Planning for what happens to your property after you’re gone can feel overwhelming, but a transfer on death deed in Texas—often called a TODD—is a clear and effective tool for passing on your real estate. Managing a loved one’s estate can be a heavy weight, but with the right legal guidance, it doesn’t have to be. This legal document acts as a beneficiary designation for your property, allowing you to name who will inherit it directly upon your death, completely sidestepping the probate process.

Understanding the Texas Transfer on Death Deed

Navigating the world of estate planning can feel like trying to read a map in a foreign language, but the Transfer on Death Deed carves a clear path for many Texas homeowners. The concept is straightforward: just as you name a beneficiary on a life insurance policy or a 401(k), a TODD allows you to do the same for your house or land.

This simple designation means the title to your property automatically transfers to your chosen person (or people) the moment you pass away. There are no court dates, no lengthy waiting periods, and no public proceedings. It avoids the time and expense of probate court because the property is considered a non-probate asset—it transfers entirely outside the authority of your will. For more on this, you can explore our guide on non-probatable assets in Texas.

Retaining Full Control During Your Lifetime

One of the most powerful features of a Texas TODD is that you retain 100% control over your property while you are alive. Naming a beneficiary does not grant them any current ownership rights or say in what you do with your property. They have no vested interest until your passing.

This means you are completely free to:

- Sell or gift the property to someone else without your beneficiary's permission.

- Take out a mortgage or refinance an existing one.

- Change your mind and revoke the TODD at any time.

This flexibility ensures your property remains your asset to manage as you see fit for the rest of your life, providing both security and complete peace of mind.

A Modern Tool in Texas Estate Planning

The Transfer on Death Deed is a relatively new addition to Texas law. The legislature introduced this valuable tool in 2015 through the "Texas Real Property Transfer on Death Act," now codified in Chapter 114 of the Texas Estates Code.

This act was a game-changer for how Texans could plan their estates. It provided a straightforward, statutory method to keep real estate out of probate without the need to establish a more complex and costly living trust. You can learn more about the history of this legislation at Texas A&M AgriLife.

Comparing a TODD to Other Estate Planning Tools

Choosing the right legal tool for your property is not a one-size-fits-all decision. A Transfer on Death Deed (TODD) is a powerful choice for many Texans, but it’s essential to understand how it compares to other common estate planning methods.

Each tool—a Will, a Living Trust, or Joint Ownership—serves a different purpose. The best option for you depends on your personal goals, family situation, and financial complexity. Let's walk through the practical differences to help you build an estate plan that truly protects your assets and your loved ones.

TODD vs. a Last Will and Testament

The most significant difference between a transfer on death deed Texas residents use and a traditional will comes down to one critical word: probate. A will is essentially a set of instructions for the probate court. After you pass away, your will must be validated by a judge, who then oversees the process of paying debts and distributing your property. This can be expensive, time-consuming, and becomes public record.

A TODD, however, is specifically designed to avoid probate for the real estate it covers. The transfer to your beneficiary happens automatically upon your death. It’s private, quick, and saves your family from the stress and cost of a court proceeding for that specific property.

TODD vs. a Living Trust

A living trust is another excellent way to avoid probate, but it is a more comprehensive tool. When you establish a living trust, you transfer ownership of your assets—your house, bank accounts, investments—into the trust itself. You typically act as the trustee during your lifetime, managing everything as usual. A qualified Texas estate planning attorney can provide step-by-step guidance on how to properly transfer property into a trust.

While a trust offers comprehensive management for all your assets and allows for detailed instructions (like protecting assets for a beneficiary with special needs), it requires more work and expense to set up. A TODD is simpler and less costly to create but only applies to the specific piece of real estate named in the deed.

Real-World Scenario: A Texas family might use a simple TODD for their family home to ensure it passes easily to their children. However, for a portfolio of rental properties or a family business, they would likely use a living trust to provide more detailed, long-term management and protection.

TODD vs. Joint Tenancy with Right of Survivorship

Many people, particularly married couples, own property as "joint tenants with right of survivorship." This arrangement means that when one owner dies, their share of the property automatically passes to the surviving owner(s), neatly avoiding probate. While it sounds similar to a TODD, there is a crucial difference in control while you are alive.

When you add someone to your deed as a joint tenant, you give them an immediate ownership stake in the property. This means you can no longer sell, refinance, or mortgage the property without their consent. It becomes a shared asset from that day forward.

A TODD avoids this issue entirely. The beneficiary you name has zero ownership rights or say while you are alive. You maintain 100% control to do whatever you want with your property.

Transfer on Death Deed vs. Other Estate Planning Tools

This table compares the key features of a TODD, Will, Living Trust, and Joint Tenancy to help you decide which is right for your Texas property.

| Feature | Transfer on Death Deed (TODD) | Will | Living Trust | Joint Tenancy with Right of Survivorship |

|---|---|---|---|---|

| Probate Avoidance | Yes | No (Guarantees probate) | Yes (If properly funded) | Yes |

| Control During Life | Full Control (Owner can sell or mortgage freely) | Full Control | Full Control (As trustee) | Shared Control (Co-owner must approve major decisions) |

| Cost & Complexity | Low cost, simple to create | Moderate cost | Higher initial cost and more complex | Low cost, but creates immediate co-ownership |

| Creditor Protection | Limited (Creditors can still make claims against the estate) | None (Assets are subject to probate claims) | Can offer significant asset protection | Property may be exposed to co-owner’s creditors |

| Privacy | High (Transfer is private) | Low (Probate is a public record) | High (Trust administration is private) | High (Transfer is private) |

As you can see, each tool has distinct advantages and trade-offs. The right choice depends on your specific estate planning goals.

The Legal Rules for a Valid Texas TODD

For a Transfer on Death Deed to be a valid part of your estate plan, it must comply perfectly with the specific requirements laid out in Texas law. A small mistake can invalidate the entire document, forcing your property back into the probate process you intended to avoid.

Understanding these legal formalities is key to creating a deed that protects your legacy. Let’s review the non-negotiable elements required by the Texas Estates Code.

Core Requirements of a Texas TODD

Every transfer on death deed in Texas must meet the same fundamental standards as any traditional deed. The law is very particular, leaving no room for error.

To be legally sound, your TODD must:

- Be in writing. An oral promise to transfer property upon death is not legally enforceable.

- Clearly identify the property. This requires the official legal description of the real estate, not just the street address. This description can be found on your current deed.

- Be signed by you (the owner/transferor). Your signature is what makes the document legally binding.

- Be notarized. You must sign the deed in the presence of a notary public, who will then officially acknowledge your signature.

These steps are the foundation of a legally recognized document. Missing any one of them will render the deed invalid. You can find more details on how these rules fit into the bigger picture in our guide to real estate considerations in Texas estate planning.

The Most Critical Step: Recording the Deed

Beyond the document's content, one requirement is paramount: the deed must be recorded before your death. The Texas Estates Code is unequivocal on this point. You must file the fully signed and notarized deed with the county clerk's office in the county where the property is located.

If a signed TODD is discovered in a desk drawer after you pass away, it is legally worthless. This pre-death recording rule makes the transfer a matter of public record and prevents potential disputes or fraud after you are gone.

The 120-Hour Survivorship Rule

Texas law also imposes a specific condition on your beneficiary. To inherit the property through the TODD, your named beneficiary must survive you by at least 120 hours (five days).

This "120-hour rule" is designed to address tragic, simultaneous death scenarios, such as a car accident involving both the property owner and the beneficiary. If your beneficiary does not outlive you by that five-day window, the TODD is voided, and the property passes as if the deed never existed—typically through your will or to your legal heirs.

The Texas framework for a transfer on death deed has strict procedural requirements. As laid out in Texas Estates Code § 114.052, the pre-death recording rule has no exceptions; an unrecorded TODD is void. Similarly, the 120-hour survivorship rule in § 114.103 is another critical safeguard. Because these rules are so precise, the most reliable way to prevent costly mistakes and ensure your wishes are honored is to work with a Texas estate planning attorney.

A Step-by-Step Guide to Create or Cancel a TODD

Deciding to create a Transfer on Death Deed is a proactive step toward securing your property for your loved ones, and the process is quite straightforward. Texas law also ensures you remain in control, providing clear methods for changing your mind. Let's walk through the steps to both create and cancel a TODD, empowering you to manage your real estate with confidence.

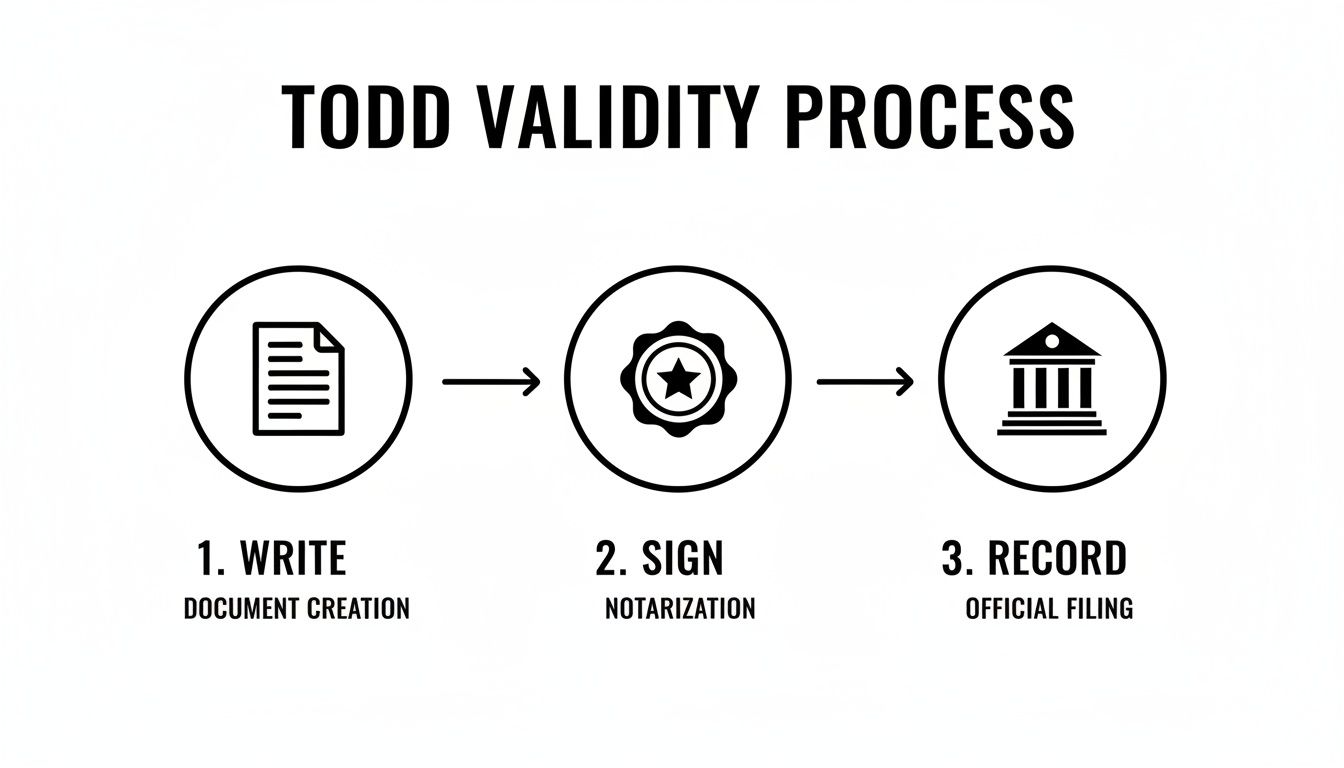

How to Create and File a TODD

Putting a transfer on death deed Texas in place involves a few key steps. Each one must be executed correctly to ensure the document is legally sound and fulfills your wishes.

The process boils down to drafting the deed, signing it before a notary, and filing it with the county.

This simple three-step flow—drafting, notarizing, and filing—is the only way to establish a legally binding TODD under the Texas Estates Code.

Here’s a closer look at each step:

Gather Your Information: Before you begin, you need two critical pieces of information: the full, official legal description of your property (found on your current deed) and the full legal names of your designated beneficiaries.

Draft the Deed Correctly: The TODD must contain specific language required by Texas law to clarify that the property transfer only occurs upon your death. While templates are available online, precise wording is vital for the deed's validity. This is where professional legal guidance can be invaluable.

Sign It with a Notary: You, the property owner (the "grantor"), must sign the deed in the presence of a notary public. The notary verifies your identity, witnesses your signature, and adds their official seal. This step is mandatory.

Record the Deed in the Right County: This is the final and most crucial step. The signed and notarized TODD must be filed in the real property records at the county clerk’s office where your property is located. Critically, this must be done before you die. A TODD that is signed but never recorded is legally worthless.

How to Cancel or Revoke a TODD

Life changes, and your wishes may change too. A TODD is flexible enough to accommodate these shifts. If you decide you no longer want the TODD in effect, Texas law provides two primary ways to cancel it. Following the proper legal steps for revocation is just as important as the creation process.

A Common Misconception: Many people believe they can simply state in their will, "I hereby cancel my TODD." This is not true. Under Texas law, your Last Will and Testament cannot override or revoke a previously recorded TODD.

To properly revoke a TODD, you must take one of these specific actions:

File a Formal Revocation Document: You can prepare a document titled "Cancellation of Transfer on Death Deed." Like the original TODD, you must sign this document before a notary and record it in the same county clerk’s office—all before your death—for it to be effective.

Record a New TODD: A simpler method may be to create and record a new Transfer on Death Deed for the same property with a different beneficiary. The law operates on a "last one recorded wins" principle, so the new deed automatically cancels the old one.

Ensuring your TODD is created or revoked correctly is a cornerstone of effective estate planning. These steps guarantee your wishes for your property are legally secure and will be honored.

Navigating Potential Risks and Complex Situations

While a transfer on death deed Texas homeowners can use is an excellent tool for straightforward estate planning, it is not a universal solution. Certain life complexities can create more problems than they solve if a TODD is used without careful consideration. Ignoring these details can lead to unintended consequences for your family.

Mortgages and Other Debts on the Property

A common question is, "What happens to my mortgage?" A TODD does not eliminate debt. Your beneficiary inherits the property, but they also inherit any liens and claims attached to it, including the mortgage.

This means your loved one receives the house and the responsibility for its payments. While federal law typically prevents the bank from calling the loan due immediately, your beneficiary will need to continue making payments or refinance the loan. The property also remains liable for other claims against your estate for up to two years after your death.

Community Property and Homestead Rights

Texas is a community property state. This means most property acquired during a marriage belongs equally to both spouses. If your home is community property, you can only use a TODD to transfer your half. Your spouse retains their half, which can create a complicated co-ownership situation between them and your beneficiary.

Furthermore, a TODD cannot override a surviving spouse's homestead rights. Texas law strongly protects a surviving spouse's right to continue living in the family home, regardless of who legally inherits it. An experienced attorney can help navigate these interconnected rights to prevent future conflicts.

Understanding the full financial picture is key. It's also a good idea to get familiar with the various Property Tax Exemptions in Texas that could affect both your estate and your beneficiary's future costs.

Scenarios with Multiple or Predeceased Beneficiaries

Naming multiple children on a TODD might seem equitable, but it can lead to complications. If you name three children, for example, they will inherit the property as "tenants in common." This requires them all to agree on what to do with it—sell, rent, or have one buy the others out. This can quickly lead to family disputes and legal expenses.

Another potential issue arises if one of your beneficiaries dies before you do. Under Texas law, that gift "lapses." It does not automatically pass to their children unless your deed specifically provides for that outcome. You could unintentionally disinherit an entire branch of your family without careful drafting. It is in these complex situations where our firm’s experience in both estate planning and resolving issues in probate becomes invaluable.

When to Consult a Texas Estate Planning Attorney

A transfer on death deed in Texas is a powerful and straightforward tool that can save your family from the complexities of probate. However, it is not the right solution for every family or every situation.

While DIY forms may seem convenient, they cannot account for your unique family dynamics or financial circumstances. Knowing when to seek professional guidance is the most important step you can take to protect your estate. Legal advice is an investment in your family's future peace of mind. An experienced Texas estate planning attorney does more than just fill out a form; we analyze your entire financial and family situation to ensure a TODD aligns with your other legal documents, such as your will and powers of attorney. This comprehensive approach closes potential loopholes and prevents future family disputes.

When a TODD Might Not Be Enough

Certain life situations are inherently complex. Using a simple tool for a complex job can lead to accidental disinheritance, family conflict, or unforeseen risks.

It is critical to consult an attorney if you:

- Have a blended family: Second marriages and step-children introduce complexities regarding community property and inheritance rights that a simple deed cannot address.

- Need to provide for a beneficiary with special needs: Leaving property directly to someone receiving government benefits like Medicaid or SSI could jeopardize their eligibility. A properly structured plan, often involving a guardianship or a special needs trust, is essential to protect them.

- Own multiple properties or have business interests: As your assets become more complex, your estate plan must evolve. A comprehensive strategy using trusts or other legal structures is often necessary to manage and protect everything you've built.

- Are concerned about creditors or family disputes: If you foresee potential conflicts, an attorney can help build a robust estate plan. We can structure your assets to provide better asset protection and reduce the likelihood of a courtroom battle among your heirs.

A well-drafted transfer on death deed can beautifully avoid probate. However, a poorly planned one can create a legal nightmare for your loved ones. The goal is to leave behind clarity and security, not a complex puzzle for your family to solve.

A TODD is just one tool in a comprehensive estate planning toolbox. A qualified attorney ensures you are using the right one for your specific needs, giving you confidence that your wishes will be honored and your loved ones will be cared for.

Your Top Questions About Texas TODDs Answered

When exploring the details of a transfer on death deed in Texas, several key questions often arise. Getting clear answers helps you feel confident in your decisions. Let's address some of the most common concerns.

Can I Leave My House to a Minor Child with a TODD?

While technically possible, it creates significant legal complications. In Texas, minors cannot legally own real estate outright. If you pass away while your beneficiary is still a child, a court must intervene.

A judge would need to appoint a legal guardian to manage the property for the minor. This process is often expensive, time-consuming, and adds unnecessary stress for your family.

A more effective approach is to name a "custodian" for the property within the deed itself, under the Texas Uniform Transfers to Minors Act (TUTMA). This allows a trusted adult to manage the property until the child reaches legal age, avoiding the need for a court-appointed guardianship.

Does a TODD Shield My Home from Creditors?

No, a Transfer on Death Deed does not make your property creditor-proof. During your lifetime, the house remains your asset and is subject to your debts.

After your death, the property remains liable for claims against your estate for up to two years. Additionally, any existing liens on the property—such as a mortgage or a tax lien—transfer with the house to your beneficiary.

What if There's Still a Mortgage on the Property?

The mortgage does not disappear. When your beneficiary inherits the property, they also inherit the responsibility for the associated loan. The mortgage is attached to the property itself.

Fortunately, a federal law known as the Garn-St. Germain Depository Institutions Act of 1982 protects your beneficiary. It prevents the lender from demanding immediate repayment of the entire loan simply because the property transferred to a relative. Your beneficiary will need to continue making payments to prevent foreclosure, but they will not face a sudden financial crisis.

How Is a TODD Different from a Lady Bird Deed?

People often confuse these two deeds, but they serve different purposes. Both tools help property avoid probate, but they function differently. A Lady Bird Deed (also known as an Enhanced Life Estate Deed) grants you a "life estate"—the right to live in the property for life—while naming a "remainderman" who automatically inherits it upon your death.

The key difference lies in flexibility and strategic application. A TODD is a direct transfer tool. A Lady Bird Deed, however, can be a strategic instrument for goals like Medicaid planning, as the property is typically not considered a countable asset during your lifetime.

Think of them as different tools for different jobs. The right choice depends on your specific financial and family goals.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

Learn more at https://texastrustadministration.com.