Navigating a loved one’s final wishes can feel overwhelming, but with the right legal guidance, it doesn’t have to be. Understanding "how to execute a will" is the first step toward clarity during a difficult time. In Texas, executing a will is a two-part process governed by the Texas Estates Code.

First, there is the legal act of signing and witnessing the document to make it official. Then, after the person has passed, comes the executor's duty of administering the estate. Getting both parts right is essential to honoring your loved one’s intentions and ensuring a smooth process for everyone involved.

What "Executing a Will" Actually Means in Texas

Legal jargon can be confusing, especially when one phrase has two meanings. "Execute a will" is a perfect example. Understanding the distinction is key to confidently handling your responsibilities, whether you are creating your own will or have been named an executor for a loved one.

The first meaning is about creating a legally valid will. This is the formal ceremony where the person making the will—the testator—signs the document according to a strict set of rules. This initial execution gives the will its legal power.

The second meaning begins after the testator has passed away. This is when the person they named as executor steps in to carry out the will's instructions. In this context, executing the will means managing the entire process of estate administration, from filing the will with the probate court to distributing assets to the beneficiaries.

Breaking down these two distinct processes can help clarify what needs to happen and when.

The Two Phases of Executing a Will in Texas

| Phase of Execution | Who Is Involved | Key Actions | Governing Law |

|---|---|---|---|

| Phase 1: Legal Signing Ceremony | The Testator, Two Credible Witnesses, a Notary Public (optional but highly recommended) | Signing the will with specific formalities, witnessing the signature, and creating a self-proving affidavit. | Texas Estates Code § 251 |

| Phase 2: Estate Administration | The Executor, Beneficiaries, Probate Court, Creditors | Filing for probate, gathering assets, paying debts, and distributing the remaining property to heirs. | Texas Estates Code (Probate sections) |

Let’s take a closer look at what each phase entails.

Phase 1: The Legal Creation and Signing

This is where it all begins, and it's all about making sure the will is legally sound. The testator must sign the will in front of two credible, disinterested witnesses who are at least 14 years old.

This step is what makes the document legally binding and ensures it can be admitted to probate without a hitch. Getting this part right prevents a world of headaches and potential challenges down the road.

Phase 2: Estate Administration by the Executor

This phase starts after the testator's death. The executor takes the reins and is responsible for making sure the will's instructions are followed to the letter.

Their duties include taking the will to court, creating an inventory of all assets, notifying any creditors, and, finally, distributing the property as the will directs. This is the practical side of things—the actual fulfillment of the testator’s wishes.

Both phases are non-negotiable. A simple mistake in Phase 1 can invalidate the entire will. An error in Phase 2 can expose the executor to personal legal liability. Here at The Law Office of Bryan Fagan, PLLC, we guide clients through both estate planning and administration, ensuring every step is handled correctly and with care.

Making the Will Legally Binding: The Signing Ceremony

For a will to hold up in a Texas court, it must be created with precision. This first phase of executing a will is arguably the most critical. It’s not just about writing down your wishes; it's about formalizing them according to the strict standards of the Texas Estates Code. This initial signing ceremony is what gives the document its legal life.

A minor slip-up here can jeopardize the entire will, leaving your final wishes open to being challenged and potentially overturned. The law is incredibly specific about who can sign, who can witness the signature, and how the entire event must unfold.

The Role of the Testator and Witnesses

The person creating the will—known as the testator—must sign the document. Alternatively, another person can sign on the testator's behalf, but only if they do so in the testator's presence and under their direct supervision.

That signature must then be "attested to" by two credible witnesses. Under Texas law, these witnesses must meet specific requirements:

- They must be at least 14 years old.

- They cannot be a beneficiary in the will.

- They have to sign the will in the testator’s presence.

"In the testator's presence" means everyone needs to be physically in the same room, observing the signing as it happens. This rule exists to prevent fraud or undue influence. To get this right, careful drafting is non-negotiable. It's worth exploring how advanced tools, including AI for will drafting, can help avoid these common pitfalls.

A Common and Costly Witnessing Mistake

Here is a real-world scenario we see all too often. A father is signing his will and asks his daughter and his next-door neighbor to act as his witnesses. The problem? His daughter is also the primary beneficiary of his will. While his intentions were good, this simple mistake creates a significant legal headache.

The Texas Estates Code states that if a beneficiary acts as a witness, it doesn't automatically void the entire will. However, it can void the gift to that beneficiary-witness unless their testimony is corroborated by another, disinterested person. This can lead to messy, expensive court battles and could mean the daughter does not receive what her father intended.

This is a perfect example of why professional legal guidance is so valuable. An experienced Texas estate planning attorney would spot this conflict immediately and ensure disinterested witnesses are used, protecting both the gift and the will's integrity.

Streamlining Probate with a Self-Proving Affidavit

One of the most useful tools in Texas estate planning is the self-proving affidavit. This is a separate statement attached to the will where the testator and the witnesses sign again, this time in front of a notary public.

This affidavit essentially pre-validates the signatures for the court. When it's time for probate, the court can accept this affidavit as proof that the will was signed correctly. This saves your executor the significant hassle and expense of tracking down the original witnesses—who may have moved or passed away—to testify in court years later. It's a simple, notarized document that makes the probate process smoother for your loved ones. You can learn more about the strict legal formalities by reviewing the complete will requirements in Texas in our detailed guide.

The Executor's Role: Administering the Estate

Once a Texas court officially accepts a will, the second, more hands-on phase of "executing a will" begins. This is where the named executor steps up to administer the estate, turning the written words into action. This is not just a to-do list; it is a serious legal responsibility known as a fiduciary duty.

This duty requires the executor to act with complete loyalty and good faith, always putting the estate's best interests first. It is the cornerstone of estate administration under the Texas Estates Code, ensuring your loved one's wishes are carried out with integrity. As a Texas trust administration lawyer, we guide executors through these fiduciary duties in Texas every day.

Kicking Off the Probate Process

The executor's journey starts by filing an application to probate the will in the county court where the deceased person lived. Once the court officially appoints the executor by issuing a document called "Letters Testamentary," their work can truly begin.

Getting these first steps right is critical for a smooth process:

- Notify Beneficiaries: Every person named as a beneficiary in the will must be formally notified that the will has been admitted to probate. Transparency from the start helps prevent potential disputes later.

- Publish Creditor Notice: The executor must also publish a notice in a local newspaper. This alerts potential creditors that the person has passed away and gives them a specific timeframe to present claims against the estate.

If these initial notifications are not handled correctly, it can cause major delays, and the executor could even be held personally liable.

Independent vs. Dependent Administration

One of the best features of modern Texas estate planning is the option for independent administration. Most wills drafted by a Texas estate planning attorney today are written to allow for this. It means the executor can handle most of the estate’s business—such as paying debts, selling property, and managing accounts—without needing court permission for every action. This makes the process faster, cheaper, and less burdensome.

In contrast, a dependent administration requires the executor to get a judge’s approval for nearly every single action. This high level of court supervision is more cumbersome and is usually only necessary when an estate is contested or unusually complex. You can learn more about the specific legal obligations involved by exploring the detailed duties of an executor of an estate in Texas.

Managing and Distributing Estate Assets

After clearing the initial legal hurdles, the executor’s job shifts to the practical management of the estate. This involves identifying, gathering, and securing all of the deceased's assets. For example, consider an estate that includes a family home in Houston, a stock portfolio, and several bank accounts. The executor's job is to ensure the mortgage and property taxes are paid, the investments are managed prudently, and the cash is consolidated into a new bank account set up for the estate.

An executor’s fiduciary duty means they absolutely cannot mix estate funds with their own money or make speculative, risky investments. Every single financial decision must be carefully documented.

This process can be surprisingly long and complex. In Texas, probate can easily take anywhere from 6-18 months and cost between 3-7% of the estate's total value. Getting professional legal guidance can significantly lower the risk of litigation—a crucial step, as data from Texas courts indicates that contested probates are on the rise. After all legitimate debts have been paid, the executor can finally distribute what's left to the beneficiaries, precisely following the instructions laid out in the will.

Navigating Key Responsibilities and Timelines

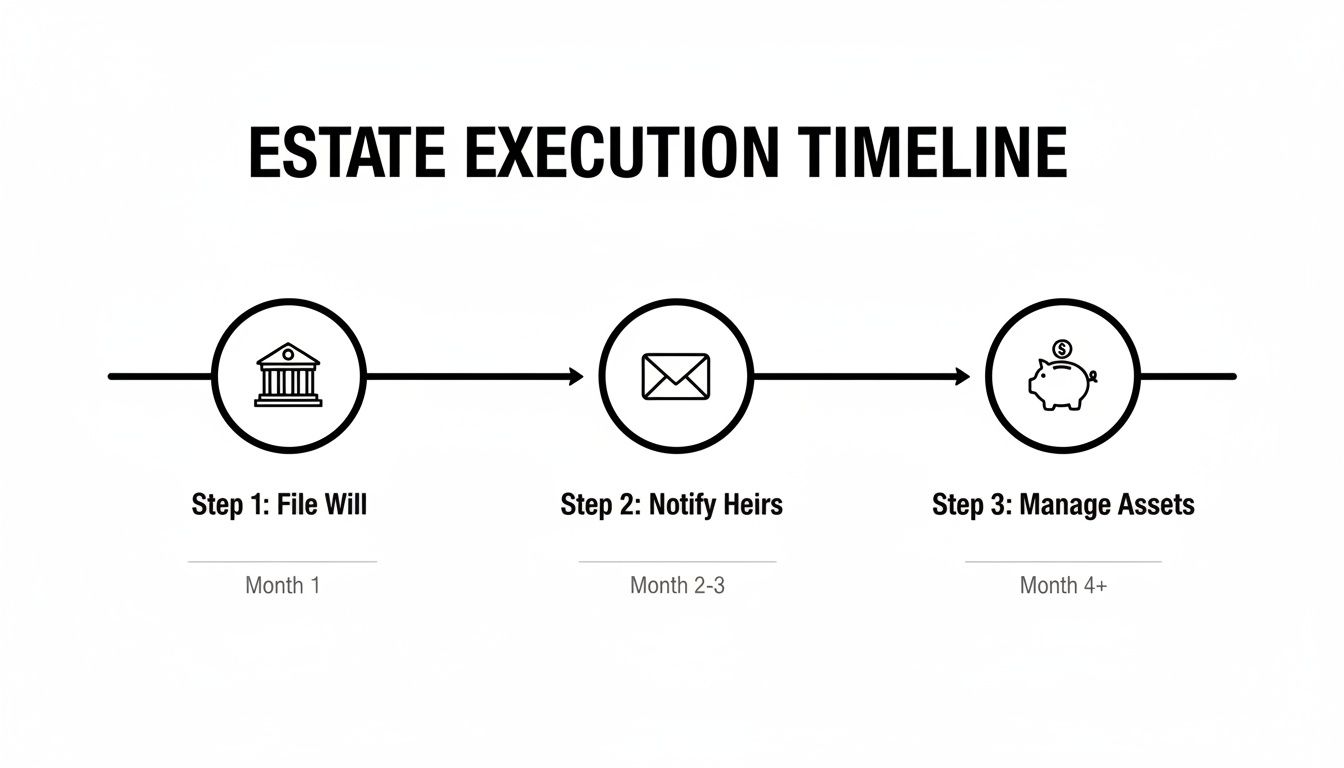

Once the court issues your official appointment, known as Letters Testamentary, you are no longer just the person named in the will—you are the executor. This role comes with a series of time-sensitive tasks, and staying organized is essential. Texas law has strict deadlines, so having a clear picture of the probate timeline will keep you on track and give beneficiaries confidence in your management.

The first few months are critical. Your job is to gather all the estate's assets, notify everyone who needs to know, and set up the proper financial accounts. Building this foundation correctly from the start is the secret to preventing future complications.

This timeline provides a high-level view of the first steps you will take after filing the will.

This sequence—filing the will, notifying the right people, and managing the assets—is the backbone of the entire probate process. It creates a structured, legally sound path forward.

Your First 90 Days as Executor

Within the first 30 to 90 days after the court grants you Letters Testamentary, you have several critical tasks. One of the first and most important is opening a dedicated bank account for the estate. This account is where any estate income will be deposited and from which its bills will be paid.

Crucial Reminder: Whatever you do, never mix estate funds with your own money. This is a serious breach of your fiduciary duty and can result in significant legal and financial trouble. Keep meticulous records of every transaction; it’s your best defense if questions ever arise.

During this initial period, you must also formally notify the beneficiaries that the will has been probated. At the same time, you will publish a "Notice to Creditors" in a local newspaper. This is the official announcement that gives anyone owed money by the decedent a set period to make a claim. Keeping the lines of communication open and clear with beneficiaries builds trust and prevents friction. For a deeper dive into what the whole process looks like, check out our guide on how long probate takes in Texas.

To help you stay on top of these duties, here is a checklist that breaks down the typical probate timeline in Texas.

Executor's Timeline: A Texas Probate Checklist

This table lays out the key tasks and legal deadlines an executor needs to manage during the probate process here in Texas. Think of it as your roadmap.

| Timeframe | Key Task | Legal Requirement (Texas Estates Code) | Pro Tip |

|---|---|---|---|

| First 30 Days | File Will for Probate | Must be filed within 4 years of the decedent's death. | Don't wait. Filing promptly gets the process started and establishes your authority. |

| First 60 Days | Post Notice to Creditors | Notice must be published within one month of receiving Letters Testamentary. | Use a newspaper of general circulation in the county where the probate is filed to meet legal standards. |

| First 90 Days | Submit Inventory to Court | An "Inventory, Appraisement, and List of Claims" is due within 90 days of your appointment. | Be thorough. An accurate inventory is the foundation for asset distribution and tax filings. Ask for an extension if needed. |

| Within 4-6 Months | Pay Debts & Taxes | Address valid creditor claims and file the decedent's final income tax return. | Always pay debts before distributing assets. This protects you from personal liability. |

| 6 Months – 1 Year | Distribute Assets | Once all debts are settled, distribute assets according to the will's instructions. | Get signed receipts from each beneficiary confirming they received their inheritance. This is your proof of a job well done. |

| After Distribution | Close the Estate | File a final accounting or affidavit to formally close the estate with the court. | This final step officially ends your duties and liabilities as executor. |

Following this timeline helps ensure a smooth, compliant, and efficient administration of the estate.

Managing Debts and Final Taxes

After you have officially notified creditors, your next major task is settling the decedent’s legitimate debts and final bills. This includes everything from credit card balances and medical expenses to final utility payments. You are also responsible for filing the decedent's final income tax return and, if the estate is large enough, a federal estate tax return.

It is absolutely vital that you pay off all debts before you begin distributing assets to the beneficiaries. If you distribute property prematurely and a valid creditor claim later appears, you could be held personally liable for that debt.

Thankfully, the Texas legal system has a fairly efficient path for most straightforward estates. Across family hubs like Austin, San Antonio, and The Woodlands, the law actually requires independent administration for about 80% of uncontested wills. This process often lets you get assets distributed within a speedy four to six months.

The Final Stretch: Distribution and Closing the Estate

Only when every last debt, tax, and administrative expense has been paid can you move on to the final distribution. Your job here is to follow the will's instructions to the letter, transferring property and funds to the beneficiaries exactly as specified.

A smart final move is to get a signed receipt from every single beneficiary acknowledging that they have received their inheritance. Once all your duties are complete, you can file the necessary paperwork to formally close the estate with the court. This final action concludes your role and responsibilities as executor.

Stumbling Blocks: Common Mistakes to Sidestep in the Will Process

Even with a clear roadmap and the best intentions, the path of executing a will is filled with potential missteps. During a difficult time, small, innocent errors can escalate into serious delays, increased costs, and added stress for a grieving family.

Knowing where others have gone wrong is half the battle. These mistakes can occur when the will is being written or when the executor is carrying out their duties, and each one can have real legal and financial consequences.

Errors When the Will is Being Made

Some of the most serious mistakes are embedded in the will long before an executor is involved. These errors during the drafting and signing process can sometimes invalidate the entire document.

- Improper Witnessing: Texas law is strict. The testator must sign the will in front of two credible witnesses, who must also sign it in the testator's presence. A classic mistake is using a beneficiary as a witness, which can jeopardize their own inheritance.

- Vague Language: Using ambiguous phrases like "my personal effects" or requesting "a reasonable amount" be set aside is an invitation for family disputes. A well-drafted will is specific, clearly stating who gets what and leaving no room for interpretation.

- Skipping the Self-Proving Affidavit: This simple step is often overlooked but causes major headaches. Without this notarized document, the executor may have to track down the original witnesses—years later—to testify in court, grinding the probate process to a halt.

Executor Missteps During Administration

Once the will enters probate, the executor is bound by a strict fiduciary duty, and any missteps can result in personal liability.

Under the Texas Estates Code, the duty of loyalty is paramount. An executor absolutely cannot mix estate funds with their own money or engage in self-dealing. Violating this can lead to removal by a judge and significant financial penalties.

Here are a few common tripwires for executors:

- Commingling Funds: An executor’s first step should be to open a separate bank account for the estate. Paying estate bills from a personal account or depositing estate income into it is a serious breach of their duty.

- Distributing Assets Too Soon: It is tempting to distribute inheritances early, but it is a major risk. If an unexpected tax bill or a valid creditor claim arises after the assets are gone, the executor might have to pay it out of their own pocket.

- Poor Communication: Keeping beneficiaries in the dark breeds suspicion and can lead to costly and unnecessary legal challenges. A good executor provides regular, honest updates to maintain trust and keep everyone informed.

A properly drafted will is a gift of peace to a family. In fact, statistics suggest that a clear will can slash family conflicts by as much as 50%. That’s a huge win, especially for families and business owners trying to preserve a legacy. You can find more insights on how solid estate planning protects families and businesses at trtworld.com. Steering clear of these common mistakes is the best way to ensure your loved one's final wishes are carried out exactly as they wanted—smoothly and without conflict.

When to Seek Professional Legal Guidance

While the Texas Estates Code is designed to make many probate matters straightforward, especially with independent administration, some situations are too complex or high-risk to handle alone. Attempting to navigate these challenges without an experienced professional can lead to costly mistakes, bitter family disputes, and even personal liability for you as the executor.

Knowing when to seek professional help is the mark of a wise executor—someone truly committed to protecting the estate and honoring their loved one’s wishes.

When Legal Counsel Is a Must

Some scenarios are immediate red flags, signaling the need for an experienced Texas probate attorney. If you encounter any of the following, getting legal advice is a critical step to ensure you fulfill your fiduciary duties.

- A Contested Will: The moment a family member threatens to challenge the will’s validity, you are entering the complex world of litigation. This is not DIY territory.

- Complex or Unusual Assets: If the estate includes business ownership interests, multiple real estate properties, or complicated investment portfolios, you need specialized knowledge to value and manage them correctly.

- Conflict Among Beneficiaries: When beneficiaries disagree on how assets should be handled, an attorney can act as a neutral guide to mediate disputes and enforce the will’s terms impartially.

- An Out-of-State Executor: If you live outside of Texas, managing probate from a distance adds logistical and legal hurdles. A local attorney is your boots on the ground, handling court appearances and filings on your behalf.

When navigating the complexities of executing a will, especially in a state like Texas, it is often critical to consult with qualified law firms and attorneys who specialize in estate law.

An experienced probate attorney does more than just file paperwork. They act as your strategic advisor, helping you anticipate challenges, manage creditor claims, and ensure every action you take complies with Texas law. This protects both you and the assets you’ve been entrusted with.

Ultimately, working with an attorney ensures that your fiduciary duties as executor are met, shielding you from personal liability while making sure the estate is settled as efficiently and correctly as possible.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.