Planning for your family's future can feel overwhelming, but understanding two key roles is the perfect place to start. The real difference between a Power of Attorney (POA) and an Executor of a Will boils down to timing.

A Power of Attorney acts for you while you're alive but can't make your own decisions. An Executor, on the other hand, steps in to manage your estate after you’ve passed away. Their duties, governed by the Texas Estates Code, are completely separate and never overlap, but both are absolutely vital for a solid Texas estate plan.

Navigating these responsibilities can be stressful, but with the right legal guidance, it doesn’t have to be. Once you grasp the fundamentals, you can make clear-headed decisions that protect your legacy and give your loved ones much-needed peace of mind.

Clarifying Two Essential Roles in Your Estate Plan

Thinking about what happens if you become incapacitated, or after you're gone, is tough but necessary. In Texas, the law provides specific tools to ensure your wishes are honored, both during your life and after. Two of the most critical roles you'll assign are the agent under a Power of Attorney and the Executor of your Will.

It's common to confuse these two roles, but under Texas law, they operate in entirely different time frames. Getting this distinction right is the first step toward building a plan that works when you need it most.

- Power of Attorney: This person is your designated agent for making decisions during your lifetime if you become unable to do so yourself.

- Executor of Will: This is your chosen representative to manage your estate after your death.

Think of it like a relay race. Your Power of Attorney agent carries the baton of responsibility for your affairs while you're alive. The moment you pass away, their authority ends, and they hand that baton to the Executor, who then begins their leg of the race: settling your estate according to your will.

Power of Attorney vs. Executor: Key Differences at a Glance

This table breaks down the defining features, responsibilities, and legal authority of a Power of Attorney agent and an Executor in Texas.

| Attribute | Power of Attorney (Agent) | Executor (Personal Representative) |

|---|---|---|

| When Authority is Active | During your lifetime, usually when you become incapacitated. | Only after your death and once appointed by a probate court. |

| Source of Authority | The Power of Attorney document you sign. | Your Last Will and Testament. |

| Legal Oversight | Generally operates privately, without direct court supervision. | Supervised by a Texas probate court. |

| Primary Responsibility | Manages your finances and/or healthcare in your best interest. | Gathers assets, pays debts, and distributes property to beneficiaries. |

| When Authority Ends | Automatically and immediately upon your death. | When the estate administration is complete and closed by the court. |

The Power of Attorney: Your Agent During Your Lifetime

While estate planning often focuses on what happens after you die, it's equally important to protect yourself while you are living. That’s where a Power of Attorney (POA) becomes essential. This is a legal document that lets you appoint a trusted person—your “agent”—to act on your behalf if you become unable to make decisions for yourself.

This authority is strictly for your lifetime. The moment you pass away, the Power of Attorney becomes void, and your agent’s power ends. This is one of the most fundamental differences when comparing a power of attorney versus an executor of a will.

The Two Primary Types of POAs in Texas

A comprehensive Texas estate plan should address both your financial and healthcare needs. To do this, we use two key types of Power of Attorney documents.

Durable Power of Attorney for Financial Matters: This document gives your agent the authority to manage your property, finances, and legal affairs. This could include paying bills, handling investments, filing taxes, or even managing real estate. The word "durable" is critical—it means the document remains effective even if you become incapacitated.

Medical Power of Attorney: This document authorizes your agent to make healthcare decisions for you when you cannot. This may involve consenting to medical procedures, choosing doctors, or accessing your medical records, all based on the wishes you've previously expressed.

Without these documents, your family may have to seek a court-ordered guardianship, a process that is often public, stressful, and expensive. A well-drafted POA allows you to avoid this, keeping your affairs private and in the hands of someone you trust.

Real-World Scenario: Protecting a Loved One

Let's consider a practical example. Imagine your mother, a retired teacher in Houston, suffers a severe stroke that leaves her unable to communicate or manage her affairs. Fortunately, she had the foresight to create a complete estate plan, naming you as her agent under both a durable and a medical power of attorney.

Because of these documents, you have the legal authority to step in immediately. You can access her bank accounts to pay her mortgage and medical bills, manage her retirement funds to cover long-term care, and consult with her doctors to make critical treatment decisions. There is no need for court intervention, delays, or public filings.

This scenario highlights the true value of a POA. It provides a seamless transition of authority, allowing you to protect your mother's financial health and honor her medical wishes during a difficult time. Your role is to act as her advocate, guided by the fiduciary principles of the Texas Estates Code and always acting in her best interest.

The Executor of a Will: Your Representative After Death

After a person passes away, the focus shifts from managing their lifetime affairs to settling their estate. This is where the Executor of a will steps in—the person you nominate to act as your legal representative and carry out your final wishes. In Texas, this role is also known as a Personal Representative.

Here’s the crucial distinction: a Power of Attorney's authority ends at the moment of death. An Executor’s responsibilities are just beginning. However, their power is not automatic. They must first be officially appointed by a Texas probate court, a step that validates your will and holds the Executor accountable to the law.

The Executor's Role Under the Texas Estates Code

The Executor's primary duty is to settle your affairs exactly as your will directs. This is a significant fiduciary responsibility that involves navigating a formal legal process. Under court supervision, the Texas Estates Code outlines the specific duties an Executor must perform.

Key step-by-step responsibilities include:

- Filing the Will for Probate: The first step is to submit your will to the appropriate Texas court to begin the probate process. A Texas estate planning attorney can guide you through this.

- Gathering and Inventorying Assets: Your Executor must locate, secure, and create a detailed inventory of all your property—from bank accounts and investments to real estate and personal belongings.

- Notifying Creditors and Paying Debts: They must formally notify creditors and use estate funds to pay all legitimate debts, final bills, and taxes.

- Distributing Property to Beneficiaries: After all debts are settled, the Executor's final major task is to distribute the remaining assets to the beneficiaries named in your will.

It is vital to understand that an Executor is strictly bound by the terms of your will. They cannot alter your instructions or distribute property based on their own judgment or pressure from others. Their sole duty is to execute your plan.

A Practical Example of an Executor in Action

Let's imagine a man from Austin passes away, naming his daughter as Executor in his will. His estate includes a house in Travis County, a vacation home in Galveston, a stock portfolio, and two classic cars.

Before she can take any action, the daughter must hire a probate lawyer and file the will with the court. Only after a judge officially appoints her as Executor can she begin her duties. She inventories both properties, has the stocks valued, and gets the cars appraised. She then publishes a notice to creditors, pays her father's final medical bills and credit card debts, and files his last income tax return.

Only when all these steps are complete—and approved by the court—can she distribute the assets. The Austin home goes to her brother, she inherits the Galveston property, and the cars and stocks are divided among the grandchildren, just as her father wished. This illustrates the structured, methodical process an Executor must follow. For a deeper look, it's worth exploring the detailed duties of an executor of an estate under Texas law.

This careful, court-supervised administration is what truly separates the power of attorney versus executor of will roles, ensuring your legacy is protected and your final wishes are honored.

Comparing Authority Scope and Timing

The clearest way to understand the power of attorney versus executor roles is to look at when each is active and what each person can legally do. These roles represent a seamless handoff, not an overlap. One person's authority must end for the other's to begin, ensuring a clear line of command over your affairs.

Simply put, a Power of Attorney operates during your lifetime. An Executor’s duties begin only after you pass away. This fundamental difference in timing dictates their authority and the legal framework they operate within.

Activation: The When and How of Their Authority

The event that brings each role to life is the most critical distinction. One is based on your capacity to act, while the other is based on your passing.

Power of Attorney Activation: An agent's power under a durable power of attorney typically begins upon your incapacity. When a doctor certifies that you can no longer make or communicate your own decisions, your agent steps into your shoes to manage your affairs in real-time.

Executor Activation: An Executor's authority activates only after your deathand once a Texas probate court has officially appointed them. Being named in the will is not enough—the court must grant them the authority to act. This process can take several weeks or longer.

This distinction is absolute. An Executor has no authority to act for you while you are alive, even if you are incapacitated. Conversely, a POA agent’s authority ends the moment you die. They cannot take any further action on behalf of your estate.

Scope of Power: What They Can and Cannot Do

The flexibility of a POA agent contrasts sharply with the rigid, defined duties of an Executor. An agent's goal is to protect your well-being while you are alive; an Executor's goal is to protect your final wishes after you are gone.

An agent's power is broad, designed to handle life's challenges—like selling property to pay for medical care or making healthcare decisions—all without court oversight. The Executor's role is different. They are bound to follow your will's instructions to the letter, under the supervision of the probate court. U.S. Census data shows that over 70% of adults over 65 may face incapacity, yet only 42% have a POA. This gap can lead to guardianship battles that drain an estate's value. You can discover more insights about estate planning statistics to see how critical this planning is.

Key Takeaway: An agent under a POA cannot change your will, alter beneficiaries, or make any decisions about how your assets are distributed after death. Their authority is for lifetime management only. An Executor cannot make healthcare decisions for you or manage your daily finances before you pass away.

This clear separation of duties is embedded in the Texas Estates Code to prevent conflicts and ensure your instructions for both life and death are honored as you intended.

A Quick Comparison Table

To outline these differences even more clearly, here is a side-by-side look at these two essential roles.

Power of Attorney vs. Executor: Key Differences at a Glance

| Attribute | Power of Attorney (Agent) | Executor (Personal Representative) |

|---|---|---|

| When Authority Starts | During your lifetime, usually upon your incapacity. | After your death and upon court appointment. |

| When Authority Ends | Automatically upon your death. | When the estate administration is legally closed by the court. |

| Governing Document | The Power of Attorney document. | The Last Will and Testament. |

| Primary Goal | To manage your affairs and act in your best interests while you are alive. | To settle your final affairs and distribute assets according to your will. |

| Court Oversight | Typically operates privately without direct court supervision. | Directly supervised by and accountable to a Texas probate court. |

| Flexibility of Action | Highly flexible to respond to your changing needs (e.g., selling assets for care). | Strictly limited to the instructions and powers granted in the will and by law. |

This comparison highlights how these roles are designed to work in sequence, not in parallel. One protects you during life, and the other protects your legacy after.

What Does It Mean to Be a Fiduciary in Texas?

When you name someone as your agent under a Power of Attorney or as the Executor of your will, you are appointing them as a fiduciary. Under Texas law, this is a profound legal commitment to act with the highest degree of loyalty and good faith. Understanding fiduciary principles is critical, as it is the ethical foundation of both roles.

A fiduciary must always put your interests (or the interests of your estate's beneficiaries) ahead of their own. This is a high standard of conduct embedded in the Texas Estates Code, designed to protect your assets and honor your wishes.

The Core Duties of a Fiduciary

While the specific tasks of a POA agent and an Executor differ, their fundamental fiduciary duties are the same. These are legally enforceable standards.

- Duty of Loyalty: This is the cornerstone. A fiduciary must be completely loyal to you or to the estate. This means no self-dealing, such as selling estate property to themselves at a low price or using their position for personal profit.

- Duty of Care: A fiduciary must manage your affairs with the same skill and prudence that a reasonable person would use to manage their own property. This involves making thoughtful, informed decisions.

- Duty to Preserve Assets: Both the agent and the Executor must protect the property under their management. This might include securing a vacant home, maintaining proper insurance, or prudently managing cash.

These duties ensure the person you trust is held accountable for their actions.

The crucial difference lies in who these duties protect. A POA's actions affect your well-being while you're alive. An Executor’s actions impact the legacy you leave for your beneficiaries. Both roles, however, demand the same unwavering ethical commitment.

The High Cost of Breaching Fiduciary Duty

The Texas legal system takes fiduciary duties very seriously. When an agent or Executor fails to meet their obligations, the consequences can be severe.

A breach can occur through misconduct like theft, but also through negligence, such as failing to file taxes on time and incurring penalties. Beneficiaries who suspect wrongdoing can take legal action to hold the fiduciary accountable.

If a breach is proven, a court may order:

- Forced Removal: The court can immediately remove the individual from their role as agent or Executor.

- Personal Financial Liability: The fiduciary could be ordered to personally repay any financial losses the estate suffered due to their mismanagement.

- Forfeiture of Compensation: They may lose the right to be paid for their services.

Choosing a diligent, organized, and trustworthy fiduciary is one of the most important decisions you will make. You can explore detailed comparisons of POA vs. Executor roles to better understand the gravity of these responsibilities. A knowledgeable Texas trust administration lawyer can also provide guidance on selecting the right person.

How to Choose the Right Person for Each Role

Selecting the right people to serve as your agent and Executor is one of the most critical decisions in your estate plan. It’s about more than just trust; it’s about finding individuals with the right skills and temperament to handle complex situations with a clear head.

The ideal candidate should be organized, financially astute, and an excellent communicator, especially when family emotions are high.

Key Qualities to Look for in a Fiduciary

When considering your options, look for someone who demonstrates these qualities.

- Unwavering Trustworthiness: This is non-negotiable. You must have absolute confidence that this person will always put your best interests first.

- Strong Organizational Skills: Both roles involve extensive paperwork, deadlines, and record-keeping. A disorganized person can turn a smooth process into a costly nightmare.

- Sound Judgment: Your agent or Executor will face important financial and legal decisions. They must be able to think critically and act sensibly.

- Effective Communication: A good fiduciary can communicate clearly and patiently with family members, beneficiaries, and professionals like lawyers and accountants to prevent misunderstandings.

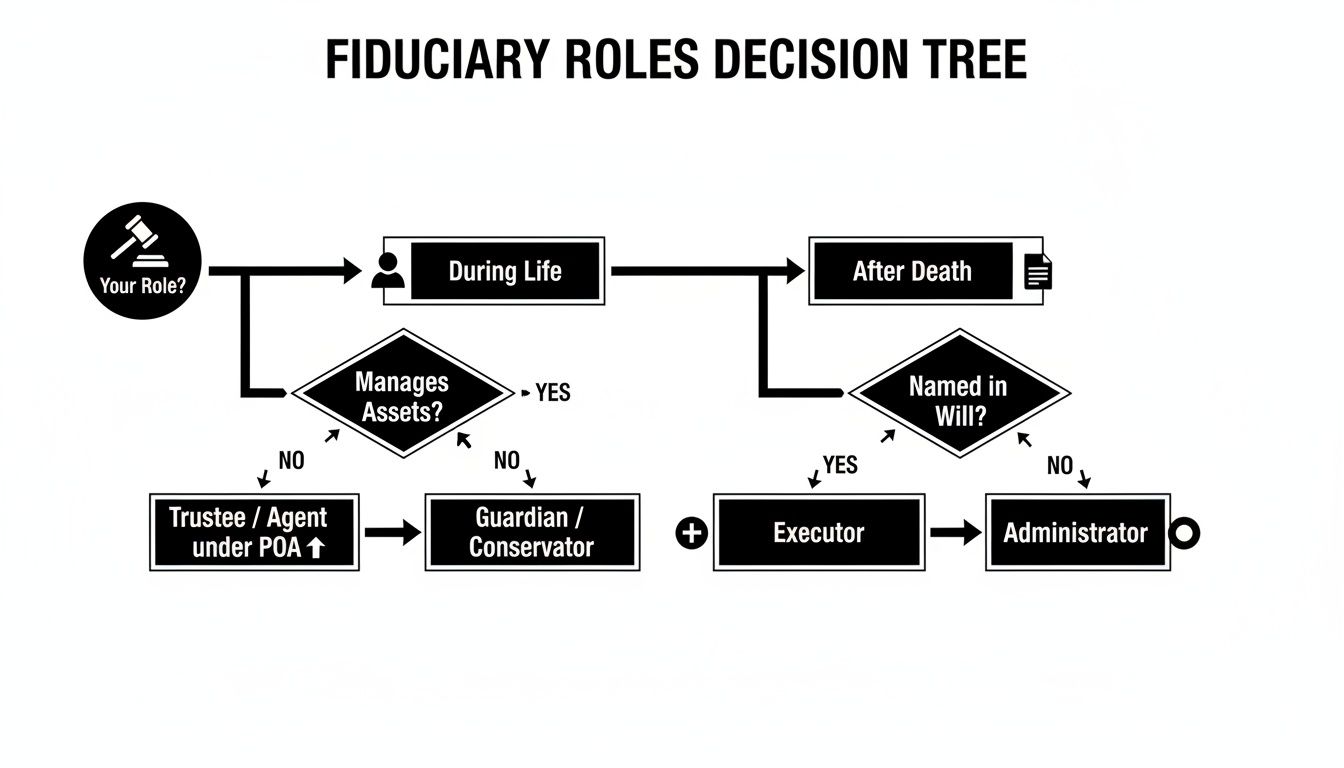

This decision tree helps visualize how these roles operate on different timelines—one managing your affairs during your life and the other stepping in after your death.

The flowchart reinforces the critical handoff: the Power of Attorney’s authority ends at death, which is precisely when the Executor’s duties begin.

Should You Appoint the Same Person for Both Roles?

Many people name the same trusted person—often a spouse or an adult child—for both roles. This can create continuity and make the transition from lifetime management to estate administration feel more seamless.

However, this may not always be the best strategy. If you have a complex estate, a family business, or anticipate potential conflict among beneficiaries, appointing different people can create natural checks and balances and avoid overburdening one person. For a deeper look, you can learn more about how to choose an executor for your will in our dedicated guide.

Ultimately, your goal is to feel confident that your affairs will be handled correctly. Without a Power of Attorney, your family's finances could be frozen if you become incapacitated. Without a will, your assets may be distributed by the state, not according to your wishes. Having both roles filled by capable individuals is essential for a complete plan.

Got Questions About POA and Executor Roles? We've Got Answers.

It's completely normal to have questions when comparing a power of attorney to an executor. These roles are foundational to your peace of mind. Here are straightforward answers to some of the most common questions we hear, grounded in Texas law.

Can the Same Person Be My Power of Attorney and Executor?

Yes, and it is quite common. Many people choose the same trusted person, such as a spouse or adult child, for both roles. This can create a smooth transition, as the person who handled your lifetime affairs will already be familiar with your finances when it's time to settle the estate.

However, consider whether this person has the time, emotional fortitude, and organizational skills to handle two demanding jobs. For complex estates or in families where conflict is possible, it may be wiser to name different people or even a professional fiduciary like a bank or trust company.

What Happens if I Only Have a Will but No Power of Attorney?

This is a critical gap in many estate plans. A will has no legal authority until after you pass away and a court validates it through probate. If you become incapacitated with only a will, no one has the immediate legal right to manage your finances or make healthcare decisions for you.

Your family would be forced to go to court to establish a guardianship. This is often a lengthy, expensive, and public process. A durable Power of Attorney is designed to avoid this, keeping your personal affairs private and in the hands of someone you chose.

Here's a common mix-up: People often assume a will can be used during lifetime incapacity. In reality, a will is only effective after death. A Power of Attorney is for lifetime management, protecting you when you are most vulnerable.

Can My Power of Attorney Agent Change My Will?

Absolutely not. An agent acting under a Power of Attorney has a strict fiduciary duty to act in your best interests. They cannot change, cancel, or create a will on your behalf. The power to make or alter a will is a personal right that cannot be delegated.

Your agent's job is to manage your assets while you are alive. They have no authority over how those assets are distributed after you're gone. That is the exclusive role of the Executor, who must follow the instructions in your will.

When Should I Review My Estate Planning Documents?

Your life changes, and your estate plan should too. It is wise to review your Power of Attorney, will, and other documents every three to five years, or immediately after any major life event.

Events that should trigger a review include:

- Marriage or divorce

- The birth or adoption of a child or grandchild

- The death of a person named as an agent, executor, or beneficiary

- A significant change in your financial situation

- Changes in Texas law that could impact your plan

Keeping your documents current ensures they reflect your present wishes and that the people you've chosen are still the right ones for the job.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.