Receiving an inheritance often comes during the difficult time of grieving a loved one. The last thing you want is for that legacy to become a point of contention in a divorce. Navigating the complexities of Texas property law can feel overwhelming, but with the right legal guidance, it doesn’t have to be. The simplest way to protect an inheritance from divorce in Texas is to keep it strictly separate from marital finances.

This means you never deposit inherited cash into a joint bank account. It means any property you buy with those funds is titled solely in your name. This discipline is the foundation of protecting your family's legacy.

Is Your Inheritance at Risk in a Texas Divorce?

It’s a scenario we see all the time at The Law Office of Bryan Fagan. A client comes in, worried, and asks, "My parents left me their house. Can my spouse really take half if we split up?" It's a valid fear, but the good news is that Texas law starts with strong protections for inherited assets.

Under the Texas Family Code, our state is a community property state. This means most assets you and your spouse acquire during the marriage are considered jointly owned. However, the law makes a critical exception for "separate property," which includes:

- Property you owned before you were married.

- Property you received as a gift intended only for you during the marriage.

- Property you acquired through an inheritance (also known as "devise or descent").

This distinction is the cornerstone of protecting your inheritance. When you inherit something, it begins as 100% your separate property. The real challenge, however, is keeping it that way.

The Danger of Commingling Assets

The single biggest threat to your inheritance is a legal pitfall called commingling. This happens when you mix your separate property with community property so thoroughly that they can no longer be clearly distinguished.

Once your assets are commingled, the burden of proof is on you to trace every dollar back to its original, separate source. Without impeccable records, this can be an expensive, and often impossible, task.

How Separate Property Becomes Community Property

It’s surprisingly easy for these lines to blur. Imagine you inherit $100,000 in cash. If you deposit that money into the joint checking account you and your spouse use for everything—groceries, mortgage payments, vacations—you've just commingled it. Your separate funds are now hopelessly mixed with community funds (like your paychecks), making it a nightmare to untangle in a divorce proceeding.

Key Takeaway: The moment you mix separate property with community property, its legal shield starts to crumble. Without a crystal-clear paper trail, a Texas court is likely to presume the entire mixed fund is community property, putting your inheritance at risk.

To give you a clearer picture, let's break down how Texas views property in a marriage.

Texas Property Rules at a Glance

Understanding these fundamental rules is the first step in creating a solid protection strategy.

| Property Type | How It's Defined in Texas | Real-World Examples | Vulnerability in a Divorce |

|---|---|---|---|

| Separate Property | Assets owned before marriage, or received during marriage as a gift or inheritance. | A house you owned before the wedding; $50,000 inherited from your grandfather; a gifted painting. | Legally protected, but can become community property if commingled or not properly documented. |

| Community Property | Assets acquired by either spouse during the marriage (excluding separate property). | Your salary; a car bought during the marriage; a joint savings account funded by paychecks. | Presumed to be jointly owned and is subject to a "just and right" division by the court. |

This table highlights why keeping inherited assets in their own lane is so critical.

The best defense is a proactive offense. Managing an inheritance correctly from day one is everything. This often means sitting down with a Texas estate planning attorney to set up the right accounts and legal structures, creating an unbreakable wall between what's solely yours and what's shared. Our firm provides expert help with all aspects of asset protection, ensuring your family’s legacy is safe, no matter what happens. A little bit of foresight now can save you from significant legal challenges later.

Using Prenups and Postnups to Shield Assets

While carefully managing your assets is a great defensive play, some of the best moves you can make to protect an inheritance are proactive. This is where prenuptial and postnuptial agreements come in. They give you and your spouse the power to formally define what constitutes marital property, creating a legally binding roadmap for your financial life together.

Many people feel that these agreements are about planning for failure, but that perspective misses the point. Think of it less like you're predicting a divorce and more like you're performing responsible financial planning for your partnership. It’s about setting clear expectations from the start to prevent misunderstandings down the road—something that can actually make a marriage stronger.

How Prenuptial Agreements Work in Texas

A prenuptial agreement, or "prenup," is a contract you sign before you get married. Here in Texas, it allows couples to essentially opt out of the default community property rules and write their own. If you're expecting a significant inheritance, a prenup can explicitly state that any inherited assets—plus any income or growth they generate—will always remain your separate property.

For a Texas prenup to be enforceable in court, it has to meet strict requirements under the Texas Family Code:

- It must be in writing and signed by both parties before the wedding.

- You both must enter into it voluntarily, without any hint of coercion or pressure.

- There must be a fair and reasonable disclosure of all assets and debts from both sides. Hiding assets is a surefire way to have the entire agreement invalidated.

The Power of Postnuptial Agreements

So, what happens if you're already married when an inheritance comes into the picture? That's where a postnuptial agreement comes in handy. It serves the exact same purpose as a prenup, but you create it after you've tied the knot. It can be used to reclassify property, including inheritances you might receive in the future.

Real-World Scenario: Let’s imagine a couple married for five years. One spouse learns they are going to inherit the family ranch. They can work with their respective attorneys to draft a postnuptial agreement that formally designates the ranch, and any income it produces, as the inheriting spouse's separate property. That one document provides incredible clarity and security for everyone involved.

These agreements aren't just for the ultra-wealthy. They are practical tools for anyone looking to protect family legacy assets, provide for children from a previous marriage, or simply bring more certainty to their financial future.

Key Provisions for Protecting Inheritances

When drafting these agreements, the details are critical. Vague language can create loopholes. Your Texas estate planning attorney will ensure the document includes precise terms that cover all bases, such as:

- Future Inheritances: The agreement needs to explicitly mention assets you haven't yet received.

- Income and Appreciation: It should clarify whether income (like rent from an inherited property) or an increase in its value will also remain separate property.

- Tracing Rules: It can establish clear rules for how you'll track and manage your separate property to avoid any commingling arguments later.

These legal documents are a cornerstone of a solid financial plan. If you want to explore more ways to shield your assets from life's curveballs, our guide on safeguarding your wealth with asset protection in Texas offers valuable insights. Approaching these conversations with your spouse from a place of mutual respect and long-term planning can turn a sensitive topic into a positive step for your financial partnership.

Using Trusts for Bulletproof Asset Protection

While prenups and postnups are a solid defense, a well-crafted trust is the ultimate fortress for your inheritance. Under the Texas Trust Code, a properly structured trust legally separates the inheritance from your personal estate. This makes it incredibly difficult for those assets to ever be classified as community property if a divorce occurs.

Think of it this way: when you inherit money or property directly, you own it outright. That direct ownership makes it easy to accidentally commingle with marital funds. A trust, on the other hand, creates a separate legal entity to hold and manage the assets. A trustee you (or the person leaving the inheritance) designates is in charge, following a specific set of rules.

This structure creates a clear legal barrier between your personal finances and the trust assets, which is the key to their protection. For a helpful visual overview of trust-based asset protection from both a financial and tax perspective, you can review this resource.

The Power of Irrevocable and Discretionary Trusts

When it comes to divorce-proofing an inheritance, not all trusts are created equal. The most powerful tools are irrevocable and discretionary trusts.

An irrevocable trust, once established, generally cannot be changed or canceled by the person who created it. That permanence is precisely what makes it so powerful. Since you, the beneficiary, cannot alter the trust or demand the funds at will, the assets are not legally considered under your control. This shields them from creditors and, importantly, divorce proceedings.

A discretionary trust takes this protection a step further. In this arrangement, the trustee has complete discretion over when, how, and if they distribute funds to you. You have no legal right to force a payment, which means a divorce court cannot order the trustee to pay your ex-spouse, either. The assets belong to the trust, not to you, until the trustee decides to make a distribution.

A Real-World Scenario: Imagine a mother wants to leave her son a $500,000 inheritance but is worried about his unstable marriage. Instead of leaving the money to him directly, her Texas trust administration lawyer helps her place the funds into an irrevocable discretionary trust. She names her daughter (the son's trusted sibling) as the trustee. Years later, the son and his wife divorce. His wife's attorney tries to claim a portion of the inheritance, but the court denies the claim. Because the assets are held in the trust and the son has no control over them, they are ruled to be separate property and are completely off-limits in the settlement.

Understanding Trustee Responsibilities Under Texas Law

The trustee is the legal gatekeeper of the trust, a role with serious legal obligations. Under Texas law, a trustee has a fiduciary duty to manage the trust's assets solely in the best interests of the beneficiaries. This is the highest standard of care recognized in our legal system.

Their responsibilities, known as fiduciary duties in Texas, are spelled out in the Texas Trust Code and include:

- Duty of Loyalty: The trustee must act exclusively for the beneficiaries. No self-dealing or conflicts of interest are permitted.

- Duty of Prudence: They are required to manage the trust’s investments and assets as a reasonably careful person would.

- Duty to Follow Trust Terms: The trustee must adhere to the instructions in the trust document precisely.

These duties ensure the trust is managed professionally and ethically, adding another layer of security for the assets inside.

The Spendthrift Provision: A Critical Shield

One of the most valuable tools in a Texas trust is the spendthrift provision. This is a specific clause written into the trust document that prevents a beneficiary from transferring—or being forced to transfer—their interest in the trust to someone else.

In plain English, it means that creditors, including a future ex-spouse, cannot force the trustee to pay them from the trust's assets. Even if a court issues a judgment against you personally, the spendthrift provision blocks them from seizing trust property to satisfy that debt.

This provision is a powerful, legally recognized shield that makes trusts one of the best answers for anyone wondering how to protect an inheritance from divorce. Getting familiar with how to create a trust in Texas will give you a much clearer picture of the steps involved. A Texas estate planning attorney can help design a trust that aligns perfectly with your family's legacy and protection goals.

Essential Steps to Avoid Commingling Your Inheritance

Legal agreements like trusts and prenups are your foundational shield, but the choices you make every day are what truly keep your inheritance separate. What you do after receiving the assets matters just as much as the planning that came before. This is your practical, step-by-step guide for preventing the financial blur of commingling.

The first and most important rule is simple: create separation. Open a brand new bank account, titled in your name only, and deposit any inherited cash directly into it. This account must be a one-way street—inheritance goes in, but marital funds (like your paycheck) must stay out.

This principle applies to all inherited assets. If you receive stocks, they need their own separate brokerage account under your name. Inherit a piece of property? Make sure the deed is titled solely in your name. This initial separation is your first and best line of defense.

The Art and Science of Tracing

From the moment an inheritance is yours, you must become a meticulous record-keeper. In legal terms, this is called "tracing," and it’s the process of creating an unbroken paper trail that proves an asset's journey from its original, inherited source.

This isn’t just about saving a few bank statements. It’s about documenting every transaction. If you sell an inherited stock and use the proceeds to buy a painting, you need records showing the stock sale and the art purchase, with all funds flowing exclusively through your separate accounts. This clean, clear documentation is the strongest evidence you can bring to court.

A Cautionary Tale of Good Intentions

Let's walk through a common scenario. Imagine you inherit $75,000. You and your spouse have been dreaming of a bigger house, so you put that money toward the down payment. The new home is titled in both your names, and you make the mortgage payments from your joint checking account.

Years later, the marriage ends. You know that $75,000 came from your family, but can you prove it? That money is now hopelessly mixed into the home's equity, which has also been built with community property (your joint mortgage payments). Without a flawless paper trail, a court will struggle to separate your initial contribution, and your inheritance could easily be divided.

An Actionable Checklist for Keeping Assets Separate

To avoid a situation like the one above, you must be disciplined. These are not just suggestions; they are critical steps for protecting what is rightfully yours.

- DO Open a Separate Account: The first thing you should do is establish a new checking, savings, or investment account titled exclusively in your name. All inherited cash goes here first. No exceptions.

- DON'T Deposit into Joint Accounts: Never, under any circumstances, deposit inherited funds into a bank account you share with your spouse. This is the fastest way to commingle your assets and lose their separate character.

- DO Title Assets Correctly: Any new asset you buy with inherited funds—whether it’s real estate, a car, or a stock portfolio—must be titled solely in your name.

- DON'T Pay Joint Debts Directly: Avoid using your separate inheritance account to pay down community debts, like a joint credit card or the mortgage on the family home. This can easily be interpreted as a "gift" to the marital estate.

- DO Keep Impeccable Records: Save everything. Every statement, every receipt, and every legal document related to the inheritance and any assets you purchase with it.

Key Insight: Consistency is everything. You must consistently and deliberately treat your inherited property as separate. Even a few slip-ups where you mix funds can weaken your legal position and create an opening for a claim against your assets.

With divorce rates remaining a real factor in financial planning—research shows nearly one in five marriages may not make it past a decade—proactively protecting inherited wealth has become essential. The small, disciplined steps you take today provide the greatest security for your future.

Handling High-Value or International Inheritances

When an inheritance involves significant wealth or assets located outside the United States, the complexity increases. The basic rule—keep your inheritance separate from marital property—still applies. But now you face a new level of legal and financial hurdles that demand a more sophisticated strategy.

In these situations, hiring specialized legal counsel isn't a luxury; it's a necessity.

Advanced Strategies for High-Net-Worth Estates

For someone with significant wealth in Texas, simply opening a separate bank account may not be sufficient. To build a true fortress around your assets, you need to use the advanced tools of estate planning.

One incredibly effective tool is a Family Limited Partnership (FLP). Think of it as creating a private company to hold your assets, like a family business or a real estate portfolio. When you transfer your inheritance into an FLP, you no longer own the assets directly. Instead, you own a partnership interest, which is much more difficult for a divorce court to divide.

For blended families, a Qualified Terminable Interest Property (QTIP) trust is another powerful strategy.

- Scenario: Let's say you've remarried and have children from a previous marriage. You want to ensure your new spouse is cared for after you're gone, but you're determined that your inherited wealth ultimately passes to your own children.

- Solution: A QTIP trust is the perfect answer. It allows your surviving spouse to receive income generated by the trust's assets for the rest of their life. But the key is this: they never actually own the assets. When they pass away, the remaining principal goes directly to the beneficiaries you named from the start—your children.

This setup compassionately provides for your current partner while firewalling your family's legacy from the new marital estate.

Key Insight: With complex estates, the strategy is to create legal structures that add layers of separation between you and the assets. The more layers, the harder it becomes, both legally and practically, to argue that the inheritance should be treated as community property.

The Unique Challenges of International Assets

Inheriting property in another country introduces a new world of complexity. If you’re a Texan who inherits a villa in Italy, you're suddenly juggling two different legal systems, fluctuating currency values, and a maze of conflicting tax laws.

Protecting an asset like that requires a coordinated team effort between your Texas estate planning attorney and legal experts in that foreign country. You'll be navigating international treaties and determining how foreign property laws interact with Texas community property rules.

Managing these assets properly is non-negotiable. One small misstep, like using joint marital funds to pay for the Italian villa's upkeep, could be all it takes for your spouse to stake a claim on a property thousands of miles away. Understanding these nuances is critical, which is why we provide detailed guidance on international estate planning and considerations for assets abroad.

The stakes are simply too high to navigate these international waters without specialized, dual-jurisdictional legal advice.

Common Questions About Inheritance and Divorce

When you're trying to understand how inheritance and divorce intersect, it can feel like walking through a legal minefield. To help clear up the confusion, here are some of the most common—and critical—questions we hear from clients. These answers cut straight to the point and reinforce the strategies we've discussed.

What Happens if I Use Inherited Money on Our Family Home?

This is, by far, the easiest way people accidentally turn their separate inheritance into a marital asset. When you use your inherited funds to pay down a community debt—like the mortgage on the house you share—you create a significant legal complication.

Under Texas law, this move might create what’s called a "reimbursement claim," meaning your separate estate could get paid back by the community estate. The challenge? The burden of proof is entirely on you and requires perfect documentation. If you don't have a crystal-clear paper trail, a court is likely to see it as a gift to the marriage, and that portion of your inheritance could be lost.

Is My Prenuptial Agreement Enough Protection?

A solid prenuptial agreement is an excellent first line of defense, but it’s not a magic shield that works on its own. The agreement must clearly state that inheritances are separate property, but your day-to-day actions must support that.

For example, if your prenup says inheritances are separate, but you immediately deposit the money into a joint checking account and use it to pay family bills for five years, you have actively undermined the document you created. Your behavior must always align with the legal agreement for it to hold up under scrutiny.

What About Income My Inheritance Earns?

This is a detail in Texas law that catches many people by surprise. While the original inherited asset (the principal) is your separate property, any income it generates during the marriage is generally considered community property.

That means:

- Rent checks you receive from an inherited rental property.

- Dividends paid out from an inherited stock portfolio.

- Interest earned from inherited cash in a savings account.

It gets even trickier if the asset's value increases due to "community effort"—for example, if your spouse spends their weekends helping you renovate that rental property. That increase in value could also be subject to a community property claim. The only way around this is with specific language in a prenuptial agreement or by using a properly structured trust. If you're just starting out, check out these smart moves for managing an inheritance for foundational tips.

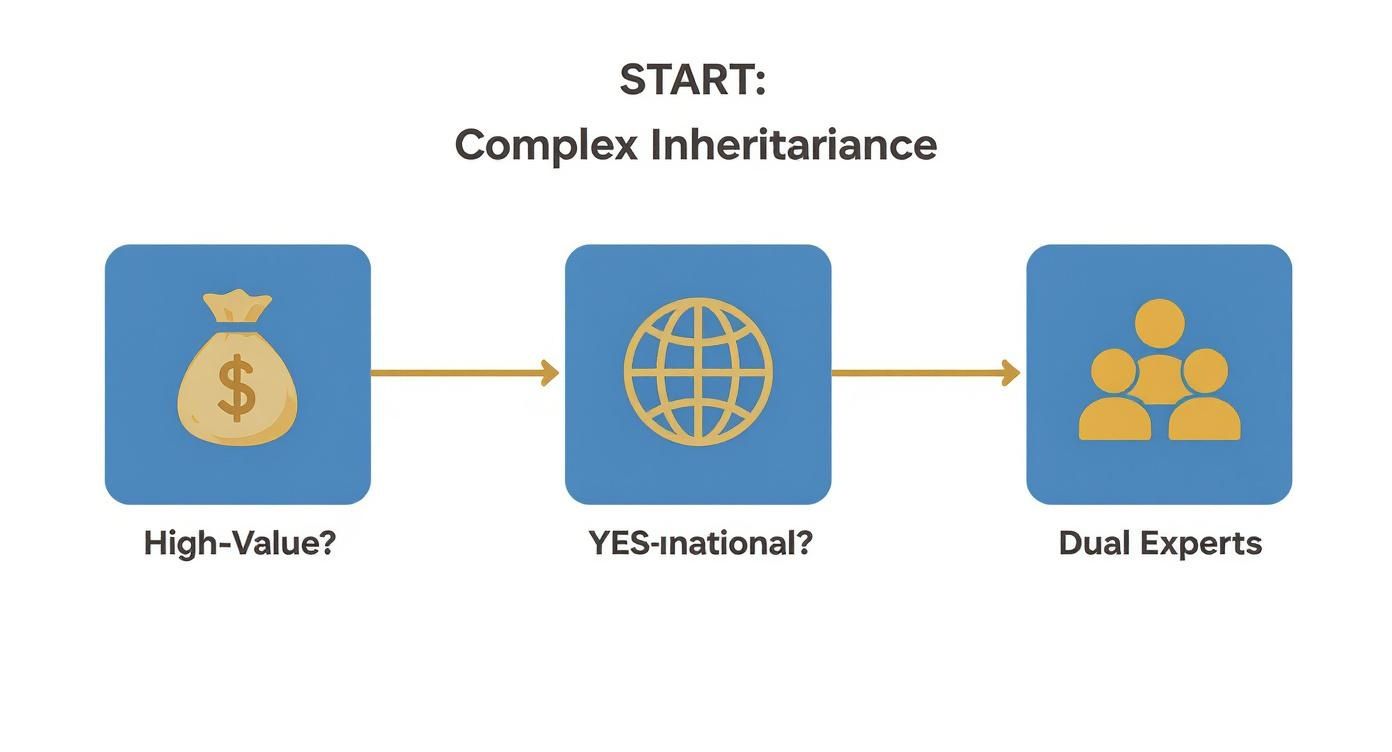

The decision tree below can help you visualize how to approach things, especially when dealing with a more complex or high-value inheritance.

As you can see, the more complex the inheritance gets—especially when international assets are involved—the more critical it becomes to bring in specialized legal experts to ensure everything is protected.

Is It Too Late to Act if Divorce Is Already Happening?

It’s never truly too late to defend your assets, but your options definitely narrow once divorce proceedings have begun. You cannot create a postnuptial agreement at this point, for instance. Your strategy must shift from proactive planning to pure defense.

Your number one job becomes an exercise in financial archaeology: gathering every record you can find to meticulously trace those inherited assets back to their source. You have to prove their separate character beyond a shadow of a doubt. This documentation is your strongest weapon.

The key is to act quickly. Your most important call should be to an experienced Texas estate planning attorney who has deep experience in complex property division. They can help you build the strongest case possible with the evidence you have and ensure your family's legacy gets the expert defense it deserves.

If you’re managing an inheritance or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.