Planning for a loved one's future, or your own, can feel overwhelming—but with the right legal guidance, it doesn’t have to be. When it comes to managing personal affairs in Texas, two terms often cause confusion: Power of Attorney and Guardianship. People sometimes use them interchangeably, but they are fundamentally different in how they are created, the control they grant, and what they mean for your personal freedom.

The core difference boils down to a single powerful concept: choice.

A Power of Attorney (POA) is a legal document you create yourself as part of a thoughtful estate plan. It is a proactive choice, where you—the "principal"—select a trusted person to act as your "agent" to manage your financial or medical affairs if you become unable to do so. You are in control, making your wishes known ahead of time.

In contrast, a Guardianship is a reactive solution imposed by a court. It is a legal proceeding that happens only after a judge has formally declared a person to be incapacitated and unable to make their own decisions. Because no Power of Attorney was put in place, the court must step in to appoint a guardian, a process that can be public, costly, and significantly limit an individual's autonomy.

Guardian vs Power of Attorney: A Clear Comparison

Navigating legal planning can feel complex, but understanding these two roles is the first step toward achieving true peace of mind for your family. Both involve one person making decisions for another, but they operate on entirely different legal foundations rooted in the Texas Estates Code.

A Power of Attorney is a cornerstone of smart estate planning. By creating one, you are not just signing a document; you are hand-picking a fiduciary—someone legally bound to act in your best interest—to step into your shoes. This proactive step keeps you in the driver's seat and ensures your wishes are respected by someone who knows you best.

A guardianship, however, is a legal proceeding of last resort. It is the path families are forced to take when a loved one is already incapacitated and can no longer manage their own affairs. A judge must intervene, appoint a guardian, and the entire process becomes public, expensive, and can strip the individual of their fundamental right to self-determination.

Key Distinctions at a Glance

So, where do these two paths truly diverge? It all comes down to how authority is granted. A POA is a private, voluntary decision made with foresight. A guardianship is a public, court-imposed arrangement born out of necessity. The clear advantage of a POA is that it allows you to plan with dignity, keeping your personal matters out of the courtroom. For a deeper academic look at these legal differences, valuable insights can be found on tandfonline.com.

To make it even clearer, let's break it down side-by-side.

At-a-Glance Power of Attorney vs Guardianship in Texas

This table cuts right to the chase, showing you the core differences between voluntarily creating a Power of Attorney and being placed under a court-ordered Guardianship in Texas.

| Aspect | Power of Attorney (POA) | Guardianship |

|---|---|---|

| Origin | Created voluntarily by an individual (the "principal") while they have capacity. | Imposed by a court order after a judge determines an individual is incapacitated. |

| Timing | Proactive—created in advance as part of an estate plan. | Reactive—initiated only after incapacity occurs and no other plan is in place. |

| Control | The principal chooses their agent and defines the scope of their powers. | The court appoints the guardian and determines the extent of their authority. |

| Cost & Privacy | Generally private, less expensive, and avoids court involvement. | Public court proceeding that is often costly, time-consuming, and complex. |

| Flexibility | Can be revoked or changed by the principal at any time, as long as they are competent. | Can only be terminated or modified by a court order, a much more difficult process. |

As you can see, the path you take has significant implications. A Power of Attorney empowers you to stay in control of your destiny, while a guardianship places that control in the hands of the court system. A Texas estate planning attorney can help you understand that planning ahead isn't just a good idea—it's essential for protecting your autonomy.

How a Power of Attorney Works in Texas

A Power of Attorney (POA) is a powerful legal instrument in Texas that allows you to direct your future, even if a time comes when you cannot speak for yourself. Think of it as your proactive instruction manual. You create this document while you have full mental capacity, giving someone you trust the authority to make decisions on your behalf. This is a voluntary choice, putting you firmly in control.

The process is governed by the Texas Estates Code. When you create a POA, two main parties are involved:

- The Principal: That's you—the person creating the POA and granting the authority.

- The Agent (or Attorney-in-Fact): This is the trusted person you have chosen to act on your behalf. They are bound by a legal responsibility called a fiduciary duty, which means they must always act in your best interest. The fiduciary duties in Texas are taken very seriously by the courts.

This structure ensures that the person managing your affairs is someone you selected, not a stranger appointed by a court.

Key Types of Power of Attorney in Texas

Not all POAs are the same; they are designed for different purposes. Understanding the two main types is key to building a comprehensive plan that protects you.

First is the Durable Power of Attorney, which is your essential tool for financial and property matters. This document gives your agent the power to manage your bank accounts, pay bills, handle real estate transactions, and oversee your investments. Its real strength, however, is right in its name.

A "durable" POA is designed to last. It remains in effect even if you, the principal, later become incapacitated. Without this specific durable language, a standard POA would become void at the exact moment you need it most. It is a non-negotiable feature for any effective long-term planning.

The second crucial type is the Medical Power of Attorney. This document gives your chosen agent the authority to make healthcare decisions for you, but only if you are unable to make them yourself. This can involve anything from communicating with your doctors and consenting to treatments to making difficult care decisions that align with your values and wishes.

The Importance of Proactive Planning

Setting up a Power of Attorney is a strategic move in any solid asset protection plan. It keeps control in your hands by letting you decide who will manage your affairs and giving them instructions on how to do it. If you don't have one, your family could find themselves in a public, expensive, and emotionally draining guardianship proceeding just to gain the authority to help you.

Real-World Scenario: Imagine a parent begins showing signs of dementia but never created a POA. Their adult children cannot access their bank accounts to pay for medical care or manage their property without petitioning a court for guardianship. A Durable Power of Attorney would have provided that authority immediately, saving an incredible amount of time, money, and heartache.

When considering these documents, especially a power of attorney for aging parents, it’s vital to have open conversations and seek sound legal advice. Taking this step now ensures their wishes are honored with dignity, keeping control where it belongs: with the family, not the court.

Unpacking the Texas Guardianship Process

What happens when someone can no longer make their own decisions and does not have a Power of Attorney? This is when families often face a difficult reality: a guardianship proceeding. This is the legal path of last resort. It is a court-supervised process that begins only when a Texas court formally declares an individual incapacitated. While the goal is to protect a vulnerable person, it comes at the high cost of their personal freedom.

A guardianship is entirely different from creating a POA. It is a public court case that is often expensive and highly restrictive. The court legally removes a person's right to make their own choices and transfers that power to a court-appointed guardian. This significant loss of autonomy is the primary reason we strongly advocate for proactive estate planning.

The Two Flavors of Guardianship in Texas

The Texas Estates Code allows courts to appoint a guardian to handle different aspects of a person's life. These powers are not one-size-fits-all; they are intended to be tailored to the specific needs of the incapacitated person, who is referred to as the "ward."

There are two primary categories of guardianship:

- Guardian of the Person: This individual is responsible for the ward's physical and personal well-being. Their duties include making decisions about medical care, living arrangements, and daily needs—ensuring the ward is safe and cared for.

- Guardian of the Estate: This guardian is responsible for the ward's financial life. They are appointed to manage the ward's income, pay bills, and handle property and investments. Their core fiduciary duty is to preserve the ward’s assets.

In many cases, the court appoints one person to serve in both roles. However, if the ward has a complex financial situation, a court might appoint a financial professional as Guardian of the Estate and a close family member as Guardian of the Person.

The Court Is Always Watching: Fiduciary Duties Explained

The entire guardianship process is under the constant supervision of the court, which is tasked with protecting the ward's best interests. This is not a one-time appointment; it is an ongoing responsibility. A guardian is a fiduciary, a legal term signifying an unwavering duty to act solely for the ward's benefit.

A guardian's power is not unlimited. They must file regular, detailed reports and accountings with the court, explaining every decision made and every dollar spent. This strict oversight is designed to ensure accountability, but it also makes the process far more cumbersome than managing affairs with a private Power of Attorney.

This system can also reflect societal disparities. For instance, research shows that Black respondents are significantly more likely to have a public guardian (18.4%) compared to just 11.2% of White respondents. Statistics like these underscore why a Power of Attorney is so often preferred—it keeps these intensely personal decisions within a trusted circle of family and friends. You can explore the full findings on these guardianship trends and their impact on autonomy for more information.

Obtaining a guardianship in Texas is not simple. The legal standard requires "clear and convincing evidence" that the person cannot care for themselves or manage their property. A physician's evaluation is almost always required. This rigorous process highlights the gravity of the legal step—one that permanently alters a person's rights. For families facing this difficult path, understanding how to obtain guardianship of a parent can bring much-needed clarity.

How Authority Begins and Ends: A Critical Distinction

When examining the difference between a guardian and a power of attorney, it's not just about who makes decisions. It’s about how that power is granted and—just as importantly—how it is terminated. The way these roles start and stop reveals the vast gap between proactive planning and a court-mandated solution.

One path offers flexibility and personal control. The other is a rigid, court-supervised process from start to finish.

A Power of Attorney (POA) comes into existence through a private, entirely voluntary decision. You, the "principal," choose to create this document while you are of sound mind. This is a strict requirement under Texas law; you cannot create a valid POA once you are deemed incapacitated.

By signing the document and having it properly notarized, you hand-pick an agent and grant them specific powers. That authority can begin immediately, or it can be "springing," meaning it takes effect upon a future date or a specific event you outline. The key takeaway is that you remain in control of the process.

Granting Power: The Proactive Path vs. The Court Mandate

The creation process for each role could not be more different. A POA is a quiet act of foresight, handled privately. A guardianship, on the other hand, is a public, formal, and often stressful legal proceeding.

Creating a Power of Attorney:

- Voluntary Action: You willingly choose to grant authority to someone you trust.

- Private Document: The process typically involves only you, your chosen agent, and your attorney. No court filings are needed to make it valid.

- Full Control: You are in charge, defining exactly what your agent can and cannot do.

A guardianship, in stark contrast, can only be initiated after a court intervenes. The process begins when someone files a petition with the court, alleging that an individual (the proposed "ward") is incapacitated and requires protection.

This is not a simple request. The court requires "clear and convincing evidence" of incapacity. This usually involves medical examinations, reports from a court-appointed investigator, and a formal hearing before a judge. The entire process becomes part of the public record.

Ending the Arrangement: Flexibility vs. Formal Court Orders

Just as their beginnings differ, so do their endings. This is where the flexibility of a POA truly shines, offering a level of autonomy that a guardianship cannot match.

If you have your mental capacity, you can revoke a Power of Attorney at any time, for any reason. This is typically done by providing written notice to your agent and any institutions that hold a copy. For more detailed guidance, you can read our article on how to void a power of attorney. A POA also automatically terminates upon the principal's death.

Ending a guardianship is a far more complex and challenging legal process.

Since a judge created the guardianship, only a judge can end it. This requires filing another formal petition with the court to "restore capacity." The ward must prove to the court that they are no longer incapacitated and can manage their own affairs. This almost always requires new medical evidence and another court hearing. The guardian cannot simply resign, and the ward cannot unilaterally declare themselves competent.

This critical difference underscores why proactive estate planning is so essential. A Power of Attorney is a flexible tool designed to serve you. A guardianship is a restrictive legal status controlled entirely by the court.

Real-World Scenarios: Choosing the Right Path

Understanding the legal definitions of a Power of Attorney versus a guardianship is important, but seeing how they apply in real-life situations makes the distinction clear. The following scenarios illustrate the challenges Texas families face every day and show how these legal tools function in practice.

These examples highlight when proactive planning makes all the difference and when a court-supervised guardianship becomes the only remaining option. Each situation represents a critical choice, helping you connect these concepts to your own family’s needs and the importance of services like asset protection and thoughtful estate planning.

The Proactive Retiree Planning for the Future

Scenario: Margaret is a healthy, sharp 72-year-old retiree in The Woodlands. She is fully capable of managing her own affairs but wants to ensure a smooth future for her children. Her goal is to authorize her daughter, Susan, to manage her finances and communicate with doctors if a health issue ever prevents her from doing so herself.

The Right Path: A Durable Power of Attorney and a Medical Power of Attorney are the perfect solutions.

Step-by-Step Guidance: By signing these documents now, while she has full capacity, Margaret grants Susan the authority to step in seamlessly if and when needed. Margaret remains in control, having chosen her agent and defined the scope of Susan's powers. This foresight ensures her wishes are honored without ever involving a court, saving her family significant time, money, and stress.

A Sudden Accident Without a Plan

Scenario: Mark is a 25-year-old professional in Austin. Like many young adults, estate planning is not on his radar. Tragically, he is involved in a serious car accident that leaves him in a coma. His parents rush to his side but discover they have no legal authority to access his bank account to pay his rent or make critical medical decisions on his behalf.

The Right Path: In this devastating situation, a Guardianship is likely the only option.

Step-by-Step Guidance: Because Mark is an adult with no Power of Attorney, his parents must petition the court to be appointed as his legal guardians. This involves a formal court hearing, presenting medical evidence of his incapacity, and ongoing court oversight. While necessary to protect him, the process is public, costly, and adds legal stress to an already heartbreaking time for his family.

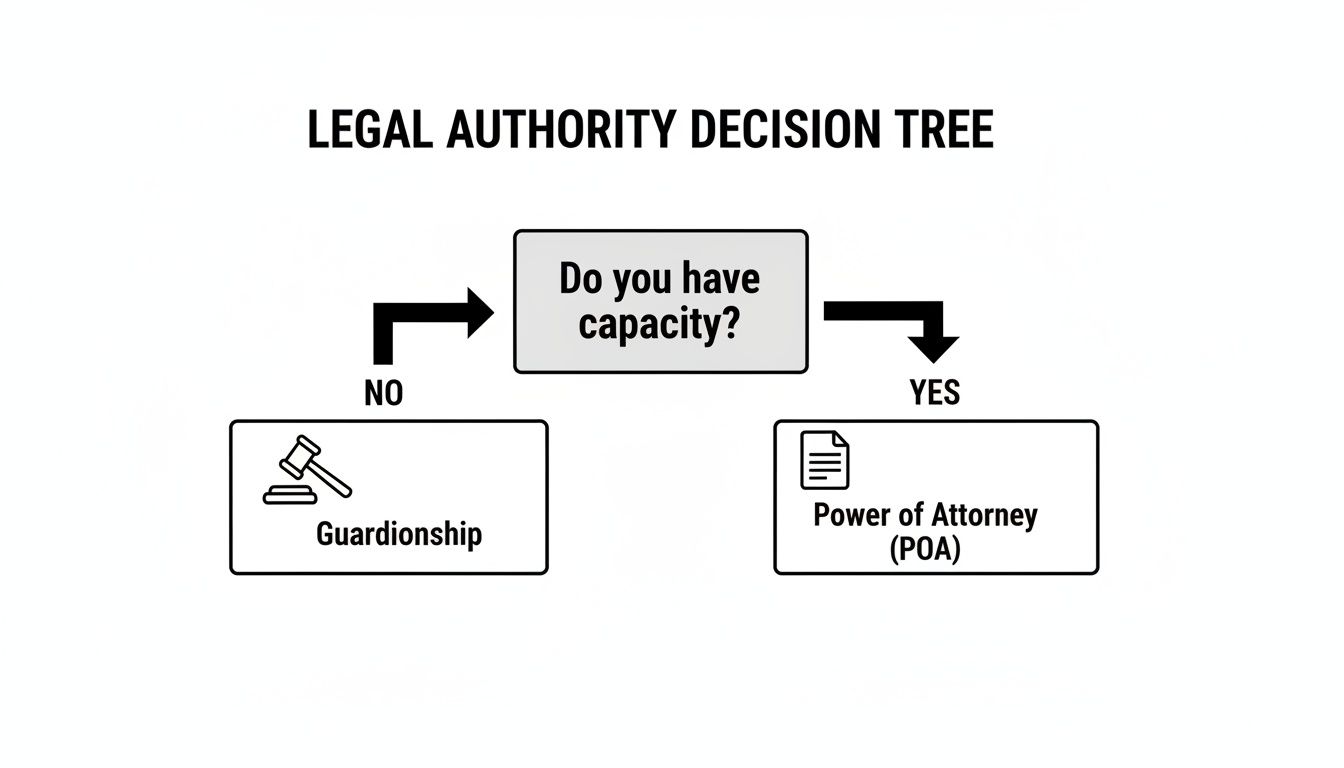

The core difference is capacity. A Power of Attorney is a choice you make when you have it; a guardianship is a court's solution when you don't. This is the fundamental principle that guides all planning.

This decision tree below clarifies this crucial distinction. It all comes down to whether you have the capacity to make your own choices.

This visual guide simplifies the main question: your legal ability to decide for yourself determines which path is even available.

An Elder Vulnerable to Manipulation

Scenario: David is deeply concerned about his 85-year-old father, George, who lives in Dallas and is showing clear signs of advancing dementia. A few years ago, George signed a Power of Attorney naming his neighbor as his agent. Now, David has discovered the neighbor is isolating George from his family and using his funds for personal expenses.

The Right Path: A Guardianship is almost certainly needed to protect George from financial exploitation.

Step-by-Step Guidance: Even with a Power of Attorney in place, it can be challenged if the agent is abusing their power. David can petition the court to establish a guardianship. If the judge finds that George is incapacitated and the neighbor has breached their fiduciary duty, the court can invalidate the POA and appoint a trustworthy guardian—like David—to protect George's health and finances. This is a key example of how a guardianship serves as a critical safety net when prior plans are exploited.

The Business Owner Needing Operational Continuity

Scenario: Maria owns a thriving small business in Houston. She is the only person authorized to sign checks, access company bank accounts, and approve new contracts. She worries that if she were suddenly incapacitated by an illness or injury, her business would grind to a halt, jeopardizing her employees' jobs and her livelihood.

The Right Path: A specific Durable Power of Attorney is the ideal tool for this situation.

Step-by-Step Guidance: Maria can work with a Texas estate planning attorney to draft a POA that is narrowly focused on her business. It can grant her trusted business manager just enough authority to handle business finances and daily operations, ensuring continuity if she is temporarily unable to do so. This is a targeted, powerful strategy that avoids the broad and cumbersome process of a court-supervised guardianship over her entire life.

Common Questions About Texas POAs and Guardianships: Getting Clear Answers

When you're planning for the future, questions are a natural part of the process. For Texas families comparing guardianships and powers of attorney, getting direct, clear answers is essential for making confident decisions. Let's address some of the most common questions we hear.

Can a Power of Attorney Actually Prevent a Guardianship?

Absolutely. A well-drafted Power of Attorney is the single most effective tool for preventing the need for a guardianship. A guardianship is designed to fill a legal vacuum that exists when someone is incapacitated and has no plan in place. By proactively naming a trusted agent to manage your finances and healthcare, you eliminate that vacuum.

If someone becomes incapacitated without a POA, their family's only recourse is the court system. However, with a valid Durable Power of Attorney and a Medical Power of Attorney already established, your chosen agent can step in immediately. This simple act of planning keeps your personal affairs out of a public courtroom and saves your family from unnecessary time, expense, and stress.

Under the Texas Estates Code, a court is required to consider less restrictive alternatives before appointing a guardian. The existence of a valid Power of Attorney is often seen by a judge as proof that your wishes have already been documented, making a guardianship unnecessary.

What If My POA Agent Goes Rogue and Misuses Their Power?

This is a significant and valid concern. The person you name as an agent has a strict fiduciary duty, a legal obligation to act solely in your best interest. If they violate that trust by misusing your funds or making decisions that harm you, there are legal remedies to hold them accountable.

If family members suspect wrongdoing, they are not powerless. They can:

- File a lawsuit against the agent to recover stolen assets and seek damages.

- Report the behavior to Adult Protective Services (APS) or law enforcement. Financial elder abuse is a serious crime.

- Petition the court for a guardianship specifically to remove the unfaithful agent and appoint a court-supervised guardian for protection.

A POA is built on trust, but the law provides powerful recourse when that trust is broken.

What’s the Real Difference in Cost?

The financial gap between establishing a Power of Attorney and undergoing a guardianship proceeding is immense. Proactive planning is not just less stressful—it is dramatically more affordable.

- Power of Attorney: The cost is generally a one-time, predictable fee paid to an attorney to draft and properly execute the documents.

- Guardianship: This is not a simple document; it is a formal lawsuit. The costs accumulate quickly and can include court filing fees, fees for the applicant's attorney, fees for the court-appointed "ad litem" attorney who represents you, and potentially the cost of a bond. These expenses can easily run into thousands of dollars, plus ongoing costs for court reporting and accountings.

Investing in a proper estate planning session to create your POAs is a small fraction of the cost your family would face with a guardianship.

Can a Guardian and a POA Agent Exist at the Same Time?

Generally, no. When a court determines a guardianship is necessary, it will issue an order formally declaring a person incapacitated. This court order almost always supersedes and terminates any existing Powers of Attorney.

The guardian’s authority, granted by the court, overrides the authority you previously gave to your agent. The court does this to establish a single, clear line of decision-making authority and ensure the ward is protected under its direct supervision.

While there may be rare instances where a court allows a POA to remain for a very specific, limited purpose, the standard rule is that the guardianship order prevails, and the agent's power is terminated. This highlights the fundamental difference—one is a private choice, while the other is a public, court-ordered transfer of your most basic rights.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.