Planning for the future can feel overwhelming, especially when it comes to securing your home for your loved ones. In Texas estate planning, the Lady Bird Deed is a uniquely powerful tool designed to provide peace of mind. It allows you to transfer your home or other real estate directly to your beneficiaries upon your death, completely bypassing the costly and time-consuming probate court process.

Think of it as naming a beneficiary for your house, much like you would for a bank account or life insurance policy. The critical advantage? You retain complete and absolute control over your property for as long as you live.

A Path to Peace of Mind for Texas Homeowners

Arranging your affairs for after you're gone is a significant responsibility, particularly concerning your home—often your most valuable asset. Like many Texans, your goal is likely to ensure your property passes to your family efficiently, without the stress and expense of a prolonged court battle. This is precisely where a Lady Bird Deed, also known as an Enhanced Life Estate Deed, demonstrates its value.

This legal instrument allows you to live in, sell, mortgage, or even give away your property without needing permission from the people you've named to inherit it. You remain in full control. It serves as a cornerstone of effective asset protection and is a prudent component of any comprehensive estate plan.

What Makes a Lady Bird Deed Different Under Texas Law

So, what distinguishes this deed from other property transfer methods? The Lady Bird Deed combines a unique set of benefits, making it a preferred choice for Texas families. Here’s what sets it apart:

- You Keep Complete Control: As the property owner, you retain the full authority to manage your property as you see fit.

- Avoid the Probate Process: Upon your passing, the property automatically transfers to your named beneficiaries, avoiding court intervention, legal fees, and lengthy delays.

- Strategic Medicaid Planning: It is an invaluable tool for protecting your home from the Medicaid Estate Recovery Program (MERP), helping to preserve your legacy for your family.

At its core, a Lady Bird Deed is about empowerment. It gives you the power to determine the future of your property with complete confidence, ensuring your wishes are honored—all while you remain in control today.

By understanding how this deed functions under the Texas Estates Code, you can make informed decisions that provide both peace of mind for you and lasting security for your family. This guide will explain how this tool works, explore its key benefits, and compare it to other estate planning options.

So, What Exactly Is a Lady Bird Deed?

Navigating the complexities of estate planning can feel like wading through dense legal jargon. However, one instrument, the Lady Bird Deed, offers a clear and straightforward path for many Texans.

In simple terms, a Lady Bird Deed is a legal document that allows you to transfer your real estate to a designated person automatically upon your death, without relinquishing any of your ownership rights while you are alive.

It functions similarly to naming a beneficiary on a retirement account, but for your real property. You decide who inherits it, but until that time, the property is 100% yours to manage as you please. You can change your mind, select a different beneficiary, or even sell the property and keep the proceeds. Your beneficiary has no legal say in your decisions.

The Key Players and How It Works Under Texas Law

To understand how a Lady Bird Deed operates, it’s helpful to know the roles involved. Under Texas law, there are three key parties:

- The Grantor: This is you, the property owner. You are the one creating and signing the deed.

- The Life Tenant: This is also you. You hold an "enhanced life estate," meaning you have the absolute right to live in, use, and benefit from the property for the remainder of your life.

- The Remainderman: This is the person (or people), often a family member or loved one, you have chosen to inherit the property. They are also known as the "remainder beneficiary."

The unique power of a Lady Bird Deed lies in its "enhanced" life estate. In a traditional life estate, the remainderman has vested rights that can limit your control. With an enhanced life estate, you retain full authority without needing their consent.

Here is a practical overview of the core features of a Lady Bird Deed in Texas.

Key Features of a Texas Lady Bird Deed at a Glance

| Feature | Description |

|---|---|

| Probate Avoidance | The property transfers automatically to the remainderman upon your death, bypassing the lengthy and often costly probate court process mandated by the Texas Estates Code. |

| Retained Control | You keep complete control to sell, mortgage, lease, or change beneficiaries without the remainderman's consent, a key fiduciary principle of self-management. |

| Medicaid Eligibility | The transfer is not considered a gift for Medicaid eligibility purposes, protecting your ability to qualify for long-term care benefits. |

| Medicaid Estate Recovery Protection | The property is not considered part of your probate estate, which can protect it from claims by the Medicaid Estate Recovery Program (MERP). |

| Tax Benefits | The remainderman receives a "step-up in basis" to the property's fair market value at the time of your death, often reducing or eliminating capital gains taxes if they later sell. |

This table summarizes why this deed is such a popular tool in Texas, but the true benefit is the complete control it leaves in your hands.

The "Enhanced" Powers You Retain

The word "enhanced" is the critical legal distinction that separates a Lady Bird Deed from more restrictive options. This term signifies a specific set of rights recognized in Texas and a few other states.

This legal concept is a game-changer rooted in real estate law. Its increasing popularity among seniors and high-net-worth families in Texas and other states speaks to its effectiveness. You can explore its application further to see why it has become a trusted asset protection tool.

During your lifetime, you retain the absolute right to:

- Sell the Property: You can sell your home to anyone at any time and retain 100% of the proceeds. Your beneficiary has no claim to the funds.

- Mortgage the Property: If you need a loan or a reverse mortgage, you can secure it without your beneficiary's signature.

- Lease or Rent the Property: You are free to rent out the property and keep all rental income.

- Change or Revoke the Deed: If your circumstances or relationships change, you can simply file a new deed naming a different beneficiary or cancel the transfer altogether.

These retained powers ensure your property remains your asset to manage as you see fit. This flexibility makes it a powerful component of any robust estate planning strategy, providing security now while guaranteeing a smooth, probate-free transfer for your family in the future.

The Top Benefits of a Texas Lady Bird Deed

When planning for your family’s future, every decision matters. In Texas, the Lady Bird Deed stands out as a uniquely effective tool, blending simplicity with robust protection. It is designed to address some of the primary concerns of Texas homeowners: avoiding probate court, maintaining control of property, shielding assets, and minimizing taxes.

Once you see how these advantages align, you will understand why a Lady Bird Deed is often a cornerstone of a well-crafted Texas estate plan. Let's review each benefit.

Bypassing the Probate Process Entirely

A significant advantage of a Lady Bird Deed is that it allows your property to completely avoid probate. Probate is the court-supervised process of validating a will and distributing assets after someone dies. While sometimes necessary, it can be a lengthy, expensive, and public process.

With a Lady Bird Deed, the transfer of your home occurs automatically upon your death. Your beneficiary simply needs to file your death certificate with the county property records to make their ownership official. This simple step-by-step process saves your family from the stress of a prolonged court proceeding and thousands in legal fees.

Retaining Absolute and Unquestioned Control

A common fear in estate planning is relinquishing control of your property prematurely. This is where the "enhanced" aspect of the deed is invaluable. Unlike other transfer deeds that may grant immediate rights to your beneficiaries, a Lady Bird Deed ensures you remain the sole authority over your property throughout your lifetime.

This means you can:

- Sell the property at any time and keep all the proceeds.

- Take out a mortgage or refinance without needing anyone's consent.

- Rent it out and retain all the income.

- Change your mind and name a different beneficiary—or cancel the deed entirely.

This level of control offers profound peace of mind. Your home remains your asset, and your financial independence is preserved. Your beneficiaries have no legal say in your property decisions until you are gone.

Protecting Your Home from Medicaid Recovery

For many Texas families, the potential cost of long-term care is a major concern. A Lady Bird Deed is an excellent tool for Medicaid planning. When you apply for Medicaid to assist with nursing home expenses, Texas generally does not count your primary residence against your eligibility. The challenge arises later. After your death, the Medicaid Estate Recovery Program (MERP) can file a claim against your estate to recoup the benefits paid.

Because a Lady Bird Deed transfers your home outside of your probate estate, it can shield the property from MERP. This prevents the state from forcing the sale of your home to repay Medicaid costs, preserving it as a legacy for your family. For a complete understanding of this protection, read our guide on how to avoid Medicaid Estate Recovery in Texas.

Unlocking Significant Tax Advantages

Finally, a Lady Bird Deed provides a significant tax benefit for your heirs through a "step-up in basis." When your beneficiary inherits the property, its cost basis for tax purposes is adjusted—or "stepped up"—to its fair market value on the date of your death.

What does this mean in plain English? If your children decide to sell the house shortly after inheriting it, they will likely pay little to no capital gains tax. This is a massive advantage, especially if the property has appreciated significantly in value over the years.

This combination of probate avoidance, retained control, Medicaid protection, and tax savings makes the Lady Bird Deed a uniquely powerful and popular tool for Texas homeowners. A skilled Texas estate planning attorney can help you leverage this tool to protect your legacy.

Comparing Lady Bird Deeds to Other Planning Tools

Choosing the right estate planning tool requires careful consideration of your goals and family situation. While a Lady Bird Deed is an excellent solution for many Texans, it's wise to evaluate all available options. Every tool has specific strengths, and the best choice depends on your unique circumstances.

Let’s compare the Lady Bird Deed with other common instruments: traditional wills, revocable living trusts, and the Texas Transfer on Death Deed (TODD). A side-by-side comparison helps clarify which option provides the most security and peace of mind for you.

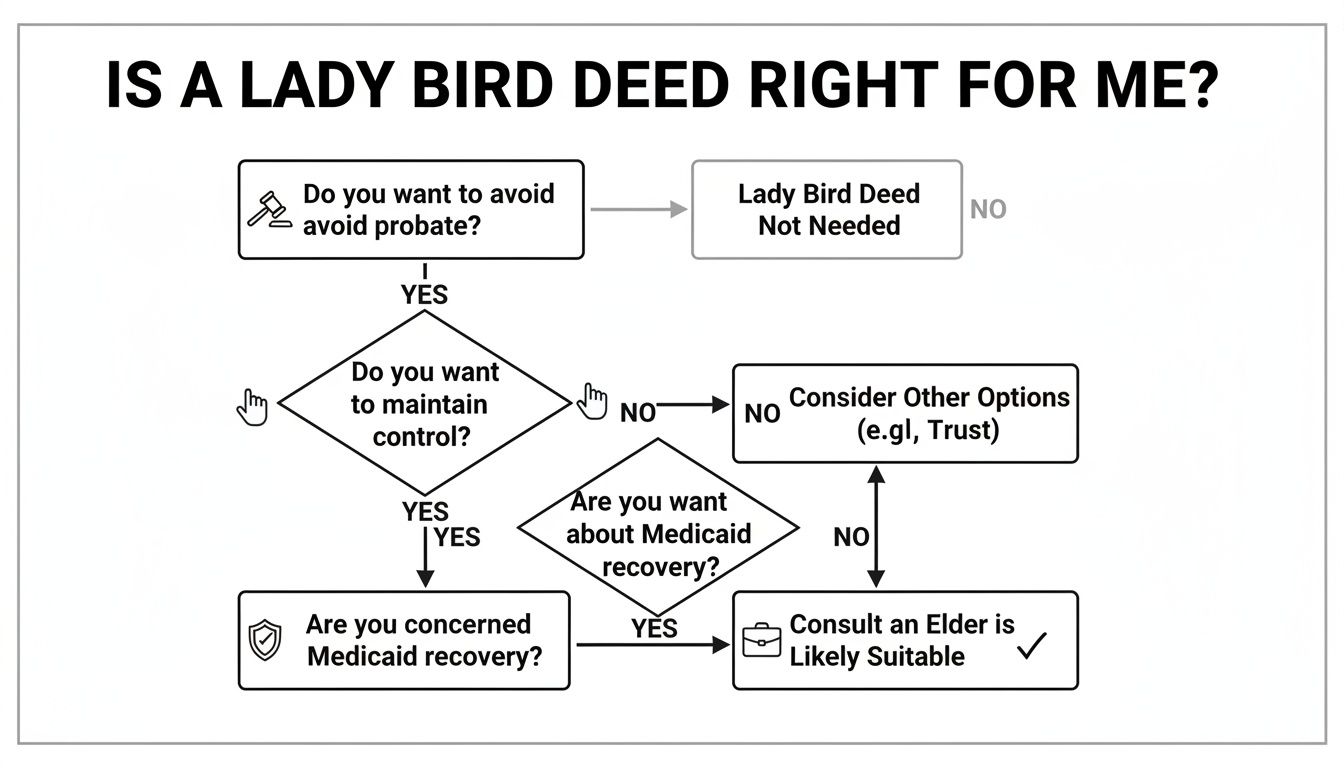

The flowchart below offers a quick assessment. It helps you determine if a Lady Bird Deed aligns with your priorities, such as avoiding probate, maintaining control, and planning for long-term care.

If your primary goals are to bypass the probate process, retain full control over your property, and shield it from Medicaid recovery, this visual guide makes it clear: a Lady Bird Deed is a topic to discuss with your attorney.

To provide further clarity, here is a breakdown of how a Lady Bird Deed compares to other common estate planning tools in Texas.

| Feature | Lady Bird Deed | Will | Revocable Trust | Transfer on Death Deed (TODD) |

|---|---|---|---|---|

| Probate Avoidance | Yes – Transfers property automatically. | No – Must go through probate court. | Yes – Assets in the trust bypass probate. | Yes – Transfers property automatically. |

| Retained Control | Yes – You keep full control to sell, mortgage, etc. | Yes – You control assets during your life. | Yes – You control assets as the trustee. | Yes – You keep control during your life. |

| Medicaid Protection | Yes – Not a countable asset; avoids MERP recovery. | No – Assets in the estate are subject to recovery. | Maybe – Depends on trust structure; complex. | No – Property is subject to MERP recovery. |

| Creditor Protection (Post-Death) | Stronger protection against creditor claims. | No – Estate assets are used to pay debts. | Yes – Trust assets are generally protected. | Weaker – Subject to creditor claims for 2 years. |

| Setup Cost & Complexity | Low – Simple and cost-effective. | Low to Moderate – Fairly simple to create. | High – More complex and expensive to set up. | Low – Simple and cost-effective. |

| Flexibility (Incapacity) | Yes – Can be signed by an agent under a POA. | N/A | Yes – Successor trustee takes over. | No – Cannot be signed by an agent under a POA. |

Let's explore what these differences mean for you and your family.

Lady Bird Deed vs. a Traditional Will

The most critical difference between a Lady Bird Deed and a will is probate. A will serves as instructions for the probate court. Any property passed through a will must go through probate—a public, often slow, and expensive legal process governed by the Texas Estates Code.

A Lady Bird Deed, however, is designed to avoid probate entirely for your real estate. The property automatically transfers to your named beneficiaries upon your death. This saves your family significant time, stress, and money. While a will is essential for other assets, a Lady Bird Deed is a more direct and efficient solution for your home.

Lady Bird Deed vs. a Revocable Living Trust

A revocable living trust is another excellent tool for avoiding probate. With a trust, you create a legal entity, transfer assets (like your house) into it, and manage them as the trustee. A successor trustee you appoint distributes the assets according to your instructions after your death.

However, trusts are more complex and costly to establish and administer. You must formally "fund" the trust by retitling assets, and there is some ongoing management. A Lady Bird Deed achieves the same probate-avoidance goal for real estate with a much simpler and more affordable document. For individuals whose primary asset is their home, it is an incredibly efficient choice.

Lady Bird Deed vs. the Texas Transfer on Death Deed (TODD)

On the surface, a Lady Bird Deed and a Texas Transfer on Death Deed (TODD) appear very similar. Both allow you to name a beneficiary to inherit property automatically, avoiding probate. But there are crucial legal distinctions.

First, a TODD leaves your property vulnerable to creditor claims for up to two years after your death. A Lady Bird Deed is structured differently under Texas law and generally offers superior protection from such claims.

Second, a TODD cannot be signed by an agent acting under a power of attorney. You, the owner, must sign it. A Lady Bird Deed, however, can be signed by your agent, providing critical flexibility if you become incapacitated.

For a more detailed comparison, our guide on the Texas Transfer on Death Deed provides further insights. Ultimately, the Lady Bird Deed's unique structure often offers more comprehensive protection and flexibility.

Getting Your Texas Lady Bird Deed Drafted and Recorded

Creating a Lady Bird Deed is a precise legal process, not a DIY project. While straightforward with expert guidance, attempting it alone can lead to title defects and undermine your planning goals. A real-world example would be a family attempting to use a generic online form that fails to include the specific "enhanced life estate" language required by Texas law, resulting in the property unexpectedly entering probate.

Each step must be followed carefully to ensure the deed is valid and enforceable.

Step 1: Consult an Experienced Texas Trust Administration Lawyer

Your first and most important step is to consult a qualified Texas estate planning attorney. They will review your complete financial and family situation to confirm that a Lady Bird Deed is the right tool for you.

This consultation ensures the deed integrates seamlessly with your will, trusts, and overall estate plan. An attorney can help you navigate complexities, such as how to name multiple beneficiaries or plan for contingencies if a beneficiary predeceases you. This professional guidance helps prevent future legal disputes and family conflict.

Step 2: Draft the Deed with Pinpoint Accuracy

Once you and your attorney agree on the strategy, they will draft the deed. This document requires absolute precision and includes several key pieces of information:

- The Full Legal Property Description: This must be the exact legal description found on your current deed, not just the street address.

- Clear Identification of All Parties: The full legal names of the grantor (you) and the remaindermen (your beneficiaries) must be included.

- The "Enhanced" Life Estate Language: This is the most critical component. The deed must contain specific legal phrasing required under Texas law to create the "enhanced life estate," which grants you the power to sell, mortgage, or revoke the deed without beneficiary consent.

A Lady Bird Deed flips the script, acting as a probate bypass superhighway. Unlike traditional deeds splitting ownership now, it reserves your full powers—occupy, lease, encumber—until death, then zips title to heirs automatically. Texas courts uphold this structure, which can save your estate months of delays and significant fees. Discover more insights about how this unique deed protects your control over your property.

Step 3: Execute the Deed Before a Notary

After reviewing and approving the deed, you must sign it in the presence of a notary public. The notary verifies your identity and confirms you are signing the document willingly. Their official stamp and signature are required to legitimize the deed in Texas. As technology evolves, it is also important to be aware of the e-signature legal requirements for law firms to ensure compliance.

Step 4: Record the Deed with the County Clerk

The final step is to record the deed by filing the signed and notarized document with the county clerk’s office in the county where the property is located. Recording the deed makes it part of the official public record and legally effective. This is the same essential step required when you learn how to transfer property to a trust; recording makes the transfer legally binding.

Common Pitfalls and When to Seek Legal Advice

While a Lady Bird Deed is an excellent tool, it is not a universal solution. Like any legal instrument, it has potential pitfalls. Without careful planning, you could inadvertently create the very stress and confusion you sought to avoid.

For example, a common mistake occurs when naming multiple beneficiaries. Imagine you name your three children as remaindermen. If one of them passes away before you, their share does not automatically go to their children (your grandchildren). Without specific language in the deed addressing this contingency, you could unintentionally disinherit an entire branch of your family.

This is precisely why professional legal guidance is essential. An experienced Texas estate planning attorney knows how to address these "what-if" scenarios, ensuring your wishes are honored regardless of future events.

Navigating Complex Family and Financial Situations

The simplicity of a Lady Bird Deed can sometimes obscure underlying family or financial complexities. A DIY deed might seem adequate, but a minor error can create significant problems that surface only after your death, leaving your loved ones with an expensive and emotionally draining legal mess.

Consider these common scenarios:

- Mortgage and Title Issues: Some mortgage lenders and title companies are unfamiliar with Lady Bird Deeds. This can cause delays or complications if you try to sell or refinance the property.

- Blended Families: If you have children from different marriages, a Lady Bird Deed must be part of a comprehensive estate planning strategy that includes a will or trust to prevent unintended consequences and family disputes.

- Beneficiary Complications: What if one of your children has creditor problems or is going through a divorce? Their share of your property could become entangled in their legal battles, creating a nightmare for your other children.

A poorly worded deed can turn an instrument of peace into a source of conflict. A simple typo in the property's legal description can invalidate the entire document, sending your home straight to the probate court you intended to avoid.

Why a Texas Estate Planning Attorney Is Your Best Protection

The value of hiring an attorney extends beyond correctly filling out a form. It lies in their ability to identify and prevent potential problems. A Texas trust administration lawyer will analyze your entire situation—your family, finances, and goals—and provide candid advice on whether a Lady Bird Deed is the right choice for you.

They provide the crucial counsel needed to align the deed with your broader goals for asset protection and family harmony. An attorney will help you determine if this tool is a perfect fit or if another instrument, like a trust, would better serve your family's long-term interests.

Answering Your Questions About Texas Lady Bird Deeds

Embarking on estate planning naturally raises questions. To provide clarity, we have compiled answers to some of the most common inquiries from Texas families considering a Lady Bird Deed. This practical Q&A addresses how this powerful tool works in real-world scenarios.

Can I Change My Mind About the Beneficiary?

Absolutely. This flexibility is a key feature of a Lady Bird Deed. As the owner, you retain the unilateral right to change or even remove beneficiaries at any time. You do not need their consent or even need to inform them.

If your circumstances change and you wish to name a new beneficiary, your attorney can simply prepare and record a new deed. This complete control contrasts sharply with a traditional life estate, where beneficiary rights are fixed and cannot be altered without their agreement.

What Happens to My Texas Homestead Exemption?

Nothing at all. A properly drafted Lady Bird Deed has no impact on your ability to claim and maintain your Texas homestead exemption for property tax purposes.

Because you retain full control, ownership, and the right to live in the home for life, Texas law continues to recognize you as the sole owner. You will continue to receive all property tax benefits to which you are entitled.

Can I Still Sell the Property After Signing a Lady Bird Deed?

Yes. You are 100% free to sell your property without seeking permission from the beneficiaries named in the deed. The "enhanced" powers reserved in a Lady Bird Deed specifically grant you this right.

Once the property is sold, the Lady Bird Deed becomes void because the asset it was intended to transfer no longer belongs to you. The proceeds from the sale are entirely yours, and the beneficiaries have no claim to them. Your financial independence remains fully intact.

Isn't This Just a Transfer on Death Deed?

While they appear similar because they both avoid probate, they are legally distinct instruments in Texas, and the differences are significant. A major distinction is that property passed via a Texas Transfer on Death Deed (TODD) remains subject to the deceased's creditor claims for up to two years after death.

A Lady Bird Deed, structured as a present gift with a retained enhanced life estate, generally offers stronger and more immediate protection from such claims. Another key difference is that a TODD cannot be signed by an agent under a power of attorney, whereas a Lady Bird Deed can. An experienced Texas estate planning attorney can explain these nuances and help you determine which tool best protects your assets.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.