Planning for your family's future can feel overwhelming, but a living trust offers a clear path to security and peace of mind. It's a legal document you create during your lifetime to hold your assets. When you pass away, those assets are handed directly to your beneficiaries, sidestepping the often cumbersome, court-supervised probate process. This structure gives you an incredible amount of control and privacy over your legacy, ensuring your wishes are carried out with compassion and efficiency.

Why a Living Trust Is a Powerful Tool in Texas

Many Texas families believe a will is the only tool they need for their estate. While a will is essential, a living trust serves a distinct and powerful purpose—its primary role is to help your estate avoid the public, costly, and often lengthy probate process.

Under the Texas Estates Code, probate is the official, court-supervised procedure for validating a will and distributing assets. A trust, on the other hand, is governed by the Texas Trust Code and functions as a private agreement. It doesn't require a judge's approval to pass your assets to your loved ones, and that distinction is where its true value lies. A skilled Texas estate planning attorney can help you navigate these laws with confidence.

The Key Advantages of a Texas Living Trust

A living trust brings several significant benefits that a will alone cannot match. Understanding these advantages makes it clear why it's a cornerstone of modern estate planning.

-

Avoiding Probate: This is the most significant benefit. Assets held in your trust pass directly to your beneficiaries according to your instructions, with no court approval needed. This private process is a cornerstone of effective trust administration.

-

Ensuring Privacy: Once a will enters probate, it becomes a public record. This means anyone can look up the details of your assets and see who inherited what. A trust remains a private document, keeping your family’s financial affairs confidential.

-

Planning for Incapacity: A living trust allows you to name a successor trustee who can manage your financial affairs if you become unable to do so yourself. This can help your family avoid a court-appointed guardianship, which can be an intrusive and expensive ordeal.

-

Maintaining Control: While you're alive and well, you typically act as the trustee of your own revocable living trust. You retain complete control over your assets—you can buy, sell, or manage them exactly as you did before.

To get a clearer picture, let's compare these two essential tools side-by-side.

Living Trust vs Will in Texas At a Glance

While both are key parts of a comprehensive estate plan, they function very differently. Here's a quick breakdown to highlight the main differences.

| Feature | Living Trust | Will |

|---|---|---|

| Probate | Avoids probate for all assets held within the trust. | Must go through the probate process to be validated and executed. |

| Privacy | A private document. Its terms and your assets are not made public. | Becomes a public record once filed for probate. |

| Incapacity Planning | Allows a successor trustee to manage your affairs without court intervention. | Does not provide for incapacity management; a separate power of attorney is needed. |

| Asset Distribution | The successor trustee distributes assets immediately and privately after your death. | A court-appointed executor distributes assets after the probate process concludes. |

| Control | You maintain full control over assets as the trustee during your lifetime. | You control your assets until death, but the will only takes effect afterward. |

| Cost & Complexity | Higher upfront cost to create and fund, but can save significant money later. | Lower upfront cost, but probate costs can be substantial for your heirs. |

This table simplifies the comparison, but the takeaway is that a living trust offers a proactive way to manage your estate both now and after you're gone, potentially saving your family significant stress and expense.

A Real-World Scenario

Imagine a common Texas family situation. A couple owns a home in The Woodlands, has a few retirement accounts, and a brokerage account. If they only have a will, their adult children would need to hire an attorney, file the will with the court, attend hearings, and wait for a judge's approval before any assets can be distributed.

Now, picture that same couple placing their home and accounts into a living trust. Their chosen successor trustee (perhaps an adult child or a trusted professional) could step in immediately after their passing. That trustee would pay any final bills and distribute the assets according to the trust's terms—all without court oversight. The savings in time, money, and stress are enormous.

Despite these clear benefits, many Texans haven't taken this crucial step.

Shockingly, despite its advantages, only 11% of Texans had a living trust in place as of 2025. This low adoption rate persists even though it allows assets to pass to beneficiaries without court intervention, avoiding a probate process that can take 6 to 12 months or longer.

Ultimately, creating a living trust is about giving your family a smoother, more secure path forward during an already difficult time. It’s an act of foresight and care that provides true, lasting peace of mind.

Designing Your Texas Living Trust Document

Think of creating your trust document as drawing the blueprint for your legacy. This is where your intentions are put on paper, transforming your wishes into a legally binding roadmap. As the grantor (the creator of the trust), you'll make several key decisions that dictate exactly how your assets are managed and protected for your family.

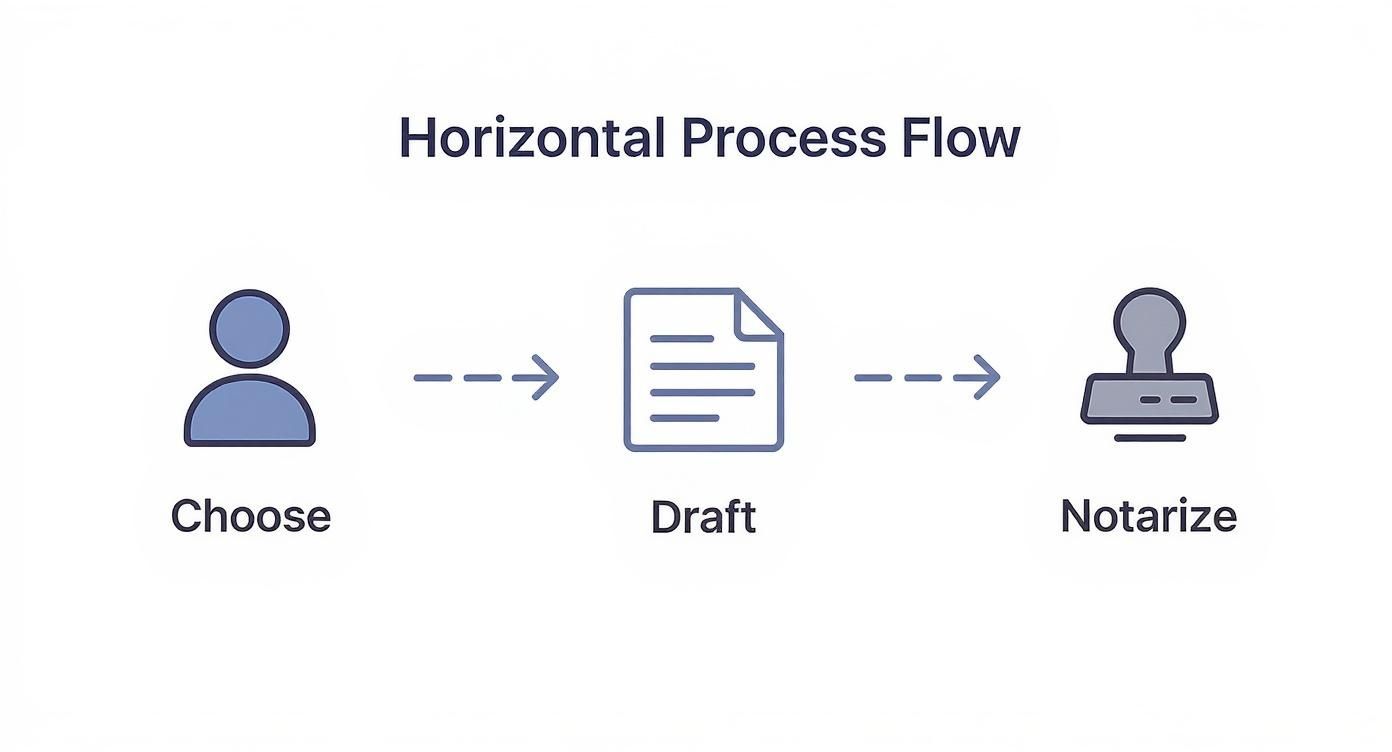

Creating a living trust in Texas is not an overwhelming ordeal when broken down into clear, manageable steps. You'll begin by choosing a structure—such as an individual trust or a joint trust for you and your spouse.

While it is not legally required to have the document notarized for it to be valid in Texas, skipping this step is a significant mistake. Having signatures notarized adds a crucial layer of protection against anyone challenging the trust's validity later on. To get a better handle on the basics, you can learn more about how these trusts operate in Texas.

Remember, this document is the official instruction manual your hand-picked successor trustee must follow. Clarity is paramount.

Individual vs. Joint Trusts for Married Couples

If you're married, one of the first decisions is whether to set up an individual trust for each of you or create a single joint trust. Neither is inherently better; the right choice depends on your family's financial situation and goals.

- Individual Trust: Each spouse creates their own trust. This is often the preferred choice for couples who wish to keep their separate property distinct. It’s also a practical solution for blended families who need to ensure certain assets are earmarked for children from a previous marriage.

- Joint Trust: Both spouses create one trust together. This is a common and efficient approach for couples who have merged their financial lives. A joint trust can simplify management, both while you're both living and after the first spouse passes away.

This choice can also be a key part of tax planning. While Texas doesn't have its own estate tax, a well-designed trust can help high-net-worth couples optimize their federal exemptions. A knowledgeable Texas estate planning attorney can analyze your assets and guide you to the most effective structure.

Drafting the Core Provisions of Your Trust

The heart of your trust lies in its written provisions. This is where you name who gets what, when, and how. Vague language can lead to confusion, family disputes, and even litigation.

Your trust document must clearly specify:

- The Grantor(s): The person or couple creating the trust.

- The Trustee and Successor Trustee(s): Who manages the assets now (usually you) and who takes over when you are no longer able to or pass away.

- The Beneficiaries: Who inherits from the trust. Be precise with names and relationships to avoid any ambiguity.

- Distribution Instructions: This is the rulebook. You can arrange for lump-sum payouts or stagger distributions at certain ages—for example, at 25, 30, and 35. You can even keep assets in the trust to be managed for a beneficiary's entire life, providing long-term asset protection.

For instance, instead of saying, "my assets go to my kids," you would name each child and detail the rules for their inheritance. Perhaps your daughter receives her share outright, while your son's share is placed into a "sub-trust" managed by the trustee due to his financial inexperience.

A Note on Fiduciary Duties: The language in your trust empowers your trustee and establishes the legal basis for their fiduciary duties in Texas. This is their legal and ethical obligation to always act in the best interests of the beneficiaries. Clear instructions make it easier for them to fulfill this critical role correctly.

The Importance of Proper Execution and Notarization

For a living trust to be valid in Texas, the grantor must sign the document. Unlike a will, there is no legal requirement for witnesses or a notary. However, choosing not to notarize your trust is a missed opportunity to strengthen your estate plan.

When you have your signature notarized, it creates a legal presumption that the signature is authentic and that you signed it freely. This simple step is a powerful defense against future claims that you were coerced, unduly influenced, or lacked the mental capacity to create the trust. It adds a formal seal of approval that helps ensure your wishes are followed without a legal battle. Any qualified Texas trust administration lawyer will insist on this as a non-negotiable step.

The Critical Step of Funding Your Trust

You’ve signed the trust document, and it has been notarized. It may feel like you’ve crossed the finish line, but there is one more essential step: funding the trust. A trust document without any assets is like an empty safe—it looks official, but it protects nothing.

This is the single most common and costly mistake people make. They complete the hard work of designing a trust and then fail to take the final step.

Funding means retitling your assets from your individual name into the name of your trust. For the trust to work as intended and keep your estate out of a Texas probate court, it must legally own the property. Any asset left outside the trust will almost certainly have to go through the public, time-consuming, and expensive probate process, defeating a primary reason for creating the trust.

What Does Funding Your Trust Look Like in Practice?

Funding your trust involves paperwork, but it is a manageable and logical process. The specific steps depend on the type of asset you are transferring. It is a hands-on task that ensures the legal structure you have carefully built will protect your legacy.

Let’s walk through a real-world scenario. A married couple in Houston creates "The Miller Family Revocable Living Trust." They own their home, a joint checking account, and an investment portfolio.

Here’s what their funding process would look like:

- For their home: They must sign a new deed transferring the property from "John and Jane Miller" to "John and Jane Miller, Trustees of the Miller Family Revocable Living Trust." The new deed is then filed with the Harris County clerk to make it official.

- For their bank account: They will visit their bank with a copy of their trust certificate and complete the necessary forms to change the account ownership to the name of the trust.

- For their investments: They will contact their financial advisor, who will help them retitle their brokerage account into the trust’s name.

Each transfer creates a clear line of legal ownership, confirming that the trust—not the individuals—is the legal owner of the assets.

This infographic provides a visual overview of the foundational steps of designing your trust, all leading up to this crucial funding stage.

As you can see, choosing the right people and carefully drafting the document are the starting points, but the plan only becomes effective once you move your assets into its legal structure.

Transferring Different Types of Texas Assets

At its core, "funding your trust" is about the legal transfer of assets into the trust's name. While the specifics can vary, the general principle of putting assets into a trust, whether it's real estate or life insurance policies, is what makes your trust effective.

Let's break down how this works for common types of assets in Texas.

-

Real Estate: This always requires a new deed. Whether it’s your primary residence in Dallas, a vacation home on Galveston Island, or a rental property in Austin, each piece of real estate needs its ownership formally transferred to the trust.

-

Bank Accounts: For checking, savings, CDs, and money market accounts, you'll work directly with your bank to retitle the accounts. You will continue to use them as you did before; only the legal owner on paper changes.

-

Non-Retirement Investment Accounts: Stocks, bonds, and mutual funds held in a brokerage account must be retitled. Your financial institution will have specific forms for this process, but it is a standard procedure.

-

Business Interests: An ownership interest in an LLC or a partnership can be assigned to the trust. However, you must first review your company's operating agreement to check for any restrictions on transfers.

Important Takeaway: Retirement accounts like 401(k)s and IRAs have a special tax-deferred status and are generally not retitled into a living trust. Instead, you can name the trust as a primary or contingent beneficiary. This is a nuanced area where guidance from a Texas estate planning attorney is vital to avoid triggering significant and avoidable tax penalties.

Failing to fund your trust correctly can unintentionally drag your loved ones back into the very probate system you were trying to avoid. Working with an experienced Texas trust administration lawyer ensures every asset is correctly titled, making your trust a fully functional tool for protecting your family’s future.

Selecting the Right Trustee for Your Plan

Choosing a trustee is one of the most significant decisions you will make when setting up your living trust in Texas. This person or institution becomes the legal steward of your legacy, tasked with carrying out your instructions with precision and integrity. They shoulder immense responsibility, and your choice will directly impact your beneficiaries' financial future.

Under the Texas Trust Code, a trustee owes a fiduciary duty to the beneficiaries. This is not a mere suggestion; it is the highest standard of care recognized by law. It legally binds them to act with unwavering loyalty and impartiality, requiring them to put the beneficiaries' interests above their own at all times.

Family Member vs. Corporate Trustee

One of the first decisions is choosing between an individual—such as a trusted family member—and a corporate trustee, like a bank's trust department. Each option has pros and cons that you need to weigh carefully based on your family's needs.

A family member often has a personal connection to your beneficiaries and may not charge a fee. This can be an excellent choice for simpler trusts, especially when family dynamics are healthy and the person you have in mind is financially responsible.

However, appointing a loved one can also create challenges. Asking one child to manage the trust for their siblings can strain relationships, particularly if difficult decisions about distributions or investments are required.

Key Qualities of an Effective Trustee

Regardless of who you choose, certain qualities are non-negotiable. Your trustee must be a person of impeccable character, capable of handling both the legal requirements and the human dynamics of trust administration.

- Financial Acumen: They do not need to be a financial expert, but they must have a solid understanding of basic financial principles and know when to seek professional advice from an accountant or financial planner.

- Impartiality: A great trustee treats every beneficiary fairly, even when faced with competing requests or conflicting personalities. Their duty is to follow the trust's instructions, not to play favorites.

- Unwavering Trustworthiness: This is the bedrock of the relationship. You are entrusting them with your life's work. You must be 100% confident in their honesty and commitment to honoring your wishes.

- Willingness to Serve: Being a trustee is a significant responsibility that involves meticulous record-keeping, tax filings, and communication. Ensure your candidate understands the commitment and is willing to take it on.

Your selection of a trustee is the single most important factor in ensuring the long-term success of your trust. This person is not just a manager of assets but a guardian of your family’s future, so the decision requires careful and honest evaluation.

A Practical Scenario in Texas

Consider this common situation. A business owner in Austin creates a trust for his two adult children. One child is a responsible financial analyst, while the other has a history of making poor financial decisions. Naming the responsible child as trustee might seem logical, but it could spark a lifetime of resentment and conflict between the siblings.

In a case like this, engaging a neutral, professional corporate trustee may be the wiser choice. A corporate trustee would manage the assets impartially based on the trust's terms, making distribution and investment decisions without emotional bias. This approach protects family relationships while ensuring the trust's goals are met.

It is critical to understand the full scope of a trustee's role. To learn more, explore our detailed breakdown of the legal obligations in our guide to trustee duties and responsibilities in Texas. This knowledge will prepare you for a candid conversation with potential candidates, ensuring they are truly ready for the role.

Understanding the Cost and Value of a Trust

A common and fair question is, "What will a living trust cost me?" However, viewing it solely as a cost misses the bigger picture.

Think of it as a strategic investment in your family's future. You are putting resources in place now to shield your loved ones from much larger financial headaches and emotional stress later. It is about taking control of your legacy and simplifying life for the people you care about most.

The Upfront Investment in Your Legacy

When you hire a qualified attorney to draft your trust, you are not just buying a document. You are paying for their expertise, a custom-tailored plan that fits your family's unique situation, and the peace of mind that comes from knowing it is done correctly under Texas law.

Typically, creating a living trust in Texas with an experienced attorney will cost between $1,000 and $4,000. The final price depends on the complexity of your assets and the specific protections you need.

Now, let's put that in perspective. The alternative, the Texas probate process, can easily tie up your family for 6 to 12 months or longer. All probate proceedings become public record, while a trust keeps everything private and can often be administered in just a few weeks. You can explore more data on the costs and benefits of trusts to see how valuable this step can be.

Comparing Trust Costs to Probate Expenses

To fully appreciate why a trust is such a smart investment, you must consider what it helps you avoid: probate. For estates managed only with a will, the court-supervised probate process can be surprisingly expensive.

The probate bill often includes:

- Attorney's Fees: Often the largest expense, sometimes calculated as a percentage of the estate's value or billed at high hourly rates.

- Court Costs: Filing fees, legal notices, and other administrative charges are unavoidable.

- Executor Compensation: The person managing the estate is legally entitled to be paid for their time and effort from the estate's assets.

- Appraisal and Accounting Fees: Experts must be paid to value assets and prepare formal reports for the court.

When tallied, the costs of probate can easily exceed the one-time fee for setting up a trust. A living trust allows your estate to bypass this entire court-supervised process, saving your beneficiaries a significant amount of money, time, and stress.

The true value of a trust isn't measured by its setup cost, but by the financial and emotional turmoil it helps your family avoid. It's a direct investment in privacy, speed, and a smoother transition during a difficult time.

The Priceless Value of Privacy and Efficiency

Beyond the financial savings, a trust offers benefits that are hard to put a price on. First is privacy. A trust is a private document. A will, however, becomes public record once it enters probate, allowing anyone—nosy neighbors, distant relatives, or salespeople—to see the details of your estate.

Then there is efficiency. Your chosen successor trustee can begin managing and distributing assets almost immediately after you pass away, without waiting for a judge's permission. This speed can be a lifeline for your loved ones, ensuring they have access to funds for immediate needs without financial disruption.

When you explore how to create a living trust in Texas, seeing the cost through this lens—as an investment in security and efficiency—makes the decision much clearer for families.

Common Questions About Texas Living Trusts

As you delve into creating a living trust in Texas, specific questions will naturally arise. This is a positive sign that you are thinking through the process carefully. Getting clear answers is key to building confidence in your estate plan.

Let's address some of the most common questions we hear.

Do I Still Need a Will If I Have a Living Trust?

Yes, absolutely. A will is a crucial companion to your living trust. It is not just recommended; it is a standard component of any robust estate plan.

A special type of will called a "pour-over will" acts as a safety net. Its primary job is to "catch" any assets you may have forgotten to transfer into your trust—or acquired just before you passed away—and "pour" them into the trust after your death.

While the pour-over will must go through probate, it simplifies the process for any property left out. Equally important, a will is the only legal document where you can name a guardian for your minor children. A trust cannot do this. A will and a trust work hand-in-hand to provide comprehensive protection.

Can I Make Changes to My Revocable Living Trust?

Yes. The flexibility of a revocable living trust is one of its greatest strengths. As the grantor, you retain full control. You can amend, change, or even revoke the trust entirely at any point during your lifetime, as long as you are mentally competent.

Life changes, and your estate plan should adapt accordingly. Certain life events should prompt a review of your trust document:

- Marriage or divorce

- The birth or adoption of a child or grandchild

- A major change in your financial situation

- The death of a beneficiary or a named trustee

Remember, any changes must be made formally through a written amendment to the trust. A Texas estate planning attorney can ensure your updates are drafted correctly and are legally binding, helping you understand how to modify a trust in Texas.

Are Assets in My Living Trust Protected from Creditors?

This is a key question with a nuanced answer. For a standard revocable living trust, the answer during your lifetime is no.

Because you retain control over the assets—you can withdraw them, spend them, and revoke the trust at will—the law considers those assets to be yours. This means your personal creditors can still reach them.

However, a trust can provide powerful protection for your beneficiaries after you are gone. By including a "spendthrift clause," you can generally prevent a beneficiary's creditors from accessing their inheritance while it remains in the trust. For stronger asset protection for yourself during your lifetime, you would need to consider more complex strategies like an irrevocable trust, which involves giving up control.

Does a Living Trust Help Reduce Estate Taxes in Texas?

This is a common point of confusion. Texas does not have a state-level estate tax or inheritance tax. Therefore, from a state tax perspective, a living trust does not offer a tax benefit here.

Where it becomes an indispensable tool is for minimizing federal estate taxes.

For married couples with estates approaching the federal exemption amount, a specialized trust (often called an AB or bypass trust) can be a game-changer. This structure allows the couple to use both of their individual federal exemptions, effectively doubling the amount they can pass to their heirs tax-free. This strategy alone can save families a tremendous amount of money, preserving your legacy for future generations.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process. You can learn more at https://texastrustadministration.com.