Planning for your family's future can feel overwhelming, but with the right legal guidance, it doesn’t have to be. When you begin this process, two terms almost always surface: "will" and "living trust." They're often mentioned together, but in Texas estate planning, they serve very different purposes. Understanding these differences is the first step toward creating a plan that protects your legacy and provides for your loved ones exactly as you intend.

At its core, the choice between a living trust vs. a will comes down to timing, privacy, and control. A living trust is a dynamic plan that manages your assets during your lifetime and after you're gone, often keeping your family out of court. A will, on the other hand, is a static document that only becomes active after your death, serving as a set of instructions for the probate court to follow.

At The Law Office of Bryan Fagan, PLLC, we know how vital it is for families to find clear, straightforward information. Our focus on optimizing legal content for search ensures that when Texans need answers about complex legal matters, they find them without wading through confusing jargon.

At a Glance: Living Trust vs. Will in Texas

To get straight to the point, let's compare the key differences. This table provides a quick snapshot of how a living trust and a will stack up on the issues that matter most to Texas families. We'll explore these details further, but this gives you a solid foundation.

| Feature | Living Trust | Will |

|---|---|---|

| When It Takes Effect | Immediately upon being signed and funded | Only after your death |

| Probate Requirement | Avoids probate for assets held in the trust | Must go through the probate court process |

| Privacy | A private document, not part of the public record | Becomes a public court record during probate |

| Incapacity Planning | Manages your assets if you become unable to | Offers no protection for incapacity |

As you can see, the differences are significant. A living trust gives you immediate control and, crucially for many families, keeps your estate out of the public probate courts. A will is guaranteed to go through probate, a process governed by the Texas Estates Code that can easily take 6–18 months and consume 2%–7% of your estate's value in fees.

This single distinction—probate vs. no probate—is why so many Texans are choosing trusts. It is a powerful tool for protecting your assets, ensuring your privacy, and making the transfer of your legacy as smooth as possible for those you love.

Comparing How Trusts and Wills Actually Work

Knowing the definitions is one thing, but understanding how a will and a living trust function in the real world for Texas families is what truly matters. The difference isn't just in the paperwork; it's in the legal processes they trigger—or avoid. A will is essentially a letter of instruction to the probate court. A living trust, by contrast, is a private framework that keeps your assets out of the court system entirely.

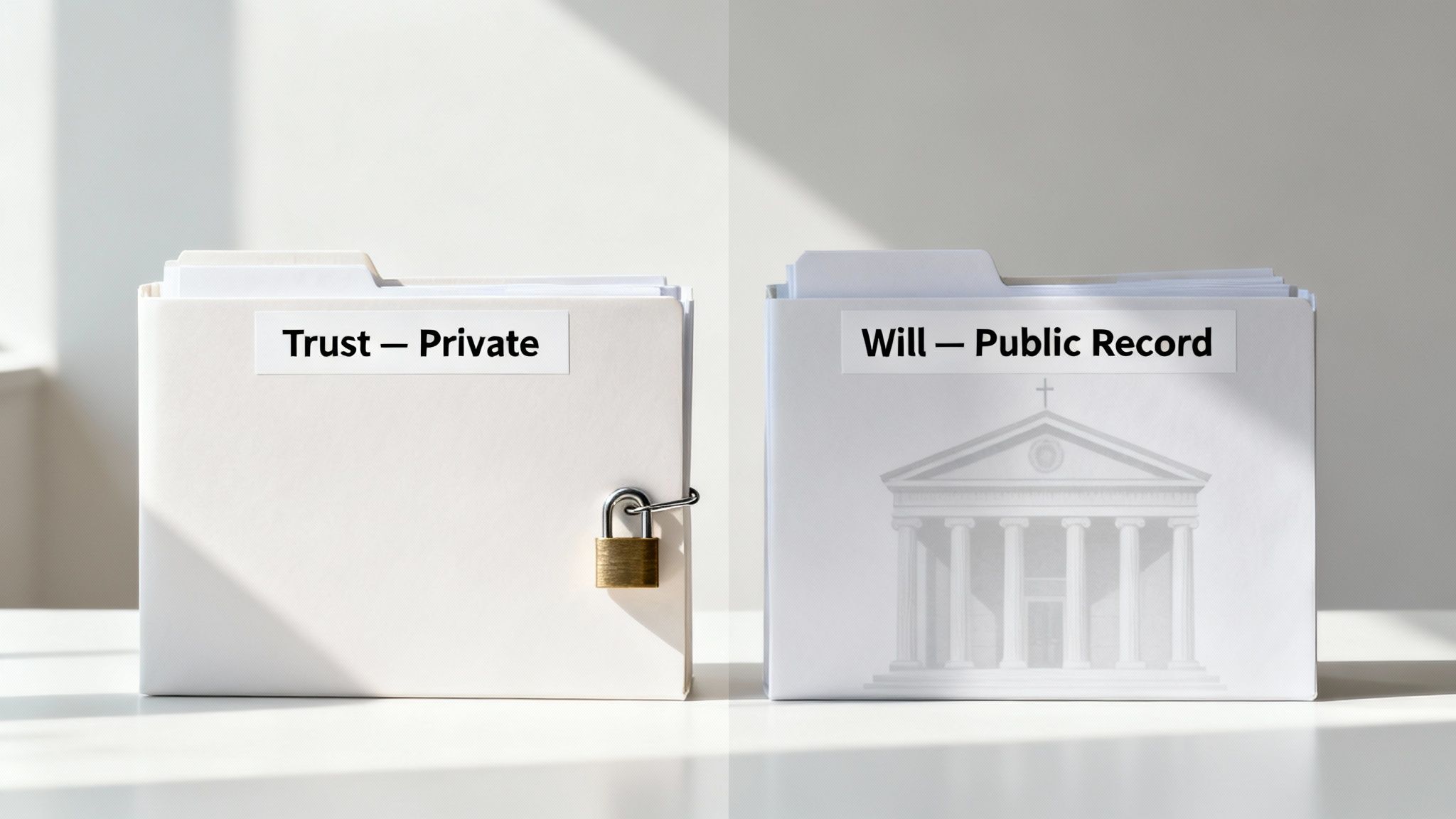

This distinction is critical. If you rely solely on a will, your estate is guaranteed to go through probate. This is a public, court-supervised process dictated by the Texas Estates Code. A trust allows for a quiet, private administration handled by a successor trustee you selected, keeping your family's affairs out of the public record.

The Critical Role of Probate in Texas

Probate is the formal legal process where a court validates your will, pays your debts, and distributes the remaining assets to your beneficiaries. While Texas has a more streamlined probate system than many states, it is still a public process that can be lengthy and expensive.

A living trust is specifically designed to avoid probate. When you transfer assets into the trust, you no longer own them personally—the trust does. Therefore, when you pass away, there are no assets in your name for the probate court to oversee. This simple change in ownership is the key to a trust's power. To understand this better, it's helpful to know the difference between probate and non-probate assets in Texas.

A will is an invitation to the courthouse. A living trust is a plan to stay out of it. This single distinction impacts the privacy, cost, and timeline of settling your estate more than any other factor.

Planning for Incapacity: A Trust's Living Benefit

A significant advantage of a trust is its ability to protect you while you are still alive. A will does absolutely nothing until after you die. It offers zero protection if you become incapacitated due to illness or injury and can no longer manage your own finances.

In that scenario, if you only have a will, your family would likely have to petition the court to establish a guardianship to pay your bills and manage your property. This is a public, costly, and emotionally draining legal process.

A living trust provides a seamless and dignified alternative.

- During Incapacity: Your chosen successor trustee can step in immediately and privately to manage the trust's assets on your behalf.

- No Court Intervention: This transition occurs without a judge's approval, protecting your privacy and saving your family from the stress of a guardianship hearing.

- Continuous Management: Your financial life continues without interruption. Bills are paid and investments are managed according to the rules you established.

This feature alone makes a living trust an invaluable tool for planning your life, not just your estate.

Privacy and Control in Estate Administration

The public nature of probate is a major concern for many families. Once a will is filed with the court, it becomes a public document. Anyone—a curious neighbor, a disgruntled relative, or a predatory salesperson—can access details of your estate, including:

- Who your beneficiaries are.

- What assets you owned.

- The total value of your estate.

A living trust is completely private. Its terms, assets, and beneficiaries remain confidential. Your chosen trustee handles everything privately, following your instructions precisely. This privacy protects your loved ones from unwanted attention and potential disputes. Furthermore, a trust offers far greater control over how and when your heirs receive their inheritance.

Real-World Scenario: Imagine you have a 20-year-old child who is not yet mature enough to handle a large inheritance. With a will, they would likely receive it in one lump sum after probate concludes. With a trust, you can create a structured distribution plan: funds for college tuition, a portion of the inheritance at age 25, another at 30, and the remainder at 35. This approach protects the assets from creditors or a future divorce. A will simply cannot provide this level of customized control. A skilled Texas estate planning attorney can help you design these distributions to fit your family's unique needs.

The Real Cost: Weighing Upfront Expenses vs. Long-Term Burdens

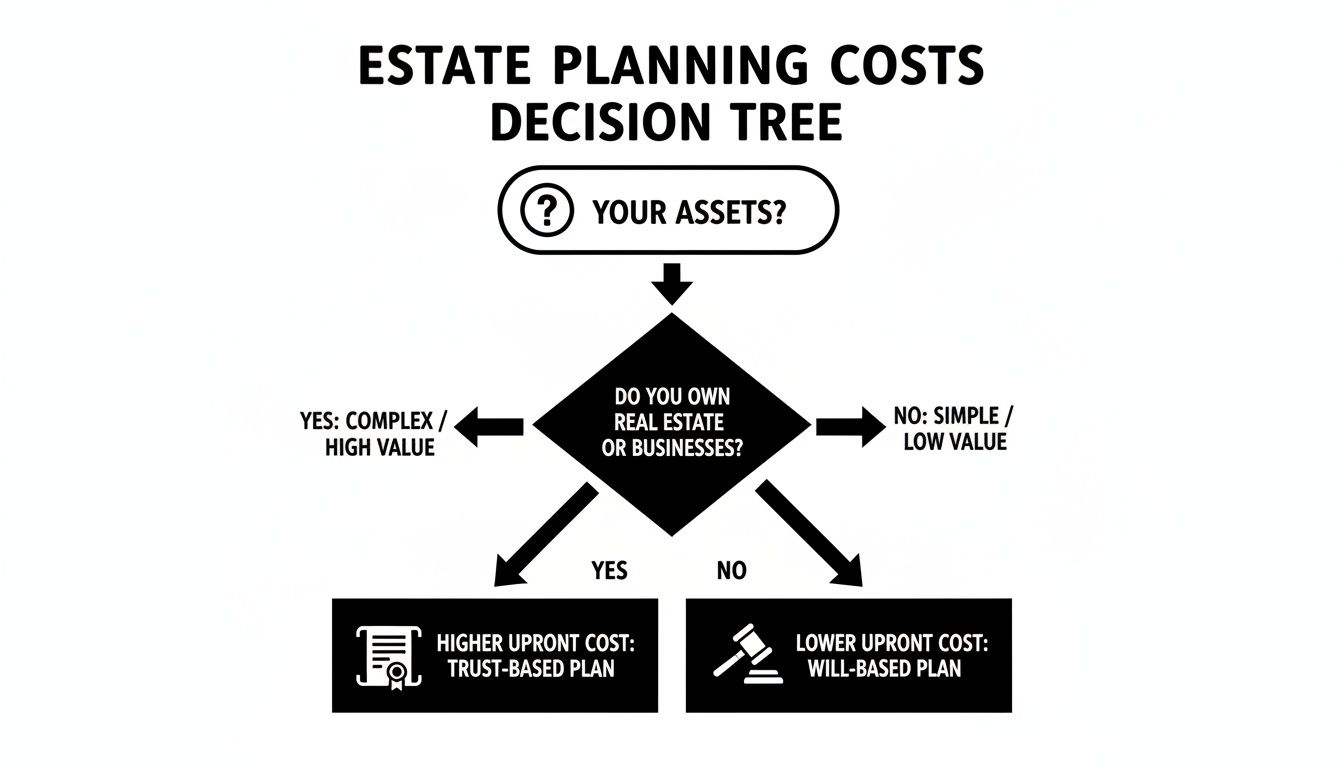

When choosing between a living trust and a will, cost is a natural and practical concern. However, the answer isn't a simple price comparison. To understand the true financial impact, you must look beyond the initial setup fee and consider the long-term costs your family may face.

On the surface, a will is the more affordable option to create. An experienced Texas attorney can draft a comprehensive will for a relatively modest flat fee, making it an appealing choice for many.

A living trust requires a larger upfront investment. The trust document is more complex, but creating it is only the first step. The second, non-negotiable step is funding the trust.

You Can't Forget to "Fund" Your Trust

"Funding" is the process of retitling your assets—your home, bank accounts, and investment portfolios—from your individual name into the name of the trust. This is the crucial action that enables your successor trustee to manage your affairs and, most importantly, keeps your estate out of probate court. Each asset requires a specific legal process, from recording a new deed for your property to changing the ownership on a brokerage account.

This detailed work is a primary reason why setting up a trust costs more initially. It requires more effort now, but this is precisely what protects your family from the expense and hassle of probate later.

Think of it this way: the higher initial cost of a trust is a one-time investment to spare your family the much larger financial and emotional toll of probate. You’re choosing to pay more now so they pay significantly less later.

This trade-off is central to the will vs. trust decision. A will might save you money today, but it could cost your estate 2% to 7% of its total value in probate fees, court costs, and legal bills. For even a modest Texas estate, these costs can easily amount to tens of thousands of dollars.

Comparing the Legwork: Now vs. Later

With a living trust, you and your attorney do the heavy lifting upfront by organizing and titling your assets correctly. With a will, you are deferring that administrative burden to your executor, who must navigate the public probate process after you are gone.

Under the court's supervision, your executor will be required to:

- File the will with the probate court and attend hearings.

- Compile a detailed inventory of all assets for the court.

- Formally notify creditors and settle all debts.

- File your final tax returns.

- Distribute assets only after receiving the court's permission.

An executor's role in Texas comes with significant legal responsibilities and personal liability. They are held to strict fiduciary duties in Texas under the Estates Code. A trustee has similar fiduciary responsibilities but carries them out privately, without court oversight. The choice is about when the work is done and who does it. A trust requires effort today for a seamless transition tomorrow, while a will guarantees a public, and often more costly, administrative process for your loved ones. For those serious about asset protection, understanding this trade-off is key.

Choosing the Right Plan for Your Texas Family

The decision between a living trust and a will is not about which is universally "better," but which is better for you. The best choice depends on your unique circumstances, your family's needs, and your long-term goals. For some Texans, a straightforward will is sufficient. For others, a living trust offers critical protections that a will cannot provide.

By examining practical scenarios, you can see how each document functions and determine which path aligns with your situation. The goal is to create a plan that gives you peace of mind, knowing your family is protected.

When a Will Might Be Enough

While a living trust offers many advantages, it is not essential for everyone. A well-drafted will, prepared by a Texas estate planning attorney, can provide the core protections some individuals need.

A simple will may be a suitable choice if you are:

- A Young Individual or Couple without Major Assets: If your primary goal is to name a legal guardian for your minor children, a will is the only document that can accomplish this. For a young family without significant assets like a home or large investment accounts, the simplicity and lower cost of a will often make it the most practical option.

- Someone with Limited Assets Titled Jointly: If most of your property is owned jointly with your spouse (e.g., a home or bank accounts with rights of survivorship), those assets will pass directly to them outside of probate. In this case, a will can cover your personal property and act as a reliable backup plan.

Even in these situations, a will guarantees that your estate will go through the public probate process. This is the trade-off: a lower initial cost in exchange for a public, court-supervised process for your heirs.

When a Living Trust Is Often the Superior Choice

For many Texas families, the benefits of a living trust far outweigh the higher setup cost. The ability to avoid probate, maintain privacy, and plan for incapacity makes it a powerful tool for asset management and protection.

A living trust is generally the better option if you:

- Own Real Estate: Placing your home or other Texas property into a living trust is one of the most effective ways to ensure it passes to your beneficiaries without probate court involvement.

- Have a Blended Family: For second marriages or blended families, a trust offers unparalleled control. It allows you to provide for your current spouse for their lifetime while ensuring your remaining assets ultimately go to children from a previous relationship, which can prevent potential conflicts.

- Are a Business Owner: A trust can ensure a smooth transition of your business ownership and management, preventing the disruptions that a lengthy probate process could cause.

- Value Privacy Above All: If the idea of your family’s finances becoming a public record is unsettling, a trust is the only way to keep your affairs completely private.

This decision tree helps visualize the financial trade-off: a higher investment now with a trust could mean avoiding much higher, less predictable costs later with a will.

The key takeaway is that you are choosing when to pay and how much control you want to retain. Probate costs are often unpredictable and can escalate quickly.

The Best of Both Worlds: A Trust with a Pour-Over Will

For most individuals who create a trust, the optimal strategy is to use both documents together. A pour-over will is a special type of will that serves as a companion and safety net for your living trust.

A pour-over will is designed to "catch" any assets you may have forgotten to transfer into your trust or that you acquired shortly before you passed away. Upon your death, the will directs those overlooked assets to be moved—or "poured over"—into your trust.

This ensures that all your assets are ultimately distributed according to the detailed instructions in your private trust document, providing the most comprehensive protection possible. For more insight, you can explore other factors to consider when choosing between a will and a trust in Texas.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

Getting Your Texas Living Trust Set Up and Funded

Once you've decided that a living trust's benefits—avoiding probate, ensuring privacy, and planning for incapacity—are right for you, the next question is how to get started. The process of creating and funding a trust is methodical and, with professional guidance, less intimidating than it may seem. Here is some step-by-step guidance.

The journey begins with a professionally drafted trust document, but it doesn't end there. A trust is only as effective as the assets it holds.

Step 1: Partner With a Texas Trust Administration Lawyer to Draft the Trust Document

While DIY legal forms are available online, they are a significant risk in estate planning. A generic template cannot account for your unique family dynamics, specific assets, or the nuances of the Texas Trust Code. Working with a skilled Texas trust administration lawyer is the most crucial step.

Together, you will define key roles:

- Grantor: You, the creator of the trust.

- Trustee: Initially, this is also you, managing your assets as you always have.

- Successor Trustee: The person or institution you name to take over if you pass away or become incapacitated.

- Beneficiaries: The individuals or charities who will inherit your assets.

Your attorney will formalize these decisions in a trust agreement that reflects your exact wishes. For a deeper look, see our guide on how to create a trust in Texas.

Step 2: Choose Your Successor Trustee Wisely

Selecting your successor trustee is one of the most important decisions you will make. This individual or institution will be responsible for managing your finances if you are unable and ensuring your legacy is distributed as you intended.

Your successor trustee is your fiduciary. Under the Texas Trust Code, they are legally obligated to act with the utmost honesty and in the best interests of the beneficiaries. This is a role of profound trust and legal responsibility, and understanding these fiduciary principles is key.

Consider candidates' financial acumen, integrity, and ability to communicate clearly. It is a demanding role that requires diligence and a steady hand.

Step 3: Fund the Trust by Retitling Your Assets

An empty trust is a useless document. Funding is the process of legally transferring your assets from your name into the trust's name. If this step is skipped, those assets will end up in probate court, defeating the primary purpose of the trust.

Common assets to retitle include:

- Real Estate: Your attorney will prepare and file a new deed to transfer your home and other properties into the trust.

- Bank Accounts: You will work with your bank to change the official owner of your accounts to the trust.

- Non-Retirement Investment Accounts: Stocks, bonds, and mutual funds in brokerage accounts must also be retitled in the trust's name.

This is the most hands-on part of the process, but it is the step that gives your trust its power.

Step 4: Align Your Beneficiary Designations

Some assets, like retirement accounts (401(k)s, IRAs) and life insurance policies, cannot be retitled into a trust. Their transfer is governed by beneficiary designations.

For these accounts, it is often wise to name your trust as the primary or contingent beneficiary. This directs the funds into the trust upon your death, where they can be managed and distributed according to your detailed instructions, rather than being paid in a single lump sum.

Answering Your Lingering Questions on Texas Wills and Trusts

Even after reviewing the details, it's normal to have questions. This is a significant decision, and you deserve complete clarity. Let's address some of the most common questions we hear from Texas families.

Do I Still Need a Will If I Have a Living Trust in Texas?

Yes, absolutely. A will is an essential partner to a living trust. We use a special type called a pour-over will as a safety net. Its primary function is to "catch" any assets that were not transferred into your trust and "pour" them in after your death, ensuring they are managed according to your plan.

Crucially, a will is the only legal document in Texas where you can name guardians for your minor children. Without a will, this deeply personal choice is left to a judge.

Can I Change My Living Trust or Will After It Is Created?

Yes. An estate plan should be a living document that evolves with you. As a trusted Texas trust administration lawyer can explain, knowing when and how to modify a trust in Texas is an important part of the process.

- Revocable Living Trusts: As long as you are mentally competent, a revocable living trust is flexible. You can amend its terms, change beneficiaries, or even dissolve it entirely.

- Wills: A will is equally adaptable. You can update it by creating a new will that revokes previous ones or by adding an amendment, known as a codocil.

Major life events—marriage, divorce, the birth of a child, or significant financial changes—should always prompt a review of your estate plan with your attorney.

What Happens If I Die Without a Will or Trust in Texas?

If you pass away without an estate plan, you are considered to have died intestate. In this case, the Texas Estates Code dictates how your property is distributed according to a rigid, predetermined formula. This process often does not align with what you would have wanted and guarantees a court-supervised administration that can be long, expensive, and stressful for your family. If your planning involves international assets or beneficiaries who require documents in other languages, you may need professional legal document translation services to avoid further complications.

Creating a will or trust is the only way to ensure your legacy is handled on your terms.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process. You can reach us at https://texastrustadministration.com.