Planning for the future can feel overwhelming, especially when it involves protecting your family and the assets you’ve worked so hard to build. Creating an estate plan is one of the most powerful and caring actions you can take, offering your loved ones clarity and security during a time they will need it most.

This isn't just about legal documents; it's your personal strategy to safeguard your legacy and ensure your wishes are honored, right here in the Lone Star State. With the right legal guidance, the process doesn't have to be intimidating.

Securing Your Legacy in the Lone Star State

This guide is designed to explain the essentials of estate planning in Texas. We will break down complex tools like wills, trusts, and powers of attorney into plain English, helping you feel confident and informed as you take the next steps to protect your family.

Why Every Texan Needs a Plan

Here's the bottom line: if you don’t have a clear plan, Texas law will make one for you. The Texas Estates Code outlines a default process, known as intestacy, that dictates how your property is divided and who gains guardianship of your minor children. More often than not, this one-size-fits-all approach doesn't match what people actually wanted.

A well-crafted estate plan puts you firmly in the driver's seat. For instance, a young couple in Houston with two small children might assume their assets would automatically go to the surviving spouse. However, without a will, Texas community property laws could divide the estate between the spouse and children—creating a complicated and unintended financial situation.

A thoughtful estate plan is your voice when you can no longer speak for yourself. It ensures your values are upheld and minimizes potential conflicts among your heirs, making a difficult time easier for those you love most.

We'll walk you through the key pieces of a solid Texas estate plan, including:

- Essential Documents: Getting a handle on what wills, trusts, and powers of attorney actually do.

- Texas-Specific Rules: Navigating our unique community property laws and the state's probate process.

- Protecting Your Loved Ones: Making sure your assets go exactly where you want them to go, with no guesswork.

Our goal is to empower you with the knowledge you need to take that next step. Whether you're just starting out or it’s time to update an old plan, a Texas estate planning attorney can help you build a foundation that protects your family for generations.

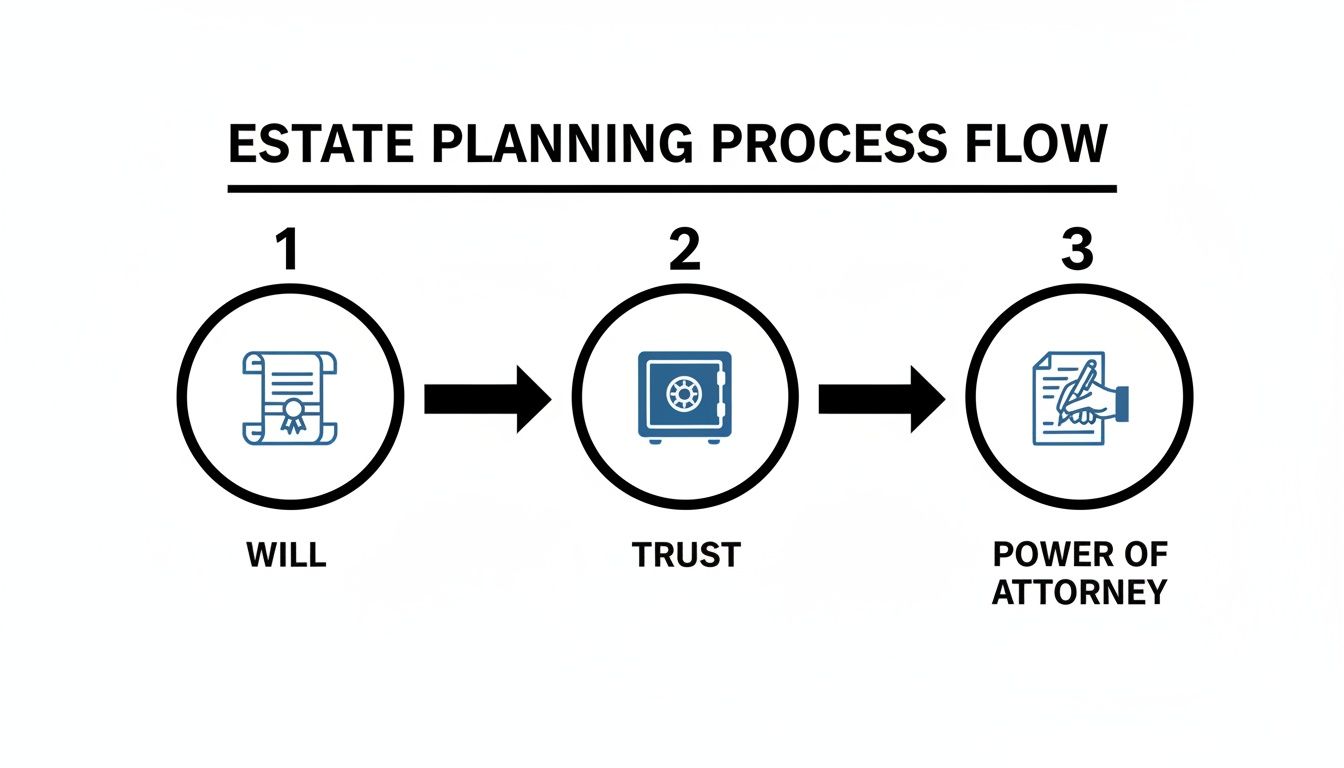

The Building Blocks of a Texas Estate Plan

A solid Texas estate plan is like a well-built house. It isn’t just one single document; it’s constructed from several essential legal components working together to shelter your family from legal storms. Each piece plays a unique, vital role in creating a safety net that honors your wishes and protects your legacy.

Putting a plan in place ensures your assets are managed and passed on exactly how you want, taking the guesswork away from your loved ones during an already tough time. To truly secure your legacy, you need a solid foundation, which starts with a clear understanding trusts and estates.

The Last Will and Testament

Most people think of a will as the cornerstone of estate planning, and for good reason. This is the document where you state exactly how you want your property divided when you pass away. But for parents, a will has an even more critical job: it's the only legal place to name a guardian to care for your minor children.

If you don't have a will, Texas courts will make these decisions based on a rigid set of state laws, and their choices may not be what you or your family would have wanted. Your will also names an executor—the person you trust to manage your estate, pay any debts, and ensure your assets get to the right people.

Trusts for More Flexibility and Control

Trusts are incredibly versatile tools that can achieve goals a will simply can't, like helping your estate avoid the public and often lengthy probate process. Here in Texas, trusts operate under the Texas Trust Code, which establishes the rules for their creation and administration.

You’ll generally encounter two main types:

- Revocable Living Trusts: You create this trust while you're alive and can change or even cancel it at any time. You transfer your assets into the trust and typically act as the first trustee, so you maintain full control. When you pass away, the assets are distributed directly to your beneficiaries without going through probate court.

- Irrevocable Trusts: As the name suggests, once you establish this type of trust, it generally cannot be changed. These are typically used for more advanced strategies, like minimizing estate taxes, protecting assets from creditors, or planning for a loved one with special needs.

Figuring out how to create a trust in Texas involves several key legal steps to ensure it is valid and accomplishes your specific goals.

Powers of Attorney for When You Can’t Speak for Yourself

Life is unpredictable. If an illness or injury leaves you unable to make your own decisions, powers of attorney are essential. These documents give a trusted person—your "agent"—the legal authority to act on your behalf in financial and medical matters while you are still alive.

To keep things simple, here’s a quick look at the most important documents that make up a complete incapacity plan.

Key Estate Planning Documents in Texas

| Document | Primary Purpose | Key Function |

|---|---|---|

| Last Will & Testament | To distribute property after death. | Names an executor and guardian for minor children; directs who gets what. |

| Revocable Living Trust | To manage assets and avoid probate. | Holds assets for your benefit and allows seamless transfer to beneficiaries. |

| Durable Power of Attorney | To manage financial and legal matters. | Lets your agent pay bills, handle investments, and manage property if you can't. |

| Medical Power of Attorney | To make healthcare decisions for you. | Empowers your agent to talk to doctors and make medical choices you would want. |

| Advance Directive (Living Will) | To state end-of-life care wishes. | Provides clear instructions on medical treatment if you are terminally ill. |

Without these documents, your family could be forced into a court-ordered guardianship to manage your affairs—a process that is often expensive, slow, and emotionally draining.

Advance Directives and Living Wills

An Advance Directive, often called a Living Will in Texas, is your voice for end-of-life medical care. It provides clear instructions to your family and doctors if you are in a terminal or irreversible condition and cannot communicate your wishes.

This document speaks for you when you cannot, ensuring your deeply personal decisions about medical treatment are respected. It relieves your loved ones from the burden of making agonizing choices without your guidance.

By combining these essential documents, a skilled Texas estate planning attorney helps you build a comprehensive plan. You get complete protection, ensuring your financial and healthcare wishes are honored, no matter what the future holds.

Navigating Texas-Specific Estate Laws

Texas has its own unique set of laws governing property and legacies. Getting estate planning in Texas right means understanding these local rules. If you don't, even a well-intentioned plan can encounter significant problems, creating stress and confusion for the very people you want to protect.

Think of a solid Texas estate plan as a three-legged stool, built to support your family when you're no longer there.

Each leg—the will, the trust, and powers of attorney—has a specific job, but they all work together to create a rock-solid foundation for your family's future.

Understanding Community Property

One of the most important Texas laws to understand is our community property system. This isn't just legal jargon; it's a fundamental concept that shapes how your assets are viewed and divided, whether in a divorce or after a death.

Essentially, most property acquired by you or your spouse during the marriage is considered owned 50/50 by both of you, regardless of whose paycheck bought it or whose name is on the title. This includes income, real estate, investments, and retirement accounts.

In contrast, separate property is what you owned before the marriage or received during the marriage as a specific gift or inheritance. Keeping these assets clearly defined is crucial. Without a will, community property rules give your surviving spouse specific rights that might not align with your wishes for your children or other family members.

Demystifying the Texas Probate Process

When someone in Texas passes away with a will, their estate typically goes through probate. This is the formal, court-supervised process outlined in the Texas Estates Code to confirm the will is valid and give the executor legal authority to settle the estate.

Here is a step-by-step guide to the Texas probate process:

- Filing the Will: The person named as executor files the will with the local probate court.

- Validating the Will: A judge holds a hearing to officially recognize the will as legally valid.

- Appointing the Executor: The court issues a document called "Letters Testamentary," which grants the executor the authority to act on behalf of the estate.

- Managing the Estate: The executor inventories assets, notifies creditors, pays outstanding debts, and files final tax returns.

- Distributing Assets: Once all obligations are met, the executor distributes the remaining property to the beneficiaries as directed in the will.

While Texas is known for a relatively straightforward probate system, it is still a public process that takes time and money. Smart planning with tools like trusts can often help your family avoid court altogether.

Trustee Responsibilities Under the Texas Trust Code

If you use a trust in your plan, you are operating under the rules of the Texas Trust Code. This law outlines the responsibilities of the person you choose to manage the trust—your trustee. These are not just suggestions; they are legally binding fiduciary duties in Texas, which is the highest standard of care recognized by law.

A trustee must always put the beneficiaries' interests first. Key fiduciary principles include:

- Duty of Loyalty: The trustee cannot use trust assets for personal benefit or favor one beneficiary over another.

- Duty of Prudence: The trustee must manage the trust's assets with the same care a sensible person would use for their own affairs.

- Duty to Account: The trustee must keep detailed records of all transactions and provide regular reports to the beneficiaries.

Failing to uphold these duties can result in serious legal consequences for a trustee. That’s why choosing a trustee is one of the most important decisions you'll make. A knowledgeable Texas trust administration lawyer can provide invaluable guidance for both the creator of the trust and the trustee tasked with its administration.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

Advanced Strategies for Asset and Tax Planning

When you've built a significant legacy—a thriving business, a valuable portfolio, or assets you're proud of—a basic will and power of attorney may not be enough. They're the starting point, not the finish line. For Texas families with substantial assets or complex dynamics, it's time to think strategically.

Advanced estate planning in Texas moves beyond simply deciding who gets what. The real goal is to protect your life's work from creditors, minimize tax liabilities, and ensure a seamless transition for the next generation.

Using Trusts for Powerful Asset Protection

One of the most effective tools for advanced planning is the Irrevocable Life Insurance Trust, or ILIT. An ILIT is a financial tool designed specifically to own your life insurance policy. When you transfer ownership of the policy into this trust, you effectively remove the death benefit from your taxable estate.

This strategy offers two key benefits. First, it can significantly reduce or even eliminate the federal estate tax your heirs would otherwise face. Second, because the trust is the legal owner of the policy, the proceeds are shielded from your creditors and the creditors of your beneficiaries.

An ILIT ensures that the full value of your life insurance policy passes to your loved ones tax-free and protected from legal claims, providing them with immediate liquidity when they need it most.

This strategy is particularly useful for providing the cash needed to pay final debts or estate taxes, preventing your family from being forced to sell cherished assets, like the family home or a business. A skilled Texas estate planning attorney can structure an ILIT to perfectly match your family's needs.

Proactive Federal Estate and Tax Planning

Effective asset and tax planning means looking ahead. It's crucial to consider factors like understanding inheritance tax and staying informed about changing laws. For example, strategic gifting allows you to transfer wealth to your heirs while you're still alive, methodically reducing the size of your taxable estate over time.

A major change is expected in 2025 that you should be aware of. The federal estate tax exemption is scheduled for a significant update at the end of the year. While the 2025 exemption is $13.61 million per person, the rules are set to change on January 1, 2026. Under the One Big Beautiful Bill Act (OBBBA) of 2025, this exemption is slated to jump to $15 million per person, or $30 million for married couples, and will be indexed for inflation.

This adjustment is a game-changer for high-net-worth families in Texas, where oil, real estate, and business assets can easily push an estate into taxable territory. You can learn more about navigating these upcoming shifts in our guide on how to minimize estate taxes.

Ensuring a Smooth Business Succession

If you are a family business owner, a succession plan isn't just a good idea—it's essential for the company's survival. Without one, the business you've dedicated your life to could be torn apart by internal power struggles, liquidated to pay estate taxes, or sold to outsiders.

A solid business succession plan typically includes these key components:

- A Buy-Sell Agreement: This is a legally binding contract that clearly defines what happens to an owner's share of the business if they die, become disabled, or retire.

- Valuation Methods: The plan must establish a fair and transparent method for valuing the business to prevent future disputes among partners or heirs.

- Funding Mechanisms: The plan often uses life insurance policies to provide the immediate cash the remaining owners need to buy out the deceased owner's share from their estate.

By working with an attorney to put this framework in place, you create a clear roadmap for the future. You transform a potential crisis into a manageable, orderly transition that protects the business, your employees, and your family's financial security.

Common Estate Planning Mistakes to Avoid

Even with the best intentions, simple mistakes can unravel an entire estate plan, leading to costly legal battles and heartbreaking family disputes. The purpose of thoughtful estate planning in Texas is to build a secure future for your loved ones, but a few common missteps can undermine your goals.

Knowing these frequent errors is the first step toward ensuring your plan is sound and truly reflects your wishes. A good Texas estate planning attorney can help you avoid these traps, saving your family from future hardship.

The Dangers of DIY or Online Wills

The temptation to save time and money with a DIY will template or online service is understandable. They seem easy and convenient. However, these tools often create more problems than they solve.

Texas has specific legal requirements to validate a will—such as proper witness signatures and precise language—that generic forms often get wrong. More importantly, a template cannot understand your unique family dynamics, specific assets, or long-term goals.

A one-size-fits-all document is a myth; it rarely fits anyone perfectly. These templates can’t account for Texas community property laws, blended families, or beneficiaries with special needs. The result is often a will that’s legally invalid or creates unintended consequences for your family.

The money you might save upfront with a DIY will can quickly disappear in legal fees as your family tries to fix the errors in probate court.

Failing to Fund Your Trust

Creating a revocable living trust is an excellent strategy for avoiding probate, but there's a critical follow-up step that many people forget: funding the trust. A trust is like an empty box; it's useless until you place your assets inside it.

This means you must formally transfer ownership of your property—your house, bank accounts, investments—from your individual name into the name of the trust. If you skip this step, the trust is merely an empty shell. Any assets not properly transferred will still be subject to the public, time-consuming probate process, defeating the purpose of creating the trust. This is one of the most common and preventable estate planning mistakes.

Forgetting to Update Your Plan

Life changes, and your estate plan should change with it. A plan that was perfect five years ago might be completely wrong for your situation today. Letting your documents gather dust after major life events is a recipe for disaster.

Here are the life changes that require an immediate review of your estate plan:

- Marriage or Divorce: Texas law has specific rules that apply in these situations. An old plan could unintentionally leave assets to an ex-spouse or exclude a new one.

- Birth or Adoption of a Child: You need to name guardians and officially include the child as a beneficiary.

- Significant Financial Changes: A large inheritance, selling a business, or a major increase in assets may require new tax planning strategies.

- Death of a Beneficiary or Executor: You must name replacements. If you don't, a court may appoint someone who you would not have chosen.

An outdated plan leads to confusion, conflict, and an outcome that may be the opposite of what you intended. A regular review ensures your plan continues to protect the people you care about most.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

How to Begin Your Estate Planning Journey

Starting the estate planning process is a profound act of care for your family. A well-thought-out plan provides clarity and security, ensuring your loved ones are protected no matter what the future holds. A clear roadmap makes the entire journey feel manageable and puts you firmly in control.

The best place to start is by getting organized. This means gathering the essential paperwork that provides a complete picture of your financial life. Think of it as creating a personal inventory that will become the bedrock of your plan.

Gather Your Essential Documents

Collecting your key documents before meeting with an attorney will make the process smoother and more efficient. This initial step helps clarify exactly what you own and what needs to be protected.

Your document collection should include items such as:

- Proof of Assets: Deeds to real estate, vehicle titles, and recent statements for all bank accounts, retirement funds (like 401(k)s and IRAs), and investment portfolios.

- Insurance Policies: Life insurance policies are especially critical, as they often represent significant assets and have named beneficiaries that must align with your overall plan.

- Business Documents: If you own a business, gather your partnership agreements, buy-sell agreements, and other important corporate records.

- Liabilities: Make a straightforward list of all your debts, including mortgages, car loans, and outstanding credit card balances.

Having these items on hand will give your attorney a running start in understanding your situation and recommending the best strategies. To make it easier, we've created a helpful estate planning documents checklist to guide you.

Make Foundational Decisions

With a clear financial picture, the next step is making some of the most important decisions in the process. These choices determine who will carry out your wishes and protect the people you love most.

One of the most critical fiduciary duties in Texas is the responsibility to act in the best interests of the beneficiaries. Choosing an executor or trustee isn’t just about picking a friend or family member; it’s about selecting someone with the integrity and diligence to honor that sacred trust.

You’ll need to carefully consider who you want to name as your:

- Executor: The person responsible for guiding your will through the Texas probate process.

- Trustee: The individual or institution tasked with managing any trusts you create according to the Texas Trust Code.

- Guardian: If you have minor children, this is the person you trust to raise them in your absence.

- Agents: The people you name in your powers of attorney to make financial and medical decisions if you are unable to.

Discussing these roles with your potential candidates ahead of time is a vital step. Finally, partnering with an experienced Texas estate planning attorney is the most crucial part of the journey. A legal professional ensures your documents are valid, tailored to your family, and compliant with Texas law, giving you and your family true peace of mind.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

Your Texas Estate Planning Questions, Answered

Navigating the world of estate planning can bring up many questions. To provide clarity, we’ve put together straightforward answers to the questions we hear most often about creating a solid plan for your family's future here in Texas. This information can help you feel more in control and confident.

What Happens If I Die Without a Will in Texas?

If you pass away without a will, you are considered to have died "intestate." In this case, you have no say in who receives your property. Instead, the Texas Estates Code dictates how your assets are distributed. The law uses a rigid formula to divide your property among your closest living relatives.

Unfortunately, this legal formula rarely matches what people actually wanted. A will is the only way to ensure you decide who inherits your property and, just as importantly, who will serve as the guardian for your minor children.

Can I Avoid Probate in Texas?

Yes. For many Texans, avoiding or simplifying the probate process is a top priority, and it is entirely achievable with the right strategy. The most common and effective tool for avoiding probate is a revocable living trust.

When you transfer your assets into a trust, they are no longer part of your probate estate. Upon your passing, those assets are transferred directly and privately to your beneficiaries according to your instructions, bypassing the court system. Other ways to keep assets out of probate include:

- Using beneficiary designations on accounts like IRAs, 401(k)s, and life insurance policies.

- Setting up joint ownership with rights of survivorship for property and bank accounts.

- Using a Transfer on Death Deed (TODD) for your real estate.

How Often Should I Update My Estate Plan?

Life is always changing, and your estate plan should adapt accordingly. A good rule of thumb is to review your documents with a Texas estate planning attorney every three to five years.

An estate plan isn't a "set it and forget it" document. It's a living strategy that needs to evolve with your life to protect the people you love.

More importantly, you should review your plan immediately after any major life event, such as:

- Getting married or divorced

- The birth or adoption of a child or grandchild

- A significant change in your finances (positive or negative)

- The death of a beneficiary, executor, or trustee

- Moving to or from Texas, as state laws differ

Keeping your plan current ensures it accurately reflects your wishes and provides the strong protection your family deserves. An experienced attorney can identify when an update is needed and help you make the necessary changes.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process. Find out more at https://texastrustadministration.com.