Managing a loved one’s estate can feel overwhelming, especially while you're grieving. The legal complexities of transferring assets can seem like a heavy burden, but with the right legal guidance, it doesn’t have to be. The key to making the process manageable lies in understanding one core difference: probate and non-probate assets. Simply put, probate assets must go through a court-supervised process, while non-probate assets can pass directly to a named beneficiary, saving time, money, and stress.

Getting this distinction right is the first step toward a smoother estate administration process here in Texas. This guide will provide clear explanations and practical advice to help you feel informed and secure in your next steps.

Understanding How Your Assets Transfer in Texas

When you're tasked with managing a loved one's estate, the first question is often, "What happens to everything they owned?" In Texas, the answer hinges on how an asset is titled and whether a beneficiary was designated. Every asset follows one of two paths after death, a journey dictated by the Texas Estates Code.

This guide is here to cut through the confusion and give you clarity and confidence. We'll walk through the two fundamental routes your assets can take: the court-supervised probate process and the much more direct transfer of non-probate assets.

The Two Paths for Estate Assets

Think of it like sending a package. Probate assets are like a package that must go through the main mail sorting facility—the probate court—before delivery. The court must verify the will, pay any debts and taxes, and confirm the rightful recipients before the package can be delivered.

Non-probate assets, on the other hand, are like a package with a pre-paid, direct-delivery sticker. They skip the sorting facility entirely and go straight to the person they're addressed to because the transfer instructions were already in place. This is what tools like trusts and beneficiary designations accomplish.

Once you grasp this key difference, you can make smarter decisions for your own estate planning, protect your family's legacy, and minimize stress for your loved ones.

The major differences boil down to:

- Court Involvement: Probate means the court is involved. Non-probate assets bypass the court system.

- Transfer Time: Non-probate assets get to heirs much faster.

- Privacy: Probate is a public court proceeding. Non-probate transfers are private.

- Control: Using non-probate tools gives you direct control over who gets what, without leaving it to a court process.

Our goal is to demystify these legal concepts and empower you with the knowledge to handle your responsibilities with peace of mind. Whether you’re an executor, a beneficiary, or planning for your own future, understanding probate and non-probate assets is the bedrock of effective estate administration in Texas.

What Are Probate Assets in Texas?

When someone passes away in Texas, their property must be legally transferred to the living. Probate assets are items that require a judge's oversight to get there. This includes anything owned solely in the deceased person's name at the time of death, without any automatic transfer plan already set up.

These assets are essentially in legal limbo. Without a clear, pre-arranged path to their new owner, they cannot be legally handed over. This is where the Texas Estates Code and the probate court provide a formal process to ensure the transfer is lawful and orderly, protecting both heirs and creditors.

Identifying Common Probate Assets

So, what kind of property typically gets caught in the probate net? Many common possessions can become probate assets if you haven't planned ahead.

Here are some real-world examples in Texas:

- Real Estate in One Person's Name: A house, land, or condo owned only by the person who passed away.

- Solely Owned Bank Accounts: A personal checking or savings account without a co-owner or a "Payable-on-Death" (POD) designation.

- Vehicles Titled to the Decedent Only: A car, truck, or boat that doesn't have a joint owner or a "Transfer-on-Death" (TOD) registration.

- Personal Belongings: This catch-all category covers everything from furniture and jewelry to art and family heirlooms that don't have a formal title.

- Investment Accounts Without Beneficiaries: A brokerage account that is individually owned and missing a TOD designation.

The common thread is sole ownership without a backup plan. If there's no co-owner or a beneficiary form to automatically direct the asset to its new home, the probate court becomes the default referee.

The Journey Through the Texas Probate Court

When an estate contains probate assets, it kicks off a formal legal process. This journey is about bringing a final, legal close to the deceased's financial life. Here is a step-by-step guide to what that process typically looks like:

- Filing the Will: The executor named in the will submits it to the appropriate Texas probate court.

- Validating the Will: The court confirms the will is legitimate and officially appoints the executor.

- Notifying Creditors: The executor must notify potential creditors, giving them a window to file claims against the estate.

- Inventorying Assets: All probate assets are gathered, listed, and appraised to determine the estate's value.

- Paying Debts and Taxes: The executor uses estate funds to pay valid creditor claims, funeral expenses, and final taxes. This is a key fiduciary duty under Texas law.

- Distributing Property: After all obligations are met, the remaining assets are distributed to the beneficiaries named in the will.

The probate process provides an essential, court-supervised framework for winding up a person's affairs. It brings legal finality, protects creditors, and confirms the rightful heirs, but its public nature and potential for delay are why many people seek to avoid it through careful planning.

While probate handles the court-supervised administration of an estate, non-probate assets get to skip this whole procedure. The U.S. Trusts & Estates industry is a massive field, a testament to how many families have to navigate these exact rules. Smart planning can help move assets out of the "probate" column and into the "non-probate" one, saving time, money, and headaches down the road. You can get a sense of the industry's scale from IBISWorld's market analysis. To really get a handle on this, a deeper dive into the court process itself can be incredibly helpful: What Is Probate And How Does It Work.

How Non Probate Assets Transfer Directly to Heirs

While probate assets are stuck waiting for a judge’s green light, non-probate assets have a pre-paid "fast pass" to bypass the court system entirely. Their secret is a legally binding, pre-arranged instruction that directs the transfer automatically.

These assets are the workhorses of modern estate planning. They allow you to ensure your loved ones receive their inheritance without the delays, expenses, and public nature of probate court. The transfer mechanism is already built in, usually through a beneficiary designation or a specific type of ownership.

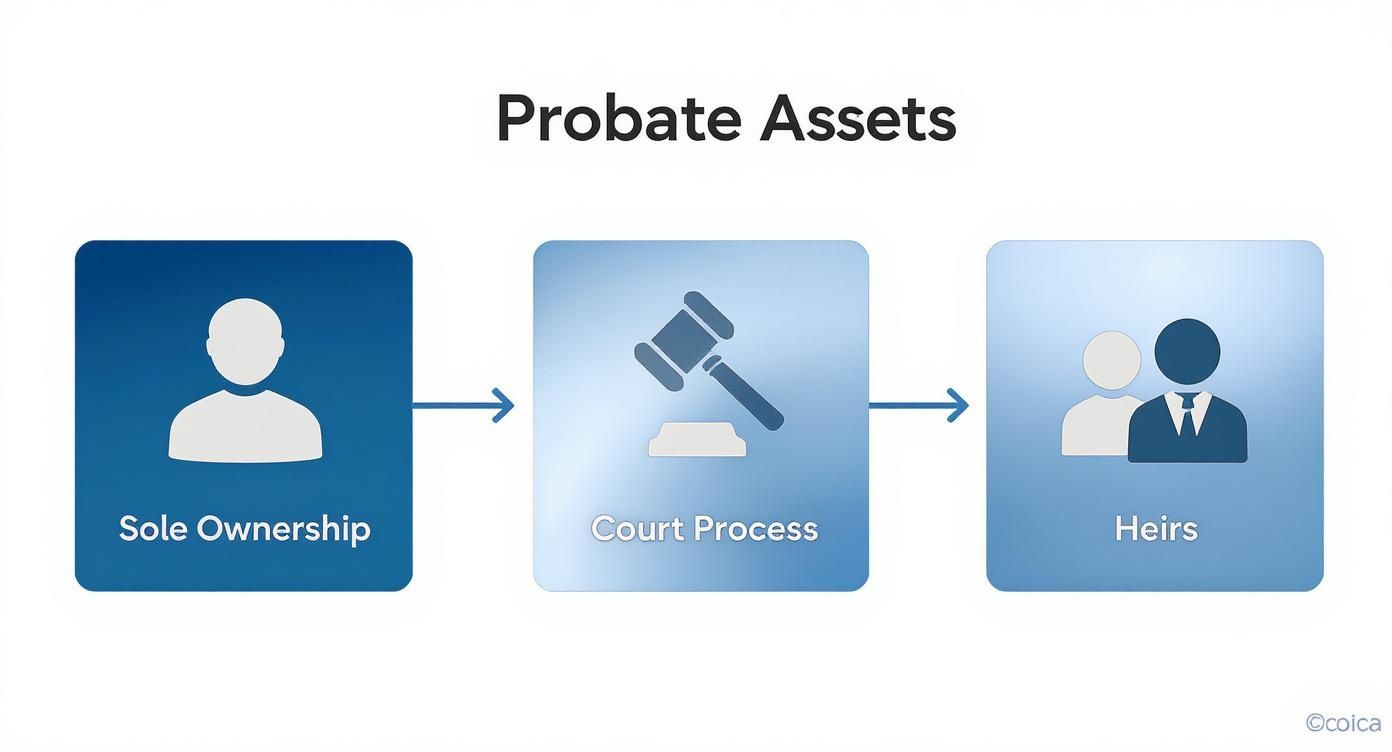

The flowchart below shows the winding, court-supervised path that probate assets must travel before they finally reach your heirs.

As you can see, assets owned by you alone, with no direct way to transfer them, get funneled straight into the court system. This is precisely the headache that non-probate assets are designed to avoid.

Common Types of Non Probate Assets and Their Transfer Mechanisms

Texas law provides several powerful tools to create non-probate assets. Each operates differently, but they all share the same goal: a direct, seamless transfer to the people you choose.

- Life Insurance Policies: The death benefit is paid straight to the beneficiary named on the policy. The beneficiary typically just needs to provide a claim form and a death certificate to the insurance company.

- Retirement Accounts: Funds in a 401(k), IRA, or 403(b) go directly to the designated beneficiary. The financial institution manages this transfer, keeping the probate court out of the picture.

- Bank Accounts with Payable-on-Death (POD) Designations: You can add a POD designation to your bank accounts with a simple form, instructing the bank to transfer the balance directly to your named beneficiary upon your death.

- Investment Accounts with Transfer-on-Death (TOD) Designations: Similar to a POD, a TOD designation on a brokerage account allows stocks, bonds, and mutual funds to transfer automatically to your chosen beneficiary.

To give you a clearer picture, here’s a quick comparison of how these two asset types stack up.

Probate vs Non-Probate Assets at a Glance

| Characteristic | Probate Assets | Non-Probate Assets |

|---|---|---|

| Transfer Method | Via court-supervised probate process | Directly to beneficiaries or co-owners |

| Control | Governed by the terms of the Will (or state law if no Will) | Governed by beneficiary designations or titling |

| Privacy | Public record (Will, inventory, etc.) | Private transaction |

| Speed | Can take months or even years | Often takes days or weeks |

| Cost | Court fees, attorney fees, executor fees | Minimal to no administrative costs |

This table makes it easy to see why so many people focus on structuring their estates to maximize non-probate assets. The benefits in terms of time, privacy, and cost are significant.

The Role of Trusts in Avoiding Probate

One of the most powerful strategies for sidestepping probate is using a trust, especially a Revocable Living Trust.

A Revocable Living Trust is a legal container you create to hold your assets while you're alive. You transfer ownership of things—your house, bank accounts, investments—into the trust. Since the trust now owns these assets, not you personally, they aren't part of your probate estate when you die.

After your death, the successor trustee you named steps in to manage and distribute the trust assets to your beneficiaries according to the rules you set out. This all happens privately, with no court supervision needed. A skilled Texas trust administration lawyer can help ensure this process aligns with Texas Trust Code principles.

Joint Ownership with Right of Survivorship

Another common way to create a non-probate asset is through joint ownership. In Texas, when property is owned as Joint Tenants with Right of Survivorship (JTWROS), it automatically passes to the surviving co-owner when one owner dies.

This is a popular setup for real estate between spouses or for joint bank accounts. The transfer happens automatically by law, completely avoiding probate. However, the ownership documents must specifically state the "right of survivorship." Other forms of co-ownership do not have this probate-skipping power.

For assets held in a trust, it’s also vital to understand the trustee responsibilities after death. The successor trustee has a fiduciary duty to follow your instructions, making their role essential for a smooth transfer. Keeping your beneficiary forms and trust documents updated is one of the simplest yet most effective ways to protect your legacy.

Actionable Strategies for Avoiding Probate in Texas

Knowing the difference between probate and non-probate assets is one thing, but putting that knowledge into action is what truly protects your legacy. By proactively structuring your estate, you can turn assets destined for court supervision into non-probate assets that pass directly—and privately—to the people you care about. This is where smart estate planning shifts from an idea to a powerful reality.

Thankfully, Texas law provides several excellent tools to make this happen. A comprehensive plan often weaves several of them together to shield a family’s assets and make inheritance a smooth process.

Establish a Revocable Living Trust

One of the most robust strategies for sidestepping probate is creating and properly funding a Revocable Living Trust. Think of a trust as a private container you create to hold your most valuable assets—your house, investments, or business interests.

While you're alive, you remain in control as the trustee. After you're gone, the successor trustee you handpicked steps in to manage and distribute everything exactly as you instructed, all without setting foot in a probate court.

Real-World Scenario: Imagine a family owns a beloved ranch in the Texas Hill Country that has been passed down for generations. By placing the ranch into a revocable living trust, the owners ensure their children will inherit it immediately upon their death without court delays. This move can prevent potential family disputes and sidestep the significant costs of probating valuable real estate.

Use Transfer-on-Death Deeds for Real Estate

For Texas homeowners looking for a simpler tool than a full trust, the Transfer-on-Death Deed (TODD) is a game-changer. A TODD lets you name a beneficiary who will automatically inherit your real estate the moment you pass away.

You file the deed with the county clerk, but it has no impact while you're alive—you can still sell or mortgage the property as you wish. When you're gone, your beneficiary simply files your death certificate, and the property is theirs, completely bypassing probate.

Properly Title Bank and Investment Accounts

It's shockingly easy for financial accounts to get stuck in probate if they aren't titled correctly. The good news is that Texas law makes it simple to add designations that ensure a direct transfer.

- Payable-on-Death (POD) Designations: For checking and savings accounts, adding a POD beneficiary is usually as easy as filling out a one-page form at your bank. The money goes directly to the person you named.

- Transfer-on-Death (TOD) Designations: You can do the exact same thing for brokerage and investment accounts. This lets your stocks, bonds, and mutual funds skip the probate process entirely.

Remember to keep these beneficiary designations up-to-date, especially after major life changes like a marriage, divorce, or the death of a named beneficiary.

Set Up Joint Ownership with Rights of Survivorship

Another straightforward strategy is to own property jointly. In Texas, if an asset is titled as “Joint Tenancy with Right of Survivorship” (JTWROS), the surviving owner automatically gets the entire asset when the other owner dies.

This is a popular method for real estate and bank accounts, especially between spouses. But the critical part is that the ownership document must explicitly state "right of survivorship" for the automatic transfer to work. Without that specific legal phrase, the deceased's share might still be pulled into probate.

A 2025 survey found that while a surprising 55% of Americans still don't have an estate plan, there's a huge shift among those who do. Over 60% of people with assets between $3 million and $5 million have set up trusts. That number skyrockets to 81% for those with $10 million or more, showing a clear preference for avoiding probate among families with significant wealth.

Each of these strategies paves a path toward a faster, more private, and less expensive transfer of your assets. The key is figuring out which combination of tools is the right fit for your family's unique situation. To dive deeper into this topic, check out our complete guide on how to avoid probate in Texas.

Common Mistakes That Can Accidentally Land Your Assets in Probate

Even the most carefully laid estate plans can be derailed by simple mistakes. A few common oversights can unravel years of planning, forcing your assets right back into the probate system you tried so hard to avoid. Think of it like building a sturdy fence but leaving the gate wide open.

Knowing these common pitfalls is the best way to safeguard your legacy and spare your loved ones the stress and expense of an unnecessary court process. An estate plan is a living roadmap that needs to keep up with your life.

The “Empty” Living Trust Fiasco

One of the most frequent errors we see is creating a Revocable Living Trust but never actually moving assets into it. This creates an “unfunded” or “empty” trust. A trust document is just a piece of paper with instructions; it has no power over assets it doesn’t legally own.

For a trust to work, you must formally retitle your assets—your house, bank accounts, investments—into the name of the trust. If you sign a trust but the deed to your home is still in your name alone, that house is going straight to probate court. It’s a small administrative step that makes all the difference.

Outdated Beneficiary Designations: A Recipe for Disaster

The beneficiary forms on your 401(k), IRA, and life insurance policies are powerful legal contracts that completely override your Will. A classic mistake is forgetting to update them after a major life event like a divorce, marriage, or birth of a child.

A Cautionary Tale: Imagine someone names their spouse as the beneficiary on a large retirement account. A decade later, they divorce and remarry but never update the form. When they pass away, that entire retirement account legally belongs to the ex-spouse, not the current one. The Will is powerless to change it.

Make it a habit to review these forms every couple of years. It’s a critical step to ensure your assets end up with the right people.

Naming a Minor Directly: An Unintended Legal Mess

Leaving an inheritance to a child or grandchild is a natural impulse, but naming a minor as a direct beneficiary on an account triggers a legal headache. In Texas, children under 18 cannot legally own or manage property on their own.

This mistake forces the asset into a court-supervised guardianship. A judge will appoint a guardian to manage the money until the child turns 18, a process that is often expensive, public, and restrictive. A far better strategy is to set up a trust for the minor's benefit, which lets a trustee you have chosen manage the funds on your terms.

Getting Joint Ownership Wrong

While joint ownership can be a simple way to skip probate, the details matter. Not all joint ownership is created equal. For an asset to pass automatically to the surviving co-owner, the title must explicitly state “with right of survivorship.”

If a property is owned by two people as "tenants in common," each person's share is treated as their separate asset. When one owner dies, their half doesn't go to the other owner—it goes into their probate estate. This small difference in legal wording can be the deciding factor between a smooth transfer and a court battle.

The only way to catch these potential landmines is to do a regular check-up on your asset titles and beneficiary forms. Sitting down with a qualified Texas estate planning attorney ensures your plan works the way you intend and reflects your current life circumstances.

Why This Matters for Executors and Beneficiaries

Understanding the difference between probate and non-probate assets isn't just a legal exercise. It’s a practical roadmap that directly shapes an executor's duties and a beneficiary's timeline for receiving their inheritance.

If you're an executor in Texas, your job changes dramatically depending on the asset type. For probate assets, you are stepping into a formal role with significant fiduciary duties under the Texas Estates Code. The court is watching, and you are legally accountable.

This means you’ll be:

- Compiling a detailed inventory of all estate property for the court.

- Identifying creditors and settling the decedent's final bills.

- Defending the will if it is contested by a disgruntled heir.

- Following the will’s instructions to the letter when distributing what remains.

Conversely, your involvement with non-probate assets is minimal. These assets have their own set of instructions and transfer automatically, keeping you out of the courtroom and lightening your legal load considerably.

The Timeline for Receiving an Inheritance

For beneficiaries, the probate vs. non-probate distinction often boils down to one thing: time. When an inheritance is a non-probate transfer, it's typically fast and private. If you’re the beneficiary of a life insurance policy, for instance, you could receive the funds within a few weeks.

Waiting for assets to wind through the court system, however, is a different story. The process can drag on for months, sometimes longer. To get a better sense of the timelines, check out our in-depth guide on how long probate can take in Texas.

This clear distinction helps manage expectations for everyone involved. A well-structured estate plan that maximizes non-probate transfers is one of the greatest gifts you can give your family, saving them from unnecessary delays and stress during a difficult time.

It's interesting to look at this historically. For a long time, our view of wealth transfer was skewed because probate records were the main source of data, and these court filings were far more common for the wealthy. This context really underscores why using non-probate assets is such a critical strategy for families from all walks of life who want to pass on their legacy smoothly. You can discover more insights about historical probate data to see how these patterns have evolved over time.

Your Top Questions About Texas Probate Assets, Answered

When you're wading through the details of Texas estate law, it’s natural for questions to arise. Let's tackle some of the most common ones we hear, providing clear, straightforward answers to help you feel confident.

Does a Will Help You Avoid Probate in Texas?

This is one of the biggest myths in estate planning. A Last Will and Testament does not avoid probate. In fact, a Will is a set of instructions written specifically for the probate court.

Think of your Will as your voice in the courtroom. It tells the judge who you want as your executor and how your probate assets should be divided. However, any asset titled solely in your name must still go through that court-supervised process. To truly avoid probate, you need to use non-probate tools like living trusts, beneficiary designations, and joint ownership with rights of survivorship.

What Happens if You Die Without a Will in Texas?

Dying without a Will is known as dying "intestate." When this occurs, the Texas Estates Code provides a rigid, one-size-fits-all formula for distributing your probate assets among your closest relatives.

The court will appoint an administrator to handle the estate, and your property could end up going to people you never intended. It's a process that can be long, expensive, and create unnecessary heartache for your family. This is why a solid estate plan is critical for every Texan.

Dying intestate is like letting the state of Texas make all the final decisions for you. A well-drafted estate plan makes sure your wishes—not the government's default rules—are what matter in the end.

Can an Estate Have Both Probate and Non-Probate Assets?

Yes, absolutely. In fact, most estates are a mixture of both. It is common for someone to have a 401(k) with a named beneficiary (a non-probate asset) alongside a car titled only in their name (a probate asset).

Smart asset protection and estate planning is about strategically converting as many assets as possible into non-probate assets. This simplifies the entire process for your loved ones. Your Will then acts as a safety net, directing where any remaining probate assets should go.

How Often Should You Review Beneficiary Designations?

You should make it a habit to review all your beneficiary designations every three to five years. It's also crucial to review them immediately after any major life event, such as a:

- Marriage or divorce

- Birth or adoption of a child

- Death of a previously named beneficiary

Remember, these designations override your Will. Outdated information could accidentally disinherit someone you love or send a significant portion of your savings to an ex-spouse. A quick check-in with your Texas estate planning attorney can help you sidestep these devastating and avoidable mistakes.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process. Learn more at https://texastrustadministration.com.