Planning for your family's future can feel overwhelming, but with the right legal guidance, it doesn’t have to be. When clients in Texas begin this process, one of their first questions is often, "How can we avoid probate?" It's a wise question to ask. The probate process, while necessary in some cases, can be lengthy, costly, and public.

Fortunately, Texas law provides several solid, time-tested ways to ensure your assets pass directly to your loved ones without getting tangled up in court. The most common strategies involve creating a revocable living trust, using beneficiary designations like Payable-on-Death (POD) or Transfer-on-Death (TOD), and establishing joint ownership with right of survivorship.

Think of these as legal pathways designed to let your estate bypass the probate courthouse, saving your family time, money, and unnecessary stress.

Why Texans Seek to Avoid the Probate Process

When a loved one passes away, the last thing their family wants is to navigate a lengthy and often confusing legal process. But that's exactly what probate can be—the court-supervised system for validating a will and distributing a person's assets.

While the Texas Estates Code provides a clear roadmap for this process, it's rarely the fastest or most private way to settle an estate. Understanding the downsides of probate is the first step in building an effective estate plan. Many families are caught off guard when a seemingly simple estate gets tangled in legal red tape, adding significant stress and expense during an already difficult time.

The Major Drawbacks of Texas Probate

Probate has a reputation for a few key challenges that can seriously affect a family's financial security and peace of mind. These are the primary concerns that motivate people to seek smarter estate planning strategies.

Here are the most common reasons families want to steer clear of probate:

- Significant Costs: Probate isn't free. Attorney fees, court filing costs, executor compensation, and appraisal fees can all add up, reducing the inheritance your beneficiaries ultimately receive.

- Lengthy Delays: The probate process can drag on for months—and in complex cases, even years. During this time, your assets are essentially frozen, and your family may not be able to access funds needed for living expenses or other financial obligations.

- Loss of Privacy: Probate is a public proceeding. Your will, along with a detailed inventory of your assets and debts, becomes part of the public record, accessible to anyone. For many families, this is a significant invasion of privacy.

- Potential for Disputes: The formal court setting of probate can unfortunately create an environment for family disagreements. Disputes over the will's validity or the executor's actions can escalate into costly and emotionally draining lawsuits.

A Real-World Probate Scenario

Consider a common scenario we see: a client, we'll call him Mr. Davis, passed away with what he believed was a solid will. He left his home, a modest investment portfolio, and a bank account to his three adult children, assuming the will made everything simple.

The problem was that his home was titled only in his name, and he had never added beneficiary designations to his financial accounts.

Because of these oversights, his entire estate had to go through probate. It took over a year to settle. During that time, his children had to pay the mortgage, property taxes, and upkeep on the house from their own pockets while waiting for the court's permission to sell it. The legal fees amounted to thousands of dollars, and having their father's finances laid bare in a public record felt like a profound invasion of privacy.

What Mr. Davis intended as a straightforward inheritance became a source of major stress and financial strain for the people he loved most.

This kind of story is all too common and highlights a critical truth: a will doesn't avoid probate; it simply provides instructions to the probate court. To bypass the court process entirely, you need different legal tools.

Proactive estate planning is about more than just writing a will. It's about structuring your assets so they pass to your loved ones seamlessly, privately, and without unnecessary delay. By taking the time to learn more about what probate in Texas entails, you can make informed decisions that truly protect your family and preserve your legacy.

At The Law Office of Bryan Fagan, PLLC, our attorneys specialize in helping families design plans that meet these goals. We believe in educating our clients, ensuring you understand all your options and feel confident in the plan you create.

Using a Revocable Living Trust to Maintain Control

When people ask for the most powerful and flexible tool to sidestep probate in Texas, the answer is almost always the revocable living trust.

Forget the myth that trusts are only for the wealthy. A trust is simply a private agreement—a legal container you create to hold and manage your assets. While a will is a letter of instructions for the probate court, a trust operates completely outside of court supervision. This means more privacy, more control, and a smoother transition for your family.

Creating a trust lets you manage your property just as you always have, but it also establishes a seamless plan for what happens when you pass away or if you become unable to manage things yourself.

Understanding the Key Roles in a Trust

To understand how a trust works, you need to know the three main players. The terms may sound formal, but the concepts are straightforward.

- Grantor (or Settlor): This is you—the person creating the trust and transferring assets into it. Because it’s a revocable trust, you retain full control. You can change the terms, add or remove property, or even dissolve the trust entirely at any time.

- Trustee: This is the manager. The trustee has a fiduciary duty to handle the trust assets according to the rules you set. While you're alive and well, you are typically your own trustee. You will also name a successor trustee to take over if you pass away or become incapacitated.

- Beneficiary: This is the person or people who will ultimately benefit from the assets in the trust. During your lifetime, you are the primary beneficiary.

This structure allows you to maintain complete authority over your property while you’re alive, with a clear succession plan that doesn’t require a judge’s permission.

How a Revocable Living Trust Works in Practice

The process begins by working with an experienced Texas estate planning attorney to draft a trust document that reflects your wishes. This document is your rulebook, detailing exactly how your assets should be managed and distributed.

Once the trust is created, the next step is critical: funding the trust. This means retitling your major assets—like your house, bank accounts, and investments—into the name of the trust. For example, the deed to your home would change from "Jane Smith" to "Jane Smith, Trustee of the Jane Smith Revocable Living Trust."

An unfunded trust is like an empty box; it serves no purpose. Any assets not properly titled in the trust's name will likely have to go through probate, defeating the primary goal.

The Major Benefits of Using a Trust

When properly funded, a revocable living trust offers significant advantages over a will alone. These benefits directly address the biggest headaches of the probate process.

Key Takeaway: A trust is a private contract for managing your assets, both during your life and after. It keeps your family out of court, protects your privacy, and ensures your instructions are followed without delay.

The popularity of trusts is easy to understand. Texas district courts saw over 12,000 probate cases filed in the last fiscal year. It's no wonder that roughly 25% of modern Texas estate plans now include a revocable living trust, up from 15% a decade ago. Families are actively seeking ways to avoid the cost, delay, and public exposure of probate.

Key benefits include:

- Complete Probate Avoidance: Assets held in the trust pass directly to your beneficiaries according to your instructions, with no court involvement.

- Unbroken Privacy: A will becomes a public record once probated. A trust is a private document, keeping your family’s finances and final wishes confidential.

- Incapacity Planning: If you become unable to manage your own affairs, your chosen successor trustee can step in immediately. This avoids the need for a costly and public court-ordered guardianship.

- Greater Control and Flexibility: You can specify how and when your beneficiaries inherit, such as distributing funds at certain ages (e.g., 25, 30, and 35) or for specific goals, like education or a home purchase.

For a deeper dive into the mechanics, our firm provides a detailed guide on what a revocable trust is and how it functions in Texas.

Revocable Living Trust vs. Traditional Will

This table breaks down the key differences between using a revocable living trust and relying on a will.

| Feature | Revocable Living Trust | Traditional Will |

|---|---|---|

| Probate Process | Avoids probate entirely for all assets held within the trust. | Requires probate through the Texas court system, a public and often lengthy process. |

| Privacy | Completely private. The trust document and your assets are not part of the public record. | Becomes a public record once filed with the probate court. Anyone can view it. |

| Incapacity Management | Your successor trustee steps in immediately without court intervention. | Often requires a separate guardianship proceeding in court, which is costly and public. |

| Asset Distribution | Immediate distribution possible after your passing, according to your trust's terms. | Distribution is delayed until the probate process is complete, which can take months or years. |

| Control Over Assets | Allows for staggered distributions and setting conditions for inheritance. | Typically distributes assets outright to beneficiaries once probate closes. |

| Upfront Cost & Effort | Higher initial cost and effort to create and fund the trust. | Lower initial cost to draft, but probate costs later can be substantial. |

| Contestability | More difficult to contest because it's a private agreement managed over time. | Easier to contest during the public probate proceeding. |

While a trust requires more work upfront, the long-term benefits of privacy, efficiency, and control make it a superior choice for many Texas families.

Real-World Example: Protecting a Family Business

Consider the Martinez family, who own a successful local construction company. If Mr. and Mrs. Martinez only had a will, their business operations could grind to a halt upon their passing. The company's assets would be frozen while the will goes through probate.

Instead, they worked with an attorney to place their business shares, commercial real estate, and investment accounts into a revocable living trust. They named their eldest son, who is active in the business, as the successor trustee.

Now, if something happens to them, their son can instantly take over management. Payroll will be met, contracts will be honored, and the business will continue running seamlessly. This protects not only the family’s legacy but also the livelihoods of their employees.

Transferring Assets Directly with Beneficiary Designations

While a revocable living trust is a comprehensive tool, it’s not the only way to keep assets out of a Texas probate court. State law provides incredibly straightforward methods to transfer property directly to your loved ones, often by simply filling out a form.

These tools are called beneficiary designations, and they transform certain assets into non-probate property. They create a legal shortcut, allowing an asset to pass directly to the person you name upon your death, completely bypassing your will and the entire court process.

Payable-on-Death (POD) for Bank Accounts

One of the easiest ways to avoid probate for your cash is by using a Payable-on-Death (POD) designation on your bank accounts. This works for checking, savings, money market accounts, and certificates of deposit (CDs).

Setup is simple. You request a POD form from your bank, name the person (or people) you want to receive the money, and sign it. During your lifetime, the money remains 100% yours—the beneficiary has no access. After you pass, your beneficiary simply presents a death certificate and their ID to the bank to claim the funds.

A POD designation is a contract between you and your bank. It is a direct command that overrules anything your will might say about that account, ensuring the money gets to your family quickly and privately.

This tool keeps cash accessible right when your family might need it most, without waiting months for a judge’s approval.

Transfer-on-Death (TOD) for Investments

Similar to a POD for bank accounts, Texas law allows for Transfer-on-Death (TOD) designations for securities like stocks, bonds, and brokerage accounts. The process is identical.

You fill out a TOD form with your brokerage firm, naming your chosen beneficiary. You retain complete control to buy, sell, and manage your portfolio. When you pass away, your beneficiary works directly with the financial institution to have the securities transferred into their name. This clean, efficient transfer avoids the delays and market risks that can arise when investments are frozen in probate.

The Texas Transfer-on-Death Deed (TODD) for Real Estate

For most Texans, their home is their single largest asset. A Transfer-on-Death Deed (TODD) is a powerful tool that allows you to pass your real estate directly to a beneficiary, probate-free.

A TODD is a special type of deed that you sign and file with the county clerk's office now, but it only becomes effective upon your death. While you're alive, you maintain full ownership. You can sell the property, refinance it, or revoke the TODD at any time.

The popularity of this strategy has grown significantly. The Texas Office of Court Administration’s Annual Statistical Report shows that over 40% of estate-related filings involve disputes over assets that could have been handled outside of probate with proper designations. In a sign of their growing use, more than 18,000 TOD deeds were filed in Texas last year—a 20% increase from the previous year. You can find more data in their full report.

A Scenario Showing These Tools in Action

Let’s look at Sarah, a retired teacher in Austin. Her estate consists of:

- Her paid-off home.

- A savings account at a local credit union.

- Her teacher retirement account.

- A life insurance policy.

Sarah wants her two adult children to inherit everything without the hassle of probate. A Texas estate planning attorney can help her implement a simple yet effective plan:

- Her home: She signs and records a Transfer-on-Death Deed, naming her two children as equal beneficiaries.

- Her savings account: She fills out a Payable-on-Death form at her credit union, again naming both children.

- Her retirement and life insurance: She confirms that her children are listed as the primary beneficiaries. These accounts are already non-probate by nature, but it’s critical to ensure the forms are up to date.

With these few steps, Sarah has ensured all her major assets will transfer directly to her children. Her will now only needs to cover personal items, which could qualify her estate for a much simpler process or even avoid probate altogether.

Beneficiary designations are powerful but require regular review. Life events like marriage, divorce, or the death of a beneficiary can make your designations outdated and cause serious unintended consequences. For more on this, our guide on updating will recipients and exploring beneficiary changes provides valuable insights.

Other Smart Ways to Dodge Probate: Joint Ownership and Gifting

Trusts and beneficiary designations are cornerstones of estate planning, but they aren't the only tools available. Texas law offers other straightforward strategies to ensure your assets reach your loved ones without court intervention.

Many families use these methods because they seem simple, but it's important to understand how they work and their potential pitfalls.

The Power of "Right of Survivorship"

Joint ownership is common for real estate and bank accounts. In Texas, you can structure it with a special feature called a "right of survivorship," which is a game-changer for avoiding probate.

When property is owned with a right of survivorship, the surviving co-owner automatically absorbs the deceased owner's share. The property becomes theirs instantly—no court, no probate.

However, this does not happen by default. The legal document—the property deed or the bank account signature card—must contain specific legal language creating this right. Without it, the deceased owner's share will be directed to their probate estate.

Think Twice Before Adding a Child to Your Bank Account

It's a common scenario: an aging parent adds an adult child to their checking account to help manage bills and to ensure the child has access to funds after the parent passes. While practical in theory, this move carries significant risks.

- Their Problems Become Your Problems: The moment you add them as a co-owner, that money is legally theirs, too. If your child gets sued, accumulates debt, or goes through a divorce, creditors can pursue the funds in your account to settle their obligations.

- You Give Up Control: Your child now has the same rights to the account as you do and could withdraw all the funds without your permission.

- Accidental Disinheritance: If you have three children but only put one on the account, that one child legally owns 100% of the funds upon your death. They have no legal obligation to share it with their siblings, regardless of what your will says.

A much safer alternative is a Payable-on-Death (POD) designation. It achieves the same probate-avoidance goal while protecting your money from your child's creditors and personal issues during your lifetime.

Gifting: Reducing Your Estate During Your Lifetime

Another way to simplify your future probate estate is to begin gifting assets now. Texas does not have a state gift tax, but you must be mindful of federal rules.

For 2024, you can give up to $18,000 to any number of individuals per year without needing to file a federal gift tax return.

This is a wonderful way to provide financial help to your children or grandchildren while also reducing the size of your future estate. A married couple could combine their allowances and give $36,000 to each of their children annually, transferring significant wealth tax-free over time.

A word of caution: gifting large assets like a house can create complex tax issues for the recipient, particularly concerning capital gains. This is not a DIY strategy; consult with an experienced Texas estate planning attorney to ensure you don't create a larger problem.

The Small Estate Affidavit: A Limited Shortcut

For very small estates, Texas law offers a simplified alternative to full probate called a Small Estate Affidavit. However, the eligibility rules are narrow. This option is only available if:

- The deceased person died without a will.

- The value of the probate estate (excluding the primary home and other exempt property) is $75,000 or less.

- The estate’s assets exceed its debts.

This affidavit is a sworn statement filed with the court, giving heirs the authority to collect the assets. It is a useful tool in the right situation but is more of a post-death cleanup procedure than a proactive planning strategy.

Common Estate Planning Mistakes That Trigger Probate

Even with the best intentions, a single oversight can steer your family right into the probate court you worked so hard to avoid. DIY wills or a "set it and forget it" mindset often lead to frustration, family disputes, and unnecessary legal fees.

https://www.youtube.com/embed/jaKuNJsLSX4

Knowing these common tripwires is your best defense. Many of these mistakes seem small but can create complex and expensive problems, highlighting why professional guidance is so valuable.

Failing to Fund Your Trust

This is one of the most common mistakes. You create a revocable living trust—an excellent move for avoiding probate—but the trust document itself is just an empty container until you place your assets inside it. This crucial step is called funding the trust.

It's easy to sign the trust documents and then forget to retitle your house, investment accounts, or business interests into the trust's name. Any asset still in your individual name when you pass away is not controlled by the trust and will likely end up in probate, defeating the trust's purpose.

Key Takeaway: An unfunded trust provides a false sense of security. You must work with your Texas estate planning attorney to ensure every intended asset is properly titled in the name of your trust.

Neglecting Beneficiary Designations

Life changes. People get married, divorced, have children, and sometimes loved ones pass away. Your estate plan must adapt. One of the most common and devastating mistakes is failing to update beneficiary designations after major life events.

- Divorce: If you forget to remove an ex-spouse as the beneficiary on your 401(k) or life insurance, they could inherit the funds, regardless of what your will or divorce decree says. The beneficiary form is the controlling document.

- Death of a Beneficiary: If your primary beneficiary passes away before you do and you haven't named a contingent (backup) beneficiary, the asset often reverts to your estate and must go through probate.

- New Additions: When you marry or a new child joins the family, you must be proactive and manually add them as beneficiaries where appropriate.

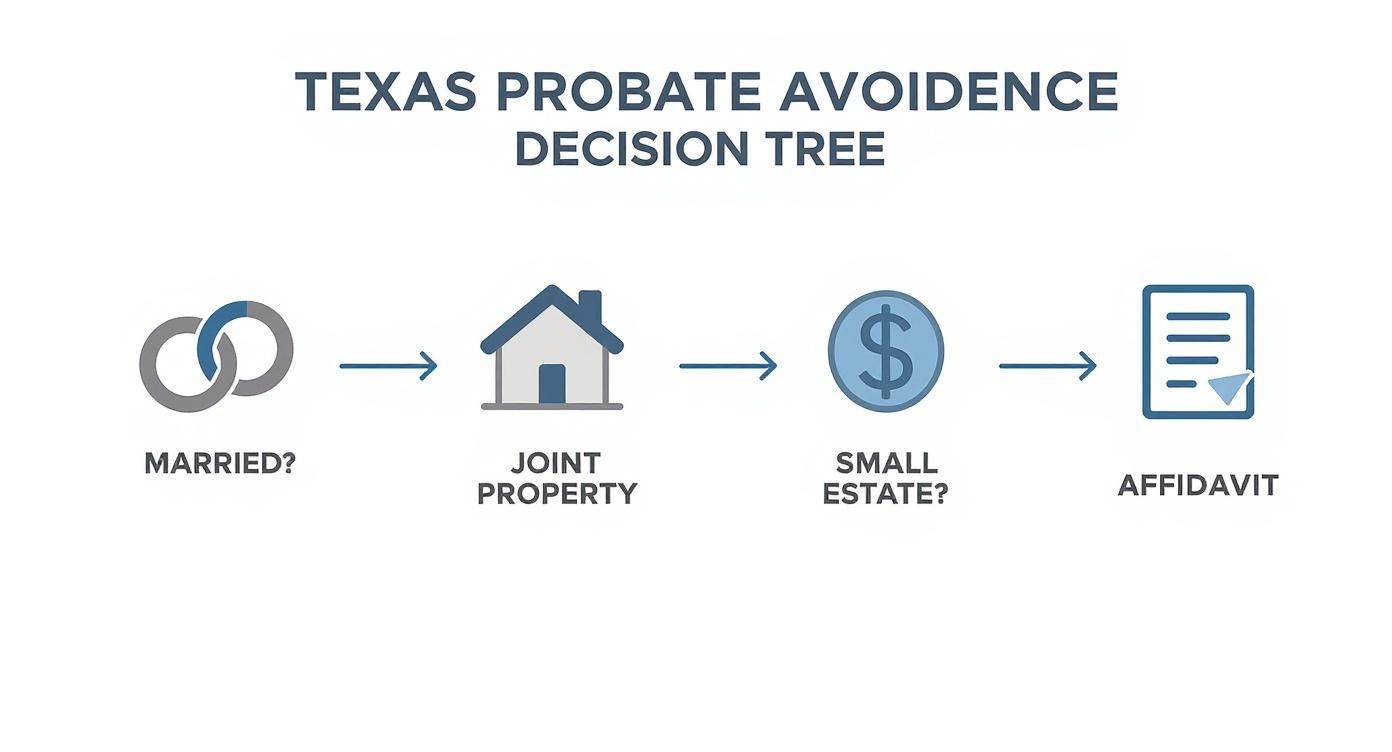

This chart maps out some of the main pathways for avoiding probate in Texas, depending on factors like marital status and estate size.

As the visual shows, your personal situation dictates the best strategies. What works for a married couple may not be the right fit for a single individual.

Misunderstanding Joint Ownership Risks

Adding a child to your property deed or bank account as a joint owner may seem like a simple probate workaround. While it does transfer the asset to the surviving owner, it can open a Pandora's box of other problems.

The moment you add someone as a joint owner, that asset is exposed to their life events, including creditors, lawsuits, or divorce. It can also cause unintended family conflict by effectively disinheriting other children, as the surviving joint owner receives 100% of the asset with no legal obligation to share. These potential issues underscore the importance of a comprehensive plan that aligns with the Texas Estates Code and your true intentions.

To help you keep these strategies straight, here's a quick overview of the primary ways to sidestep probate in Texas.

Probate Avoidance Strategies at a Glance

This table breaks down the main tools we use, who they're generally best for, and a key consideration for each.

| Strategy | Best For | Key Consideration |

|---|---|---|

| Living Trust | Individuals with significant assets, real estate, or complex family situations. | Requires diligence in funding the trust by retitling assets into its name. |

| Joint Ownership with Right of Survivorship | Married couples for assets like a primary home or joint bank accounts. | The asset becomes exposed to the joint owner's creditors and potential legal issues. |

| Payable-on-Death (POD) / Transfer-on-Death (TOD) | Bank accounts, brokerage accounts, and vehicles. | A simple way to name a direct beneficiary, but doesn't offer any asset protection. |

| Small Estate Affidavit | Very small estates (under $75,000, excluding the homestead) with no will. | Only applies in specific, limited circumstances and requires all heirs to agree. |

| Affidavit of Heirship | Primarily for transferring title to real estate when there is no will. | Relies on the testimony of disinterested witnesses and may not be accepted by all title companies. |

Each of these methods has its place, but they are not one-size-fits-all. The right approach depends entirely on your assets, your family, and your ultimate goals.

If you’re building a plan to keep your family out of court, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys have helped countless Texas families create solid, reliable plans.

Your Burning Questions About Dodging Probate

It is completely normal to have questions when making important decisions to protect your family’s future. Let’s tackle some of the most common questions we hear from Texans about avoiding probate.

These are not textbook definitions; they're real-world answers grounded in how the Texas Estates Code actually works.

Can I Really Do This Without a Lawyer?

While you can technically file a Transfer-on-Death Deed or set up a POD account on your own, attempting to DIY your entire estate plan is risky. Estate planning isn't just about filling out forms; it's about crafting a comprehensive strategy where every component works together.

A seasoned Texas estate planning attorney does more than draft documents. They ensure your plan is legally sound, properly funded, and accounts for potential complexities like blended families, special needs beneficiaries, or changes in tax law. A small mistake on a deed or beneficiary form can disinherit a loved one or, ironically, send your estate right into the probate court you were trying to avoid.

I Have a Will, So I'm Skipping Probate, Right?

This is one of the biggest misconceptions in estate planning. A will does not avoid probate. In fact, a will is a document written specifically for the probate court.

Think of it as your personal set of instructions to the probate judge, telling them how to divide your property. The probate process is the legal system for validating your will and ensuring your wishes are carried out. To truly bypass the court system, you must use non-probate tools like a living trust, joint ownership with right of survivorship, or beneficiary designations.

What If I Own Property in Another State?

Owning real estate outside of Texas can create a major complication. If a vacation home in Colorado or a condo in Florida is titled only in your name, your family will likely face a second probate process in that state. This is called ancillary probate.

This means double the trouble: hiring another lawyer in that state, paying a new set of court fees, and experiencing even more delays. This scenario alone is a compelling reason to consider a revocable living trust. A well-funded trust can hold title to properties across state lines, keeping everything under one unified plan and avoiding probate in every location.

How Often Should I Dust Off My Estate Plan?

An estate plan is not a "set it and forget it" document. Life changes, and your plan must adapt. As a general rule, we advise clients to review their estate plan with an attorney at least every three to five years.

However, you should not wait for that three-year mark if a major life event occurs. Schedule a review immediately following a marriage, divorce, the birth or adoption of a child, the death of a beneficiary or executor, or a significant change in your finances.

Keeping your plan current ensures it continues to reflect your wishes and complies with any changes in Texas law. For tailored advice on these complex issues, it is always best to speak with legal professionals. You can learn more about what these lawyers do by reading about firms specializing in estate planning and probate.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process at https://texastrustadministration.com.