Planning for the future of a loved one with a disability can feel overwhelming—but with the right legal guidance, it doesn’t have to be. You want to ensure they have every possible resource and opportunity, but the maze of government assistance rules can be daunting. This is exactly where a Special Needs Trust (SNT) becomes one of the most powerful tools in your estate plan.

A special needs trust in Texas is a specific legal instrument designed to hold assets for a person with disabilities without disqualifying them from essential government benefits like Medicaid and Supplemental Security Income (SSI). It acts as a protective shield, allowing you to provide for your loved one's quality of life—funding needs like therapy, education, and recreation—while navigating the government's strict asset limits.

Securing Your Loved One's Future in Texas

Think of an SNT as a carefully constructed financial safety net. It allows you to set aside funds to truly enhance your loved one's life, all without disrupting the means-tested benefits they depend on for critical healthcare and basic living expenses.

Why Asset Limits Matter

Here’s the core challenge: federal rules are incredibly strict. An individual generally cannot have more than $2,000 in countable assets to remain eligible for programs like Medicaid and SSI. A direct inheritance or settlement could instantly disqualify them.

A special needs trust in Texas solves this problem by making the funds held within it 'invisible' to agencies like the Social Security Administration and Texas Health and Human Services. This simple but powerful distinction preserves eligibility while unlocking crucial supplemental support. Governed by the Texas Trust Code, these trusts are the foundation of thoughtful planning for families like yours.

To give you a clearer picture, here's a quick rundown of what an SNT can do for you and your family.

Key Benefits of a Texas Special Needs Trust

| Benefit | How It Works in Texas |

|---|---|

| Preserves Government Benefits | Assets in the trust are not counted toward the $2,000 asset limit for SSI and Medicaid, ensuring continuous coverage. |

| Enhances Quality of Life | Funds can pay for supplemental needs not covered by benefits, like specialized therapies, education, travel, and personal care. |

| Provides Professional Management | A chosen trustee manages and invests the funds, making sure they are used responsibly and for the beneficiary's best interest. |

| Offers Peace of Mind | You can rest assured knowing your loved one will be financially cared for even when you're no longer able to provide that care yourself. |

These benefits work together to create a stable, secure future where your loved one can thrive.

Going Beyond the Basics: Practical Examples

An SNT isn't just about preserving benefits; it's about enriching a life. The funds can be used for a wide range of expenses that improve well-being, foster independence, and bring joy.

Here are just a few real-world scenarios:

- Medical Care: Paying for specialized dental procedures or therapies not covered by Medicaid.

- Education: Funding vocational training programs, tutoring, or courses to develop new skills.

- Personal Support: Hiring personal care attendants, companions, or home health aides to assist with daily living.

- Recreation and Travel: Covering expenses for vacations, hobbies, and social activities that enhance quality of life.

Beyond the finances, developing crucial autism life skills is essential for building true independence and improving daily life for many beneficiaries. A well-funded SNT can provide the resources to support these vital goals. For families navigating these complexities, understanding the full legal landscape, including tools like guardianship, is vital. You can learn more about how these concepts intersect in our detailed guide on guardianship in Texas for special needs.

First-Party vs. Third-Party SNTs: Which is Right for Your Family?

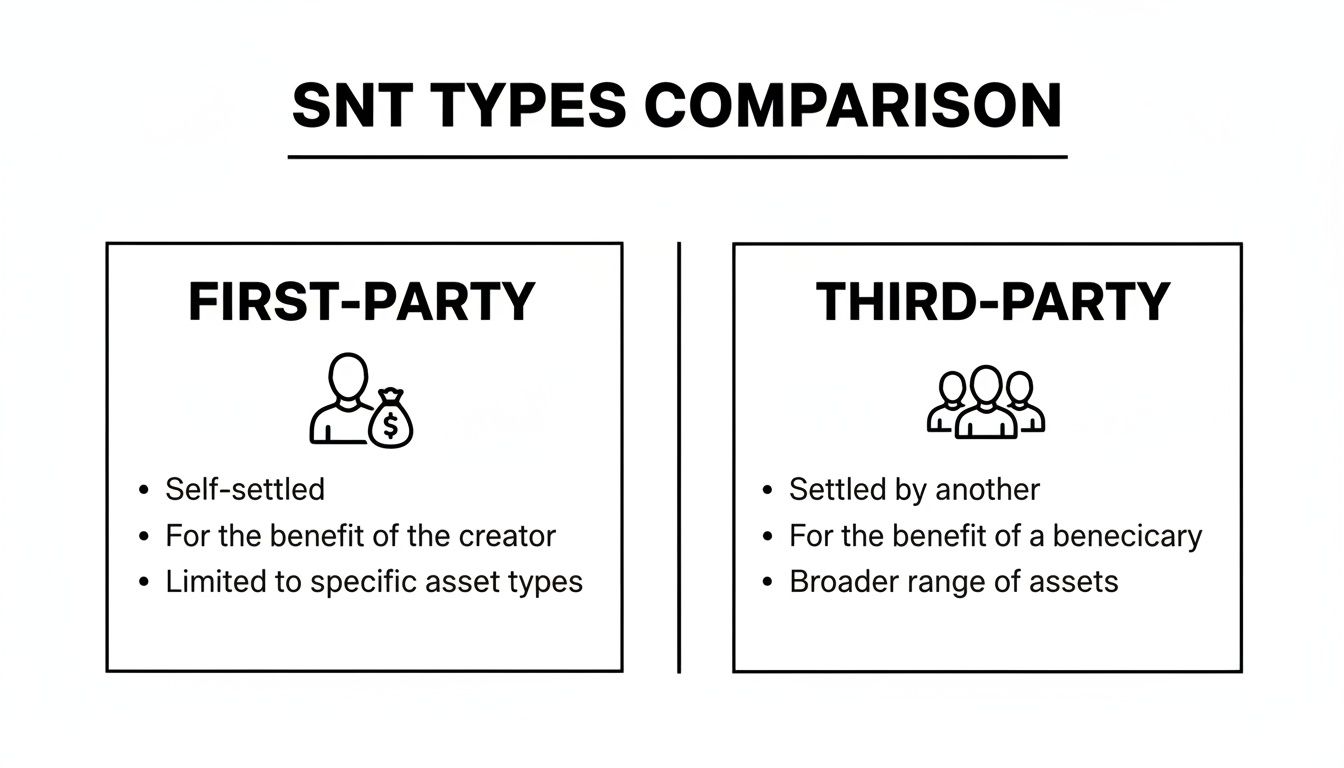

When you start looking into a special needs trust in Texas, you'll quickly discover they are not a one-size-fits-all solution. The most important distinction depends on one key factor: the source of the funds. This detail has significant legal and financial implications. The two main types, First-Party and Third-Party SNTs, are designed for completely different situations.

Getting this choice right from the start is the bedrock of a solid estate plan for a loved one with a disability. A seasoned Texas estate planning attorney can help you navigate this decision, ensuring the trust functions exactly as intended when it matters most.

First-Party Special Needs Trusts Explained

A First-Party SNT is used when the money funding the trust already belongs to the person with a disability. This situation often arises from an unexpected event that could suddenly disqualify them from needs-based government benefits like SSI and Medicaid.

Common sources for these funds include:

- A personal injury lawsuit settlement.

- An inheritance left directly to the individual.

- Life insurance proceeds where the individual was the named beneficiary.

- Assets received in a divorce.

The primary purpose of a First-Party SNT is to shield these assets and preserve the beneficiary's eligibility for public aid. Because the beneficiary's own funds are used, these are sometimes called "self-settled" trusts.

Under federal law, a First-Party SNT has strict requirements. It must be established before the beneficiary turns 65 and must be created by a parent, grandparent, legal guardian, or a court. Most importantly, it must contain a "Medicaid payback" provision.

This payback clause is a non-negotiable requirement. It states that when the beneficiary passes away, any money remaining in the trust must first be used to repay the state of Texas for all Medicaid services they received during their lifetime. Only after this government debt is settled can any leftover funds be distributed to other family members or heirs.

The Power of a Third-Party Special Needs Trust

In contrast, a Third-Party SNT is funded with assets that belong to anyone other than the beneficiary. This is the go-to tool for proactive, forward-thinking estate planning. Parents, grandparents, and other relatives use this type of trust to set aside funds for their loved one's future care without jeopardizing their benefits.

Funding for a Third-Party SNT can come from various sources:

- Gifts from family members made during their lifetime.

- Proceeds from a life insurance policy owned by a parent or grandparent.

- An inheritance specifically directed into the trust through a will or another trust.

The single greatest advantage of a Third-Party SNT is that it completely avoids the Medicaid payback requirement. Since the money never legally belonged to the beneficiary, the state has no claim to it.

This gives families tremendous control. The person who creates the trust (the grantor) gets to decide exactly what happens to any remaining funds after the beneficiary is gone. Those assets can be passed down to other children, grandchildren, or even a favorite charity. This makes it a far superior tool for long-term asset protection and building a family legacy. This structure aligns perfectly with the core fiduciary duties in Texas, where a trustee's primary role is to carry out the grantor's wishes. A skilled Texas trust administration lawyer is essential to ensure those duties are met with precision.

How SNTs and ABLE Accounts Work Together

When planning for a loved one with a disability in Texas, many families wonder: should we set up a Special Needs Trust or open an ABLE Account? The best answer is often both. These two powerful tools are not competitors; they are partners designed to work in tandem to secure different aspects of your loved one's financial future.

SNTs and ABLE Accounts: The Perfect Partnership

The most effective strategy often involves using the SNT as the main reservoir for funds and the ABLE account as a tool for daily expenses. A Special Needs Trust acts as the strong, long-term foundation of your financial plan. It’s built to hold significant assets—such as an inheritance, a life insurance payout, or settlement funds—without any caps on contributions.

An ABLE account, on the other hand, functions more like a specialized checking account. It's ideal for managing daily expenses and gives the beneficiary a sense of financial independence. A Texas trust administration lawyer can help you structure this two-pronged approach to maximize both long-term protection and daily flexibility.

What Is an ABLE Account?

An ABLE (Achieving a Better Life Experience) account is a tax-advantaged savings account for individuals with disabilities. Funds in the account can be used for qualified disability expenses—such as housing, food, education, and transportation—without jeopardizing means-tested benefits like Medicaid or SSI. This gives the beneficiary direct control over their spending on everyday needs.

However, ABLE accounts have strict limitations. These rules are precisely why a special needs trust in Texas remains the superior vehicle for holding and protecting substantial assets.

This chart breaks down the two main SNT types, highlighting where the money comes from for each.

As you can see, Third-Party SNTs, which are funded by family and friends, offer a way to protect assets without the Medicaid payback rules that hamstring First-Party trusts.

Here’s how this powerful partnership looks in action: the SNT trustee can make regular, planned transfers of money into the beneficiary’s ABLE account. The beneficiary can then use their ABLE debit card to pay for groceries, their share of the rent, or other qualified expenses.

This setup delivers several key advantages:

- Empowerment: It gives the beneficiary more independence and control over their daily finances.

- Protection: The bulk of the assets remains shielded inside the SNT, safe from contribution limits and creditors.

- Flexibility: The SNT can still be used directly by the trustee for major, non-recurring expenses like a modified vehicle, specialized medical equipment, or a vacation.

This layered approach honors the core principles of fiduciary duties in Texas. The trustee maintains ultimate control over the primary assets while promoting the beneficiary's autonomy and quality of life in a structured, compliant manner.

Comparing Special Needs Trusts and ABLE Accounts

To truly understand why SNTs and ABLE accounts work so well together, it helps to see their differences side-by-side. Each has a distinct role to play in a comprehensive financial plan.

The table below highlights the key features that set them apart, from who can contribute to how much money can be held in each account.

| Feature | Special Needs Trust (SNT) | ABLE Account |

|---|---|---|

| Contribution Limits | No limit on contributions. | Capped annually at the federal gift tax exclusion amount ($18,000 in 2024). |

| Asset / Balance Caps | No limit on the total assets held within the trust. | Texas has a lifetime maximum of $500,000. SSI benefits are suspended if the balance exceeds $100,000. |

| Age Requirements | No age limit for the beneficiary. | The beneficiary's disability must have occurred before age 26 (expanding to age 46 on January 1, 2026). |

| Flexibility | Extremely flexible; can be used for nearly any expense that benefits the individual. | Funds are restricted to "Qualified Disability Expenses" (QDEs) like housing, food, and education. |

| Medicaid Payback | Required for First-Party SNTs, but not for Third-Party SNTs. | Subject to a Medicaid payback claim upon the beneficiary's death. |

This comparison makes it crystal clear: for a substantial inheritance or a legal settlement, a special needs trust in Texas is the only vehicle that provides unlimited asset protection.

While ABLE accounts are a fantastic supplement for daily living expenses, they cannot replace the robust, long-term security of a well-drafted SNT. An experienced Texas estate planning attorney can help you design a plan that leverages the unique strengths of both, creating a financial safety net that is both strong and flexible. You can also explore more details about the expanded eligibility rules and other specifics for Texas ABLE accounts.

The Trustee's Role and Fiduciary Duties

Choosing the right trustee for a special needs trust in Texas is one of the most critical decisions you will make. This role requires more than just financial acumen; you are entrusting this person or institution with the well-being of your loved one.

The trustee acts as the guardian of the trust's purpose. They are tasked with managing the assets and making distributions that enrich the beneficiary's life—all without inadvertently jeopardizing essential government benefits like Medicaid or SSI. The entire role is built on a foundation of fiduciary duties, which are strict legal obligations under the Texas Trust Code that demand the highest standard of care.

Trustee Responsibilities Under Texas Law

At its heart, being a trustee means putting the beneficiary's interests completely ahead of your own. The Texas Trust Code is clear: the beneficiary’s welfare is the sole priority. These core duties guide every decision a trustee makes. We dive deeper into the legal specifics in our guide to trustee duties and responsibilities in Texas, but the main pillars are:

- Duty of Loyalty: The trustee must act only for the beneficiary's benefit, avoiding all self-dealing or conflicts of interest.

- Duty of Prudence: They must manage the trust's assets as a reasonably careful person would, balancing growth with risk management.

- Duty of Impartiality: If the trust names remainder beneficiaries, the trustee must treat all parties fairly.

Practical Advice for Trustees: Step-by-Step Guidance

Beyond these legal principles, the day-to-day job of a trustee is hands-on. It requires a unique blend of financial skill, detailed organization, and genuine compassion.

A trustee’s most vital function is to make discretionary distributions that enhance the beneficiary's quality of life but do not count as "in-kind support and maintenance" that could reduce SSI payments. This requires a deep understanding of complex Social Security and Medicaid rules.

Here’s a step-by-step look at a trustee's practical responsibilities:

- Asset Management: Invest the trust funds to ensure they last and grow over the long term.

- Making Distributions: Pay vendors directly for expenses that improve quality of life, such as therapy, education, transportation, and personal care items.

- Record-Keeping and Accounting: Maintain flawless records of every transaction. Using effective record keeping strategies is a key part of this fiduciary duty.

- Tax Filings: Ensure the trust's federal and state tax returns are filed correctly and on time.

- Communication: Keep the beneficiary and their family informed about the trust’s finances and activities.

Choosing the Right Trustee for Your Family

So, who should you choose? Your options include a family member, a professional fiduciary, or a corporate trustee like a bank. A family member brings a personal touch but may lack financial expertise. A professional or corporate trustee offers deep expertise in trust law and investments but comes at a cost.

There is no single right answer. Speaking with a Texas trust administration lawyer can help you weigh the pros and cons of each option, ensuring you select a trustee who will be a faithful steward for your loved one's future.

Reporting Requirements for a Texas SNT

Once you have created a special needs trust in Texas, the work of trust administration begins. A critical part of this is handling the reporting rules set by government agencies. You must officially notify agencies like the Social Security Administration (SSA) and the Texas Health and Human Services Commission that the trust exists. This step formally designates the trust assets as "non-countable" for benefit calculations.

Failing to report correctly can undo your careful planning and lead to a devastating loss of benefits. That’s why having a Texas trust administration lawyer on your side is essential for keeping everything on track and ensuring your loved one remains protected.

Why Reporting is Non-Negotiable

The purpose of an SNT is to hold assets without them being counted toward the strict asset limits for programs like SSI and Medicaid. Once a trust is funded, you must formally inform the government. If you skip this step, those agencies may view the trust funds as available cash, which can trigger a reduction or termination of benefits.

Proactive reporting is your best defense. By communicating transparently with the SSA and Texas Medicaid from the start, you create a clear paper trail and demonstrate that the trust is fully compliant with all federal and state rules, heading off potential misunderstandings.

Key Reporting Timelines and Procedures

When it comes to reporting, timing and accuracy are everything. The SSA must be notified within 10 days after the end of the month the trust first receives assets. This requires providing a copy of the trust document and an accounting of the assets it holds. You can learn more about these critical SNT reporting requirements to understand their importance.

Here’s a quick rundown of the essential steps:

- Initial SSA Notification: As soon as the trust is funded, the trustee must contact the Social Security Administration.

- Reporting to Texas Medicaid: The Texas Health and Human Services Commission must also be notified according to state-specific requirements.

- Ongoing Reporting: The trustee must maintain meticulous records of all distributions and be prepared to provide a full accounting to government agencies upon request.

This process highlights the weight of a trustee's fiduciary duties in Texas. They are legally responsible for ensuring the trust is managed in compliance with all laws, including reporting deadlines. Working with an experienced Texas estate planning attorney from day one ensures these rules are followed to the letter, providing true peace of mind.

How to Create and Fund Your Trust

Taking the first step to set up a special needs trust in Texas does not have to be overwhelming. With the right legal partner, it’s a straightforward journey to create a clear roadmap for your loved one's future security.

The process begins with an initial consultation with a Texas estate planning attorney who understands your family's unique situation. This meeting allows us to listen to your hopes for your loved one and answer your questions.

Step-by-Step Guidance for Creating the Trust

Once we understand your goals, the work of bringing the trust to life begins. Your attorney will meticulously draft a customized trust document, ensuring every provision aligns with the Texas Trust Code and strict federal rules.

Here’s a look at the foundational steps we’ll take together:

- Consultation and Goal Setting: We will sit down with you to map out your family’s needs and long-term goals for the beneficiary.

- Strategic Drafting: Our attorneys will craft a personalized trust agreement, naming the beneficiary, appointing a trustee, and building in all necessary legal protections.

- Thorough Review: We will walk you through the full document, explaining it in plain English so you feel completely confident and informed before signing.

This collaborative approach ensures the final trust document perfectly reflects your wishes and offers the strongest possible protection.

Funding the Trust: An Essential Step

A trust document is just paper until it is "funded"—the process of transferring assets into the trust's name. This is the move that turns the trust from a plan into a powerful tool for asset protection.

Common ways to fund a special needs trust include:

- Lifetime Gifts: Making direct contributions of cash, stocks, or other assets into the trust.

- Life Insurance: Naming the trust as the beneficiary of a life insurance policy.

- Testamentary Transfers: Directing assets to the trust through your will or another part of your estate plan.

The right method depends on your financial situation and overall estate plan. An experienced attorney can help you pinpoint the most effective funding strategy. The path to establishing a special needs trust is detailed, but our team is here to offer clear, compassionate guidance. If you’re ready to learn more, our guide on how to create a trust in Texas offers a more detailed look into the process.

Frequently Asked Questions About Texas SNTs

When planning for a loved one's future with a special needs trust in Texas, it's natural to have questions. Here are clear answers to some of the most common inquiries we receive from families like yours.

What can a special needs trust pay for in Texas?

An SNT is designed to pay for "supplemental needs"—anything that improves a person's quality of life beyond what basic government benefits cover. This is a broad category, offering significant flexibility.

Common examples include:

- Out-of-pocket medical and dental care

- Physical or occupational therapy

- Education, tutoring, or vocational training

- Transportation, including a modified vehicle or ride-sharing services

- Home furnishings, technology, and personal care items

- Recreation, vacations, and hobbies

The key rule is to avoid paying directly for basic food and shelter, as this can reduce SSI payments. A knowledgeable Texas trust administration lawyer can provide guidance to ensure every distribution protects the beneficiary's benefits.

Who is the best choice for a trustee?

You can name a family member, a close friend, a professional fiduciary, or a corporate trustee like a bank. The best choice depends on your family’s situation, the complexity of the trust assets, and the beneficiary's needs. The ideal trustee is responsible, financially savvy, and understands their fiduciary duties under the Texas Trust Code.

What happens to leftover funds when the beneficiary passes away?

This depends entirely on the type of trust.

For a First-Party SNT (funded with the beneficiary's own money), any remaining funds must be used to repay Medicaid for services provided during the person's lifetime.

For a Third-Party SNT (funded by others), there is no Medicaid payback requirement. The person who created the trust decides where the remaining assets go, making it a powerful tool for asset protection and preserving a family legacy.

Do I need a lawyer to create a Texas SNT?

Yes. Special Needs Trusts are complex legal instruments that must align perfectly with federal and Texas state laws. A mistake in drafting can jeopardize your loved one's benefits. Working with an experienced estate planning attorney who specializes in Texas trust law is the only way to ensure the trust is structured correctly and provides rock-solid protection for the long term.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process. Contact us for a free consultation and get the clear, compassionate advice you deserve.