Losing a loved one is difficult enough without the legal complexities that often follow. When it comes to managing an estate in Texas, the court grants authority through one of two key documents: Letters Testamentary or Letters of Administration. Navigating this process can feel overwhelming, but with the right legal guidance, it doesn’t have to be. Think of these documents as the official authorization you'll need for banks and other institutions to let you manage the deceased's assets.

Your First Steps in Navigating a Loved One's Estate

Stepping into the role of managing a loved one’s estate is a significant responsibility, but you don't have to navigate it alone. The journey typically begins with a court process called probate. It’s how the court validates the will (if there is one) and officially appoints someone to represent the estate in accordance with the Texas Estates Code.

That official authority comes in the form of a court order that issues either Letters Testamentary or Letters of Administration. Understanding the difference between them is your first crucial step toward fulfilling your duties with confidence.

Why These Letters Are Essential

Simply put, these letters are your court-issued license to act. Without them, you are essentially powerless to handle the estate's business. Financial institutions, government agencies, and anyone else holding the deceased's assets will demand this official proof before they permit you to:

- Access the deceased's bank accounts.

- Settle outstanding debts and pay final bills.

- Sell a house or other property.

- Distribute assets to the beneficiaries or heirs as required by the will or Texas law.

These letters give you the power to legally step into the deceased's shoes and manage their affairs. This is a significant responsibility governed by fiduciary principles, meaning you must act in the estate's best interests at all times.

| Document Type | When It's Used | Title of Appointee | Authority Source |

|---|---|---|---|

| Letters Testamentary | When the deceased left a valid will | Executor | Named in the Will |

| Letters of Administration | When the deceased did not leave a will (intestate) | Administrator | Appointed by the Court |

Beyond the emotional weight of loss, obtaining these letters is one of the first key steps for families after a loved one's death. The specific document you'll need hinges entirely on whether there's a valid will, which is a critical piece of the puzzle. An experienced Texas trust administration lawyer can provide practical advice to help you through this process.

Sorting Out Letters Testamentary and Letters of Administration

When you step in to handle an estate in Texas, the first thing you'll need is the legal authority to act. This authority comes in the form of a court-issued document, and the two you'll hear about most are Letters Testamentary and Letters of Administration. While they both grant you control over the estate, they arise from very different circumstances. The main difference boils down to a single, critical question: did the deceased leave a valid will?

Think of these "Letters" as the official keys to the estate. Without them, you're locked out. You can't access bank accounts, pay off debts, sell a house, or give the heirs their rightful inheritance. They are the court's stamp of approval that lets you properly administer the estate.

What Are Letters Testamentary?

Letters Testamentary are what the court issues when a person dies with a valid will that names an executor. The executor is the individual or institution the deceased trusted and specifically chose to carry out the instructions in their will.

The process is guided by the Texas Estates Code. When the will is submitted to a probate court and proven valid, the court formally appoints the person named as executor. The Letters Testamentary are the official document proving this appointment, giving the executor the power to act for the estate. This is a common part of the estate planning process.

What About Letters of Administration?

On the other hand, you have Letters of Administration. These are granted when a person dies without a will, a situation known as dying "intestate." Since there is no will, there is no pre-chosen executor. The Texas probate court must step in and appoint an administrator to manage the estate.

The court follows a priority list set by state law, usually starting with the surviving spouse, followed by the children. The appointed person receives Letters of Administration, granting them the legal authority to settle the estate according to Texas's default inheritance laws. Interestingly, the idea of appointing administrators has a long history. Colonial legal practices sometimes issued letters of administration even when a will existed, a holdover from Dutch law before our modern distinctions became clear.

The core difference is simple but has massive implications for how an estate is handled:

Letters Testamentary are driven by the deceased’s personal wishes outlined in their will. Letters of Administration are driven by the rules of Texas law when no wishes were left behind.

This single distinction shapes who takes charge and the legal framework they must follow.

| Criteria | Letters Testamentary | Letters of Administration |

|---|---|---|

| Triggering Event | The deceased left a valid will. | The deceased died without a will (intestate). |

| Appointee's Title | Executor | Administrator |

| Source of Authority | The deceased's will, confirmed by the court. | Texas Estates Code, appointed by the court. |

| Guiding Document | The last will and testament. | Texas laws of intestate succession. |

Determining which path you need to take is the first step in properly administering the estate. Whether you've been named an executor or need to apply to be an administrator, this distinction will define your entire probate journey.

A Detailed Comparison of When Each Document Is Used

While both Letters Testamentary and Letters of Administration confer legal power over an estate, the paths to obtaining them are quite different, as are the responsibilities they entail.

Understanding these differences is critical if you are stepping up to manage a loved one's final affairs. The entire process hinges on whether they left a valid will. That single fact shapes the entire probate process, from who is appointed to the degree of court supervision required. An executor named in a will usually has a clearer path, guided by the deceased's own words. An administrator, however, follows a route laid out by Texas law, which can often involve more court oversight.

Source of Authority: A Will Versus State Law

The most fundamental difference between the two is the source of authority. For Letters Testamentary, the authority flows directly from the will itself. The person who passed away (the "testator") personally chose the executor, demonstrating a high level of trust.

When that will is presented to a judge, the court’s primary role is to confirm the will is legitimate and formally recognize the testator's chosen representative. It's a process that honors the deceased's final wishes.

Conversely, the power granted by Letters of Administration comes directly from the Texas Estates Code. When someone dies "intestate" (without a will), they have left no instructions. The court must appoint an administrator based on a strict legal order of priority. This means the authority is statutory, not personal.

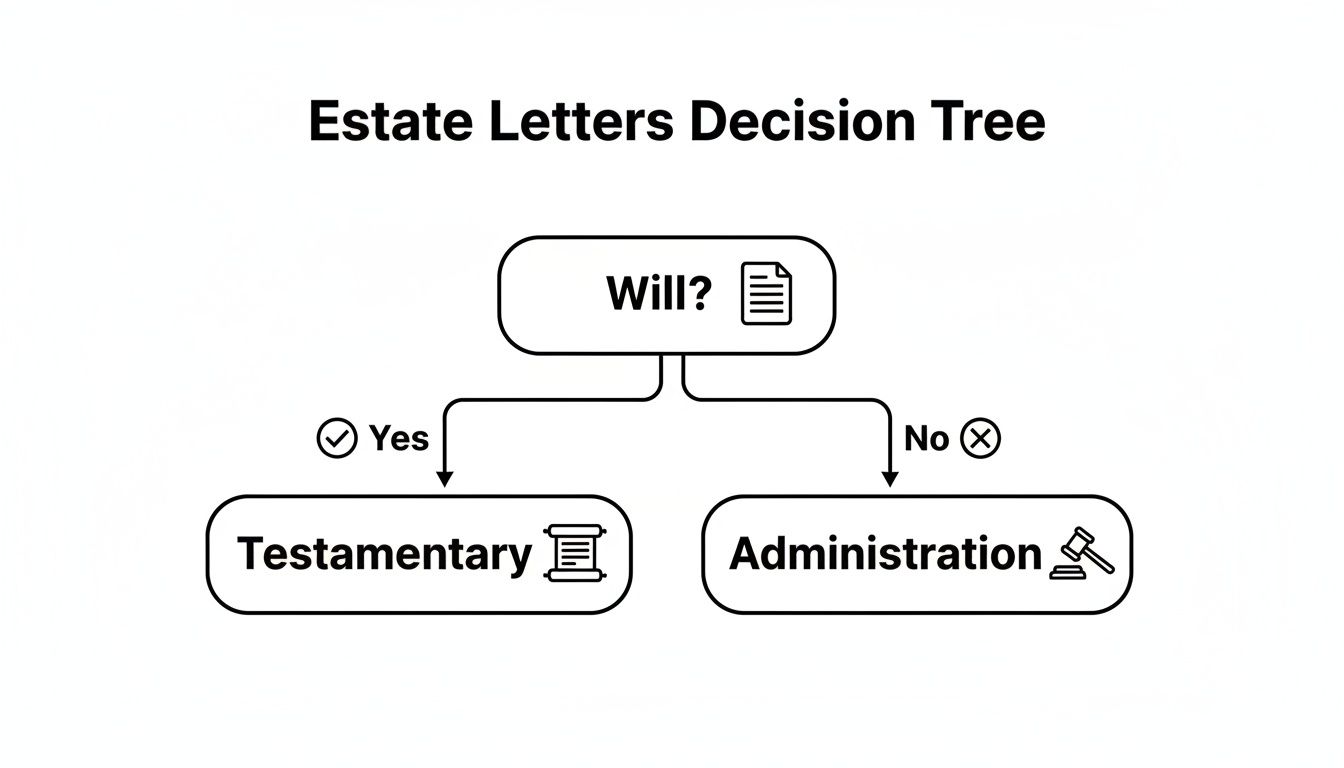

This decision tree gives you a quick visual on whether you will be seeking Letters Testamentary or Letters of Administration.

As you can see, the presence of a will is the critical fork in the road, directing the estate settlement down one of two distinct legal paths.

The Selection Process: Chosen by the Deceased or Prioritized by Law

How the person in charge is selected is another major point of difference.

Executor Selection: The executor is hand-picked by the testator and named in the will. This is often a trusted family member, a close friend, or a professional advisor. The court's role is simply to confirm that choice, provided the person is legally qualified and accepts the role.

Administrator Selection: Without a will, the court must appoint an administrator based on a priority list set by the Texas Estates Code. The typical order is:

- The surviving spouse

- The principal beneficiary from a revoked will

- Any other heir (such as a child, parent, or sibling)

- A creditor of the estate

This legal hierarchy can become complicated, especially if family dynamics are strained or if several heirs with equal priority cannot agree on who should be in charge. You can get a deeper dive into these roles in our guide on the differences between an administrator vs executor.

Key Takeaway: An executor is a personal choice, reflecting the decedent's trust. An administrator is a legal appointment dictated by state law, which may not align with what the family would have wanted.

Court Supervision and Requirements: Independent vs. Dependent

The level of court oversight is where the practical differences become most apparent. A well-drafted Texas will often designates an "independent executor."

This allows for a streamlined form of probate, a significant advantage in Texas. Once an independent executor receives their Letters Testamentary, they can handle most estate business—paying debts, selling property, and distributing assets—with minimal court supervision. This saves time, reduces legal fees, and simplifies the entire process. The will can also waive the requirement for the executor to post a bond, which is an insurance policy for the estate.

In contrast, an administrator appointed by the court almost always serves in a "dependent administration." This is a much more hands-on process for the court. The administrator needs a judge's permission for many actions, such as selling a house or paying a significant bill. They are almost always required to post a bond, and the process involves more formal accountings and reports, making it more time-consuming and expensive.

Real-World Scenario: Letters Testamentary

Imagine Maria’s father passes away with a will naming her as the independent executor and waiving the bond. After the will is probated, the court issues Letters Testamentary to Maria. She can immediately begin paying her father's final bills, list the family home for sale, and divide the remaining assets among her siblings according to the will—all without needing court permission for each step. This clear, step-by-step guidance allows her to settle the estate efficiently and with confidence.

Real-World Scenario: Letters of Administration

Now, consider James, who dies suddenly without a will. His two adult children have equal priority to be the administrator but cannot agree. After a court hearing, his daughter is appointed. Because it’s a dependent administration, she must post a costly bond. Before she can sell James's car to pay off a loan, she has to file a motion and get a judge to sign an order. This adds weeks of delay and extra attorney's fees to an already stressful situation.

How to Get Your Hands on These Letters in a Texas Probate Court

Whether you need Letters Testamentary or Letters of Administration, your path leads through the Texas probate court system. This may sound intimidating, but it is a structured legal process laid out by the Texas Estates Code. Understanding the steps involved can make the experience feel much more manageable.

This is a formal legal proceeding designed to protect everyone involved—heirs, beneficiaries, and creditors alike. Following each step correctly is key to avoiding frustrating delays during an already difficult time.

Step 1: Kicking Off the Probate Process

The first step is filing an application with the appropriate probate court, which is typically in the county where the deceased person lived. This application contains crucial information, such as the date of death, their last known address, and a list of potential heirs.

If there is a will, you will file it along with the application. Your request to the court will be to formally recognize the will as valid and appoint the executor named in it. If there is no will, you will ask the court to legally identify the heirs and appoint an administrator.

Step 2: The Waiting Period and Public Notice

Once the application is filed, Texas law requires a brief waiting period before a hearing can take place. During this time, the county clerk will post a public notice at the courthouse, announcing that a probate case has been initiated.

This public posting is a mandatory legal step that ensures transparency. It gives anyone with an interest in the estate, such as creditors or other potential heirs, a fair opportunity to come forward.

Step 3: The Court Hearing

After the waiting period ends, the court schedules a hearing. Here, you will provide testimony directly to the judge. The focus of your testimony will depend on which type of Letters you are seeking:

- For Letters Testamentary: You will need to "prove up" the will. This typically involves testifying that the deceased was of sound mind when they signed it and that all legal formalities were followed correctly.

- For Letters of Administration: The focus shifts to proving who the legal heirs are. You may need witnesses or documents like birth and marriage certificates to establish the family tree for the court.

The judge will listen to the testimony, review the evidence, and, if everything is in order, sign an order admitting the will to probate or officially determining the heirs.

The core responsibility of a personal representative—ensuring accountability—has deep historical roots. In late medieval England, courts started requiring detailed probate accounts after granting letters. This practice peaked after 1585 but declined after 1685 when mandatory accounting was eliminated, showing how the principle of fiduciary oversight has evolved over centuries.

Step 4: The Final Steps: Oath and Bond

With the judge's order signed, the appointed executor or administrator must take an oath of office. This is a formal promise to faithfully perform all the duties required by law.

In many cases, particularly in dependent administrations, the court will also require you to post a bond. A bond acts as an insurance policy that protects the estate’s assets from mismanagement. Once you’ve taken the oath and filed any required bond, the court will officially issue your Letters Testamentary or Letters of Administration. This document is the tangible proof of your authority, which you can show to financial institutions to begin settling the estate. You can learn more about the probate process in Texas in our detailed guide.

Your Responsibilities After Receiving Letters

Receiving your official letters testamentary or letters of administration from the court marks the beginning of your duties, not the end. The moment you have that document, you are formally recognized as a fiduciary—a person legally and ethically required to act in the best interests of the estate. This is a serious legal role that comes with significant duties and personal liability.

Under the Texas Estates Code, your mission is to gather the decedent's assets, pay their legitimate debts, and distribute what remains to the correct beneficiaries or heirs. This entire process requires diligence, transparency, and meticulous attention to detail.

Trustee Responsibilities Under Texas Law: The Fiduciary Duty

Being a fiduciary in Texas means you are held to one of the highest legal standards of care. This is a strict rule, not a suggestion. Your guiding principles are loyalty and prudence, known as your fiduciary duties in Texas. This means every decision must be made with the estate's best interest at heart, and you must manage its assets as carefully as you would your own.

Failing to meet these standards can have severe consequences, including being removed by the court, being held personally liable for losses, or facing lawsuits from beneficiaries. Understanding your responsibilities is essential for both fulfilling your role and protecting yourself.

Your role as an executor or administrator is one of profound trust. The court and the family are relying on you to safeguard the decedent's legacy with integrity. Meticulous record-keeping is your best defense against potential disputes and ensures you fulfill your legal obligations correctly.

A Step-by-Step Guide to Your Key Responsibilities

Once the letters are in your hand, you can begin the practical work of administration. While every estate is unique, the core duties are consistent. A methodical approach ensures that nothing is overlooked.

Here is some practical advice for your checklist:

- Inventory and Appraise Estate Assets: Your first task is to create a detailed list of everything the decedent owned, including bank accounts, real estate, vehicles, and personal items. You have 90 days from your appointment to file a formal "Inventory, Appraisement, and List of Claims" with the court, unless the will waives this requirement.

- Notify Creditors: Texas law requires you to publish a notice to creditors in a local newspaper. You must also send direct notice to any known secured creditors. This starts a legal timeline for them to submit claims against the estate.

- Manage Estate Property: This includes securing physical assets, maintaining real estate, and overseeing financial investments. For properties, you might consider services for Expert Estate Caretaker & Maintenance.

- Pay Valid Debts and Taxes: After reviewing creditor claims, you must use estate funds to pay all valid debts. You are also responsible for filing the decedent's final income tax return and any required estate tax returns.

- Communicate with Beneficiaries: Keeping beneficiaries informed about the estate's progress is a key part of your fiduciary duty. Regular, honest communication can prevent misunderstandings and build trust.

After all assets are collected and debts are settled, your final major task is to distribute the remaining property. If there is a will, you must follow its instructions precisely. If there is no will, you will distribute the assets according to the heirship determination made by the court.

Common Questions About Letters of Administration and Testamentary

Navigating the probate process often brings up practical questions that can cause stress. While every family's situation is unique, many people encounter similar concerns. Here are clear, straightforward answers to some of the most common questions about letters testamentary or letters of administration in Texas.

Our goal is to demystify the legal jargon and empower you with the knowledge needed to move forward with confidence.

How Long Does It Take to Get the Letters?

While there is no single answer, you can generally expect the process of obtaining either Letters Testamentary or Letters of Administration to take one to three months from the date the application is filed with the court.

Several factors can influence this timeline:

- The Court's Caseload: A busy probate court may have a longer wait for a hearing date.

- Application Accuracy: Errors or missing information on your application can cause delays, as it may be rejected and require refiling.

- Case Complexity: An estate with complex family dynamics, unknown heirs, or a potential will contest will naturally take longer.

Texas law also includes a mandatory waiting period after an application is filed and public notice is posted. An experienced probate attorney can ensure all paperwork is completed accurately to prevent unnecessary delays.

What Happens If I Cannot Find the Original Will?

Misplacing an original will complicates matters, but it does not make probate impossible. If you only have a copy, Texas law provides a specific process to probate a "lost will."

However, the legal standard is higher. You will need to prove three key things to the court:

- The will was executed properly: You must show that the original will was signed and witnessed according to Texas law.

- The contents of the will: You must prove that the copy is a true and accurate version of the original.

- Why the original is missing: You must convince the court that the testator did not revoke the will. For example, you might provide evidence that it was accidentally destroyed in a house fire or lost during a move.

Proving a lost will is more complex than a standard probate and is a situation where the guidance of a skilled Texas estate planning attorney is invaluable.

A missing will adds another legal hurdle, but it's not an insurmountable one. The Texas Estates Code carves out a specific path, but be prepared for a higher burden of proof to satisfy the court.

Does Every Estate in Texas Need to Go Through Probate?

No, not every estate requires formal probate. Texas law offers several simpler and less expensive alternatives for smaller or more straightforward estates.

These alternatives may be appropriate if:

- The estate's value (excluding the homestead and other exempt property) is under $75,000. In this case, a Small Estate Affidavit can often be used to transfer property without a full probate proceeding.

- There is a will and no debts, other than a mortgage on the primary residence. A Muniment of Title proceeding can transfer title to the beneficiaries named in the will without appointing an executor.

- Assets are structured to bypass probate. This includes bank accounts with payable-on-death (POD) designations or property owned with a right of survivorship. Life insurance policies and retirement funds with named beneficiaries also pass directly to those individuals outside of the probate process.

Determining the best path forward requires a careful review of the estate's assets, debts, and family situation. A consultation with a legal professional can help identify the most efficient and cost-effective strategy. They can also assist with related needs, such as establishing a guardianship or planning for asset protection.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process. Visit us at https://texastrustadministration.com to learn more.