Planning for your child’s future is one of the most profound things you can do as a parent. In Texas, setting up a trust for a child is a powerful way to provide long-term security and ensure your hard-earned assets are managed according to your wishes. Managing this process can feel overwhelming—but with the right legal guidance, it doesn’t have to be.

A trust is a legal framework where you, the grantor, transfer assets to a trustee—someone you appoint—to manage for your child's benefit. Unlike a simple will, a trust offers superior control over how and when your child receives their inheritance, protecting it from potential creditors and keeping your family’s financial affairs private by avoiding the public probate court process.

Why a Trust Is a Smart Move for Your Child’s Future

Many people believe a will is sufficient for their [estate planning] needs. While a will is essential, relying on it alone for minor children can create significant complications. Under the Texas Estates Code, a minor cannot legally own property above a certain value. If they inherit directly from a will, the court must step in to manage the funds.

The court’s solution is to appoint a guardian to oversee the inheritance until your child turns 18. This court-supervised guardianship can be expensive, time-consuming, and is a matter of public record. More importantly, it may not align with your specific wishes for how the money should be used to support your child.

The Power of Control and Protection

A trust bypasses these guardianship challenges entirely. By creating a trust, you establish a private, legally enforceable plan for how your assets are managed and distributed, all based on your precise instructions. You set the rules.

Instead of your child receiving a large lump sum on their 18th birthday—a scenario that makes many parents uneasy—you can design a distribution plan that reflects your family’s values. For instance, you can specify that the funds are to be used for:

- Education: To cover tuition, books, and living expenses for college or a trade school.

- Major Life Events: A down payment on their first home or seed money to start a business.

- Staggered Distributions: Releasing the inheritance in stages—perhaps at ages 25, 30, and 35—to allow them time to gain financial maturity.

A trust acts as a protective shield for the inheritance. It ensures your assets are used for your child’s benefit, safeguarding them from potential immaturity, creditors, or even a future divorce. This level of customized control is something a standard will simply cannot offer.

Key Benefits of a Trust vs a Will for a Child

Comparing a trust and a will side-by-side highlights their different roles in leaving assets to children. Both are critical components of a comprehensive estate plan, but a trust provides far more nuance and protection.

Here’s a practical breakdown of how they compare.

| Feature | Trust for a Child | Will Only |

|---|---|---|

| Asset Control | You dictate the exact terms for distributions (age, milestones, use). | Child gets everything outright at age 18, with no strings attached. |

| Probate | Avoids the public probate process, keeping affairs private and fast. | Must go through the public, and often lengthy, probate process. |

| Court Oversight | Managed privately by your chosen trustee, no court intervention needed. | May require a costly court-appointed guardianship for a minor. |

| Asset Protection | Can protect assets from your child’s future creditors or legal troubles. | Once the child owns the assets, they are vulnerable to creditors. |

Ultimately, a trust provides a more sophisticated and protective approach, giving you peace of mind that your child will be cared for exactly as you intended.

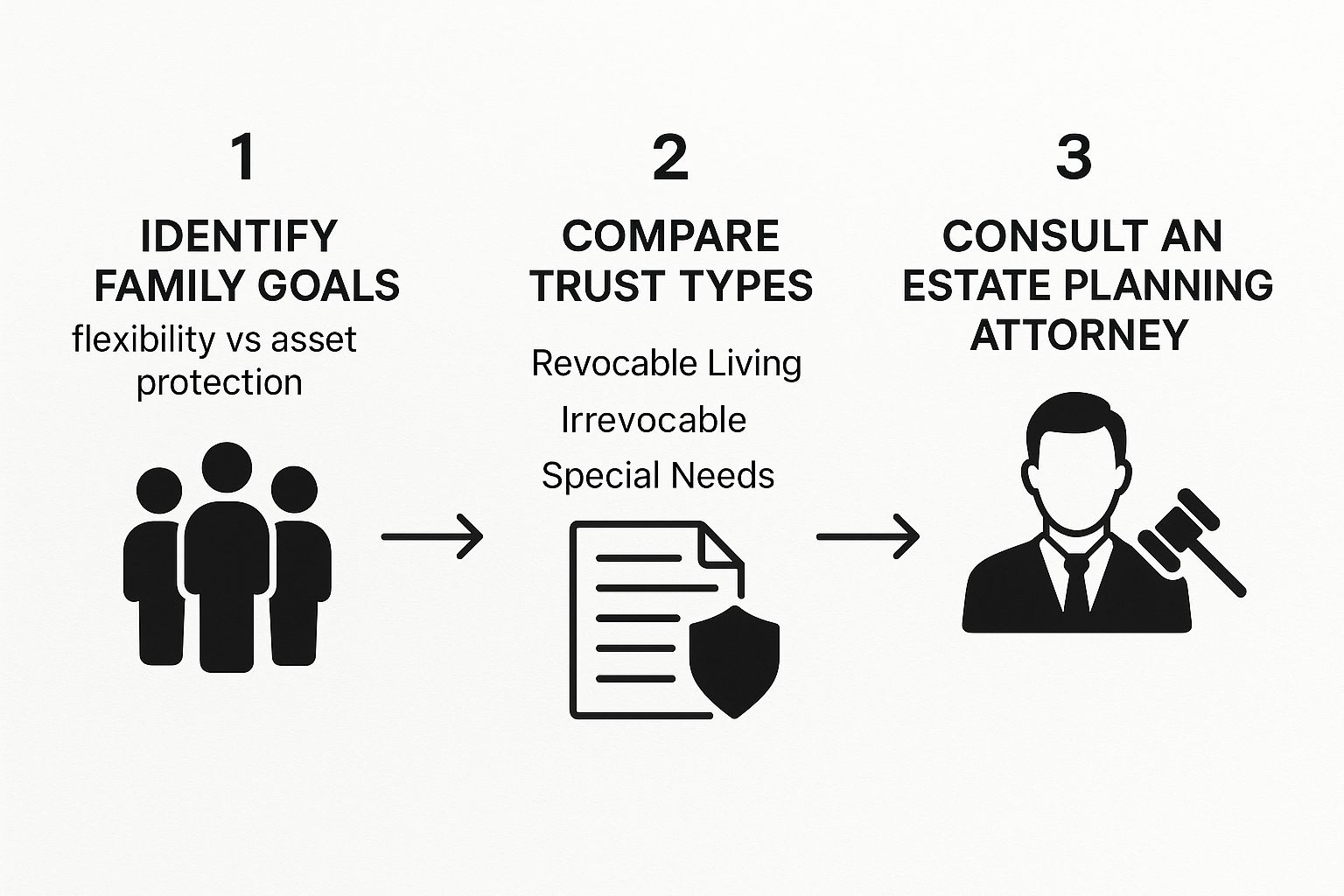

Choosing the Right Type of Trust for Your Family

Once you decide to establish a trust, the next step is determining which type best suits your family. The right choice depends on your specific goals, family dynamics, and financial situation. This is not a one-size-fits-all decision; it’s about selecting the legal structure that aligns with your vision for your child’s future.

The primary choice is between a revocable and an irrevocable trust. Think of it as creating a plan in pencil versus one in permanent ink. Each serves a distinct purpose, and understanding their differences is key to making an informed decision with your Texas estate planning attorney.

Revocable Living Trusts: A Flexible Approach

For many parents, the Revocable Living Trust is the preferred option. As the name implies, it is "revocable"—meaning you can amend, modify, or even dissolve it at any time during your lifetime. You maintain complete control over the assets within the trust.

This flexibility is a significant advantage. Life is unpredictable. As your family or financial circumstances change, you can adjust the trust accordingly. You might need to change the trustee, add another child as a beneficiary, or alter the distribution terms. Our firm offers a detailed guide on what a revocable trust is that further explains how these adaptable instruments work.

Irrevocable Trusts: The Shield of Asset Protection

An Irrevocable Trust, once created and funded, generally cannot be changed or revoked. By transferring assets into an irrevocable trust, you legally relinquish ownership and control. While this may sound daunting, it offers powerful benefits.

Because the assets are no longer legally yours, they are typically protected from your personal creditors and lawsuits. This structure can also be a strategic tool for minimizing estate taxes. For families focused on long-term wealth preservation and asset protection, an irrevocable trust is a robust solution.

Trusts for Specific Family Needs

Beyond these two primary types, Texas law allows for specialized trusts designed for unique family circumstances. These instruments address specific challenges that a general trust may not cover.

Here are two common examples we encounter in our practice:

- Testamentary Trust: This trust is created within your will and only becomes active after your death. While it provides for a child without a separate living trust, the will must first go through the probate process.

- Special Needs Trust (SNT): For parents of a child with disabilities, an SNT is essential. It is carefully drafted to hold assets for the child's benefit without disqualifying them from vital government assistance programs like Medicaid or Supplemental Security Income (SSI).

This flowchart illustrates the simple, three-step process for identifying the best trust for your family’s needs.

As you can see, the process begins with clarifying your personal goals before delving into the legal mechanics.

A Real-World Scenario in Texas

Consider a Texas family with two young children and a small business. They want to ensure their children are cared for if something happens to them but need to retain control over their business assets for now. They could establish a revocable living trust, naming themselves as trustees and their children as beneficiaries. They can transfer their home and personal savings into the trust while keeping the business separate. Their will would include a testamentary trust provision for the children, funded by the business assets upon their passing. This layered approach provides both immediate flexibility and long-term security.

Ultimately, choosing the right trust is about matching the legal tool to your family's story. Do you need the ongoing flexibility of a revocable trust, or is the asset protection of an irrevocable trust your main priority? Answering this question honestly will point you in the right direction.

How to Create and Fund Your Child’s Trust

This is the practical stage where your vision for your child’s future becomes a legal reality. The process involves clear, manageable steps. With an experienced Texas estate planning attorney, you can confidently build a lasting plan.

Step 1: Defining Your Goals and Distribution Terms

Before any documents are drafted, we must clarify your objectives. What do you want the trust to accomplish for your child? Being specific now helps prevent future confusion and disputes.

Think about key life stages. Do you want the trust to fund a college education? Provide a down payment for a first home? You determine the purpose.

Next, we define the distribution terms. A common concern for parents is a child receiving a large sum of money before they are mature enough to handle it. The Texas Trust Code provides the flexibility to structure distributions in a way that aligns with your child’s maturity and your family's values.

Effective strategies include:

- Age-Based Payouts: A classic approach where funds are released in stages—for example, one-third at age 25, one-third at 30, and the remainder at 35.

- Milestone-Based Payouts: Tying distributions to achievements like graduating from college, getting married, or starting a business.

- Discretionary Distributions: Granting the trustee authority to distribute funds for the child's health, education, maintenance, and support (known as the "HEMS" standard).

Your attorney will translate your personal goals into the clear, legally enforceable language of the trust document. This initial planning phase is the foundation of the entire structure.

Step 2: Drafting the Formal Trust Document

With a clear plan, your attorney will draft the formal trust agreement. This legal document officially creates the trust, naming the key parties—you as the grantor, your chosen trustee, and your child as the beneficiary—and outlining all the rules.

This document serves as the instruction manual for your trustee. It must be drafted with precision to comply with Texas law, ensuring its validity and function. It will detail everything from the trustee’s powers to the distribution schedule and name a successor trustee in case your first choice is unable to serve.

Step 3: The Critical Step of Funding the Trust

This is the most crucial—and often overlooked—step. An unfunded trust is powerless. It is merely a document until you legally transfer ownership of your assets into it.

Think of the trust as a separate legal entity. You are moving assets from your individual name into the trust's name. The process varies by asset type:

- Real Estate: Your attorney will prepare and file a new deed to transfer the property title from "Jane Doe" to "Jane Doe, Trustee of the Doe Family Trust."

- Bank Accounts: You will open a new account in the trust's name or retitle an existing one, providing the bank with a copy of the trust agreement or a certificate of trust.

- Life Insurance Policies: You will update the beneficiary designation on your policy to name the trust as the beneficiary. This prevents the proceeds from being paid directly to a minor, which would trigger court involvement.

- Investment Accounts: You will work with your brokerage firm to change the title on your accounts to the name of the trust.

Properly funding your trust is the final, essential move in setting up a trust for a child. It makes the protective structure you've built legally effective, with all assets in place and ready for management according to your wishes.

Selecting the Right Trustee for Your Child

After designing the trust, you must make one of the most critical decisions: choosing the trustee. This person or institution becomes the legal steward of your child’s inheritance, and their integrity and diligence will directly impact your child's financial future.

Under the Texas Trust Code, a trustee has a fiduciary duty to act exclusively in the best interests of the beneficiary—your child. This is the highest standard of care recognized by law.

Trustee Responsibilities Under Texas Law

A trustee’s role goes far beyond writing checks. They are bound by strict legal and ethical obligations. Understanding these fiduciary principles is essential before appointing someone. You can learn more about the comprehensive duties of a trustee to see the full scope of the role.

Key fiduciary duties in Texas include:

- Duty of Loyalty: The trustee must act solely for the beneficiary's benefit, avoiding all self-dealing or conflicts of interest. For example, they cannot borrow from the trust or sell trust assets to themselves.

- Duty of Prudent Investment: Trustees must invest and manage trust assets as a sensible investor would, balancing growth with risk management to protect the child’s future.

- Duty to Account: Trustees must maintain meticulous records and provide regular, detailed accountings to the beneficiaries, ensuring full transparency.

These are not mere suggestions; they are legal requirements. We explore these obligations further in our detailed guide.

Family Member vs. Corporate Trustee

Parents often debate whether to appoint a family member or a professional corporate trustee, such as a bank or trust company. Each has distinct advantages and disadvantages.

A family member offers a personal connection. They know your child and understand your family’s values. However, they may lack the financial expertise to manage a complex portfolio or the emotional detachment needed to deny an unwise request from the beneficiary.

A corporate trustee provides professional expertise, impartiality, and regulatory oversight. They are specialists in investment management, tax compliance, and trust administration. The trade-offs are the fees they charge and the absence of a personal relationship with your child.

Real-World Scenario: Imagine your 22-year-old child requests a large distribution to invest in a friend's risky startup. A family member trustee might struggle to say no without causing a family conflict. A corporate trustee, bound by its duty of prudent investment, would analyze the request objectively and likely refuse, protecting the trust from a speculative gamble.

The Importance of a Successor Trustee

Life is unpredictable, which is why your trust must name at least one successor trustee. This individual or institution steps in if your primary choice cannot serve due to death, disability, or resignation.

Failing to name a successor could send the trust to court, where a judge would appoint one for you—a situation that undermines the very control and peace of mind you sought to establish.

Managing the Trust and Its Tax Implications

https://www.youtube.com/embed/7cML9PGX51c

Creating and funding a trust is a significant achievement, but it is the beginning of a long-term process. A trust is not a static document; it is a dynamic financial vehicle that requires ongoing management to remain effective and compliant with tax laws.

The trustee is responsible for everything from prudent investing and tax filings to providing regular updates to the beneficiary. This diligent oversight ensures the trust functions as intended for years to come.

Navigating the Tax Landscape

Trust taxation can seem complex, but the rules are manageable with proper guidance. When you transfer assets into a trust, gift tax rules may apply. However, the high federal gift tax exemption means most families will not owe any tax.

The primary concern is often the trust's income tax. Income generated by trust assets, such as stock dividends or rent, is taxable. Depending on the trust's structure, the tax liability may fall on the trust itself or pass through to your child.

For example, an irrevocable trust is a separate taxable entity and must file an annual income tax return using IRS Form 1041. These trusts have "compressed" tax brackets, meaning they reach the highest tax rates much more quickly than an individual. You can learn more about how to navigate irrevocable trust tax benefits in our in-depth article.

Ongoing Duties and Financial Oversight

A trustee's duties extend beyond tax season. The Texas Trust Code requires them to continuously manage trust assets prudently. This involves making sound investment decisions to preserve and grow the principal while managing risk. It includes strategies like understanding portfolio rebalancing to maintain the trust's long-term financial health.

Open communication is also a critical fiduciary duty. The trustee must provide periodic accountings to the beneficiary, offering a transparent view of all transactions, earnings, and distributions. This builds trust and ensures everyone remains informed.

A well-managed trust is a living entity. Its success depends on the trustee’s active and diligent oversight, ensuring it adapts to both the beneficiary’s needs and the ever-changing financial environment.

When to Modify or Terminate a Trust

Life changes, and sometimes a trust needs to be updated. While irrevocable trusts are designed for permanence, Texas law allows them to be modified or terminated under certain conditions.

This process, known as decanting, typically requires the agreement of the trustee and all beneficiaries and may involve court approval. The goal is to ensure any changes align with the grantor’s original intent.

Common reasons for modification include:

- Changes in tax laws that make the original terms inefficient.

- A significant change in the beneficiary's needs.

- The trust has become too small to administer cost-effectively.

Modifying a trust is a complex legal matter that requires guidance from a skilled Texas trust administration lawyer to ensure compliance with the Texas Trust Code.

Common Questions About Setting Up a Child’s Trust

Setting up a trust is a significant decision, and it is natural to have questions. As a Texas estate planning attorney, I find that clear answers help families move forward with confidence.

Here are some of the most common questions I hear from parents.

How Much Does It Cost to Set Up a Trust?

The cost of setting up a trust varies based on the complexity of your finances and the type of trust you need. A simple testamentary trust within a will will be less expensive than a highly customized irrevocable trust designed for advanced asset protection.

While low-cost online templates may seem appealing, they often lead to improperly drafted or unfunded trusts, resulting in costly court battles down the road. Investing in experienced legal counsel ensures your trust is drafted correctly, funded properly, and compliant with the Texas Trust Code. This initial investment can save your family significant expense and distress later.

Can I Be the Trustee for My Own Child’s Trust?

Yes, you can. In Texas, it is common for the person creating the trust (the grantor) to also serve as the initial trustee of a revocable living trust. This allows you to maintain control over the assets during your lifetime.

However, it is crucial that you name a successor trustee. This is the person or institution that will take over management of the trust if you pass away or become incapacitated. Choosing a reliable and capable successor is one of the most important steps in the process.

Appointing yourself as trustee is convenient for now, but the real legacy protection comes from who you pick to follow you. That person needs the integrity and financial smarts to carry out your wishes exactly as you intended.

What Happens if the Trust Isn't Fully Funded When I Pass Away?

This is a common and serious mistake. An unfunded trust is an empty legal shell. If assets like your home or bank accounts are not officially titled in the name of the trust, the trust has no control over them.

To prevent this, we use a tool called a "pour-over will." This special type of will acts as a safety net. Its sole purpose is to "catch" any assets you may have forgotten to transfer into the trust and "pour" them in after your death. While these assets must first go through probate, the pour-over will ensures they ultimately end up in the trust and are managed according to your rules.

How Do I Protect Trust Assets from a Child’s Future Divorce?

This is a wise question. A well-drafted trust can provide excellent protection. By including a spendthrift provision, you can generally shield trust assets from the claims of your child's creditors, which can include a future ex-spouse in a divorce proceeding.

We can also add another layer of protection by giving the trustee discretion over distributions rather than mandating them. This makes it far less likely that the assets will be considered marital property. A Texas estate planning lawyer can build these specific safeguards into the trust, protecting your child’s inheritance from life’s unpredictable turns.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.