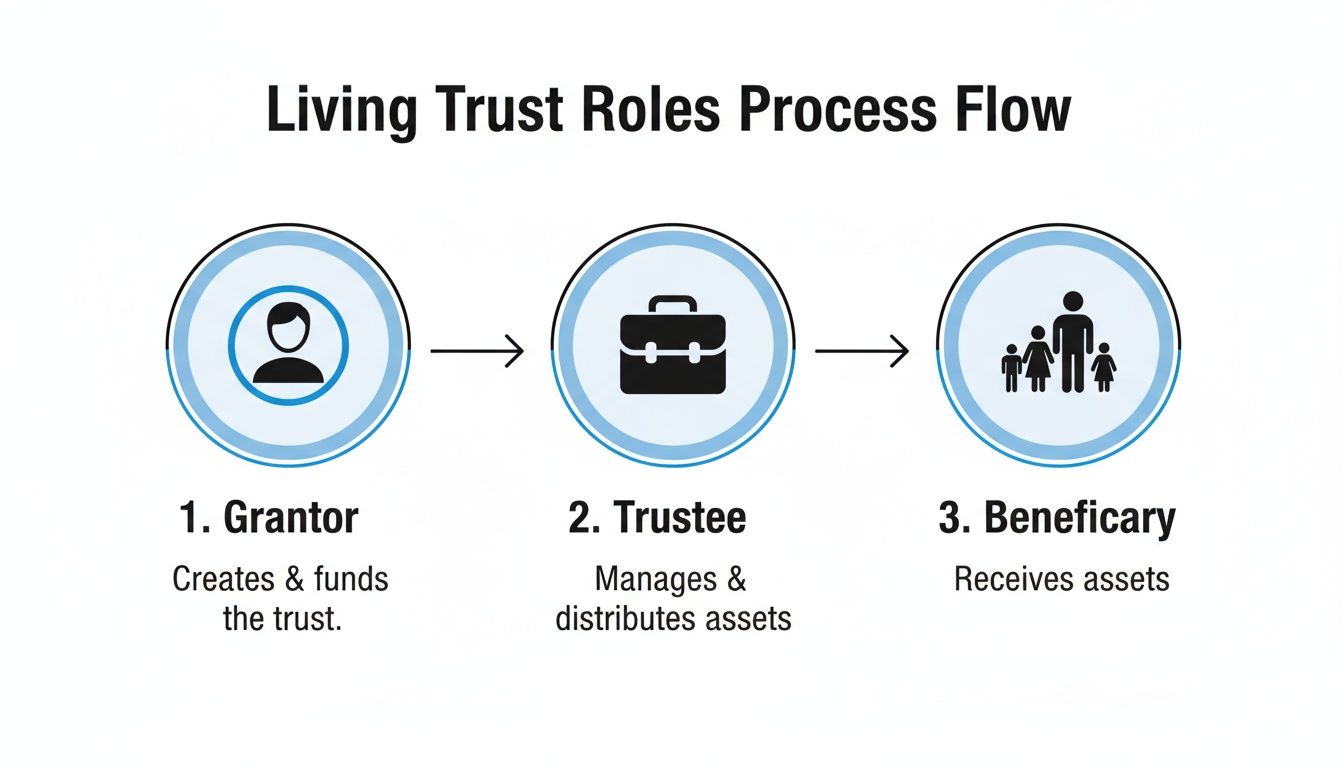

A living trust in Texas operates based on a clear, straightforward structure. Imagine you are creating a secure box to hold your most valuable assets. This box is your living trust, and it is defined by three key roles.

You, the creator of the trust, are known as the Grantor. You decide which assets go inside—your house, bank accounts, or investments. You also appoint someone to manage the box, called the Trustee. Initially, the Grantor and Trustee are almost always the same person: you. This ensures you maintain total control.

Finally, you name the people who will receive the contents of the box after you pass away. These are your Beneficiaries. The entire arrangement is governed by a rulebook you write—the trust document—which lays out exactly how your assets should be managed and distributed.

The Core Mechanics of a Living Trust

During your lifetime, since you are both the Grantor and the Trustee, your day-to-day life doesn't change. You can still buy, sell, and manage your assets just as you always have. The only difference is that the trust is now the legal owner on paper.

The true power of the trust becomes clear in two key situations. First, if you become incapacitated and can no longer manage your affairs, the Successor Trustee you pre-selected can step in immediately. They will follow your instructions to manage the assets for your benefit, bypassing the need for a public and often stressful court process to establish a guardianship.

Second, upon your passing, the Successor Trustee takes charge and distributes everything to your beneficiaries according to your precise wishes. This process happens privately and efficiently, away from the delays and public scrutiny of probate court.

Revocable vs. Irrevocable Trusts: A Critical Distinction

In Texas, living trusts generally come in two forms. Choosing the right one is essential for your estate planning goals.

- Revocable Living Trust: This is the most common type, prized for its flexibility. As the Grantor, you can change its terms, add or remove assets, or even dissolve the entire trust at any time. It is designed to avoid probate and manage incapacity but does not offer protection from creditors.

- Irrevocable Living Trust: Once created, an irrevocable trust generally cannot be changed. When you transfer assets into it, you relinquish control and ownership. This is an advanced tool often used for specific goals like minimizing estate taxes or for robust asset protection from future lawsuits or creditors.

Understanding this distinction is the first step in creating a plan that aligns with your family's needs. A knowledgeable Texas estate planning attorney can explain the pros and cons to help you make an informed decision.

While the benefits of privacy and avoiding court are clear, a surprising number of people lack a plan. In 2025, only 13% of Americans have a living trust. Another 24% have a will, leaving 55% with no plan at all. In Texas, this is particularly significant, as the probate process makes wills a public record. Counties like Travis and Hays often publish wills online for anyone to view.

Living Trust vs. Will in Texas: A Quick Comparison

To put it all in perspective, let’s compare how a living trust stacks up against a traditional will. Both are vital estate planning tools, but they serve very different functions under Texas law.

| Feature | Living Trust | Will |

|---|---|---|

| Probate | Avoids the probate process entirely for assets held in the trust. | Must go through the public probate court process. |

| Privacy | A private document that is not filed with the court. | Becomes a public record once submitted for probate. |

| Incapacity Plan | The successor trustee can manage assets if you become unable to. | Does not provide for incapacity management; requires a separate Power of Attorney. |

| Control | You manage assets as the trustee during your lifetime. | Has no legal effect until after your death and probate is initiated. |

| Cost & Time | Higher upfront cost to create, but can save significant time and money later. | Lower upfront cost, but the probate process can be costly and lengthy for heirs. |

Ultimately, a living trust in Texas is about proactive control. It offers a private, efficient, and direct path for your assets that a will alone simply cannot provide.

Step-by-Step Guidance for Creating and Funding Your Trust

Setting up a living trust in Texas is a methodical, step-by-step process. While it requires careful attention to detail, think of it as building a solid financial structure to protect your assets. With the right legal guidance, creating a trust is far less intimidating than it may seem. Let's walk through the essential stages of bringing your trust to life so it functions exactly as you intend under the Texas Trust Code.

The process begins with a thorough consultation with an experienced Texas estate planning attorney. This is not a time for shortcuts. A well-drafted trust agreement is the foundation of your entire plan, and an attorney will ensure every detail is tailored to your unique circumstances—from selecting the right successor trustee to clearly defining how and when your loved ones will receive their inheritance.

Once the legal document perfectly reflects your wishes, it's time to make it official by signing the trust agreement in front of a notary public. This act gives your trust legal authority, transforming it from a plan on paper into a real legal entity ready to hold your assets.

The Most Important Step: Funding Your Trust

A common and critical mistake is creating a trust but failing to fund it. An empty trust is like an empty vault—it exists, but it protects nothing. Funding is the process of formally transferring legal ownership of your assets into the trust's name.

This is where meticulous detail is crucial. You are essentially retitling your property from your personal name to the trust’s name.

- Real Estate: For your home or other Texas properties, a new deed must be drafted and filed with the county clerk. The deed will officially transfer ownership from "John Doe" to "The John Doe Revocable Living Trust."

- Bank Accounts: You will need to work with your bank to retitle your checking and savings accounts. This often involves closing your personal accounts and opening new ones under the trust's legal name.

- Investment Accounts: Brokerage accounts, stocks, and bonds must also be formally transferred. Your financial advisor can assist with the necessary paperwork to change the account owner to your trust.

Properly completing this step is paramount. For a more detailed breakdown, you can learn more about how to transfer property to a trust to ensure your plan is secure. If you skip funding, your assets could be forced back into the public probate process, defeating a primary reason for creating the trust.

This diagram helps visualize the three essential roles in any living trust.

As you can see, the process begins with the Grantor (you) who creates the trust. The Trustee (initially also you) manages it, and the Beneficiary is the person who will ultimately receive the assets. It’s a clear flow of responsibility designed for your peace of mind.

A Real-World Example: The Garcia Family Trust

Let's consider a practical scenario. Imagine the Garcia family in Houston creates "The Garcia Family Living Trust" to avoid probate and simplify the inheritance process for their two children.

- Drafting the Trust: They meet with their attorney to create a trust document. They name themselves as co-trustees and appoint their oldest child as the successor trustee.

- Executing the Document: They sign the final document with a notary at their lawyer's office, making it legally binding.

- Funding the Trust: They complete the following checklist:

- File a new deed for their home with the Harris County Clerk.

- Visit their bank to retitle their joint savings account into the trust's name.

- Contact their financial advisor to update the ownership on their investment portfolio.

By completing these steps, the Garcias ensure their most important assets are safely held within their trust. This proactive approach guarantees their successor trustee can manage the estate seamlessly and that their children will inherit their legacy without the burden of court proceedings. It highlights why fully implementing your estate plan is just as vital as creating it.

Trustee Responsibilities Under Texas Law

Being named a trustee for a living trust in Texas is a significant honor and a serious legal responsibility. When you accept this role, you are bound by a strict set of obligations known as fiduciary duties. These duties are not mere suggestions; they are legal requirements outlined in the Texas Trust Code designed to protect the trust's beneficiaries.

A trustee acts as the guardian of the trust's assets. Your sole duty is to manage the property for the exclusive benefit of the beneficiaries, always following the instructions left by the trust's creator. This is a legal contract with significant consequences if ignored.

Whether you are choosing a trustee for your own estate or have been asked to serve as one, understanding these responsibilities is critical. A misstep can lead to personal liability and family disputes. Consulting with a Texas trust administration lawyer is the best first step to ensure you are prepared.

Core Fiduciary Duties in Texas

The Texas Trust Code outlines several key responsibilities that every trustee must uphold. These principles ensure a trustee acts with absolute integrity and care.

- Duty of Loyalty: This is the cornerstone of a trustee's role. You must act only in the best interests of the beneficiaries, which means avoiding all self-dealing and conflicts of interest. For example, a trustee cannot sell a trust-owned property to themselves at a discount or use trust funds to finance a personal business venture.

- Duty of Prudence: A trustee must manage the trust's assets as a reasonably "prudent" person would manage their own property. This involves making sensible investment decisions, protecting assets from loss (e.g., maintaining property insurance), and ensuring assets are productive. You are not expected to be a financial genius, but you must be diligent and responsible.

- Duty to Account: You must maintain meticulous records of all transactions—every dollar in and every dollar out. Trustees are required to provide regular statements, or "accountings," to the beneficiaries, clearly showing all income, expenses, and distributions. Transparency is essential for building trust and preventing conflict.

These are just the highlights. For a more comprehensive overview, you can explore the full scope of trustee duties and responsibilities in our detailed guide.

From Legal Principles to Practical Tasks

Beyond these foundational duties, a trustee has a long list of day-to-day tasks that require organization and diligence. This is where legal theory becomes real-world action.

A trustee’s role is one of immense trust and legal obligation. Under the Texas Trust Code, a fiduciary must place the interests of the beneficiaries before their own, manage assets with care, and maintain absolute transparency. Failing to meet these standards can expose the trustee to significant personal liability.

Consider a successor trustee in San Antonio who takes over a trust created for the grantor’s young children. Their job is not just to hold the assets but to actively manage them for the children's future.

This trustee would need to:

- Inventory and Secure Assets: The first step is to identify and take legal control of all property owned by the trust, from the family home to brokerage accounts.

- Pay Debts and Expenses: They must use trust funds to settle the grantor's final debts, pay taxes, and cover the ongoing administrative costs of the trust.

- Invest and Manage Assets: In line with the duty of prudence, the trustee must invest the funds wisely to generate income and growth for the children's future needs, such as education or healthcare.

- Distribute Assets: They must follow the trust's instructions precisely, making distributions to the beneficiaries exactly as the grantor intended.

Fulfilling these fiduciary duties in Texas requires diligence, integrity, and sound judgment. It is a demanding role, but with clear guidance from an experienced Texas estate planning attorney, a trustee can confidently navigate their responsibilities and honor the legacy they have been entrusted to protect.

Advanced Trust Strategies for Asset Protection and Tax Planning

For many Texas families, a standard revocable living trust in Texas is an excellent starting point—it's like building a solid foundation for your financial house. However, for those with significant assets, a business, or complex family dynamics, more advanced strategies are needed to build a true fortress around your wealth.

When your goals expand to include robust asset protection, minimizing estate taxes, and creating a legacy that lasts for generations, Texas law offers powerful tools that go far beyond the basics. These strategies are designed to shield your hard-earned wealth from future creditors, lawsuits, and taxes in ways a simple trust cannot.

Using Irrevocable Trusts for a Stronger Shield

While a revocable trust offers flexibility, an irrevocable trust provides superior asset protection. When you transfer assets into an irrevocable trust, you legally relinquish direct control and ownership. This separation is key. Because you no longer technically own those assets, they are generally shielded from future lawsuits or creditors.

This is a powerful tool for professionals in high-risk fields, like doctors or contractors, and for business owners who want to insulate their personal assets from business liabilities. A well-designed irrevocable trust can ensure that a core part of your wealth remains secure, no matter what the future holds.

Texas has become a premier destination for sophisticated estate planning. A significant change was extending the "rule against perpetuities" to 300 years—a massive increase from the previous 90-year limit. This has made our state a magnet for high-net-worth families and private trust companies looking to establish multi-generational legacies.

Sophisticated Tools for Tax Planning

When your estate is large enough to attract the attention of the IRS, advanced trusts become essential for preserving your wealth. Two of the most effective tools in a Texas estate planner's toolkit are:

- Irrevocable Life Insurance Trust (ILIT): An ILIT is created for the sole purpose of owning your life insurance policy. By removing the policy from your personal ownership, the death benefit payout is excluded from your taxable estate. This strategic move can save your family a substantial amount in estate taxes and provide them with immediate, tax-free liquidity to cover expenses without having to sell other assets.

- Spousal Lifetime Access Trust (SLAT): A SLAT is an advanced strategy where one spouse makes a gift into a trust that benefits the other spouse. This removes the assets from the couple's combined taxable estates, while the beneficiary spouse can still access the funds if needed. It allows you to achieve the tax benefits of gifting while keeping the assets accessible within the family.

A Real-World Scenario: A Multi-Layered Plan

Let's imagine a family in Dallas with a successful business they want to pass down to their children. They are concerned about protecting their personal wealth from business liabilities and minimizing estate taxes.

Their Texas estate planning attorney might design a comprehensive, multi-layered plan:

- A foundational revocable living trust to hold their primary residence and personal assets. This helps them avoid the public probate process and simplifies administration.

- An irrevocable trust funded with their non-business investments, creating a firewall that protects this wealth from potential business-related creditor claims.

- An ILIT to hold a large life insurance policy, providing their heirs with a tax-free fund to cover any estate taxes or other expenses.

This is not just a single document but a cohesive strategy. It protects their current assets, facilitates a smooth business transition, and secures their legacy for generations to come.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

Common Questions About Living Trusts in Texas

As you explore setting up a living trust in Texas, it's natural to have questions about the practical details. Understanding how a trust works in real-world situations can give you the confidence to move forward with your estate plan. Let's address some of the most common questions we receive.

Our goal is to demystify the process, address practical concerns, and clear up common misconceptions. An informed decision is always the best decision for your family’s future.

If I Have a Living Trust, Do I Still Need a Will?

Yes, absolutely. A special type of will, called a pour-over will, serves as an essential safety net for your living trust.

Its purpose is simple but critical: it is designed to "catch" any assets that you may have forgotten or failed to transfer into your trust during your lifetime. Upon your death, this will directs—or "pours"—those overlooked assets into your trust. Without a pour-over will, those assets would likely have to go through the public probate process, undermining one of the primary benefits of having a trust.

Can a Trust Help Me Qualify for Medicaid?

This is a complex area where the details are crucial. A standard revocable living trust will not help you qualify for Medicaid. Because you retain control over the assets in a revocable trust, the government still considers them yours when determining your eligibility for benefits.

However, certain types of irrevocable trusts can be powerful tools for long-term care planning. These are not simple documents; they are complex legal instruments that must be carefully structured by a skilled Texas estate planning attorney to comply with strict government rules.

A common mistake is assuming that any trust will protect assets from long-term care costs. A revocable trust offers no such protection for Medicaid planning, and this misunderstanding can be a costly error. Expert legal advice is non-negotiable in this area.

How Much Does It Cost to Set Up a Living Trust?

The cost depends on the complexity of your financial situation and your specific goals. While DIY online forms may seem like a bargain, they often result in trusts that are drafted incorrectly, are not funded properly, or fail to comply with Texas law. A trust that doesn't work when your family needs it most is no bargain at all.

Investing in a professionally drafted trust is almost always more cost-effective in the long run than the thousands of dollars and months of stress your loved ones could face in probate court. It is an investment in your family’s security and peace of mind.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

Learn more at https://texastrustadministration.com.