Planning for a loved one’s estate can feel overwhelming, but certain legal tools are designed to provide flexibility and peace of mind when it’s needed most. A disclaimer trust acts as a strategic "wait-and-see" provision within a will or trust. It gives the surviving spouse the option—but not the obligation—to move specific assets into a specially created trust. This powerful decision can be a game-changer for minimizing estate taxes and protecting family wealth for future generations. It is essentially a financial safety net, providing a critical opportunity for a second look after one spouse passes away.

What a Disclaimer Trust Means for Texas Families

Effective estate planning is about preparing for an uncertain future. A disclaimer trust is one of the most effective ways to build adaptability directly into your plan, ensuring your family can respond to the financial and legal landscape they face at the time of your death. Instead of being locked into a rigid plan created years ago, it empowers your surviving spouse to make the best possible decision with current information, guided by a knowledgeable Texas estate planning attorney.

The Core Purpose of a Disclaimer Trust

At its heart, a disclaimer trust is designed to give your family a second chance to optimize your estate plan. When one spouse passes away, their will typically leaves all assets to the surviving spouse. A disclaimer provision, however, gives the survivor up to nine months to formally "disclaim"—or refuse—some or all of that inheritance.

Those disclaimed assets do not simply return to the estate or go to another heir chosen by the survivor. Instead, they automatically transfer into a pre-established trust, often called a bypass or credit shelter trust. This is the key mechanism for achieving specific financial goals. Our guide on how to create a trust in Texas explains the fundamentals of establishing these vital legal structures.

That nine-month window is the magic ingredient. It provides the breathing room to evaluate the estate's current value, check the latest tax laws, and consider the surviving spouse's own financial needs before making a decision that can't be undone.

Why Is This Flexibility So Important?

A disclaimer trust offers significant advantages over a more rigid estate plan. It allows for strategic, on-the-spot decisions that can yield substantial benefits for your family’s financial future.

To understand how this works, let's explore the key features of a disclaimer trust and the powerful benefits they offer Texas families.

Disclaimer Trust at a Glance Key Features and Benefits

| Feature | Description | Benefit for Your Family |

|---|---|---|

| Optional Refusal of Assets | The surviving spouse has the choice to accept or "disclaim" inherited assets within nine months of their partner's death. | This creates a crucial decision-making window, allowing the family to adapt to current financial and legal realities instead of being locked into an old plan. |

| Automatic Transfer to Trust | Any assets the spouse disclaims are automatically moved into a pre-set bypass or credit shelter trust. | Protects assets from the surviving spouse's future creditors and legal issues, and ensures they are managed according to the deceased's original wishes. |

| Tax Exemption Utilization | The trust uses the deceased spouse's estate tax exemption, shielding the assets (and their future growth) from taxes. | This can lead to significant estate tax savings, preserving more of your family's wealth for the next generation. |

| Legacy Protection | The trust's terms dictate that the assets will eventually pass to specific beneficiaries, usually the children. | It guarantees that the children from the first marriage will receive their inheritance, which is especially important in blended family situations. |

As you can see, this is not merely a minor legal adjustment; it is a strategic tool crafted to protect and preserve your family’s legacy for generations.

For a complete strategy to secure your future, it’s vital to consider all the essential estate planning documents that work together, like wills and powers of attorney. A disclaimer trust is a powerful piece of a comprehensive plan, especially when crafted by an experienced Texas estate planning attorney who understands your family's unique needs.

How a Disclaimer Trust Creates Powerful Flexibility

Think of a disclaimer trust as a built-in "second look" for your estate plan. It’s a powerful tool that gives your family a chance to make the best financial decision based on what’s happening right now, not based on a plan you might have put together years—or even decades—ago. This flexibility is its single greatest strength.

Imagine your inheritance is a gift handed to your surviving spouse. A disclaimer provision gives them the legal right to politely say, "Thank you, but I don't need all of this at the moment." The specific assets they "disclaim"—or formally refuse—then flow into a separate, pre-established bypass trust that you've already set up in your will or living trust.

This is not an all-or-nothing decision. Your spouse has the power to disclaim specific assets, a percentage of the estate, or the entire inheritance, depending on what makes the most financial sense for the family at that time.

The "Wait-and-See" Advantage

The greatest benefit of a disclaimer trust is the "wait-and-see" advantage. After the first spouse passes away, the surviving spouse has up to nine months to gain a clear understanding of the entire financial landscape. This period is a critical window for intelligent, strategic planning.

During these nine months, they can:

- Evaluate the current market value of all assets, from stocks to real estate.

- Get up to speed on the latest federal and Texas estate tax laws and exemption amounts.

- Assess their own personal financial needs and future income projections.

- Consider long-term goals for children and other beneficiaries.

Only after weighing all these factors do they need to make a final, irreversible choice. This adaptability makes the disclaimer trust a go-to strategic tool for Texas families facing an uncertain financial future, as it avoids locking them into a decision that may no longer be optimal. Understanding how assets move through this process is key; you can get a better handle on the difference between probate and non-probate assets in our detailed guide.

How Disclaiming Assets Works in Practice

Let’s walk through a real-world scenario here in Texas. A husband passes away, leaving a sizable estate to his wife. When they first drafted their wills, their combined net worth was well below the estate tax exemption, so they planned for a simple transfer to her. But by the time he dies, their investments have grown significantly, and the tax laws have changed.

Without a disclaimer trust, his wife would inherit everything directly. While that transfer is tax-free between spouses, all those assets—plus any future growth—are now part of her taxable estate. This could set their children up for a substantial estate tax bill when she passes away.

With a disclaimer provision, she has a much better option. She can work with a Texas trust administration lawyer to formally disclaim a portion of the inheritance. Those disclaimed assets then automatically fund the bypass trust, making use of her late husband's estate tax exemption.

A core principle of fiduciary duties in Texas is managing assets prudently for beneficiaries. A disclaimer trust empowers a surviving spouse to do just that by making a tax-savvy decision that preserves more wealth for the next generation.

This strategic move achieves several goals at once: it reduces the size of the wife's taxable estate, shields the disclaimed assets from her future creditors, and ensures that wealth is protected for their children exactly as intended. It transforms a moment of uncertainty into an opportunity for intelligent, protective planning.

The Strict Legal Rules for a Valid Disclaimer in Texas

For a disclaimer trust to be effective, the surviving spouse's decision to refuse assets must adhere to a strict set of legal rules. This is not a casual agreement; it is a formal legal process with tight deadlines and specific requirements under both the Texas Estates Code and the Internal Revenue Code. A mistake in any detail can invalidate the entire strategy, potentially leading to significant tax consequences.

This is precisely where the guidance of a skilled Texas estate planning attorney becomes indispensable. They ensure every requirement is met, protecting your family’s assets and honoring your original intentions.

The Unforgiving Nine-Month Deadline

The timeline is the most critical rule of all. A surviving spouse has a non-negotiable window of nine months from the date of the first spouse's death to make a formal, written disclaimer. This deadline is absolute. There are no extensions, regardless of the circumstances.

The concept of a "qualified disclaimer" and its rigid deadline was established by the Tax Reform Act of 1976 to provide families with clear, predictable rules for estate administration, and it remains the foundation of disclaimer law today.

It's vital to understand that this nine-month clock starts ticking at the moment of death, which is why you cannot afford to delay addressing estate matters.

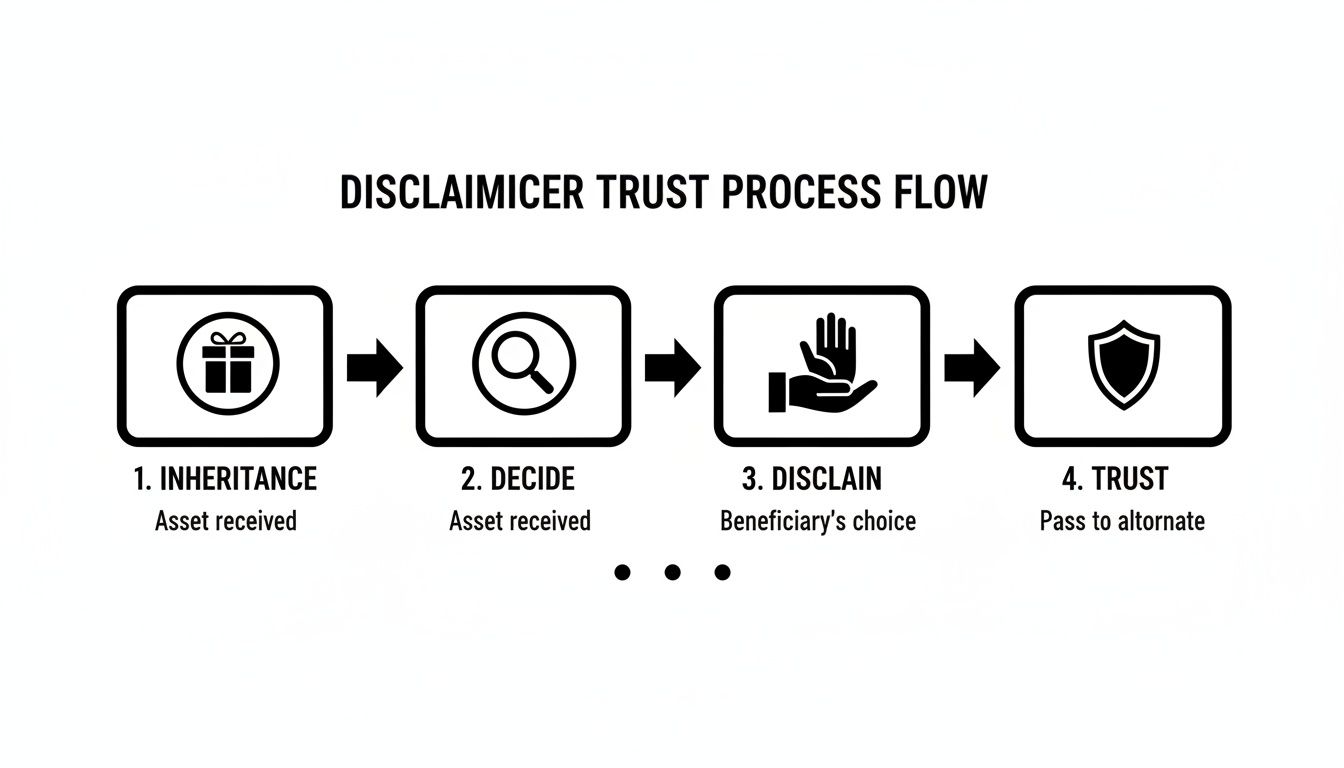

The flowchart below provides a high-level overview of the key steps, from initial inheritance to final asset protection.

As you can see, the process hinges on careful decision-making before the formal disclaimer is made and the assets are secured in the trust.

Essential Requirements for a Valid Disclaimer

Beyond the strict nine-month timeline, several other conditions must be met for the disclaimer to be legally binding and recognized by the IRS. A misstep here can unravel the entire plan.

Here are the key legal requirements you can't ignore:

- It Must Be in Writing: A verbal agreement is insufficient. The disclaimer must be a formal, written legal document that clearly identifies the deceased spouse, the surviving spouse (the "disclaimant"), and the specific assets or interests being refused.

- Delivered to the Executor: This written document must be delivered to the executor of the deceased's estate or the trustee responsible for the assets. This ensures the person with legal authority over the estate receives official notice.

- No Acceptance of Benefits: The surviving spouse cannot have accepted any interest in or benefits from the assets they plan to disclaim. For instance, depositing a dividend check from an investment account into a personal bank account before disclaiming it would be considered "acceptance" and would invalidate the disclaimer for that asset.

- Automatic Transfer to the Trust: Once disclaimed, the assets must pass to the bypass trust automatically without direction from the surviving spouse. The will or trust document itself must explicitly direct the disclaimed property into the disclaimer trust.

According to the Texas Estates Code, a disclaimer is effective as of the date of the decedent's death. Legally, this means the disclaimed property is treated as if the surviving spouse never received it—which is the key to unlocking the tax and asset protection benefits.

Working with a Texas trust administration lawyer is the best way to navigate these complexities. We can help you draft the formal disclaimer document, ensure it’s delivered correctly, and advise you on how to avoid actions that could be construed as acceptance, safeguarding your family's financial future.

The Strategic Upside of a Disclaimer Trust

At first glance, willingly refusing a significant inheritance might seem counterintuitive. But in the context of sophisticated estate planning, the decision to use a disclaimer trust is driven by its powerful strategic advantages. This is about more than just numbers; it’s about providing your family with security, control, and peace of mind for generations to come.

For most Texas families, the primary reason to consider this strategy is the potential for significant estate tax savings. When a surviving spouse disclaims assets, those assets move into the bypass trust. This action effectively utilizes the deceased spouse's lifetime estate tax exemption, which might otherwise be wasted.

By taking this step, you ensure that a portion of your family's wealth—and all of its future growth—is shielded from being taxed again when the surviving spouse eventually passes away. Without a disclaimer, those assets would merge into the survivor's estate, potentially pushing it over the exemption limit and creating a substantial tax liability for your children.

Gaining a Powerful Shield for Your Assets

Another major benefit is asset protection. Life is unpredictable. After a spouse passes away, the survivor could face unexpected challenges—a lawsuit, unforeseen business debts, or other claims from creditors.

Once the disclaimed assets are securely held within the disclaimer trust, they are legally separate from the surviving spouse’s personal finances. This means they are generally beyond the reach of any future creditors or legal judgments. The trust acts as a protective shield, preserving that inheritance for its intended beneficiaries, such as your children.

In keeping with fiduciary duties in Texas, a disclaimer trust allows a surviving spouse to act prudently, safeguarding assets not just from taxes but also from external threats. It's a way to ensure the original estate plan's goals are honored, no matter what happens.

This separation offers a profound sense of security, allowing you to rest assured that a core part of your family’s legacy is protected, whatever the future may hold.

Locking in Your Legacy, Especially for Blended Families

Disclaimer trusts are a game-changer for blended families. If you have children from a previous marriage, a common concern is ensuring they ultimately receive their intended inheritance.

If all your assets pass directly to your new spouse, there is no legal guarantee your children will ever receive them. The surviving spouse could remarry, amend their own will, or deplete the assets, unintentionally or intentionally disinheriting your children.

A disclaimer trust resolves this issue effectively. The trust document, created by you, specifies the final beneficiaries. While your surviving spouse can receive income and support from the trust during their lifetime, they cannot change where the assets ultimately go. This guarantees your children receive their inheritance, providing clarity and preventing potential family disputes.

Disclaimer Trust vs Outright Inheritance A Comparison for Texas Families

To see the benefits in action, it is helpful to compare leaving everything directly to a spouse versus providing the option of a disclaimer trust. The differences in tax efficiency, asset protection, and ultimate control are significant. This strategy is one of several important estate planning tools; how to modify a trust in Texas is another key concept for ensuring your plan remains effective over time.

The table below breaks down the key distinctions for Texas families.

| Consideration | Outright Inheritance to Spouse | Using a Disclaimer Trust |

|---|---|---|

| Estate Tax Impact | The deceased's tax exemption is often wasted. All assets and their growth become part of the survivor's taxable estate. | Uses the deceased's exemption. Disclaimed assets and their future growth are removed from the survivor's taxable estate, saving taxes. |

| Asset Protection | The inherited assets are vulnerable to the surviving spouse's future creditors, lawsuits, or a subsequent divorce. | Assets in the trust are protected from the surviving spouse's creditors and legal claims, preserving them for heirs. |

| Control Over Final Heirs | The surviving spouse has total control and can leave the assets to anyone they choose in their will, potentially disinheriting children. | The original will or trust dictates the final beneficiaries (e.g., children), ensuring the deceased's wishes are honored. |

| Flexibility | The decision is permanent at the time the will is signed. There is no room to adapt to future circumstances. | Provides a nine-month window to assess finances and tax laws before making an irrevocable decision, offering maximum flexibility. |

As you can see, the disclaimer trust is not about giving something up. It is about adding a layer of strategic flexibility and protection that can make all the difference in securing your family's financial future.

Common Pitfalls and How to Avoid Them

While a disclaimer trust is an excellent estate planning tool, it is not a "set-it-and-forget-it" solution. It is a sophisticated instrument that must be handled with skill and care. A few common missteps can easily derail the entire strategy, leading to the very financial and family stress you were trying to avoid.

Knowing these potential pitfalls is the first step in avoiding them. Navigating this process requires a sharp eye for detail and the guidance of an experienced attorney, as a small mistake can have significant, irreversible consequences.

The Danger of Accidental Acceptance

One of the most common and damaging errors is accidental acceptance. Before a surviving spouse can legally disclaim an asset, they cannot have accepted any benefit from it. This rule is ironclad, and even a small, unintentional action can invalidate the disclaimer.

For example, if a dividend check from a stock portfolio arrives, and the surviving spouse deposits it into their personal bank account, they have legally "accepted" the benefit of that portfolio. At that moment, the right to disclaim those stocks is lost. The same applies to using a vacation home or driving a car that was solely in the deceased's name.

To steer clear of this trap:

- Consult an Attorney First: As soon as possible after a spouse's passing, your first call should be to a Texas estate planning attorney. Do not move or use any assets until you have received legal advice.

- Maintain Separation of Assets: Do not comingle the deceased’s assets with your own. Avoid using joint accounts for personal expenses until your lawyer gives you clearance.

- Ask Before You Act: Before selling an asset, using it, or collecting income from it, confirm with your attorney that doing so will not jeopardize your right to disclaim.

The "No Take-Backs" Rule

Another critical point is that a qualified disclaimer is irrevocable. Once you sign the formal written disclaimer and deliver it to the estate's executor, the decision is final. You cannot change your mind a year later if your financial situation changes.

This finality is precisely why the law provides a nine-month window. This period is not a deadline to rush toward but a time for careful, thoughtful evaluation with your professional advisors. The choice you make will have long-lasting effects on your family’s finances.

Because the decision is permanent, it is essential to work with your legal and financial team to model different scenarios. This step-by-step guidance helps you make a confident, educated choice about what to disclaim—and how much—based on a clear understanding of the long-term impact.

Poor Communication and Family Pressure

Dealing with an estate is an emotional time, and when communication breaks down, conflicts can arise. A surviving spouse may feel pressured by their children to disclaim assets for tax reasons or feel guilty about refusing an inheritance. This external pressure can cloud judgment during an already difficult period.

The best defense is clear, open communication from the beginning. The initial estate planning conversations should cover why the disclaimer trust is included. This helps the surviving spouse understand it is not about rejecting a gift but about using a smart strategy to protect the entire family. A knowledgeable Texas trust administration lawyer can help manage everyone's expectations and ensure decisions are made for sound financial reasons, not out of guilt or pressure.

If you need help setting up your estate plan or are facing the complexities of a disclaimer, don't go it alone. Contact The Law Office of Bryan Fagan, PLLC for the guidance you need.

When to Discuss a Disclaimer Trust with Your Attorney

Deciding if a disclaimer trust is the right move for your estate plan is a significant conversation, one best had with a professional who understands your family’s unique circumstances. This strategy is not a one-size-fits-all solution, but in the right situations, it provides powerful advantages.

Navigating the Texas Trust Code and IRS regulations on your own is a daunting task. It requires a deep understanding of the law to ensure every detail is handled correctly. An improperly executed disclaimer can trigger serious financial consequences, which highlights why expert guidance is not just a good idea—it's essential.

Who Should Consider This Strategy

While every family’s needs are different, certain situations make a disclaimer trust particularly valuable. You should strongly consider discussing this option with a Texas estate planning attorney if you and your spouse:

- Have substantial or growing assets: If your combined estate is approaching—or could one day exceed—the estate tax exemption limits, a disclaimer trust offers a crucial tax-saving opportunity.

- Are part of a blended family: This tool provides a reliable way to ensure your children from a previous relationship receive their intended inheritance while still providing for your current spouse.

- Want maximum flexibility for the future: If you value having a plan that can adapt to changes in tax laws, asset values, or family needs, the "wait-and-see" approach of a disclaimer trust is hard to beat.

A proactive consultation does more than just produce legal documents; it brings clarity and builds a strategy personalized for you. It empowers you to make confident, informed decisions that will protect your loved ones for years to come.

Leaving your family’s financial security to chance is a risk not worth taking. Knowing when to seek professional advice is key, and understanding the typical cost of a lawyer consultation can help you prepare for these important discussions. Think of it as an investment in your family’s peace of mind.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

Questions We Hear All the Time About Disclaimer Trusts

When Texas families begin exploring disclaimer trusts, a few key questions almost always arise. Let's walk through some of the most common ones, breaking down the concepts into practical, easy-to-understand answers.

What Happens If My Spouse Misses the Nine-Month Disclaimer Deadline?

This is a critical question, and the answer is unforgiving. If the strict nine-month deadline passes, the opportunity to make a qualified disclaimer is lost—permanently. The assets are then treated as if the surviving spouse fully inherited them, meaning they become part of their taxable estate.

This can lead to a much larger estate tax liability down the road, completely negating one of the primary benefits of this trust. The inflexible nature of this deadline is why it is so important to consult with a Texas estate planning attorney shortly after a spouse passes away to map out your options.

Can I Be the Trustee of My Own Disclaimer Trust in Texas?

Yes, in many cases, you can. In Texas, it is common for the surviving spouse to also serve as the trustee of the disclaimer trust. However, this requires very careful legal drafting to comply with IRS rules.

The trustee’s powers must be precisely limited. If they are not, the IRS could deem that the spouse has too much control, which could pull the trust's assets back into their personal estate for tax purposes. To avoid this, distributions of the trust principal are typically restricted by what's known as an "ascertainable standard."

This technical term simply means that funds can only be distributed for specific, defined needs, such as:

- Health: Covering medical bills, health insurance, and long-term care.

- Education: Paying for tuition or other educational expenses.

- Maintenance and Support: Providing for regular living expenses to maintain your established lifestyle.

Drafting this language correctly is a job for a skilled attorney who can ensure the trust document provides necessary flexibility while meeting all strict legal requirements.

Are Disclaimer Trusts Only for Very Wealthy Families?

Not at all. While these trusts are excellent tools for minimizing estate taxes for high-net-worth families, their benefits extend much further. They offer powerful advantages for many other Texas families as well.

A disclaimer trust is like building a fortress around your family’s legacy. It provides excellent asset protection, shielding inherited wealth from a surviving spouse’s future creditors, potential lawsuits, or even claims from a later remarriage.

This strategy is also a game-changer for blended families, where it is crucial to ensure assets are ultimately preserved for children from a prior marriage. Because life is unpredictable—tax laws change, and financial situations shift—the flexibility of a disclaimer trust makes it an incredibly resilient planning tool for any family wanting to protect what they’ve built. A conversation with an experienced Texas trust administration lawyer can help you determine if it’s the right fit for your unique situation.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.