When a loved one's estate needs to be settled, managing the legal details can feel overwhelming. The first step is understanding the critical difference between probate and nonprobate assets. This distinction determines whether an asset goes through a court-supervised process or passes directly to loved ones. Grasping this concept is the key to a smoother, faster, and more private estate settlement here in Texas.

A Compassionate Introduction to Your Estate

Losing a family member is one of life's most difficult experiences, and the legal maze that follows can be confusing. At The Law Office of Bryan Fagan, PLLC, we understand. The last thing you want to do while grieving is decipher the Texas Estates Code. Our goal is to cut through the complexity and offer clear, compassionate guidance that empowers you and your family.

This guide explains the one idea that shapes every estate settlement: the divide between probate and nonprobate assets. Understanding this can lift a significant weight off your shoulders and help you sidestep potential headaches down the line.

Understanding the Two Paths an Asset Can Take

Think of it this way: every single thing a person owns will travel down one of two paths after they pass away. Understanding these paths is the bedrock of both effective estate planning and a smooth administration process.

Probate Assets: These are the assets owned solely by the deceased, with no automatic "transfer-on-death" instructions attached. To get these assets to the right heirs or beneficiaries, they must go through the probate court. You can think of this as the formal, public, court-supervised route.

Nonprobate Assets: These assets are structured to bypass the court system entirely. They come with pre-arranged instructions—like a beneficiary designation or a joint ownership title—that allow them to transfer directly and privately to the intended recipient.

This diagram neatly shows how an estate is split into these two categories. The probate side needs a judge's oversight, while the nonprobate side flows directly to the inheritors.

As you can see, what really matters is how an asset is legally titled, not what's written in a will. A will only controls the probate assets. With the right legal strategy from a Texas estate planning attorney, you can intentionally structure your estate so that more of your assets take the simpler, nonprobate path, saving your family time, money, and stress.

Getting a Handle on Probate vs. Nonprobate Assets

When it comes to settling an estate in Texas, not all assets are treated equally. They fall into two distinct buckets: probate and nonprobate. Understanding which is which is the key to a smooth and predictable process for your family.

So, let's break down what these legal terms really mean. Think of the probate process, laid out in the Texas Estates Code, as the official, court-supervised route for settling an estate. It's the legal system for validating a will and ensuring all debts are paid and assets are distributed correctly to the right people.

With that in mind, probate assets are any properties owned solely by the person who passed away, with no backup plan for automatic transfer. These assets are essentially frozen in the deceased's name until a probate judge gives the green light to move them to the heirs. A will is the instruction manual, but the court has to approve it first.

On the flip side, nonprobate assets are built to skip the courthouse. They have a pre-arranged transfer plan built right in, like a beneficiary designation or joint ownership, letting them pass directly to the new owner when the time comes.

An Analogy to Make It Click

To really wrap your head around this, picture your loved one’s assets as packages needing delivery.

Probate assets are like a package that has to go through the main post office for inspection. The will tells the postmaster (the court) where it should go, but the postmaster has to verify the instructions before sending it on its way.

Nonprobate assets are like a package with a pre-paid, direct-delivery label attached. The instructions are part of the package itself, so it goes straight to its destination, no detours necessary.

This simple difference is the foundation of how an estate gets settled. It’s not about how much an asset is worth, but all about how it’s legally titled and set up.

Here's a critical point many Texans miss: Under state law, a beneficiary designation on something like a life insurance policy or an IRA will legally trump whatever your will says about that asset. This is why having a coordinated estate plan is so vital.

Probate vs Nonprobate Assets at a Glance

Getting a clear picture of the differences between probate and nonprobate assets is the first step toward smart asset protection and a headache-free estate administration. This table lays out the core distinctions side-by-side.

| Characteristic | Probate Assets | Nonprobate Assets |

|---|---|---|

| Transfer Method | Transferred via court order after will validation. | Transferred automatically by contract or title. |

| Court Involvement | Required. The process is court-supervised. | Not required. Bypasses the probate court entirely. |

| Privacy | Public record. Wills and inventories are filed publicly. | Private. The transfer is a confidential transaction. |

| Speed of Transfer | Slower. Can take months or even years. | Faster. Often accessible within days or weeks. |

| Governing Document | Controlled by the terms of a valid will. | Controlled by beneficiary designation or titling. |

By understanding these fundamentals, families can better prepare for what's ahead. An experienced Texas estate planning attorney can help you structure your assets to line up with your goals, ensuring things are as straightforward as possible for the people you leave behind.

Common Examples of Each Asset Type in Texas

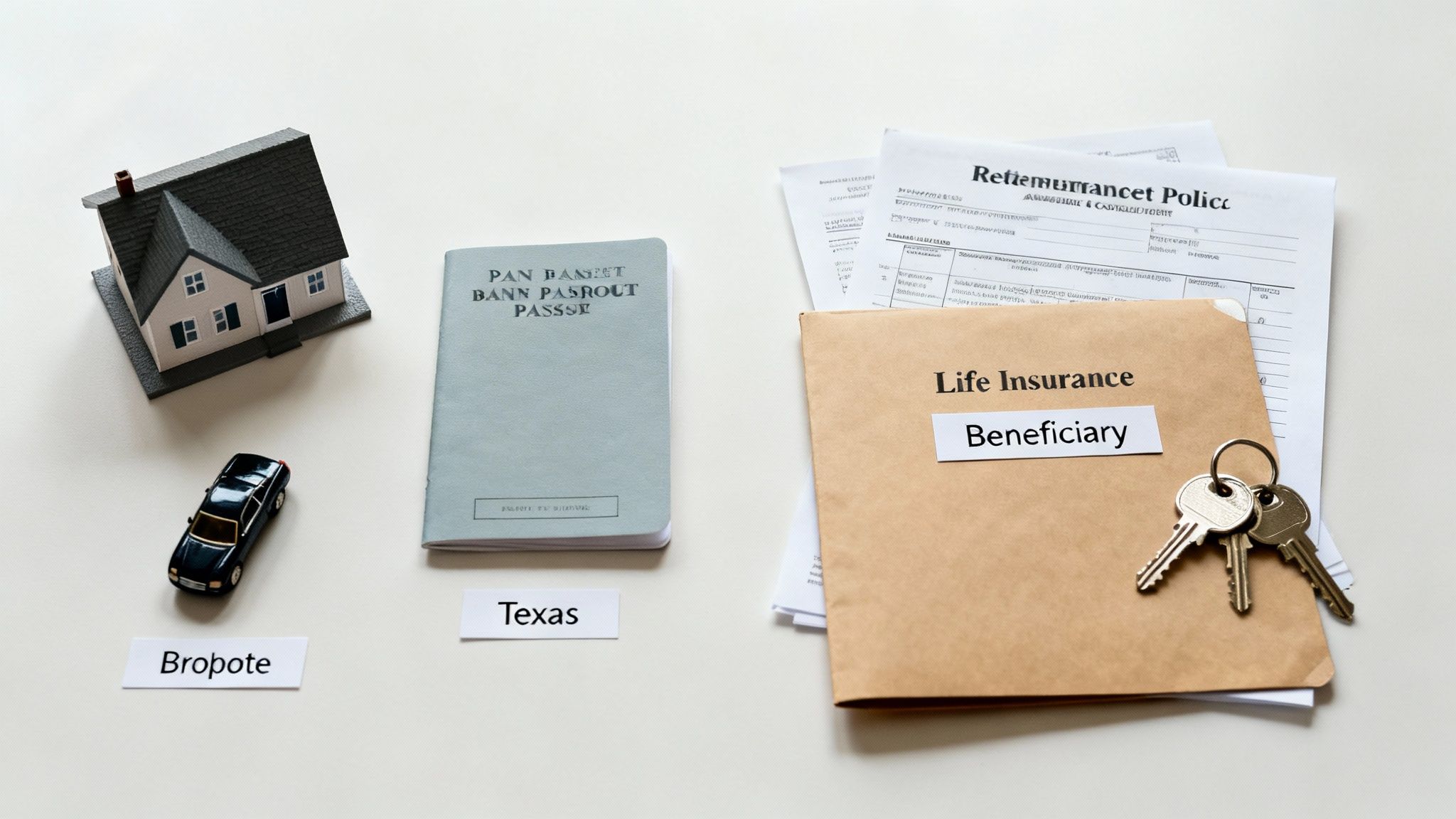

To make the distinction between probate and nonprobate assets crystal clear, it’s helpful to see how these legal concepts apply to the everyday things you own. Let's walk through some real-world examples you'd find in a typical Texas estate. You might be surprised by which category certain items fall into.

Assets That Typically Go Through Probate

Probate assets are those owned solely in the deceased person's name without a direct transfer mechanism. A will directs their distribution, but only after the probate court gives its approval.

Common examples include:

- Individually Owned Real Estate: A family home or piece of land titled only in the name of the person who passed away.

- Personal Bank Accounts: A checking or savings account held by one person without a "Payable on Death" (POD) designation.

- Solely Owned Vehicles: A car, truck, or boat with a title in the decedent’s name alone.

- Tangible Personal Property: Valuables like jewelry, artwork, furniture, and collectibles that belonged exclusively to the individual.

- Investment Accounts: A brokerage account in the decedent's name without a "Transfer on Death" (TOD) beneficiary named.

Essentially, if an asset lacks a co-owner with survivorship rights or a named beneficiary, it’s destined for the probate process. The executor appointed in the will is responsible for gathering these assets for the court to oversee.

Assets That Typically Avoid Probate

Nonprobate assets are designed for efficiency, passing directly to a new owner based on pre-set instructions. This transfer happens outside the authority of a will or the probate court.

According to the Texas Trust Code, assets held within a properly funded living trust are considered nonprobate. The trust document itself acts as the instruction manual for distribution, allowing the successor trustee to manage and transfer assets privately and without court delay.

Common examples include:

- Life Insurance Policies: The death benefit is paid directly to the beneficiaries named in the policy.

- Retirement Accounts: Funds in a 401(k), IRA, or other retirement plan go to the designated beneficiaries.

- Payable-on-Death (POD) Bank Accounts: The money in the account is automatically transferred to the named POD beneficiary.

- Jointly Owned Property with Right of Survivorship: In Texas, when one owner of a joint account or property with survivorship rights passes away, their share automatically goes to the surviving owner(s).

- Assets Held in a Living Trust: Any property titled in the name of a trust is controlled by the trust’s terms, not the probate court.

A knowledgeable Texas trust administration lawyer can help you review your assets to ensure they are structured to match your intentions, minimizing court involvement and simplifying the process for your family.

Why This Distinction Matters for Texas Families

Understanding the difference between probate and nonprobate assets isn’t just a legal exercise; it directly impacts your family’s experience after you're gone—affecting time, money, and privacy. This distinction is a key component of an estate plan that protects your loved ones from unnecessary stress.

The probate process in Texas, while necessary in some cases, has potential downsides. It’s a public court proceeding, which means your will and an inventory of your assets become public record. Furthermore, it can be a lengthy and expensive process, often leaving beneficiaries waiting for funds or property they may need.

The Impact on Time and Cost

This is where the benefit of nonprobate assets becomes clear. These transfers are almost always faster, cheaper, and more private. By setting up your assets to pass directly to your loved ones, you can help them sidestep the common delays associated with court schedules and legal procedures.

For example, a life insurance policy with a named beneficiary can often be paid out within weeks, whereas an asset passing through probate might take months or longer before it can be distributed.

Protecting Your Legacy and Privacy

Beyond speed and cost, the probate vs. nonprobate distinction plays a significant role in privacy and protection from claims. Nonprobate transfers are private transactions between an institution and your beneficiary, keeping your financial affairs out of the public record. They can also be more difficult to challenge in a will contest because the transfer is based on a binding contract (like a beneficiary form) or legal title, rather than the will itself.

Here's a key piece of Texas law to remember: The Texas Estates Code says a will only controls assets that are part of the probate estate. If an asset has a beneficiary designation or is jointly owned, it will go to that person—no matter what your will says.

A well-crafted estate plan minimizes court involvement, protects your privacy, and gets your legacy into the right hands efficiently. A seasoned Texas estate planning attorney can review your assets and map out the best strategies to make that happen.

Think about the benefits:

- Privacy: Nonprobate transfers are private, keeping your family’s financial business out of the public eye.

- Speed: Beneficiaries can often access assets like life insurance or retirement funds in weeks, not the months (or longer) it can take for probate to conclude.

- Cost-Effectiveness: Avoiding court and minimizing legal administration can save your estate significant money.

- Security: Assets with proper beneficiary designations are much less likely to be tied up in a dispute between heirs.

By being strategic about how your assets are titled and who is named as a beneficiary, you create a protective shield for your family. For more in-depth strategies, you’ll find our guide on how to avoid probate in Texas incredibly helpful.

How to Strategically Plan and Streamline Asset Transfers

Once you understand the difference between probate and nonprobate assets, you are in a position to make informed decisions about your estate. With strategic planning, you can convert assets that would normally go through probate into nonprobate assets. This means a faster, more private, and less expensive transfer to the people you care about. It’s all about making your estate plan work for you, not for the court system.

Sometimes the simplest actions make the biggest impact. By filling out a few forms and being clear on your goals, you can make the entire process much easier for your family down the road.

Practical Steps to Keep Your Estate Out of Probate

You can start putting these probate-avoidance strategies into place right now. These are well-established methods recognized by the Texas Estates Code and form the bedrock of any solid estate plan.

Here are some of the most powerful steps you can take:

- Use Beneficiary Designations: For your bank accounts, this is called a Payable-on-Death (POD) designation. For investment and brokerage accounts, it’s a Transfer-on-Death (TOD) designation. These simple forms act as a direct contract that allows the funds to pass to your chosen person, no probate court required.

- Review Your Real Estate Titles: Owning property as Joint Tenants with Right of Survivorship (JTWROS) is a powerful tool. When one owner passes away, their share automatically transfers to the surviving joint owner without court intervention.

- Establish a Living Trust: This is one of the most comprehensive tools for probate avoidance. When you transfer assets like your house, investments, and bank accounts into a trust, they are no longer part of your personal probate estate. The trust document then dictates who gets what, all handled privately and efficiently by your chosen successor trustee. If you want to learn more, check out our guide on how to create a living trust in Texas.

These tools have become critical for modern estate planning. However, many people overlook them, leaving their families vulnerable to the public and often lengthy probate process.

Your Plan Is Not a "Set It and Forget It" Deal

Your work isn't finished once the paperwork is signed. Life changes—people get married, divorced, have children, or relationships evolve. That's why you must review your estate plan regularly. It is absolutely essential.

A beneficiary designation on your life insurance policy or 401(k) is a legally binding contract. Here's the critical point: it overrides whatever your will says. If you forget to update these forms after a major life event like a divorce, your ex-spouse could inherit the asset, even if your will names your current partner or children.

This is exactly why ongoing management is non-negotiable in smart estate planning. A Texas trust administration lawyer can be your most valuable partner here, helping you perform periodic check-ups to make sure your asset titles and beneficiary choices are always in sync with your current life and wishes. For those with more complex family situations or significant wealth, exploring Family Office solutions for comprehensive estate planning can offer advanced strategies to manage everything, ensuring every last detail is perfectly aligned.

Let's Secure Your Future, Together

Understanding the difference between probate and nonprobate assets is the first major step in creating an effective estate plan. While the concepts can seem complex, you don't have to navigate them alone. Here at The Law Office of Bryan Fagan, PLLC, our entire focus is on clarifying Texas estate planning, probate, and asset protection for families just like yours.

These legal principles govern the transfer of significant wealth. Consider that private households around the world hold financial assets totaling roughly EUR 269 trillion, as detailed in these global wealth findings on allianz.com. This illustrates the massive scale of assets subject to these transfer rules.

Building Your Legacy with Confidence

Our job is to cut through the legal jargon and provide a clear, straightforward path that protects what you've built and takes care of the people you love. Modern estate planning also involves ensuring your critical legal documents are secure. For insights on protecting legal documents from editing, it's useful to see how today's tools can add a layer of security to your plan.

There is real peace of mind that comes from knowing you have a solid plan in place. When you’re ready to take that next step, our team is here to help you build a secure future for your family.

A Few Common Questions About Texas Assets

When you start digging into estate administration, many specific questions come up. Here are clear, straightforward answers to the questions we hear most often from Texas families.

Does a Will Let My Family Avoid Probate?

This is one of the biggest misconceptions in estate planning. The short answer is no. In fact, a will is the primary instruction manual for the probate court. It is the document that tells the judge how you want your probate assets distributed, but it does not avoid the process itself.

Assets that skip probate do so because of their legal titling—such as having a beneficiary named directly on an account or being held inside a trust. A will does not have the power to override these mechanisms.

What Happens if a Beneficiary Dies Before the Account Owner?

This is a critical "what if" that shows why you need to review your plan regularly. If the primary beneficiary on a nonprobate asset (like a 401(k) or a life insurance policy) passes away before you do, and you never named a contingent (or backup) beneficiary, that asset usually reverts to your estate.

When that happens, it instantly becomes a probate asset. It will then be distributed according to your will or, if you don't have one, by Texas intestacy laws. This can cause significant, unintentional delays and drag the asset into court oversight.

A key takeaway: Always, always name both primary and contingent (backup) beneficiaries on all your nonprobate accounts and policies. It’s a simple step that acts as a crucial safety net for your estate.

Are Joint Bank Accounts Always Nonprobate Assets?

Not necessarily. This detail often causes confusion, and it all comes down to how the account is titled. For a joint bank account in Texas to be a true nonprobate asset, it must include "Right of Survivorship" (ROS) language. This specific legal phrase ensures that when one owner dies, the funds automatically and immediately belong to the surviving owner.

If an account is just held jointly without that specific ROS language, the deceased person’s share may be treated as a probate asset. You can get a better sense of how these kinds of issues affect timelines in our article about how long the probate process can take.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.