Losing a loved one is hard enough, and the thought of handling their estate can feel overwhelming. Many Texas families worry about a complex and lengthy probate process. Fortunately, for certain estates, Texas law offers a unique, streamlined alternative called a muniment of title.

Think of it as a way for the court to officially validate a will, allowing that document to act like a deed to transfer property to the beneficiaries. This process is designed to be simpler and faster, helping you honor your loved one's final wishes without the stress of a full probate administration.

A Simpler Path Through Texas Probate

Managing a loved one's final affairs is a significant responsibility. The last thing you need is to be bogged down in a confusing legal maze. A muniment of title provides a straightforward path for qualifying estates, offering clarity and peace of mind during a difficult time.

Bypassing Traditional Administration

Under the Texas Estates Code, this process is a perfect fit for a specific scenario: the deceased left a valid will and had no outstanding debts, with the common exception of a mortgage on their home. Because there are no debts to settle, the estate can skip the formal appointment of an executor and avoid the ongoing court supervision that comes with a standard probate.

So, what are the practical benefits for your family?

- It’s Fast: A muniment of title is often much quicker than full probate administration, meaning assets get into the hands of beneficiaries sooner.

- It’s Cost-Effective: By eliminating the need for an executor and minimizing court involvement, the legal costs are typically lower.

- It’s Simple: The primary goal is to validate the will so it can serve as the official link in the property's chain of title, making the transfer clear and legal.

Once the court approves the application, its order legally recognizes the will as the document transferring ownership. You then file a certified copy of the will and the court’s order in the county’s property records. This simple step solidifies the beneficiaries' ownership, just as if they had received a deed.

Of course, this approach isn't a one-size-fits-all solution. It won't work for estates with complex assets or a list of debts that need to be paid. While it offers a simpler path, you must be certain your loved one’s estate qualifies. Learning how to avoid probate in Texas can provide valuable context on this and other estate planning tools.

Our goal with this guide is to explain the muniment of title process in plain English, empowering you to decide if it's the right choice for settling your loved one's estate.

Qualifying for a Muniment of Title

Not every estate can use the simplified muniment of title process. The Texas Estates Code sets clear, non-negotiable requirements to ensure fairness and prevent future legal complications. Understanding these rules is the first step in determining if this streamlined probate path is available for your loved one’s estate.

A Valid Will Is Essential

The entire muniment of title process hinges on one critical document: a valid, written will. Without a will, the law considers the estate "intestate," and the court must follow a different set of rules for distributing property.

This shortcut is not an option if a person dies without a will or if the will they left is declared invalid by the court. The will must clearly state the deceased's wishes and meet all of Texas's legal formalities. If you have any doubts about the will's validity, consulting with a probate attorney is a crucial step. It may surprise you to learn that not all wills must go through probate, but a muniment of title absolutely requires one. You can learn more in our article about whether all wills go through probate.

The Estate Must Be Free of Debt

The second major requirement is that the estate cannot have any unpaid debts. This is a firm rule with one significant exception: debt secured by real property, such as a mortgage on a home. The logic is simple—if there are no creditors awaiting payment, there is no need for a formal administration process with an executor managing the estate's finances.

This means the deceased cannot have left behind any outstanding:

- Credit card balances

- Medical bills

- Personal loans

- Other unsecured financial obligations

Real-World Scenario: A mother passes away, leaving her home to her two children in her will. She has a mortgage on the home but has paid off all her credit cards and has no other debts. Her estate is an ideal candidate for a muniment of title because the only remaining debt is secured by the real estate itself.

This focus on debt-free estates is what makes the process so efficient. It was designed specifically for these kinds of straightforward situations.

The Four-Year Time Limit for Filing

Finally, Texas law imposes a deadline. A will generally must be submitted for probate within four years of the person’s death. This statute of limitations applies to a muniment of title just as it does to any other type of probate.

If more than four years have passed, it may still be possible to probate the will as a muniment of title, but it becomes more complicated. The applicant must prove to the court that they were not "in default" for the delay, which requires a compelling reason and strong evidence. Meeting all these qualifications is the key to using this much simpler path.

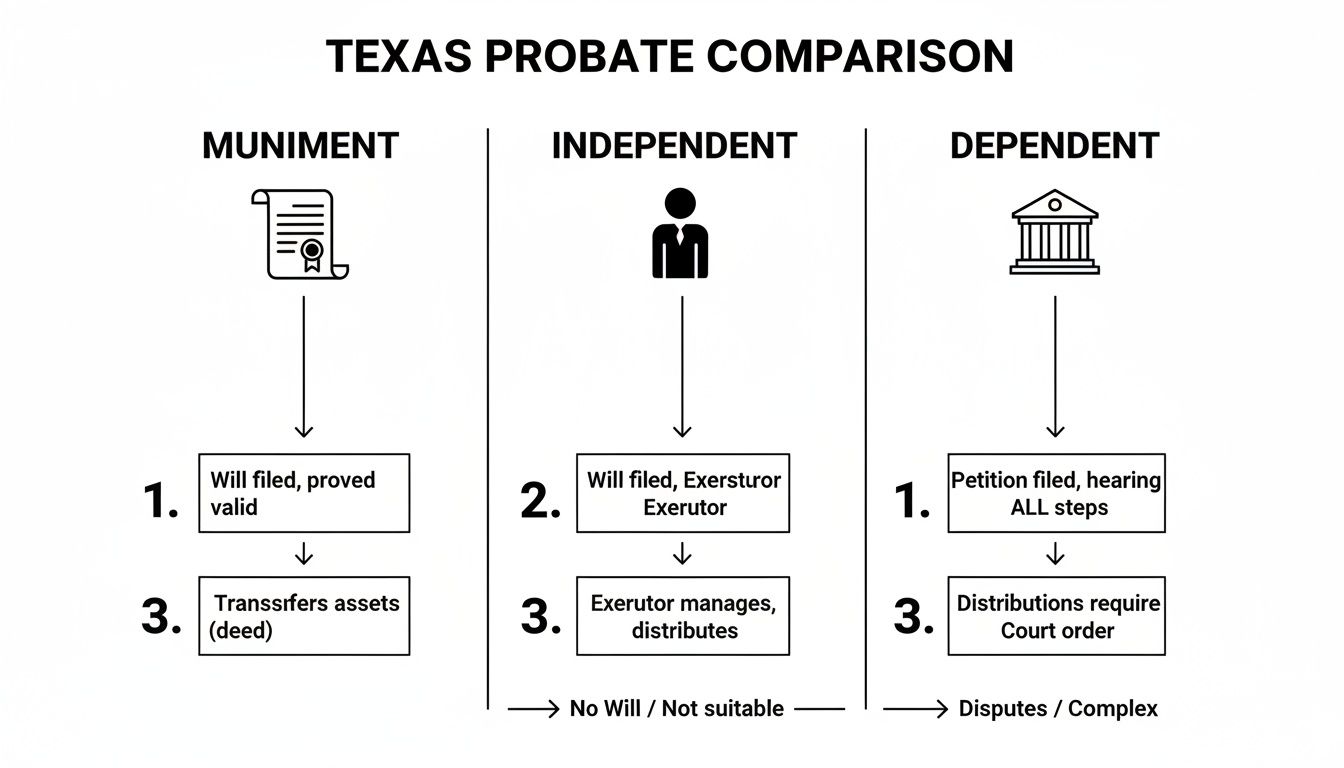

Muniment of Title vs. Traditional Probate

Understanding your options is the first step toward making a confident decision for your family. Probate in Texas is not a one-size-fits-all process, and the path you choose can significantly impact the time, cost, and stress involved. A muniment of title is a unique alternative, and understanding how it compares to traditional probate methods will highlight its benefits.

The primary difference lies in the level of court involvement and whether an executor or administrator is needed. A muniment of title is designed for simplicity; it is less of a full administration and more of a court's official stamp of approval on a will.

Comparing the Main Texas Probate Paths

When a will goes through probate in Texas, families typically encounter three main routes. Each is designed for a different situation, with varying levels of complexity and court oversight, as outlined in the Texas Estates Code.

-

Muniment of Title: This is the most streamlined path. It validates the will, allowing it to act as a direct transfer of title to the heirs. There is no executor and no administration because the estate has no unsecured debts.

-

Independent Administration: This is the most common form of probate in Texas. The will names an "independent executor" who is appointed by the court. They manage the estate—paying debts, gathering assets, and distributing property—with minimal court supervision.

-

Dependent Administration: This is the most complex and costly option. The court must approve nearly every action the administrator takes, from selling property to paying bills. It is typically reserved for estates with significant conflict among heirs or complex debt issues.

For a more detailed comparison, you can explore our guide on the probate process in Texas.

The Executor Role Makes All the Difference

The most significant distinction between a muniment of title and even the simplest independent administration is the complete absence of an executor. In a traditional probate, the executor has fiduciary duties to manage the estate’s assets responsibly. They are the person in charge of settling all the deceased's affairs.

A muniment of title completely bypasses this role. Since there are no unsecured debts to pay, there is no need for someone to manage that process. The court's order itself becomes the legal tool that transfers property, making the process much faster and less of an administrative burden for the family.

The core benefit of a muniment of title is its efficiency. By removing the need for an executor and ongoing administration, it directly transfers assets to the rightful heirs as outlined in the will, saving both time and money.

To help you visualize these differences, we've created a straightforward comparison table.

Texas Probate Options at a Glance

This table breaks down the key features of each probate path, giving you a quick snapshot of what to expect.

| Feature | Muniment of Title | Independent Administration | Dependent Administration |

|---|---|---|---|

| Executor Required? | No | Yes | Yes (Administrator) |

| Court Involvement | Minimal (one hearing) | Low (initial appointment) | High (constant supervision) |

| Typical Timeline | 1-2 months | 6-12 months | 1 year or more |

| Overall Cost | Lowest | Moderate | Highest |

| Best For | Debt-free estates with a valid will and simple assets. | Estates with some debts but a clear will and cooperative heirs. | Complex estates, disputes among heirs, or significant debts. |

This practical breakdown highlights why a muniment of title is often the perfect choice for simple, debt-free estates, honoring the will's instructions without the procedural weight of a full administration.

Step-by-Step Guidance for the Muniment of Title Process

If a muniment of title seems right for your loved one’s estate, knowing the steps involved can provide a great sense of relief. The process is designed to be direct, turning a seemingly complex legal procedure into a series of clear, manageable actions. Here is our step-by-step guidance for this process.

Kicking Off the Legal Process

The journey begins by filing an Application to Probate Will as a Muniment of Title. This is a formal request submitted to the appropriate probate court, typically in the county where the deceased resided.

Along with the application, you must submit the original, signed will. A copy is not sufficient. This filing officially asks the court to recognize the will's validity and certify it as the legal instrument for transferring the estate's assets. This is the crucial first step that sets the process in motion.

The Waiting Period and Public Notice

Once the application is filed, a mandatory waiting period begins. Texas law requires that a public notice, known as a citation, be posted at the courthouse. This serves as a public announcement that a will is being considered for probate.

This notice must remain posted for at least 10 days before a court hearing can be scheduled. It is a procedural safeguard to ensure that any potential interested parties (though rare in these simple cases) have an opportunity to be aware of the proceedings.

This flowchart provides a visual comparison of how the muniment process stacks up against other Texas probate options.

As you can see, the muniment path is the most direct, eliminating the administrative steps required in independent or dependent administration.

The Court Hearing and Judge's Order

After the waiting period concludes, a hearing is held before a probate judge. During this hearing, the judge will review the application, the will, and listen to testimony to confirm that all legal requirements have been met.

The judge will verify a few key points:

- That the will is valid and was executed correctly.

- That the estate has no unpaid debts, other than a mortgage on real property.

- That there is no necessity for a formal administration.

If the judge is satisfied that all legal criteria are met, they will sign an Order Admitting Will to Probate as a Muniment of Title. This court order is the key document that officially validates the will and gives it the legal authority to transfer property.

This court order is the most important document in the process. It serves as official, legally binding proof that the will is valid and that the individuals named in it are now the rightful owners of the assets.

Finalizing the Property Transfer

With the judge’s order in hand, the final step is to make the property transfer part of the public record. You will obtain a certified copy of both the will and the court’s order.

You then file this certified packet in the real property records of every Texas county where the deceased owned property. This action formally updates the chain of title, notifying the public that ownership has legally passed from the deceased to the beneficiaries, as directed by the will.

Finally, within 180 days of the order being signed, the applicant must file a sworn affidavit with the court. This document confirms that, to the best of their knowledge, the terms of the will have been fulfilled. It is the final step that officially concludes the process.

Common Hurdles and When to Seek Legal Advice

While probating a will as a muniment of title is a simpler path, it is still a legal process with potential challenges. Knowing what to watch for can help you avoid frustration and unexpected delays, ensuring a smooth transfer of your loved one's assets.

When Unexpected Debts Surface

The discovery of a hidden debt is the most common obstacle in a muniment of title proceeding. As required by the Texas Estates Code, the estate must have no unsecured debts. If a forgotten medical bill or an old personal loan comes to light after you have started the process, it can bring everything to a halt.

If a legitimate creditor emerges, the court's order may be voided. This would force the estate to start over with a more formal administration to handle creditor claims, defeating the purpose of choosing this streamlined route. This is why a thorough search for any potential debts is a critical first step.

Dealing With Unfamiliar Institutions

A common frustration arises when an out-of-state bank or financial institution is unfamiliar with the muniment of title process. While it is well-established in Texas, many national companies are only trained to recognize Letters Testamentary—documents that appoint an executor.

Scenario: A family successfully uses a muniment of title to transfer their mother's house. But when they visit her national bank to close her savings account, the manager asks for Letters Testamentary. The problem? A muniment of title doesn't appoint an executor, so those letters don't exist.

This can lead to a difficult standoff. An experienced Texas estate planning attorney can be invaluable in these situations. They can communicate directly with the institution, provide the court order, and explain the specific Texas laws that make it a valid substitute for letters testamentary.

Complications From a Poorly Drafted Will

The muniment of title process relies on the will itself to act as the transfer document. This only works if the will is clear and unambiguous. A poorly drafted, vague, or contradictory will can create significant problems. The judge must be able to read the will and understand the deceased's intentions precisely.

For example, if the will leaves an asset to a beneficiary who has already passed away but fails to name an alternate, the court may need to hold additional hearings to interpret the will's intent. This adds time and expense to the process. It is a powerful reminder that having a well-drafted will, created with professional legal guidance, is essential.

Engaging a knowledgeable attorney from the beginning can help you navigate these potential issues. An attorney can verify the estate’s eligibility, guide you through a comprehensive debt check, and manage communications with financial institutions, keeping the process on track.

Your Questions About Muniment of Title Answered

It is natural to have questions when navigating any legal process. When it comes to a specific procedure like a muniment of title, getting clear answers is the first step toward feeling confident and in control. Here, we address some of the most common questions Texas families ask about this probate option.

Our goal is to provide direct, easy-to-understand information to help you determine the best path forward for your family.

How Long Does the Muniment of Title Process Take in Texas?

One of the primary advantages of this process is its speed. While every court's docket is different, a muniment of title is always significantly faster than a full probate administration.

After the application is filed, there is a mandatory waiting period of approximately two weeks before a hearing can be set. If the will is self-proven and all requirements are met, a judge can often sign the order at the first hearing. From start to finish, the entire process can frequently be completed in just one to two months, compared to the six months to a year that a standard probate can take.

What if We Find a Debt After the Muniment of Title Is Granted?

Discovering an unexpected debt after the order has been granted is a serious complication. A core requirement for a muniment of title is that the estate has no unpaid debts (other than a mortgage on real property). If a valid creditor appears after the court has finalized the order, it can invalidate the entire proceeding.

In that situation, the original order would likely be set aside. The estate would then need to transition to a more formal administration process to properly notify creditors and settle the debt as required by the Texas Estates Code. This underscores the importance of conducting a thorough search for all debts before filing.

Can a Muniment of Title Transfer Bank Accounts or Vehicles?

Yes. While often associated with real estate, a certified court order for a muniment of title is a powerful legal document that can transfer various other assets, including:

- Bank and brokerage accounts

- Stocks and bonds

- Vehicles and other personal property

However, you may encounter challenges with some financial institutions, particularly large national banks headquartered outside of Texas. They may be unfamiliar with this specific Texas procedure and mistakenly demand Letters Testamentary, which are not issued in a muniment of title case because no executor is appointed.

This is a situation where a seasoned probate attorney, such as a Texas trust administration lawyer, provides immense value. They can contact the institution's legal department, provide a copy of the court order, and explain the relevant Texas laws. This professional intervention can resolve what might otherwise be a significant obstacle.

Persuading these institutions to comply may require persistence, but with the right legal support, you can successfully transfer these assets to the rightful beneficiaries.

If you’re managing an estate or planning for your own future, you don't have to navigate these questions alone. Contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our experienced Texas attorneys provide trusted, compassionate guidance for every step of the process. You can learn more and schedule your appointment at https://texastrustadministration.com.