When you lose a loved one, navigating the legal system can feel overwhelming—but with the right legal guidance, it doesn’t have to be. The grief of loss is heavy enough without the added stress of confusing court procedures and paperwork. This guide is designed to bring clarity and confidence to a difficult time.

The probate process in Texas is the court-supervised legal framework for settling a person’s final affairs. It serves as a formal accounting to ensure that their assets are properly managed, debts are paid, and property is distributed according to their wishes. Our goal is to explain this process in plain English, empowering you with the knowledge you need to move forward.

What Is an Executor’s Role in Texas?

The person responsible for managing the estate is called an executor (if named in a will) or an administrator (if appointed by a court). This role comes with significant legal responsibilities known as fiduciary duties under the Texas Estates Code. Simply put, an executor must always act in the best interests of the estate and its beneficiaries.

Your key duties will include:

- Validating the Will: Presenting the will to the probate court to have it legally recognized.

- Gathering Assets: Identifying, inventorying, and securing all property of the deceased.

- Paying Debts and Taxes: Using estate funds to settle all legitimate claims, final expenses, and taxes.

- Distributing Property: Transferring the remaining assets to the beneficiaries named in the will or determined by state law.

Why You Shouldn't Go It Alone

Each step in the probate process is governed by strict rules and deadlines. For example, a will must generally be filed for probate within four years of the decedent’s death. Missing a deadline or mismanaging assets can lead to family disputes, delays, and even personal liability for the executor. This is where an experienced probate attorney becomes an essential partner.

A knowledgeable Texas trust administration lawyer can transform an overwhelming task into a manageable process. They provide the clarity and step-by-step guidance needed to fulfill your duties correctly, allowing you to honor your loved one’s legacy with confidence and peace of mind.

What Probate Is and Why It Is Necessary in Texas

When someone passes away in Texas, their financial world doesn't just stop. The probate process is the formal, court-supervised system that steps in to wrap everything up. Think of it as a final, legal accounting of a person's financial life, ensuring everything is handled correctly and transparently.

This process serves a few critical roles. First, it officially validates the deceased person's will, confirming it's the real deal. From there, the court formally appoints the executor named in the will, giving them the legal authority to manage the estate’s business. Without this stamp of approval, the executor would have no power to act.

The Purpose of a Formal Probate Process

So, why do we need this formal process? Probate creates a clear, legal pathway for transferring property from the person who passed away to their rightful heirs. It’s the official system for figuring out who gets what, paying off any lingering debts, and settling disagreements that might pop up between family members.

The entire rulebook is laid out in the Texas Estates Code, which keeps the executor’s actions transparent and accountable. This court oversight is absolutely essential. It makes sure all legitimate bills and taxes are paid before anyone inherits a dime, which protects the beneficiaries from future legal claims against the property they receive.

Probate provides a definitive conclusion to a person's financial life. It confirms the will's validity, settles debts with legal finality, and ensures that title to property passes cleanly to the new owners, offering peace of mind to all parties.

Not All Assets Go Through Probate

One of the biggest misconceptions out there is that every single thing a person owns has to be dragged through the probate court. Thankfully, that's not the case. Texas law allows certain assets, known as non-probate assets, to pass directly to a new owner without any court involvement.

Getting a handle on this distinction is the cornerstone of smart estate planning. These assets work because they have a beneficiary designation built right in, which acts like a direct command telling the financial institution who gets the asset when the owner dies.

Common examples of non-probate assets include:

- Life Insurance Policies: The payout goes straight to the beneficiary named on the policy.

- Retirement Accounts (401(k)s, IRAs): The funds are transferred directly to the designated beneficiary.

- Payable-on-Death (POD) Bank Accounts: The money automatically goes to whoever is named as the POD beneficiary.

- Property Held in a Living Trust: Any assets titled in the name of a trust are controlled by the trustee and completely bypass the probate process.

These assets show just how powerful a well-thought-out estate plan can be. By using beneficiary designations and tools like trusts, you can make the transfer of your wealth much smoother, potentially saving your loved ones from the time and stress of a formal probate process. For a deeper look into this topic, you can learn more about probate and non-probate assets in our detailed guide. A little proactive planning now can make a world of difference for your family down the road.

The Different Types of Texas Probate Administration

Here in Texas, we know that one size rarely fits all, and that’s especially true when it comes to settling an estate. The law recognizes that every family’s situation is different. Thankfully, the Texas Estates Code provides a few different paths for handling an estate, each tailored for specific circumstances.

Picking the right one isn't just a legal formality; it can save your family a significant amount of time, money, and heartache. The best route depends on a few key things: the size of the estate, whether there’s a valid will, and how well everyone is getting along.

Independent Administration: The Go-To Texas Method

By far, the most common and efficient option in Texas is Independent Administration. Think of it as the express lane of probate. Once the court appoints an executor (or administrator), they can manage the estate with minimal hand-holding from a judge. They’re free to pay debts, sell property, and hand out assets to the heirs without asking for the court's permission for every little thing.

This streamlined path is usually available if:

- The will specifically requests an independent administration.

- All the beneficiaries agree to it, even if the will doesn't say so.

This approach dramatically cuts down on court appearances and legal fees, which is why it’s the preferred method for most Texas estates. It’s a great example of how our state law tries to make things easier when possible. You can learn more about how different procedures impact timelines by reviewing some state-specific probate timeline comparisons.

Dependent Administration: When Court Oversight Is Needed

When things are a bit more complicated, the alternative is Dependent Administration. This is the scenic route—slower, more formal, and with a whole lot more court supervision. The administrator has to get a judge’s sign-off for nearly every action, from paying the electric bill to selling the house.

This more restrictive path is usually necessary when:

- The person died without a will (intestate), and the heirs can’t agree to an independent administration.

- The will is silent on the issue, and the beneficiaries are in conflict.

- There are major disputes that need a judge’s oversight to keep things fair.

While it’s definitely more expensive and takes much longer, dependent administration provides a crucial layer of protection when an estate is tangled up in disagreements.

Simplified Options for Smaller, Simpler Estates

Texas law also offers a couple of shortcuts for smaller or more straightforward estates, helping families sidestep the complexities of a full-blown administration.

Muniment of Title

If the deceased left a valid will and the only major debt is a mortgage on their house, a Muniment of Title can be a fantastic shortcut. This process is less about administering an estate and more about simply asking the court to recognize the will as the official document transferring property ownership. No executor is ever appointed.

A Muniment of Title is one of the quickest ways to handle a Texas estate that has a will. It’s basically a title-transfer mechanism, making it perfect for simple estates without any credit card bills or other unsecured debts.

Small Estate Affidavit

For very small estates valued at $75,000 or less (not counting the homestead), a Small Estate Affidavit can be a real lifesaver. This is a sworn statement filed with the court that allows heirs to collect property without going through probate at all. It’s a quick, cost-effective solution, but it’s only available if there was no will and the estate’s assets are worth more than its debts.

To help you see how these options stack up, here’s a quick comparison.

Comparing Probate Options in Texas

This table breaks down the key features of each type of probate administration in Texas, giving you a clear picture of which path might be best for a particular situation.

| Probate Type | Best For | Court Supervision | Typical Timeline |

|---|---|---|---|

| Independent Administration | Estates with a valid will or full beneficiary agreement. | Minimal | 6-12 Months |

| Dependent Administration | Disputed estates or when there's no will and no agreement. | High | 1-2+ Years |

| Muniment of Title | Estates with a will and no unsecured debts. | Low | 2-4 Months |

| Small Estate Affidavit | Estates under $75,000 with no will. | Very Low | 1-2 Months |

As you can see, the path you take can have a massive impact on how long the process takes and how involved the court will be. Choosing correctly from the start is one of the most important decisions you’ll make.

Your Step-by-Step Guide to the Texas Probate Process

Navigating probate in Texas can feel like trying to solve a tricky puzzle, but once you have a clear roadmap, each piece falls right into place. Understanding the timeline and the order of events really helps take the mystery out of the whole affair, empowering you to handle your responsibilities with confidence.

Think of it like a series of milestones you have to reach, one after the other, to make sure the estate is settled correctly and by the book. From that first trip to the courthouse to the final act of distributing assets, every single action is guided by the Texas Estates Code to protect everyone involved.

Step 1: Filing the Application and Posting Notice

The official starting gun for the probate process is filing an Application for Probate. This legal document gets filed with the court in the county where the person who passed away lived. It’s a formal request asking the court to recognize the will as valid and to officially appoint an executor to manage the estate.

Once that application is filed, the clock starts on an approximately two-week waiting period. During this time, the county clerk posts a public notice right there at the courthouse. This lets the world know a probate application has been submitted, giving anyone who might want to contest the will or the application a chance to step forward.

Step 2: The Initial Court Hearing

After the waiting period is over, a hearing gets scheduled with a judge. The person who applied to be the executor has to show up and provide some testimony under oath. The main goal here is simple: prove the will is legitimate and confirm that the person asking to be the executor is who they say they are.

The judge will run through a series of standard questions to lock down the key facts, like the date of death and confirming that the will presented is, in fact, the final one. If everything checks out, the judge will sign an order officially admitting the will to probate.

Step 3: Getting Your Authority as Executor

With the judge's signed order in hand, the person named as executor must then take an Oath of Executor. This is a sworn promise to the court that you will faithfully do everything the will and Texas law require. It’s the moment you formally accept the serious responsibilities that lie ahead.

Right after taking the oath, the court issues a critical document known as Letters Testamentary. Think of these letters as your official badge of authority. They grant you the legal power to act for the estate—to walk into a bank, talk to financial institutions, and manage all the assets left behind.

Letters Testamentary are the key that unlocks your ability to manage the estate. Without this court-issued document, banks, creditors, and other institutions won't recognize your authority to handle the deceased's affairs.

Step 4: Notifying Creditors and Making an Inventory

One of the first big jobs for an executor is to let potential creditors know what's happening. The standard way to do this is by publishing a notice in a local newspaper within one month of getting your Letters Testamentary. On top of that, you have to directly notify any known secured creditors within two months.

At the same time, you have to start the massive task of tracking down and cataloging everything the estate owns. Within 90 days of your appointment, you must file a detailed report with the court called an Inventory, Appraisement, and List of Claims. This document is a complete list of all property owned by the decedent when they passed, along with its estimated value. Juggling all these duties can be a lot, which is why we created a handy executor of estate checklist to help you stay on track.

Step 5: Paying Off Debts and Distributing the Estate

Once the inventory is filed and approved, and creditors have had a chance to make their claims, your focus shifts to settling the estate's bills. This means paying off all valid debts, covering final expenses, and handling any taxes owed using the estate's funds.

Only after every last debt and administrative cost has been paid can you move on to the final, rewarding step: distributing the remaining assets to the beneficiaries exactly as the will instructs. This is what the entire probate process builds up to—the moment the decedent’s final wishes are officially carried out.

Understanding the Costs and Timeline of Texas Probate

When a family is facing probate, two questions always bubble to the surface first: "How much is this going to cost?" and "How long is this whole thing going to take?" These aren't just details; they're the practical realities that cause the most stress. Getting a handle on them early helps manage expectations and brings a sense of control.

While every estate is different, the costs and timeline are shaped by a few key factors. Let's peel back the layers to see what you can realistically expect.

The total cost of settling an estate comes from several different places. It’s important to remember that these expenses are paid directly out of the estate's funds before any assets are handed over to the beneficiaries.

Here’s a look at the usual suspects:

- Court Filing Fees: You can't start probate without filing an application with the court, and that comes with a fee. In major Texas counties like Harris or Travis, this usually lands somewhere between $300 and $500.

- Executor Compensation: The Texas Estates Code allows the person managing the estate—the executor—to be paid for their time and effort. The standard commission is 5% of the funds that move in and out of the estate.

- Attorney Fees: This is often the biggest piece of the pie. Having a sharp legal mind in your corner is essential to get through probate correctly and without costly mistakes.

Breaking Down Attorney Fees

In Texas, probate lawyers typically charge in one of two ways. For a simple, straightforward estate, many attorneys will offer a flat fee. This gives everyone peace of mind because you know the exact cost upfront. If the estate is more complex—maybe there are family disputes or tricky assets—an hourly rate is more common.

So, what's the damage in 2025? In metro areas like Houston, Fort Worth, and Austin, you can expect to see hourly rates from $200–$500 per hour. For those simpler cases with a flat fee, a range of $3,000 to $7,000 for full representation is pretty standard.

As a general rule of thumb, many experts estimate that total probate administration costs often land around 3%–7% of the estate’s gross value for a typical case.

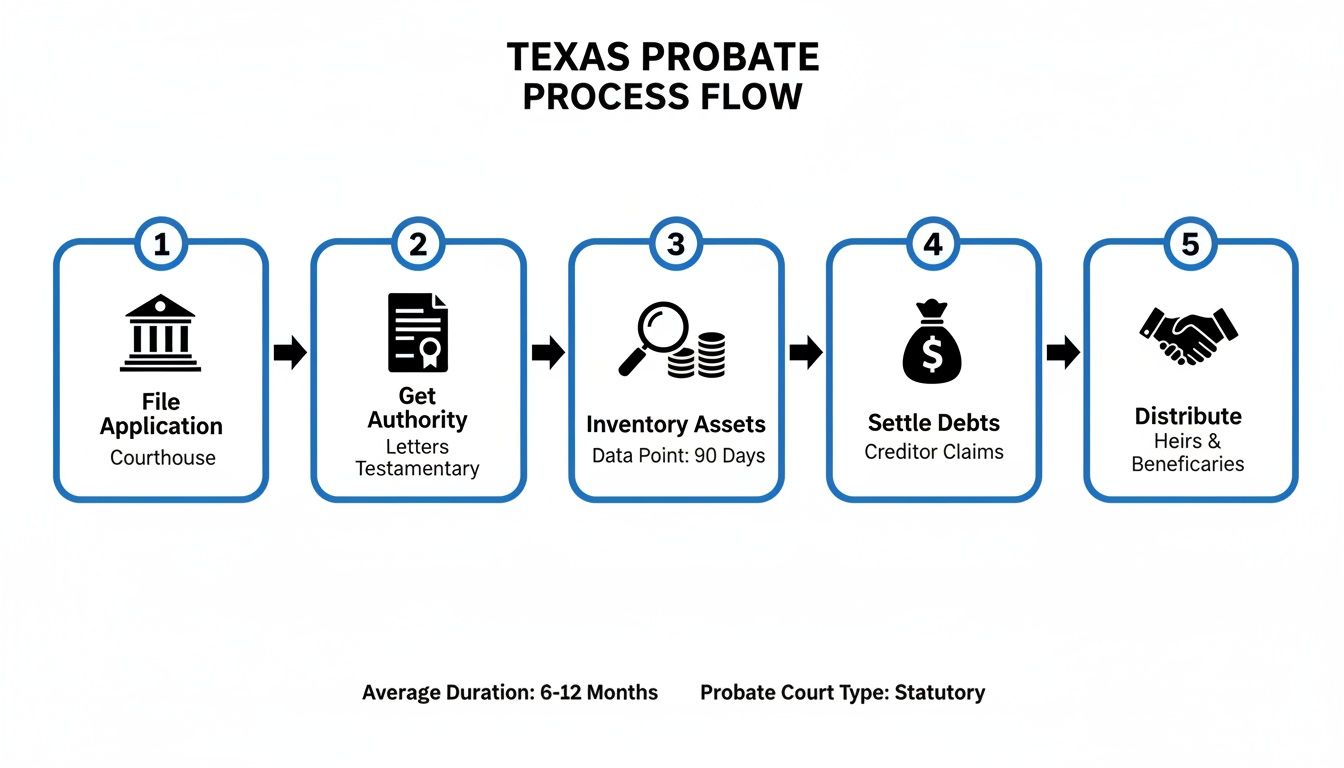

This flowchart gives you a bird's-eye view of the standard probate process in Texas, from that initial court filing all the way to distributing the assets to the heirs.

Think of this as your roadmap. It highlights the key milestones the executor has to hit to settle an estate the right way under Texas law.

Setting Realistic Timeline Expectations

In a perfect world, a simple, uncontested independent administration could be wrapped up in as little as six to twelve months. But let's be honest, perfect worlds are rare. That's a best-case scenario.

Several things can easily stretch out the timeline.

The complexity of the estate, arguments among beneficiaries, or even just a backed-up court system can add months, or even years, to the process. It’s always smart to mentally prepare for a journey that might take longer than a year.

The single best way to keep both costs and timelines in check is to work with an experienced probate attorney. They know the shortcuts, can sidestep common pitfalls, and help squash potential disputes before they blow up. For a deeper dive, check out our guide on how long probate can take in Texas.

And while we're focused on Texas here, it can be interesting to see how things work elsewhere. For instance, the way fees are structured can vary quite a bit, like in this breakdown of Ontario probate fees.

How Thoughtful Estate Planning Can Avoid Probate

Let's be honest: the best way to handle the headaches of the probate process in Texas is to set things up so your family can skip it entirely. Think of proactive estate planning as more than just a legal checklist; it’s one of the greatest acts of care you can offer your loved ones, shielding them from the stress, cost, and public scrutiny of court proceedings.

With the right tools in place, you can make sure your assets pass directly to your heirs, no courthouse required. This doesn't just make their lives easier during an already tough time—it protects your family’s privacy and hard-earned wealth.

Key Strategies for Avoiding Probate in Texas

There are several powerful legal instruments that let you call the shots on how your assets are distributed, completely outside of a will. An experienced Texas estate planning attorney can walk you through the options and find the perfect fit for your situation, which may involve asset protection strategies.

Here are a few of the most common probate-avoidance tools:

- Revocable Living Trusts: A trust is basically a private legal container you create to hold your assets. You transfer property into it, and when you pass away, a successor trustee you've named distributes everything according to your private instructions. No probate court needed.

- Beneficiary Designations: This is one of the simplest methods. By naming beneficiaries directly on things like life insurance policies, retirement accounts (401(k)s, IRAs), and bank accounts (Payable-on-Death or POD), that money goes straight to the people you chose.

- Joint Ownership with Right of Survivorship: This is a popular option for real estate and bank accounts. When you title property this way, it means that when one owner passes away, the asset automatically belongs to the surviving owner. Simple as that.

Probate often becomes a necessary evil simply because of a lack of planning. It's surprising, but recent surveys show that only about 24% of Americans have a valid will, which forces countless families into court-supervised administration. Smart planning gives you a way out. For a deeper dive into these methods, check out this simple guide on how to avoid probate court through effective estate planning.

Why Planning Ahead Matters Most

Creating a solid estate plan is one of the most important things you can do to protect your family's future. It puts you in the driver's seat of your own legacy, dramatically reduces the chances of family disputes, and spares your loved ones from a mountain of unnecessary legal burdens.

By working with a skilled Texas estate planning attorney, you can build a plan that not only gives you peace of mind today but ensures a streamlined, private process for your family tomorrow.

Common Questions About the Texas Probate Process

Going through probate for the first time brings up a ton of questions. It's completely normal to feel a bit lost in the legal maze. Let's walk through some of the most common concerns we hear from families across Texas, breaking them down into clear, straightforward answers to help you see the path forward.

What Happens If There Is No Will in Texas?

When someone passes away without a will, the law calls this dying intestate. It’s a common misconception that the state just swoops in and takes everything. That's not how it works in Texas. Instead, the Texas Estates Code lays out a rigid formula for who gets what.

Think of it as a default family tree. The law decides how to divide the property among the closest living relatives. For instance, if the person was married and all their children were with their surviving spouse, the spouse inherits a large share, and the kids get the rest. A common real-world scenario involves a blended family, where the deceased had children from a prior marriage. In that case, Texas law carefully divides community and separate property between the surviving spouse and the children, which can become quite complex. The probate process itself, however, often gets more complicated and may require a more supervised dependent administration, where a judge has to sign off on nearly every single move the court-appointed administrator makes.

Do I Need a Lawyer for Texas Probate?

In almost every case, the answer is a firm yes. Texas courts generally require you to have an attorney to probate a will or administer an estate. This isn't just a rule to make things difficult; it's about protecting everyone involved. The executor or administrator isn't just representing themselves—they're acting on behalf of all the beneficiaries and creditors. This is a serious legal responsibility known as a fiduciary duty.

An executor is responsible for the financial interests of others. The court requires legal representation to ensure these duties are fulfilled according to the law, protecting the estate from costly errors and protecting the executor from personal liability.

While a super simple process like a Small Estate Affidavit might be manageable on your own, having a skilled Texas probate lawyer in your corner is invaluable for everything else. An attorney makes sure you hit every deadline, file the right paperwork, and can help you navigate any family disagreements before they turn into full-blown legal battles.

How Are Estate Debts Paid During Probate?

Handling the deceased's final bills is one of the most critical jobs for an executor. Texas has a very formal, structured process for this. First, the executor has to publish a legal notice in a local newspaper to alert any unknown creditors. They also have to send a direct, formal notice to any known secured creditors, like a mortgage company.

Creditors then have a limited time to file a formal claim against the estate. The Texas Estates Code sets up a clear pecking order for who gets paid and when. You can't just start paying bills randomly.

The priority for payment generally looks like this:

- Funeral expenses and costs of last illness (up to a certain amount).

- Expenses of administration, which includes things like court costs and attorney's fees.

- Secured debts, like the mortgage on the house.

- Child support that is past due.

- State taxes.

- Claims for repayment of state medical assistance (like Medicaid).

- All other unsecured claims, such as credit card debt or personal loans.

Only after every legitimate debt is paid off can the executor distribute what’s left to the beneficiaries. This system ensures the process is fair and orderly for everyone.

If you’re managing an estate or planning for your own, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the probate process.