Losing a loved one is a profoundly difficult experience, and the legal responsibilities that suddenly appear can feel overwhelming—especially when there’s no will to light the way. This is where a letter of administration of estate comes in. It’s the official document a Texas probate court issues to grant someone the legal power to manage the assets of a person who passed away without a will.

This court order is the critical first step in a legal process known as an intestate administration, and with the right legal guidance, it doesn’t have to be an overwhelming journey.

Navigating a Texas Estate Without a Will

When someone dies without a valid will in Texas, state law decides how their property gets divided. This process, governed by the Texas Estates Code, can feel tangled and confusing, but you don't have to face it alone. The entire journey starts with obtaining the legal authority to act on behalf of the estate.

Think of a letter of administration of estate as the official "key" to unlocking everything your loved one left behind. Without this key, bank accounts are frozen solid, property can’t be sold, and outstanding debts can't be settled. The court gives this key to a qualified person, called the Administrator, who can then legally access, manage, and ultimately distribute the deceased's assets according to Texas law.

Your Roadmap to a Clear Process

We’ve designed this guide to be your roadmap, breaking down the entire journey into clear, manageable steps. We'll walk you through what these letters are, who is eligible to get them, and the step-by-step process for obtaining them, giving you the clarity needed to move forward with confidence. Our goal is to demystify this legal process and empower you to settle your loved one’s affairs successfully.

For smaller estates with a clear line of inheritance, Texas law sometimes allows for a simpler legal tool. You can learn more about how an Affidavit of Heirship works in our detailed article, which explains this alternative probate procedure.

Here’s what we’ll cover in this guide:

- Defining the Document: We'll explain what a Letter of Administration actually is and what legal powers it grants.

- Eligibility: We’ll break down who the court can appoint to manage the estate under the Texas Estates Code.

- Court Procedure: You'll get step-by-step guidance for the Texas court process.

- Administrator Duties: We’ll outline the serious responsibilities you must uphold, including your fiduciary duties.

By the end, you'll have a much better handle on these elements, allowing you to approach the administration process with a sense of control and purpose. It’s all about ensuring your loved one's estate is handled with respect and in full compliance with Texas law.

Understanding the Letter of Administration

So, what exactly is this critical court document? A Letter of Administration of Estate is the official green light from a Texas probate court when someone passes away without leaving a valid will. In legal terms, this is called dying "intestate."

The person appointed to handle the estate acts as its temporary CEO. The Letter of Administration is their official badge of authority, proving they have the court's blessing to take charge. This piece of paper isn't just a formality—it's the key that unlocks real legal power to perform the crucial tasks needed to settle the deceased's affairs.

The Power Granted by a Letter of Administration

Once the court issues this letter, the Administrator can legally step into the shoes of the person who passed away and begin the work of winding up the estate. This authority is absolutely essential for protecting and distributing the estate’s assets according to Texas law.

Key powers include:

- Accessing Financial Accounts: Gaining control over checking, savings, and investment accounts held in the deceased's name.

- Managing Property: Paying mortgages, collecting rent from tenants, and even selling real estate if necessary to pay the estate’s debts.

- Communicating with Creditors: Officially notifying creditors of the death and negotiating the settlement of any valid debts.

- Gathering Assets: Locating and securing all property that belonged to the estate, from vehicles to personal heirlooms, as part of your fiduciary principles.

Without this document, the entire estate is essentially frozen. No one has the legal standing to act, leaving assets vulnerable and bills unpaid.

Letters of Administration vs Letters Testamentary

It is very important not to confuse a Letter of Administration with its counterpart, Letters Testamentary. While both documents grant similar powers, they arise from completely different situations as defined in the Texas Estates Code. Understanding this distinction is the first step in navigating the correct probate journey.

To make this crystal clear, let's look at a simple comparison.

Letters of Administration vs Letters Testamentary in Texas

When a probate court grants someone authority to manage an estate, the type of "letter" issued depends entirely on whether a valid will exists. This table breaks down the key differences.

| Feature | Letters of Administration | Letters Testamentary |

|---|---|---|

| Triggering Event | The person died without a valid will (intestate). | The person left behind a valid will. |

| Appointed Person | An Administrator | An Executor |

| Selection Method | Appointed by the court based on a legal priority list. | Named by the deceased directly in their will. |

| Governing Rules | Distribution of assets must follow Texas intestacy laws. | Distribution of assets must follow the will's instructions. |

Grasping this fundamental difference clarifies the entire legal path forward. The specific document the court provides dictates who is in charge and how the estate’s assets will ultimately be distributed to the rightful heirs. This isn't just legal jargon; it’s the foundation of a lawful and orderly estate settlement.

For a deeper look into how these roles function within the larger court process, you may find practical advice in our guide on the probate process in Texas.

Who Can Serve as an Administrator in Texas

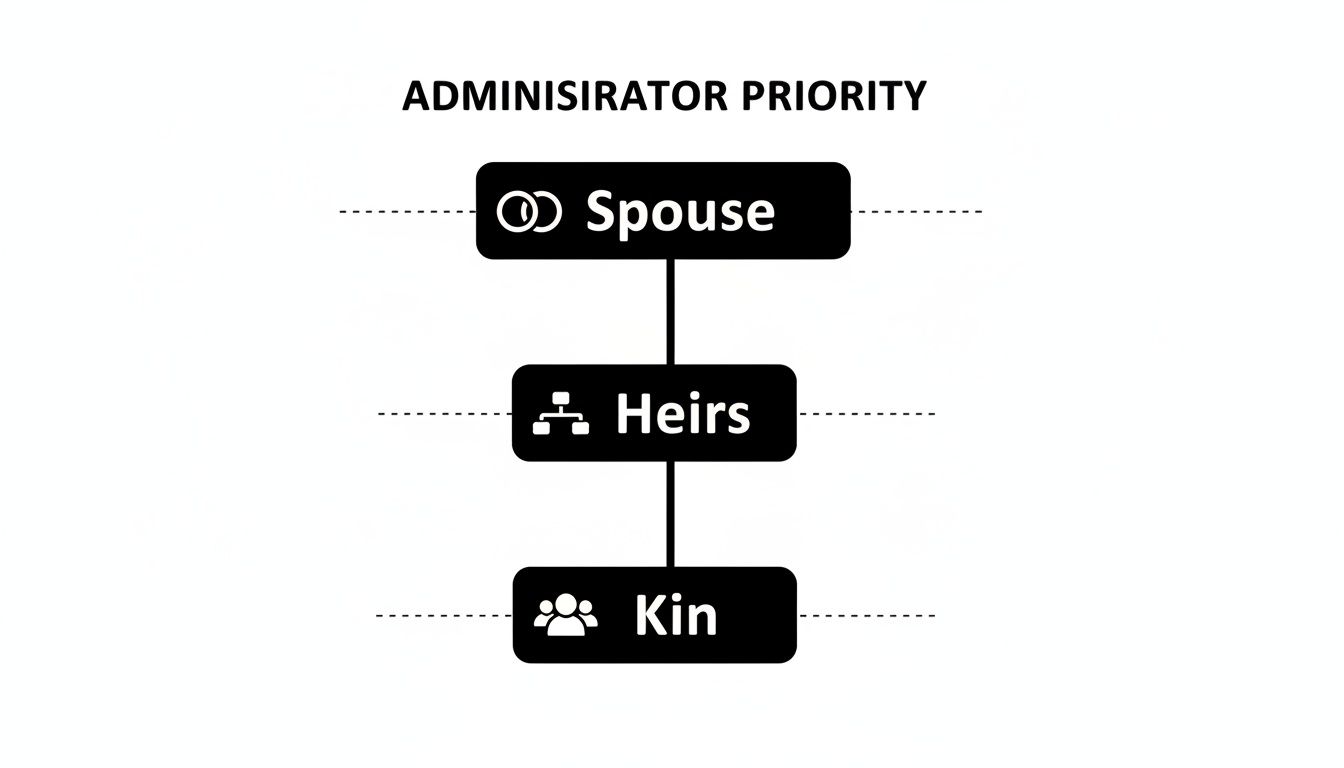

When a loved one passes away without a will, the court must appoint someone to manage the estate. However, this is not a role just anyone can assume. The Texas Estates Code establishes a clear order of priority, creating a list of who has the first right to serve as the Administrator.

The court methodically follows this list, appointing the first person who is both eligible and willing to take on the responsibility. This hierarchy is designed to give the individual with the closest relationship to the deceased the first opportunity to manage their affairs.

The Legal Order of Priority

Texas law sets up a clear, predictable sequence for the court to follow, which helps minimize family disagreements. It is a straightforward system based on the relationship to the person who passed away.

Here is the general order of priority:

- The Surviving Spouse: The deceased’s legal spouse is at the top of the list and has the primary right to serve.

- The Principal Devisee or Legatee: While this term is more common when a will is involved, in an intestate estate (one without a will), it generally refers to the main heir, such as a child.

- Any Other Heir: If the principal heir is unable or unwilling to serve, any other legal heir—such as another child, a parent, or a sibling—is next in line.

- The Next of Kin: This category includes more distant relatives, based on their degree of kinship.

- A Creditor: If no family members are available, a person or company the deceased owed money to can apply. This ensures that the estate’s debts are properly handled.

- Any Other Qualified Person: In the rare event that no one else steps forward, the court has the discretion to appoint another suitable and willing individual.

Disqualifications That Prevent Someone from Serving

Just because someone is high on the priority list does not guarantee their appointment. The Texas Estates Code also outlines specific disqualifications to protect the estate's assets and ensure a fair process for all heirs.

A person cannot serve as an administrator if they are:

- Incapacitated: An individual who has been legally declared incompetent cannot manage an estate.

- A Convicted Felon: A felony conviction is a major barrier unless the person has been pardoned or had their civil rights fully restored.

- A Non-Resident of Texas Without a Resident Agent: Living out of state is not an automatic disqualification, but you must appoint a resident agent in Texas who can accept legal notices on your behalf.

- A Corporation Not Authorized to Act as a Fiduciary: Only specific financial institutions with the proper authority can fill this role.

- Someone with a Conflict of Interest: The court can deny an appointment if it finds someone "unsuitable" due to a conflict that would prevent them from acting in the estate's best interest.

Choosing the right person goes beyond legal eligibility. The best Administrator is organized, trustworthy, and an excellent communicator. They hold a significant fiduciary duty to every heir, a legal responsibility that demands transparency and diligence to prevent family disputes and legal complications. For more information, you can read our article comparing the roles of an administrator vs. an executor in Texas.

The Step-by-Step Process to Get a Letter of Administration

Obtaining a letter of administration of estate is not an overnight task. It is the result of a structured court process designed to ensure everything is handled fairly and legally. While it may sound intimidating, the process follows a predictable path.

Think of this section as your step-by-step guidance. We've broken down the entire journey into clear, sequential steps to demystify the legal proceedings here in Texas. With this guide, what feels like a legal mountain becomes a series of manageable hills to climb.

Filing the Application with the Court

Your journey begins by filing a formal document with the appropriate probate court, usually in the county where the deceased lived. This document is typically called an Application to Determine Heirship and for Letters of Administration.

This application is a crucial legal petition that provides the court with essential facts: the date of death, the last place of residence, and a list of all known legal heirs, including their names, ages, and addresses. Most importantly, it formally requests that the judge appoint a specific person as the Administrator.

When deciding who to appoint, the court follows a legal hierarchy.

As you can see, the law places the surviving spouse first in line, followed by other heirs. This ensures that the people closest to the deceased have the first opportunity to manage the estate.

The Attorney Ad Litem and Protecting Heirs

Once the application is filed, the court’s primary concern becomes protecting the interests of every potential heir. This is especially true for heirs who may be unknown or unable to represent themselves, like minors. To address this, the court appoints a neutral, third-party attorney called an Attorney Ad Litem.

This attorney’s sole responsibility is to conduct an independent investigation to find and verify every legal heir. They will review evidence, interview family members, and sometimes perform genealogical research. They then file a report with the court, confirming who the rightful heirs are under Texas law so that no one is overlooked.

The Court Hearing and Judicial Decision

After the Attorney Ad Litem has completed their investigation and filed their report, the court schedules a formal hearing. This is where all the information is presented to the judge. The person applying to be the Administrator will provide testimony, confirming the facts stated in the application.

Based on the evidence presented, the judge will make two critical decisions:

- Determination of Heirship: The judge signs an official order that legally identifies all of the deceased person’s heirs.

- Appointment of Administrator: The judge will also formally appoint the applicant as the Administrator of the estate, provided they are qualified and there are no objections.

Many people are unfamiliar with the probate bond. At the hearing, the judge will set the amount for this bond, which is essentially an insurance policy the Administrator must purchase. It protects the estate's assets from any mistakes or misconduct, providing a financial safety net for the heirs and creditors.

Taking the Oath and Securing the Bond

The judge's decision in court is not the final step. Before receiving the official letter of administration of estate, the newly appointed Administrator must complete two final tasks. First, they must purchase the probate bond for the exact amount ordered by the judge.

Second, they must take a sworn Oath of Administrator. This is a formal, solemn promise to faithfully carry out all the duties required by Texas law and to always act in the estate's best interest. It’s a serious commitment to their responsibilities.

Once the bond is filed with the court and the oath is signed, the county clerk will issue the official Letters of Administration—the physical documents that serve as the Administrator's proof of authority to act for the estate.

When the court provides you with the letter of administration of estate, it's a significant step forward, but it is also the beginning of your duties. This document officially makes you a fiduciary, meaning you are legally and ethically bound to act solely in the best interests of the estate and its heirs.

This is not a title to be taken lightly. It is a serious legal role with responsibilities defined in the Texas Estates Code. You are held to a high standard, and understanding these duties is the best way to protect yourself from personal liability and ensure a smooth process for everyone involved.

Think of it this way: you have been named the temporary guardian of your loved one's financial legacy. Every decision, from paying a bill to selling a vehicle, must be made for the benefit of the heirs, not for your own convenience or gain.

Your Core Responsibilities Under Texas Law

As the Administrator, you are legally required to handle several key tasks with complete diligence and transparency. These duties are the foundation of your role and demand careful attention.

Here are your primary responsibilities:

- Gather and Inventory All Assets: Your first task is to find, secure, and list everything the estate owns. This detailed document, called an "Inventory, Appraisement, and List of Claims," must be filed with the court, typically within 90 days of your appointment.

- Notify Creditors: You must publish a notice in a local newspaper to inform potential creditors of the death. This starts the clock for them to file a claim against the estate.

- Settle Debts and Taxes: Using the estate's funds, you will pay all valid debts, handle the final income taxes, and cover any estate taxes that may be due. This must be done before any assets are distributed to the heirs.

- Manage and Protect Estate Property: You are responsible for prudently managing all assets. This could mean keeping up with mortgage payments on a house, overseeing investment accounts, or ensuring a vehicle is safely stored until it is sold or distributed.

Your role is essential, especially considering that studies show only about 32%–35% of American adults have a will. This means a significant number of estates fall into intestacy, requiring court involvement. Banks and financial institutions almost always require these court-issued letters to release 50% to 90% of a typical estate's liquid assets, making you the indispensable key to unlocking them. You can find more on the importance of these records by reviewing U.S. probate records information on familysearch.org.

Avoiding Common Pitfalls and Personal Liability

The concept of fiduciary duties in Texas is serious. If you breach these duties, even unintentionally, the consequences can be severe. You could even be held personally liable for any financial damage to the estate.

A common and dangerous mistake is commingling funds—mixing your personal money with the estate's money. This is strictly prohibited. You must open a dedicated bank account for the estate and conduct all transactions through it. For example, using estate funds for personal expenses is a direct violation of your duty.

Another pitfall is playing favorites. For instance, if you and your sibling are the only heirs, you cannot simply give yourself a valuable family heirloom without accounting for its value and ensuring your sibling receives their fair share from the total estate. By law, all heirs must be treated equitably.

Key Takeaway: As an Administrator, your actions must always be guided by loyalty and good faith. Document every transaction, maintain transparency, and ensure every decision can be justified as being in the best interest of the entire estate. You work for the estate, first and foremost.

Common Challenges and How a Probate Attorney Can Help

Obtaining a letter of administration of estate and settling a loved one's affairs isn’t always a simple process. Often, families encounter legal and emotional challenges that can halt progress and create tension during an already difficult time.

Understanding these potential roadblocks is half the battle. Navigating the complexities of the Texas Estates Code requires more than just good intentions—it demands a solid strategy. From family disagreements to valuing complex assets, the challenges can feel overwhelming, but they are manageable with the right professional in your corner. An experienced probate attorney can act as your guide, preventing minor issues from escalating into costly, prolonged legal battles.

Navigating Heirship and Family Disagreements

One of the most common hurdles arises when family members cannot agree on who should serve as the Administrator. While the law provides a priority list, it doesn't prevent siblings from disagreeing, with each believing they are the best person for the role. This can easily lead to a contested court hearing, delaying the entire process.

Another significant challenge is identifying all legal heirs. For example, if a loved one had children from a previous marriage or distant relatives who have lost contact, the process becomes more complex. The court-appointed Attorney Ad Litem must conduct a thorough search. This investigation can be time-consuming and complicated, especially with incomplete family records, pushing back the timeline for closing the estate.

Tackling Complex Assets and Deadlines

Not all assets are as straightforward as a bank account. What if the estate includes a family business, mineral rights, or a valuable art collection? Accurately valuing these unique assets for the court's official inventory requires specialized expertise. An incorrect valuation could lead to disputes with other heirs or issues with creditors.

Furthermore, the probate process involves strict deadlines. For example, once appointed, the Administrator typically has only 90 days to file the detailed "Inventory, Appraisement, and List of Claims." Missing this or any other critical deadline can result in court sanctions or even removal as Administrator, adding another layer of stress and expense.

A skilled probate attorney is more than just a legal advisor; they are a problem-solver and mediator. A Texas trust administration lawyer can help negotiate agreements between family members, assist in locating hard-to-find heirs, and connect you with qualified appraisers for complex assets, ensuring everything is handled correctly and efficiently.

Bringing a Texas estate planning attorney on board is an investment in your peace of mind. Their guidance can help shield you from personal liability, ensure you fulfill your fiduciary duties, and turn a stressful ordeal into a well-managed process. By addressing these common challenges proactively, you can protect the estate, honor your loved one's memory, and preserve family harmony. This type of legal support is also invaluable for asset protection and guardianship matters.

Untangling the Mysteries: Your Top Questions About Texas Letters of Administration

When you're navigating the probate process, it’s natural for questions to arise. This section provides clear, straightforward answers to common concerns families have about a letter of administration of estate in Texas.

How Long Does It Take to Get a Letter of Administration?

It's one of the first questions on everyone's mind. Generally, you can expect the process of obtaining a Letter of Administration in Texas to take between two and four months. However, this timeline is not guaranteed.

Several factors can cause delays:

- A Complicated Family Tree: If identifying all legal heirs is difficult, the Attorney Ad Litem will need more time for their investigation.

- The Court's Schedule: The probate court's caseload and schedule can directly affect how soon you can get a hearing.

- Family Disputes: When heirs cannot agree on who should be the administrator, contested hearings can cause significant delays.

What Will This Cost?

There is no single price tag, as the final cost depends on the complexity of the estate. Key expenses include court filing fees, payment for the court-appointed Attorney Ad Litem, the cost of a probate bond, and any legal fees. A straightforward case will always be less expensive than one involving disputes or complex assets.

Can I Handle This Myself Without a Lawyer?

While it is technically possible in the simplest of cases, it is strongly discouraged. The risks are simply too high.

Mistakes in identifying heirs, missing critical legal deadlines, or mismanaging assets can leave you personally liable for any financial losses. Hiring an experienced probate attorney is not just about convenience; it is about protecting yourself from costly errors and ensuring everything is done correctly.

What Happens if Nobody Steps Up to Be the Administrator?

If no one applies, the estate essentially enters a state of limbo. All assets are frozen and inaccessible.

This means debts can accumulate, property may fall into disrepair, and bank accounts cannot be touched. Eventually, a creditor will likely take legal action to initiate the administration of the estate to get paid, which often makes an already difficult situation more complicated for the family.

If you’re managing an estate or planning for your own future, you don’t have to do it alone. Contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.