Planning for the future can feel overwhelming, but with the right legal guidance, it doesn't have to be. A durable power of attorney, or DPOA, is a cornerstone legal document here in Texas that allows you to handpick a trusted person—we call them an "agent"—to handle your financial and legal affairs. The critical part is that its power stays in effect even if you become incapacitated, making sure your affairs are managed without needing a court to step in.

Why a Durable Power of Attorney Is a Must-Have for Every Texan

Thinking about the future can be daunting, but taking proactive steps to protect your family's financial stability is one of the most empowering things you can do. A durable power of attorney isn't just for when you're older; it's a vital shield that keeps your life running smoothly, no matter what curveballs come your way.

Without one, your family could face an expensive, emotionally draining court battle just to get the authority to manage your affairs.

A Common Texas Scenario

Let’s picture this: You're a busy professional in Houston, managing your career while also looking after your aging parents up in The Woodlands. One day, a sudden accident leaves you unable to make decisions, sign checks, or pay your mortgage. Without a durable power of attorney, your loved ones are thrown into a legal nightmare. They would have to petition a court for guardianship under the Texas Estates Code.

That process can drag on for months and rack up thousands in legal fees. In fact, Texas probate data shows that court-appointed guardianships can cost $5,000 to $10,000 in initial fees and take a grueling three to six months to establish.

The Practical Benefits of a DPOA

A well-drafted DPOA brings incredible peace of mind because it puts you in control of your own future. Here's what it allows you to do:

- Avoid Guardianship: You appoint your agent, keeping the decision out of a judge's hands. This step-by-step guidance saves your family a world of time, money, and heartache.

- Choose Your Decision-Maker: You can select someone you personally know and trust to act in your best interests, rather than a court-appointed stranger.

- Keep Your Finances Running: Your agent can step in immediately to manage bank accounts, pay bills, and handle investments, preventing financial chaos.

- Protect Your Assets: A DPOA is a vital piece of a complete asset protection strategy, helping to safeguard the legacy you've built.

This document is more than a legal form; it’s an act of compassion that shields both you and your family from future uncertainty. While creating legal documents can feel like a big task, there are resources out there to make it easier. For those looking for a starting point, a Free AI Contract Generator might offer some initial guidance. You can also dive deeper into our guide on the different power of attorney documents available in Texas.

Why Durability Is The Secret Sauce Under Texas Law

Not all powers of attorney are created equal. The single most important word to remember is “durability.” This feature, as laid out in the Texas Estates Code, transforms a simple legal document into a powerful shield for your future and is a cornerstone of smart estate planning.

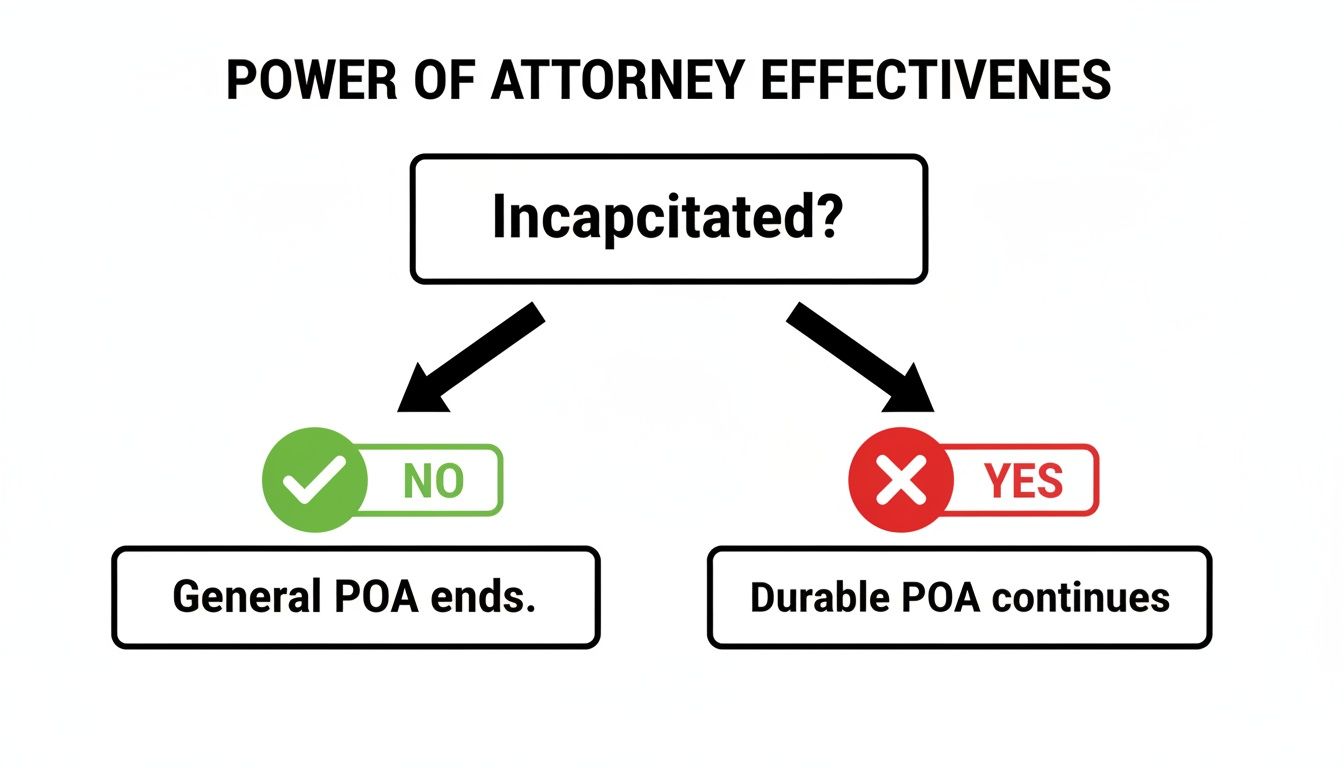

Think of it like this: a general power of attorney works fine while you are fully capable. But the moment you become incapacitated, its power vanishes—failing you at the exact moment you need it most.

A durable power of attorney, on the other hand, is built to last. It remains effective even if you can no longer make decisions for yourself, ensuring the person you’ve chosen can step in seamlessly to manage your affairs.

Comparing Your Options in Texas

The differences between these documents are significant. Making the right choice protects your wishes and saves your family from the agonizing process of a court-ordered guardianship.

Let's lay out the distinctions so you can see them side-by-side.

Comparing Types of Powers of Attorney in Texas

| Feature | Durable Power of Attorney | General Power of Attorney | Springing Power of Attorney |

|---|---|---|---|

| Effective When? | Immediately upon signing (unless you add "springing" terms). | Immediately upon signing. | Only when a specific event happens, usually your incapacity. |

| Stays Valid During Incapacity? | Yes. This is its most important job and the core reason for its existence. | No. Its power evaporates the moment you're deemed incapacitated. | Yes. It's specifically built to activate when you become incapacitated. |

| Primary Use Case | Planning for potential incapacity, giving someone seamless control over your affairs. | Short-term, specific tasks while you're fully competent (like selling a car while you're traveling). | Incapacity planning for people who want the agent's power to lie dormant until absolutely necessary. |

| Potential Drawback | Your agent gets immediate authority, so you have to trust them completely. | It leaves a massive hole in your plan, offering zero protection if you unexpectedly become incapacitated. | Proving you're incapacitated can cause serious delays. Banks get nervous and demand letters from doctors, which takes time. |

This table makes it clear why durability is the bedrock of any solid estate plan. It closes the dangerous gap that a general power of attorney leaves wide open.

The Problem with "Springing" into Action

You might be looking at the "springing" power of attorney and thinking it sounds like a good compromise. The problem is, it comes with a massive real-world hurdle.

The authority only "springs" to life after your incapacity is officially certified by a doctor. This sounds straightforward, but in reality, it can trigger frustrating delays. Financial institutions are notoriously cautious and will often demand extensive proof, like letters from two different physicians, before they will honor the document.

A durable power of attorney that is effective immediately completely sidesteps these bureaucratic nightmares. It empowers your agent to act fast, right when you need them, preventing missed bill payments and protecting your assets while your loved ones are stuck trying to prove your condition to a bank.

While a non-durable POA becomes worthless upon mental decline, a DPOA just keeps working. It gives your agent the power they need to negotiate deals, manage digital assets, and handle online accounts. In Texas, a POA is generally assumed to be durable if worded correctly according to the Estates Code, but it's always best to be explicit. For fiduciaries, an immediate DPOA prevents those "springing" delays that can snarl up to 30% of cases due to verification headaches, as noted in recent insights on thomsonreuters.com.

At the end of the day, the durability provision is your safety net. It guarantees the person you trust has the authority they need, exactly when they need it. A Texas estate planning attorney can walk you through these options and help you figure out which structure is the right fit for your family.

Selecting Your Agent and Their Fiduciary Duties

Choosing the person who will act as your agent is the single most important decision you'll make when setting up a durable power of attorney. This isn't just about picking a close family member; it's about entrusting someone with immense authority over your finances. You need to choose someone you trust without a shadow of a doubt.

When you grant this power, Texas law places a heavy legal and ethical responsibility on your agent. It's called a fiduciary duty, which is the highest standard of care recognized by our legal system. This duty is a cornerstone of the Texas Estates Code, and it's vital that both you and your potential agent understand exactly what it means.

Who Should You Choose as Your Agent?

The ideal agent is a mix of integrity, financial common sense, and the confidence to act on your behalf. They don't need to be a financial expert, but they must be organized, responsible, and 100% committed to looking out for your best interests.

When weighing your options, look for these key traits:

- Unwavering Trustworthiness: This is non-negotiable. Your agent will have access to your bank accounts, your home, and your assets. You need complete faith in their honesty.

- Financial Responsibility: How do they handle their own finances? Someone who is careful and organized with their own money is more likely to treat yours with the same respect.

- Clear Communication Skills: Your agent may need to speak with bankers, doctors, or lawyers. You want someone who can communicate clearly and advocate for you effectively.

- Willingness to Serve: Being an agent can be a demanding, time-consuming role. You must have a frank conversation with the person you have in mind to ensure they are truly willing and able to take on this responsibility.

It's also smart to name at least one successor agent as a backup. If your first choice cannot serve for any reason, your successor can step in without delays or court involvement.

Understanding Fiduciary Duties in Texas

The moment your agent accepts the role, they become a fiduciary. This legal term means they are required by law to act only in your best interest, putting your needs far ahead of their own.

Under Texas law, a fiduciary relationship is built on utmost good faith, trust, and candor. An agent cannot engage in self-dealing or place their personal interests in conflict with their duties to you, the principal. These are core fiduciary principles.

If an agent violates these duties, the consequences can be severe. They could be held personally liable for any financial losses and even face a lawsuit. A seasoned Texas trust administration lawyer can walk your chosen agent through these responsibilities to ensure everyone is on the same page.

The infographic below illustrates why this duty is so critical. A durable power of attorney is designed to work during your incapacity—exactly when you are most vulnerable.

As the chart shows, the "durable" feature keeps the document active, allowing your agent to manage your affairs when you cannot.

Core Fiduciary Duties Explained

The Texas Estates Code outlines an agent's responsibilities in detail. Here are the main fiduciary duties in Texas your agent must follow:

- Duty of Loyalty: The agent must act for your benefit and your benefit alone. This means no conflicts of interest. They cannot use your money for their personal gain unless you specifically authorize it in the DPOA.

- Duty to Act in Good Faith: Every decision must be made honestly, with your best interests as the guide. The agent must follow your instructions and preserve your estate plan as you intended.

- Duty of Care: Your agent must manage your property with the same care and prudence they would use for their own. This involves making sensible financial choices and protecting your assets.

- Duty to Keep Records: Your agent must keep meticulous records, tracking every penny that comes in and goes out. This ensures accountability and protects both you and the agent.

For example, if your agent knows your will leaves your Dallas home to your daughter, they cannot sell that house and give the money to someone else. That would be a clear violation of their duty to preserve your estate planning intentions and could lead to a difficult probate dispute.

Customizing the Powers You Grant Your Agent

A durable power of attorney is not a generic, one-size-fits-all document. Think of it as a custom-tailored suit, designed to fit your unique financial life and personal wishes.

While the Texas legislature provides a "statutory" form that works as a helpful checklist, the real strength of a DPOA is your ability to decide exactly what authority your agent will have. This is where you take control.

This customization is critical. You can grant your agent sweeping powers to handle nearly every aspect of your financial life, or you can narrow their authority to specific tasks. The most important thing is to be intentional, ensuring the document reflects your trust in your agent and addresses your specific situation.

Broad vs. Limited Authority

Granting broad authority can be incredibly effective, especially if you have complete trust in your agent. It provides the flexibility to manage unexpected situations without the delay of going to court for permission. For most people, this is the most practical route because it is impossible to predict every financial need that might arise.

On the other hand, you may feel more comfortable limiting your agent’s powers. For example, you could authorize them to pay monthly bills and manage a checking account but specifically forbid them from selling your home or altering retirement investments. This approach adds a layer of protection around key assets.

Under the Texas Estates Code, any power you grant must be crystal clear and explicit. Banks and other financial institutions have the right to reject a DPOA if the language is too vague, so specificity is your best defense against future roadblocks.

This is precisely why working with a knowledgeable Texas estate planning attorney is so vital. We can help you draft the document with precise language that institutions will recognize and respect, ensuring your agent can act the moment you need them to.

Specific Powers You Can Grant

The standard Texas form lays out several categories of powers you can grant by initialing next to them. Each one covers a different area of your financial life.

- Real Property Transactions: Lets your agent buy, sell, lease, or mortgage real estate on your behalf.

- Banking and Financial Transactions: With this, your agent can manage bank accounts, sign checks, make deposits, and access your safe deposit box.

- Business Operations: Empowers your agent to keep your business running by paying employees, managing contracts, and handling daily operations.

- Insurance and Annuities: Your agent can manage, purchase, or cash out insurance policies and annuities.

- Government Benefits: Covers the authority to apply for and manage benefits like Social Security, Medicare, or VA benefits.

- Tax Matters: Allows your agent to file your tax returns and deal with the IRS if needed.

A Real-World Scenario: Protecting a Business

Imagine a small business owner in Austin who runs a thriving catering company. She is the sole owner and handles everything. What happens if she is in a serious car accident and incapacitated for months? Who will sign employee paychecks, pay suppliers, and negotiate with clients?

Without a durable power of attorney, her business would grind to a halt. Her family would be forced into a costly and time-consuming guardianship proceeding, which could destroy the business she built.

By creating a DPOA ahead of time, she can grant her trusted business manager (her agent) specific authority for business operations. This simple step ensures the business continues to run smoothly, protecting her employees' jobs, her company's reputation, and the value of her most important asset.

Making Your DPOA Official in Texas

For a durable power of attorney to have any real power, you must sign and finalize it exactly as Texas law requires. An improperly executed DPOA is worthless and can leave your family facing the very guardianship court process you were trying to avoid.

The rules in the Texas Estates Code aren’t just suggestions; they are strict requirements. Fortunately, with proper guidance, getting it right is straightforward, ensuring your DPOA is a solid tool your agent can use when needed.

The Must-Haves for a Valid Texas DPOA

To make your durable power of attorney legally binding in Texas, there are a few non-negotiable steps. If you miss one, a bank has every right to reject the document, leaving your agent powerless.

The absolute essentials are:

- It must be in writing. A verbal agreement will not hold up in court.

- You (the principal) must sign it. If you are physically unable, someone else can sign for you, but it must be done in your presence and at your direction.

- Your signature must be acknowledged by a notary public. The notary confirms your identity and that you are signing willingly.

Without a notary's seal, your DPOA is not legally enforceable in Texas. It’s a simple but crucial step that prevents fraud and validates the document.

Common Mistakes That Can Invalidate Your DPOA

Many people with good intentions stumble at the finish line, often by using a generic template from the internet. These one-size-fits-all forms can create devastating problems.

A classic mistake is using a form that is missing the specific "durable" language required by Texas law, or simply forgetting to have it notarized. Financial institutions are trained to look for these errors and will reject a DPOA that doesn't follow the Texas Estates Code to the letter.

Other frequent slip-ups include:

- Vague Language: Using fuzzy terms makes financial institutions nervous. If they can’t determine exactly what you’ve authorized, they are likely to say no.

- Improper Witnessing: While not always mandatory for a financial DPOA in Texas, having witnesses can add an extra layer of protection, especially if you think someone might challenge the document's validity.

- Forgetting to Name Backups: If your first-choice agent cannot serve, your DPOA could become useless without a successor agent named.

The simplest way to sidestep these landmines is to work with an experienced Texas estate planning attorney. We know what banks need to see and draft documents designed to work without a hitch when your family needs them most.

Storing and Sharing Your DPOA

Once your DPOA is official, what you do with it is just as important. The original document should be kept somewhere safe but accessible. A fireproof box at home is often a better choice than a bank's safe deposit box, which can be difficult for your agent to access.

Your agent must know where the original is and how to get it. You should also provide them with a high-quality copy. It is also wise to give copies to your primary bank or financial advisor. Getting the document on file with them now can make things infinitely smoother for your agent later.

How to Revoke or Change Your DPOA

Life changes, and your estate plan should be able to change with it. When you create a durable power of attorney, you retain the absolute right to change your mind. As long as you have the mental capacity to make your own decisions, you remain in control.

Sometimes, a DPOA ends automatically. The most common trigger is the principal's death; the moment you pass away, your agent’s authority vanishes. Other automatic terminations under Texas law can occur, such as a divorce (if your spouse was your agent) or if a court starts a guardianship proceeding.

The Steps to Formally Revoke a DPOA

If you decide to switch agents or revoke the document entirely, the process is straightforward but must follow specific legal steps. You cannot simply tell your agent they are fired; you must formalize it to prevent confusion and protect yourself.

The process involves these key actions:

- Create a Written Revocation: You will need a formal, written document that clearly states your intention to revoke the old power of attorney. Like the original DPOA, this new document must be signed and notarized to be legally binding.

- Notify Your Former Agent: Send a copy of the signed and notarized revocation to the person whose authority you are canceling. The best way to do this is via certified mail, so you have a legal paper trail proving they received it.

- Inform All Other Parties: You must also let any bank, financial institution, or person who has a copy of your old DPOA know that it is no longer valid. Providing them with the revocation notice prevents them from honoring the outdated document.

Failing to properly notify all parties can create a real mess. If a bank, unaware of the change, lets your former agent withdraw money from your account, it could spin into a legal nightmare for your family to untangle. Clear, thorough communication is your best defense.

Following these steps ensures your wishes are respected and that there is no ambiguity about who has the authority to act for you. You can learn more about how to formally void a power of attorney in Texas in our detailed guide. Working with a Texas estate planning attorney can ensure every detail is handled correctly, safeguarding your assets and your legacy.

Getting Answers to Your Durable Power of Attorney Questions

When you start exploring the details of a durable power of attorney, practical questions naturally arise. Getting clear answers is the best way to feel confident you're making the right decisions for your family. Let's tackle some of the most common questions we hear from people across Texas.

Does a Durable Power of Attorney Let My Family Skip Probate?

This is a common question, and the answer is a straightforward no. A durable power of attorney is a powerful tool for managing your financial life while you're alive, but its authority ends the moment you pass away.

Probate is the court-supervised process for handling your estate after you are gone. A DPOA is strictly for managing your affairs while you are still here. To help your family avoid or simplify probate, you will need different estate planning tools, such as:

- A Revocable Living Trust

- Payable-on-death (POD) or transfer-on-death (TOD) designations on bank and retirement accounts

- A Transfer on Death Deed for real estate

Think of it this way: a DPOA is for lifetime management, while a will or trust is for after-life distribution. A comprehensive estate plan, prepared by a Texas estate planning attorney, will include both to ensure you are covered.

Can My Agent Use the DPOA to Change My Will?

Absolutely not. Your agent cannot touch your will. A will is a separate legal document with its own strict rules under the Texas Estates Code. Your agent has zero power to change, revoke, or rewrite it.

Changing a trust is more complex. While it is technically possible to give an agent the power to modify a trust, it requires incredibly specific and clear language in the DPOA. This is rarely advisable, as granting such power carries significant risks and should only be considered after a thorough discussion with your attorney.

What If the Bank Won't Accept the DPOA?

It’s incredibly frustrating when a bank or another institution refuses to honor a DPOA, but Texas law offers protection. The Texas Estates Code is clear: if a third party improperly refuses to honor a valid statutory DPOA, they can be held liable for damages and any attorney's fees it takes to force compliance.

If your agent runs into trouble, they should not argue with the bank representative. Instead, they should calmly ask for the bank's refusal in writing and then call our office immediately. We know how to handle this. We will contact their legal department to ensure your DPOA is respected as you intended.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process at https://texastrustadministration.com.