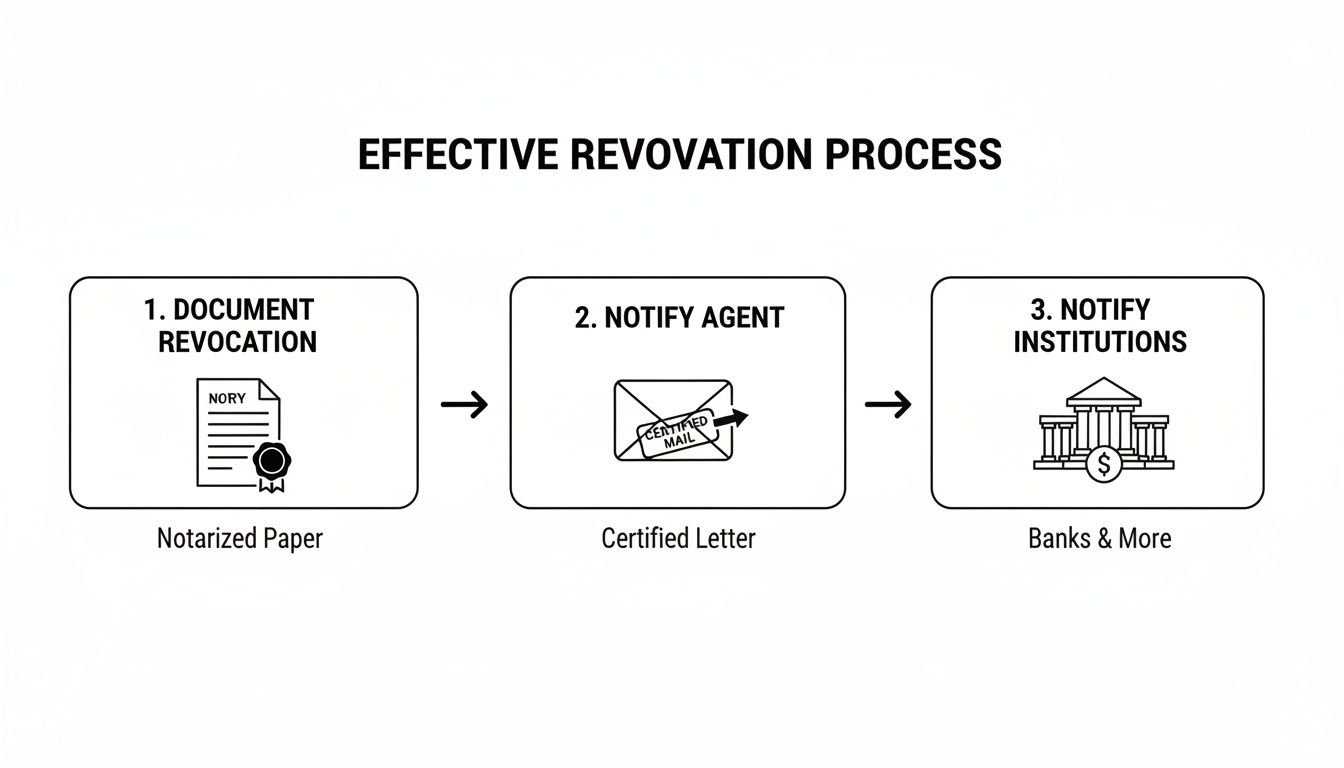

Deciding to void a power of attorney in Texas is a significant step, but ensuring it's handled with legal precision is crucial for protecting your interests. The process requires a formal, written "Revocation of Power of Attorney," which you must sign before a notary public. Afterward, you must deliver copies to your former agent and any institutions, like your bank or doctor, who relied on the original document. Following these steps ensures your decision is legally airtight and officially terminates the agent's authority.

Why You Might Need to Revoke a Power of Attorney

Managing a loved one's affairs, or planning for your own, can feel overwhelming—but with the right legal guidance, it doesn’t have to be. A Power of Attorney (POA) is a legal tool built on a foundation of absolute trust. When that foundation cracks, you must act to protect your interests. Life is unpredictable, and the person who was once the perfect choice to manage your affairs may no longer be a good fit.

It’s a common misconception that a POA is set in stone. The reality in Texas is that as long as you are mentally competent, you have full control to change your mind at any time, for any reason. Before we get into the "how," it’s important to have a solid grasp of What Is A Power Of Attorney. Understanding what a POA truly is makes it crystal clear why voiding an outdated one is so critical for your financial and personal well-being.

Common Reasons for Revocation

Many life events can make revoking a POA necessary. These situations aren’t failures; they're simply a reflection of changing circumstances and relationships.

- Divorce or Separation: If your spouse was your agent, a divorce fundamentally alters that relationship. Leaving them with control over your finances or healthcare decisions after a separation is often untenable.

- Loss of Trust: This is perhaps the most urgent reason. You may have discovered your agent has acted irresponsibly, made decisions you disagree with, or has simply become uncommunicative. Trust is the absolute core of the agent-principal relationship and a key component of their fiduciary duties in Texas.

- Agent's Unavailability: Your chosen agent might move away, become ill, pass away, or simply decide they no longer wish to handle the responsibility.

- A Better Choice Emerges: As life goes on, someone else—like an adult child who has matured—may become a more appropriate and capable choice to act as your agent.

The risks of not acting are immense. An old POA can be an open door to financial exploitation, an issue that is particularly devastating for seniors. The FBI reported an 11% increase in fraud cases targeting individuals over 60 from 2022 to 2023 alone, with POA abuse being a common tool for criminals. An outdated POA can lead to drained bank accounts, unauthorized property sales, and a complete loss of your financial security.

Protecting Your Right to Choose

Ultimately, revoking a POA is about reclaiming your autonomy. The person you appoint holds significant power, and it's essential that this power remains with someone who has your complete and unwavering confidence.

While a POA is a vital estate planning tool, it's very different from a court-ordered arrangement like a guardianship. To get a clearer picture, you can read our guide explaining the difference between a power of attorney and guardianship. The legal process in Texas is designed to be clear and definitive, ensuring that when you decide to make a change, your wishes are respected and legally enforceable.

Drafting a Formal Revocation of Power of Attorney

If you've decided to void a power of attorney in Texas, you cannot simply tell your agent they are no longer needed. That won't hold up legally. You must create a formal, written document called a "Revocation of Power of Attorney." This is a strict requirement under the Texas Estates Code to ensure your decision is official, clear, and legally binding.

Think of this document as the official "off switch" for the powers you granted. Getting this step right is the single most important part of taking back control over your affairs. Without a properly drafted and executed revocation, your old agent could still potentially act on your behalf—the exact situation you are trying to prevent.

Key Elements of a Texas Revocation Document

Your revocation document does not need to be filled with complicated legal jargon. It just needs to be precise and contain a few key pieces of information to be valid under Texas law.

Here’s what you must include:

- Your Full Legal Name: As the "principal," you are the one who created the original POA.

- Your Former Agent's Full Legal Name: Be specific to avoid any confusion about who is being removed.

- The Date of the Original POA: Pinpoint the exact date the power of attorney you are canceling was signed.

- A Clear Statement of Revocation: This is the heart of the document. It must be a direct, unmistakable sentence declaring that you are revoking any and all authority granted to that agent in that specific POA.

While you can find legal form templates online to use as a starting point, it's always wise to have a qualified Texas estate planning attorney review the final document to ensure it is fully compliant with current Texas law.

The Non-Negotiable Notarization Requirement

Once you have the document drafted with all the correct information, you need to sign it. But here’s a critical point for Texans: your signature alone isn’t enough.

You must sign the revocation in the presence of a notary public. The notary's role is to verify your identity, witness you sign, and then apply their official seal. This act of notarization is what gives your revocation its legal authority. It transforms your written statement into an official instrument that banks, hospitals, and courts will recognize.

Key Takeaway: In Texas, an un-notarized revocation is legally invalid. Third parties like financial institutions are trained to look for a notary seal and will reject a revocation document without one. Skipping this step renders the entire effort ineffective.

A Real-World Scenario: A Texas Revocation

Imagine Maria, who lives in Houston, signed a POA in 2018 naming her brother, David, as her agent. They've since had a major falling out, and she now feels it's necessary to revoke his power to protect her assets.

The core of Maria's revocation document would need clear, direct language, such as:

"I, Maria Rodriguez, of Harris County, Texas, do hereby revoke and terminate the Durable Power of Attorney dated June 15, 2018, in which I appointed my brother, David Rodriguez, as my agent. I hereby revoke any and all powers and authority granted to David Rodriguez in that document, effective immediately upon the signing of this instrument."

This language is direct and leaves no room for misinterpretation. It clearly identifies the principal (Maria), the agent (David), and the exact document being voided (by date), and it unequivocally states the intention to revoke all authority. After drafting this, Maria would take it to a notary, sign it in their presence, and have it sealed. That simple but crucial process ensures her decision is legally sound, completing the first major step in voiding her old power of attorney.

Notifying All Parties: Making Your Revocation Effective

You have your notarized revocation document in hand. While this feels like the finish line, it’s really just the beginning. A revocation sitting in your desk drawer is legally ineffective. It only gains its power once the right people are aware it exists.

In Texas, the law operates on a concept called "actual notice." This means your revocation is only binding on third parties like your banker or doctor once they have actually received a copy. Until they have it in their hands, they are legally permitted—and even expected—to continue honoring the old Power of Attorney.

Failing to properly notify everyone leaves a dangerous window open for a former agent to cause harm. Proper notification isn't just a suggestion; it’s the final step that slams the door shut on their authority for good.

Who Needs to Receive a Copy?

Your notification list must be comprehensive. Think about every single person, business, or institution that has a copy of the old POA or has ever dealt with your former agent. Missing even one can create significant problems.

Your must-notify list should include:

- Your Former Agent: This is non-negotiable and the most important person to inform.

- Financial Institutions: Every bank, credit union, brokerage firm, or investment company.

- Healthcare Providers: Your primary care doctor, specialists, hospitals, and any long-term care facilities.

- Government Agencies: The Social Security Administration, IRS, or Veterans Affairs, if your agent interacted with them.

- Your Professional Team: This includes your accountant, financial advisor, or any other professional your agent had authority to contact.

The goal is to create an undeniable paper trail so that no one can ever claim they were not informed of the change.

The Proper Method for Notification

A quick phone call or an email is insufficient. You need solid, legal proof that your notice was sent and received. The most reliable method in Texas is to use Certified Mail with a Return Receipt Requested from the U.S. Postal Service.

This method provides a signed postcard mailed back to you, proving the exact date the recipient received your notice. That postcard is your legal shield. If your ex-agent ever tries to claim, "I was never told," you have irrefutable evidence to the contrary.

A verbal notification carries zero legal weight in Texas when revoking a POA. An unproven notification is just as useless. Certified mail creates the ironclad record you need to protect yourself and make the revocation legally binding.

This method is especially critical when dealing with an uncooperative individual. The signed receipt makes it extremely difficult for them to continue acting on your behalf and provides powerful evidence if you need to take further legal action.

To ensure your revocation is effective, it's crucial to inform all relevant parties. This checklist helps you track who to notify and why it's so important.

Who to Notify When You Revoke a Power of Attorney

| Party to Notify | Why It's Critical | Recommended Notification Method |

|---|---|---|

| The Former Agent | They must be legally informed that their authority has been terminated to prevent them from acting further. | Certified Mail with Return Receipt |

| Banks & Credit Unions | Prevents the former agent from accessing accounts, withdrawing funds, or making financial transactions. | Certified Mail with Return Receipt |

| Investment/Brokerage Firms | Protects your retirement accounts, stocks, and other investments from unauthorized trades or transfers. | Certified Mail with Return Receipt |

| Doctors & Hospitals | Ensures the former agent cannot make medical decisions or access your private health information. | Certified Mail with Return Receipt |

| Accountant or CPA | Stops the ex-agent from filing taxes, accessing financial records, or dealing with the IRS on your behalf. | Certified Mail with Return Receipt |

| County Clerk's Office | If the original POA was recorded (for real estate), the revocation must also be recorded to clear the title. | In-Person Filing or Certified Mail |

Proper notification isn't just a formality; it's the action that legally finalizes your decision and protects you from potential misuse of the old power of attorney.

A Real-World Example: Completing the Process

Let's return to Maria. After getting her Revocation of Power of Attorney signed and notarized, she knows her work isn't done. She makes a clear list:

- Her former agent, David.

- Her primary bank in Houston.

- The investment firm managing her 401(k).

- Her cardiologist’s office.

She makes four copies of the notarized document. The next day, she goes to the post office and sends each one via Certified Mail with a return receipt requested. Over the next week, the signed green postcards arrive in her mailbox. She carefully staples each receipt to her original revocation document and places it all in her safe deposit box.

By being so methodical, Maria has officially and legally terminated David's authority. She didn't just sign a piece of paper; she ensured every key party received actual notice. Now she has complete peace of mind, knowing her decision is final, secure, and legally bulletproof.

When Things Get Complicated: Revoking a POA with a Difficult Agent or Real Estate

Revoking a Power of Attorney is usually a straightforward process, but sometimes complications arise. You might find yourself facing a difficult situation, like dealing with an uncooperative former agent or a POA that involves real estate.

These scenarios can feel overwhelming, but it’s critical to remember that Texas law provides clear and powerful tools to enforce your decision. Even when things get messy, you have a legal path forward to protect your assets and ensure your wishes are respected.

Dealing With a POA Tied to Real Estate

If the original Power of Attorney was recorded with a county clerk's office—a common step if the agent was given authority to handle real property—you have one more essential task. You must record your notarized Revocation of Power of Attorney in the same county clerk's office where the original POA was filed.

This action officially removes the agent's authority from the public record, giving notice to title companies and others that the former agent no longer has any power over your property. Skipping this step can create a significant cloud on your property's title, leading to major complications later.

As this process shows, the real power behind your revocation comes from deliberate, thorough communication—from the notarized document to notifying every single party involved.

Handling an Uncooperative Former Agent

What happens if you’ve done everything correctly—you’ve sent the notarized revocation by certified mail—but the former agent refuses to comply? Perhaps they won't return your property or continue trying to access your bank accounts. This is not just frustrating; it is a breach of Texas law.

When an ex-agent ignores a valid revocation, they are violating their fiduciary duties. You have several legal options to force compliance.

- Attorney Demand Letter: The first step is often to have a lawyer send a formal demand letter. This serves as a legal warning, stating that the agent's authority is terminated and demanding the immediate return of any property.

- File a Civil Lawsuit: If the letter is ignored, you can take them to court. You can ask a judge for an order compelling the former agent to return your assets and provide a full accounting of every action they took.

- Sue for Damages: If the agent’s actions after revocation caused you financial loss, you may be able to sue them for damages. Texas law takes breaches of fiduciary duty very seriously.

It's a common fear that a difficult agent can hold your assets hostage. The reality is that the law is squarely on your side. A court order can force their hand, and they may be held financially responsible for their misconduct.

The challenges of managing these documents are why understanding the specifics of a POA and other directives is so important. For more context, check out our detailed guide on unraveling the POA and Advanced Directive mysteries.

Remember, you are never without recourse. An experienced Texas estate planning attorney can help you take decisive action, providing the legal leverage needed to resolve the situation and restore your peace of mind.

Establishing a New Power of Attorney to Protect Your Future

Revoking a Power of Attorney is a crucial step in protecting your assets and autonomy. However, the process isn't complete once the old document is voided.

Leaving the agent position vacant creates a significant gap in your estate planning. If you were suddenly unable to make decisions for yourself, who would step in? Without a valid POA, your family might have to endure a lengthy and public court process to gain control of your affairs.

That's why the most critical next step is to immediately put a new Power of Attorney in place. This is about making a deliberate, thoughtful choice to grant that authority to someone you trust today, ensuring your future is secure.

Selecting Your New Trustworthy Agent

Choosing a new agent is a decision that requires careful consideration. You need someone who is not only trustworthy but also organized, responsible, and capable of handling complex financial or medical issues under pressure.

The person you name has a significant fiduciary duty under the Texas Estates Code—a legal and ethical obligation to act solely in your best interest.

As you consider your options, ask yourself:

- Are they reliable? Do they have a proven history of following through on their commitments?

- Are they financially responsible? They should be capable of managing their own finances and yours prudently.

- Do they have good judgment? Can they remain level-headed and make sound decisions, especially in stressful situations?

- Are they willing to serve? Have a frank conversation with your potential agent. Ensure they understand the role and are genuinely willing to accept the responsibility.

Your new agent should be someone with whom you can communicate openly and who understands your values and wishes for the future.

The Importance of a Durable POA in Texas

It is vital to understand the difference between a general Power of Attorney and a Durable Power of Attorney. A general POA becomes invalid the moment you become incapacitated. In contrast, a durable POA is designed to remain in effect precisely when you need it most.

A Durable Power of Attorney ensures your chosen agent can continue managing your affairs—paying your bills, handling investments, and making healthcare decisions—if an accident or illness leaves you unable to do so yourself.

Without a durable POA, your family could be forced into a costly and public court proceeding to establish a guardianship simply to gain the authority to help you.

By creating a new, durable POA, you are proactively mapping out your future with confidence. This single document is one of the most powerful tools you have to maintain control over your life, no matter what comes your way.

Some Texans also explore specialized tools like a "springing" POA, which only takes effect after a specific event, such as a doctor certifying your incapacity. We cover this in more detail in our guide on what is a springing power of attorney.

Ultimately, voiding an old POA and creating a new one are two sides of the same coin. The first act closes a door on a situation that no longer serves you. The second opens a new door to a secure future, managed by someone who has earned your complete trust.

Common Questions About Voiding a Texas Power of Attorney

The process of voiding a power of attorney can raise many questions. Feeling confident in your decisions is essential for moving forward with peace of mind.

Below, we answer some of the most common questions we hear from clients, providing clear answers grounded in Texas law to help you navigate this process.

Can I Revoke a Power of Attorney if My Agent Disagrees?

Yes, absolutely. As the principal who granted the power, you hold the authority. Your right to revoke that power does not require your agent's permission or consent.

As long as you are legally competent to make your own decisions, this authority is yours alone. The agent’s role is to serve your interests, not to control them. If you have decided to terminate their authority, their opinion on the matter is legally irrelevant. The key is to formalize your decision with a written, signed, and notarized revocation, followed by proper notice.

What Happens if I Become Incapacitated Before Revoking the POA?

This is a critical situation where timing is everything. If you signed a durable power of attorney, it was specifically designed to remain effective even if you become incapacitated. This means that once you are no longer legally competent, you lose the ability to revoke the POA yourself.

In that scenario, if an agent is acting improperly, your loved ones would need to pursue a more complex legal path by petitioning a Texas court to establish a guardianship. If the court appoints a guardian, that person can then ask the judge to terminate the problematic POA. This underscores the importance of acting swiftly if you have any doubts about your agent’s integrity.

Is a Verbal Revocation Legally Binding in Texas?

No. A verbal statement has no legal power against a written Power of Attorney in Texas.

Banks, hospitals, and other institutions require formal, legal paperwork. They will not—and should not—act on a verbal command. Your revocation must be in writing, signed by you, and notarized to be effective and enforceable.

Key Takeaway: As far as the law and financial institutions are concerned, an unwritten revocation is a non-event. Always create a formal, notarized document to ensure your decision is legally sound.

Should I Hire a Lawyer to Void a Power of Attorney?

While you can technically draft a revocation on your own, consulting an experienced Texas estate planning attorney is a prudent step. An attorney ensures your revocation is legally sound and that you create an undeniable record terminating your agent's authority.

Here’s where professional legal guidance is invaluable:

- Legal Compliance: An attorney ensures your document meets all requirements of the Texas Estates Code, leaving no room for error.

- Managing Difficult Agents: If an agent is uncooperative, refuses to return property, or you suspect financial abuse, a lawyer can step in with a formal demand letter and pursue legal action if necessary.

- Handling Complexities: If real estate was involved and the original POA was recorded, a lawyer will handle the necessary filings to clear the public record.

- Peace of Mind: Knowing that a professional has handled every detail correctly allows you to move forward with confidence.

Hiring a lawyer is about making your decision to revoke final and absolute, ensuring your rights are fully protected.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process. Learn more at https://texastrustadministration.com.