Planning for the future can feel overwhelming, but understanding the key roles in your estate plan is the first step toward peace of mind. You will encounter two critical roles: the Power of Attorney and the Executor. People often confuse them, but the distinction is simple and vital: they operate on completely different timelines.

A Power of Attorney (POA) gives someone the legal authority to act for you while you are alive. An Executor, on the other hand, is the person who steps in to manage and settle your estate after you have passed away. Think of it as a relay race—the POA agent runs the first leg of the race during your lifetime, and the Executor takes the baton for the final lap after you're gone. These roles never overlap, but both are absolutely essential for a comprehensive Texas estate plan.

Defining the Key Roles in Your Estate Plan

Navigating legal terminology can be challenging, but grasping these two roles is essential to creating a plan that truly protects you and your family. In Texas, both the person you name in a Power of Attorney (your "agent") and your Executor are considered fiduciaries. This is a legal term defined by the Texas Estates Code, meaning they have a legal and ethical duty to act solely in your best interest. The primary difference between them is when their duties begin and end.

Core Functions at a Glance

To provide clarity, let's break down exactly what each person does and when. This simple chart lays out their distinct—yet equally vital—responsibilities within your estate plan.

| Attribute | Power of Attorney (Agent) | Executor of a Will |

|---|---|---|

| When Effective | During your lifetime, often upon incapacity. | Only after your death and probate court approval. |

| Source of Authority | A legal document you sign while competent. | Your Last Will and Testament, validated by a court. |

| Primary Goal | To manage your financial or healthcare affairs if you cannot. | To settle your estate and distribute assets to beneficiaries. |

| Authority Ends | Automatically and immediately upon your death. | When the estate administration is complete and closed. |

Why Both Roles Are Essential for Texans

A common misconception in Texas is that having a will is sufficient for a complete estate plan. However, a will has zero power until after you die and a judge validates it in probate court. This creates a significant potential vulnerability: who will manage your affairs if you become ill or incapacitated and are unable to make decisions for yourself?

This is precisely where a Power of Attorney becomes indispensable. By naming an agent, you decide who can pay your mortgage, manage your investments, or communicate with doctors on your behalf. Without a POA, your family could be forced into a costly, public, and stressful guardianship proceeding simply to gain the authority to help you. You can explore why a Power of Attorney is essential when planning for incapacity in our detailed guide.

In Texas, a comprehensive estate plan protects you during two distinct phases: while you are living but may need assistance, and after you have passed away. A Power of Attorney covers the first phase, and a Will appoints an Executor for the second.

Understanding this fundamental difference is the key to creating a seamless plan with no gaps. It ensures a smooth transition of authority, provides clear instructions for your loved ones, and protects your assets at every stage.

Power of Attorney vs. Executor: A Detailed Takedown

While people often group them together, a Power of Attorney (POA) and an Executor operate on entirely separate timelines with fundamentally different responsibilities. Getting this distinction right is the bedrock of a solid Texas estate plan.

When Does the Clock Start and Stop?

The most significant difference is when each person has authority. One is a lifetime document; the other is strictly for after-death matters.

- Power of Attorney (Agent): An agent’s authority is active while you, the "principal," are still living. You can structure it to be effective immediately upon signing, or you can create a "springing" POA that takes effect upon a specific trigger, such as a doctor certifying your incapacity. However, the rule is absolute: all authority granted under a POA ends instantly and automatically the moment you pass away.

- Executor of a Will: An Executor’s authority only begins after your death. Even if you named your daughter as Executor in your will years ago, she has no power to act until you pass away and a Texas probate court officially validates the will and appoints her. Her duties conclude only when your estate is fully settled and all assets have been distributed to your beneficiaries.

A common misconception is that a POA agent can alter a will. This is a legal impossibility. An agent's power is strictly for managing your affairs during your lifetime and vanishes completely upon death.

Where Does Their Power Come From?

The legal source of authority defines what each role can and cannot do. A POA is a private directive you create, while an Executor receives their authority from a judge, guided by your will.

A POA is created when a competent individual (the principal) signs a notarized document granting an agent specific powers. This is a private arrangement. Conversely, an Executor, though nominated by you in your will, only receives legal authority through a formal court probate process after your death. There is no overlap. The POA's authority terminates with you, a principle upheld in 95% of jurisdictions.

This clear distinction ensures a clean handoff from the person managing your lifetime affairs to the person settling your final estate. While 80% of POAs successfully help families avoid costly and public conservatorships, an Executor's duty is to follow the will precisely under court supervision. You can learn more about the legal distinctions between POA and Executor to see how these roles are structured by law.

A Real-World Texas Scenario

Let’s consider Sarah, a Houston resident with a well-drafted estate plan.

- During Her Lifetime: Sarah suffers a stroke and can no longer manage her finances. Her son, David, is her agent under a Durable Power of Attorney. He immediately steps in to pay her medical bills from her bank account, manage her investments, and handle her healthcare decisions. David is acting as her fiduciary, making choices for her benefit while she is alive.

- After She Passes: The moment Sarah passes away, David’s authority under the POA ceases. He can no longer write checks from her account or access her property. Sarah’s will names her daughter, Emily, as Executor. Emily must now take the will to the Harris County probate court. Only after a judge validates the will and officially appoints Emily as Executor can she legally gather Sarah's assets, pay final debts, and distribute the inheritance as the will directs.

This example perfectly illustrates the sequential nature of these roles. David’s job ends precisely where Emily’s begins.

Key Differences Power of Attorney vs Executor

Sometimes, a side-by-side comparison provides the most clarity. This table offers a straightforward, at-a-glance look at the fundamental differences between a Power of Attorney and an Executor in Texas.

| Attribute | Power of Attorney (Agent) | Executor of a Will |

|---|---|---|

| Effective Timeline | During the principal's lifetime only. | Begins only after the principal's death. |

| Source of Authority | The Power of Attorney document, signed by the principal. | The Last Will and Testament, confirmed by a probate court order. |

| Governing Law in Texas | Texas Estates Code, specifically chapters on Durable Powers of Attorney. | Texas Estates Code, primarily chapters related to probate and estate administration. |

| Primary Responsibility | To manage the principal's financial and/or healthcare decisions as specified. | To marshal estate assets, pay debts, and distribute property to beneficiaries. |

| Termination of Authority | Authority ceases automatically upon the principal's death. | Authority ends when the estate is fully settled and closed by the court. |

Understanding these distinctions is crucial for effective estate planning and is the best way to prevent the legal headaches and family conflicts that arise from misunderstanding these roles.

Understanding When Each Role Is Active

One of the most common points of confusion in estate planning is the timeline—when does each person's authority actually start and stop? The difference between a power of attorney and an executor is almost entirely defined by this timeline. A clear understanding is essential for a seamless plan that doesn't leave you or your assets unprotected.

A Power of Attorney (POA) is a lifetime document. Its authority can begin in a couple of ways. It can be effective the moment you sign it, or it can be a "springing" POA that only activates after a specific event, such as a doctor certifying in writing that you are incapacitated and unable to manage your own affairs.

But the end point is absolute and non-negotiable under Texas law. All authority granted to an agent under a Power of Attorney terminates instantly and automatically the moment the principal dies. There are no exceptions.

The Executor’s Authority Begins After Death

Conversely, an Executor's authority does not exist while you are alive. You could name your most trusted child as Executor in your will for decades, but they have zero legal power to act on your behalf while you are living.

An Executor's role only begins after two things have occurred:

- The person who wrote the will (the testator) has passed away.

- A Texas probate court has officially admitted the will to probate and issued Letters Testamentary—the legal document that grants the Executor their power.

Without that court order, the person named in the will is merely a nominated Executor, not an appointed one, and has no legal right to access or manage estate assets.

A Real-World Texas Scenario: The Handoff of Authority

Consider this common situation: David holds a Durable Power of Attorney for his elderly mother, Sarah, who lives in The Woodlands. For two years, he has used it to pay her nursing home bills, manage her investments, and handle medical paperwork because she can no longer do so herself.

One Tuesday, David is her legal agent, acting with full authority. On Wednesday morning, Sarah passes away peacefully. At that exact moment, David's power of attorney becomes null and void. He can no longer legally access her bank accounts, pay her final bills, or manage her property.

Sarah's will names her daughter, Emily, as Executor. Emily must now take the will to the Montgomery County probate court. Only after a judge validates the will and appoints Emily can she gain control of Sarah’s estate, a process that can take several weeks. This scenario illustrates the clean, sequential handoff from one role to the next.

A Power of Attorney operates during the final chapter of a person's life, while the Executor's role is to write the epilogue. The two roles never share the stage, ensuring a clear separation between lifetime management and posthumous estate settlement.

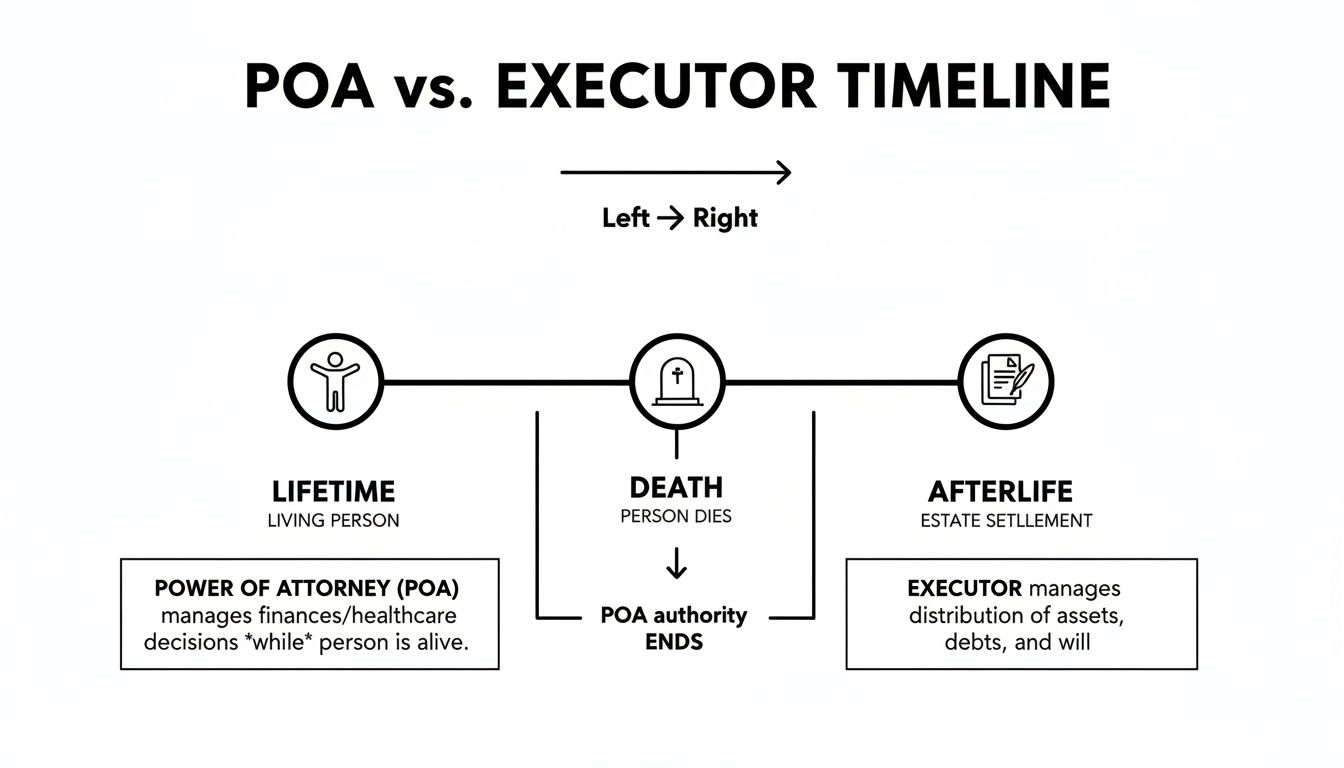

This infographic helps visualize the distinct and non-overlapping timelines for a Power of Attorney and an Executor.

As the visual clarifies, the POA's authority is strictly for the principal's lifetime. It ends at death, which is precisely when the Executor's journey through probate begins.

This separation of duties is a cornerstone of American probate law. An agent with a POA handles financial and healthcare decisions during life, often when someone is incapacitated. An executor’s role only activates after death to settle the estate according to the will. This design prevents any overlap, ensuring that the person managing living affairs and the person settling the estate have distinct legal authority. You can learn more about this foundational legal distinction and its historical roots. Understanding this timeline is fundamental to both asset protection and proper estate administration.

Scope of Authority and Fiduciary Duties in Texas

A fiduciary duty is the highest standard of care under Texas law, binding both a Power of Attorney agent and an Executor. It requires them to act with absolute loyalty, always placing the interests of the person they serve above their own. This is a core principle of the Texas Estates Code.

However, the scope of their authority—what they are legally permitted to do—is entirely different. The agent's authority is defined by the Power of Attorney document you create. The Executor's authority is defined by your will and granted by a Texas probate court.

Authority of an Agent Under a Power of Attorney

An agent's power flows directly from you, the principal, and is detailed in the Durable Power of Attorney document. Under the Texas Estates Code, you can grant your agent broad authority or very specific, limited powers.

These powers are focused on managing your affairs while you are alive and may include the ability to:

- Handle daily banking, such as paying bills and making deposits.

- Buy or sell real estate on your behalf.

- Manage your investment portfolio and retirement accounts.

- File tax returns and communicate with the IRS.

- Make healthcare decisions (if a Medical Power of Attorney is also in place).

The core purpose is lifetime management. Every action an agent takes must be for your benefit while you are living.

Authority of an Executor Under a Will

An Executor's authority begins only after you have passed away. Their role, governed by the Texas Estates Code, is exclusively focused on the post-death administration of your estate. Once officially appointed by a probate court, their job is not to manage your life but to respectfully close it out according to your wishes.

An Executor's primary duties include:

- Locating and creating an inventory of all estate assets.

- Notifying creditors and paying all valid debts and final taxes.

- Managing estate property, which may include maintaining or selling a home.

- Distributing the remaining assets to the beneficiaries named in your will.

An Executor’s power is laser-focused on settling the estate as directed by your final wishes. For a deeper look into their responsibilities, you can learn more about what an executor does in Texas in our detailed guide.

Here is the critical difference: A POA agent acts to preserve the principal's financial well-being during their lifetime. An Executor acts to carry out the deceased person's final wishes and legally conclude their estate for the beneficiaries.

Practical Scenarios Clarifying the Boundaries

Let's apply this to a real-world context. Imagine Robert, a homeowner in Dallas.

Scenario 1: The Power of Attorney in Action

Robert has a stroke and becomes incapacitated. His agent, acting under a Durable Power of Attorney, determines that Robert needs to move into a nursing facility. To fund this expensive care, the agent sells Robert's Dallas home. The proceeds are used to cover Robert's medical bills and living expenses. This is a perfectly legal and appropriate action because it serves Robert's best interests while he is alive.

Scenario 2: The Executor in Action

Now, assume Robert passes away. The same Dallas home is now part of his estate, and his will names his daughter as Executor. Her authority to sell the house is now tied to the will and the needs of the estate. If the will directs her to "sell the house and divide the proceeds among my children," that is what she must do. Alternatively, if the estate has significant debts, she may need to sell the home to pay creditors before the children receive their inheritance. Her decisions are guided by the will and her fiduciary duty to the estate, not Robert's personal needs.

This comparison highlights how the "why" behind an action defines everything in the power of attorney vs. executor debate. Both roles are essential components of a complete estate plan, but they operate in different timelines under separate legal frameworks to protect you and your legacy.

How to Choose the Right Person for Each Role

Selecting the person who will act as your agent under a Power of Attorney and the one who will serve as the Executor of your will are two of the most significant decisions in your estate plan. These choices are not just names on a document; they determine who will manage your life and legacy when you cannot. The goal is to choose with confidence, knowing your affairs will be in capable and trustworthy hands.

This means looking beyond emotional ties and focusing on who is genuinely best suited for the specific, and often demanding, duties each role requires.

Essential Qualities for Your Agent and Executor

While their responsibilities differ, the ideal candidates share core traits. Your fiduciaries need the right combination of integrity, skill, and temperament to handle their duties effectively under the Texas Estates Code.

Look for someone who demonstrates:

- Absolute Trustworthiness: This is non-negotiable. Both your agent and executor will have significant control over your finances. You must have complete faith in their honesty and integrity.

- Strong Organizational Skills: An executor, in particular, must navigate extensive paperwork, court deadlines, and communication with beneficiaries. An agent must also keep meticulous records of all financial transactions made on your behalf.

- Financial Competence: They do not need to be a financial expert, but they should be responsible with their own finances and capable of managing budgets, paying bills, and making sensible financial decisions.

- Impartiality and Good Judgment: This is crucial, especially in complex family situations. You need someone who can remain neutral, communicate clearly, and make difficult decisions without being influenced by emotions or family conflicts.

Should You Name the Same Person for Both Roles?

It is quite common—and often practical—to appoint the same person for both roles. Naming a spouse or a trusted child as both your agent and executor can create a seamless transition, as they will already be familiar with your financial situation.

However, there are also compelling reasons to choose different people. The required skill sets can vary. For example, an agent under a healthcare power of attorney needs empathy and the strength to advocate in a medical setting, while an executor needs a more administrative and financial mindset.

Choosing different people can also be a strategic move to balance workloads and play to individual strengths. A child who lives nearby might be the perfect agent for handling local banking issues, while a more detail-oriented child living across the country could be the ideal Executor.

Before making a final decision, consider these factors:

- Geographic Proximity: How practical is it for your chosen person to handle hands-on tasks? An agent may need to meet with local bankers, and an executor might need to manage property here in Texas.

- Willingness to Serve: This is not a role to be assigned without discussion. Have a frank conversation with your potential candidates. Ensure they understand the responsibilities and are genuinely willing and able to take them on.

- Potential for Conflict: If you have multiple children, selecting one over the others could cause tension. Sometimes, naming a neutral third party, like a professional fiduciary or corporate trustee, is the wisest choice to maintain family harmony.

Ultimately, your decision should prioritize the effective management of your affairs and the peaceful execution of your final wishes. For more guidance, our firm provides strategies for choosing the ideal Executor to help you make a truly informed choice.

Putting It All Together for a Bulletproof Estate Plan

Now that we have clarified the differences between a power of attorney and an executor, you can see how they function together. These roles are not an "either/or" choice. They are two essential pillars that support your complete Texas estate plan, working in sequence to protect you and your legacy at different stages.

A will, by itself, does nothing for you while you are alive. If you become incapacitated without a durable power of attorney, your family could face a costly and public guardianship proceeding. Conversely, a power of attorney is instantly void upon death, leaving your final wishes unprotected without a valid will and an executor ready to act.

From Understanding to Action

The goal is to move from learning to action. A complete plan leaves no gaps where your family might be left vulnerable or uncertain. This means having both documents professionally drafted, signed, and stored safely, each carefully tailored to your specific wishes.

A solid estate plan is a shield for your family. The power of attorney protects them from the stress of guardianship while you’re alive, and the will protects them from the chaos of intestacy after you’re gone.

Creating these documents is not a one-size-fits-all process. Your unique family situation, the assets you own, and your personal goals all influence how your plan should be structured. This is where professional legal guidance from a Texas estate planning attorney is invaluable. You need an expert who can customize these documents to your life, ensuring every wish is legally sound and fully protected.

If you’re ready to put your plan in order, or if you are managing an estate and need guidance, The Law Office of Bryan Fagan, PLLC is here to help.

Answering Your Top Questions

As you delve into estate planning, specific questions will naturally arise. Here are some of the most common inquiries we receive from Texans seeking clarity on the Power of Attorney vs. Executor roles.

Can I Name the Same Person as My Agent and Executor?

Yes, and it is a very common practice in Texas. Naming a trusted spouse, child, or friend for both roles can create a smoother transition, as they will already be familiar with your finances and wishes.

However, it is critical to remember that they will not hold both roles simultaneously. Their authority as an agent under a Power of Attorney terminates the moment you pass away. Their role as Executor only begins after a Texas probate court officially appoints them, a process that can take several weeks.

What Happens If I Only Have a Will and Become Incapacitated?

This is a significant and dangerous gap in many estate plans. A will has no legal authority until after you die and a judge validates it in probate court. It offers no protection for you during your lifetime.

If you become incapacitated without a Durable Power of Attorney, your family would be forced to petition the court to establish a guardianship. This process is expensive, time-consuming, and emotionally draining. Ultimately, a judge—not your family—will decide who manages your finances and personal care. A Power of Attorney allows you to make that choice for yourself, ahead of time.

Does a Power of Attorney Have to Be Filed with the Court?

No, a Power of Attorney document does not need to be filed with a Texas court to be valid. For it to be legally binding, you (the principal) simply need to sign it before a notary public.

However, while court filing is not required for validity, it may be necessary to record the document in the county property records. This step is particularly important if your agent will be handling real estate transactions, as it provides official public notice of their authority to act on your behalf.

Think of it this way: a Power of Attorney is for managing your affairs if you can't during life. An Executor is for settling your estate after you're gone. A rock-solid estate plan needs both to make sure you're covered, no matter what happens.

By implementing both a comprehensive will and a durable power of attorney, you provide your loved ones with a clear roadmap. You save them from legal complications and ensure your wishes are honored precisely.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.