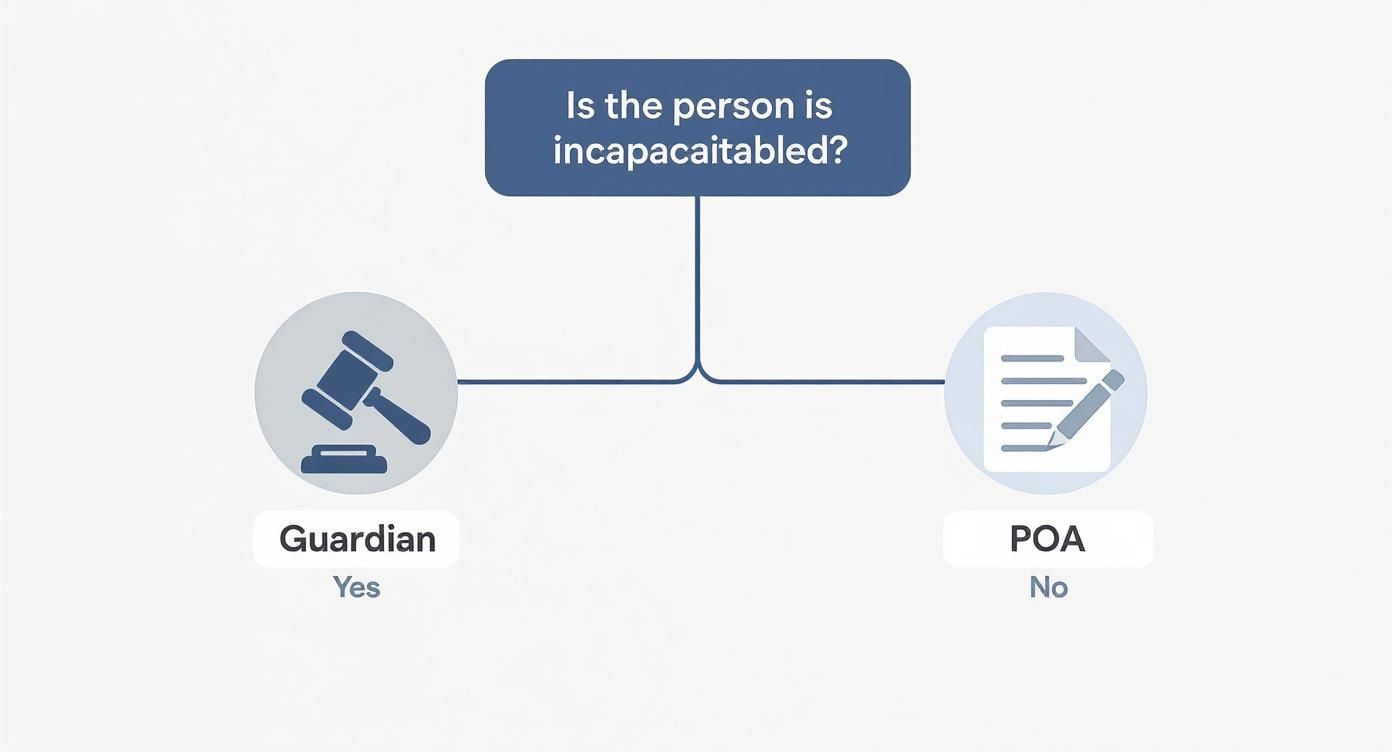

Planning for a loved one's future, or your own, can feel overwhelming when faced with complex legal terms. Understanding the difference between a Power of Attorney (POA) and a legal guardianship is crucial, but it doesn’t have to be complicated. The most important distinction is this: a Power of Attorney (POA) is a document you create voluntarily, choosing who makes decisions for you if you become unable. In contrast, a legal guardian is appointed by a Texas court after a person has already been found to be incapacitated.

Think of it this way: a POA is proactive planning. Guardianship is a reactive, court-ordered solution. With the right legal guidance, you can feel confident and secure in your next steps.

Comparing Key Roles in Texas Estate Planning

When planning for the future, two key figures often emerge: the agent under a Power of Attorney and a court-appointed legal guardian. While both are fiduciaries—meaning they are bound by fiduciary principles and have a legal duty to act in another's best interest—they are established under vastly different circumstances and operate with different levels of authority and oversight under Texas law.

This simple distinction is the core of the matter. A Power of Attorney is a choice you make before you need help, while guardianship is a court-ordered measure that happens after the fact.

As the infographic highlights, being proactive is the secret to staying out of court, which is a primary goal for any solid estate planning strategy.

In the U.S., the distinction between these roles boils down to appointment and authority. A legal guardianship is a public, court-supervised role, whereas a power of attorney is a private legal document you create to appoint someone you trust to act on your behalf. You can find more insights on these legal roles over at pew.org.

To illustrate how different these roles are, let’s compare their key attributes under Texas law.

Key Differences: Legal Guardian vs. Power of Attorney Agent

| Attribute | Legal Guardian | Power of Attorney Agent |

|---|---|---|

| Appointment | Appointed by a Texas court after a legal incapacity hearing. | Chosen by the individual (Principal) while they are still competent. |

| Timing | Reactive; established after a person can no longer make decisions. | Proactive; created before incapacity occurs as part of estate planning. |

| Control | The individual (Ward) loses their legal rights to make decisions. | The Principal retains control and can revoke the POA if competent. |

| Oversight | Requires ongoing court supervision, including annual reports and accounting. | Generally a private arrangement with no court oversight unless challenged. |

| Cost & Privacy | Can be expensive, time-consuming, and is a public court record. | More cost-effective, private, and quicker to establish. |

The takeaway is clear. While both roles are designed to protect someone who cannot make their own decisions, one is a choice made with foresight, and the other is a solution imposed by necessity.

The Role of a Legal Guardian Under Texas Law

When a loved one can no longer make safe decisions for themselves and never put a Power of Attorney in place, the Texas legal system provides a safety net: guardianship. Unlike a POA, which is a private document you choose to create, a guardianship is a court-ordered relationship. It is established only after a judge formally declares a person to be incapacitated in a public legal proceeding. It is truly the option of last resort.

The path to guardianship is a formal one that runs directly through a courtroom. The process begins when someone files an application, leading to a hearing where evidence is presented to prove the proposed “ward” cannot manage their own affairs. This is not taken lightly; the process is designed to safeguard an individual’s rights before removing them.

Guardianship Types and Responsibilities Under the Texas Estates Code

The Texas Estates Code is specific about the types of guardianships available, ensuring the court’s solution is only as restrictive as necessary. The two main types are:

- Guardian of the Person: This individual is responsible for the ward's personal and medical well-being. They decide where the ward lives, what healthcare they receive, and oversee their daily care.

- Guardian of the Estate: This guardian manages the ward's financial life. They are responsible for paying bills, managing investments, and protecting the ward’s property and assets.

A court may appoint one person to handle both roles or split the duties between two different people. For families exploring this for an aging relative, understanding the process for establishing guardianship for elderly parents is an essential first step.

Fiduciary Duties in Texas and Strict Court Oversight

A guardian is never acting alone—they are under the constant supervision of the court. They are held to the highest legal standard of a fiduciary, which means they must act exclusively in the best interests of the ward. This significant responsibility comes with extensive oversight, including:

- Posting a bond to financially protect the ward’s assets.

- Filing a detailed inventory of all the ward’s property with the court.

- Submitting annual reports and accountings that detail the ward's condition and every financial transaction.

This level of scrutiny exists to protect the ward from neglect, abuse, or financial exploitation.

The core principle of guardianship in the Texas Estates Code is the legal transfer of a person's decision-making rights to someone else, but always under the watchful eye of a judge.

This court-supervised approach is a global standard for protecting society's most vulnerable. International studies confirm that guardianship is a critical tool when someone has lost capacity without a POA in place and emphasize that the appointment must follow strict legal and medical evaluations. You can explore these professional perspectives on the Oxford Academic website.

Understanding Power of Attorney in Texas

While guardianship is a court-ordered solution, a Power of Attorney (POA) is a proactive tool you create as part of your estate plan. It is a strategic choice to protect your future while you are still in control. A POA is a legal document in which you (the “principal”) grant someone you trust (the “agent”) the authority to make decisions for you, all while you have full mental capacity.

This is a powerful instrument. It allows you to decide ahead of time who will manage your affairs if you ever become unable to do so. By creating a POA, you remain in control, ensuring your wishes are respected without the need for judicial intervention.

Essential Types of POAs for Texas Estate Planning

The Texas Estates Code outlines several types of POAs, but two are fundamental to any comprehensive estate plan, as they cover your finances and your health.

- Durable Power of Attorney for Financial Affairs: This document authorizes your agent to handle your financial matters—such as paying your mortgage, managing investments, or handling real estate transactions. The word "durable" is critical; it means the POA remains effective even if you become incapacitated.

- Medical Power of Attorney: This document empowers your agent to make healthcare decisions for you if you cannot communicate them yourself. This includes crucial choices about treatments, medical providers, and end-of-life care, ensuring your medical preferences are honored.

To learn more about these critical documents, you can explore planning for incapacity with power of attorney essentials and see how they fit into a larger estate planning strategy.

The Fiduciary Duties of a POA Agent in Texas

Choosing an agent is an act of immense trust, and Texas law enforces this with strict legal standards. An agent under a POA is a fiduciary, legally obligated to act only in your best interest.

An agent cannot use their position for personal gain. Their responsibility is to manage your property and affairs with care, maintain meticulous records, and always act with complete loyalty and good faith. These fiduciary duties in Texas provide a legal backbone that protects you from mismanagement or exploitation.

The flexibility, privacy, and control offered by a POA make it an indispensable part of estate planning. It allows you to appoint someone you know and trust to step in smoothly when needed, completely bypassing the public, costly, and often stressful guardianship process.

The Appointment Process and Authority: A Side-by-Side Look

The fundamental difference between a legal guardian and a power of attorney lies in how they are created and the power they wield. One is a private, proactive choice you make for yourself; the other is a public, reactive measure managed by the court system. Understanding this distinction is key to effective estate planning.

A Power of Attorney (POA) is born from foresight. It is a private document you prepare with a Texas estate planning attorney while you are fully capable of making your own decisions. You, the "principal," handpick your "agent" and define exactly what they can and cannot do. You are in control.

Guardianship, conversely, only becomes an option when control has already been lost. It is a formal, public court proceeding initiated under the Texas Estates Code when a person is believed to be incapacitated and unable to manage their own affairs.

Step-by-Step Guidance: The Path to Appointment

Appointing an agent through a POA is straightforward. You consult with an attorney, draft the document outlining the agent's authority, and sign it. No court approval is needed, making the process quick, private, and cost-effective.

The road to guardianship is far more complex and invasive. It is a full legal process that includes:

- Filing a Formal Application: A concerned party must file a legal application with the court.

- Medical Examination: A physician must examine the proposed "ward" and submit a report to the court confirming their incapacity.

- Court-Appointed Investigator: The court appoints an investigator to review the situation and provide a report.

- A Public Hearing: A judge hears all evidence and testimony before making a final decision.

This public process can be lengthy, emotionally draining for families, and result in significant legal fees.

Defining the Scope of Authority

Another critical difference is who determines the decision-maker's authority. With a POA, you define the scope. You can grant your agent broad authority or limit their power to specific tasks, like selling a property or managing a single bank account. The document is tailored to your specific wishes.

A guardian’s authority is not defined by you—it is granted by a judge. The court order specifies what decisions the guardian can make, whether for the "person" (healthcare and living arrangements) or the "estate" (finances). The guardian’s authority is based on what the court deems necessary, not what you would have wanted, and often requires the guardian to seek court permission for major decisions, adding further oversight and delay.

The core distinction is autonomy. A Power of Attorney preserves your right to choose your decision-maker and define their powers, keeping your affairs private. A guardianship transfers that control to the court, making personal matters part of the public record.

By planning ahead with a POA, you are not just avoiding the guardianship process. You are ensuring your personal and financial life remains in the hands of someone you trust, managed on your terms. This proactive step is a cornerstone of both effective estate planning and strong asset protection.

When Guardianship Is the Only Choice

Creating a Power of Attorney is always the preferred, proactive path. However, life doesn’t always follow a plan. Sometimes, pursuing a court-ordered guardianship is the only way to protect someone you love.

When proactive planning did not occur or is no longer sufficient, guardianship serves as a critical safety net. This typically happens in a few specific and often difficult situations.

Real-World Scenarios: No POA in Place When Capacity Is Lost

This is the most common reason families end up in court. An individual loses the mental capacity to manage their own affairs but never signed a Power of Attorney.

For example, your elderly mother suffers a severe stroke, leaving her unable to communicate or manage her finances. Without a Durable Power of Attorney, who will pay her mortgage or make urgent medical decisions? The family's hands are tied. Petitioning the court for guardianship is the only way to obtain the legal authority to step in and provide care.

When a Power of Attorney Agent Acts Improperly

A Power of Attorney is only as reliable as the agent wielding it. If family members suspect the agent is misusing their authority—perhaps using their father's savings for personal expenses—they can initiate a guardianship proceeding.

This action brings the situation under judicial review. The court can investigate the agent's actions, suspend the POA, and appoint a neutral guardian. This process turns a private agreement into a public matter governed by the strict fiduciary duties outlined in the Texas Estates Code.

Protecting Minors and Adults with Special Needs

Guardianship is not limited to seniors. It is also the legal tool used to appoint someone to raise a minor child if their parents pass away without naming a guardian in their will.

It is also crucial when a child with severe disabilities turns 18. On their birthday, they become a legal adult, and their parents' authority to make decisions on their behalf ceases. A guardianship is necessary to continue managing their healthcare and financial needs into adulthood.

For families trying to determine the right level of care, understanding the signs that memory care might be necessary can often clarify when it’s time to seek legal intervention. These situations highlight the key difference: a POA is about planning, while guardianship is about protection when planning wasn't possible or has failed.

Planning Ahead With a Power of Attorney

Securing your future begins with smart estate planning, and a Power of Attorney (POA) is one of the most powerful tools available. This single document can provide immense peace of mind by allowing you to hand-pick your decision-makers before a crisis occurs.

This one proactive step can prevent family disputes and help you avoid the expensive, public, and emotionally taxing guardianship process. You decide who will be in charge, ensuring it is someone you trust to honor your wishes.

A Practical Example of Proactive Planning

Consider this real-world scenario. Maria, a retired teacher, has a sudden fall and requires major surgery, leaving her temporarily unable to manage her finances or communicate her medical wishes. Years ago, however, Maria worked with a Texas estate planning attorney to create a Durable and Medical Power of Attorney, naming her son, David, as her agent.

Because of her foresight, David can act immediately.

He can access her bank accounts to pay the mortgage and medical bills. He can consult with her doctors to ensure Maria receives the care she would have chosen for herself. There are no court battles or family arguments. Her planning ensures a seamless transition, protecting both her health and her assets.

A Power of Attorney is your voice when you can no longer speak for yourself. It is a private instruction sheet that keeps the court out of your personal life and empowers the people you trust most.

By planning ahead, you connect your personal wishes directly to your asset protection. For more details, our firm offers guidance on unraveling the mysteries of POAs and advanced directives. For a broader perspective on related legal topics, you may find these additional insights on family legal planning useful. Taking this step is about securing your legacy and shielding your loved ones from uncertainty.

Common Questions About Texas POAs and Guardianships

When navigating these legal tools, specific questions often arise. Here are straightforward answers to the concerns we hear most frequently from families across Texas.

Can a Guardianship Override a Power of Attorney?

Yes, it can. If a court declares a person incapacitated and finds that the agent under a Power of Attorney is not acting in their best interest, the court can appoint a guardian. Once a guardian is appointed, their authority officially supersedes that of the POA agent. This serves as a critical legal safeguard against potential misconduct or abuse.

What Happens if a POA Agent Is Mismanaging Funds?

This is a serious concern, but you have recourse. If you suspect an agent is misusing their authority, you can petition the court for intervention. Under the Texas Estates Code, you have the right to ask a judge to review the agent's actions, demand a full accounting of all transactions, and even have them removed. If the situation is severe, initiating a guardianship proceeding is a powerful move that subjects the agent’s decisions to judicial scrutiny and protects the principal's assets.

How Can a Power of Attorney Be Revoked?

As long as the person who created the POA (the principal) remains mentally competent, they retain full control. They can revoke a Power of Attorney at any time. To do so effectively, the principal must provide a written revocation notice to the agent. It is also crucial to deliver this notice to any institution that has the original POA on file, such as banks or healthcare providers. Consulting a Texas estate planning attorney is the best way to ensure the revocation is legally sound and all relevant parties are notified.

If you’re managing an estate or planning for your future, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.