Managing a loved one’s trust can feel overwhelming, especially after a loss. When a trustee passes away, it's natural to wonder what comes next. The good news is that the trust document itself holds the keys, and with the right legal guidance, the path forward is clear.

Usually, a successor trustee is already named in the trust, ready to step up and manage the trust's assets and responsibilities. Your first and most important job is to locate that legal document and begin the transition process.

Your First Steps After a Trustee Passes Away

Losing a loved one is difficult enough without the added stress of legal and financial duties. The death of a trustee can seem like a major complication, but Texas law and a well-drafted trust provide a clear path forward.

It's critical to understand that the trust itself is still valid. Think of it like a company whose CEO has retired; the business continues, but it needs new leadership. Your immediate priority is to find the official trust agreement. This document is the instruction manual left by the person who created the trust (the grantor), and it outlines the specific rules for this exact situation. Following its directions is essential for a smooth, legal, and conflict-free transition of power.

Locating The Trust And Identifying The Successor

You'll typically find the trust document filed with other important estate planning papers—such as wills, deeds, and financial statements. Once you've located it, carefully read the section on trustee succession. This part will name the person or institution designated to take over.

The continuity of a trust hinges on this built-in succession plan. In a real-world scenario, imagine a Texas family whose father, the trustee of their family trust, passes away. His trust document clearly names his eldest daughter as the successor. Because of this clear instruction, the transition is seamless. The daughter can step in and assume her duties almost immediately, ensuring the trust assets are managed without interruption.

But what if no one is named? This is where things can get complicated. Without a designated successor, the beneficiaries may need to petition a Texas court to appoint one, a process that can delay distributions and add unnecessary stress.

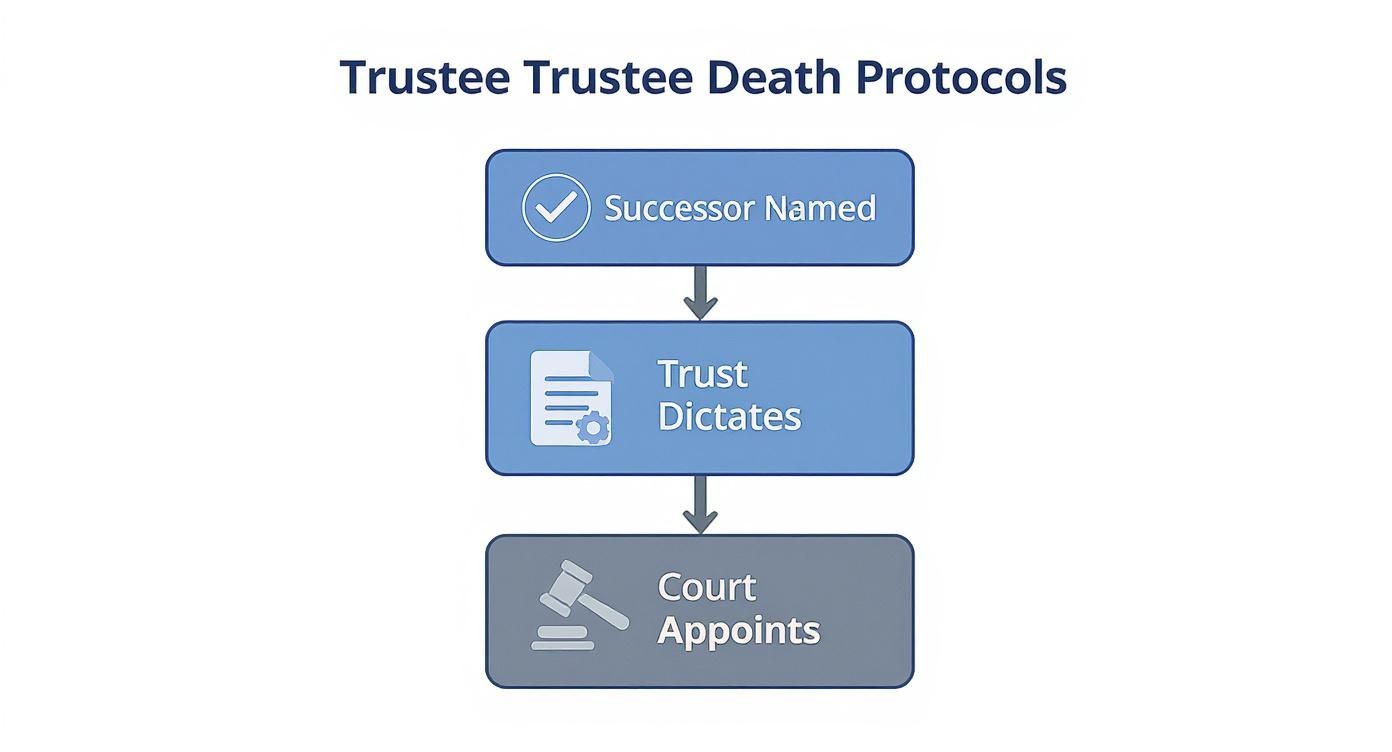

This flowchart breaks down the three main paths for appointing a new trustee after one has died.

As you can see, the ideal route is having a successor trustee already named in the trust. However, even if the trust is silent on the matter, there are still legal avenues to explore with the help of an experienced attorney.

An Immediate Action Plan

To help you get oriented during this stressful time, we've created a step-by-step guide. Following these initial actions can bring much-needed clarity.

| Priority Action | Why It's Important | Who Is Responsible |

|---|---|---|

| Secure the Trust Document | This is your legal playbook. It contains all instructions and identifies the successor trustee. | Family members, the person named as successor trustee, or the deceased's attorney. |

| Obtain Official Death Certificates | Financial institutions and government agencies require certified copies to process changes. | The successor trustee or a close family member. |

| Notify Interested Parties | Informing beneficiaries and any co-trustees is a crucial first step and a legal duty under the Texas Trust Code. | The successor trustee or the person handling the deceased's affairs. |

| Consult a Texas Trust Attorney | Expert legal advice prevents missteps, ensures compliance with Texas law, and protects you from liability. | The successor trustee. |

Taking these initial steps methodically will help ensure you're on the right track from day one.

Here is a more detailed look at this practical advice:

- Secure the Trust Document: Find the original, signed trust agreement. This is your primary source of authority and your guide.

- Obtain a Death Certificate: You will need several official copies of the death certificate to prove the trustee has passed away when dealing with banks and other financial institutions.

- Notify Interested Parties: Let the beneficiaries and any co-trustees know about the trustee's death. Open communication from the start helps prevent future conflicts and is a key part of your duties, which include respecting beneficiary rights in Texas trust administration.

- Consult a Texas Trust Attorney: Bringing in a legal expert early is one of the smartest moves you can make. A Texas trust administration lawyer will ensure you follow every procedure correctly, protecting both you and the trust from potential liability.

How to Identify and Empower the Successor Trustee

Once you have the trust document, the next step is to officially pass the torch to the successor trustee. This isn't a ceremonial handshake; it's a critical legal process dictated by the Texas Trust Code. Getting this right gives the new trustee the unquestioned authority needed to manage everything from bank accounts to real estate and carry out the grantor's wishes.

The trust document is your map. You’ll need to comb through it to find the exact clause naming the successor trustee, often labeled "Trustee Succession."

Most well-drafted trusts name a primary successor and at least one alternate in case the first person cannot or will not serve. This foresight is a hallmark of solid estate planning because it helps keep the trust out of court.

The Formal Acceptance of Trusteeship

Being named in a document isn't enough to make it official. The successor trustee must formally accept the role. This is a legally significant step that confirms they are ready and willing to take on all the fiduciary duties in Texas that come with the title.

The Texas Trust Code states that a trustee accepts the role by following the method laid out in the trust document. If the document is silent, acceptance occurs when the person knowingly begins acting as trustee—exercising their powers or performing their duties.

However, the best practice is to sign a formal "Acceptance of Trusteeship" document. This signed and notarized statement serves as clear proof that the power has officially been transferred, preventing any confusion down the line.

A formal, written Acceptance of Trusteeship is the clearest way for a successor to assume their role. It eliminates any question of authority when dealing with banks, financial institutions, and county clerks, making the entire trust administration process smoother.

Notifying Beneficiaries of the Change

Once the new trustee has formally accepted the position, one of their first tasks is to notify all trust beneficiaries of the change in leadership. This is more than good manners—it’s a legal requirement under the Texas Trust Code and a cornerstone of transparent trust administration.

This first communication is about building trust and starting the relationship on the right foot. The notice should be simple and clear: state that the previous trustee has passed away and introduce the new trustee who is now in charge.

Taking Control of Trust Assets

With the legal paperwork in order, the new trustee must take physical control of the trust's assets. This is where their legal authority is put into action. The process usually involves a few key steps:

- Financial Accounts: Present the trust document, death certificate, and Acceptance of Trusteeship to banks and investment firms to gain signature authority over all accounts.

- Real Estate: File an affidavit or a new deed with the county clerk's office. This updates the public record to show the change in trusteeship and ensures the property's title is clear.

- Other Property: Take possession of any tangible personal property held by the trust, like vehicles, jewelry, or valuable collections.

Let's walk through a real-world scenario. Imagine Sarah is the successor trustee for her late father's trust in Texas, which holds his house, an investment portfolio, and a checking account.

- First, Sarah signs a notarized Acceptance of Trusteeship.

- Next, she drafts and sends a formal notice to her siblings (the other beneficiaries), informing them that she is now the trustee.

- Finally, she gathers the trust documents and her father's death certificate, heads to the bank to take control of the account, and works with a Texas estate planning attorney to file the correct paperwork to update the deed to the family home.

By following this step-by-step guidance, Sarah properly and legally transfers authority to herself. This ensures she can manage the trust exactly as her father intended, all while being protected by Texas law.

The Successor Trustee’s Immediate Responsibilities

Stepping into the role of a successor trustee is a significant legal commitment. Your number one job is to act in the best interest of the beneficiaries. This is your fiduciary duty, a principle central to the Texas Estates Code that requires the highest standard of care. Your mission is to be loyal, prudent, and impartial while carrying out the grantor's wishes exactly as they are written in the trust.

Creating an Inventory and Securing Assets

Your first major assignment is to identify and take control of everything the trust owns. This means tracking down every asset—bank accounts, real estate, stocks, bonds, and personal property—and securing it under your authority as the new trustee. You are now the legal guardian of this property.

This process involves creating a detailed inventory, documenting each asset and its estimated value on the date the previous trustee passed away. This document serves as the foundation for your administration, giving everyone a clear snapshot of what you are managing.

Under the Texas Trust Code, a trustee has a legal duty to take reasonable steps to control and protect trust property. This isn't just a suggestion—it's a legal requirement that protects both you and the beneficiaries from future disputes.

Notifying Key Parties and Updating Accounts

Once you have a handle on the assets, it’s time to start notifying financial institutions. You must formally inform all banks, brokerage firms, and other entities about the change in trusteeship. Be prepared to provide them with a certified copy of the death certificate and your legal paperwork, like a signed Acceptance of Trusteeship, to gain access to the accounts.

At the same time, you need to reach out to all the beneficiaries. Let them know you have officially taken the reins and provide your contact information. This first communication is critical for building transparency and a positive relationship.

Obtaining a New Tax ID Number

A crucial step that is often missed is determining if the trust needs a new Taxpayer Identification Number (TIN), also known as an Employer Identification Number (EIN), from the IRS. When the creator (grantor) of a revocable trust dies, that trust automatically becomes irrevocable. At that moment, it transforms into its own separate legal entity for tax purposes and needs its own tax ID.

You will use this new EIN to open a bank account in the trust's name and to file the trust’s annual income tax returns (Form 1041). A Texas trust administration lawyer can quickly determine if a new EIN is needed and handle the application for you, ensuring you are squared away with the IRS from the start.

The Importance of Meticulous Record-Keeping

From day one, keep meticulous records of every action you take, every dollar that comes in or goes out, and every decision you make. This includes:

- Financial Transactions: Keep a detailed ledger of all income the trust receives and every expense it pays.

- Communications: Save copies of every email, letter, and text you exchange with beneficiaries, creditors, or financial advisors.

- Decisions: Document your reasoning for any significant decisions, especially when making discretionary payments or selling assets.

This paper trail is your best defense against potential disagreements from beneficiaries later on. It proves you are fulfilling your fiduciary duties in Texas responsibly and with complete transparency. To learn more, you can check out our guide on effective trust administration strategies in Texas. If you act with confidence and follow these steps, you will honor the trust creator's legacy and fulfill your legal obligations.

Managing Final Accounting and Tax Obligations

When you step into the role of a successor trustee, you take over the trust's financial helm. A major part of this transition is formally closing the books on the previous trustee's tenure. This involves handling a final accounting and tackling specific tax obligations to ensure a clean, legal, and compliant handover.

This isn’t just good bookkeeping; it’s a core piece of your fiduciary duties in Texas. Preparing a final accounting protects everyone involved—you, the beneficiaries, and the trust itself—by creating a clear record of all financial activity up to the moment you took charge.

The Duty to Prepare a Final Accounting

The final accounting is a detailed report of every transaction that occurred while the deceased trustee was in charge, covering their final period of service. This document proves the trust was managed correctly and gives you a clean slate for your own administration.

Under the Texas Trust Code, trustees are legally required to account for their management of the trust. As the successor, this responsibility falls to you to ensure this final account is completed and shared with the beneficiaries. Typically, this report will include:

- A complete list of assets the trust held at the start of the accounting period.

- All income received, such as dividends, interest, or rent payments.

- All expenses paid, from administrative costs and property taxes to professional fees.

- Any distributions made to beneficiaries during that time.

- A final list of assets remaining in the trust on the day the prior trustee passed away.

This level of detail creates transparency and helps prevent future disputes by giving beneficiaries a full picture of the trust's financial health.

A thorough and accurate final accounting is your best defense against future claims of mismanagement. It establishes a clear line between the prior trustee's actions and your own, protecting you from liability for decisions made before your time.

Navigating Final Tax Responsibilities

After the accounting, you must handle taxes for both the trust and, in some cases, the deceased trustee. This can feel daunting, but it becomes much more manageable when you know what's required. Bringing a Texas trust administration lawyer or a CPA on board at this stage can be a lifesaver.

Your main tax duties will usually include two key forms:

-

Form 1040 – The Deceased's Final Personal Income Tax Return: If no one else (like a probate executor) is managing the deceased’s personal estate, you may need to ensure their final personal tax return is filed. This covers their income from January 1st up to their date of death.

-

Form 1041 – The Trust's Income Tax Return: As the new trustee, this is your direct responsibility. You must file the U.S. Income Tax Return for Estates and Trusts, which reports the trust's income, deductions, and any money distributed to beneficiaries for the year.

Understanding Trust Income vs. Principal

A common point of confusion for new trustees is the distinction between a trust's income and its principal. Here’s a plain English explanation:

- Principal (or Corpus): These are the original assets put into the trust—the core property, like a family home, a brokerage account, or land.

- Income: This is the money those core assets generate, such as rent collected from the home or dividends paid by stocks.

The trust document is your guide; it will spell out exactly how income and principal should be handled and distributed. Getting this right is critical for filing accurate tax returns and, most importantly, for carrying out the grantor's wishes. Properly managing these finances is a key component of effective tax strategies for Texas trusts.

By diligently handling these accounting and tax duties, you build a solid foundation of trust and legal compliance that will serve you well throughout your time as trustee.

Handling Trust Assets and Beneficiary Distributions

Once the initial administrative tasks are complete, it's time to manage the trust's assets and care for the beneficiaries. This is where you truly step into the role and begin to make the grantor's wishes a reality. You will be doing everything from retitling property to making distributions, and with this clear, step-by-step guidance, you can handle these duties with confidence.

Taking Legal Control of Trust Property

First, you need to officially put your name on everything the trust owns. This is a critical step that legally replaces the former trustee's name with yours. Without this, you have no authority to manage, sell, or distribute the assets.

The process depends on the type of asset:

- Real Estate: You will need to file an "Affidavit of Successor Trustee" or a new deed with the county clerk's office where the property is located. This document officially updates the property records to show you are now in charge.

- Financial Accounts: For bank and brokerage accounts, visit the financial institution with the trust document, the death certificate, and your Acceptance of Trusteeship. They will update their records and give you signature authority.

- Business Interests: If the trust holds an interest in a family business or LLC, the company's operating agreement will outline the steps to formally document the change in trustee.

Managing Assets According to the Trust’s Rules

Now you must manage the assets wisely. The Texas Trust Code includes the "prudent investor rule," which requires you to act with reasonable care, skill, and caution. This often means consulting experts, like a financial advisor, to help make sound investment choices. A key part of this responsibility also involves understanding the tax implications of trusts and ensuring every transaction is accounted for and reported correctly.

Real-World Scenario: Let's say a Texas trust owns a small ranch and several rental properties. As the new trustee, your job is to keep the ranch operational and the rent checks coming in. That means you're reviewing the books, collecting rent, and handling maintenance—all while keeping meticulous records of every single transaction.

Making Distributions to Beneficiaries

This is the main event—getting the assets to the people they were intended for. The trust document is your sole playbook. It will tell you exactly who gets what, when they get it, and how it should be delivered.

Some trusts are simple, directing you to distribute everything immediately. Others are more complex, instructing you to hold assets for years and make payments for specific needs like college tuition or medical bills.

Your duty of impartiality is crucial here. You must treat every beneficiary fairly, as the trust directs. You cannot play favorites unless the trust specifically instructs you to. This is where having a Texas trust administration lawyer is invaluable. An attorney can help you interpret complex distribution clauses, guide you on making discretionary payments, and ensure every move aligns with the grantor's intent and Texas law. An expert in asset protection can also provide strategies for distributing assets in a way that safeguards them for the beneficiaries.

When You Should Consult a Texas Trust Attorney

Stepping into a trustee’s shoes is a significant responsibility. While some trust administrations are straightforward, many situations have complexities that require professional legal guidance. Knowing when to call in an experienced attorney is essential—not just for the trust, but to protect yourself from personal liability.

Think of an attorney as a proactive partner whose job is to ensure every step you take aligns with the Texas Trust Code and honors the grantor's wishes.

Key Scenarios Requiring Legal Guidance

If you’re facing any of the scenarios below, your next move should be to consult with a Texas estate planning attorney.

Here’s when you absolutely need legal counsel:

- No Successor Trustee Is Named: If the trust document doesn’t name a backup, or if everyone named is unable or unwilling to serve, you will likely need the court to appoint a new trustee. An attorney can guide you through that judicial process.

- Ambiguous Trust Language: If the instructions for managing assets or making distributions are vague, you are facing a high risk of disputes. A lawyer can provide a solid legal interpretation, ensuring your actions are defensible and correct.

- Conflict Among Beneficiaries: Disagreements between beneficiaries can quickly escalate into costly litigation. An attorney can serve as a neutral third party, enforce the trust's terms, and protect you from getting caught in the crossfire.

- Complex or Unusual Assets: If the trust holds a family business, commercial real estate, mineral rights, or other unique investments, you need professional guidance for proper valuation, management, and distribution.

Hiring an attorney is an investment in peace of mind. Their guidance helps prevent costly errors, minimizes the risk of personal liability, and ensures the trust administration process is handled efficiently and in accordance with Texas law.

Being a trustee is a massive responsibility. You are not expected to be an expert in law, finance, and family dynamics all at once. If you feel uncertain or overwhelmed, it’s a sign that it’s time to get trusted, Texas-based legal guidance to help you confidently fulfill your duties and protect the legacy the grantor worked so hard to build.

Frequently Asked Questions About a Trustee's Death

When a trustee passes away, it's natural for questions to arise. It's a confusing time, and you're suddenly faced with a legal process you likely weren't expecting. Let’s walk through some of the most common questions we hear from Texas families.

What if the Successor Trustee Cannot Serve?

This is a common "what if" that a well-drafted trust usually addresses. If the first person named as the successor trustee has also passed away, is incapacitated, or declines the role, you should go right back to the trust document.

Most trusts name a second or even third alternate trustee for this exact scenario.

If there is no backup named, Texas law allows the beneficiaries to ask a court to appoint a new trustee. This is not something you should attempt alone; a Texas trust administration lawyer is your best guide for navigating the court process smoothly and efficiently.

How Long Does a Successor Trustee Have to Distribute Assets?

There is no single answer to this question. The timeline is found entirely within the pages of the trust agreement. Some trusts are designed for a quick and immediate distribution of assets after the grantor passes. Others are designed to hold and manage assets for years, or even for generations.

The successor trustee has a fiduciary duty to follow those instructions precisely. This means they must act promptly to settle the trust's final affairs—paying debts, filing tax returns, and then distributing the assets as the trust directs. Unreasonable delays can give beneficiaries grounds to take legal action, so it is important to act diligently.

Can Beneficiaries Challenge a New Successor Trustee?

Yes. Beneficiaries have the right to ensure the successor trustee is doing their job correctly and ethically. A trustee has powerful fiduciary duties in Texas, which legally require them to always act in the beneficiaries' best interests, manage trust assets prudently, and never use their position for personal gain.

If a beneficiary believes the trustee is mismanaging funds, ignoring the trust's rules, or engaging in self-dealing, they can petition the court. They might ask for a formal accounting to review all transactions or even request that the court remove the trustee from their role. The first call in such a situation should always be to a lawyer experienced in trust disputes and probate law.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.