Planning for your family’s future is a profound responsibility, and creating a trust is one of the most effective ways to ensure your wishes are carried out with privacy and efficiency. A trust acts as a clear, private roadmap for your loved ones, allowing them to manage your assets without the public and often lengthy probate court process. Managing these details can feel overwhelming, but with the right legal guidance, it doesn’t have to be.

This guide provides step-by-step guidance on how to create a trust in Texas, explaining the process in plain English so you can feel informed and secure in your next steps.

Why Do So Many Texans Use Trusts for Estate Planning?

At its core, a trust is a legal arrangement where you (the grantor) transfer assets to a person or institution (the trustee) to manage for the benefit of others (the beneficiaries). For anyone seeking more control and privacy than a will can offer, a trust is a foundational piece of a solid estate plan.

In Texas, trusts are governed by the Texas Trust Code, which provides a clear legal framework. Understanding the key players involved is the first step toward seeing how a trust can work for your family.

The Key Roles in a Texas Trust

Every trust has three essential parties. It is common for one person to fill multiple roles at the beginning.

- The Grantor (or Settlor): This is the person creating the trust and funding it with their assets. The grantor sets all the rules for how the trust will operate.

- The Trustee: This is the manager—the person or entity responsible for administering the trust's assets according to the rules set by the grantor. While alive, the grantor often serves as the initial trustee, maintaining full control. A key part of the process is naming a successor trustee to take over upon the grantor's incapacity or death.

- The Beneficiary: This is the person, group of people, or charity who will ultimately benefit from the assets in the trust.

This structure provides the flexibility and power to protect your legacy and adapt to life’s changes.

The Major Benefits of a Texas Trust

Texans are drawn to trusts for several compelling reasons, but the most significant is the ability to avoid the probate process. When an estate is settled using only a will, it must go through probate court. This is a public process where a judge validates the will and oversees the distribution of assets.

A trust, on the other hand, is a private document. Assets held within the trust can be distributed directly to your beneficiaries without court involvement, saving your family considerable time, expense, and the stress of a public proceeding.

Here's a practical example: imagine you own a family home in Houston. If the home is titled only in your name, your family must go through probate to transfer ownership after you pass away. However, if the home is owned by your trust, your successor trustee can transfer the deed to your children privately and efficiently, according to your instructions. A Texas estate planning attorney can help you use a trust to protect what matters most.

Choosing the Right Type of Trust for Your Goals

Selecting the right type of trust is the most critical decision in your estate plan. It determines how your assets are managed, who benefits, and when. The best choice depends entirely on your goals—whether you need flexibility, asset protection, or care for a loved one with special needs.

In Texas, the primary options are revocable and irrevocable trusts. Understanding their differences is the first step toward building a robust estate plan.

The Flexible Path: Revocable Living Trusts

The revocable living trust is the most popular choice for Texas families due to its flexibility. As the grantor, you can modify, add to, or even terminate the trust at any time while you are alive.

Think of it as a living document that adapts with you. A young couple might create one and later update it after having more children or purchasing a new property. You remain in control, typically serving as the initial trustee. The main advantage of these trusts is that they keep your affairs private and out of probate court, ensuring a smooth transition of assets to the next generation.

The Protective Shield: Irrevocable Trusts

In contrast, an irrevocable trust is designed for permanence. Once you transfer assets into it, you generally cannot revoke it or change the terms without the beneficiaries' consent. This lack of flexibility is its primary strength.

Because you have relinquished control, the assets are no longer legally considered yours. This offers several key advantages:

- Asset Protection: It can shield assets from future lawsuits or creditors.

- Estate Tax Reduction: For large estates, it is a key tool for minimizing federal estate taxes.

- Medicaid Planning: It is a common strategy to help qualify for long-term care benefits without exhausting your savings.

For example, a business owner concerned about potential liabilities could place their family home in an irrevocable trust. If the business later faces financial difficulties, the home is protected. A skilled Texas trust administration lawyer can help determine if this level of protection aligns with your needs.

The core difference boils down to control versus protection. A revocable trust offers complete flexibility, while an irrevocable trust provides a powerful shield for your assets and may offer significant tax benefits.

Deciding between these options is a common challenge. Our guide on the differences between a living trust and a will can provide additional clarity.

Revocable vs Irrevocable Trusts: Key Differences

This table offers a side-by-side comparison of these two foundational estate planning tools.

| Feature | Revocable Living Trust | Irrevocable Trust |

|---|---|---|

| Flexibility | High. Can be changed or canceled at any time by the grantor. | Low. Cannot be easily modified or terminated. |

| Control | Grantor retains full control over the assets, often as trustee. | Grantor gives up control and ownership of the assets. |

| Probate Avoidance | Yes. Assets in the trust bypass the probate process. | Yes. Assets are outside the probate estate. |

| Asset Protection | None. Assets are still considered yours and are vulnerable. | High. Protects assets from creditors and lawsuits. |

| Estate Tax Benefits | No. Assets are included in your taxable estate. | Yes. Can remove assets from your estate to reduce taxes. |

| Medicaid Planning | No. Assets count toward eligibility limits. | Yes. Often used to help qualify for long-term care benefits. |

Ultimately, a revocable trust focuses on managing your assets for your benefit and avoiding probate, whereas an irrevocable trust is about protecting those assets for others.

Specialized Trusts for Unique Family Needs

Beyond these two primary types, Texas law accommodates specialized trusts for specific family situations.

Special Needs Trusts (SNTs)

If you have a child or loved one with a disability who relies on government benefits like Medicaid or Supplemental Security Income (SSI), a Special Needs Trust is essential. A direct inheritance could disqualify them from these vital programs. An SNT creates a fund for supplemental needs—such as therapy, education, or travel—without jeopardizing their benefits.

Charitable Trusts

For those with philanthropic goals, a charitable trust is an excellent way to support a cause you care about while potentially providing financial benefits to your family and reducing your tax burden. You can structure it to provide income to your children for a set period before the remaining assets go to charity, or vice versa.

Choosing the right trust structure is a monumental decision that will impact your family for generations. Consulting with a Texas estate planning attorney is the best way to clarify your goals and build a trust that provides true security.

Drafting the Core Components of a Texas Trust

Your trust agreement is the legal blueprint for your legacy—a private instruction manual for your trustee on how to manage and distribute your assets. Getting these core components right is essential for ensuring a smooth transition and preventing future family disputes.

Crafting a trust that complies with the Texas Trust Code requires meticulous attention to detail. Every clause serves a purpose, from naming the key parties to establishing the rules for your wealth.

Identifying the Grantor, Trustee, and Beneficiaries

First, the trust document must clearly identify the three main roles. Legal precision is paramount.

- The Grantor (or Settlor): This is you, the creator and funder of the trust. The document must state your full legal name and your clear intent to create the trust.

- The Trustee: This is the manager. For a living trust, you will likely serve as the initial trustee. However, it is crucial to name a successor trustee—the person or institution that takes over upon your incapacity or death.

- The Beneficiaries: These are the individuals or charities who will benefit from the trust assets. Be specific with names and relationships to avoid ambiguity.

Choosing your successor trustee is one of the most important decisions in the entire process. This individual or entity has a fiduciary duty—the highest standard of care under Texas law—to act in the best interests of the beneficiaries.

A trustee must manage assets prudently, avoid conflicts of interest, and maintain clear communication with beneficiaries. You need someone who is not only trustworthy but also organized, financially responsible, and capable of impartial judgment.

A Texas trust administration lawyer can help you evaluate candidates and decide whether a family member, friend, or corporate trustee is the right fit for your situation.

Defining Key Provisions and Distribution Instructions

With the parties identified, the next step is to outline the operational rules of your trust. These provisions make your wishes legally binding.

Essential Trust Provisions:

- Declaration of Trust: A clear statement confirming the creation of the trust and the intent to transfer property into it.

- Trustee Powers: A detailed list of what your trustee is authorized to do (e.g., sell property, invest assets). The Texas Trust Code provides default powers, but you can customize them.

- Successor Trustee Clause: Clearly outlines who takes over as trustee and what event triggers the transition (e.g., death, resignation, or medical certification of incapacity). It is wise to name at least two alternate successors.

- Spendthrift Provision: This is a vital clause for asset protection, as it generally prevents a beneficiary's creditors from accessing their inheritance while it is held in the trust.

The heart of the document is the distribution instructions. Here, you specify who gets what, when, and how. You can be as creative and detailed as you wish.

For instance, instead of a lump-sum distribution to a young adult, you could structure it to align with life milestones, providing one-third of their share at age 25, another third at age 30, and the remainder at age 35. This staggered approach helps protect beneficiaries from the challenges of sudden wealth. You can also attach conditions, such as requiring funds to be used for education or a down payment on a home. Our attorneys can help you craft language that ensures your intentions are crystal clear, providing for your loved ones long after you are gone.

Bringing Your Trust to Life Through Proper Funding

A well-drafted trust is only a blueprint; it has no power until you fund it. Funding is the process of legally transferring ownership of your assets from your name into the name of the trust. An unfunded trust is ineffective and cannot help your family avoid probate.

To begin, Texas law requires you to execute your trust document by signing it in front of a notary public. This formal act makes the trust a valid legal entity, ready to hold your property.

The Nuts and Bolts of Transferring Assets

Once the trust agreement is signed and notarized, you must systematically re-title your assets. Each asset type has a different transfer process.

Common Asset Types and How to Fund Them:

- Real Estate: Your attorney will prepare and file a new deed with the county clerk to transfer ownership of your Texas home or other properties to the trust.

- Bank Accounts: You will need to work with your bank to change the title on checking, savings, and money market accounts to the trust's name. Often, this involves opening new accounts in the name of the trust.

- Investment Accounts: Contact your brokerage firm to re-title your non-retirement investment accounts. They will provide specific transfer forms to complete.

- Business Interests: If you own an interest in an LLC or partnership, you must formally assign your ownership to the trust in accordance with your company’s operating agreement.

This process requires careful record-keeping to ensure no assets are left behind.

Don't Forget About Beneficiary Designations

Some assets, often called "non-probate assets," are transferred via beneficiary designations rather than re-titling.

Failing to update beneficiary designations is one of the most common and costly estate planning mistakes. An outdated designation on a life insurance policy or 401(k) can override your trust's instructions, potentially sending assets to an ex-spouse or forcing them into probate.

For assets like life insurance policies, IRAs, and 401(k)s, you can name your trust as the primary or contingent beneficiary. This ensures the proceeds flow into the trust, where your trustee can manage them according to your wishes. You can learn more about probate and non-probate assets in our detailed guide.

By methodically funding your trust, you empower it to function as designed, providing seamless protection for your loved ones and ensuring every piece of your estate is managed under one cohesive plan.

Navigating Key Legal and Financial Considerations

Once your trust is drafted and funded, there are ongoing legal and financial factors to consider. Understanding these details ensures your trust remains effective and aligned with your goals as laws and life circumstances change.

This includes managing tax implications, planning for potential long-term care needs, and staying current with the Texas Trust Code. This is where the ongoing guidance of a knowledgeable Texas estate planning attorney provides lasting value.

Understanding Tax Implications for Your Trust

A common question is how a trust affects taxes. The answer depends on the type of trust.

With a revocable living trust, the tax situation is simple. During your lifetime, the IRS considers it a "grantor trust," meaning it is transparent for income tax purposes. You will continue to file your personal tax return using your Social Security number, just as you always have.

An irrevocable trust is different. Because you have relinquished control of the assets, the trust becomes a separate taxable entity. It will require its own Taxpayer Identification Number (TIN) from the IRS and must file its own annual income tax return. For a closer look at this topic, explore our guide to tax strategies for Texas trusts.

Planning for Medicaid and Long-Term Care

The high cost of long-term care is a significant concern for many Texas families. A properly structured irrevocable trust can be a cornerstone of Medicaid planning.

By transferring assets into a specific type of irrevocable trust, you can start the five-year "look-back" clock for Medicaid eligibility. After five years, assets held in the trust are generally not counted when determining your eligibility for long-term care benefits. This powerful strategy can help preserve your life savings for your heirs rather than spending them down on care. This is a highly specialized area of law where professional guidance is essential.

Keeping Up with the Evolving Texas Trust Code

The laws governing trusts in Texas are not static. The legislature updates the Texas Trust Code to meet the evolving needs of modern families, making it crucial to periodically review your plan. An experienced attorney can ensure your documents remain compliant and effective under current law.

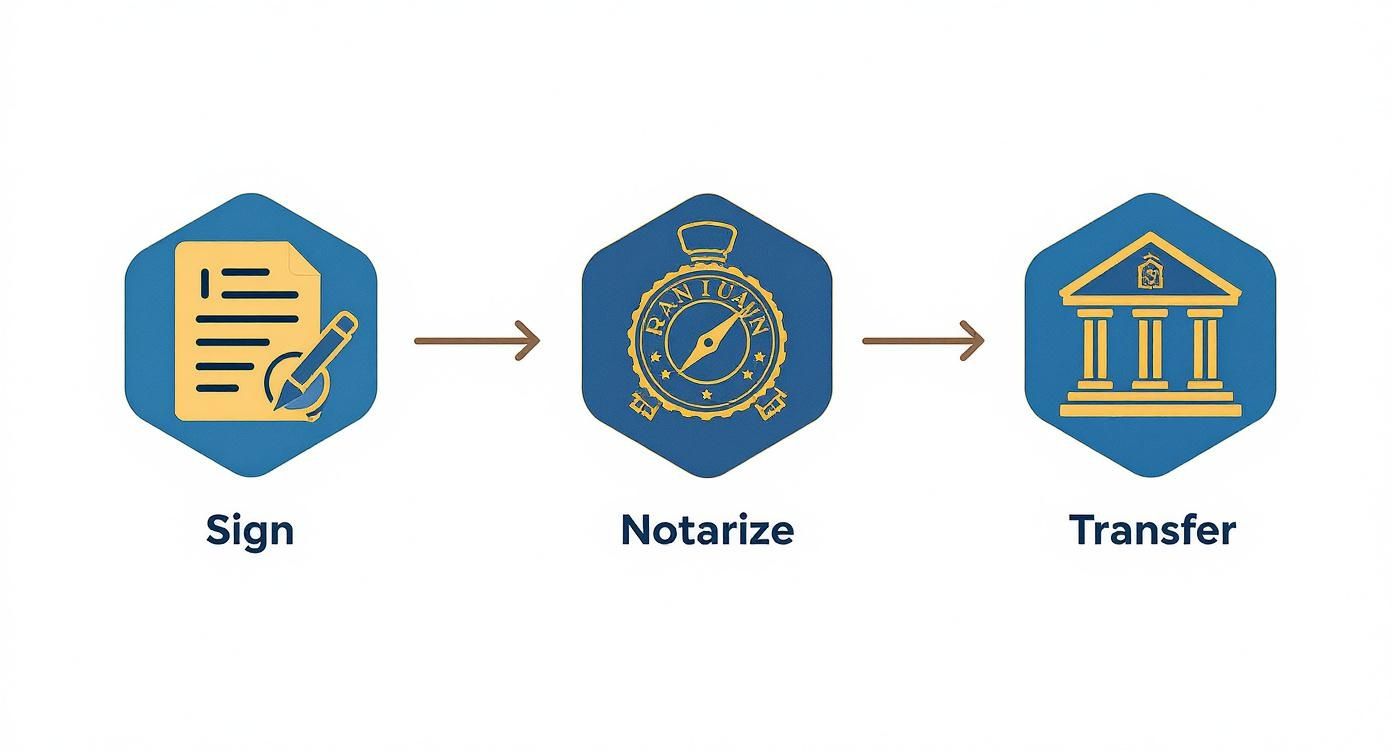

This infographic breaks down the essential three-step process for making your trust legally effective.

As you can see, a trust is not complete after signing. It must be properly notarized and, most importantly, funded with your assets to become fully operational and serve its purpose.

Common Questions About Creating a Texas Trust

It is natural to have questions when delving into estate planning. Getting clear, straightforward answers is the best way to feel confident about protecting your family’s future. Here are some of the questions we hear most often.

What Is the Average Cost to Set Up a Trust in Texas?

The cost depends on the complexity of your needs. For a standard revocable living trust prepared by an experienced attorney, the cost typically ranges from $1,500 to $3,000. More complex trusts involving advanced tax planning or special provisions will cost more.

While DIY online services may seem cheaper, they cannot provide the personalized legal advice needed to ensure your trust is properly drafted, funded, and compliant with Texas law. An initial investment in professional guidance can save your family from significant legal expenses and disputes in the future. A consultation with a Texas estate planning attorney can provide a firm estimate based on your specific goals.

Can I Be the Trustee of My Own Living Trust?

Yes, absolutely. For a revocable living trust in Texas, the grantor almost always serves as the initial trustee. This arrangement allows you to maintain complete control over your assets throughout your lifetime. You can manage, buy, and sell property as you always have.

The critical step is naming a successor trustee in your trust document. This is the trusted person or institution that will step in to manage the trust if you become incapacitated or pass away, ensuring a seamless transition and avoiding court intervention.

One of the most important fiduciary duties in Texas is the duty of loyalty, meaning the trustee must act solely in the best interests of the beneficiaries. Choosing a successor who understands this responsibility is paramount.

Does a Trust Protect My Assets from Creditors?

This is a critical question, and the answer depends on the type of trust.

Revocable Living Trust: No. Because you retain full control and can revoke the trust at any time, Texas law considers the assets to be yours. Therefore, they remain vulnerable to your creditors.

Irrevocable Trust: Yes, this is a different story. A properly structured irrevocable trust can provide powerful asset protection. By giving up control over the assets, they are generally no longer considered part of your personal estate and can be shielded from future lawsuits or creditors.

Do I Still Need a Will if I Have a Living Trust?

Yes, this is a point that cannot be overstressed. You should always have a specific type of will, called a pour-over will, to complement your living trust. This will acts as a safety net.

A pour-over will is designed to "catch" any assets you may have forgotten to transfer into your trust or acquired shortly before your death. The will's sole function is to direct that these assets be "poured over" into your trust. While these assets may have to go through probate, the will ensures they are ultimately distributed according to your trust's instructions, rather than by Texas intestacy laws.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.