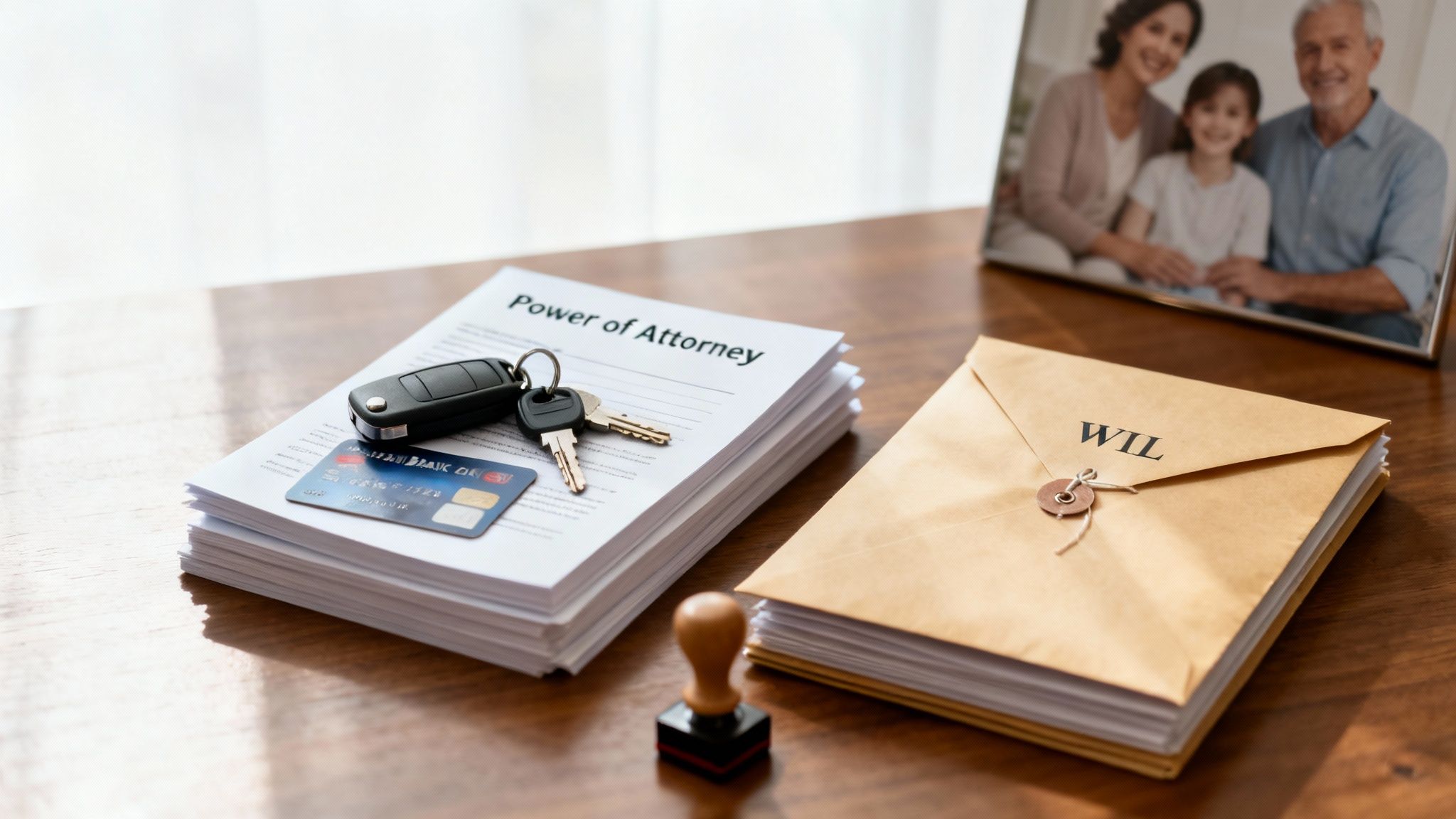

Managing a loved one's affairs, or planning for your own, can feel overwhelming—but with the right legal guidance, it doesn’t have to be. A common point of confusion is understanding the difference between an executor of a will vs. a power of attorney. The two roles sound similar, but in Texas estate law, they are fundamentally different, and the distinction all comes down to timing.

A Power of Attorney (POA) is a crucial document for lifetime planning. It grants authority to a trusted agent to act on your behalf during your lifetime, especially if you become unable to make decisions for yourself. Conversely, an Executor's authority begins only after you have passed away. Understanding this key difference is the bedrock of a sound estate plan that protects you and your family.

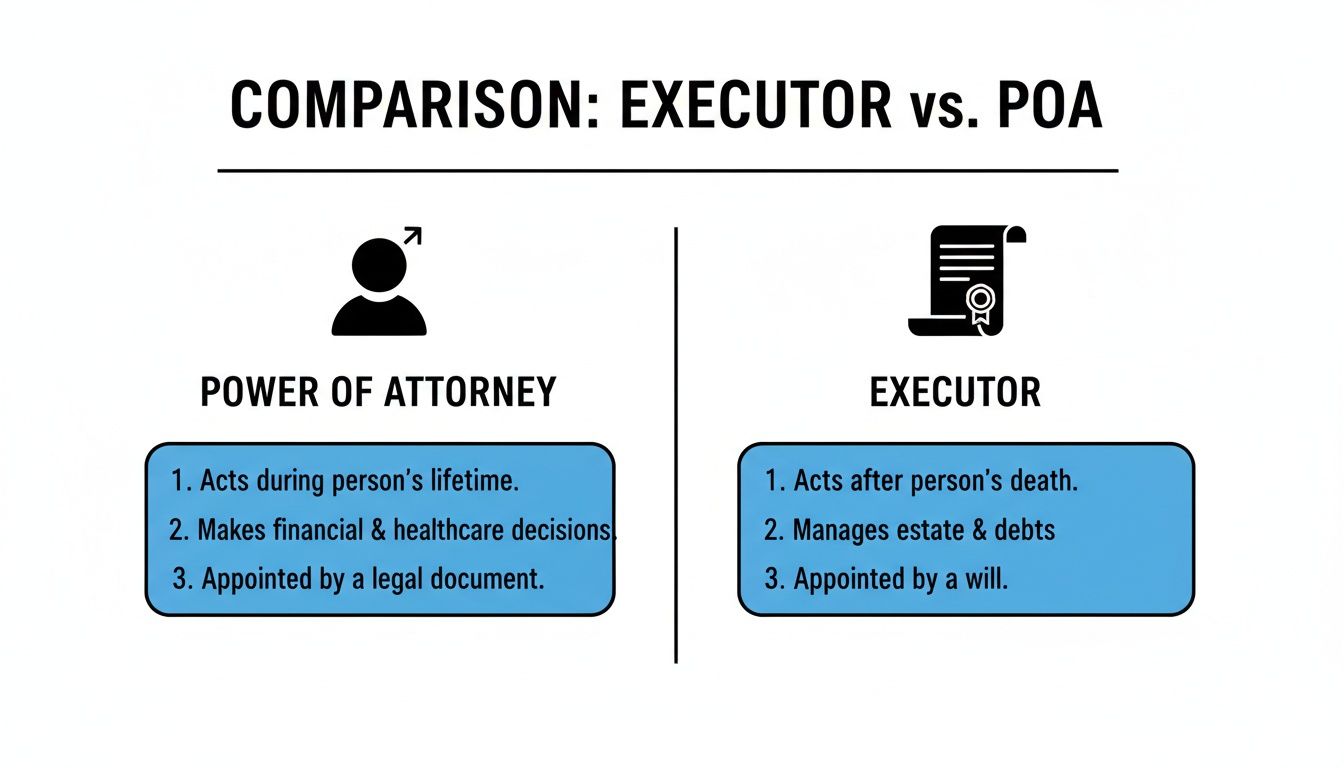

Key Differences: Executor vs. Power of Attorney

When navigating a loved one's estate, you'll encounter a lot of legal terminology. While both an Executor and an agent under a Power of Attorney are fiduciaries—meaning they are legally bound by a duty to act in another person’s best interest—they operate in entirely separate timeframes under the Texas Estates Code.

Think of a Power of Attorney as your lifetime support plan. You appoint a trusted individual, called an "agent," to manage your financial or medical affairs while you are alive. This role becomes invaluable if you are ever incapacitated and cannot manage your own affairs. However, the moment you pass away, that agent's authority legally terminates. Instantly.

This is where the Executor steps in. Named in your will, the Executor's job is to manage and settle your estate after you're gone. Their duties do not begin until a Texas probate court officially appoints them, a process that only occurs after death. The Executor’s sole focus is on finalizing your affairs according to your will, not managing them during your life. To explore their specific duties, you can learn more about what an executor does in our detailed guide.

This visual lays out the two roles side-by-side, making the distinction crystal clear.

As you can see, the agent's authority is for the living, while the executor's authority is for settling the estate of the deceased. It's a clean handoff from one to the other.

Executor vs. Agent Under Power Of Attorney At A Glance

For a quick reference, this table breaks down the fundamental differences between the person acting under a POA and an Executor. It highlights when their authority is active and what their primary purpose is.

| Attribute | Power of Attorney (Agent) | Executor of a Will |

|---|---|---|

| When Authority is Active | During the principal's lifetime only. | Begins only after the principal's death and court appointment. |

| Primary Function | To manage financial and/or healthcare decisions for a living person. | To settle the deceased's estate, pay debts, and distribute assets. |

| Source of Authority | A signed Power of Attorney document. | A Last Will and Testament, validated by a probate court. |

| Termination of Authority | Automatically terminates upon the principal's death. | Terminates when the estate is fully administered and closed. |

Ultimately, these roles are not interchangeable—they are two separate, vital components of a comprehensive estate plan designed to protect you during your life and carry out your wishes after you're gone.

When Each Role's Authority Begins And Ends

The most critical difference between an executor and an agent under a power of attorney comes down to one thing: timing. These roles are designed for completely separate stages of life and are never active at the same time. Getting this timeline right is the absolute key to creating a protective estate plan that leaves no gaps for your family to fall through.

Think of it like a relay race. A Power of Attorney (POA) runs the first leg of the race—during your lifetime. Its authority kicks in the moment it's properly signed and notarized, empowering your agent to act for you while you are alive.

In contrast, an executor is waiting to receive the baton. Their authority is triggered only by death. Their power simply doesn't exist until after you've passed away and a Texas probate court officially gives them the green light.

The Power Of Attorney Is For Lifetime Needs

Let’s imagine a parent suffers a sudden stroke, leaving them unable to communicate or manage their finances. This is where a durable power of attorney becomes invaluable. Their designated agent can immediately step in to:

- Pay the mortgage and utility bills from the parent’s bank account.

- Talk to doctors and make crucial medical decisions.

- Manage investment accounts to prevent financial loss during the crisis.

This power is immediate, helping the family avoid a costly and public guardianship proceeding. The agent’s authority, however, has a hard stop.

Key Takeaway: A Power of Attorney’s authority ends automatically and instantly upon the death of the principal. The agent has no legal standing to pay for the funeral, distribute property, or handle the estate from that moment forward.

This automatic termination is a fundamental pillar of Texas law. It creates a clean break where one person's duties end and another's must begin. For a deeper dive into this vital tool, you can check out our guide on planning for incapacity with Power of Attorney essentials.

The Executor's Role Begins After Death

The second a person passes away, the agent under the POA is powerless. This is the moment when the person named as executor in the will must step up to the starting line. Their authority, however, isn't automatic.

An executor's journey starts by filing the will with the correct Texas probate court. It’s only after a judge validates the will and formally appoints them that they receive "Letters Testamentary"—the official document granting them power over the estate. This court-supervised process protects both the deceased’s wishes and the beneficiaries’ interests.

This clear separation—one for life, one for after death—is precisely why both documents are essential pieces of a complete estate plan. A POA protects you during incapacity, while a will and its executor protect your legacy afterward.

Comparing Fiduciary Duties Under Texas Law

Both an agent under a Power of Attorney and an Executor of a will are entrusted with managing someone else's affairs. In legal terms, this makes them a fiduciary. This is a position of utmost trust, and Texas law imposes a strict duty of loyalty and care on anyone serving in this capacity. However, while they share this core principle, their specific duties are tailored to very different circumstances.

Think of it this way: your agent is your co-pilot, managing things for your direct benefit while you're still on the journey. Your Executor is the person who lands the plane, settling your final affairs for the benefit of those you've left behind.

Understanding these two distinct roles is the cornerstone of a solid estate plan. Let's break down what each job actually entails.

An Agent’s Duties Under A Power Of Attorney

An agent's power flows directly from the Power of Attorney document you sign. In Texas, the most common and useful type is a durable power of attorney, which is specifically designed to stay in effect even if you become incapacitated. That's really its main purpose.

The agent’s mission is simple but profound: act solely in your best interest while you are alive. Their fiduciary duties are defined by the specific powers you grant them, which might include:

- Financial Management: Tapping into your bank accounts to pay the mortgage, managing your investment portfolio, and handling all the little day-to-day money matters.

- Real Estate Transactions: Buying, selling, or managing property on your behalf, but only if you've explicitly authorized it in the POA.

- Healthcare Decisions: If you have a separate Medical Power of Attorney, your agent can make life-or-death decisions about your medical treatment when you can't.

Your agent must be a meticulous record-keeper, tracking every single action they take. Their power, while broad, is strictly for your benefit and ends the moment you pass away.

An agent's duty is to preserve and manage your assets for your well-being. An executor's duty is to gather those assets, settle your final affairs, and distribute what remains to your beneficiaries.

An Executor’s Duties Under The Texas Estates Code

The Executor's role is governed by a different set of rules. Their authority doesn’t kick in until after you've died, and even then, only after a probate court officially validates your will and appoints them. Their duties are spelled out in the Texas Estates Code, and their primary loyalty is to the estate itself—meaning they must act in the best interests of your creditors and beneficiaries.

An Executor's role is a formal, step-by-step process of closing out your life's affairs. The key tasks include:

- Gathering and Inventorying Assets: This means finding and securing everything you owned—from the house and car to your grandmother's antique jewelry—and creating a detailed inventory for the court.

- Notifying Creditors: They must publish a formal notice to anyone you might have owed money to and then pay off all legitimate debts and final expenses from the estate's funds.

- Filing Final Taxes: The Executor is responsible for preparing and filing your final income tax return and any estate tax returns that might be required.

- Distributing the Inheritance: After all the bills and taxes are paid, the Executor's final job is to distribute the remaining property to your beneficiaries, following the instructions in your will to the letter.

This role demands serious organization and strict adherence to legal deadlines. Part of this fiduciary duty today also involves protecting sensitive digital documents, from online financial records to the estate plan itself. A skilled Texas estate planning attorney is invaluable for guiding an Executor through these complex legal and financial responsibilities.

How These Roles Are Created And When They End

Understanding the legal requirements for appointing an executor or a Power of Attorney agent is absolutely critical for a solid estate plan here in Texas. The two processes are quite different, by design. One is a private matter for managing things while you're alive, while the other begins a public, court-supervised process after you're gone. Following the proper legal steps ensures these documents will be effective when your family needs them most.

Creating A Valid Power of Attorney

Appointing an agent through a Power of Attorney is a relatively straightforward process, but Texas law requires strict adherence to legal formalities. It begins with a written document that clearly defines the specific powers you are granting to your chosen agent.

For the document to be effective in Texas, especially during a period of incapacity, it must be a durable power of attorney. This specific language ensures your agent's authority continues even if you can no longer make decisions for yourself.

Here are the essential steps:

- Drafting the Document: The POA must clearly name you (the principal), your agent, and the exact powers you are handing over.

- Signing on the Dotted Line: You must sign the document in front of a notary public. While witnesses are not always required for a financial POA, having them can add an extra layer of legal protection.

- Providing a Copy to Your Agent: Your agent will need a signed copy to present to banks, medical providers, or any other institution they must deal with on your behalf.

Here’s a crucial point: A Power of Attorney’s authority dies when you do. It terminates automatically and immediately upon the principal's death. There's no grace period—the agent’s power to act is gone in that instant.

The simplicity of creating a POA is intentional—it's meant to be a flexible tool for lifetime planning. But that simplicity hits a brick wall at death, creating a legal gap that only an executor is empowered to fill.

Appointing And Empowering An Executor

Unlike a POA agent, an executor cannot simply be named in a document and get to work. Their path to authority is more formal and is supervised by the Texas probate court system.

First, you nominate your executor in your Last Will and Testament. This is your stated preference, but it does not grant them any legal power yet. After you pass away, the nominated individual must file an application with the proper Texas court to begin the probate process. If you need guidance on this important decision, our guide on how to choose an executor for your will offers practical advice.

The court then formally appoints the executor, ensuring they are qualified and suitable for the role. Once the judge approves the appointment, the court issues a document called Letters Testamentary. This is the official legal proof of the executor's authority to act on behalf of the estate.

Without these letters, an executor is powerless. They cannot access bank accounts, sell property, or distribute assets to beneficiaries. Their role is complete only when all debts are paid, all assets are distributed according to the will, and the court officially closes the estate.

Why A Complete Estate Plan Requires Both

Relying on just one of these crucial documents is like building a bridge that only goes halfway across a river. A Power of Attorney protects you and your assets during your lifetime if you can't make decisions for yourself, while a Will with an Executor protects your legacy after you're gone. A truly secure estate plan needs both to ensure there are no gaps where your family’s well-being could be at risk.

Without both documents in place, you leave your loved ones vulnerable. They could face legal voids, unnecessary court battles, and serious financial stress right when they're least equipped to handle it.

Scenario 1: The Sudden Medical Emergency

Imagine a parent in Texas suffers a severe fall and is hospitalized, completely unable to communicate. Without a durable Power of Attorney, who pays their mortgage? Who gets into their bank account to cover the mounting medical bills?

The answer is grim: no one. Without a court order, no one can legally touch their finances. This forces the family into a lengthy and expensive guardianship proceeding just to keep the lights on.

A POA, on the other hand, gives a trusted agent immediate authority to step in, manage household finances, and prevent a crisis. At this moment, the Will is irrelevant because the parent is still alive.

Scenario 2: The Void After Death

Now, let's say that same parent passes away. The agent under the POA, who had been diligently managing their affairs, suddenly loses all legal authority. The second the heart stops, the Power of Attorney becomes void.

This creates a dangerous legal gap. Funeral arrangements need to be paid for, the house needs to be secured, and bills are still coming in, but the agent can’t act. This is precisely where the Executor nominated in the Will must step forward.

But their authority isn't instant. They must first go to a Texas probate court to be officially appointed. Without a Will clearly naming an Executor, this process can drag on for months, leaving assets unprotected and bills unpaid.

Key Takeaway: The Power of Attorney provides a seamless handoff to an agent during incapacity. The Will provides the next handoff to the Executor after death. Without both, the baton gets dropped, creating chaos and legal hurdles for your family.

Scenario 3: The Incapacitated Business Owner

Consider a small business owner in Texas who becomes incapacitated after an accident. A Power of Attorney is absolutely critical for operational continuity.

The designated agent can make payroll, pay suppliers, and manage contracts, keeping the business afloat. Without it, the business could quickly fail, jeopardizing not only the owner's livelihood but their employees' jobs as well.

Having both documents creates a comprehensive safety net that covers you through every stage of life and beyond. This proactive planning isn't just about legal documents; it's about saving your family from the very real financial costs of court proceedings. Practitioners estimate probate costs can average 3%–7% of an estate's gross value, yet 56% of Americans wrongly believe these costs are $1,000 or less. You can learn more about how a comprehensive estate plan can protect your assets and reduce costs.

Got Questions About Executors and POAs? We’ve Got Answers.

Navigating the details of executors versus powers of attorney can bring up many questions. Getting clear, Texas-specific answers is essential to building an estate plan that effectively protects you and your family. Let's address some of the most common concerns we hear from our clients.

Can I Name the Same Person to Be My Power of Attorney Agent and My Executor?

Yes, and this is a very common strategy in Texas. Naming the same trusted individual for both roles can create a seamless transition. The person who was already familiar with your finances and personal wishes during your lifetime is often well-positioned to efficiently manage your estate after you're gone.

However, it's important to be thoughtful. Consider whether this person has the time, skills, and emotional fortitude to handle two demanding roles back-to-back. Acting as an agent can be stressful, and taking on executor duties immediately after a loved one's passing can be overwhelming. It is always wise to name a successor agent and a successor executor in your documents in case your first choice is unable or unwilling to serve.

What Happens If I Die in Texas Without a Will That Names an Executor?

If you pass away without a will in Texas, you are said to have died “intestate.” In this situation, the probate court will appoint an administrator to settle your estate. This person's responsibilities are similar to an executor's, but with one critical difference: your assets will be distributed according to a rigid statutory formula, not according to your personal wishes.

The intestate process is often more complex, expensive, and time-consuming for your family. It can also lead to disputes among relatives over who should be appointed to manage the estate. Creating a will ensures you choose your own representative and control how your legacy is distributed.

Does a Power of Attorney Have to Be Filed With a Texas Court to Be Valid?

No, in most cases, a Power of Attorney document does not need to be filed with a court to be legally valid in Texas. It becomes effective as soon as it is properly signed and notarized according to state law.

The primary exception relates to real estate transactions. If your agent needs to sell, buy, or mortgage property on your behalf, the Power of Attorney document must be recorded with the county clerk in the county where the property is located. For most other purposes, such as banking or healthcare, your agent will simply need to provide a valid, notarized copy of the document.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process. You can schedule your consultation at https://texastrustadministration.com.