When a loved one passes away without a will, managing their estate can feel overwhelming—but with the right legal guidance, it doesn’t have to be. You're grieving, and on top of that, you're suddenly faced with legal questions about their property and how to handle everything they left behind.

This situation, known legally as dying "intestate," is incredibly common in Texas. The good news is you don't always have to navigate a complicated and costly court process. For many families, an Affidavit of Heirship provides a simpler, more direct path to transferring property and settling your loved one's affairs.

What Happens to Property When Someone Dies Without a Will?

For many Texas families, the Affidavit of Heirship offers a practical solution. It is a sworn legal document that identifies the deceased person’s rightful heirs, allowing for the clear and efficient transfer of property, particularly real estate, without going through the formal probate process. Think of it as a formal family history, recorded and sworn to, that tells the world who the legal heirs are.

Why This Tool Is So Common in Texas

Let's face it: most people don't have a comprehensive estate plan. Roughly 60% of Americans pass away without a will, which means over 1.5 million estates each year are settled based on state laws. An Affidavit of Heirship is tailor-made for these exact scenarios, helping families sidestep a probate process that can easily cost $7,000-$10,000 or more.

This legal instrument shines in a few specific situations:

- The primary asset in the estate is real estate, like the family home.

- There are no significant debts, aside from a mortgage on the property.

- All the heirs agree on how the property should be handled.

By filing an affidavit in the county property records, you create a clean, official chain of title that establishes the heirs as the new owners. It empowers you to manage your loved one's final affairs confidently, even when there's no will to guide you. For a broader look at the process, our guide on how to settle an estate in Texas can provide helpful context.

Understanding the Affidavit of Heirship Under Texas Law

So, what exactly is an Affidavit of Heirship? In simple terms, it’s an official family story, written down and sworn to under oath. Its main purpose is to clearly identify the rightful heirs of someone who passed away without a will, as defined by the Texas Estates Code.

This is not a document that comes from a courtroom. Instead, it’s a detailed statement of facts covering the deceased person's family tree, marital history, and children. The goal is to create a clear, public record of who is legally entitled to inherit property—especially real estate.

How This Document Works in Texas

Under the Texas Estates Code, an Affidavit of Heirship serves as powerful evidence of ownership after it has been filed in the county's public property records for at least five years. It is important to understand that it is not a court order that automatically transfers a property title.

Once filed, the affidavit establishes what attorneys call a prima facie case. This legal term means the facts in the document are presumed to be true unless someone provides evidence to the contrary.

After being on file for five years, that affidavit becomes solid proof of the facts it contains. This is what creates a clean and insurable chain of title, which is what title companies need to issue a policy for a sale or transfer of the property.

At its core, an Affidavit of Heirship is a practical tool for Texas families seeking a straightforward alternative to probate. If you want to dive deeper, you can discover insights on affidavit requirements here.

Key Components of a Valid Affidavit

For this document to be legally sound in Texas, it must be prepared correctly. Getting the details right is critical for it to be accepted by county clerks and title companies.

Every valid Affidavit of Heirship must include:

- A complete summary of the deceased person’s family history, including all marriages, children (both natural and adopted), and other key relatives.

- The full names and current addresses of all known legal heirs.

- The sworn signatures of two disinterested witnesses. These are individuals who knew the deceased and their family but have no financial stake in the estate—they will not inherit anything.

These witnesses are the linchpin. Their testimony, given under oath, corroborates the family history and gives the document its legal authority and credibility. This requirement helps ensure the process is transparent and based on verified facts, providing peace of mind to everyone involved.

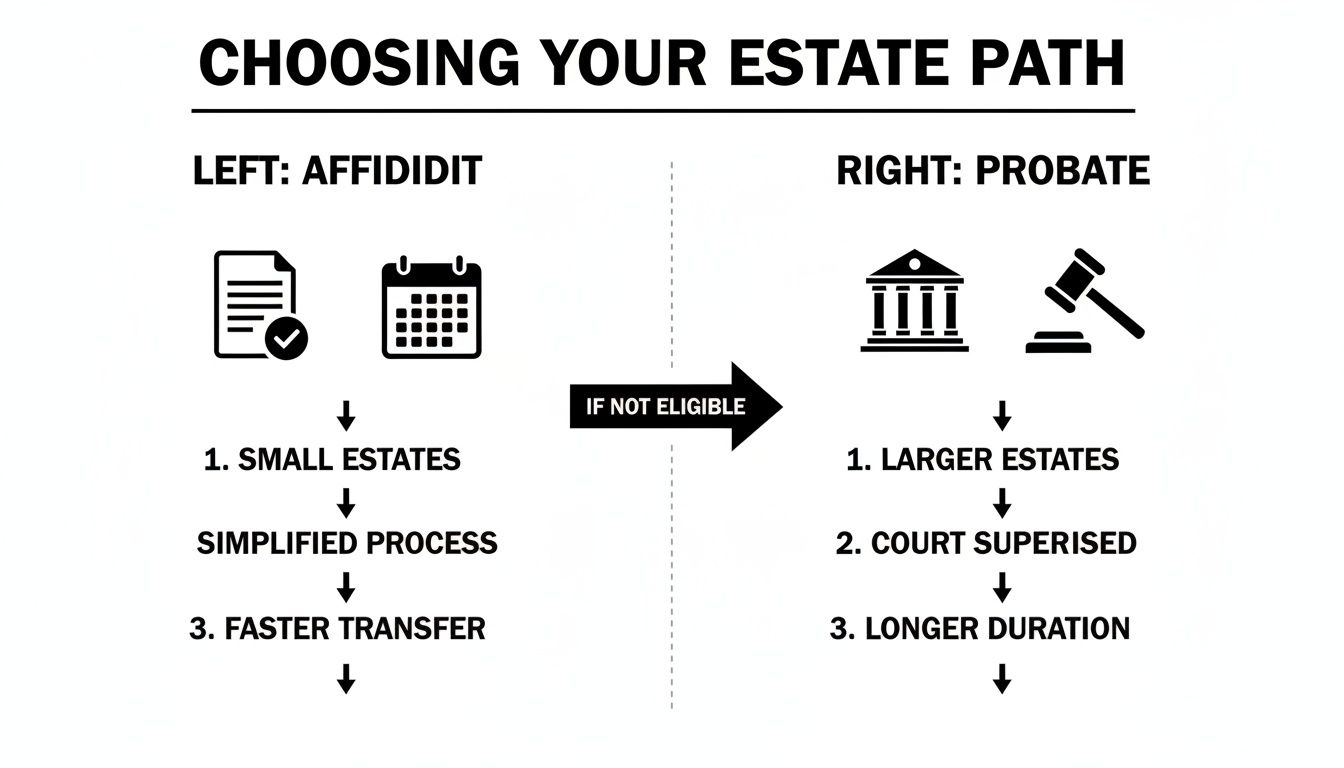

Choosing Between an Affidavit of Heirship and Full Probate

Deciding on the right legal path for a loved one's estate can be a heavy burden. How do you know if an Affidavit of Heirship is the right choice, or if you need to prepare for the formal probate process? The best option almost always depends on the specific details of the estate and your family’s situation.

Think of an Affidavit of Heirship as the express lane. It’s often the best route when the estate is straightforward. This is especially true when the main asset is the family home, there are few debts, and every heir agrees on what should happen next. It's designed to be a simpler, faster, and more cost-effective solution for these clear-cut cases.

When an Affidavit Makes Sense

This tool is most effective under specific conditions. You should consider an Affidavit of Heirship if your situation includes the following:

- A Simple Estate: The largest asset is real estate, with few other valuable assets to divide. For a deeper look at what qualifies, you can learn about the differences between probate and non-probate assets.

- No Will: The decedent passed away without a valid will (dying "intestate").

- Heir Agreement: All legal heirs have been identified and are in 100% agreement on how to handle the property. Any disagreement can derail the process.

- Minimal Debts: The estate has few or no creditors, and any existing debts are easily managed.

A Clear Comparison of Your Options

To see the difference, it helps to compare the two options side-by-side. Probate is a formal, court-supervised process for validating a will and settling an estate. An affidavit, on the other hand, is a sworn statement filed in public records to establish heirship. The differences in time, cost, and complexity are significant.

Here’s a table to help you compare the key distinctions.

Affidavit of Heirship vs Formal Probate in Texas

| Factor | Affidavit of Heirship | Formal Probate |

|---|---|---|

| Court Involvement | Minimal to none. It’s filed directly in county property records without court supervision. | Extensive. The entire process is overseen by a probate court and a judge. |

| Time to Complete | Relatively quick. It can often be completed in a few weeks once you have all the necessary information. | Takes longer. You're typically looking at six months to a year, and it can drag on if there are disputes. |

| Cost | Much less expensive. Costs mainly consist of attorney fees for drafting and county filing fees. | Significantly more costly due to court fees, higher attorney fees, and other administrative expenses. |

| Complexity | Simple. The process is focused on documenting family history and identifying the rightful heirs. | A complex legal process with strict deadlines, formal notices, and required court hearings. |

| Creditor Claims | Does not formally cut off creditor claims. Creditors could potentially pursue the estate’s assets later. | Includes a formal system for notifying creditors and sets a firm deadline for them to file claims. |

Ultimately, choosing the right path depends on your specific circumstances. For many Texas families with uncomplicated estates, the affidavit offers a less stressful and more direct way to transfer property.

Your Step-by-Step Guide to Filing in Texas

Navigating the legal steps after a loved one passes can feel daunting, but filing an Affidavit of Heirship in Texas is a straightforward process. With proper preparation, you can confidently update the property’s title for your family.

First, you'll need to gather a complete family history of the person who passed away—including all marriages, divorces, children (both biological and adopted), and any other potential heirs under Texas law. You will also need the property's official legal description.

Finding the Right Witnesses

This next step is absolutely critical: you must find two disinterested witnesses. The law is very specific about this requirement.

A disinterested witness must meet two criteria:

- They cannot be someone who stands to inherit anything from the estate.

- They must have personally known the deceased for a significant period and be familiar with their family history.

These witnesses will have to swear under oath that all the family details in the affidavit are true to the best of their knowledge. Their testimony gives the document its legal weight.

Drafting and Executing the Affidavit

Once you have your information and witnesses, it's time to draft the affidavit. This document will list all known heirs, their relationship to the deceased, and their share of the property according to Texas intestacy laws.

After it's drafted, the affidavit must be signed by at least one heir and both disinterested witnesses in front of a notary public. The notary's seal makes the document legally valid.

The infographic below clarifies the difference between using an affidavit and undergoing the formal probate process.

As you can see, the affidavit is a much simpler route for straightforward estates, allowing you to bypass the court supervision required in probate.

The Final Step: Filing the Document

The last step is to file the completed, signed, and notarized Affidavit of Heirship in the real property records of the county where the property is located. This action places the affidavit on the public record, which is what title companies look for to confirm the new owners of the property.

While this process is less complicated than a court case, it is still a formal legal procedure. For more complex situations, it may be helpful to understand the probate process in our detailed guide.

Recognizing the Risks and Limitations

While the Affidavit of Heirship is a useful tool for many Texas families, it is not a universal solution. It’s important to understand its limitations to avoid potential complications. Knowing the risks helps you make an informed decision for your loved one’s estate.

One of the most common challenges is that not all third parties are required to accept it. While Texas title companies generally recognize a properly filed affidavit, some banks, financial institutions, or out-of-state entities may refuse it. They can insist on court-issued documents, such as Letters Testamentary from a formal probate, which can halt your progress.

When the Affidavit Might Not Be Enough

Beyond third-party refusal, certain estate complexities can make an affidavit a risky choice. It's often unsuitable if the estate has significant debts beyond a simple mortgage. The affidavit process lacks a formal system to notify creditors, meaning a creditor could make a claim against the property years later, creating legal issues for the heirs.

Here are other situations where an affidavit may fall short:

- Disputes Among Heirs: If there is any disagreement among family members about who should inherit, the affidavit is not the right tool. Its validity depends on complete agreement.

- Unknown Heirs: The discovery of a previously unknown heir can invalidate a filed affidavit, creating a title dispute that can be costly and time-consuming to resolve.

- Complex Assets: If the estate includes more than just real estate—such as stocks, business interests, or large bank accounts—an affidavit will not be sufficient. It is designed for the simple transfer of real property, not a complex asset portfolio.

The Critical Importance of Accuracy

The greatest risk lies in the details. An Affidavit of Heirship is a sworn statement of fact, and any error—a misspelled name, a forgotten marriage, an incorrect date—can create a serious defect in the property's title.

This isn't just about paperwork. Inaccuracy can invalidate legitimate claims and could result in a valuable family home becoming unclaimed property held by the state. You can learn more about how heirship requirements protect assets and why precision matters.

These potential pitfalls are why professional guidance from a Texas estate planning attorney is so important. An experienced lawyer can review your family’s situation, confirm if an affidavit is the appropriate path, and ensure the document is drafted and filed correctly. This protects your family’s interests and provides peace of mind.

Exploring Other Texas Probate Alternatives

While an Affidavit of Heirship is an excellent tool for real estate, it’s not a one-size-fits-all solution. If your family’s situation doesn’t quite fit—perhaps the estate has other assets or its value is below a certain threshold—you have other options.

The Texas Estates Code offers different paths designed for various circumstances. Knowing your choices allows you to select the most secure and cost-effective way to settle your loved one’s affairs.

The Small Estate Affidavit

For smaller estates, the Small Estate Affidavit (SEA) is often the perfect answer. This is a streamlined court procedure for situations where the person died without a will and their estate’s value (not including their homestead and other exempt property) is $75,000 or less.

The main limitation is that the SEA cannot be used to transfer real property other than the homestead. It is designed to help heirs quickly collect other assets, such as bank account funds or vehicle titles, without going through full probate. After filing a sworn affidavit with the court and getting a judge's approval, you have the legal authority to gather and distribute the assets.

The Determination of Heirship Proceeding

What if the situation is more complicated? Perhaps there are questions about the rightful heirs, or a bank is refusing to release funds without a formal court order. In these cases, you will likely need a Determination of Heirship.

This is a formal court process where a judge issues a binding legal judgment. That judgment officially identifies the deceased's heirs and their exact share of the estate under Texas law.

A Determination of Heirship provides the same legal certainty as a full probate but is typically more focused. It's the ideal solution when you need to definitively settle questions about the family tree, clear up confusion about unknown heirs, or satisfy a third party that requires a court order.

Every family's situation is unique. An experienced Texas estate planning attorney can listen to your story, review the specifics, and help you determine which path—an Affidavit of Heirship, a Small Estate Affidavit, or a formal heirship proceeding—makes the most sense for you.

Common Questions About the Texas Affidavit of Heirship

As you learn more about the Affidavit of Heirship, a few questions often arise. Getting these answers can provide the clarity you need to move forward with confidence. Let's address some of the most common concerns we hear from Texas families.

Can You Use an Affidavit of Heirship for Bank Accounts?

Generally, the answer is no. An Affidavit of Heirship is designed almost exclusively for transferring the title to real property, like a house or land.

Financial institutions, such as banks and credit unions, have their own strict procedures and almost always require official court documents, like Letters of Administration from a probate case, before releasing funds from a deceased person's account. For smaller estates consisting only of personal property, a Small Estate Affidavit may be the appropriate tool, but an Affidavit of Heirship will not work for this purpose.

What Happens If an Heir Was Left Off the Affidavit?

Discovering that a rightful heir was omitted from a filed affidavit is a serious legal issue. An incomplete or incorrect affidavit creates a cloud on the property's title, making it difficult, if not impossible, to sell or refinance.

If you find that an heir was left out, the only solution is to file a corrected affidavit. This new document must include the omitted heir and be signed and sworn to by the same type of disinterested witnesses as the original. Correcting this error quickly is critical to preventing major disputes later.

How Long Does It Take for the Affidavit to Become Effective?

While the affidavit is legally valid as soon as it's filed with the county property records, it doesn't gain its full power immediately. In Texas, title companies typically observe a "seasoning" period—usually between three to five years—before they will issue a title insurance policy based on the affidavit alone.

This waiting period acts as a buffer, allowing time for any unknown heirs or creditors with a potential claim to come forward.

Do All Heirs Have to Sign the Affidavit?

No, it is not legally required for every heir to sign the Affidavit of Heirship. What is required is that the document must be signed by at least one person with firsthand knowledge of the deceased's family history. Additionally, two disinterested witnesses—people who knew the deceased but will not inherit from the estate—must also sign.

Of course, having more heirs sign can add to the document's credibility. However, its legal authority comes from the sworn statements of a knowledgeable individual and two neutral witnesses. Getting this right is a major step in avoiding the family disputes that can derail 20-30% of intestate cases. You can read the full research about these findings to learn more.

If you’re managing an estate or planning your own, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process.