Managing a loved one’s trust can feel overwhelming—but with the right legal guidance, it doesn’t have to be. When the time comes to wind it down, it's more than just paperwork—it’s a formal legal process guided by a specific set of rules. The Texas Trust Code lays out the groundwork for termination, typically when the trust's original purpose has been served, all beneficiaries are in agreement, or it simply no longer makes financial sense to keep it going.

With a clear understanding of the process, you can navigate the dissolution with confidence.

Understanding When and Why a Trust Can Be Dissolved

Winding up a trust often comes at an emotional time, perhaps while you are grieving. It can feel like a lot to handle. The good news is that the reasons for dissolving a trust are usually clear-cut. This is not a decision made on a whim; it’s almost always driven by specific circumstances that make continuing the trust impractical or out of sync with what the person who created it (the grantor) originally intended.

As the trustee, you are held to strict fiduciary duties in Texas. This means every action you take, especially during termination, must be in the best interests of the beneficiaries and in full compliance with the law. This responsibility is a cornerstone of the Texas Estates Code and fiduciary principles.

Common Reasons for Trust Termination

So, what are the triggers that set a trust dissolution in motion? Recognizing these scenarios is your first step.

- Fulfillment of Purpose: The trust has done its job. A classic example is a trust created to pay for a grandchild's college education. Once the final tuition bill is paid, its purpose is complete.

- Beneficiary Agreement: Everyone is on the same page. If all beneficiaries are adults and agree the trust is no longer needed, they can often move to dissolve it and manage their inheritances directly.

- Economic Impracticality: The trust is costing more than it's worth. If the trust's assets have dwindled to the point that administrative fees are consuming the benefits, it's time to close it. The Texas Trust Code even provides a streamlined process if a trust's value falls below $50,000.

- Changed Circumstances: Life threw a curveball. An unexpected event can make the trust unnecessary. For example, a special needs trust created for a beneficiary who, thankfully, makes a full recovery and no longer requires that specific support.

A key concept in Texas law is a trust’s “material purpose.” This is the bedrock of the grantor's intent. Even if every beneficiary agrees to terminate, a court might block the dissolution if it would undermine a core goal, like protecting a beneficiary from creditors or ensuring they have financial support for the long haul.

This table summarizes the primary legal avenues available under the Texas Trust Code for terminating a trust, helping you identify the most suitable option for your situation.

Key Pathways to Dissolve a Trust in Texas

| Method of Dissolution | Governing Texas Trust Code Section | Primary Requirement | Best Suited For |

|---|---|---|---|

| Fulfillment of Purpose | § 112.051 | The trust's stated objective has been achieved. | Trusts with a single, clear goal, like funding education or reaching a specific age. |

| Beneficiary Consent | § 112.054(a) | Unanimous agreement among all beneficiaries. | Situations where adult beneficiaries are capable of managing assets on their own. |

| Uneconomical Trust | § 112.054(b) | Trust value is less than $50,000. | Small trusts where administrative costs outweigh the benefits of continuation. |

| Judicial Modification/Termination | § 112.054 | A court finds that circumstances have changed or continuation is impractical. | Complex situations, beneficiary disputes, or when the material purpose is unclear. |

Understanding these options is the first step in charting a course for a smooth and legally sound trust dissolution.

The Trustee’s Role in Initiating Dissolution

The process begins when either the trustee or a beneficiary sees a valid reason to terminate. From there, the trustee's job is to assess the situation, review the trust document for specific instructions on dissolution, and communicate openly with everyone involved.

This initial work lays the groundwork for a successful termination, whether it’s a straightforward agreement or one that requires a judge’s approval. Getting familiar with the different types of trusts and their rules can also provide valuable context. An experienced Texas estate planning attorney is your best ally here, ensuring every step you take honors the trust’s terms and complies with state law.

Before you can dissolve a trust, you must start with the document that created it. Think of the trust agreement as the constitution for this financial entity—it lays out all the rules, powers, and limitations set by the grantor.

This document is your roadmap. Buried within its legal language are the specific instructions for how and when it can be terminated. Some are straightforward, like a trust that terminates when a child turns 25. Others are more nuanced, giving a trustee the power to wind things up once certain life goals are met. Your first job is to carefully read it, cover to cover.

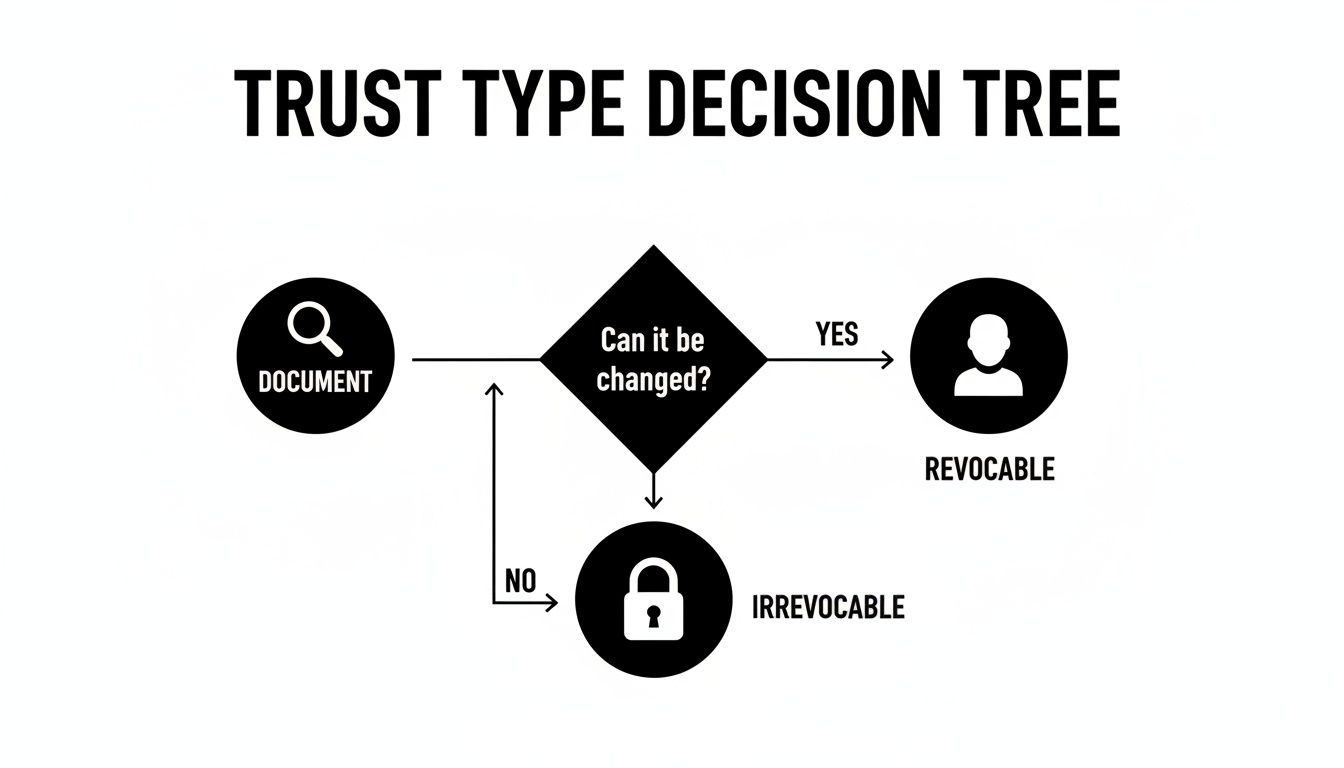

Revocable vs. Irrevocable: The Fork in the Road

Immediately, you need to determine if you are dealing with a revocable or an irrevocable trust. This single distinction changes everything about the path forward.

- Revocable Trusts: These are flexible tools often used in estate planning. While the grantor is alive and has mental capacity, they can typically change or dissolve the trust with relative ease.

- Irrevocable Trusts: This is a different matter. As the name implies, these trusts are meant to be permanent. Once established, the grantor usually cannot simply undo it. Winding down an irrevocable trust is a more significant undertaking, almost always requiring the consent of the beneficiaries and often court involvement.

Most trusts automatically become irrevocable when the grantor passes away. This is the moment when many families start looking at their options, making this distinction absolutely critical.

What Was the Point? Uncovering the Trust’s Material Purpose

Beyond the type of trust, you need to understand why it was created. This is what lawyers call the material purpose. Was the goal to fund a grandchild's education? To protect a family ranch from creditors? Or to provide for a loved one with special needs?

This is not just a philosophical question; it's a legal one. Under the Texas Trust Code, the material purpose is paramount. Even if every beneficiary agrees to terminate the trust, a judge can—and likely will—refuse if ending the trust would undermine a core goal the grantor had.

Real-World Scenario: When the Purpose Becomes Moot

Imagine a Houston couple set up a trust years ago to pay for their daughter's medical school tuition. However, the daughter chooses a different career path and has no plans to attend medical school. The trust holds a substantial amount of money with no way to fulfill its original mission. The "material purpose" is now impossible to achieve. This is a classic example of a significant change in circumstances that gives the family a very strong argument to go to court and have the trust terminated.

This type of situation happens more often than you might think. In fact, Texas Trust Code Section 112.054 directly addresses this, allowing for a trust to be modified or terminated if, because of circumstances not known to or anticipated by the grantor, doing so would further the purposes of the trust.

Ultimately, the trust document is your primary source of truth. It contains the rules of the road. But if the language is vague, or if life has thrown a curveball the grantor never anticipated, your next call should be to a Texas trust administration lawyer. They can help you decipher the legal terms, analyze the material purpose, and lay out the best strategy for your family's situation.

Choosing Your Path: Judicial vs. Non-Judicial Dissolution

Once you have reviewed the trust document and have a solid handle on its purpose, the next step involves the beneficiaries. Texas law provides two main paths for dissolving an irrevocable trust. Each is designed for different family dynamics and legal situations: one path avoids the courthouse, while the other requires a judge's approval.

Figuring out the right approach depends on your specific circumstances. If everyone is in agreement, you can often find a faster, more private solution. But if there is any disagreement or a legal complication, you are almost certainly heading to court.

The Power of Agreement: Non-Judicial Dissolution

When every beneficiary agrees that a trust’s time has come, Texas law offers an efficient way to make it happen without court intervention. The tool for this is a Non-Judicial Settlement Agreement (NJSA).

Governed by the Texas Trust Code § 111.004, an NJSA allows all interested parties to resolve matters themselves, including terminating the trust. The main conditions are that the agreement cannot violate a "material purpose" of the trust and that everyone involved must sign it. This is often the preferred method because it is private, faster, and much less expensive than a formal court proceeding.

Real-World Scenario: A Family Business Venture

Consider three adult siblings who are the sole beneficiaries of a trust their late parents established. The trust holds a sizable investment portfolio intended to provide supplemental income. Now, all three want to start a business together and need the capital that's locked up in the trust. Because they are in total agreement, they can hire a Texas trust administration lawyer to draft an NJSA. The agreement will formally dissolve the trust and specify how the assets will be divided among them to fund their new venture, allowing them to move forward without a lengthy court process.

For an NJSA to be a viable option, you must meet a few requirements:

- Unanimous Consent: Every beneficiary must agree. If even one person objects, this path is closed.

- Capacity: All beneficiaries signing the agreement must be adults who are legally capable of entering into a binding contract.

- No Material Purpose Violation: The dissolution cannot undermine one of the core reasons the trust was created.

This decision tree gives you a great visual for that first fork in the road, which all starts with what kind of trust you're dealing with.

As you can see, the trust's original design—whether it's flexible and easy to change (revocable) or locked down (irrevocable)—sets the entire strategy for how you can take it apart.

When Court Intervention is Necessary: Judicial Termination

Sometimes, getting everyone to agree is not possible. When that happens, the trustee or a beneficiary must file a petition with the appropriate Texas court and ask a judge to terminate the trust.

This formal route is unavoidable in a few common scenarios. If beneficiaries are in conflict, if one is a minor who cannot legally consent, or if it is unclear whether ending the trust would violate its material purpose, a judge must intervene and make the final decision.

The vast majority of trust disputes in Texas revolve around attempts to end them. It’s interesting to see how broader societal shifts, which you can read about on platforms like Pew Research, influence family dynamics and lead to more of these dissolution requests.

Another significant reason to go to court is when a trust becomes too small to justify the cost of managing it. Under Texas Trust Code § 112.054, a trustee can terminate a trust with a value under $50,000 on their own after notifying the beneficiaries. But for larger trusts where administrative costs have become impractical compared to the trust's size, you will need a court to approve the dissolution.

When you petition the court, you must come prepared with solid evidence. This could include:

- Financial statements showing the trust is no longer economical.

- Signed affidavits from beneficiaries explaining why their circumstances have changed.

- Testimony from experts about the grantor's original intent.

Walking into a courtroom requires a real understanding of legal procedure and fiduciary duties. This is where bringing in a Texas estate planning attorney is non-negotiable. They can help you build a strong case and make sure every legal requirement is met, protecting both the trustee and the beneficiaries. An attorney can also help you look at other options, like a guardianship for a minor beneficiary or different asset protection strategies if a full termination isn't the best move.

A Trustee's Guide to Final Fiduciary Duties

Getting approval to dissolve a trust is a major step, but for the trustee, the real work is just beginning. This final phase is where your fiduciary duties in Texas are truly tested. It is a careful process of tying up loose ends—accounting for every dollar, paying off any debts, and preparing everything for the final distribution.

Think of yourself as the captain of a ship being decommissioned. Your job isn't done until you've ensured every piece of cargo is accounted for, every crew member (the beneficiaries) is treated fairly, and every creditor has been paid. Rushing this stage or cutting corners can leave you personally liable for any mistakes.

For anyone serving as a trustee, especially when a trust is ending due to the grantor's death, understanding the full scope of your duties is essential. Getting a clear picture of trustee responsibilities after death provides essential context for the tasks ahead.

Conducting a Meticulous Final Accounting

Transparency is not just a buzzword in trust administration; it is the foundation of everything you do. This is especially true in the final accounting. The Texas Trust Code is clear: a trustee has a legal duty to keep beneficiaries reasonably informed. A thorough final accounting is how you meet that obligation. It is not just a good idea—it is a legal requirement that protects you as much as it protects the beneficiaries.

This final report must tell the complete financial story of the trust from the last accounting period right up to the very end.

It must include:

- A Complete Asset Inventory: A detailed list of every asset the trust held at the beginning of the accounting period, along with its fair market value.

- A Record of All Transactions: Every dollar in and every dollar out must be documented. This includes all income (dividends, interest, rent) and every expense (fees, taxes, repairs).

- A Schedule of Proposed Distributions: The accounting must clearly state how the remaining assets will be divided among the beneficiaries, according to the trust's terms or any settlement agreement.

Real-World Scenario: The Perils of Incomplete Records

I once saw a trustee in Austin face legal trouble while dissolving a family trust containing stocks, real estate, and a small business. He provided the beneficiaries with a simple spreadsheet showing only the final distribution amounts, omitting a detailed breakdown. A beneficiary became suspicious about the high "administrative costs" and filed a lawsuit. The court sided with the beneficiary, finding the trustee had breached his fiduciary duty by not providing a proper accounting. The trustee was held personally liable for mismanaged funds and the beneficiary's legal fees. This is a harsh lesson in why transparent accounting is never optional.

Settling Debts and Filing Final Taxes

Before any beneficiary receives a distribution, you must ensure all of the trust's legitimate debts are settled. This involves actively identifying and notifying potential creditors, reviewing any claims that are submitted, and paying off all outstanding bills. This duty to creditors is a core part of your role as trustee.

At the same time, you must wrap up the trust's final tax obligations. This is often a multi-step process with the IRS and the state.

Your key tax duties will likely include:

- Filing the trust's final income tax return on Federal Form 1041.

- Providing each beneficiary with a Schedule K-1. This form reports their share of the trust's income, deductions, and credits, which they will need for their personal tax returns.

- Addressing any potential estate or gift tax issues that might apply.

Failing to file taxes or pay creditors can lead to penalties and interest, which reduces the funds available for beneficiaries and can make you personally liable. It is wise to consult with a Texas trust administration lawyer and a qualified CPA. Our firm can help you navigate these duties; review our detailed overview of trustee duties and responsibilities to get a better sense of the big picture.

Finalizing the Dissolution: Distributing Assets and Closing the Books

After completing the legal groundwork and finalizing the accounting, you have reached the home stretch. This is the moment everyone has been waiting for—when the trust's assets are distributed to the beneficiaries.

This is more than just writing checks. This phase involves precise legal steps to transfer ownership and, just as importantly, to protect you as the trustee from future legal challenges. Every move must align perfectly with the trust document or the settlement agreement. Getting this right ensures a clean finish and peace of mind for everyone.

Transferring Assets to Beneficiaries

Moving assets from the trust to the beneficiaries is not a one-size-fits-all process. Different assets require different transfer methods, and your job is to handle each one correctly. You are essentially converting the trust's property into the beneficiaries' personal property.

Here’s what this typically involves:

- Retitling Real Estate: You will need to prepare and file a new deed to officially transfer ownership of any real property from the trust's name to a beneficiary.

- Moving Financial Accounts: This means working directly with banks and brokerage firms to close the trust's accounts and transfer the funds or securities into new accounts under the beneficiaries' names.

- Distributing Personal Property: For tangible items like jewelry, art, or family heirlooms, you must coordinate physical delivery and, crucially, obtain written confirmation that the beneficiary has received them.

The tax implications of these distributions can be complex, and consulting experienced tax accountants is almost always a smart move to ensure compliance.

The Importance of Receipts and Releases

This may be the single most critical step for your own protection as a trustee. Before transferring any assets, you must have each beneficiary sign a receipt and release document. This is a powerful legal agreement that accomplishes two vital things.

First, the "receipt" part confirms the beneficiary received their fair share of the assets, as laid out in the final accounting. Second, the "release" part absolves you of any further liability for your management of the trust. By signing, the beneficiary is officially stating they are satisfied and will not sue you later.

A signed release is your best defense against future claims of mismanagement. Without it, you leave the door open for a beneficiary to second-guess your decisions years down the road, potentially leading to costly litigation long after the trust is closed.

Formally Closing the Trust’s Affairs

The very last step is to formally conclude the process and document that the trust is terminated. This creates a definitive end to your duties. If the dissolution was court-supervised, you will likely need to file a final report with the court and obtain an order officially discharging you as trustee.

If you handled the dissolution without court involvement, those signed receipts and releases are your primary proof that the job is done. This documentation, along with the final tax returns and a final accounting showing a zero balance, effectively closes the books. It is advisable to keep a complete record of everything stored safely for several years. You can learn more about the details involved by exploring our guide to what trust accounting entails.

When You Need a Texas Trust Administration Lawyer

While some trust terminations may appear straightforward, they are rarely simple. The reality is often a complex intersection of legal rules, financial maneuvers, and sensitive family dynamics. Knowing when to call a professional is what a responsible trustee does to protect everyone involved.

There are a few red flags that should prompt you to call an attorney right away. If you sense disagreements brewing among beneficiaries, it is far smarter to get ahead of the conflict. Do not wait for it to escalate into a full-blown court battle. A good lawyer can step in, mediate the conversation, and ensure a fair process for everyone.

Situations That Absolutely Require Legal Counsel

The complexity of the trust itself is another major signal. If you are dealing with sophisticated assets—such as a family business, commercial real estate, or a large investment portfolio—you need specialized knowledge. One wrong move in valuing or distributing these assets can lead to serious financial and legal consequences.

You should also seek an attorney's help when:

- The Trust Document is Vague: If the instructions for termination or distribution are unclear, you need a lawyer to interpret the grantor's intent while staying within the bounds of Texas law.

- A Beneficiary is a Minor or Incapacitated: You cannot simply hand over assets to someone who cannot legally consent. There are specific legal procedures to follow to protect their interests.

- Significant Tax Implications Exist: Winding down a trust can trigger various tax consequences, from capital gains to income taxes. An attorney, often working with a CPA, can map out a strategy to minimize the tax impact.

Bringing in an experienced Texas trust administration lawyer is a proactive move. It shields you from personal liability, guarantees you're following the Texas Trust Code to the letter, and ultimately, honors the wishes of the person who created the trust. It gives you a clear, defensible path to the finish line.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.

Frequently Asked Questions About Dissolving a Trust

When a trust reaches the end of its life, it's natural for trustees and beneficiaries to have a lot of practical questions. Let's tackle some of the most common concerns that come up during the trust dissolution process right here in Texas.

How Long Does It Typically Take to Dissolve a Trust in Texas?

The timeline for dissolving a trust can vary widely based on its complexity. A simple, straightforward trust where all beneficiaries are in agreement and no court involvement is needed might be wrapped up in just a few months.

However, if the situation requires a court petition—perhaps due to beneficiary disagreements or other legal issues—the process can easily extend to a year or more. Factors like complex assets, outstanding creditor claims, and final tax filings all influence the timeline.

What Happens If One Beneficiary Does Not Agree to Dissolve the Trust?

If unanimous consent is required for a non-judicial termination and one beneficiary objects, that informal route is no longer an option. This is a common scenario that moves the process into a more formal legal setting.

The typical next step is to file a petition with the court, asking for a judicial termination. A Texas judge will then examine the trust's original purpose, listen to the reasons for the objection, and consider the family's overall situation before making a decision. This is precisely when you need a seasoned Texas trust administration lawyer in your corner.

A single dissenting voice can stop an informal dissolution in its tracks. This really underscores the need for clear communication and, when that fails, relying on the courts to sort things out and keep the process moving.

Can a Trustee Be Held Personally Liable During Dissolution?

Yes, a trustee can absolutely be held personally liable. Serving as a trustee comes with strict fiduciary duties in Texas. You are legally required to provide a full accounting of all assets, act with total impartiality, and follow the trust's instructions to the letter.

If a trustee fails in these duties—for example, by providing a sloppy accounting, distributing assets incorrectly, or ignoring creditors—they can be held personally responsible for any financial damage caused to the beneficiaries. This is precisely why obtaining legal advice and having beneficiaries sign releases are critical steps to protect anyone in this role.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.