Managing a loved one’s trust can feel overwhelming—but with the right legal guidance, it doesn’t have to be. At its core, trust accounting is the detailed financial record-keeping for a trust. Think of it as the trust's financial diary. It’s a complete report that tracks every single transaction—all the money coming in, all the money going out, and a clear reason for each. It tells the story of how the trust's assets are being looked after over time, ensuring every action aligns with Texas law and the creator's wishes.

Why Trust Accounting Is Essential for Texas Families

Stepping into the role of a trustee carries significant responsibility, but understanding your duties is the first step toward managing a trust with confidence. Trust accounting isn't just about crunching numbers; it’s about upholding a legal and ethical promise to the beneficiaries. In Texas, this process is fundamental to proper trust administration.

Under the Texas Trust Code, a trustee has a fiduciary duty to always act in the beneficiaries' best interests. Meticulous accounting is the primary way a trustee proves they have met this high standard. To understand the mechanics, it helps to know what a trust account is and how it serves as the financial hub for all trust activity.

The Purpose of a Trust Accounting

A clear and accurate accounting isn't just paperwork—it serves several crucial functions. It creates transparency, builds confidence, and protects everyone involved from potential disputes.

Here’s why it’s so important:

- Promotes Transparency: It gives beneficiaries a clear window into how the trust’s assets are being managed, preventing misunderstandings and building trust.

- Fulfills Legal Duties: Texas law requires trustees to keep beneficiaries reasonably informed. A formal accounting is the best way to meet this legal requirement and other fiduciary duties in Texas.

- Protects the Trustee: For the person in charge, detailed records are the ultimate shield. If questions about mismanagement ever arise, a solid accounting proves every decision was made carefully and in accordance with the trust's rules.

- Creates a Historical Record: It serves as the official financial history of the trust, which is invaluable for filing taxes, making distributions, and resolving any questions that may arise years later.

Ultimately, trust accounting is the backbone of responsible trust management. It provides the structure needed to honor the creator's wishes and ensure a smooth, fair process for every beneficiary.

Your Core Fiduciary Duties as a Texas Trustee

Being named a trustee is more than just a title; it is a serious legal and ethical commitment to act in the best interests of the beneficiaries. This is known as a fiduciary duty, and under the Texas Estates Code and Texas Trust Code, it is the highest standard of care one person can owe another.

Meticulous trust accounting is how you demonstrate that you have fulfilled this duty. It is the detailed story of your trusteeship. It’s not just about good bookkeeping; it’s the primary way you show that you've honored your obligations. Every decision, from paying a routine bill to making a major investment, is a chapter in that story, and your accounting is the proof that you put the beneficiaries first.

The Duty of Loyalty and Impartiality

At the heart of your role is the duty of loyalty. This means you must manage the trust only for the benefit of the beneficiaries—never for your own. This duty also demands impartiality, meaning you must treat all beneficiaries fairly as outlined in the trust agreement.

For example, imagine a trust in Austin has two siblings as equal beneficiaries. One needs a distribution for an urgent medical need, while the other wants the funds to remain invested for long-term growth. Impartiality doesn’t mean treating them identically; it means balancing their competing needs fairly, without playing favorites, according to the trust's terms.

Your trust accounting demonstrates this loyalty in black and white by:

- Preventing Conflicts of Interest: Your records must be clear that there was no self-dealing. For example, you cannot sell trust property to yourself or a relative.

- Ensuring Fair Distributions: The accounting will show every payment made, proving that each one aligns with the trust's instructions and legal requirements.

- Justifying Expenses: Every dollar spent from the trust, including your own compensation, must be reasonable and clearly documented for the benefit of the trust.

The Duty of Prudence

Next is the duty of prudence. This requires you to manage the trust’s property with the same care and skill a sensible person would use to manage their own affairs. You are expected to make sound investment choices, protect the assets, and avoid overly risky ventures.

For instance, if you are responsible for investing the trust's funds, you cannot simply put all the money into a single, volatile stock. A prudent trustee diversifies investments to manage risk. This involves making informed decisions based on sound advice, not just hoping for the best. Reviewing common strategies for SMSF trustees can provide insight into prudent investment practices.

A solid trust accounting report will detail every investment gain, loss, and management fee. This paperwork is your best line of defense if a beneficiary ever questions your investment strategy, because it shows a thoughtful, compliant process.

These fiduciary duties are the legal and ethical guardrails for your role as a trustee. For a deeper look at the specific responsibilities you're taking on, see our guide to trustee duties and responsibilities in Texas. Proper accounting is the language you use to communicate that you've upheld these duties with integrity.

The Anatomy of a Texas Trust Accounting Report

At first glance, a formal trust accounting report can look intimidating with its schedules, numbers, and legal terms. However, its structure is logical and designed for one purpose: clarity.

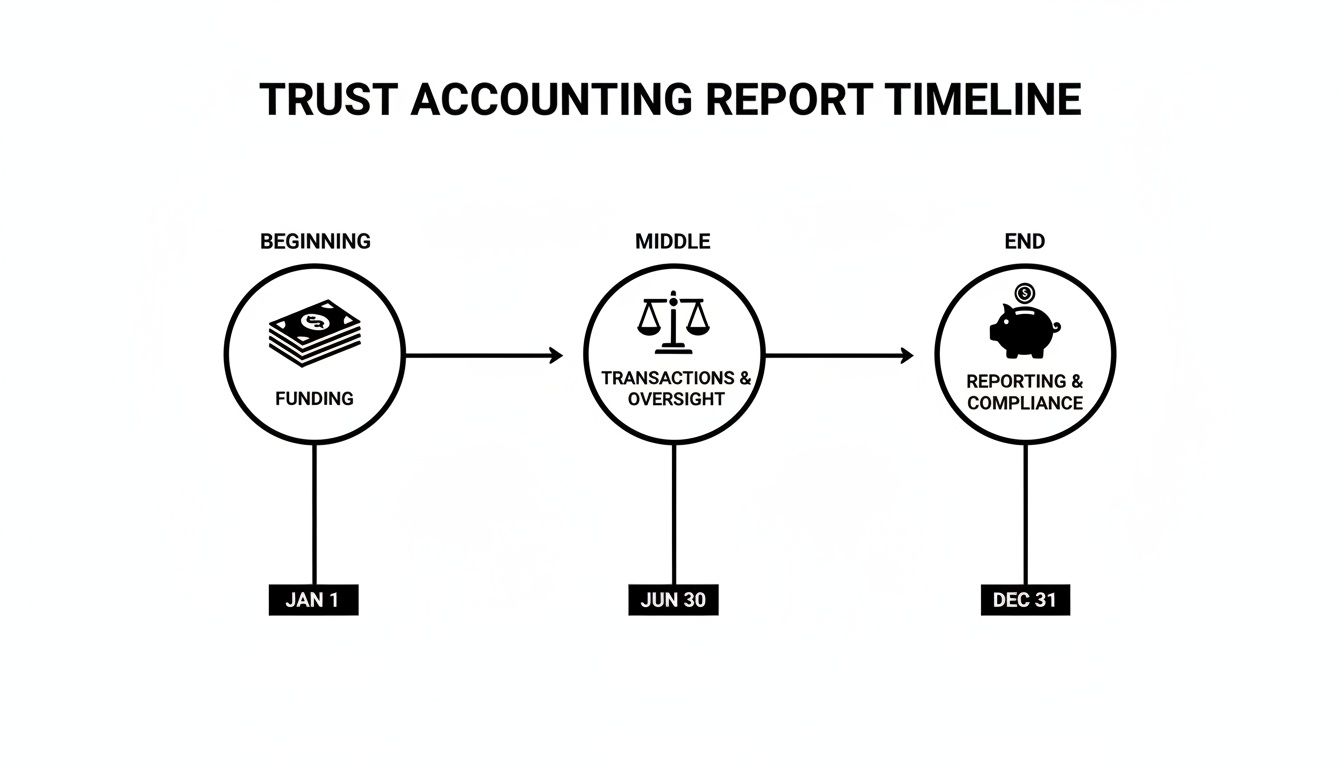

Think of it as a story with a clear beginning, middle, and end. The story starts with what the trust owned on day one, walks through every transaction during the accounting period, and concludes with a snapshot of what the trust owns now. Breaking it down makes it a manageable tool for trustees and beneficiaries alike.

The Starting Line: Assets on Hand

Every trust accounting begins with a list of every asset the trust held on the first day of the accounting period, often called "Assets on Hand at Beginning of Period." It sets the stage for everything that follows.

For a new trust, this is the initial property used to fund it. For an existing trust, this starting inventory will match the ending inventory from the previous accounting period, creating a seamless financial trail.

You’ll typically see assets like:

- Cash: Balances in checking, savings, or money market accounts.

- Real Estate: The fair market value of any properties the trust owns.

- Investments: Stocks, bonds, mutual funds, and other securities, listed with their current market value.

- Other Property: This could include valuable personal items, business interests, or loans owed to the trust.

Charting the Flow: Receipts and Disbursements

Once the starting point is established, the report details all financial activity—the comings and goings of the trust's money and property. It’s broken down into two main categories: receipts (money coming in) and disbursements (money going out).

Receipts detail all the income and other assets the trust received. This section is itemized to show exactly where the money came from, such as interest from bank accounts, dividends from stocks, rental income, or capital gains from selling an asset.

Disbursements show every dollar that left the trust. This section is equally detailed, documenting all expenses and distributions. You’ll see items like property taxes, insurance payments, legal fees, property maintenance costs, and trustee compensation. Crucially, this is also where payments to beneficiaries are recorded.

Documenting Distributions to Beneficiaries

This is often the most closely examined part of a trust accounting. The distributions section provides a clear record of every asset—whether cash or property—paid out to the beneficiaries as specified in the trust document.

Each distribution must be itemized, showing the date, the amount (or a description of the property), and which beneficiary received it. This demonstrates impartiality and proves the trustee is following the grantor's wishes. Properly documenting these transactions is a key part of the distribution of trust assets and helps prevent disputes.

A well-documented distribution schedule is a trustee’s proof of fairness. It shows that they have acted in accordance with the trust document, treating all beneficiaries equitably as required by their fiduciary duty.

The Finish Line: Assets on Hand at the End

Finally, the report concludes with the "Assets on Hand at End of Period," or the ending inventory. This is a final snapshot of everything the trust owns on the last day of the accounting period. The math must add up perfectly:

Starting Assets + Total Receipts – Total Disbursements = Ending Assets

This final balance sheet provides a complete picture of the trust's financial standing and serves as the starting inventory for the next accounting period, bringing the story full circle.

Key Components of a Texas Trust Accounting Report

This table breaks down the standard sections in a formal trust accounting, helping trustees and beneficiaries understand what to look for.

| Component | What It Means | Real-World Example |

|---|---|---|

| Beginning Inventory | A list of all assets and their values at the start date. | On Jan 1, the trust held a home valued at $400,000 and $50,000 in a checking account. |

| Receipts | All money or assets that came into the trust. | Received $1,500 in monthly rent for the home; received $120 in stock dividends. |

| Disbursements | All money paid out for expenses, fees, and distributions. | Paid $4,500 in property taxes; paid $800 for plumbing repairs; paid trustee fee of $500. |

| Distributions | Specific payments made to beneficiaries. | Distributed $10,000 to Beneficiary A as required by the trust for educational expenses. |

| Ending Inventory | A list of all remaining assets and their values at the end date. | On Dec 31, the trust holds the home ($400,000) and a new cash balance of $35,820. |

By understanding these core parts, a seemingly complex legal document becomes a straightforward story about how the trust is being managed.

A Practical Guide to Trustee Record-Keeping

Effective trust accounting doesn't require a finance degree or expensive software. It comes down to consistent, clear daily habits. With a system in place, record-keeping transforms from a daunting task into a simple routine. Let’s walk through a step-by-step example to see how this works in practice.

A Year in the Life of a Texas Trust

Imagine a trust established in Houston to support the creator's two adult children. As the trustee, you are tasked with managing the assets and handling distributions. Here’s a step-by-step guide to logging the first few months of activity:

- January 1: The trust is funded with a $500,000 cash deposit into a new trust bank account. Your first entry documents this initial principal.

- February 15: The trust receives a $1,200 dividend check from stock holdings. You log this as "Receipt: Dividend Income," categorizing it separately from the principal.

- March 30: The property tax bill for a trust-owned home arrives. You pay $4,500 from the trust account and record it as a "Disbursement: Property Tax Expense."

- April 20: One beneficiary requests funds for college tuition, as allowed by the trust document. You issue a $10,000 check and log it as a "Distribution to Beneficiary A."

This simple timeline begins the trust's financial story. Each entry has a date, a description, and a category—the fundamental building blocks of the formal trust accounting report you'll prepare later.

This infographic breaks down the core stages of the trust accounting cycle.

As you can see, it's a continuous loop: you receive funds, manage them prudently, and report everything transparently to remain compliant with Texas law.

Best Practices for Flawless Record-Keeping

A few core principles are essential for protecting both the trust and yourself. Adhering to these practices demonstrates that you are taking your fiduciary duties seriously and helps you avoid costly mistakes.

Avoid Commingling Funds

This is the golden rule: never mix trust assets with your own. The trust must have its own dedicated bank account. Using trust funds to pay a personal bill, even if you intend to repay it immediately, is a serious breach of your duty called commingling and can result in legal consequences. This separation is non-negotiable.

Keep Every Receipt and Invoice

Every transaction, no matter how small, needs a paper trail. Whether you use digital files or a physical filing cabinet, you must keep copies of all receipts, bank statements, invoices, and contracts. This detailed documentation is your proof that every dollar was spent legitimately and for the trust's benefit.

Documenting your decisions is just as important as documenting transactions. For significant actions—like selling a trust asset or making a large, discretionary distribution—write a brief memo explaining your reasoning. This record can be invaluable if a beneficiary ever questions your judgment.

Global Standards for Trust Records

The need for detailed records is a global standard. Since 2015, for example, the British Virgin Islands has required trustees to keep detailed records for at least five years to meet international compliance rules. This global push toward standardized trust accounting practices highlights why Texas law is so strict about trustee record-keeping.

By building these organized habits, you create a solid foundation for your role. This diligent approach not only keeps you compliant but also builds the confidence and trust of the beneficiaries you serve.

Steer Clear of These Common Trust Accounting Blunders

Even the most well-intentioned trustees can make mistakes, but knowing the common pitfalls is your best defense. Simple errors can quickly escalate into beneficiary disputes, legal battles, and even personal liability. Protecting the trust’s assets—and yourself—starts with knowing what to avoid.

Think of this as your guide to the most frequent and preventable errors in trust accounting. By recognizing these common slip-ups, you can take proactive steps to ensure your administration is smooth, transparent, and compliant with Texas law.

Mistake 1: Commingling Funds

This is the cardinal sin of trust management. Commingling is the legal term for mixing trust assets with your personal money. It can be as simple as using the trust's debit card for a personal purchase or depositing a rent check from a trust property into your own bank account.

- Real-World Scenario: A trustee in Dallas pays a plumber for an emergency repair at a trust-owned rental property with his personal credit card, intending to "pay himself back" from the trust later.

- Why It's a Problem: This single act blurs the legal line between the trustee's funds and the trust's funds. It creates a record-keeping nightmare and opens the door to accusations of self-dealing, even with good intentions. Under the Texas Trust Code, this is a clear breach of your duty of loyalty.

- How to Avoid It: From day one, open a separate, dedicated bank account for the trust. Never use trust funds for personal expenses or personal funds for trust expenses.

Mistake 2: Lousy Record-Keeping

Failing to document every transaction is asking for trouble. Beneficiaries have a legal right to know how trust assets are being managed. Every expense, down to the penny, needs a receipt or invoice to back it up.

- Real-World Scenario: A trustee in Houston frequently uses cash from the trust account for small maintenance items—like buying cleaning supplies—but doesn't get receipts for these "minor" expenses.

- Why It's a Problem: At the end of the year, there are hundreds of dollars in cash withdrawals with no paper trail. Beneficiaries will rightfully ask where that money went, leading to suspicion and distrust.

- How to Avoid It: Become a meticulous record-keeper. Save every receipt, invoice, and bank statement. Always document the purpose of every expenditure.

Mistake 3: Misreading the Trust Document

The trust document is your rulebook, not a set of suggestions. You must follow its terms to the letter. Making distributions that are not permitted—or failing to make those that are required—can lead to serious legal consequences.

- Real-World Scenario: A trust document specifies distributions are for a beneficiary's "health and education." The beneficiary asks for money to start a business. The trustee, wanting to be helpful, gives them the funds.

- Why It's a Problem: A business startup does not fall under "health and education." The trustee has overstepped their authority and made an improper distribution. Other beneficiaries could sue the trustee to repay the money to the trust from their own pocket.

- How to Avoid It: Read the trust document thoroughly. If any term is unclear, consult a Texas estate planning attorney. When in doubt about a distribution request, always seek legal advice before writing a check.

Understanding why these essential practices for managing trusts are critical is key. Avoiding these common mistakes is vital to fulfilling your duties and protecting the legacy someone entrusted to you.

When to Partner With a Texas Trust Attorney

While this guide provides a solid map for trust accounting, some situations are too complex or high-stakes to handle alone. Recognizing when to call a legal professional is not a sign of failure—it is the mark of a responsible and prudent trustee. Bringing in an expert protects you from liability and ensures you are acting in the best interests of the trust and its beneficiaries.

Think of an attorney as your co-pilot. When trust terms are ambiguous, an attorney can provide a clear legal opinion on the grantor's intent. This helps you make decisions that honor your duties and prevent disputes.

Navigating Complex Trust Scenarios

Certain administrative duties carry a higher degree of risk and require specialized knowledge. In these moments, partnering with a Texas trust administration lawyer is critical for protecting everyone involved.

You will want a lawyer on speed dial in these situations:

- Managing a Business: If the trust owns a family business, you need guidance on corporate governance, succession planning, and keeping business finances separate from other trust assets.

- Intricate Tax Issues: Trusts can involve complex tax obligations. An attorney, often working with a CPA, can help you navigate estate taxes, generation-skipping transfer taxes, and income tax strategies to preserve the trust's value.

- Beneficiary Disputes: When beneficiaries disagree, an attorney can act as a neutral third party to mediate, enforce the trust's terms, and prevent disagreements from escalating into costly lawsuits.

Seeking legal advice is an investment in peace of mind. A qualified attorney ensures your actions are compliant with the Texas Trust Code, protects you from personal liability, and provides the confidence to manage the trust effectively.

Modifying or Terminating a Trust

Sometimes, a trust's original terms no longer make sense for the beneficiaries. Deciding how to modify a trust in Texas or terminate it entirely is a major legal action that requires court oversight and professional guidance.

An attorney is your advocate in this process. They can petition the court on the trust's behalf, represent its best interests, and ensure every step is handled legally and ethically.

A good legal partner brings clarity when the path forward is uncertain. If you are looking for experienced counsel, it may be time to learn more about finding the right attorneys who specialize in trusts in Texas. They can help you face every challenge with confidence.

Your Top Questions About Texas Trust Accounting Answered

Whether you are a trustee or a beneficiary, questions about the process are natural. The entire process is guided by Texas law, but understanding how those rules apply to your family’s situation is what truly matters. Here are some of the most common questions we receive.

How Often Does a Trustee Have to Show the Books in Texas?

Transparency is essential in Texas trust administration. Under the Texas Trust Code, a beneficiary has the right to demand a formal accounting from the trustee. You can exercise this right once every 12 months.

An accounting is also legally required at other key moments:

- When the trust is terminating and assets are being distributed for the last time.

- When a new person takes over as trustee.

This system ensures beneficiaries have regular opportunities to review the trust's financial health.

What if the Trustee Just Says No to Providing an Accounting?

A trustee's refusal to provide a requested accounting is a major red flag and a direct violation of their legal duties. If this happens, you have legal options. The first step is to send a formal written demand.

If they ignore it, it is time to seek professional help. Your next step is to work with a Texas trust administration lawyer to file a motion in court, asking a judge to order the trustee to produce the accounting. This legal action is often necessary to enforce your rights.

Can the Trustee Get Paid for Managing the Trust?

Yes. Texas law recognizes that managing a trust is significant work. The Texas Trust Code allows trustees to receive "reasonable compensation" for their services. What is considered "reasonable" depends on factors like the trust's complexity, the amount of work involved, and the professional skill required.

Any payment to the trustee must be documented in the trust accounting, detailing the amount, the date, and the specific work it was for. This transparency allows beneficiaries to confirm the fees are fair and justified.

What’s the Difference Between Trust Principal and Income?

Understanding the difference between principal and income is fundamental to trust accounting. A simple analogy can help: think of the trust as a fruit tree.

The tree itself is the principal—the core asset that generates value, like real estate, a stock portfolio, or the original cash that funded the trust. The fruit that grows on the tree each year is the income—things like rent checks, stock dividends, or interest payments.

These two categories must be tracked separately because the trust document often has different rules for each. For example, a trust might state that beneficiaries receive all income generated each year, but the principal (the tree) must remain untouched. Proper accounting ensures these rules are followed for both distributions and taxes.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

https://texastrustadministration.com