Planning for your family’s future can feel overwhelming, but with the right legal guidance, it doesn’t have to be. When considering a trust vs. a will in Texas, the primary difference comes down to court involvement. A will is a set of instructions for distributing your assets that must go through the public probate court system after you pass away. A trust, on the other hand, allows your assets to be managed and transferred privately, both during your lifetime and after, completely avoiding the probate process. This single choice determines whether your family's financial affairs become a public record or remain confidential.

Understanding Your Texas Estate Planning Options

Securing your family’s future is one of the most significant steps you will ever take. While the process may seem complex, it boils down to selecting the right legal tools to protect your assets and provide for the people you love. Here in Texas, the two foundational documents for estate planning are a Last Will and Testament and a Revocable Living Trust.

At The Law Office of Bryan Fagan, PLLC, our goal is to explain these options in plain English, empowering you to make confident decisions. Both a will and a trust are designed to ensure your property is distributed according to your wishes. However, they operate in fundamentally different ways and offer distinct advantages.

Wills and Trusts: A Brief Overview

A will is a static document governed by the Texas Estates Code. It remains dormant until after your death and must be validated by a probate court before its instructions can be carried out. In contrast, a trust, governed by the Texas Trust Code, is a private legal entity that you create and fund during your lifetime.

This core distinction impacts everything—privacy, cost, and your control over your assets. A will’s journey through probate means your estate’s details become part of the public record. Trust administration, however, is a private family matter from beginning to end, managed according to your specific instructions.

| Feature | Last Will and Testament | Revocable Living Trust |

|---|---|---|

| When It Works | Only after your death | Immediately upon creation and funding |

| Court Involvement | Requires the probate process | Avoids the probate process |

| Privacy | Becomes a public court record | Remains a private document |

| Incapacity Plan | Does not manage assets if you are incapacitated | Provides for asset management if you become incapacitated |

Understanding these differences is the first step toward building an estate plan that provides true peace of mind. With guidance from an experienced Texas estate planning attorney, you can confidently select the right strategy—whether a will, a trust, or a combination of both—to safeguard your family’s future.

What Is a Will and How Does It Work in Texas?

A Last Will and Testament is the cornerstone of many estate plans. It is a legal document that contains your final instructions for what happens after you are gone. In Texas, a properly executed will serves as your voice, clearly stating how you want your property and assets distributed among your loved ones.

However, a will accomplishes more than just asset distribution. It is also the document where you name an executor to manage your estate and, for parents, a guardian for your minor children. The executor is the person you entrust to carry out your wishes. They are responsible for gathering your assets, settling any debts, and ensuring your beneficiaries receive their inheritance. For more details on the legal specifics, see our guide on will requirements in Texas.

The Role of an Executor and Guardian

Choosing an executor is a significant decision. This person acts as a fiduciary, which means they have a legal duty to act in the best interests of your estate. Their responsibilities, outlined in the Texas Estates Code, are substantial and require someone who is trustworthy, organized, and diligent.

For parents, naming a guardian is arguably the most critical function of a will.

- Guardian of the Person: This is the individual you want to raise your children, handling their daily care, education, and well-being.

- Guardian of the Estate: This person manages the inheritance you leave for your children until they reach adulthood. Often, one person fulfills both roles, but you can name different people.

If you do not name a guardian in your will, a judge will make this monumental decision for you. While the court will act in the child’s best interests, its choice may not align with what you would have wanted.

A Critical Point: A will has no legal authority until after you pass away and a Texas probate court officially validates it. This court-supervised process, known as probate, is a mandatory step for every will in the state.

Understanding the Texas Probate Process

Probate is the formal legal process where a court confirms the validity of your will and officially appoints your executor to administer the estate. While Texas is known for having a more streamlined probate system than many other states, it is still a public, court-managed proceeding.

Once a will is filed for probate, it becomes a public record. This means anyone can access the courthouse records or look online to see the details of your estate, including:

- The total value of your assets

- A list of your specific properties

- The names of your beneficiaries and what they inherited

- The identities of your chosen executor and guardian

For families who value their privacy, this public exposure is a significant drawback. Your family’s financial situation—from the value of your home to personal heirlooms—is laid bare for public inspection. Furthermore, the probate process can introduce delays and add costs, keeping assets tied up for months while the estate moves through the court system.

How a Revocable Living Trust Works in Texas

While a will is a set of instructions for after your death, a Revocable Living Trust is a dynamic tool that provides control and privacy over your assets throughout your life and beyond. By creating a trust, you establish a private legal entity to hold and manage your property, keeping it out of the public probate court system.

This structure is built around three key roles, which you typically fill yourself at the start:

- Grantor: This is you—the person creating the trust and transferring assets into it.

- Trustee: The manager who handles the assets according to the trust’s rules. You act as your own trustee, maintaining full control.

- Beneficiary: The person who benefits from the assets. During your lifetime, you are the primary beneficiary.

Because you control all three roles, your day-to-day life remains unchanged. You can still buy, sell, and manage your property just as you always have. The true power of a trust is activated when you are no longer able to manage your affairs.

Bypassing Probate and Ensuring Privacy

The most compelling reason to choose a living trust is its ability to completely avoid the probate process. Since the trust—not you as an individual—legally owns the assets, there is nothing for a court to administer when you die. This fundamental principle is a cornerstone of the Texas Trust Code.

Upon your death or incapacitation, your designated successor trustee seamlessly takes control to manage or distribute the assets according to your instructions. This process, known as trust administration, occurs privately. There are no court filings and no public records. To learn more about this key advantage, you can read our detailed guide on how to avoid probate in Texas.

A trust is more than just an estate plan; it’s a continuity plan. It ensures your assets are managed according to your exact wishes by a person you trust, without the delays, costs, and public exposure of court proceedings.

Gaining Greater Control Over Your Legacy

A trust also provides a level of control that a will cannot match. Instead of your heirs receiving their inheritance in a single lump sum, a trust allows you to set specific terms for how and when they inherit.

For example, you could structure distributions to occur at certain ages, such as 25, 30, and 35. You could also link distributions to life milestones, like graduating from college or purchasing a home. This is also an ideal tool for providing long-term financial support for a beneficiary with special needs without jeopardizing their eligibility for government benefits. This flexibility ensures your wealth supports your loved ones exactly as you intend. A knowledgeable Texas trust administration lawyer can help you tailor these provisions to your family’s unique circumstances, creating a truly personalized legacy.

Comparing Trusts and Wills Across Key Factors

Choosing between a will and a trust is a personal decision that dictates how your legacy is managed and who remains in control. To make the right choice for your family in Texas, it is essential to compare these two powerful tools based on the factors that matter most.

The decision between a Living Trust vs. Will is one of the most important in estate planning, as each path has a profoundly different impact on your assets and your family’s experience. Let's examine the real-world differences in how they handle probate, privacy, costs, and long-term control.

Probate Avoidance: The Fundamental Difference

The most significant distinction between a will and a trust is their relationship with the Texas probate courts. This single factor affects everything from how quickly your assets are distributed to how much privacy your family retains.

A will is designed to go through probate. It is a set of instructions for the judge and has no legal power until a court validates it. While Texas has a relatively efficient system, court oversight is still mandatory, which can lead to delays and legal costs.

In contrast, a living trust is created to bypass probate entirely. Because you transfer your assets into the trust during your lifetime, they are owned by the trust, not by you personally. When you pass away, there is nothing for the court to administer. Your chosen successor trustee can step in immediately to manage and distribute your assets privately, following the rules you already established.

Privacy Protection: Public Record vs. Private Document

In an age where privacy is paramount, the difference here is stark. A will becomes an open book, while a trust remains a private family document.

Once a will is filed for probate in Texas, it becomes a public court record. This means anyone—a curious neighbor, a distant relative, or a financial predator—can look up the value of your estate, see who your beneficiaries are, and read your specific instructions. This public exposure can lead to uncomfortable situations, including unwanted solicitations or even challenges to the will.

A trust, governed by the Texas Trust Code, is a completely private document. Its terms are only shared between the trustee and the beneficiaries. Your finances, family dynamics, and final wishes remain confidential, shielded from public scrutiny.

A trust ensures the transfer of your wealth remains a private family affair, managed by the people you trust, not a public court system. You simply can't achieve this level of confidentiality with a will.

Will vs. Trust: A Side-by-Side Comparison for Texans

To make the decision clearer, let's compare these two tools head-to-head. This table provides a quick, at-a-glance overview of the key differences when choosing between a will and a living trust in Texas.

| Feature | Last Will and Testament | Revocable Living Trust |

|---|---|---|

| Probate | Required. Must be filed with and validated by a Texas probate court. | Avoids Probate. Assets are managed and distributed by the successor trustee without court oversight. |

| Privacy | Becomes a public record once filed in court. Anyone can access the details. | A completely private document. The terms are confidential to the trustee and beneficiaries. |

| Cost | Lower upfront cost to create, but can lead to significant back-end probate expenses. | Higher upfront cost to create and fund, but avoids costly probate fees later. |

| Effective Date | Only takes effect after your death. | Becomes effective immediately upon signing and funding. |

| Incapacity Planning | Offers no protection. A court-ordered guardianship may be needed if you become incapacitated. | Excellent for incapacity. Your successor trustee can manage assets for you without court action. |

| Control After Death | Limited control. Assets are distributed outright to beneficiaries. | Maximum control. Can hold assets in trust for beneficiaries, protecting them for years. |

| Asset Protection | No asset protection for beneficiaries. Inheritances are exposed to creditors and lawsuits. | Can be structured to provide significant asset protection for beneficiaries' inheritances. |

| Ease of Administration | Requires court supervision, formal accountings, and can be a lengthy process. | Administration is private, efficient, and managed directly by the trustee you appointed. |

As you can see, the choice is not just about avoiding probate; it is about ensuring privacy, maintaining control, and protecting your family from unnecessary complications.

Cost Considerations: Upfront vs. Long-Term Expenses

Cost is a common concern, but it is important to consider the entire financial picture. A will may seem less expensive initially, but a trust often saves your family significantly more money and stress in the long run.

- Will Costs: The initial fee to draft a will is typically lower. The hidden costs emerge during probate—court filing fees, attorney's fees, and executor compensation—which can consume a percentage of your estate's value.

- Trust Costs: A living trust has a higher upfront cost because it is a more complex legal document and requires formally transferring your assets into it (a process called "funding"). However, by avoiding probate, you eliminate those future court and legal fees, potentially saving your estate thousands of dollars and months of delay.

For many Texas families, the initial investment in a trust pays for itself many times over by preserving the assets you worked hard to accumulate. For a deeper dive, you can explore more factors to consider when choosing between a will and a trust.

Management During Incapacity

A comprehensive estate plan should protect you not only after you are gone but also if you become unable to manage your own affairs. In this regard, a trust offers a significant advantage.

A will is only effective after you die, so it provides no protection for incapacity. If you have only a will and suffer a serious illness or injury, your family would likely need to go to court to establish a guardianship. This is a public, costly, and often stressful process just to gain the authority to manage your finances.

A living trust, however, is designed for this exact scenario. If you become unable to act as your own trustee, the successor trustee you pre-selected can step in seamlessly to manage your assets for your benefit. There is no court intervention, no delay, and no public disclosure of your private health or financial matters. Your life continues with minimal disruption, all according to the plan you created.

When to Choose a Will, a Trust, or Both

Understanding the mechanics of wills and trusts is one thing; determining which is right for your situation is another. The correct answer in the "trust vs. will in Texas" debate depends on your family structure, your assets, and your ultimate goals. Let’s walk through a few practical, real-world scenarios to illustrate how these tools function.

There is no one-size-fits-all solution, but these examples can help clarify which path may be best for you.

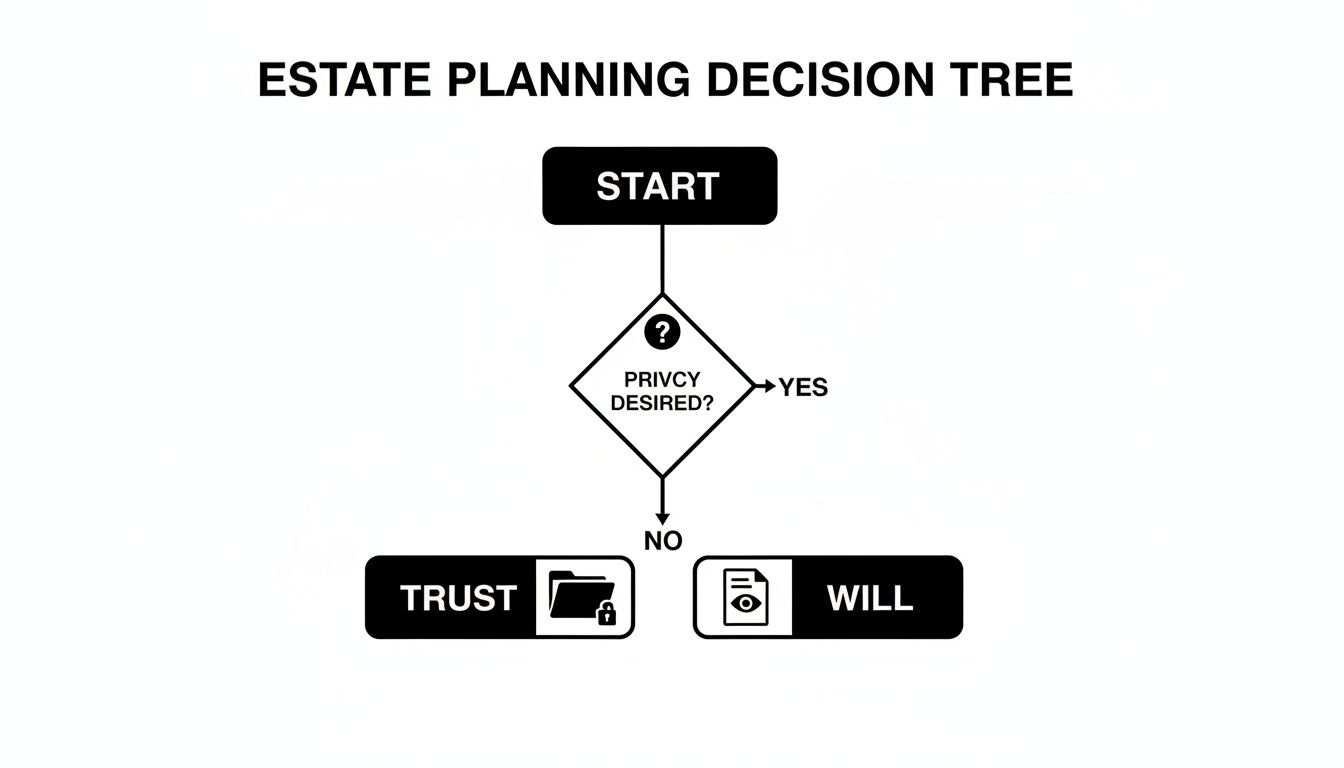

As this chart illustrates, if maintaining your family's financial privacy is a top priority, a trust is almost always the superior choice.

Scenario One: The Young Family with Minor Children

Imagine a young couple with two small children and their first home. Their primary concern is not complex asset protection; it is ensuring their children are cared for by the right people if the unthinkable happens.

For them, a will is essential. It is the only legal document where they can name a guardian for their minor children. Without a will, a judge who does not know their family would decide who raises their children—a worst-case scenario for any parent. They might add a trust later as their assets grow, but a well-drafted will addresses their most immediate and critical need.

Scenario Two: The Established Professional or Business Owner

Now, consider a successful business owner whose main goals are ensuring a seamless business transition and keeping her financial affairs private. For her, probate would be a disaster, potentially halting business operations and exposing her wealth to public scrutiny.

A revocable living trust is the clear solution. By transferring her business interests and other significant assets into the trust, she ensures a smooth transition of control. Her chosen successor trustee can step in immediately to manage the business without waiting for court approval, protecting both her legacy and her privacy. The frustrating delays and public nature of probate are completely avoided.

Scenario Three: The Blended Family

Let's look at a blended family. A husband wants to provide for his second wife for the rest of her life, but he also wants to ensure his assets ultimately pass to his children from a prior marriage. This common and sensitive situation is difficult to manage effectively with a simple will.

A trust provides the perfect structure. He can establish a trust that allows his wife to live in their home and use the trust's assets for her support. The trust document can then specify that upon her passing, the remaining assets are distributed to his children. This approach honors his commitments to both his wife and his children, mitigating potential family conflicts. It offers a level of detailed control that a will simply cannot provide, ensuring his wishes are followed precisely.

The Best of Both Worlds: Using a Pour-Over Will

For many Texans, the most effective estate plan is not an "either/or" choice but a combination of both a will and a trust. This is achieved using a special tool called a pour-over will.

A pour-over will is a safety net designed to work with your living trust. Its primary function is to "catch" any assets you may have forgotten or neglected to transfer into your trust. Upon your death, the will directs your executor to "pour" these remaining assets into your trust. While those specific assets will have to go through probate, the will ensures they are ultimately managed and distributed privately according to your trust's terms. Using both documents creates a comprehensive, gap-free plan.

Consider this real-world example: A Texas family's patriarch passed away unexpectedly with an estate valued at around $800,000. He had a simple will but no trust. The probate process, governed by the Texas Estates Code, turned their private finances into a public record. It took over eight months for the court to validate the will, incurring attorney fees, court costs, and executor payments that consumed 5-7% of the estate—between $40,000 and $56,000. You can discover more about avoiding these pitfalls by reading our detailed analysis.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

Busting Common Myths About Texas Wills and Trusts

Misinformation about estate planning is common and can lead to serious legal and financial consequences for the very people you want to protect. When it comes to the "trust vs. will" debate in Texas, it is critical to separate fact from fiction. Let's address some of the most damaging myths we encounter in our practice.

Myth 1: Trusts Are Only for the Wealthy

This is perhaps the most persistent myth. Many people hear the word "trust" and imagine vast fortunes and sprawling estates. This is simply not true. While trusts are excellent tools for managing large estates, their primary benefits—privacy, probate avoidance, and control—are valuable to families at all asset levels.

At its heart, a trust is about maintaining control and shielding your loved ones from a public and often frustrating court process. A family with a paid-off home and some savings can benefit from a trust just as much as a millionaire. A skilled Texas estate planning attorney can design a trust that is tailored to your assets and goals, regardless of their monetary value.

Myth 2: A Will Keeps Your Estate Out of Probate

This is a significant and costly misunderstanding. A Last Will and Testament does not avoid probate; it guarantees it. A will is essentially a set of instructions for the probate court. It has no legal authority until a Texas judge validates it, a process dictated by the Texas Estates Code.

Even with Texas’s relatively efficient probate process, it is still a formal, public, and court-supervised proceeding. Your will and your family's financial details become public record. The only way to bypass the court system is with assets held in a trust or through other non-probate tools like beneficiary designations.

Key Takeaway: A will is a ticket to the probate process, not a way around it. A revocable living trust is the primary tool used to avoid probate entirely.

Myth 3: Online Templates Are a Safe Substitute for a Lawyer

In an effort to save money, many people are tempted by do-it-yourself will or trust templates found online. This is an incredibly risky approach. These one-size-fits-all documents often fail to account for the specific legal requirements of Texas law, potentially rendering them invalid.

Furthermore, a template cannot understand your unique family dynamics, the nature of your assets, or your long-term objectives. An improperly drafted document creates ambiguity, which often leads to expensive family disputes and litigation—costs that far exceed what you would have paid for professional legal advice. Hiring a qualified attorney ensures your plan is legally sound and effectively accomplishes your goals, protecting your family from a potential legal disaster. This step is non-negotiable for achieving real asset protection and true peace of mind.

Your Texas Estate Plan Questions, Answered

When you start digging into estate planning, a lot of questions pop up. It’s completely normal. To give you some clarity, we've put together answers to the questions we hear most often from Texans just like you.

Can I Have Both a Will and a Trust?

Not only can you, but it’s often the smartest move. Think of a will and a trust as a powerful team working together to protect your legacy. A well-crafted estate plan usually has both. The trust does the heavy lifting, managing and distributing most of your assets privately and efficiently. Then, you have what’s called a pour-over will acting as a safety net. Its job is simple: to catch any assets you might have forgotten to put into the trust and "pour" them in after you pass away. It’s the perfect backup plan.

Do I Need to Update My Estate Plan?

Absolutely. Life doesn’t stand still, and neither should your estate plan. We tell our clients to pull it out and take a look every three to five years, or anytime something major happens in their life. What counts as a major event? Things like:

- Getting married, divorced, or remarried

- Welcoming a new child or grandchild

- A big swing in your finances—up or down

- Losing a beneficiary, executor, or trustee you had named

- Changes in Texas or federal estate tax laws

Keeping your plan current ensures it always reflects what you actually want, not what you wanted five years ago.

Is My Out-of-State Will or Trust Valid in Texas?

Generally, yes. If your will or trust was valid in the state where you signed it, Texas will usually recognize it. However, "recognized" and "optimized" are two very different things. Every state has its own quirks, and Texas is no exception. We’re a community property state, for instance, which completely changes how marital assets are handled. It's always a good idea to have a Texas estate planning attorney review your out-of-state documents. We can spot potential hiccups and make sure your plan works seamlessly with our local laws.

An out-of-state plan might be legally valid here, but it wasn't built for Texas law. A quick review can save your family from expensive headaches tied to community property rules and local probate court practices.

What Happens if I Die Without a Will or Trust?

If you pass away without an estate plan, the state of Texas has a plan for you—it’s just probably not the one you would have chosen. This is called dying "intestate." When this happens, the Texas Estates Code lays out a rigid formula for who gets your property. The court steps in, appoints an administrator, and your assets are divided up among your relatives based on a legal flowchart. Your actual wishes won't be part of the equation. It's a process that can drag on, cost a fortune in legal fees, and create a lot of stress for your family. The only way to stay in the driver's seat is to create your own plan.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process. https://texastrustadministration.com