Losing a loved one is tough enough without having to navigate a complex legal process on top of it all. Managing a loved one’s estate can feel overwhelming, but with the right legal guidance, it doesn’t have to be. One of the first questions we hear from families is, "How long is this probate thing going to take?" In Texas, a straightforward, uncontested probate case typically wraps up in about 9 to 18 months, but that timeline can stretch depending on the estate's complexity.

Understanding the Texas Probate Timeline

Probate is the court-guided process for validating a will, settling a person's final affairs, and distributing their assets to the rightful heirs and beneficiaries. While court involvement might sound intimidating, its purpose is to ensure everything is handled legally and orderly. With a clear map of the steps, managing an estate is an achievable task.

The most significant factor influencing the timeline is whether the estate is handled through Independent Administration or Dependent Administration, as defined by the Texas Estates Code.

- Independent Administration: This is the most efficient and common route in Texas. If the will specifically calls for it, or if all beneficiaries agree, the executor can manage most tasks—like paying debts and selling property—without constant court approval. This significantly speeds up the process and reduces costs.

- Dependent Administration: This path involves much more court supervision. The executor must get a judge's permission for almost every action. It’s a slower and more expensive process, often necessary when the will is unclear, the estate is insolvent, or family disputes arise.

A well-drafted will is the single best tool for a smooth probate journey. It lays the groundwork for an Independent Administration and clearly states the decedent's wishes, which helps prevent many potential arguments before they start.

Key Phases of the Probate Journey

The probate process can be broken down into several key stages, each with its own general timeframe. Knowing what's coming can make the entire experience feel less daunting. A well-organized estate settlement timeline is your best friend for keeping everything moving forward.

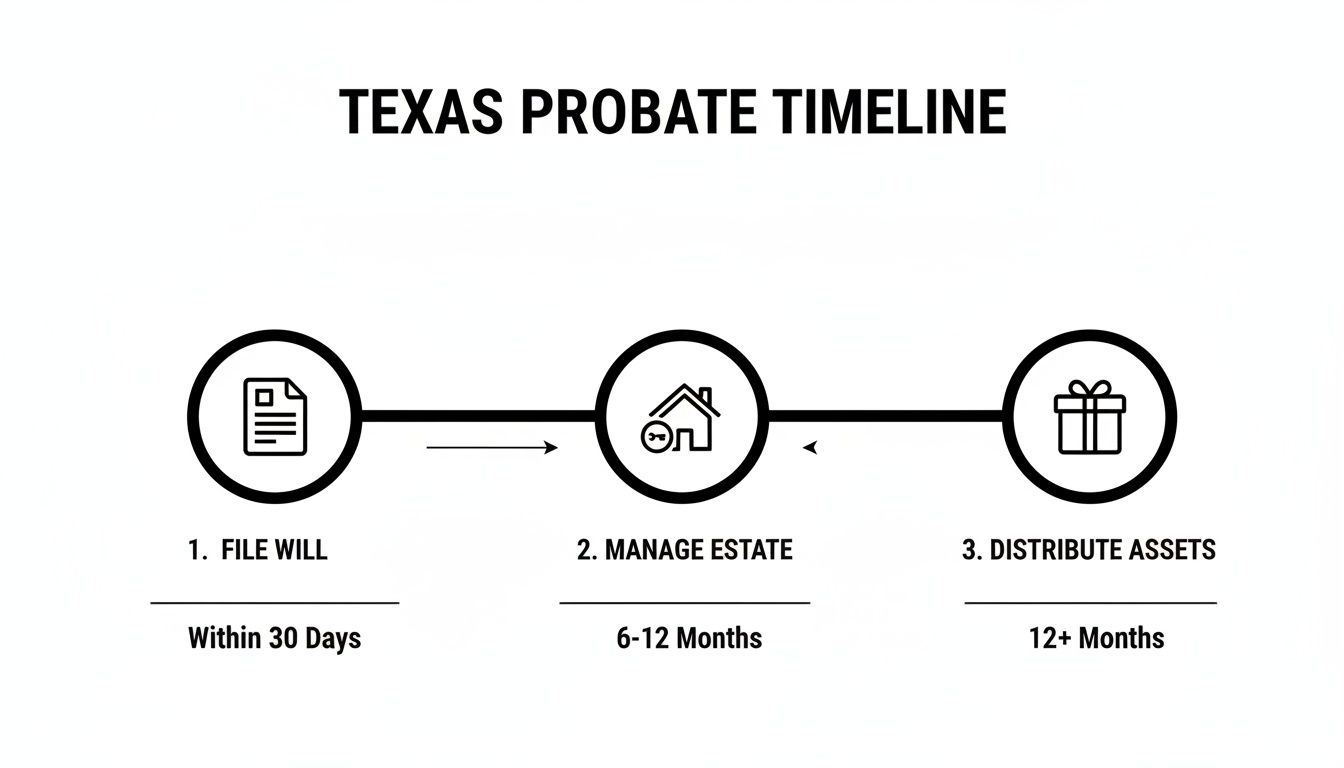

This graphic provides a high-level view of the major milestones you'll encounter when settling an estate in Texas.

As you can see, the path is logical, moving from initial court filings through the final distribution of assets to the heirs.

Setting Realistic Expectations for Probate Duration

It’s important to set realistic expectations from the beginning. The probate timeline often surprises people. While the national average is between 9 and 20 months, a recent survey found that only 2% of Americans believed it would take that long. Compounding this, a staggering 68% of Americans do not have a will, which forces their estate into a much longer court process.

For families in Texas, navigating the Texas Estates Code without a proper estate plan can easily turn a straightforward process into a year-long headache.

The Texas Estates Code places a fiduciary duty on the executor, meaning they have a legal obligation to act in the best interests of the estate and its beneficiaries. This responsibility highlights why it's so critical to manage the process carefully, diligently, and with full transparency.

To give you a clearer picture, let's walk through the different phases you can generally expect in a Texas probate.

Typical Phases of the Texas Probate Process

This table breaks down the key stages and their estimated durations, giving you a better sense of the journey from start to finish.

| Probate Phase | Typical Duration | Key Activities Involved |

|---|---|---|

| Filing and Initial Hearing | 2-4 weeks | Submitting the will and application to the court, posting legal notices, and attending the first hearing to validate the will and appoint the executor. |

| Notice to Creditors | 1 month | The executor must publish a notice in a local newspaper to inform potential creditors of the death so they can file claims against the estate. |

| Inventory and Appraisal | 90 days | The executor has 90 days from their appointment to compile a detailed inventory of all estate assets, get them appraised if necessary, and file it with the court. |

| Creditor Claim Period | 4+ months | Creditors have a specific timeframe to submit claims. The executor reviews, validates, and pays all legitimate debts using estate funds. |

| Final Accounting & Distribution | 1-3 months | Once all debts and taxes are settled, the executor prepares a final accounting, obtains court approval (if required), and distributes the remaining assets to the beneficiaries. |

While this table provides a helpful roadmap, remember that every estate is unique. Unexpected issues can arise, which is why having an experienced guide can make all the difference.

Key Factors That Shape Your Probate Timeline

Every estate has its own story, and its path through probate is just as unique. While we can discuss averages, several key factors can either accelerate the process or slow it to a crawl. Understanding these variables will give you a much clearer idea of what your specific situation might look like.

Without a doubt, the single biggest influence on your timeline is the type of administration the court grants. In Texas, this one decision sends the estate down two very different roads.

Independent vs Dependent Administration

Think of Independent Administration as the express lane for probate. If the will specifically requests it—or if every beneficiary agrees—the executor gets to manage most of the estate’s business without seeking court permission for each step. This includes actions like paying debts and selling property. That freedom shaves a massive amount of time and legal fees off the process, making it the preferred method in Texas whenever possible.

Dependent Administration, on the other hand, is like being stuck in rush-hour traffic. Here, the executor must get a judge’s approval for almost every move. That means filing formal motions, setting court dates, and waiting for judicial review. This intense supervision is sometimes necessary, especially with family disputes or insolvent estates, but it significantly prolongs the process and increases costs.

Estate Size and Complexity

Common sense dictates that the more complex an estate is, the longer it takes to settle. A simple estate with a house, a few bank accounts, and a car can be managed quite efficiently.

However, several factors can extend the probate timeline:

- Owning a business: A business must be valued, its operations managed during probate, and its future determined (whether sold, liquidated, or passed to an heir). This is a project in itself.

- Out-of-state property: If real estate is owned in another state, a second probate case, called ancillary probate, must be opened there. This means running two processes simultaneously.

- Significant debts: The executor is responsible for identifying all creditors, verifying their claims, and paying them from the estate. This can turn into a lengthy negotiation process, especially if the estate lacks liquid assets.

The more assets and liabilities there are to juggle, the more time it takes to inventory, manage, and distribute everything correctly. Getting a clear picture of all probate and non-probate assets at the outset can help streamline the process.

The Will: Testate vs Intestate

Whether the person who passed away had a valid will (testate) or died without one (intestate) is a game-changer. A clear, well-written will acts as a detailed instruction manual for the executor and the court, reducing confusion and minimizing the potential for arguments.

When there’s no will, the court must apply the strict inheritance laws from the Texas Estates Code. This usually requires a more formal, time-consuming proceeding just to legally identify the heirs. For example, if a decedent had children from a prior marriage, the court must meticulously determine how community and separate property should be divided, a process that can become quite complex.

While most estates settle in 12 to 18 months on average, even the simplest probate cases take a minimum of six to nine months. That’s because of built-in legal waiting periods—like the required notice for creditors—that you just can’t skip. If there's no will—which happens in a reported 68% of cases—the door is wide open for disputes, potentially stretching the timeline past two years.

Beneficiary Relationships

Finally, the family dynamic can make or break a probate timeline. When all beneficiaries are cooperative and communicate well, things tend to go smoothly.

However, if there is conflict, suspicion, or disagreement, the entire process can grind to a halt. All it takes is one unhappy heir to contest the will or object to the executor's actions. This can trigger a lawsuit that adds years and a mountain of legal bills to the process. For executors, being transparent and keeping everyone informed is the best defense against these kinds of delays.

Common Roadblocks That Can Delay Probate

Even a seemingly straightforward estate can hit unexpected speed bumps, stretching a simple process into a long, stressful ordeal. If you know what these potential roadblocks look like, you can better prepare for them—and in some cases, steer clear of them altogether. Most of these issues arise from family disputes, missing paperwork, or complicated finances that need a careful legal hand to untangle.

For many families, the biggest delays boil down to one thing: conflict. When emotions are high after a loss, disagreements over a loved one's final wishes can flare up and bring the probate process to a grinding halt.

Will Contests and Beneficiary Disputes

One of the most frequent and disruptive roadblocks is a will contest. This is a formal legal challenge where an interested party—usually a family member—alleges that the will is invalid. In Texas, a will can be contested for a few key reasons:

- Undue Influence: The challenger claims someone manipulated or pressured the deceased into changing the will for their own benefit.

- Lack of Testamentary Capacity: This argument suggests the deceased was not of sound mind when they signed the will, perhaps due to illness or medication, and did not understand the nature of the document.

- Improper Execution: The will was not signed or witnessed according to the strict rules laid out in the Texas Estates Code. For instance, a holographic (handwritten) will must be written entirely in the testator’s handwriting.

- Fraud or Forgery: The claim is that the will is a fake or was signed based on false information.

A will contest stops everything. No assets can be distributed and no debts can be paid until the court resolves the matter. This can drag on for months, sometimes years, racking up significant legal fees.

Even without a formal will contest, beneficiaries can still disagree over how the estate is managed. An heir might object to the executor selling the family home, while another feels their inheritance was undervalued. These disputes require careful negotiation or, if they escalate, a judge's intervention to move forward.

Locating Heirs and Missing Beneficiaries

It might sound surprising, but another common snag is simply finding everyone who needs to be involved. The executor has a legal duty to notify every beneficiary named in the will, plus any potential heirs who might inherit if there was no will. People move, change their names, or lose touch with family over the years.

When an heir cannot be found, the executor must demonstrate to the court that they have made a diligent effort to locate them. This can involve hiring investigators, publishing notices, and searching public records. If the person still can't be found, the court may appoint an attorney to represent the missing heir's interests, adding another layer of time and complexity.

Probate disputes are becoming increasingly common. With a massive transfer of wealth expected in the coming years and statistics showing that less than half of adults have a will, the potential for family conflict is high. This trend highlights the critical need for clear communication and professional legal guidance. Discover more insights about the challenges of probate on bncjlaw.com.

Complicated Debts and Tax Issues

Finally, the estate's financial picture can throw a major wrench in the timeline. If the deceased left behind substantial debts—like a large mortgage, business loans, or significant credit card balances—the executor must navigate the creditor claims process carefully. This involves several critical steps:

- Notifying all known creditors of the death.

- Publishing a legal notice to alert any unknown creditors.

- Evaluating the validity of every claim received.

- Negotiating payments, especially if the estate does not have enough cash to cover all its debts.

Things get even more complicated if the estate is large enough to trigger federal estate taxes. Filing an estate tax return (Form 706) is a highly detailed process that demands precise valuation of every asset. The IRS gives you nine months from the date of death to file, but it can take many more months for them to review it and issue a "closing letter." This letter is often required before the estate can be finalized and distributed. An experienced Texas estate planning attorney is invaluable for managing these financial hurdles efficiently.

The Executor's Role: A Step-by-Step Guide

Being named an executor is a profound act of trust. With that trust comes significant legal responsibility. While the title may sound intimidating, the job is practical: methodically gathering assets, settling final bills, and ensuring the remaining property reaches the intended beneficiaries.

This entire process is governed by the Texas Estates Code, which exists to ensure everything is handled fairly and transparently.

Understanding your duties from day one is the best way to ensure a smooth process that honors both your loved one and their beneficiaries. Let’s walk through the major steps you'll take as an executor in Texas.

The Initial Steps: Filing and Authorization

Your first official move is to file an Application to Probate the Will with the appropriate court in the county where the deceased lived. In Texas, you generally must do this within four years of their death. This application initiates a court hearing where a judge validates the will and formally appoints you as the executor.

Once appointed, you will be granted Letters Testamentary. This document is your official proof of authority to act on behalf of the estate. With these letters, you can access bank accounts, communicate with financial institutions, and manage all other estate assets.

Fiduciary Duty: The Heart of Your Responsibility

The core concept you must understand is fiduciary duty. This is a profound ethical and legal obligation. It means you must act with absolute good faith and loyalty, always putting the interests of the estate and its beneficiaries above your own.

In simple terms, you cannot play favorites among beneficiaries, engage in self-dealing (such as selling estate property to yourself at a discount), or make decisions that benefit you personally at the estate's expense.

"A fiduciary duty requires the executor to be prudent, transparent, and diligent. Every decision, from selling property to paying a bill, must be made to preserve and protect the value of the estate for those who will inherit it."

This high standard of care is why keeping detailed records is not just a good idea—it’s a legal requirement. Total transparency is your best defense against potential disagreements. You can learn more by digging into our detailed guide on what an executor does in Texas.

Managing the Estate: Assets and Debts

After receiving your Letters Testamentary, your next major task is to gain a complete picture of the estate's assets. This involves creating a comprehensive inventory and appraisal of everything the deceased owned. You have 90 days from your appointment to file a detailed "Inventory, Appraisement, and List of Claims" with the court.

Simultaneously, you must address the decedent's debts. This involves a formal notification process:

- Publish a Notice: You are legally required to publish a notice in a local newspaper to alert any creditors you might not know about.

- Notify Known Creditors: If you are aware of specific debts—like a mortgage or car loan—you must send a direct, formal notice to those creditors.

- Pay Valid Claims: You will then review every claim, reject any that are invalid, and pay all legitimate debts and final taxes using estate funds.

Only when every last debt, tax bill, and administrative expense has been paid can you move on to the final, rewarding step: distributing what remains to the beneficiaries.

Executor's Checklist for Texas Probate

To fulfill your duties properly and keep the process moving, staying organized is essential. This checklist breaks down the tasks you will need to handle from start to finish.

| Task | Description | Key Consideration |

|---|---|---|

| File the Will | Submit the will and an application for probate to the county court. | This must be done within four years of the date of death. |

| Obtain Letters Testamentary | After the initial hearing, the court issues this document giving you legal authority. | This is your key to accessing and managing all estate assets. |

| Notify Beneficiaries | Formally inform all beneficiaries named in the will about the probate proceedings. | Open communication can prevent future misunderstandings and disputes. |

| Inventory Estate Assets | Create a detailed list of all property, including real estate, bank accounts, and personal items. | This must be filed with the court within 90 days of your appointment. |

| Manage Creditor Claims | Publish a notice to creditors and pay all valid debts and final taxes from estate funds. | Keep meticulous records of all payments and communications. |

| Distribute Remaining Assets | Once all obligations are met, distribute the assets to the beneficiaries as directed in the will. | Ensure you have a signed receipt from each beneficiary confirming they received their inheritance. |

| Close the Estate | File any final accountings or reports required by the court to formally close the probate process. | For independent administrations, this step may be simpler, but it's still a crucial final action. |

Following these steps methodically will not only help you meet your legal obligations but will also provide peace of mind that you've honored your loved one’s final wishes correctly.

When you're facing the probate process, it can feel like you’re stuck on a legal conveyor belt with no control. But that’s not entirely true. While some parts of the process have timelines set by law, you’re not powerless.

Taking proactive steps can significantly streamline the process. Better yet, with the right legal tools, you can help your loved ones sidestep probate altogether. This is where smart asset protection and thoughtful estate planning truly shine, saving your family time, money, and stress.

Even if an estate is already headed for probate, you can still facilitate a smoother process. The cornerstone is a clear, professionally drafted will. It is your final word—it cuts through confusion, names a capable executor you trust, and can specifically request an Independent Administration, the fast track through Texas probate.

Beyond the will, keeping well-organized financial records and fostering open communication within the family can work wonders. When everyone knows the plan and where to find important documents, the executor can begin their duties with confidence.

Strategies to Bypass Probate Entirely

The best way to shorten the probate timeline is to make it irrelevant. Texas law offers several powerful tools that allow assets to pass directly to your beneficiaries without court permission. A knowledgeable Texas estate planning attorney can help you implement these strategies, ensuring your legacy is transferred efficiently.

These methods create a direct inheritance pipeline, turning a complicated court proceeding into a simple administrative task.

- Revocable Living Trusts: This is the most comprehensive probate avoidance tool. You transfer assets into a trust that you manage during your lifetime. After you pass away, the successor trustee you named steps in and distributes everything according to your instructions—all completely outside the probate system.

- Transfer on Death Deeds (TODDs): For real estate, a TODD is a simple and effective tool. It allows you to name a beneficiary who will automatically inherit your property upon your death, completely bypassing probate.

- Payable on Death (POD) Designations: You can add a POD designation to most bank accounts. It works like a beneficiary designation, allowing the person you name to claim the funds directly from the bank with a death certificate.

- Beneficiary Designations on Retirement Accounts and Life Insurance: Your 401(k)s, IRAs, and life insurance policies already include this probate-avoidance feature. The key is to check and update your named beneficiaries regularly, especially after major life events like marriage or divorce.

By using a trust or beneficiary designations, you’re essentially pre-sorting your estate for your loved ones. This simple act of organization pulls those assets out of the court's reach, paving the way for a private, fast, and much cheaper transfer to your family.

The Power of Proactive Planning

Putting these tools to work requires careful thought and solid legal drafting to ensure they function as intended. A trust, for example, is useless if it's not properly "funded"—meaning you must legally transfer your assets into it. Likewise, beneficiary designations need a check-up after life events like marriage, divorce, or the birth of a child.

Engaging in estate planning is more than drafting documents; it's about creating a clear, legally sound roadmap for the future. It provides the peace of mind that comes from knowing you’ve protected your family from the headaches of a drawn-out probate battle. By taking control of your legacy now, you give your loved ones the gift of a simpler, more private settlement when they need it most.

Your Top Questions About Texas Probate Answered

When you're managing an estate, questions will inevitably arise. It's only natural to wonder about the practical details of the process. This section addresses some of the most common concerns families face, helping you feel more confident about the path ahead.

Can I Sell a House During Probate in Texas?

Yes, you can, but how you do it depends on the type of administration.

With an Independent Administration, the executor has the authority to sell real estate without seeking court permission first, as long as it is in the best interest of the estate. This is the more efficient path.

However, in a Dependent Administration, the process is much longer. The executor must get the court's approval for nearly every step. This involves filing applications, obtaining appraisals, notifying all interested parties, and attending a court hearing to get a judge's sign-off. Following the Texas Estates Code meticulously is non-negotiable.

What Happens If a Person Dies Without a Will in Texas?

When someone passes away without a will, they have died "intestate." This almost guarantees the probate process will be longer, more complex, and more expensive. Without a will as a guide, Texas law dictates who the legal heirs are.

This typically requires a formal court process called a "determination of heirship." The court will appoint a separate attorney (an "attorney ad litem") to conduct an investigation to identify the family tree and report back. Once the heirs are identified, the court appoints an administrator who often must post a bond and operate under a restrictive Dependent Administration. All of these extra steps add significant time and money.

An intestate estate means the state makes the decisions, not the person who passed away. This can create results the decedent never would have wanted and puts a heavy burden on the family to navigate a much more rigid and public court process.

How Much Does Probate Cost in Texas?

There's no single price tag for probate in Texas. The cost depends on the estate's complexity, the type of administration required, and whether family disputes arise. Generally, you can expect expenses like:

- Court filing fees

- Compensation for the executor or administrator

- Costs for publishing legal notices

- Appraisal fees for valuing property

- Attorney’s fees

An uncontested estate with an Independent Administration is by far the most affordable route. Conversely, if you are dealing with a will contest, a complicated Dependent Administration, or litigation between beneficiaries, the legal costs can escalate significantly.

Do All Estates in Texas Need to Go Through Probate?

No, not every estate must go through formal probate. A major goal of smart estate planning is to ensure as many assets as possible can pass to their new owners without court intervention.

Assets that typically skip probate include:

- Assets with Beneficiary Designations: Life insurance policies, 401(k)s, IRAs, and bank accounts with a Payable on Death (POD) clause go directly to the named person.

- Assets in a Living Trust: Property held in a Revocable Living Trust is managed by your chosen successor trustee and distributed according to the trust's terms—no court required.

- Property with Rights of Survivorship: Real estate owned as joint tenants with rights of survivorship automatically passes to the surviving owner.

Furthermore, for smaller estates valued at $75,000 or less (excluding the homestead and certain other exempt assets), a simpler and faster alternative called a Small Estate Affidavit can often be used instead of formal probate.

If you’re managing an estate or planning for your own, you don't have to figure all this out on your own. Contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.