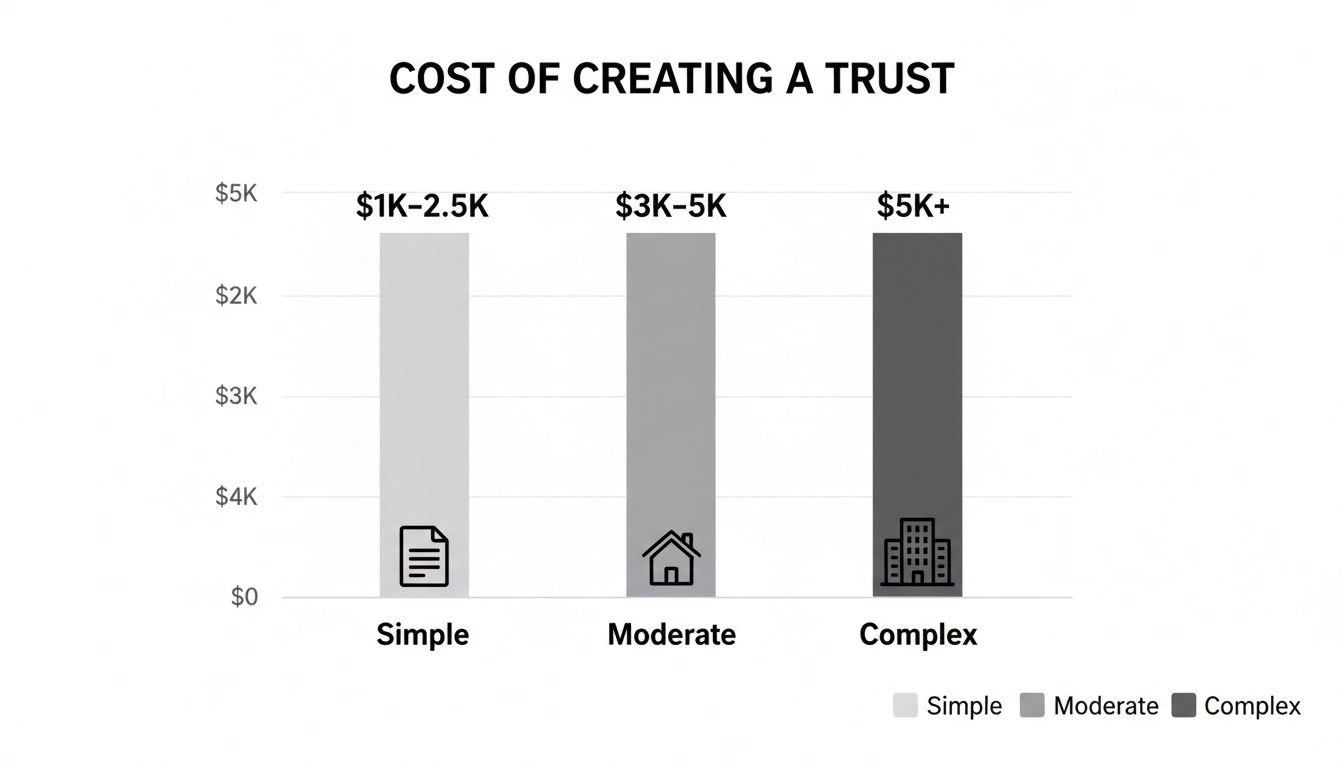

Planning for your family's future can feel overwhelming, but with the right legal guidance, it doesn’t have to be. One of the first questions many people ask is, "What is the real cost to set up a trust?" It's a practical and important question. In Texas, the cost to set up a trust typically ranges from $1,000 for a straightforward plan to over $5,000 for more complex estates.

Think of this upfront cost not as an expense, but as a strategic investment. By creating a trust now, you are taking a crucial step to protect your assets, provide for your loved ones, and avoid the significantly higher costs and public nature of the Texas probate process down the road.

Understanding the Investment in Your Family's Security

It’s easy to focus on the initial price tag, but setting up a trust is a foundational investment in your family’s well-being and your own peace of mind. A properly drafted trust, compliant with the Texas Trust Code, is one of the most powerful tools available for protecting your legacy. It ensures your wishes are followed precisely, all while keeping your family’s affairs private and out of court.

Of course, there’s no one-size-fits-all price. The final cost to set up a trust depends entirely on your unique circumstances and goals.

Key factors that will shape the final cost include:

- The Complexity of Your Assets: An estate with a primary residence and a few bank accounts is simpler to structure than one involving business ownership, multiple real estate properties, and diverse investment portfolios.

- Your Family Dynamics: Planning for blended families, providing for minor children, or establishing protections for a loved one with special needs requires more detailed and specialized legal work.

- The Type of Trust: A basic revocable living trust will have a different cost than a complex irrevocable trust designed for advanced goals like asset protection or minimizing potential estate taxes.

A Visual Guide to Trust Setup Costs

To give you a clearer picture, this chart breaks down the typical cost ranges for setting up a trust in Texas, based on estate complexity.

As you can see, the investment aligns with the level of legal strategy required to properly protect what you've worked so hard to build.

Estimated Trust Setup Costs in Texas at a Glance

For a quick summary, here’s a table comparing the typical costs for different types of trusts when working with a Texas estate planning attorney versus using a generic DIY online service.

| Type of Trust | Attorney-Drafted Cost Range | DIY Online Service Cost Range | Best For |

|---|---|---|---|

| Simple Revocable Living Trust | $1,000 – $2,500 | $200 – $600 | Individuals/couples with straightforward assets (a home, bank accounts, basic investments) and simple distribution plans. |

| Moderate Revocable Living Trust | $3,000 – $5,000 | N/A | Families with multiple properties, business interests, minor children, or specific instructions for beneficiaries. |

| Irrevocable Trust (e.g., ILIT, GRAT) | $4,000 – $8,000+ | N/A | Individuals needing advanced asset protection, estate tax planning, or special needs provisions. |

| Testamentary Trust (within a Will) | $1,500 – $3,500 | $150 – $400 | People who want to create a trust that only becomes active after their death, often for minor children. |

This table highlights that while DIY options appear cheaper, they are only suitable for the simplest scenarios and lack the legal oversight to handle Texas-specific complexities.

Typical Cost Ranges in Texas

Working with an experienced Texas estate planning attorney ensures your trust is fully compliant with state law. Nationally, a basic revocable living trust costs between $1,000 and $4,000. Here in Texas, a simple trust for a family with standard assets typically falls in the $1,000 to $2,500 range. For those with more complex needs, such as multiple properties or specific beneficiary instructions, the cost is generally between $3,000 and $5,000. You can learn more about these trust cost insights from various industry sources.

It can be tempting to use a cheap online DIY service, but this approach comes with significant risks. These services cannot provide the customized legal advice needed to navigate Texas law. Critically, they cannot help you properly fund the trust—the process of transferring assets into it. An unfunded trust is effectively useless, leaving your family exposed to the very probate process you sought to avoid.

An experienced attorney provides more than a document; they deliver a comprehensive strategy to protect your family for generations.

Breaking Down the Fees of Creating a Trust

Understanding the total cost to set up a trust is one thing; knowing what you are paying for provides true clarity and confidence. The final price is not an arbitrary number but the sum of professional services and administrative costs, all working together to build a secure legal foundation for your family.

Think of it like building a custom home. The total cost includes the architect’s plans, permits, materials, and skilled labor. Each component is vital to ensuring the final structure is sound and meets your vision. By breaking down the fees, you can see the true value behind the investment and budget accordingly.

Attorney Fees: Flat Rate vs. Hourly Billing

The largest portion of the cost covers the legal expertise of a qualified Texas estate planning attorney. This fee is for the strategic counsel, custom drafting, and legal guidance required to create a trust that is enforceable under the Texas Trust Code and achieves your family’s unique goals. Attorneys typically use one of two billing models:

- Flat Fee: This is a single, all-inclusive price for the entire trust creation process. At The Law Office of Bryan Fagan, PLLC, we prefer this model because it provides you with complete cost certainty from the start. There are no surprise bills or hidden fees.

- Hourly Billing: Some attorneys charge by the hour. While suitable for certain legal matters, this model can create unpredictability in estate planning, as the final cost can increase with every phone call, question, or revision.

Modern law firms often use sophisticated tools like legal data integration and reporting services to enhance efficiency and thoroughness. The cost of these advanced systems is typically integrated into the overall service fees, ensuring you receive top-tier service.

Essential Administrative and Funding Costs

Beyond attorney fees, several other costs are required to properly establish and fund your trust. These are critical details often overlooked by DIY kits but are essential for a trust to function correctly.

A trust is merely a stack of paper until it is properly "funded." This means legally transferring ownership of your assets into the trust's name. Failing to complete this step is one of the most common and costly mistakes in estate planning.

Here are some of the key administrative fees you can expect:

- Court Filing Fees: While a trust is designed to avoid court, certain documents—especially those related to real estate—may need to be filed with the county clerk. These fees are set by the county and are typically modest, often under $50 per document.

- Asset Retitling Fees: To transfer real estate into your trust, a new deed must be drafted and recorded. This involves county recording fees and the legal work to ensure the title is transferred correctly.

- Appraisal Fees: If you are placing unique or high-value assets like a business, art collection, or antiques into the trust, an official appraisal may be needed to establish its value for legal and tax purposes.

- Notary Fees: Your trust documents must be formally signed and notarized to be legally binding.

Understanding these components demystifies the cost to set up a trust. It transforms an intimidating number into a clear, logical investment in your family's protection and future security.

How Revocable and Irrevocable Trusts Affect Cost

When you explore the cost to set up a trust, you will quickly learn that not all trusts are the same. The fundamental purpose of the trust is the single biggest driver of its complexity and final price. The choice between a revocable and an irrevocable trust is a critical decision in your estate plan that directly impacts the process and cost.

Think of a revocable trust as a flexible blueprint for your estate. As the creator, you can modify the plans, add provisions, or even dissolve it entirely. Because of its adaptability, it is simpler to draft and is generally the more affordable option. It is an excellent tool for avoiding probate and organizing your assets for a seamless transition. To better understand this foundational tool, you can learn more about what a revocable trust is and how it functions.

Why Irrevocable Trusts Cost More

An irrevocable trust, in contrast, is like a permanent fortress designed to protect your assets. Once it is established and assets are transferred into it, you generally cannot make changes. This permanence is its greatest strength, offering powerful protections that revocable trusts cannot provide.

These significant benefits often include:

- Asset Protection: Shielding your wealth from potential future lawsuits or creditors.

- Estate Tax Reduction: Moving assets out of your taxable estate to minimize potential federal estate taxes.

- Government Benefits Planning: Helping a loved one qualify for needs-based programs like Medicaid without having to spend down their inheritance first.

Because these trusts are engineered for such high-stakes objectives, they must be constructed to comply with strict rules under the Texas Trust Code and federal law. This requires far more intricate legal drafting and strategic foresight, which naturally corresponds to a higher upfront investment.

Understanding the Cost Spectrum of Irrevocable Trusts

There is no single price for an irrevocable trust; the cost depends on its specific purpose. For advanced goals like asset protection and Medicaid planning, setup costs can range from $2,000 to over $20,000. A more basic version might fall in the $2,000-$5,000 range, but highly specialized trusts for special needs or complex tax planning can easily exceed that, from $5,000 to $20,000.

For high-net-worth families in Texas, a complex irrevocable trust often averages between $5,000 and $10,000. This price reflects the detailed, specialized work required from an experienced Texas estate planning attorney.

An irrevocable trust is an investment in certainty. While the initial cost is higher, the long-term financial protection it provides for your family can be priceless, saving them from potential taxes, creditors, and legal disputes that could otherwise diminish your legacy.

A Real-World Scenario: Protecting a Child with Special Needs

Let's consider a practical example. Imagine a family in Houston with a child who has special needs and will require lifelong care. They want to leave an inheritance for their child but worry it will disqualify them from crucial government benefits like Medicaid or Supplemental Security Income (SSI).

If they place the inheritance in a simple revocable trust, those funds would be counted as the child's own asset. As a result, the child would likely lose their benefits until the inheritance is spent down, defeating the purpose of their planning.

Instead, they consult with a Texas trust administration lawyer to create a Special Needs Trust, a specific type of irrevocable trust. This document is meticulously structured to hold the inheritance for the child's benefit, not in the child's name. The trustee can then use the funds for supplemental needs—such as therapy, education, or travel—without jeopardizing the child's government assistance.

While this trust costs more to set up than a basic plan, for this family, that higher cost is a necessary and worthwhile investment in their child's lifelong security and well-being.

DIY Trusts vs. An Attorney: A Costly Mistake?

The promise of a cheap online form to protect your life’s work can be alluring. The internet is filled with do-it-yourself (DIY) trust kits that offer a fast, low-cost solution. However, this path, while seemingly a bargain, is fraught with hidden risks that can cost your family dearly in the long run.

Consider this analogy: would you build your dream home using a generic, one-size-fits-all blueprint from the internet? Of course not. That blueprint knows nothing about your property's unique landscape, local building codes, or your family's specific needs. A DIY trust is no different—it's a generic template that ignores the complexities of Texas law and your unique financial and family situation.

Any initial savings from a DIY service disappear the moment something goes wrong. An improperly drafted or, more commonly, unfunded trust can be declared invalid, forcing your estate directly into the public and expensive probate court you were trying to avoid.

The True Cost of Cutting Corners

The initial price of an online trust service is just the beginning. A closer look at the total cost over a decade reveals a different story. Many of these services attract you with a low entry fee, then charge recurring annual fees for "updates" or simply to access your documents. These fees accumulate over time.

For example, data projections over ten years show that a popular online service could end up costing $2,390, including annual update fees. In contrast, while the initial investment with an attorney is higher, a professionally drafted trust often saves families a fortune by successfully avoiding probate, where legal and court fees can easily consume 3-7% of an estate's total value.

A trust is not a simple fill-in-the-blank form. It is a powerful legal instrument that must be meticulously tailored to your assets, your family, and the specific rules of the Texas Trust Code. A single error can have devastating consequences.

Common DIY Trust Failures We See All the Time

A seasoned Texas estate planning attorney provides comprehensive strategic guidance, not just a document. Here are some of the most common and damaging failures we see with DIY trusts:

- Improper Funding: This is the most frequent and catastrophic mistake. A trust is an empty container until you legally transfer your assets—your house, bank accounts, investments—into its name. DIY services do not handle this critical step, leaving countless trusts completely ineffective.

- Violating Texas Law: Generic online forms often omit specific language required by the Texas Trust Code or include provisions that are invalid in our state, opening the door to expensive legal challenges.

- Lack of Customization: Cookie-cutter templates cannot account for real-life complexities like blended families, minor children, loved ones with special needs, or business succession planning. This lack of nuance often leads to family disputes and unintended consequences.

- No Legal Counsel: When questions or issues arise, there is no expert to call. You are left to interpret dense legal language on your own, a recipe for costly errors. You can gain a better understanding of professional guidance by exploring the details of estate planning attorney costs.

To illustrate the difference, let's compare the two approaches over the long term.

DIY Trust vs Attorney-Drafted Trust: A 10-Year Cost and Risk Comparison

| Feature | DIY Online Trust Service | Attorney-Drafted Trust | Key Takeaway |

|---|---|---|---|

| Initial Cost | $300 – $600 | $2,500 – $7,500+ | DIY is cheaper upfront, but it's only a small piece of the total picture. |

| Ongoing Fees | Often includes annual "membership" or "update" fees ($200+/year). | Typically none, unless you need significant revisions. | Recurring fees can make the DIY option more expensive over time. |

| Asset Funding | Not included. You must retitle all assets yourself, a complex and often-missed step. | Guided process is included. The firm ensures your house, accounts, and investments are correctly titled in the trust's name. | An unfunded trust is useless. Professional guidance here is critical for the trust to actually work. |

| Legal Counsel | None. You're on your own to interpret the law and make decisions. | Direct access to an expert for advice on Texas law, asset protection, and family dynamics. | Invaluable for complex situations and ensuring the trust accomplishes your goals. |

| Customization | Very limited. Based on generic templates that can't handle unique family or financial situations. | Fully customized to your specific needs (blended families, special needs, business succession, tax planning). | A tailored plan prevents disputes and ensures your specific wishes are honored. |

| Validity Risk | High. Prone to errors, omissions, and failure to comply with Texas-specific laws. | Very low. Drafted by a licensed attorney to be legally sound and enforceable in Texas courts. | The risk of an invalid DIY trust can send your entire estate to probate, defeating the purpose. |

| Estimated 10-Year Cost | ~$2,390 (initial fee + recurring charges) | $2,500 – $7,500+ (one-time investment) | The cost gap narrows significantly over time, especially before considering potential legal fees from DIY errors. |

| Probate Avoidance | Uncertain. High risk of failure due to improper drafting or funding, leading to probate. | Certain. A properly drafted and funded trust avoids probate, saving 3-7% of the estate's value. | For a $1M estate, avoiding probate can save $30,000 – $70,000—far more than the cost of the attorney. |

Ultimately, engaging an experienced attorney is an investment in certainty. It provides the assurance that your assets are titled correctly, your instructions are legally sound, and your family will be protected during their most vulnerable time. That peace of mind is priceless and something no online form can deliver.

Key Factors That Influence Your Trust's Final Cost

Determining the exact cost to set up a trust in Texas is not like looking at a price tag on a shelf, because no two families are alike. The final cost is tailored to the complexities of your assets, your family structure, and your long-term goals. Understanding what drives the price will help you approach the process with clarity.

Think of it like commissioning a custom suit. An off-the-rack suit has a set price, but it likely won't be a perfect fit. A tailored suit, crafted specifically for you, requires more skill and time, making it a greater investment. A trust is no different; it must be precisely tailored to your family’s unique circumstances to offer real, lasting protection.

Asset Complexity

The nature and variety of your assets are the single biggest factor influencing the cost. An estate with a primary home, a few bank accounts, and a 401(k) involves relatively straightforward planning. However, certain assets require more intricate legal work.

Common examples include:

- Business Ownership: Planning for business succession requires careful legal structuring to ensure a smooth transition and protect the business's value.

- Out-of-State Property: If you own a vacation home in Florida or a rental property in Colorado, we must navigate that state's specific laws to correctly title it in your Texas trust, adding a layer of complexity.

- Unique Assets: Items like art collections, intellectual property, or significant mineral rights require specialized valuation and more detailed planning.

Family Dynamics and Goals

Your family structure and objectives for the trust are equally important. A simple plan to divide assets equally between two adult children is one thing, but life is often more complex.

A trust is more than a financial document; it's a deeply personal plan that must account for human relationships. The more detailed your instructions for protecting loved ones, the more careful the legal drafting must be.

Situations that often increase complexity and cost include:

- Blended Families: Ensuring your current spouse and children from a prior marriage are all provided for requires precise legal language to prevent future disputes.

- Beneficiaries with Special Needs: A Special Needs Trust is essential to provide for a loved one without disqualifying them from vital government benefits. This is a highly specialized area of law.

- Spendthrift Provisions: If you are concerned that a beneficiary may not manage their inheritance wisely, we can include spendthrift clauses to protect their inheritance from creditors and poor decisions. This adds another level of detailed drafting.

Advanced Planning Needs

Finally, if your goals extend beyond simply avoiding probate, your plan will naturally be more sophisticated. This is especially true for high-net-worth families seeking to shield their legacy from significant taxes and other financial risks.

These advanced strategies often involve irrevocable trusts designed for specific outcomes, such as reducing the federal estate tax. For those exploring this, it's beneficial to learn more about the significant irrevocable trust tax benefits available. This level of planning demands a deep understanding of both the Texas Trust Code and federal tax law, making an experienced Texas estate planning attorney an indispensable partner.

Looking Beyond Setup: The Ongoing Costs of Trust Administration

Establishing and signing your trust is a major milestone in protecting your family’s future, but it is not the final step. A trust is not a "set it and forget it" document; it is a living tool that requires ongoing administration to function correctly and remain compliant with the law. Understanding these long-term administration costs is key to ensuring your plan works as you intended for years to come.

Think of it like buying a new car. The purchase price is the major upfront cost, but you must still budget for fuel, insurance, and maintenance to keep it running smoothly. Trust administration is the ongoing maintenance for your financial vehicle, ensuring it reliably carries your legacy to its destination. These costs are essential investments in the security and effectiveness of your estate plan.

What Goes Into Ongoing Trust Administration Costs?

Proper trust administration ensures your plan functions correctly and keeps your family out of court. These responsibilities, governed by the Texas Trust Code and reflecting core fiduciary principles, are what make the trust work. Some of the most common ongoing costs include:

- Professional Trustee Fees: If you appoint a corporate trustee (like a bank or trust company) or a professional to manage the trust, they will charge a fee for their services. This fee typically ranges from 0.5% to 2% of the trust's total assets annually. It covers investment management, beneficiary distributions, tax filings, and fulfilling their legal fiduciary duties.

- Accounting and Tax Prep Fees: A trust is a separate legal entity and often must file an annual income tax return (Form 1041). An accountant will be needed to handle these filings and maintain accurate financial records for the trust.

- Legal Fees for Modifications and Guidance: Life changes. You may want to add a new grandchild as a beneficiary or adjust distribution terms. A Texas trust administration lawyer can help you formally amend the trust document, ensuring all changes are legally sound and properly implemented.

Proper administration is not just a good idea—it is a legal requirement under the Texas Estates Code. A trustee has a fiduciary duty to manage the trust's assets prudently. Neglecting this duty can lead to personal liability and the very legal battles your trust was designed to prevent.

Planning for the Long Haul

While these ongoing costs may seem daunting, they are minimal compared to the alternative: a mismanaged trust entangled in litigation. A well-drafted trust will often include provisions for these administrative expenses to be paid directly from the trust's assets, so the financial burden does not fall on your loved ones.

When you partner with an experienced Texas estate planning attorney from the outset, we help you incorporate these long-term considerations into your plan. We help you anticipate future needs and design a trust that makes administration as efficient and seamless as possible, providing true, lasting peace of mind for you and your beneficiaries.

Common Questions About Texas Trust Costs

As you delve into the details of setting up a trust, specific questions will naturally arise. We have found that most families share similar concerns, so let's address some of the most common ones we hear to help you feel confident and prepared for your next steps.

Is a Flat Fee or an Hourly Rate Better for Setting Up a Trust?

Most of our clients appreciate the certainty of a flat fee. It provides complete transparency on the total cost from day one. You can ask questions and explore your options without worrying about a running clock or surprise bills.

While an hourly rate may be suitable for unpredictable legal matters, creating a comprehensive estate plan should not feel rushed. A flat fee allows you to focus on making the best decisions for your family. During your free consultation, we can discuss which approach best fits your unique situation.

Can I Fund My Trust Myself to Save Money?

While you can technically fund your own trust, this is the most critical and high-risk step in the entire process. Funding is the legal act of retitling your assets—your home, bank accounts, and investments—into the name of the trust.

A single mistake or forgotten account can leave an asset outside the trust, forcing it into probate court. This would defeat one of the primary purposes of creating the trust. We strongly recommend working with an attorney to ensure every asset is transferred correctly, guaranteeing your plan will work as intended when your family needs it most.

Under the Texas Trust Code, an unfunded trust is little more than an empty box. Getting professional help with this final step is what gives the document its real teeth and legal power.

Does a Trust Help Me Avoid Estate Taxes in Texas?

This is a common point of confusion. The good news is that Texas does not have a state-level estate tax. However, your estate could still be subject to federal estate taxes if its total value exceeds the federal exemption amount.

A standard revocable living trust is an excellent tool for avoiding probate, but it does not inherently reduce federal estate taxes. For that purpose, you would need certain types of advanced irrevocable trusts specifically structured by a Texas estate planning attorney to minimize or eliminate that tax liability. This is a complex area of law where professional guidance is essential to protect your family's inheritance.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process. Schedule your free consultation with us today.