Navigating the legal landscape when making decisions for a loved one can feel overwhelming, but with the right guidance, it doesn't have to be. In Texas, two common tools often come up: a Power of Attorney and a Legal Guardianship. While they sound similar, understanding the difference between a power of attorney and a legal guardian is critical for protecting your family's future.

The simplest way to think about it is this: A Power of Attorney (POA) is a proactive choice you make for yourself while you have the capacity, while a legal guardianship is a reactive measure taken by a court when no other plan is in place.

Understanding The Core Difference In Texas

Choosing between these two paths isn't just a legal technicality; it profoundly impacts a person's autonomy, privacy, and finances. Getting this right is one of the most important parts of planning for the future and a key focus for any experienced Texas estate planning attorney.

A thoughtfully prepared Power of Attorney keeps you in the driver's seat. It allows you to hand-pick someone you trust to act for you, avoiding the time, expense, and public nature of a court proceeding. This is the heart of effective Texas estate planning.

Key Distinctions At A Glance

A POA lets you (the "principal") grant authority to a trusted person (your "agent") to handle certain affairs. The key here is that you don't give up your own rights; your agent simply gets to act on your behalf. To get a better feel for the specifics, it's helpful to understand exactly what a Power of Attorney entails.

A legal guardianship, on the other hand, is a much more drastic step. A court determines that a person (the "ward") is legally incapacitated and appoints a guardian to take over their decision-making. This court order essentially overrides any existing POA and transfers the ward’s legal rights to the guardian.

Before we dive into the nitty-gritty details, let's look at a quick side-by-side comparison.

Power of Attorney vs Legal Guardian At a Glance

This table breaks down the fundamental differences between these two roles in Texas, giving you a high-level view of how they operate.

| Feature | Power of Attorney (POA) | Legal Guardian |

|---|---|---|

| Origin | Created by the individual (Principal) | Appointed by a Texas court order |

| Timing | Established proactively while the individual has legal capacity | Established reactively after incapacity is proven in court |

| Control | The Principal chooses the agent and defines their specific powers | The court selects the guardian and determines their authority |

| Privacy | A private legal document shared only when necessary | A public court proceeding with records available to the public |

| Oversight | The agent acts independently without direct court supervision | The guardian is directly accountable to the court and must file regular reports |

| Cost | Relatively inexpensive to create as part of an estate plan | Significantly more expensive due to court costs and legal fees |

As you can see, the differences are stark. One is a private arrangement rooted in personal choice, while the other is a public, judicial process born out of necessity.

How Each Role Is Legally Established in Texas

The legal roads to a Power of Attorney versus a guardianship couldn't be more different. Think of it as proactive planning versus reactive court intervention. One is a private, deliberate step you take for yourself; the other is a public, court-driven process others start when that planning was missed. Getting a handle on these differences is the key to protecting your own autonomy down the line.

The Power of Attorney: A Private Act of Trust

Putting a Power of Attorney in place here in Texas is a straightforward, private affair. It's a cornerstone of any solid estate plan, designed to be set up long before a crisis ever hits.

The most important piece of the puzzle is that the principal—the person granting the authority—must have legal capacity when they sign. This just means they need to fully understand what the document is and what it does.

The actual process is simple: you sign a specific legal document in front of a notary public. While the Texas Estates Code offers statutory forms to make it easier, working with an estate planning attorney ensures the document is perfectly tailored to your situation and checks all the legal boxes.

In Texas, we generally work with two main types of POAs:

- Durable Power of Attorney: This document is for financial matters. It’s called "durable" because it stays effective even if you become incapacitated later on.

- Medical Power of Attorney: This appoints someone to make healthcare decisions for you, but only when a doctor says you can't make them for yourself.

A Power of Attorney is your voice, captured on paper. It’s a direct reflection of your wishes and your trust in a person you’ve hand-picked, all done without ever setting foot in a courthouse.

The Guardianship: A Public Court Proceeding

Guardianship, on the other hand, is a whole different ballgame. It's a public, formal, and often emotionally draining court process. It’s truly a last resort, kicking in only when someone has already lost the capacity to manage their affairs and has no alternatives, like a POA, in place.

The journey starts when someone files an Application for Guardianship with the court, claiming that a person (the "proposed ward") is incapacitated and needs a guardian. From that moment, the court system takes over, following a strict set of steps designed to protect the proposed ward's rights.

Here’s what that typically looks like in a step-by-step process:

- Medical Evaluation: The court requires a letter or certificate from a physician to get a clear picture of the person’s physical and mental state.

- Appointment of an Attorney Ad Litem: The judge appoints an independent attorney to represent the proposed ward’s best interests. This attorney digs into the situation and advocates for what the individual would want.

- Court Hearing: A formal hearing is held where the judge looks at all the evidence—medical reports, testimony, you name it—to decide if the person is legally incapacitated and if a guardianship is truly necessary.

- Judge's Order: If the judge agrees, they’ll sign an order officially appointing a guardian and laying out their exact powers and duties.

This court-supervised path is deliberately rigorous to protect an individual’s fundamental rights. But that also means the process is far more expensive, time-consuming, and public than signing a POA. For families facing this difficult situation, understanding the legal maze for a guardianship for elderly parents is critical. When you see these two paths side-by-side, the value of planning ahead becomes crystal clear.

Comparing Decision-Making Powers and Authority

https://www.youtube.com/embed/bVCcrq_qFV8

One of the biggest differences between a Power of Attorney and a legal guardian boils down to who calls the shots. The authority given to a POA agent is strictly defined by the person creating the document—the principal. A guardian’s power, however, is handed down by a judge. Grasping this distinction is key to understanding the trade-off between maintaining your personal freedom and being placed under the court's supervision.

An agent operating under a Power of Attorney is on a leash, so to speak. They can only do what the document specifically says they can do. When you set up a POA, you’re in the driver's seat, deciding which powers to grant. For example, a Texas Durable Power of Attorney can give an agent sweeping financial authority to manage everything from your bank accounts and investments to buying and selling real estate for you.

On the flip side, you can also draw up a very narrow POA, limiting your agent to just one specific task, like selling a particular piece of property while you’re out of the country. This adaptability makes the POA an incredibly precise instrument for delegating exactly what you want, when you want it. For a deeper dive into this flexibility, feel free to check out our guide on planning for incapacity and power of attorney essentials.

The Court-Defined Authority of a Guardian

A guardian’s authority isn’t shaped by personal wishes but is instead hammered out by a Texas judge. This power is based entirely on the court’s judgment of what’s needed to keep the ward safe. The final court order lays out, in no uncertain terms, what decisions the guardian is allowed to make.

Texas law actually splits the role of a guardian into two, though it’s common for one person to wear both hats:

- Guardian of the Person: This person is in charge of the ward's physical health and safety. Their authority covers major life decisions about medical care, where the ward lives, and day-to-day personal care.

- Guardian of the Estate: This individual takes the reins of the ward’s financial world. They’re tasked with paying bills, managing property, and protecting the ward’s assets, all under the watchful eye of the court.

A Critical Distinction in Fiduciary Duty

Both an agent and a guardian are considered fiduciaries. That’s a legal term meaning they have a sworn duty to act in someone else’s best interest. But the standards they are held to are worlds apart, and this is a crucial point when comparing a power of attorney versus a legal guardian.

An agent under a POA must follow the principal's known wishes and instructions to the letter. A guardian, however, has a duty to act in the ward's "best interests," a standard that is defined and overseen by the court.

This isn't just legal nitpicking; the real-world consequences are massive. An agent's number one job is to execute the principal's stated wishes, even if they personally think it’s a bad idea. Their loyalty is to the instructions they were given.

A guardian’s loyalty, on the other hand, is to the ward’s well-being as the court sees it. They have to make choices that a "prudent person" would make for the ward’s care and financial security, and they have to constantly report back and justify those choices to a judge. This effectively makes the court, not the individual’s own past wishes, the final authority guiding the guardian’s every move.

Fiduciary Duties and Accountability: A Tale of Two Trusts

In Texas, both a Power of Attorney agent and a court-appointed guardian are considered fiduciaries. It’s a hefty legal term, but it boils down to one simple, powerful idea: they are bound by a duty of trust and must always act in the best interest of the person they’re serving. But how that trust is enforced and monitored is where these two roles diverge dramatically. Understanding these fiduciary principles is essential for families navigating Texas trust and estate matters.

Think of it this way: a guardian operates under the bright, constant spotlight of a judge’s supervision. An agent, on the other hand, works behind a curtain of privacy, a system built entirely on the trust the principal placed in them. The curtain only gets pulled back if someone suspects trouble and decides to take legal action.

The POA Agent: A Duty Built on Personal Trust

Under the Texas Estates Code, the person you name as your agent in a Power of Attorney isn't just a helper; they're your trusted representative. Their main job is to act in good faith, staying loyal to you and following your instructions and what you’d reasonably expect. This isn’t a casual arrangement—it demands care, competence, and diligence. These fiduciary duties in Texas are serious.

An agent's core duties are pretty clear-cut:

- Act in Good Faith: Every single decision must be honest and have your best interests at heart.

- Avoid Conflicts of Interest: Your agent can't use your money for their own gain or get into situations where their personal interests clash with yours.

- Keep Meticulous Records: They must keep a detailed log of every transaction made on your behalf. If asked, they have to be ready to show their work and provide a full accounting.

- Preserve Your Estate Plan: Their actions should respect and uphold your known estate plan whenever possible, not undermine it.

These responsibilities are serious, but the system relies on a passive enforcement model. Your agent doesn’t have to file reports with a court or get a judge's permission for their actions. Accountability comes from the personal trust you place in them and the threat of a lawsuit if a family member smells something fishy. It’s a system that puts a premium on privacy and your autonomy.

A Power of Attorney is built on a foundation of personal trust. A legal guardianship, however, is built on a foundation of judicial oversight. This is the fundamental difference in how accountability works.

The Guardian: Held to a Higher Standard of Accountability

A legal guardian in Texas is more than just a helper; they are an officer of the court. That status comes with a level of accountability that’s worlds apart from a POA agent. From the moment they are appointed, their actions are under direct and continuous judicial supervision. This whole structure is designed to provide the maximum level of protection for the "ward"—the person who a court has legally determined is incapacitated.

This intense accountability involves several required steps:

- Posting a Bond: The court will almost always require the guardian to purchase a bond. This acts like an insurance policy, protecting the ward's assets from being mishandled or stolen.

- Filing an Initial Inventory: Right out of the gate, the guardian has to file a sworn, detailed inventory of every single piece of the ward’s property and all their assets with the court.

- Seeking Court Approval for Major Moves: A guardian can’t just decide to sell the ward’s house on a whim. For big transactions like that, they must file a formal application and get a judge’s express permission first.

- Submitting Annual Accountings: Every year, the guardian must file a comprehensive financial report with the court. This "annual accounting" details every dollar that came in and every dollar that went out. The judge then reviews and must approve this report.

This constant oversight ensures every decision is transparent and can be justified. While both the POA agent and the guardian are fiduciaries, the guardian’s duty isn’t just to the ward—it’s also directly to the court. This transforms the guardian's role into a public trust, while the agent's role remains a private one.

When to Choose a POA or Pursue Guardianship

Deciding between a Power of Attorney and a legal guardianship really boils down to the specific circumstances your family is navigating. Knowing the practical differences between these two paths is the key to protecting your loved ones. To make things clearer, let's walk through a few common, real-world scenarios that we see Texas families face all the time.

These examples really drive home the critical difference between proactive planning and reactive crisis management. Each situation demands its own unique legal approach.

Scenario 1: Proactive Planning for the Future

Picture a healthy, married couple in their late 50s. They're on top of their finances, in great health, and want to be prepared for whatever life throws their way. Their main goal is to ensure that if one of them becomes unable to make decisions, the other can step in immediately without getting the courts involved.

In this situation, creating Durable and Medical Powers of Attorney is the perfect solution. By working with a Texas estate planning attorney, they can each appoint the other as their agent. Taking this step now means their wishes are legally documented, which protects their autonomy and keeps their private matters out of a public courtroom. This is the very foundation of effective personal planning. For anyone wanting to dig into the details, you can learn more about Power of Attorney documents) and how they're structured.

Scenario 2: Sudden Incapacity With No Plan

Now, let's look at a completely different situation. A 70-year-old man has a severe stroke that leaves him incapacitated and unable to communicate. He never got around to creating a Power of Attorney, figuring he had plenty of time. His adult children are now staring down a mountain of unpaid bills, mortgage payments, and urgent medical decisions, but they have zero legal authority to touch his bank accounts or even speak to his doctors.

Since there are no advance directives in place, the family’s only route forward is to pursue guardianship. This means petitioning the court to have their father declared legally incapacitated and then asking a judge to appoint one of them as his guardian. The process is public, expensive, and slow, but it's the only way to get the legal authority needed to manage his affairs and make sure he gets proper care.

Scenario 3: When a POA Isn’t Enough

Finally, here’s a more complicated and painful scenario. An elderly mother has a Durable Power of Attorney that names her oldest son as her agent. Unfortunately, her other children start noticing that their mother's bank accounts are dwindling, and their brother gets evasive whenever they ask about finances. They have a gut-wrenching suspicion that he's mismanaging her money for his own gain.

Even with a POA in place, if there is evidence of abuse, neglect, or exploitation, a guardianship may be necessary to protect a vulnerable person. A court-ordered guardianship will always supersede a Power of Attorney.

In a heartbreaking situation like this, the concerned siblings may need to seek an emergency guardianship. They can present evidence of financial abuse to a judge and ask the court to step in. If the judge agrees that their mother is at risk, the court will appoint a neutral guardian, immediately revoke the son’s authority under the POA, and place their mother and her assets under the court's direct protection. While understanding how to properly set up a power of attorney for aging parents can help avoid these conflicts, guardianship remains the ultimate safety net.

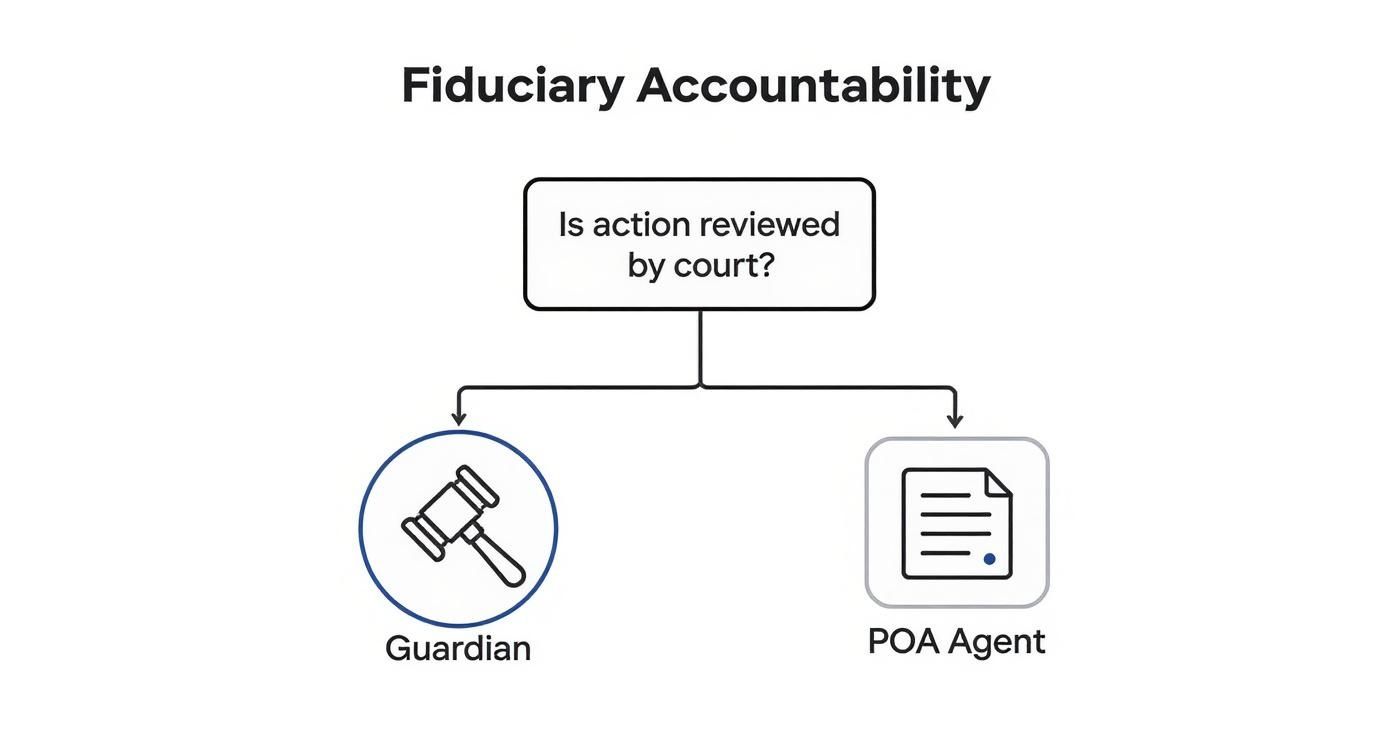

This decision tree shows the core difference in accountability: a guardian's actions are reviewed by a court, while a POA agent acts privately.

The key takeaway is that guardianship adds a mandatory layer of judicial oversight specifically designed to protect the individual. A POA, on the other hand, operates on a foundation of trust that remains private unless someone challenges it.

Lingering Questions About Texas POAs and Guardianships

Once you start digging into the differences between a Power of Attorney and a guardianship, it's natural for more questions to pop up. It’s a lot to take in, and these are powerful legal tools. But getting clear, straightforward answers is the best way to feel confident about what to do next.

Let's walk through some of the most common questions we hear from Texas families. We'll ground every answer in how things actually work under Texas law to clear up any confusion.

Can a Power of Attorney Be Used After Someone Dies?

No. This is a huge misconception, and it’s critical to get this right. In Texas, any Power of Attorney—whether for financial or medical decisions—instantly becomes void the moment the person who made it (the principal) passes away. The agent's authority is immediately extinguished.

From that point on, the power to manage the deceased’s estate shifts to the executor named in their will. That person then has to start the formal probate process to settle the estate. It's a completely separate legal proceeding, and the POA has no role in it whatsoever.

What Happens If I Have a POA but Someone Tries to Get a Guardianship Over Me?

Think of a properly signed Durable Power of Attorney as your first and best line of defense against a guardianship you don't want. Texas law actually requires courts to look for "less restrictive alternatives" before taking the drastic step of appointing a guardian, which would strip you of your basic rights. A valid POA is the gold standard of a less restrictive alternative because it shows you've already made your wishes known.

That said, a POA isn't a magical shield. If someone presents compelling evidence that your chosen agent is abusing their power, neglecting you, or stealing from you, a judge can absolutely step in. In that situation, the court can appoint a guardian to protect you, and that court order will legally cancel out the Power of Attorney.

A well-drafted Power of Attorney is your voice, protecting your choices from an unwanted guardianship. But a Texas court's number one job is to ensure a person's safety, and it will not hesitate to intervene if an agent is causing harm.

How Much Does It Cost to Set Up a POA Versus a Guardianship?

The price difference here is night and day. Creating a Power of Attorney is a predictable and relatively low-cost part of the estate planning process. You’ll typically pay a one-time flat fee to an attorney to make sure the document is drafted correctly and does exactly what you need it to do.

A guardianship, on the other hand, is a full-blown lawsuit, and it gets expensive fast. The costs can pile up quickly and often include:

- Court filing fees to even open the case.

- Medical exam costs for the doctor's letter required by the court.

- Your lawyer's fees (the person applying for guardianship).

- Attorney ad litem fees—the court will appoint a separate lawyer to represent the person who might need a guardian, and you have to pay for them, too.

It’s not uncommon for the guardianship process to cost thousands of dollars just to get started, with more expenses down the road for annual reports and other court requirements.

Can I Have Both a Power of Attorney and a Guardian at the Same Time?

Nope, it's one or the other. If a Texas court appoints a guardian for you, that court order automatically terminates any Power of Attorney you previously signed. The guardian appointed by the judge becomes the only person with legal authority to make decisions for you in the areas specified by the court.

This is a big reason why judges see guardianship as the absolute last resort. It overrides the personal choices you made and the people you trusted when you signed your POA. The court's decision takes precedence, placing your life under the direct supervision of the legal system. It really drives home the value of planning ahead to make sure your voice is the one that gets heard.

If you’re managing a trust or planning your estate, contact The Law Office of Bryan Fagan, PLLC for a free consultation. Our attorneys provide trusted, Texas-based guidance for every step of the process. You can learn more at https://texastrustadministration.com.