Managing a loved one's estate after they pass can feel overwhelming, but with the right legal guidance, it doesn’t have to be. The first step in this journey is securing a court order called Letters of Testamentary or Letters of Administration.

Think of these documents as your official, court-approved key to the estate. They grant you the legal authority to act on behalf of your loved one—allowing you to access bank accounts, manage property, and settle debts with the full backing of Texas law. This guide will explain these critical documents and provide step-by-step guidance to help you navigate your responsibilities with confidence and compassion.

Your First Steps in Navigating a Texas Estate

After a loved one passes, the duty of settling their affairs often falls to a family member. It is a process that involves both legal procedure and emotional endurance, but you don't have to walk this path alone. With clear, compassionate guidance, you can fulfill your duties and ensure your loved one's final wishes are honored.

Your journey begins at the Texas probate court. This is the legal system that oversees how a person's property is distributed after death, following the rules outlined in the Texas Estates Code. Your primary objective is to obtain the official document proving you are the person in charge.

Beginning the Process with Confidence

Before you can apply to the court, you must have your paperwork in order. The most crucial document is the official death certificate. For a deeper understanding of this document, it’s helpful to review the details on understanding the Texas death certificate and its importance. You will need it for nearly every step of the process.

Once the death certificate is in hand, you can begin preparing your application for the court. This guide will walk you through what comes next, helping you understand the difference between Letters of Testamentary and Letters of Administration, what is required to obtain them, and how to use them effectively.

The probate process is not meant to be a trap; it is designed to provide an orderly and fair conclusion to an estate. As an executor or administrator, your role is that of a fiduciary—a person legally obligated to act in the best interests of the estate and its beneficiaries.

Our goal is to demystify this process, providing a clear roadmap so you can manage your responsibilities with knowledge and peace of mind. Whether you need assistance with the initial court filing, are facing complex family dynamics, or simply want to ensure you are following the law, professional legal guidance can make all the difference.

What Are Letters of Testamentary and Letters of Administration?

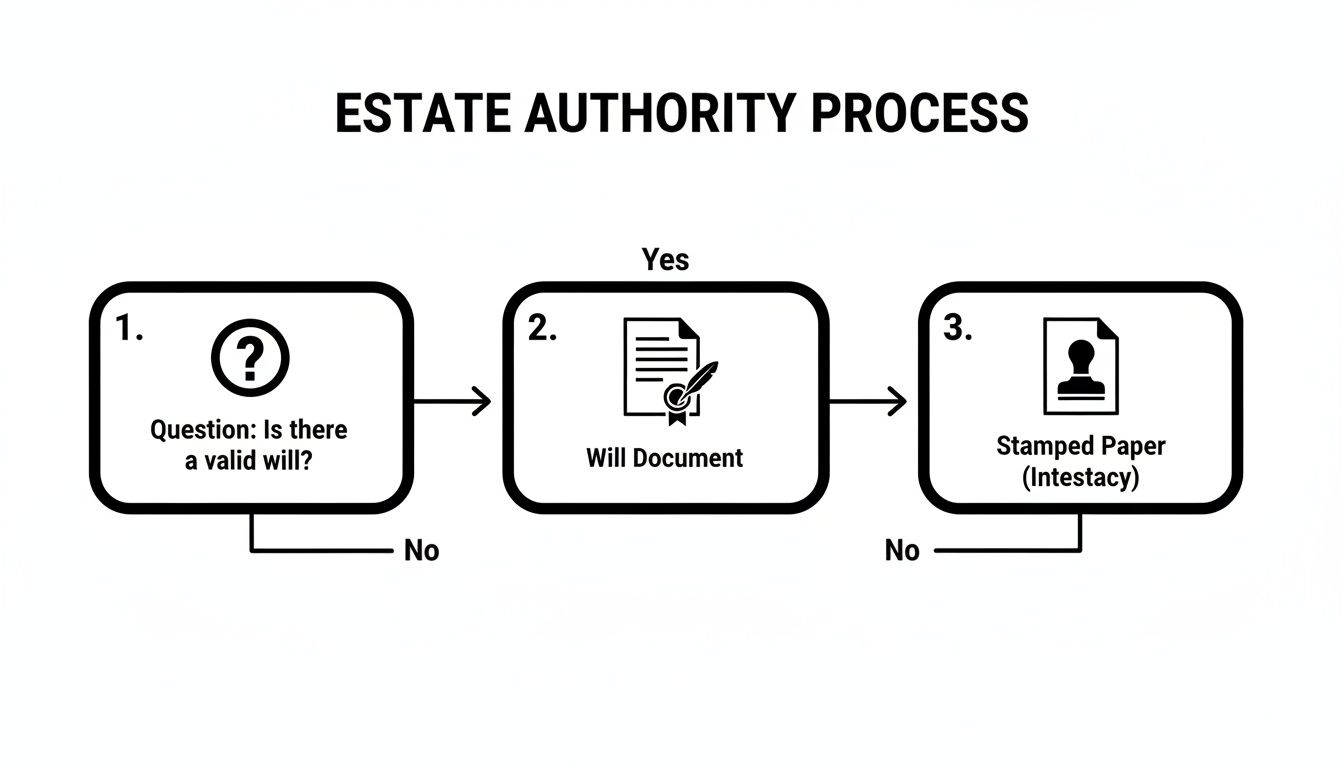

Imagine a loved one’s estate as a locked room containing their assets, debts, and final responsibilities. To enter this room and manage everything inside, you need a key. In Texas, the probate court grants this key in one of two forms. The one you receive depends on a single, critical question: did the deceased leave a valid will?

Letters of Testamentary are issued when the deceased had a will that named someone to be in charge—the Executor. This document is the court’s official confirmation, granting the Executor the legal power to act. It is the formal proof they will show to banks, financial institutions, and creditors to demonstrate they are authorized to manage the estate according to the will's instructions.

On the other hand, the court issues Letters of Administration when there is no will. This is known as dying “intestate.” These letters may also be necessary if a will exists but fails to name an executor, or if the named person is unable or unwilling to serve. In such cases, the court appoints an Administrator to manage the estate, not based on a will, but according to the default inheritance rules set by Texas law.

For a more detailed comparison of these roles, you can explore the key differences between an administrator vs. an executor in Texas.

The Core Distinction: Will vs. No Will

The existence of a valid will is the most important factor. A will serves as your loved one’s final instruction manual, and the probate court's primary duty is to ensure those instructions are followed.

- Example Scenario: Sarah’s mother passed away, leaving a will that named Sarah as the executor. After the court validates the will, it will issue Sarah Letters of Testamentary, empowering her to distribute her mother’s assets to the beneficiaries named in the will.

- Example Scenario: In contrast, if Sarah’s mother had died without a will, the court would need to appoint an Administrator. As the surviving daughter, Sarah could apply for this role. If appointed, she would receive Letters of Administration and would be required to distribute her mother's property according to Texas intestacy laws, which might differ from her mother’s unwritten wishes.

Letters of Testamentary vs. Letters of Administration at a Glance

While both documents grant the authority to manage an estate, the process for obtaining them—and the source of that authority—is quite different. Understanding this from the start will help set clear expectations for the process ahead.

This table breaks down the core differences to help you quickly identify which path applies to your situation.

| Factor | Letters of Testamentary | Letters of Administration |

|---|---|---|

| Triggering Event | The person died with a valid will. | The person died without a will (intestate). |

| Appointed Person | An Executor, named in the will. | An Administrator, appointed by the court. |

| Source of Authority | The decedent's wishes, as stated in the will. | Texas state law (intestate succession rules). |

| Primary Goal | To carry out the specific instructions in the will. | To distribute assets according to state law. |

At its core, both sets of letters serve the same purpose: to empower one person with the legal authority to act on behalf of the deceased. The difference lies in where that authority originates—from the decedent's will or from the court's decision.

This distinction is not merely a technicality; it influences every step of the probate process, from determining who inherits property to how debts are paid. Grasping this fundamental difference is the first step toward confidently navigating your duties.

How to Get Your Letters Through the Texas Probate Process

Obtaining official letters of testamentary or administration is not an immediate event. It is a structured court process, governed by the Texas Estates Code, designed to be methodical and transparent. While it may seem like a complex legal maze, we will break it down into a manageable, step-by-step path.

The process begins when you or your attorney file an application for probate in the appropriate Texas county court—typically the county where the deceased resided. This application is a formal request for the court to either validate the will or, if none exists, to appoint an administrator.

Once the application is filed, a mandatory waiting period begins. Texas law requires the application to be publicly posted for at least 10 days before a hearing can take place. This step, known as "posting citation," serves as a public notice, giving anyone with an interest in the estate (such as creditors or other potential heirs) an opportunity to come forward.

The Court Hearing and Taking Your Oath

After the waiting period, the court will schedule a hearing. This is a significant milestone in the process. You will appear before a probate judge, usually with your attorney, to provide testimony and confirm the facts stated in your application.

- If a will exists: Your primary task is to prove the will is valid. This often involves testimony from one of the original witnesses to the will, although the Texas Estates Code provides alternative methods of proof.

- If there is no will: The court will conduct an "heirship proceeding" to formally determine the legal heirs according to Texas law. In these cases, the court often appoints an independent attorney, known as an attorney ad litem, to protect the interests of any unknown or unrepresented heirs.

Once the judge is satisfied with the evidence, they will sign an order. This order grants you authority, either by admitting the will to probate or by legally declaring the heirs. However, you are not finished yet. Before the court clerk can issue your letters, you must complete two final steps.

First, you must sign and file an Oath of Executor or Administrator. This is a sworn promise to the court that you will faithfully perform all the duties required by law. It is your formal pledge to act as a fiduciary for the estate.

Securing the Estate with a Bond

Next, the court may require you to post a bond, particularly if you are administering an estate without a will. A bond is essentially an insurance policy designed to protect the beneficiaries and creditors from potential mistakes or misconduct on your part as you manage the estate.

The judge determines the bond amount, which is typically based on the estimated value of the estate's assets (excluding real estate). However, a well-drafted will often includes a provision waiving this requirement, which can save the estate significant time and expense. After you have taken the oath and filed any required bond, the court clerk will finally issue your official letters of testamentary or administration.

This flowchart illustrates the key decision point that determines which type of letters you will receive.

As you can see, the presence of a valid will is the fork in the road that directs the entire probate journey.

Key Takeaway: The probate process is a sequence of legally required steps—filing, posting, a hearing, your oath, and sometimes a bond—that all lead to the issuance of your letters. Every step is built to ensure the process is transparent and protects the interests of everyone involved.

Understanding this sequence helps you know what to expect and prepare for what comes next. For a deeper dive into the entire journey, learn more about the probate process in Texas and how to handle each stage. Navigating these court requirements with an experienced Texas trust administration lawyer ensures you remain compliant and avoid costly delays, allowing you to focus on your duties.

Your Powers and Duties as Executor or Administrator

Once the court clerk issues your letters of testamentary or administration, your real work begins. This document is much more than just a piece of paper; it is the legal key that unlocks your authority to manage the estate.

With this power comes a profound legal and ethical responsibility known as a fiduciary duty. This is the highest standard of care recognized under the law. It requires you to manage the estate with unwavering loyalty, acting solely in the best interests of the beneficiaries or heirs. The fiduciary duties in Texas are clearly defined and must be followed meticulously.

Think of it as stepping into the deceased's financial shoes to wrap up their affairs with honor. The Texas Estates Code outlines these responsibilities, which generally fall into a few key categories. Your first major task is to take control of all estate property, from bank accounts and investments to real estate and family heirlooms.

Core Fiduciary Responsibilities in Texas

As a fiduciary, your duties are clearly defined and demand careful attention to detail. Any missteps can lead to personal liability, so it is crucial to understand what the law expects from you from the outset.

Here are the primary tasks you are now authorized—and required—to perform:

- Gather and Inventory Assets: Your job is to locate, secure, and create a comprehensive list of everything the decedent owned. This includes accurately valuing those assets, which involves understanding fair market value (FMV) for tax purposes and ensuring a fair distribution.

- Notify Creditors: Texas law requires you to publish a notice to creditors in a local newspaper. You must also send direct notice to any known secured creditors, such as a mortgage company. This initiates a strict timeline for them to file claims against the estate.

- Pay Valid Debts and Taxes: You will use estate funds to settle all legitimate debts, file the final income tax return, and handle any potential estate taxes. This must be done before any assets are distributed to the beneficiaries.

- Manage Estate Property: Throughout the process, you must protect the estate’s assets. This could involve anything from maintaining a home and paying property taxes to managing investment accounts or even operating a business until it can be sold or passed on to heirs.

Putting Your Authority into Action

Your letters are the official proof of authority that you will present to third parties. For example, you will provide a certified copy to a bank to close the decedent's accounts and open a new estate account. You will also need them to sign a listing agreement with a real estate agent and, ultimately, to sign the deed when selling the decedent’s home.

The concept of holding an executor accountable is not new; it has deep historical roots. In late medieval England, courts began requiring executors to file detailed probate accounts, a practice that became widespread in the late 1500s. By the 1680s, over 450 such accounts were filed annually. However, when a law in 1685 removed this mandatory requirement, the number of surviving records dropped by over 80%. This historical fact underscores why modern laws, like the Texas Estates Code, place such a strong emphasis on fiduciary duties and transparent record-keeping.

A Note on Record-Keeping: Document everything. Every action you take—every dollar spent, every bill paid, every asset sold—must be recorded with precision. These meticulous records are your best defense against future disputes and are essential for the final accounting you will provide to the beneficiaries and the court.

Successfully fulfilling these duties requires a combination of diligence, impartiality, and organization. For a complete overview of what is expected, check out our guide on the duties of an executor of an estate in Texas. A structured approach not only ensures legal compliance but also builds trust and transparency with all parties involved.

Common Challenges and When to Seek Legal Help

While many estate administrations in Texas follow a clear and predictable path, some encounter unexpected roadblocks that can turn a straightforward process into a complex and emotionally draining ordeal.

Recognizing these potential challenges helps you know when a situation requires more than diligence—it demands professional legal assistance. Common issues include disputes among beneficiaries, challenges to the will's validity, or the discovery of significant, unexpected debts that could render the estate insolvent. These are not minor hiccups; they are serious legal events that can jeopardize the entire process if not handled by an expert.

Identifying Red Flags in Estate Administration

Certain situations should immediately prompt you to consult an experienced Texas probate attorney. Attempting to handle these complex issues alone can lead to costly mistakes, personal liability, and lasting damage to family relationships. It is time to seek guidance if you encounter any of the following:

- A Contested Will: If an heir or beneficiary formally challenges the will, alleging issues like undue influence or lack of mental capacity, the probate process becomes a lawsuit. You will need a legal strategy to defend the will in court.

- Family Disputes: Disagreements over asset distribution, the sale of property, or your actions as executor can escalate quickly. An attorney can act as a neutral party to mediate disputes and enforce the terms of the will or state law.

- Complex Assets: Estates that include business interests, large real estate portfolios, or sophisticated investments require specialized knowledge to manage and value correctly.

- Insolvent Estates: If the estate’s debts exceed its assets, you must follow a strict legal priority for paying creditors. Mishandling this process could make you personally liable for unpaid debts.

The Value of Proactive Legal Counsel

Seeking legal help is not a sign of failure; it is a smart, proactive step to protect the estate and yourself. A seasoned Texas estate planning attorney does more than offer advice—they become a strategic buffer between you and contentious parties, ensuring every action you take complies with the Texas Estates Code. This is especially critical in high-value estates where the financial stakes are significant.

History shows that probate has long been a major mechanism for wealth transfer. An analysis of 60 million probate records from 1892 to 1992 revealed that total probated wealth doubled from £5 billion to £10 billion in just the last ten years of that period. This highlights how probate reflects broader economic trends and why proper legal navigation is so important, particularly as estates become more complex. You can learn more about these historical probate insights and wealth distribution findings.

When emotions are running high and legal complexities arise, an attorney’s objective guidance is invaluable. They ensure you meet your fiduciary duties, resolve disputes according to the law, and keep the estate administration moving as smoothly as possible, ultimately preserving your own peace of mind.

Concluding Your Estate Administration Duties

We have walked through the entire process, from understanding your role as an executor or administrator to obtaining your official letters and fulfilling your duties. While it may seem daunting, the Texas probate process, as outlined in the Texas Estates Code, provides a structured map for bringing order to the task of settling a loved one's final affairs.

Think of Letters of Testamentary or Administration as your official authorization from the court. It is the legal document that confirms, "You're in charge now." Grasping this simple fact provides a solid foundation for handling everything that follows. Adhering to the court's rules and acting with honesty and care are the cornerstones of successfully completing this process.

Final Thoughts on Your Fiduciary Role

Serving as an executor or administrator is a significant responsibility. The role demands careful attention to legal deadlines, meticulous record-keeping, and clear communication with everyone involved, from family beneficiaries to creditors. Every decision you make, from inventorying assets to paying final bills, must be guided by one core principle: act in the best interest of the estate. This commitment is how you honor your loved one’s legacy and ensure their assets are protected and distributed correctly.

Remember, the probate system provides the structure, but you bring the integrity and compassion to the process. Your role is vital in bringing closure and order during a difficult time for your family.

Navigating the legal requirements for letters of testamentary or administration while grieving can feel overwhelming. But you do not have to do it alone. The smoothest path is often one guided by sound legal advice from someone experienced in Texas estate law.

If you are managing an estate and need a trusted guide, The Law Office of Bryan Fagan, PLLC is here to help. Our attorneys offer the straightforward, Texas-specific guidance you need for every step. Contact us for a free consultation to ensure you are handling your duties with confidence and peace of mind.

Frequently Asked Questions About Texas Probate Letters

When navigating the Texas probate process, many practical questions arise. We have answered some of the most common ones about obtaining and using letters of testamentary or administration to provide a clearer picture of the path ahead.

How Long Does It Take to Get Letters in Texas?

This is a common question, and the answer is: it depends. The timeline can vary based on the court's caseload and the complexity of the estate.

After you file the application, there is a mandatory 10-day waiting period before the court can hold a hearing. If everything is in order and there are no contests, you might receive your letters within four to eight weeks from the filing date. However, if complications arise, such as a will contest or a dispute over heirship, the process could take several months or even longer.

Can I Act for the Estate Before I Get My Letters?

In short: no. You have no legal authority to act on behalf of the estate until the court officially appoints you and issues the letters.

Attempting to access bank accounts, sell property, or pay debts before you are legally appointed as the executor or administrator can lead to serious legal consequences. You could become personally liable for any mistakes and create significant complications for the probate case. The letters are your official proof of authority to show banks, government agencies, and other entities.

It is often frustrating for families when a bank refuses to speak with them, even if they are named as executor in the will. However, the bank is legally obligated to wait for court-issued letters to protect the estate's assets from unauthorized access.

Do I Always Need an Attorney to Get Probate Letters?

Yes. In Texas, if you are applying to be an executor or administrator, you are required to have an attorney. This is not just a recommendation; it is a legal mandate.

The reason is that you are not just representing yourself. You are acting in a fiduciary capacity, a position of trust, responsible for protecting the interests of beneficiaries and creditors. The court requires that you have legal counsel to ensure you follow the Texas Estates Code precisely. A seasoned Texas estate planning attorney will ensure the paperwork is accurate, represent you in court, and guide you through your duties to prevent accidental liability.

What Happens if I Lose the Original Letters?

Do not worry! This is easily resolved. The court clerk can issue as many certified copies of your letters of testamentary or administration as you need at any time after your appointment. You simply need to visit the clerk's office where the probate was filed, request the copies, and pay a small fee for each one.

It is a good practice to order several certified copies from the beginning, as you will be surprised by how many entities require one. You will likely need to provide them to:

- Banks and financial institutions

- Life insurance companies

- The county clerk's office (for real estate transactions)

- The IRS and the Texas Comptroller's office

Most of these institutions will need to keep an original certified copy for their records, so having multiple copies on hand will save you time and trips to the courthouse.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.