Planning for your family’s future can feel complex, but with the right legal guidance, it doesn’t have to be. For Texas families looking to pass on wealth efficiently, one of the most effective tools in estate planning is the Crummey trust. This specific type of irrevocable trust allows you to make financial gifts to your loved ones that qualify for the annual federal gift tax exclusion, a powerful strategy for reducing your taxable estate while providing for the next generation.

Understanding the Crummey Trust Under Texas Law

Under federal tax law, gifts are categorized as either "present interest" or "future interest." A present interest gift, like handing someone cash, is immediately available to them. This is why it qualifies for the annual gift tax exclusion, which in 2024 allows you to give up to $18,000 per person without filing a gift tax return or using your lifetime exemption.

Contributions to a standard trust, however, are often considered "future interest" gifts because the beneficiary cannot immediately access the funds. As a result, they don't qualify for the annual exclusion. A Crummey trust is a clever legal structure designed specifically to solve this problem.

The Key: The "Right of Withdrawal"

A Crummey trust works by giving each beneficiary a temporary, legally enforceable right to withdraw any new contribution made on their behalf. This limited window of opportunity is known as the "Crummey power."

Here’s a simple real-world scenario: imagine a Houston family wants to gift money to their grandchildren. When they contribute funds to the Crummey trust, the trustee must send a formal notice—often called a "Crummey letter"—to each grandchild (or their legal guardian). This letter explains that a gift was made and that they have a right to withdraw it, typically within 30 to 60 days.

The crucial element is the opportunity to take the money, even if the unspoken understanding is that they will not. Because this right exists, the IRS classifies the contribution as a present interest gift, making it eligible for the annual gift tax exclusion.

Once the withdrawal window closes, the right expires, and the funds remain in the trust. The trustee then manages the assets according to the trust's terms, protecting them for the beneficiary’s future needs. While this is a powerful tool, it's just one of many; you can explore other types of trusts available in Texas to build a comprehensive estate plan.

Why Texas Families Use This Strategy

For many Texas families, a Crummey trust is a cornerstone of smart wealth transfer. It offers a structured way to move assets out of a taxable estate over time, minimizing future estate taxes while providing long-term financial security for loved ones.

Here’s a step-by-step look at what a Crummey trust accomplishes.

Crummey Trust at a Glance

| Key Component | Description and Purpose in Texas |

|---|---|

| Annual Gift Tax Exclusion | Allows you to gift up to $18,000 per beneficiary (in 2024) each year without filing a gift tax return or using your lifetime gift tax exemption. |

| Crummey Withdrawal Powers | Grants beneficiaries a temporary right to withdraw gifts. This is the legal mechanism that converts the gift to a "present interest" for tax purposes. |

| Irrevocable Nature | As defined by the Texas Trust Code, once established, the trust’s terms are generally fixed. This removes assets from your taxable estate and provides robust asset protection. |

| Trustee Management | You appoint a trustee whose fiduciary duties in Texas require them to manage the funds for long-term goals like education or a home purchase. |

This structure provides the best of both worlds: tax-efficient gifting and controlled asset management.

- Maximized Tax-Free Gifting: You can consistently pass significant wealth to children and grandchildren without the burden of gift tax filings.

- Powerful Asset Protection: As an irrevocable trust, the assets inside are generally safe from beneficiaries' creditors, divorces, or legal judgments.

- Controlled Distributions: You determine how and when the bulk of the trust funds are eventually distributed, ensuring your legacy is used wisely.

A qualified Texas estate planning attorney can ensure your trust is structured and administered correctly to meet all your financial goals.

The Landmark Court Case That Created the Crummey Trust

To fully appreciate the Crummey trust as a respected estate planning tool, it’s helpful to understand its origins. This strategy is not a loophole; it was validated by the U.S. legal system in a landmark 1968 court case. The story provides Texas families with the confidence they need when using this powerful method for wealth transfer. It all began with a father named Clifford Crummey.

A Father's Plan and an IRS Challenge

In 1962, Clifford Crummey established an irrevocable trust to make tax-free gifts to his children. He made annual contributions and gave his children—some of whom were minors—a brief window to withdraw the funds. As intended, they never exercised this right, allowing the money to accumulate for their future.

The IRS challenged this arrangement, arguing that because the beneficiaries did not immediately receive the funds, the gifts were of a "future interest." This classification would have disqualified the gifts from the annual gift tax exclusion (then $3,000 per person). The dispute set the stage for a legal battle that would shape modern estate planning.

The Decisive Ruling: Crummey v. Commissioner

The case, Crummey v. Commissioner, reached the U.S. Tax Court, which in 1968 sided with the Crummey family. This ruling set a crucial legal precedent. The court determined that the mere existence of the legal right to withdraw the funds—the "Crummey power"—was sufficient to qualify the gift as a "present interest."

The court's logic was clear: as long as a beneficiary has an unrestricted, legally enforceable right to demand the funds for a reasonable period, the gift qualifies for the annual exclusion. It does not matter if the beneficiary is a minor or if they are unlikely to exercise that right.

This ruling legitimized the strategy and gave the trust its name. It has since become a cornerstone of sophisticated estate planning in Texas and across the country. For a deeper analysis of how this case influences modern trust law, you can explore the nuances of Crummey trust mechanics on financestrategists.com.

What This History Means for Your Texas Estate Plan

The outcome of Crummey v. Commissioner provides legal certainty. It confirms that this trust structure is a court-approved method for tax-efficient gifting. For Texas families, this means you can confidently use a Crummey trust to:

- Systematically reduce your taxable estate through annual exclusion gifts.

- Fund long-term goals, such as life insurance policies or education funds, in a tax-efficient manner.

- Protect assets for your children and grandchildren while retaining control over the ultimate distribution of funds.

This history underscores the importance of working with an experienced Texas estate planning attorney. Proper drafting and administration are essential to honor the principles established in this case and secure your family's legacy.

Maximizing Tax-Free Gifting with Crummey Powers

The true value of a Crummey trust lies in its practical application—transforming complex estate planning goals into tangible tax savings. It allows Texas families to transfer significant wealth over time without incurring gift or estate taxes. The key is understanding how Crummey withdrawal powers unlock the annual gift tax exclusion for contributions to an irrevocable trust.

Let’s review a common real-world scenario. A couple in Austin wants to establish a large life insurance policy to provide liquidity for their estate and create a legacy for their three children and five grandchildren. To ensure the life insurance proceeds are not included in their taxable estate, they create an Irrevocable Life Insurance Trust (ILIT). The annual premium for the policy is $144,000.

Without Crummey provisions, funding the trust to pay this premium would be considered a "future interest" gift, forcing them to use a significant portion of their lifetime gift tax exemption. By incorporating Crummey powers, they can leverage the annual gift tax exclusion for each of their eight beneficiaries.

A Texas Gifting Strategy in Action

Here is a step-by-step breakdown of how this strategy works. In 2024, the annual gift tax exclusion allows an individual to give up to $18,000 to any number of people, tax-free. A married couple can combine their exclusions to give up to $36,000 per beneficiary.

- Total Beneficiaries: 3 children + 5 grandchildren = 8 people

- Combined Annual Exclusion per Beneficiary: $18,000 (from spouse 1) + $18,000 (from spouse 2) = $36,000

- Total Tax-Free Gifting Capacity: 8 beneficiaries x $36,000 = $288,000 per year

By each gifting $18,000 to the trust for each of their eight beneficiaries (totaling $144,000), they can cover the entire life insurance premium without filing a gift tax return or using any of their lifetime exemption. Over a decade, that amounts to $1.44 million transferred out of their estate, completely tax-free. To learn more about this specific structure, you can learn more about how a Life Insurance Trust works in Texas.

Trustee Responsibilities and the Crummey Letter

This powerful strategy depends on meticulous execution by the trustee. Under the Texas Trust Code, a trustee has a fiduciary duty to act in the beneficiaries' best interests and adhere strictly to the trust's terms. For a Crummey trust, this includes the critical administrative task of sending the "Crummey letter."

Each time a contribution is made, the trustee must promptly provide formal written notice to each beneficiary (or their parent/guardian if they are a minor). This letter is a legal requirement, not just a courtesy.

It must clearly state:

- The amount contributed on their behalf.

- Their absolute and unconditional right to withdraw that amount.

- The specific time frame for exercising this right (typically 30-60 days).

Proper and timely notification is the legal evidence that establishes the beneficiary's "present interest" in the gift, which is essential for its tax-free status. Maintaining meticulous records, including copies of each letter and proof of delivery, is the best defense against a potential IRS audit.

This is why Crummey trusts are a preferred strategy for Texas families and business owners. They allow for maximum use of the annual gift tax exclusion without eroding the lifetime exemption—a critical advantage, especially with the exemption amount scheduled to decrease significantly after 2025. An experienced Texas trust administration lawyer can provide the guidance needed to ensure compliance and protect the family's long-term financial goals.

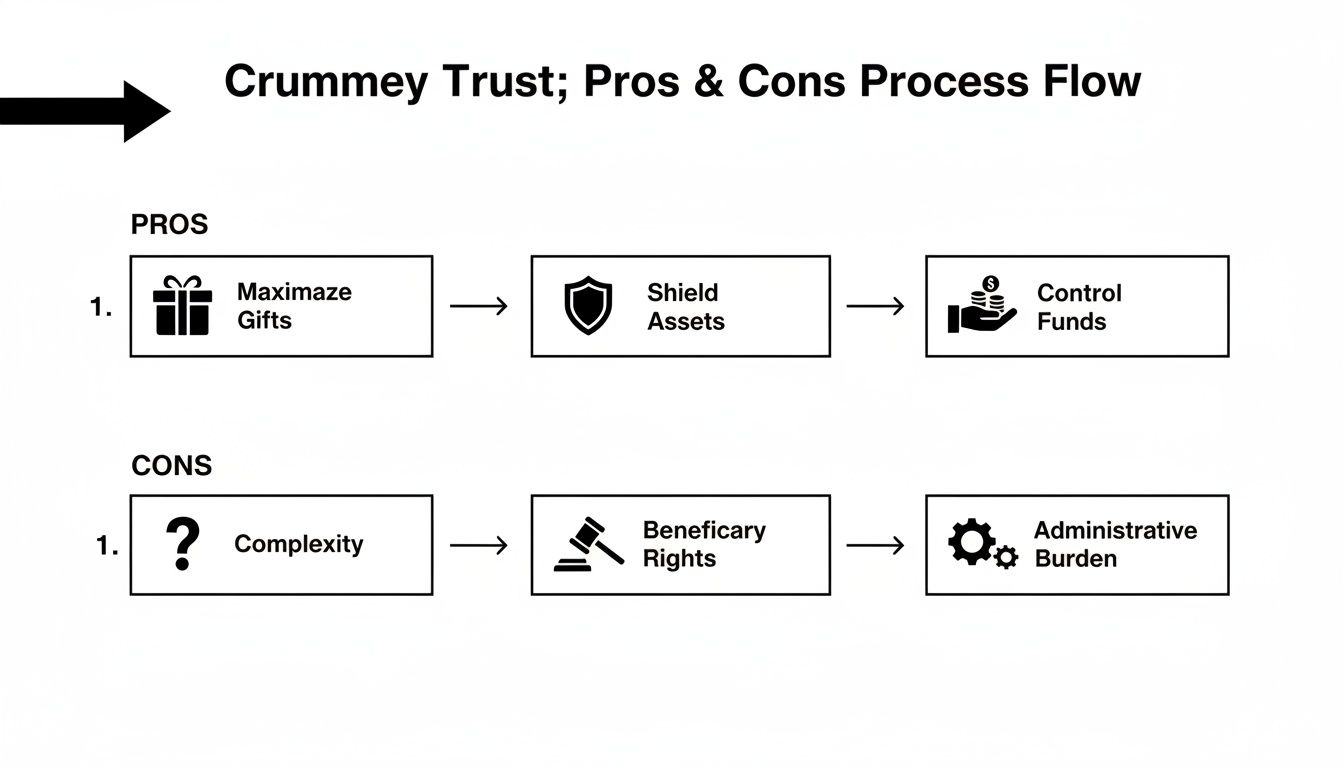

Weighing the Pros and Cons of a Crummey Trust

A Crummey trust is a powerful estate planning tool, but it is not a universal solution. It’s important to understand both its advantages and its potential complexities to determine if it is right for your family. With proper legal guidance, the risks are manageable and are often far outweighed by the significant benefits.

The Upside: Significant Benefits of a Crummey Trust

The primary appeal of a Crummey trust lies in its ability to leverage the tax code to achieve key estate planning objectives.

- Maximize Tax-Free Gifting: The trust’s main function is to facilitate gifts that qualify for the annual gift tax exclusion ($18,000 per person in 2024). This allows you to transfer substantial assets out of your taxable estate over time without using your lifetime gift tax exemption.

- Provide Asset Protection: Because these trusts are irrevocable, the assets transferred into them are generally protected from the claims of future creditors, both for you and your beneficiaries.

- Maintain Long-Term Control: While beneficiaries have a brief window to withdraw annual gifts, you, as the grantor, define the long-term distribution rules in the trust document. This ensures that the bulk of the assets are used for significant life events, such as education or a home purchase.

- Efficiently Fund Life Insurance: Crummey trusts are frequently used to create an Irrevocable Life Insurance Trust (ILIT). This structure enables you to pay for large life insurance premiums with tax-free gifts, and the death benefit is ultimately paid to beneficiaries free of estate taxes.

Using a Crummey trust helps achieve sophisticated planning goals that would otherwise be tax-inefficient. To better understand these advantages, it is helpful to explore the tax benefits of irrevocable trusts as part of your overall strategy.

Navigating the Potential Risks and Complexities

While the benefits are significant, a Crummey trust requires careful and ongoing administration to function correctly. A knowledgeable Texas estate planning attorney is essential for navigating these potential issues.

A common question is, "What if a beneficiary actually withdraws the money?" While rare—as it often undermines their own long-term financial interests—it is a legal possibility. To prevent the IRS from deeming the withdrawal right a "naked power," the trust must hold sufficient liquid assets to honor a withdrawal request.

Decades of trust law have shown that the risks associated with a Crummey trust are almost always administrative, not structural. Meticulous execution is key.

The administrative burden is another important consideration. The trustee has a fiduciary duty under Texas law to send a formal Crummey notice to every beneficiary for every contribution. Failure to do so in a timely and proper manner can jeopardize the gift's tax-free status.

Finally, managing a trust for minor beneficiaries adds another layer of complexity. Since a child cannot legally manage their own finances, their parent or legal guardian must receive the Crummey notice on their behalf. Proper documentation is crucial to demonstrate compliance with Texas law.

This side-by-side comparison can help you make an informed decision.

Weighing the Pros and Cons of a Crummey Trust

| Advantages | Potential Disadvantages and Solutions |

|---|---|

| Maximizes the Annual Gift Tax Exclusion to transfer substantial wealth tax-free over time. | Beneficiary Could Withdraw Funds: A beneficiary might exercise their withdrawal right. Solution: Clear communication about the long-term goals of the trust can mitigate this risk. |

| Provides Creditor Protection by moving assets into an irrevocable structure. | Strict Administrative Requirements: The trustee must send timely Crummey notices for every contribution. Solution: Work with a professional trustee or an attorney to establish a compliance system. |

| Offers Grantor Control over long-term distribution schedules, preventing misuse of funds. | Complexity with Minor Beneficiaries: Notices must be sent to a legal guardian. Solution: Implement clear legal procedures and maintain meticulous records from the start. |

| Reduces the Taxable Estate and helps minimize or avoid federal estate taxes. | Potential for IRS Scrutiny: Failure to adhere to the rules can result in the loss of tax benefits. Solution: Partner with an experienced Texas trust attorney to ensure full compliance. |

| Can Protect Assets for Beneficiaries who may lack financial responsibility (spendthrift protection). | Trust Must Be Funded with sufficient liquid assets to cover potential withdrawals. Solution: Coordinate with a financial advisor to maintain appropriate liquidity within the trust. |

For most Texas families, the strategic benefits of a Crummey trust far exceed the administrative requirements, especially when managed with professional guidance.

Bringing Your Texas Crummey Trust to Life

Establishing a Crummey trust is a sophisticated estate planning strategy that requires precision. The process involves several key steps, and partnering with a seasoned legal professional is the best way to ensure it is executed flawlessly.

Working with specialized trust attorneys for estate planning ensures every step, from drafting the initial document to ongoing administration, is handled correctly.

Step 1: Draft an Ironclad Trust Document

The trust document is the foundation of your plan. It is not a generic template but a custom-drafted legal instrument prepared by a Texas estate planning attorney. It must include specific Crummey provisions that grant beneficiaries their temporary withdrawal rights, define the notification window (typically 30 to 60 days), and detail the consequences of exercising or ignoring that right. Precise language is non-negotiable to avoid IRS scrutiny and protect the trust's tax benefits.

Step 2: Choose a Reliable Trustee

Selecting a trustee is one of your most critical decisions. This individual or institution is legally responsible for managing the trust in accordance with its terms and the Texas Trust Code. Their fiduciary duties in Texas demand loyalty, prudence, and diligence.

A trustee's responsibilities include:

- Safeguarding and prudently investing trust assets.

- Sending annual Crummey notices in a timely manner.

- Keeping meticulous records of all transactions.

- Filing any required tax returns for the trust.

Due to these significant responsibilities, many families appoint a corporate trustee or work closely with a Texas trust administration lawyer to ensure professional oversight and limit personal liability.

This visual flow illustrates how a well-managed Crummey trust maximizes gifts while protecting assets for your loved ones.

As shown, each step builds on the last to create a powerful tool for transferring wealth and securing your family’s future.

Step 3: Fund the Trust and Implement the Gifting Strategy

Once the trust is created, you can begin funding it with annual gifts. This initiates a recurring process:

- You Make a Gift: You transfer funds into the trust's account.

- Trustee Sends Notices: The trustee immediately sends a formal Crummey notice to each beneficiary, informing them of their right to withdraw their share of the contribution.

- Withdrawal Period Begins: Beneficiaries have the specified time (e.g., 30 days) to exercise their right.

- The Power Lapses: When they do not withdraw the funds, their right expires. The money is now fully integrated into the trust, and the trustee can use it for its intended purpose, such as paying a life insurance premium.

Step 4: Maintain Impeccable Records

A flawless paper trail is your best defense against an IRS audit. The trustee must maintain a detailed file documenting every step of the process.

Under Texas law, a trustee has a legal duty to keep clear and accurate accounts. For a Crummey trust, this means retaining copies of every contribution, every Crummey letter, and proof of mailing for each notice. This documentation validates the "present interest" nature of your gifts.

Diligent administration is a legal requirement that protects the grantor, the trustee, and the beneficiaries. Given the detail-oriented nature of this work, professional support can be invaluable.

Real-World Crummey Trusts: Scenarios and Sidesteps

Understanding the theory of a Crummey trust is one thing; seeing how it functions in the real world provides true clarity. Successful trust administration requires flawless execution. Knowing common scenarios and potential pitfalls can make a significant difference in protecting your family's financial future. This is where an experienced Texas trust administration lawyer becomes an indispensable partner, guiding you through every step to ensure compliance and success.

A Real-World Texas Scenario: Funding Grandchildren's Education

Imagine a couple in Fort Worth wants to create a fund for their five grandchildren's college education. They establish a single Crummey trust, naming each grandchild as a beneficiary.

Each year, both grandparents contribute $18,000 to the trust for each grandchild. This results in an annual contribution of $180,000 ($36,000 per grandchild), all accomplished without using their lifetime gift tax exemptions. The trustee sends Crummey notices to the parents of each minor grandchild, who allow the withdrawal rights to lapse. The funds remain in the trust, invested and growing. By the time the oldest grandchild is ready for college, a substantial, tax-free education fund is available.

Common Mistakes and How to Avoid Them

Even with the best intentions, simple administrative errors can jeopardize a Crummey trust's tax advantages. Here are the most common mistakes and practical advice on how to avoid them.

Forgetting to Send Timely Crummey Notices

This is the most frequent and critical error. If a beneficiary is not formally notified of their withdrawal right, the IRS can argue the gift was of a "future interest," thereby disqualifying it from the annual exclusion.- The Fix: The trustee should use a detailed annual checklist. The moment a contribution is made, notices must be sent via a trackable method, such as certified mail. Keep pristine copies of every notice and proof of delivery in the trust's permanent records.

Failing to Maintain Liquidity

The IRS may disregard a "naked power" if the trust lacks sufficient liquid assets to honor a withdrawal request. If the only asset is illiquid—such as an interest in a family business or a life insurance policy with no cash value—the withdrawal right is not considered genuine.- The Fix: The trustee must ensure the trust holds enough cash or easily liquidated assets to cover at least one beneficiary’s potential withdrawal at all times. This substantiates the legitimacy of the Crummey power.

Meticulous record-keeping is not just good practice; it is a trustee's fiduciary duty under the Texas Trust Code. A clear paper trail is your absolute best defense against any future challenge to the trust's validity or tax treatment.

- Sloppy or Non-Existent Record-Keeping

A trustee must be able to prove that every administrative step was handled correctly. This includes documenting contributions, proving notices were sent, and tracking whether withdrawal rights were exercised or lapsed. Without this documentation, defending the trust during an audit is nearly impossible.- The Fix: Maintain a dedicated trust administration binder or secure digital file. This file should contain the trust document, bank statements, copies of all Crummey letters, and a log of every transaction. An experienced Texas estate planning attorney can provide templates and systems to make this process foolproof.

Got Questions About Crummey Trusts? We’ve Got Answers.

As you explore the details of a Crummey trust, questions are sure to arise. To provide clarity and help you feel confident in your decisions, here are straightforward answers to the questions we frequently hear from Texas families.

What Happens if a Beneficiary Actually Takes the Money?

This is a valid and important concern. A beneficiary can, in fact, withdraw the funds. For the trust to be legitimate in the eyes of the IRS, the beneficiary's right to withdraw the money specified in their Crummey notice must be real and unrestricted.

In practice, this rarely happens. Most beneficiaries understand that taking a small, short-term gain could jeopardize a much larger future inheritance. However, the possibility must be real. If a beneficiary does choose to withdraw the funds, the trustee is legally obligated to provide the money. This is why the trust must be funded with enough liquid assets to cover a potential withdrawal.

Can I Be the Trustee of My Own Crummey Trust?

No, you cannot. As the grantor of an irrevocable trust, you must relinquish control over the assets. If you name yourself as trustee, the IRS will likely argue that you have retained control, which would pull the assets back into your taxable estate and defeat a primary purpose of the trust. You must appoint an independent trustee—such as a trusted family member, a professional, or a corporate trustee—to manage the trust and fulfill the fiduciary duties required by the Texas Trust Code.

How Long Does a Beneficiary Have to Make a Withdrawal?

The law requires the withdrawal period to be "reasonable." While the IRS has not defined a specific timeframe, the accepted legal standard is between 30 and 60 days from the date the beneficiary receives their Crummey notice. This provides ample time for the beneficiary to consider their options without leaving the withdrawal power open indefinitely. A skilled Texas estate planning attorney will ensure the trust document specifies a compliant timeframe.

With Gift Tax Exemptions So High, Why Bother with a Crummey Trust?

While the lifetime gift tax exemption is currently at a historic high (over $13 million per person in 2024), the Crummey trust remains a valuable tool. First, this high exemption amount is temporary and is scheduled to be cut in half at the end of 2025. Second, and more importantly, the Crummey trust utilizes the annual gift tax exclusion. By leveraging the annual exclusion each year, you can transfer significant wealth to your heirs over time without ever touching your lifetime exemption. It is a powerful strategy to maximize your tax-free gifting potential.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.